The organization's financial assets, which do not need to be used immediately in economic circulation, are often placed in deposit accounts in a bank. For the use of the organization’s financial resources, the bank accrues interest to it. (Article 834 of the Civil Code of the Russian Federation).

Question: How to reflect in an organization’s accounting the receipt of interest on a deposit in a smaller amount due to the organization’s early termination of a bank deposit agreement concluded last year? On December 26 last year, the organization placed funds in the amount of 3,000,000 rubles in a deposit account with the servicing bank. for a period of 270 days at 10% per annum. Interest is paid in a lump sum upon expiration of the bank deposit agreement. In case of early termination of the contract, the interest rate, according to the terms of the contract, is reduced to 1% per annum. On March 31 of this year, due to a lack of working capital, the organization terminated the bank deposit agreement. According to the terms of the accounting policy, the organization prepares interim financial statements on a monthly basis. View answer

Bank deposit agreement

The accountant works with an existing contract, while paying attention to a number of significant points:

- For what period is the deposit placed?

- Will the deposit be replenished?

- What is the mechanism for calculating interest upon early termination. Usually these conditions are stipulated in the text of the agreement, but if such information is not available, you should be guided by the norm of the Civil Code of the Russian Federation (Article 837 - 5), according to which the amount of interest is equal to that of similar demand deposits.

- Terms and procedure of payments. Interest begins to accrue from the next day after the placement of funds until the date of return of these funds to the organization (Civil Code of the Russian Federation, Article 839, paragraph 1), and is paid according to the periods specified in the agreement. As a rule, this is a month or a quarter. If the condition is not specified, the quarter is taken into account by default. Interest not claimed by the organization is added to the deposit amount, on which new interest is calculated (Civil Code of the Russian Federation, Art. 839, paragraph 2).

income in the form of interest on a deposit in accounting ?

It is also important to know the method of calculating interest. With simple interest, the amount invested is taken as the basis, on which interest is calculated. The base amount does not increase. Payment is made according to periods. With compound interest, interest is added to the deposit amount and interest is charged on the newly formed amount. Paid on the day the deposit is returned in one amount.

Let's look at both situations with an example. Let 20,000 rubles be invested at 9% per annum for a period of 2 years.

Simple interest. In the first year you will receive 20,000 * 9% = 1800 rubles and the same amount in the second year. The total deposit amount with interest will be 20,000+1800+1800 = 23,600 rubles.

How to reflect interest on a deposit in tax accounting ?

Compound interest. In the first year you will receive 20,000 * 9% = 1,800 rubles. In the second year:

- 20000+1800=21800 rubles – basic amount.

- 21800*9% = 1962 rubles – interest.

The total amount (with interest) will be 20000+1800+1962 = 23762 rubles.

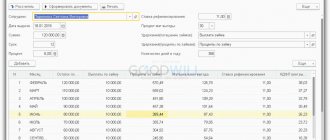

Interest on the balance of funds on the current account in 1C: Accounting

Published 04.11.2019 15:46 Author: Administrator Today, banks offer many bonuses to motivate customers to open a current account with them. One of these bonuses is the accrual of interest on the cash balance. This advantage allows temporarily free money to “work” without allowing it to be frozen and withdrawn from circulation. Unlike deposits and bank deposits, current accounts with interest accrual allow the organization to use funds at any time.

These accruals are unlikely to bring much profit, but they are quite capable of covering the cost of some bank services or compensating for the level of inflation. It is clear that no organization will refuse to receive this kind of “passive income”, but accountants who are faced with this operation for the first time have many questions. In the article we will analyze this operation in detail using the 1C: Enterprise Accounting program as an example.

Receipt of interest to the organization's current account

Typically banks transfer interest either on the last day of the month or on the first day of the next month. The receipt of funds to the organization's current account is reflected in the bank statement by the document “Receipt to the current account” (“Bank and cash desk” - “Bank statements”).

In accounting, the receipt of interest accrued on the cash balance to the current account is reflected by the posting:

Dt 51 “Current accounts” Kt 76.05 “Settlements with various debtors and creditors” - interest was received on the balance of the current account.

In this document, it is important to correctly indicate the type of transaction: “Other receipts.”

Interest accrual

Interest is calculated using the “Operation” document (“Operations” – “Operations entered manually” – “Create” button – “Operation” document type).

Next you need to enter the following entry:

Dt 76.05 “Settlements with various debtors and creditors” Kt 91.01 “Other income” - Interest accrued on the balance of the current account.

For tax accounting purposes, income in the form of bank interest is recognized as non-operating (clause 6 of Article 250 of the Tax Code of the Russian Federation).

It is important to remember: interest must be accrued on the last day of the month, regardless of when the bank actually transferred the funds to the organization’s current account. (Clause 1 of Article 271 of the Tax Code of the Russian Federation)

Such income is not included in the sales book, since it is not subject to VAT (Article 149 of the Tax Code of the Russian Federation).

Checking reflection in the program

We generate a report “Account Analysis” (76.05) or a balance sheet for account 76.05

The interest amount is accrued and transferred to the organization's current account.

Author of the article: Marina Alenina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Avatar 04/10/2020 22:31 I quote Olga:

I quote Sergey: I quote Olga: Good afternoon. And if from the statement, as part of other income, it would be a mistake to immediately indicate the corresponding account as 91.01?

This confused me too... Why drive through 76?

I talked to my accountant friends and they all said that they do it directly on 91.01. Good afternoon Quote from the article: “It is important to remember: interest must be accrued on the last day of the month, regardless of when the bank actually transferred the funds to the organization’s current account. (Clause 1 of Article 271 of the Tax Code of the Russian Federation) “Friends are mistaken, the calculation of interest must be carried out precisely through account 76 in this case in order to comply with this requirement of the Tax Code. Good afternoon I don’t understand why you refer to paragraph 1 of Art. 271 of the Tax Code of the Russian Federation (general norms), when it comes specifically to non-operating income (special norms), here you need to see clause 4 of Art. 271 of the Tax Code of the Russian Federation, “For non-operating income, the date of receipt of income is recognized as: 2) the date of receipt of funds to the taxpayer’s current account (cash) - for income: in the form of gratuitously received funds.” Your responsibilities in the contractual relationship with the bank do not include accruing interest in the form of a bonus, why should you accrue them? So who is making mistakes - the author or the friends? )) Quote -1 Sergey 02/15/2020 16:35 Quoting Olga:

I quote Sergey: I quote Olga: Good afternoon. And if from the statement, as part of other income, it would be a mistake to immediately indicate the corresponding account as 91.01?

This confused me too... Why drive through 76?

I talked to my accountant friends and they all said that they do it directly on 91.01. Good afternoon Quote from the article: “It is important to remember: interest must be accrued on the last day of the month, regardless of when the bank actually transferred the funds to the organization’s current account. (Clause 1 of Article 271 of the Tax Code of the Russian Federation) “Friends are mistaken, the calculation of interest must be carried out precisely through account 76 in this case in order to comply with this requirement of the Tax Code. 1 maybe..., 2 - probably..., but when it’s already 3, then.... And what is the requirement of the Tax Code? Article and point? Quote -1 Olga 01/27/2020 19:16 I quote Sergey:

I quote Olga: Good afternoon. And if from the statement, as part of other income, it would be a mistake to immediately indicate the corresponding account as 91.01?

This confused me too... Why drive through 76?

I talked to my accountant friends and they all said that they do it directly on 91.01. Good afternoon Quote from the article: “It is important to remember: interest must be accrued on the last day of the month, regardless of when the bank actually transferred the funds to the organization’s current account. (Clause 1 of Article 271 of the Tax Code of the Russian Federation) “Friends are mistaken, the calculation of interest must be carried out precisely through account 76 in this case in order to comply with this requirement of the Tax Code. Quote 0 Sergey 01/27/2020 18:52 Quote Olga:

Good afternoon. And if from the statement, as part of other income, it would be a mistake to immediately indicate the corresponding account as 91.01?

This confused me too... Why drive through 76?

I talked to my accountant friends and they all said that they do it directly at 91.01. Quote +3 Olga 11/13/2019 16:12 Good afternoon. And if it would be a mistake to immediately indicate the corresponding account as 91.01 from the statement as part of other income?

Quote

+2 Inna 11/13/2019 10:51 Thank you. current article. I really liked that there were links and explanations on the tax code. This is very important for a novice accountant.

Quote

+4 Victoria 11/12/2019 5:04 pm Thanks for the article. As always, clear and informative

Quote

Update list of comments

JComments

Accounting

The following accounts can be used to account for the deposit:

- 58 (according to PBU 19/2 -3);

- 55.3.

The chosen methodology should be recorded in the accounting policy. Money is credited to the deposit and the deposit is closed on these accounts in transactions with accounts 51, 52. Interest is also taken into account using accounts 91 and 76.

Postings when calculating interest using the simple option:

- D 55.3(58) K51(52) - deposit transferred for storage.

- D 76 K91.1 - interest accrued on the deposit.

- D 51 (52) K76 - interest on the deposit was received into the account (depending on the terms of the agreement - for the entire period of the agreement or monthly, quarterly).

- D 51(52) K 55.3(58) - return of money from the deposit.

Postings when calculating compound interest:

- D 55.3(58) K51(52) - deposit transferred for storage.

- D 55.3(58) K91.1 - interest has been accrued on the deposit for the month (each month the base increases by the amount of interest calculated in the previous period).

- D 51(52) K 55.3(58) - return of money from the deposit and interest.

When terminating a contract early, you need to take into account the frequency with which interest is paid, whether a simple or complex calculation method was used, whether the termination and conclusion of the contract took place in the same year or in different years.

Let's use the data from the example above. Invested 20,000 rubles at 9% per annum, calculated using the simple interest method. For the 1st, 2nd, and 3rd months of one quarter, the organization accrued: 1800/365 * (30+30+31) = 448.77 rubles. The bank calculated the same period at a reduced rate of 0.01%:

- 20000*1%= 200 per annum.

- 200/365 *(30+30+31)= 49.86 rubles.

- 448.77- 49.86 = 398.91 – interest excessively accrued by the organization, adjusted amount.

The amount is reversed in accordance with PBU 9/99-6.4: D 76 (55, 58) K91.1 - 398.91 “reversal” if the contract affects only the current year, and is written off as losses of previous years in accordance with PBU PBU 10/99-11 in otherwise: D91-2 K76 (55, 58) - 398.91.

Which accounts are involved in accounting entries for accounting for deposit transactions?

The deposit account refers to the so-called special accounts in the bank, for the accounting of which account 55 is intended in the accounting department. The Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n, as amended on November 8, 2010) provides for several sub-accounts for this account. Deposits are accounted for in subaccount 55.3 “Deposit accounts”.

Since deposits are recognized as financial investments in accordance with clause 3 of PBU 19/02, they can also be taken into account in account 58 “Financial investments” by opening the corresponding sub-account.

NOTE! The organization establishes the method of accounting for the movement of money on deposit in its accounting policy.

Accounts 55 and 58 are active, so an increase in funds on deposit will be by debit, and a decrease in the deposit account or returned to the owner to the current account will be by credit.

As for the entries on the receipt of interest on the current account and, accordingly, their accrual, account 91 “Other income and expenses” will be involved in them. Subaccount 1 to this account “Other income” is intended to reflect various income, including interest received, from activities not related to the main one.

The terms of the bank deposit agreement may affect taxes and accounting for the depositor. Find out how to check the wording of the contract from the Transaction Guide from ConsultantPlus. Get trial access to the K+ system and study the material for free.

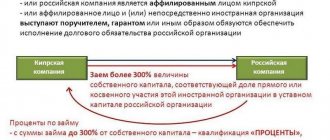

Tax accounting

The deposit amount is not an expense for tax purposes either when using the general tax regime (OSNO) or when the organization operates on the simplified tax system; the return of such an amount after the expiration of the deposit agreement is not recognized as income (Article 270-1, 346.16, 346.15, 251-1 clause 10 of the Tax Code of the Russian Federation)

Interest on the deposit does not affect the VAT tax base. The Ministry of Finance has repeatedly written about this in its explanations and letters (for example, document No. 03-07-15/41198 dated 04-10-13).

At the same time, according to Art. 250-1 of the Tax Code of the Russian Federation, interest on a deposit is the organization’s non-operating income, which should be recorded in the accounting data every month, regardless of the terms of payment and the accrual of interest under the agreement. In addition, interest should be reflected on the date of termination of the contract (Article 271 - 6 paragraph 1.3 of the Tax Code of the Russian Federation). In total, interest is calculated as specified in the agreement.

The simplified tax system also recognizes interest on deposits as income on the basis of Art. 346.15-1 Tax Code of the Russian Federation. Simple interest is included in the income side for tax purposes on the day it is received in the organization’s bank account, and compound interest is included on the day the interest is added to the deposit amount.

In case of early termination of the contract, when calculating interest, the bank applies a reduced rate, and for the bank client, interest is calculated and included in income every month, according to the original terms of the contract.

When calculating income tax (OSNO), a difference is created. It needs to be corrected. If the contractual relationship with the bank began and ended in the same year, then the data for the reporting periods are adjusted by submitting updated declarations or by entering data to reduce them in the declaration of the period when the contract was terminated (Article 81-1, Article 54-1 of the Tax Code of the Russian Federation) .

Inflated income reflected in various tax periods is corrected by declaring updated data for the corresponding period or by including the excess income amount in losses of the previous period (Article 265-2-1 of the Tax Code of the Russian Federation).

Under the simplified tax system, if interest was paid at the end of the contract, no problems will arise. The actual amount transferred will be included in the data for the corresponding period.

Interest amounts are calculated by the bank and included in income in the amount calculated by it. If the agreement is terminated early, the organization can reduce its tax base by the amount of excess income received in the previous period.

Attention! If a contract is entered into and terminated in the same month, revenue should be recognized on the day the contractual obligations are terminated. The interest rate is taken based on the condition of urgent demand by the organization of the deposit amount.

How interest goes to the organization's account

Typically, the bank transfers interest on the last days of the current month or the first days of the next month. The receipt of funds becomes known after viewing the document “Receipt to the current account” (“Bank and cash desk” - “Bank statements”).

Interest on the balance of funds that arrived at the account of an organization or enterprise is reflected by posting Dt 51 “Settlement accounts” Kt 76.05 “Settlements with various debtors and creditors.”

In the corresponding field, indicate the required type of transaction - “Other receipts”.

Entries for interest on loans received

Accounts 66 and 67 are intended to account for received borrowed funds. The first accounts for funds received for a period of up to 1 year (short-term), and the second accounts for long-term ones. In correspondence with the same accounts, entries are made to calculate interest on the loan or credit received. But you need to reflect the interest separately here:

- from the amount of the principal debt;

- from interest accrued under other agreements.

Thus, the borrower’s entries for the accrual of interest under the loan agreement in the credit part of the accounting record will always have correspondence with account 66 or 67. The choice of the account shown in the debit part depends on whether the borrowed funds are provided for the purpose of acquiring (creating ) specific investment asset. If such a purpose is specified in the loan agreement, then until the start of using this asset, interest forms its value (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n):

Dt 08 (07) Kt 66 (67).

In all other situations, including for interest accrued after the start of using the investment asset, the following posting is used:

Dt 91 Kt 66(67).

Persons using simplified accounting have the right not to include interest in the cost of an investment asset.

The payment of interest to the lender will be reflected in the entry:

Dt 66 (67) Kt 51 (50).