D 91 to 68 wiring what does it mean

Home > Accounting and audit > D 91 to 68 wiring what does it mean

Account 68 of accounting is an active-passive account “Calculations for taxes and duties”, which represents general information on settlements with budgets for taxes and duties paid by the enterprise and the taxes of its employees.

Account 68 in accounting

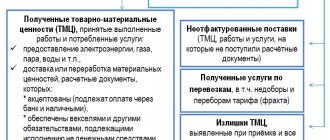

Account 68 is credited for amounts according to tax returns or calculations in correspondence:

- Account 99 - for the amount of accrued income tax;

- Invoice 70 - for the amount of personal income tax;

- Accounts 20, 25, 26, 44 - for the amount of local taxes, transport tax, property tax, etc.;

- Accounts 90.3, 91.2, 76.AV - when calculating VAT for the reporting quarter;

- Invoice 51 - upon receipt of overpaid tax from the budget.

The debit of the account records the amounts of taxes actually transferred to the budget, including the amounts of VAT written off from account 19.

Subaccounts 68 “Calculations for taxes and fees”

Subaccounts under account 68 are used for taxes and fees paid by the company, depending on its chosen field of activity and tax regime. In this case, a separate sub-account is opened for each type of tax:

Additional sub-accounts can also be opened under account 68:

- 68.11 - UTII;

- 68.12 – simplified tax system;

- 68.13 – Trade fee.

Typical wiring

The main transactions for this account are presented in the table:

Accounting for calculations of taxes and fees is carried out on account 68, which reflects the accrual of taxes and their payment to the budget. In accordance with the applicable tax regime, an organization can open the necessary sub-accounts on account 68 according to the types of taxes paid.

Save so you don't lose!

Subaccounts of account 68 “Calculations for taxes and fees”

By analogy with account 69 “Calculations for social insurance and security”, several subaccounts can be distinguished on account 68.

In particular, for the calculation and payment of personal income tax (abbreviated as personal income tax or income tax, as people like to call it), a subaccount 68.1 is opened.

Accrual, payment, deductions, restoration and other transactions with value added tax (VAT) are reflected in subaccount 68.2.

If an organization pays excise taxes, then a subaccount 68.3 is opened to account for them.

Organizations on the general taxation system that pay income tax open a subaccount 68.4 to record it.

If an organization owns vehicles on which transport tax is paid, then subaccount 68.7 is used.

To account for tax paid on the property of organizations, subaccount 68.8 is used.

If an organization is a payer of the single tax on imputed income (UTI) for certain types of activities, then a subaccount 68.11 is opened to reflect calculations for UTII.

And single tax payers under the simplified taxation system open a subaccount 68.12.

If an organization pays any other types of taxes: water, mineral extraction, etc., then it can open additional sub-accounts on account 68.

Typical transactions for account 68

Accounting entries for the debit of account 68:

- D68 K50 – taxes and fees were paid in cash from the cash register.

- D68 K51 – tax amounts from the current account are transferred.

- D68 K19 – VAT allocated for purchased goods, materials and other valuables is sent for reimbursement from the budget.

Accounting entries for account credit 68:

- D70 K68.1 - reflects the amount of personal income tax withheld from personnel wages and subject to payment to the budget.

- D90.3 K68.2 – reflects the amount of VAT on sold products, goods, services.

- D91.2 K68.2 – reflects VAT payable to the budget on sold fixed assets and intangible assets.

- D90 K68.3 – excise tax is charged on sold excisable goods.

- D99 K68.4 – corporate income tax has been assessed for payment to the Federal Tax Service.

- D20, 26 (44, 91.2) K68.7 - reflects the amount of transport tax payable to the budget.

- D26 (44, 91.2) K68.8 – reflects property tax for payment to the budget.

- D99 K68.11 – reflects the UTII accrued for payment.

- D99 K68.12 – reflects the single tax accrued for payment under the simplified tax system.

What is value added tax and why is it needed? We looked into it here. In this article, we will look at how VAT is accounted for in accounting and what transactions are reflected in accounting. Also here you will find an example of accounting for tax on purchased and sold goods with transactions (calculation and reimbursement of value added tax).

Dear readers! The article describes typical situations, but each case is unique.

If you want to find out how to solve your particular problem , use the online consultant in the lower right corner of the site or call direct numbers:

+7 ext.445 — Moscow — CALL

+7 ext.394 — St. Petersburg — CALL

here - if you live in another region.

It's fast and free!

To account for value added tax calculations, it is used

buhgalterdoc.ru

Postings for other taxes and fees

Account 68 in accounting is used in every commercial organization, since any economic activity should bring benefits not only to the entrepreneur, but also to the state.

The table shows the most common entries for the accrual and payment of amounts to the budget: Account assignments for account 68

| Dt | CT | Characteristics of a business transaction |

| 91 | 68.06 | Tax has been assessed for the use of water resources and on the property of the enterprise |

| 20 | 68.07 | The amount of land tax payable has been taken into account |

| 99 | 68.04 | Organizational income tax accrued |

| 70 | 68.01 | The amount to be paid for personal income tax has been allocated |

| 75 | 68.07 | Tax accrued on dividends paid |

| 90 | 68.03 | The amount of excise tax on goods sold is reflected |

| 68 | 51 | The amount of obligations to the state budget has been paid |

| 68 | 66 | Tax debt paid off with a loan |

Account 68 forms one of the main articles of the enterprise's obligations. Timely tax payments and the reliability of the information reflected are the key to successful and legal activities of the company.

Characteristics of account 26

The expenses recorded in this account do not have a direct impact on the formation of the cost of goods produced or services provided. But there is a factor of indirect impact on final product prices due to the need to redistribute costs. Account 26 “General production expenses” is intended to reflect amounts for:

- remuneration of administrative workers;

- rental of general utility premises;

- taxes and contributions transferred to the budget;

- information, consulting and audit services;

- providing all necessary business units.

The 26th account in the accounting department includes expenses for:

- maintaining non-production equipment in working order;

- retraining and retraining of employees belonging to the category of non-working specialties;

- accrued depreciation for objects involved in production management.

The main document regulating the 26th accounting account and operations on it is PBU 10/99. Its provisions regulate the rules for monthly write-off and attribution of general business expenses to cost. Each enterprise has a choice of how to distribute the amounts written off. The adopted methodology must be enshrined in the accounting policies of the organization.

Account 26 in accounting is classified as active, that is, the accumulation of expenses on it is carried out in debit. Loan costs are written off at the end of the month. It is important that at the end of the month the account has a zero balance. Analytical accounting is carried out in the context of departments for whose needs cash flows were directed and cost items. Account 26, for which there are no subaccounts, is carried out in analytics using subaccounts.

General business expenses are characterized by the use of a full or partial journal-order form. In the latter option, it is enough to maintain a journal order 5 for the purposes of synthetic and analytical accounting. In the full form, the analytics are taken into account in statement 15, and synthetic accounting is reflected in the order journal 10.

Subaccounts 91 accounts:

- 91.1 “Other income” - 91 1 accounting account is intended to reflect various income transactions for non-core activities of the company. An exception is extraordinary income of the organization.

- 91.2 “Other expenses” - account 91 2 in accounting is used to reflect transactions on expenses not related to the main activities of the business.

- 91.9 “Balance of other income/expenses - the account is intended for monthly calculation of the balance of 91 accounts. in order to close it. At the same time, the balance of the remaining sub-accounts continues to “hang”, which allows you to obtain information about the accumulated balances at any time. Closing with final transactions is written off to the debit or credit of the savings account. 99.

The financial characteristics of account 91 “Other income and expenses” make it possible to obtain generalized information on those operations of the company that are not directly related to the main types of OKVED. As a rule, such operations do not greatly affect the financial results of a business, but are nevertheless important for calculating reliable data on income, costs, and profits. Information can be presented in a generalized form or with analytics by types of income and expenses.

Account 91 Other income and expenses - postings in the 1C 8.3 program

Account 91 “Other income and expenses” of the chart of accounts collects “ information” about other income and expenses of the reporting period.

You must understand that every income most often has an accompanying expense. For example, when selling a product, we not only receive income, but also incur expenses in the form of the cost of the product sold. Accounts such as account 90 and account 91 are necessary to “output” the final “financial result” (profit or loss) from each sales transaction. Managers need to clearly understand which sales operations were unprofitable, and which operations brought profit and in what amount.

“Other” income includes: – income from “renting” property; – income from participation in other organizations; – income from the “sale of fixed assets” and non-core assets; – “interest” on loans provided; – “interest” on deposits placed in the bank; – fines from suppliers and other contractors in our favor; - exchange differences;

The account has three sub-accounts:

91.1 “Other income” - we collect other income for each sales transaction 91.2 “Other expenses” - we collect other expenses for each sales operation 91.9 “Balance of other income and expenses” - the difference (91.1 minus 91.2) at the end of the month is written off by posting to account 99 “ Profit and loss".

Summary of account 91: (see all bookmarks)

– on the account we collect “information” about “other income and expenses”, which do not form a significant part in the organization’s activities.

– postings in 1C 8.2 for account 91 are mainly formed by four documents: document “Sales of goods and services” (accrual of revenue, accrual of cost) document “Receipt to current account” (accrual of revenue) document “Transfer of fixed assets” (accrual of revenue , costing) document “Write-off of fixed assets” (costing)

– if you build the SALT according to the account, you will see all the OS that have been received into ownership, put into operation and are currently in operation.

RENTAL INCOME

Posting: D. 62 “Settlements with customers” – K.91 “Other income and expenses”

Description: by posting we record “information” about the occurrence of an “obligation” from the buyer to our organization and by posting we record “information” about the occurrence of “other non-operating” income in the sales amount.

Amount: sales amount

Document 1C 8.3: Sales of goods and services.

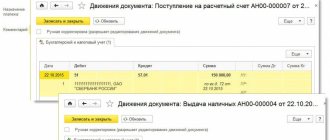

INCOME from interest on a bank deposit

Posting: D. 51 “Current accounts” – K.91 “Other income and expenses”

Description: by posting we recorded “information” about the receipt of funds to the current account (account 51) and by posting we recorded “information” about the occurrence of “other non-operating income” (account 91) as a result of interest received on a deposit in the bank.

Amount: amount received.

Document 1C 8.3: Receipt to the current account. .

DISPOSAL of fixed assets – sale to a counterparty

Posting: D. 62 “Settlements with customers” – K. 91 “Other income and expenses”

Description: by posting we recorded “information” about the buyer’s “obligation” that arose (account 62) and by posting we recorded “information” about the arising other income (account 91) as a result of the sale of a fixed asset.

Amount: the amount of proceeds from the sale of a fixed asset. Posting date: date of sale or disposal from the document “Act of write-off of an asset”, document “Act of disposal of an asset”, document Torg-12

Document 1C 8.2 creating wiring D.62 - K.91:

doc.”OS Transfer”

– set the field.Counterparty, the counterparty whose obligation we reflect on account 62.

– tab. Settlements accounts, issue “account for accounting of settlements with the buyer” = account 62.01/62.02.

– tab. Fixed assets, issue “expense account” = account 91.02

Posting: D. 91 “Other income and expenses” – K. 01 “Fixed assets”

Description: by posting we recorded “information” about expenses in the amount of “residual value of fixed assets”, which will have to be attributed to the financial result (account 91) and by posting we recorded “information” on the disposal of an asset from the fixed assets of the organization (account 01 ) as a result of the sale.

Amount: “residual” value of the object Posting date: date of sale or disposal (indicated in the invoice or write-off act)

Document: document “Act of write-off of an asset” or document “Act of disposal of an asset”.

Document 1C 8.2 creating wiring D.91 - K.01:

doc.”OS Transfer”

– tab. Fixed assets, set the “expenses account” = account 91.02 – the program knows that the fixed assets are listed on account 01.01 (in the document “Acceptance for accounting of fixed assets” we indicate “account for the fixed assets object”). Accordingly, in the document it is necessary to issue only an “expense account”, and where to write off the OS we indicated to the program earlier, in the document “Acceptance for accounting of OS”.

Posting: D. 91 “Other income and expenses” – K. 68.02 “VAT”

Description: by posting we recorded “information” about the costs associated with the sale of fixed assets, on the payment of VAT tax (account 91) and by posting we recorded “information” on the accrual of “liabilities” to the budget of the Russian Federation (account 68.02). When using different taxation systems, some organizations have an obligation to charge tax on the “sale” transaction, which is what we did. The accrued tax is part of the expense of the operation, which we reflected on account 91 (debit 91 just recorded the expense that is associated with our sales operation).

Amount: estimated value

Document 1C 8.2 creating wiring D.91 - K.68.02:

doc.”OS Transfer”

– tab. Fixed assets, set “account for VAT expenses” = account 91.02 – the program knows that account 68.02 should always correspond with this cell.

DISPOSAL of fixed assets - as a result of loss of performance

Posting: D. 91 “Other income and expenses” – K.01 “Fixed assets”

Description: by posting we recorded “information” about the premature “expense for the period” that arose (account 91) and by posting we recorded “information” about the write-off of a fixed asset (account 01) as a result of loss of performance.

Amount: the amount of the “residual” value of the asset. Posting date: date of disposal (indicated in the act of write-off of fixed assets) Document: document “Act of write-off of fixed assets”.

Document 1C 8.2 creating wiring D.91 - K.01:

doc.”Decommissioning of OS”

– we issue “account for settlements” = invoice 91.02.

– indicate the “fixed asset item” that is subject to write-off.

– the program knows that the fixed asset is listed on account 01.01 (in the document “Acceptance for accounting of fixed assets” we indicate “account for accounting of the fixed asset object”). Accordingly, in the document it is necessary to issue only an “expense account”, and where to write off the OS we indicated to the program earlier, in the document “Acceptance for accounting of OS”.

www.finbuh1c.ru

Typical causes of errors in income tax calculations

| # | Problem | Solution |

| 1 | Incorrectly closed cost accounts for BU or NU in the context of accounting types NU/PR/BP. Balances in cost registers get stuck. | Check SALT and cost statement. There should be no final residues. Correct errors if any. If necessary, re-calculate the cost (make sure that the calculation is carried out without errors). Then carry out the determination of fin. results and income tax calculations. |

| 2 | The turnover in the cost accounts does not correspond to the turnover in the cost register. | Somewhere in the documents the cost item is incorrectly indicated (the nature of the costs is not correct). |

| 3 | Failure to comply with the basic rule: «BU = NU + PR + VR« (so-called “boroto”) | Discrepancies can be found by requesting accounting accounts by registrars and, if necessary, account analytics. A report on analyzing the state of tax accounting can help with this, but it is not very convenient to use. |

| 4 | There are BP balances on accounts for which SHE and IT are not automatically generated. Example: Dt 91.02 VR Kt 14 There is no account 14 in tax accounting, so you have to replace account 14 with account 96. | For a list of accounts for which ONA and ONO are generated automatically, see the table of types of assets and liabilities. If it is necessary to reflect BP where SHE and ONO are not calculated automatically, it is necessary to perform the calculation manually and reflect it by posting to the account. 09 or 77 in correspondence with account 68.04.2 In practice, I recently had to manually reflect IT by asset type “Accounts payable”, because... the debt was reflected in the accounting system earlier than in the non-accounting account, which resulted in a temporary difference. |

| 5 | Income and expense accounts (20, 26, 44, 90, 91, 99) according to the type of accounting BP correspond with other types of accounting. As a result, no deferred tax is generated. Example: Dt 91.02.1 VR Kt 01.09 NU | It is necessary to either replace the BP with another type of accounting (if the BP was indicated incorrectly), or select a loan according to the type of BP accounting with an account for which SHE/IT is automatically calculated (see Appendix 1 below). I had to correct the wiring from the example to Dt 91.02 VR Kt 01.09 VR. |

| 6 | BP is written off to PR (directly or indirectly). | Most often it happens when an asset is written off for items that are not accepted for tax accounting. In this case, excessive accrual of PNA/PNO occurs. It is treated by writing off VR for VR, methodically this is more correct. Technically, it is solved by substituting the accepted cost item into the TC of the cost document and resetting the amount of the accounting unit to zero (if the accounting amount is non-zero) - this is how a posting is obtained according to the accounting type BP. |

| 7 | Assets containing temporary differences are credited and written off according to different analysts. As a result, postings may be generated at 77 instead of 09 and vice versa. | For example, a construction project entered using the “self-supporting” construction method, but left from the “contract” construction method (there was a “re-grading” according to subcontos, in the context of which ONA and ONO are formed). Analytics needs to be fixed. |

| 8 | Incorrectly closed standardized cost items in tax accounting. | It is necessary to timely retransmit the document “Routine tax accounting operations (for income tax)” during the closing of the month. |

| 9 | The “Determination of Financial Results” document was re-posted in December when the “Year Closing” document was carried out. | Remove the “Year Closing” document from execution, then redo the financial determination. results and income tax calculations. Don't forget to close the year at the end of the calculation. |

| 10 | In the period there are manual entries for 09 and/or 77 accounts. | Such postings need to be found and either transferred to a future period, or the activity must be removed for the period of income tax calculations. If you leave them, the tax calculation will take into account their presence and make such entries so that the final balance corresponds to the calculated balance. If you manually adjust invoices 09 and 77, then either do not re-post the tax calculations after this, or cancel the activity/take the document forward! |

| 11 | Manual postings to accounts. 09 “Loss of the current period” | Manually adjusting account 09 for the loss of the current period is a very strange idea. Most likely, such wiring can (and even better) be removed. The rule “ ConOstDt 09_UbTekPer = ConOstDt_99.01_NU x 20% ” must always be observed! |

| 12 | There are postings in correspondence with account 84 | It is necessary to manually calculate and accrue conditional income/expenses. The calculation algorithm is the same as in stage 4 of income tax calculations (see above). In the resulting posting, instead of the 99th account, substitute 84. |

If you know other reasons for incorrect income tax calculations, write in the comments!

ANNEX 1:

Account 91 - active or passive

Account 91 belongs to the category of mixed, or active-passive. It simultaneously takes into account both assets and liabilities. And its balance is changeable - it can only be debit or only credit.

On credit 91 accounts during the month reflect income from other sources, and on debit - other expenses. At the end of the month, the debit and credit turnovers are compared, the smaller is subtracted from the larger and the result is obtained. If the balance turns out to be a credit balance, income exceeds expenses, and the company generates profit from other activities. If it's the other way around, it's a loss.

There should be no balance left in the account at the end of each month. It is written off to the Profit and Loss account.

How does the 26 count work?

Position 26 of the Chart of Accounts, called “General expenses,” accumulates data on costs that are related to management needs, but not to the process of creating finished products. This account is active. Thus, the accumulation of costs incurred is reflected in the debit part, and the write-off of these costs at the end of the reporting period occurs on a credit basis, i.e. at the end of the reporting period, account balance 26 is reset to zero. In this case, analytical accounting is carried out in the context of the divisions for the maintenance of which financial flows were directed.

Reflection of transactions with VAT

Depending on the type of activity, an enterprise can carry out various VAT transactions. We will consider the main such operations using examples.

VAT when making a contribution to the authorized capital of another organization

In January 2016, Yantar JSC purchased from Rubin LLC a batch of construction and repair materials worth 48,350 rubles, VAT 7,375 rubles. In March 2016, Yantar JSC acquired a stake in the authorized capital of Amethyst JSC. The cost of the share is 54,280 rubles. Construction materials previously purchased from Rubin LLC were transferred to pay off the debt on the contribution to the authorized capital of Amethyst JSC.

These transactions were reflected in the accounting of Yantar JSC with the following entries:

| Debit | Credit | Description | Sum | Document |

| 10 | 60 | Construction materials purchased from Rubin LLC have been received (RUB 48,350 – RUB 7,375) | RUB 40,975 | Packing list |

| 19 | 60 | The amount of VAT on purchased building materials is reflected | RUR 7,375 | Invoice |

| 68 VAT | 19 | VAT on the cost of building materials is accepted for deduction | RUR 7,375 | Invoice |

| 58 | 76 | The acquisition of a stake in Amethyst JSC was taken into account | RUR 54,280 | Contract of sale |

| 76 | 10 | Reflected the transfer of construction materials to pay off the debt on the contribution to the authorized capital of Amethyst JSC | RUB 40,975 | Transfer and Acceptance Certificate |

| 19 | 68 VAT | The amount of VAT on purchased building materials, previously accepted for deduction, has been restored | RUR 7,375 | Certificate of acceptance and transfer of construction materials, Invoice |

| 58 | 19 | The amount of VAT recovered when making a contribution to the authorized capital of “Amethyst” is taken into account | RUR 7,375 | Certificate of acceptance and transfer of construction materials, Invoice |

| 76 | 91.1 | The amount of income from the transfer of building materials is taken into account (RUB 54,280 – RUB 40,975) | RUB 13,305 | Certificate of acceptance and transfer of construction materials, Invoice |

| 68 Income tax | 99 PNO | The amount of permanent tax asset is taken into account (RUB 13,305 * 20%) | RUB 2,661 | Accounting certificate-calculation |

VAT on sales of goods

In April 2015, JSC Everest sold LLC Kazbek a batch of goods - 12 inflatable boats for fishing:

- selling price of one boat – 94,350 rubles, VAT 14,392 rubles;

- unit cost of goods – 73,150 rubles.

The accountant of Everest JSC reflected these transactions with the following entries:

| Debit | Credit | Description | Sum | Document |

| 45 | 43 | The cost of a batch of boats sold by Kazbek LLC was taken into account (RUB 73,150 * 12 units) | 877.800 rub. | Costing |

| 76 | 68 VAT | The amount of VAT is reflected on the cost of sales (RUB 14,392 * 12 units) | RUB 172,704 | Invoice |

| 51 | 62 | Funds have been credited from Kazbek LLC as payment for a batch of inflatable boats (RUB 94,350 * 12 units) | 1,132,200 rub. | Bank statement |

| 62 | 90.1 | The amount of revenue from the sale of boats is taken into account | 1,132,200 rub. | Packing list |

| 90.2 | 45 | The cost of boats sold is written off as expenses | 877.800 rub. | Costing |

| 90.3 | 76 | The amount of VAT on revenue is taken into account | RUB 172,704 | Invoice |

VAT on the amount of advances received

An agreement was concluded between JSC Stimul and LLC Rubikon for the supply of cabinet furniture worth RUB 1,143,850, VAT RUB 174,486. On January 12, 2016, the supplier JSC Stimul received an advance payment in the amount of 100% of the cost of furniture delivery. On January 15, 2016, furniture was shipped from the warehouse of Stimul JSC to Rubicon LLC.

In the accounting of Stimul JSC, the accountant made the following entries:

| Debit | Credit | Description | Sum | Document |

| 51 | 62.2 | Funds have been credited from Rubikon LLC as an advance payment for the supply of cabinet furniture | RUB 1,143,850 | Bank statement |

| 76 Advances received | 68 VAT | The amount of VAT on the prepayment received is taken into account | RUR 174,486 | Invoice |

| 62.1 | 90.1 | Furniture was shipped from the warehouse of Stimul JSC to Rubikon LLC. | RUR 174,486 | Packing list |

| 90.3 | 68 VAT | The amount of tax on the sale of furniture is reflected | RUR 174,486 | Invoice |

| 62.2 | 62.1 | The repayment of the debt of Rubicon LLC with the previously transferred advance is reflected | RUB 1,143,850 | Bank statement, delivery note |

| 68 VAT | 76 Advances received | The VAT amount is accepted for deduction | RUR 174,486 | Invoice |

VAT upon termination of the contract

In June 2015, JSC Europe entered into an agreement with LLC Asia to carry out work to repair the production line of workshop No. 2. The cost of the work (327,350 rubles, VAT 49,934 rubles) was transferred as an advance to the bank account of Asia LLC. In August 2015, the contract with Asia LLC was terminated, the work was not completed, and the funds were returned to the account of JSC Europe.

When recording transactions, the accountant of Asia LLC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 51 | 62 Advances received | Funds have been credited as an advance payment from JSC Europe for the repair of the production line of workshop No. 3 | RUR 327,350 | Bank statement |

| 62 Advances received | 68 VAT | The amount of VAT accrued on the advance received from JSC “Europe” | RUR 49,934 | Invoice |

| 68 VAT | 51 | The amount of VAT transferred to the budget is 1/3 of the amount of quarterly obligations (RUB 49,934 / 3 months) | RUR 16,644 | Tax return |

| 62 Advances received | 51 | Funds were transferred to JSC “Europe” as a return of a previously received advance | RUR 327,350 | Payment order |

| 68 VAT | 62 Advances received | The VAT amount is accepted for deduction | RUR 49,934 | Tax return |

VAT on free transfer of property

JSC “Mecenat” carried out a free transfer of diagnostic equipment to the “Health Center”:

- cost of equipment - 874,650 rubles;

- the price of diagnostic equipment according to the assessment report is RUB 1,112,420.

JSC “Mecenat” made the following postings:

| Debit | Credit | Description | Sum | Document |

| 91.2 | 41 | Transferred equipment is reflected in expenses | RUR 874,650 | Packing list |

| 91.2 | 68 VAT | The amount of VAT is taken into account (RUB 1,112,420 * 18% / 118%) | RUR 169,691 | Transfer and Acceptance Certificate |

Stage 1 – calculation of PNA and PNA according to PR

We look at the Tax accounting register by type of accounting PR in turnover on accounts 90 and 91 not in correspondence with the account.

99.01. It is obvious from the entries that permanent differences are included in income tax calculations only after they are reflected in the income or expenses of the organization. Any balances of PR on the balance sheet accounts of assets or liabilities DO NOT AFFECT the tax calculation!

Postings are generated:

Dt 99.02.3 Kt 68.04.2 for the amount (TurnoverDt * Profit Tax Rate) – PNO

Dt 68.04.2 Kt 99.02.3 for the amount (TurnoverKt * Profit Tax Rate) – PNA

General rule:

If profit (income minus expenses) according to accounting data is greater than according to NU data, then a permanent tax asset (PTA) is formed, otherwise a permanent tax liability (PTA) arises.Simply put: positive amount of PR in income * 20% = PNA; positive PR in expenses * 20% = PNO

Example:

Dt 26 PR for 100,000 rubles. – costs are reflected. At the end of the month, they will form a debit turnover on the account. 90.

Dt 99.02.3 Kt 68.04.2 for 20,000 rubles. – reflection of PNO

Correspondence of account 91 with other accounting accounts

Almost any activity of the organization can become a source of other income and expenses, therefore the number of corresponding accounts is almost equal to the number of accounts in the plan. We have collected all the numbers in a table.

| Only by debit | Only on loan |

| 01 02 03 04 07 08 10 11 14 15 16 19 20 21 23 28 29 58 59 60 63 66 67 68 69 70 71 73 76 79 81 94 98 99 | 07 08 10 11 14 15 20 21 23 28 29 41 43 45 50 51 52 55 57 58 59 60 63 66 67 62 71 73 75 76 79 81 96 98 99 |