When the RSV is considered untimely submitted

To calculate insurance premiums in clause 7 of Art.

431 of the Tax Code of the Russian Federation sets the deadline for reporting - the 30th day of the month following the billing or reporting period. If you submit a payment to the Federal Tax Service at least 1 day later than this deadline, it will be considered untimely submitted. From time to time, insurance premium payers have the legal opportunity to submit the DAM a day or two later than the deadline reporting date and not be fined. This opportunity is provided by clause 7 of Art. 6.1 of the Tax Code of the Russian Federation, the norms of which provide for the postponement of the reporting date to the next working day if it coincides with a weekend and (or) a non-working holiday.

In 2022, such an opportunity will present itself. But any delay in sending the calculation to the inspectorate is fraught with a fine. We'll talk about its size below.

In 2022, the deadlines for submitting the DAM will be postponed:

- for 2022 - on Monday, 02/01/2021, from Saturday, 01/30/2020;

- for 9 months of 2022 - on Monday, 11/01/2021, from Saturday, 10/30/2020.

The remaining calculations must be submitted on time:

- for the 1st quarter of 2022 - until 04/30/2021;

- for the first half of 2022 - until July 30, 2021.

What kind of reporting is submitted for social contributions?

Calculation of insurance premiums (DAM) is mandatory reporting by payers.

Insurance premiums are paid for compulsory pension, medical, social insurance and insurance against industrial accidents. Currently, the payment of insurance premiums is controlled by the Federal Tax Service. Previously, these functions were performed by off-budget funds: the Pension Fund and the Social Insurance Fund. In case of failure to submit reports, a fine for failure to submit the RSV-1 was paid to the Pension Fund. In connection with the transfer of mandatory payments for social insurance, the payer has an obligation to provide the following reports:

| Report | Where is it provided? | Contents of the report | Frequency of provision | Deadline |

| RSV | Inspectorate of the Federal Tax Service | About accrued insurance premiums | Quarterly | Until the 30th day of the month following the reporting quarter |

| SZV-M | Pension Fund | Lists of working employees | Monthly | Until the 15th of the next month |

| SZV-STAZH | Information about employees' length of service | Annually | No later than March 1 of the following year | |

| 4-FSS | FSS RF | On the calculation and payment of contributions for injuries | Quarterly | On paper - until 20, electronically - until the 25th of the month following the reporting quarter |

Each regulatory body checks the accuracy of its reporting. For violations, a company is subject to a fine for failure to submit reports to the Pension Fund, the Federal Tax Service or the Social Insurance Fund, depending on the report.

Amount of fine for late reporting

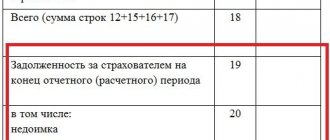

The rules by which a fine is imposed for late submission of the DAM are prescribed in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The amount of the fine is determined by calculation - 5% of the unpaid amount of insurance premiums payable on the basis of the submitted DAM, for each full or incomplete month.

The amount calculated in this way does not always represent the final amount of the fine to be transferred to the budget. The legislator has established limits beyond which the amount of the fine cannot go: no less than 1000 rubles. and no more than 30% of the specified amount of contributions.

The amount of the fine for late submission of the DAM in 2022 is calculated using the same algorithm.

A fine for failure to submit (late submission) of the DAM is not all that can await the contribution payer. Tax authorities have a legislatively enshrined opportunity to suspend transactions on bank accounts if they do not receive the DAM within 10 days after the deadline for its submission (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

In addition, the manager can also be fined 300–500 rubles. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation). The size of this punishment may increase in the future: legislators plan to increase it by at least 5 times.

Responsibility for failure to submit the RSV

After the transfer of administration of insurance premiums to the tax authorities, liability for violations in this area is regulated by tax legislation. The fine for failure to provide DAM is established by Article 119 of the Tax Code of the Russian Federation. It provides for the imposition of penalties on the offending company in the amount of 5% of the unpaid amount of social contributions calculated for payment in the overdue report. If the company paid everything on time, but submitted the DAM to the Federal Tax Service late, then it will have to pay the minimum fine for late submission of the DAM - 1000 rubles. (clause 2 of article 119 of the Tax Code of the Russian Federation).

In addition, if the payer is required to provide a report electronically, but submitted it on paper, then he will be fined 200 rubles. (Article 119.1 of the Tax Code of the Russian Federation). In 2022, the threshold at which an organization is entitled to submit a report has been reduced to 10 people. All enterprises with a larger number of employees are required to submit reports electronically.

An example of how to calculate the fine for failure to submit the DAM in 2022

LLC "Company" with 30 employees provided the DAM for 2022 on 02/10/2020. The report was sent by mail in paper form. The amount payable for December was 300,000 rubles. and was transferred on the same day, that is, also late. Since the organization did not pay contributions on time and was late with the report, the fine will be 5% of the unpaid amount of social contributions. In addition, the organization is required to report electronically. For violating the delivery procedure, another fine in the amount of 200 rubles was applied to her.

The fine for RSV will be:

300,000 × 5% + 200 rub. = 15,200 rub.

When can the fine be reduced?

If the payer of contributions has mitigating circumstances, the amount of the fine for the DAM can be reduced (clause 1 of Article 112 of the Tax Code of the Russian Federation). The presence of at least one such circumstance makes it possible to halve the fine amount (clause 3 of Article 114 of the Tax Code of the Russian Federation).

What mitigating circumstances help reduce the fine in court, see the figure:

If the payer of contributions violates the deadlines for submitting the DAM for the first time, this will be considered an aggravating circumstance and may lead to an increase in the amount of the fine.

Tax authorities or judges evaluate aggravating and mitigating circumstances when deciding on the amount of tax sanctions.

Punishment provided by law for late submission (consequences)

Before considering what consequences await a taxpayer for late submission of insurance premium calculations to the tax department, it is necessary to accurately identify situations that qualify as violations, which include the possibility of disciplinary sanctions.

Tax officials consider the following cases to be failure to provide calculations for insurance premiums:

- discrepancy between the total amounts of deductions compared to payments when taking into account all employed employees - the match should be noted monthly;

- provision of inaccurate personal information on attracted personnel - full name, SNILS numbers, identification codes.

Since 2022, the list of punishable errors has expanded significantly, including the presence of inaccurate information on the following items:

- amounts of deductions for reporting and billing periods;

- base for calculating contributions to the Pension Fund within the limits of the maximum value;

- the amounts transferred to the Pension Fund within the maximum value;

- final indicators of deductions;

- bases used to determine the additional tariff;

- the amount of transfers to the Pension Fund of the Russian Federation within the framework of additional tariffs;

- general data based on the results of the declaration.

Article on the topic: Peculiarities of submitting the calculation of form 4-FSS

Technical violations in the calculation of insurance premiums for compulsory medical insurance, according to explanations from tax authorities, cannot cause the declaration to be rejected.

For untimely submission of reports or inaccuracies in the submitted calculation, a company, individual entrepreneur or individual who committed these violations may be subject to the following penalties:

- fines, within the framework established by the current Tax Code of the Russian Federation;

- administrative sanctions established by the Code of Administrative Offenses - applied to officials through whose fault the violation was committed.

Important! In addition to the listed sanctions, in more serious situations, the tax service has the right to block the company’s bank accounts, which will become a serious problem for the continuation of activities. Such consequences are possible if the calculation is not provided ten days after the date on which it should be submitted.

How will they be punished if there are errors in the calculation or the method of presentation is not followed?

The Tax Code of the Russian Federation does not provide for a separate fine for errors in the DAM. However, the verification program does not pass reports with incorrect personal data, since these errors prevent the identification of insured individuals. Such a DAM is considered unrepresented (Clause 7, Article 431 of the Tax Code of the Russian Federation). Then the tax authorities notify the payer of the contributions about this, and he needs to correct the report.

If, during an inspection, inspectors reveal an understatement of the contribution base in the DAM, the contribution payer may be fined under clause 3 of Art. 120 of the Tax Code of the Russian Federation in the amount of up to 20% of unpaid contributions, but not less than 40,000 rubles. (letter of the Ministry of Finance dated May 26, 2017 No. 03-02-07/1/32430).

Fine 200 rubles. company or individual entrepreneur controllers have the right if the DAM should be submitted electronically, but was received by the Federal Tax Service in paper form (Article 119.1 of the Tax Code of the Russian Federation).

Let us remind you that from 2022, insurers with an average number of employees for the previous billing/reporting period of more than 10 people are required to submit the DAM in electronic form. (clause 10 of article 431 of the Tax Code of the Russian Federation). This limit was established as of 01/01/2020. (Law “On Amendments...” dated September 29, 2019 No. 325-FZ). This rule applies to subsequent years until any additional changes are introduced.

Personalized accounting

Employers submit the SZV-M form , and also once a year - SZV-STAZH . Personalized records are maintained in accordance with the instructions approved by Order of the Ministry of Labor of the Russian Federation dated December 21, 2016 No. 766n. Since October 2018, changes have been made to it regarding the procedure for correcting errors. Now you can only correct information that the Pension Fund of Russia has accepted. If information about an employee who was previously absent from it is entered , then this is considered an addition, not a correction of the data. And to avoid being fined for such an addition, you need to meet the deadline.

Let us note that the Pension Fund of Russia has fined “forgotten” employees for untimely registration before, but policyholders managed to challenge such fines in court. The arbitrators indicated that this change can be regarded as an adjustment to a previously submitted form, and no penalty is imposed for it.

You can find out when the Pension Fund will fine you for personalized accounting forms from the following diagram.

Fine 500 rubles for each insured person

| Submission of the original or updated form after the deadline | Submitting clarifications, additions or adjustments after receiving a notification from the Pension Fund of Russia | Submitting a corrective or cancellation form if an error (including unnecessary information) is found independently | |

| << No < | Submission within 5 days of receipt of notification | >> Yes >> | No fine is imposed |

Penalty calculator for failure to submit a tax return (calculation of contributions)

For periods before 01/01/2017, calculations of insurance premiums were provided to the Pension Fund. The fine for late submission of a report to the Pension Fund of the Russian Federation was established by Article 46 212-FZ and was calculated according to slightly different rules. The minimum fine payment was 1000 rubles. But it was clarified that its amount is calculated based on the amount of contributions accrued for payment for the last three months of the reporting period. As a result, the penalty rate was simplified and set at 5%.

Law 212-FZ provided for not only a fine for late submission of reports to the Pension Fund of the Russian Federation, but also liability for failure to comply with the procedure for submitting RSV-1. If the report was submitted in paper form when the electronic form was required, then a fine of 200 rubles was collected.

In connection with the payment of insurance contributions for each person subject to compulsory pension insurance, the employer is obliged to submit reports to the Pension Fund:

- SZV-M - information about insured persons;

- SZV-STAZH - information about the length of service.

The Pension Fund's fine for late submission of a report is established by Article 17 of Law 27-FZ “On Personalized Accounting”. Penalties are provided in the amount of 500 rubles. for each person for whom information was not submitted or was submitted in error.

Payment of contributions for injuries is regulated by Federal Law 125-FZ of July 24, 1998. This type of social contributions is completely left under the responsibility of the Social Insurance Fund. The Social Insurance Fund controls the accrual and transfer of mandatory payments and the financing of measures to reduce injuries at the enterprise.

Article 26.30 of the law establishes liability for failure to provide 4-FSS in the amount of 5% of the amount of payments accrued for transfer. Penalties cannot exceed 30% of the amount charged. The minimum sanction is the same amount as the fine for failure to submit a report to the Pension Fund - 1000 rubles.

All policyholders, that is, legal entities and entrepreneurs with employees, are required to submit insurance premium calculations. In this case, the calculation must be submitted even if the company did not conduct business during the reporting period and no payments were made to individuals.

You can submit a document electronically or in paper form. If the company has more than 25 employees, the form is sent electronically; if there are fewer than 25 employees, the report can be prepared on paper.

When are reports required to be submitted?

To avoid a fine for late submission of settlement documents for insurance premiums, the taxpayer must accurately represent the acceptable deadlines for submitting calculations. The determination of these periods is influenced by the billing and reporting periods established by Art. 423 of the Tax Code of the Russian Federation, after which the days for submitting documents are calculated.

The period defined as a settlement period is limited to the calendar year, and for the reporting period – to the initial quarter, six and nine months from the beginning of the year.

Submission of calculations for insurance premiums will be untimely if the reporting documentation is submitted late by at least one day from the 30th of the following month for the periods noted above. But this deadline may be postponed if the specified calendar transfer of reporting falls on a weekend. In this situation, the reporting date is moved to the next weekday.

An organization, individual entrepreneur or citizen who pays insurance premiums must be careful in reporting as required by tax legislation. For failure to submit or untimely provision of relevant payments, violators may be held accountable within the framework of current legislation.

Related article: Appendix 9 to Section 1 - calculation of insurance premiums