How to find out Octmo companies?

To find out OKATO, you can contact the Federal Tax Service office, use the tax service terminal, or call the tax service hotline. However, such methods require time and effort; it is much easier to find out the OKATO code online using the Internet.

Interesting materials:

What is heavy water? What is Typhoid status? What is Timomegaly? What is Tin? What is authentication type? What is the payment type in a payment order? What is the encryption type? What is super soft fabric? What is TNT Premier? What is the winter solstice point?

How to make a payment with 11-digit OKTMO

11 January 2018

In September 2022, the Ministry of Finance tightened the requirement of rule 107n for filling out budget details. One of the requirements is that the length of the OKTMO field is equal to only 8 characters. Previously, input of either 11 or 8 characters was allowed. 11-digit OKTMOs are assigned to city municipalities, but 8-digit OKTMOs are also assigned to urban entities for which they are credited to the budget. Now, when paying a tax, fine, or state duty to the budget of the Russian Federation, you may encounter difficulties if an eleven-digit OKTMO is indicated on the receipt. For example, let’s take payment through Sberbank Online as an example. If we enter the old OKTMO with a length of 11 characters, then it simply will not fit in the OKTMO field. Only 8 characters will be included.

In the overwhelming majority, to make a payment using the 11-digit OKTMO, it is enough not to enter the last 3 digits.

For example, for the city of Nizhny Novgorod, an OKTMO of 11 characters is 22701000001. But also for the city of Nizhny Novgorod, an OKTMO of 8 characters is assigned 22701000. Therefore, if the receipt has an OKTMO of 11 characters and it ends with 001, as for a city municipality, then the last tail You can safely discard and enter the first 8 characters. The same is true for any city. If OKTMO ends in 001 and consists of 11 characters, then simply do not enter the last 3 characters, but enter only the first 8. If OKTMO is written on the receipt as 11 characters and ends with zeros, then just in case you need to check whether this OKTMO is not really old OKATO? For example, this can be done in the OKATO and OKTMO compliance directory.

If you don’t wear this OKATO there or you find that it’s still OKTMO, then the recommendation is the same - just discard the last 3 zeros.

OKTMO code

The territory of Russia is very large. For convenience, the whole country is divided into small territories - municipalities. Power in these territories is in the hands of local elected self-government. There are more than 20 thousand municipalities in total. For normal interaction with government authorities, each such entity has its own special code.

The OKTMO code is necessary to distinguish and establish regions, cities, districts, settlements, etc. The code also helps to find out where a certain organization or individual entrepreneur is registered. In this case, it is necessary to know the TIN or at least the address of a particular business entity.

What is Octmo in Sberbank Online

OKTMO codes are used so that Rosstat can systematize information about the activities of organizations and individual entrepreneurs. First, Rosstat reads the codes from the reports submitted by the payer (organization or individual entrepreneur). Then, using the codes, it recognizes which municipal entity the legal entity or entrepreneur belongs to.

OKTMO

is a classifier of objects of the administrative-territorial division of the Russian Federation, part of the “Unified System of Classification and Coding of Technical, Economic and Social Information of the Russian Federation” (USCC). Approved on December 14, 2005.

What; is OKTMO

- Declaration of the simplified tax system;

- UTII declaration;

- VAT declaration;

- 2-NDFL, 3-NDFL, 4-NDFL;

- land tax;

- transport tax;

- mineral extraction tax;

- excise tax declaration;

- gambling tax return.

The OKTMO code was introduced not so long ago - in 2014. Before this, the OKATO classifier (All-Russian Classifier of Objects of Administrative-Territorial Division) was used. But he could not indicate the city, intra-city district, town or village in which the enterprise is located. Thanks to the OKTMO classifier, it is much easier for Rosstat to process and systematize information.

In all required documents today, the law requires entering the code OKTMO, not OKATO. To replace the usual combination of numbers with the correct one, you need to use the translation tables developed by the Ministry of Finance of the Russian Federation. This can easily be done online using numerous Internet services.

The OKTMO code replaced OKATO (All-Russian Classifier of Administrative-Territorial Divisions) in 2014. The reason for the change is the improvement of the rubricator, which added a position for specific settlements of a lower classification level.

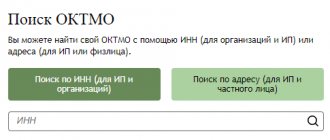

- You can find out OKTMO by address or place of residence on the official tax resource - nalog.ru; for this you will need to enter information about the subject of the Russian Federation, as well as the municipality. As an alternative search, you can use the service on the website www.ifias.ru.

- You can find out OKTMO by OKATO (the old code used until 2014) by using the official service on the tax website by clicking on the link in the first paragraph. You can also use an alternative - on the website oktmo.rf.

- Some people try to find out OKTMO by TIN, this is possible, but we will not give an example, since it is difficult and you will still have to enter the address, so you will perform the search described in the second paragraph.

You may like => Personal income tax for individuals 2022

What is the easiest way to find out OKTMO? You can look at the code in the registration certificate, but only an individual entrepreneur or the head of an organization can do this, but what if there is no access to such documentation? In this case, the easiest way is to use special services.

Octmo 11 digits Sberbank asks for 8

Since 2014, the previously used OKATO has been replaced by a new code - OKTMO. How does OKTMO stand for? Considering that the purpose of the encoding is practically the same as in the previously used one, OKTMO as a decoding of the abbreviation sounds as follows - an all-Russian classifier of territories of municipalities.

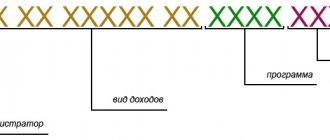

- Name – the first 2 digits, which reflect the name of the region of the country;

- Identification – 3 subsequent characters that provide information about the area or city;

- Information about the object – the last 3 numbers, where the specific city or town of the organization’s location is encrypted.

Organizations and entrepreneurs quite often make mistakes in the tax payment details, so the Federal Tax Service requires the development of a bill introducing a fine for incorrectly indicated OKTMO. Today, tax payments must be made even if the OKTMO is incorrectly specified, however, if the bill is approved, then you will have to pay for errors.

You may like => Does the Chernobyl Zone Have a Property Tax?

The OKTMO structure contains a special system of control numbers, which makes it possible to reduce possible errors in the process of entering identification codes into the database to a possible minimum. The changes associated with the replacement of classifiers do not apply to filling out tax returns for all types of taxes.

The code is assigned automatically when registering a new legal entity or individual entrepreneur. Most often, such information is transmitted to entrepreneurs in a notification from the territorial division of Rosstat, since it is this service that mainly uses the territory classifier when generating statistical information on various topics.

The territory classifier is a huge collection of data, and if an entrepreneur has lost or forgotten his code, it will be difficult to understand it on his own. To make it easier for companies, numerous services operate online. Information can be obtained for free, for example, on the Tax Service website using the “Find out OKTMO” program.

What is Octmo in Sberbank Online

KBK

- Budget classification code. And in order to understand exactly for what purposes a citizen transfers funds to the budget, another code of twenty digits was added for convenience, separated by spaces. You never know where the Pension Fund will want to spend a citizen’s money. But with KBK he will no longer be able to get away with it and will have to transfer it where it should be, and not to Mercedes. And in order to make it very convenient to enter this KBK into the payment slip, the hand-assed graphical interface developers count spaces as separate numbers, and everything that, due to spaces, exceeds the twenty-character limit is simply cut off. Suffer citizen, before copy-pasting the KBK, do not forget to manually remove the spaces!

BIC

— Bank Identification Code. The only thing from the above that brings goodness and light. This code uniquely identifies the bank and even its specific branch, if there is more than one. Since the BIC is also used by commercial banks that don’t give a damn about their clients, a de facto standard was set in the user interface - if the client specified the BIC in the information bank, then all other data of the desired bank is pulled up and displayed automatically. There is no need to enter any TIN or bank name, everything is done for the client. To make a transfer, all that remains is to indicate the account number, full name of the payment recipient and the amount.

How many characters - meaning

The directory contains certain code values officially assigned to municipalities and regions (subjects) of the Russian Federation.

Consequently, business entities and other organizations located and operating within a certain territory must use the code of this territory when preparing bank statements and financial statements.

Thus, OKTMO is an ordered sequence of 8 (eight) or 11 (eleven) digital characters, the combination of which indicates a specific territory and contains the following information:

- A subject (region) of the Russian Federation is indicated by a combination of the first (I) and second (II) digits of this code.

- Each populated area located within the borders of a given subject of the Russian Federation is designated by a combination of the third (III), fourth (IV) and fifth (V) digits of OKTMO.

- Rural/urban settlements, as well as territories located between them, within a particular locality are indicated by a combination of the sixth (VI), seventh (VII) and eighth (VIII) digits.

- A settlement located within a specific municipal territory is designated by a combination of the ninth (IX), tenth (X) and eleventh (XI) digits.

Principles of application

The OKTMO directory was developed by the department of state statistics, since it is this structure that uses the corresponding codes in its activities.

The use of data contained in OKTMO is regulated by Order No. 159-st, approved by Rosstandart on June 14, 2013.

It should be noted that the current OKTMO classifier was developed and implemented from 01/01/2014 as a replacement for the OKATO directory, which was used previously (before 01/01/2014) for the same purposes.

The new directory provides for a more extensive coding of territories than the OKATO directory, which has already been taken out of service since 01/01/2014. Thus, OKTMO has in-depth detail of municipalities.

However, business entities do not need to delve into the existing procedure for compiling codes, since their meanings do not need to be generated independently. The finished code can be easily found in the reference book.

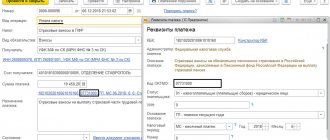

On what line of the payment slip is it written?

Order number 107n, approved by the Ministry of Finance of the Russian Federation, provides for updated rules for drawing up bank payments.

This regulatory act prescribes the replacement of the OKATO code with the OKTMO code when drawing up a document on non-cash transfer of money from a bank account.

This indicator should be reflected in field 105 of the payment slip - exactly where OKATO was previously registered.

It is noteworthy that OKTMO and OKATO agree with each other only in the first and second digits.

The remaining signs designating territorial (municipal) entities have completely changed.

When drawing up relevant documents, tables for converting canceled OKATO codes into existing OKTMO codes are often used.

Whose code should be indicated in field 105 – the payer or the recipient?

In the payment order, in field 105, you should enter the unique code of the particular municipality within which the non-cash payment is made or the payer (business entity) operates.

If the organization has separate divisions, the required documentation should reflect the code of exactly the territorial area in which the corresponding division is located.

What should I set for taxes?

If a tax payment is transferred on the basis of a tax declaration, the OKTMO corresponding to this declaration should be specified in the payment order issued.

Thus, in the payment slip in field 105 you need to enter the code of the territorial area within whose borders the mobilization of tax payment funds is carried out.

It is important to remember that this code is a requisite that clearly provides a clear identification of the payment being made.

When filling out a payment order to pay taxes, the payer should indicate the code of the recipient of this payment - the municipality/region.

Octmo 11 digits Sberbank asks for 8

OKATO is a decoding of the territorial affiliation of an economic entity. The abbreviation means the all-Russian classifier of administrative-territorial entities. The encoding was developed by Rosstat. The goal is to simplify the automatic processing of data provided in a number of documents. Using the code, it is easier to determine whether financial contributions belong to a particular territory.

- Name – the first 2 digits, which reflect the name of the region of the country;

- Identification – 3 subsequent characters that provide information about the area or city;

- Information about the object – the last 3 numbers, where the specific city or town of the organization’s location is encrypted.

Features of reflecting OKTMO in the payment slip

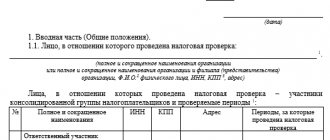

Reconciling the invoices did not take much time - both merchants successfully completed the task of filling them out. But a dispute still broke out over one prop. The OKTMO code, reflected in everyone’s payment document in field No. 105, for some reason had a different length. For individual entrepreneur M.N. Zakharov it consisted of 11 characters, and the founder of Sadko LLC counted only 8 digits in his code. Did someone really miss some characters or add extra ones?

IMPORTANT! OKTMO codes can be found using the All-Russian Classifier of Municipal Entities (approved by order of Rosstandart dated June 14, 2013 No. 159-st).

In addition, it turned out that friends used different sources to obtain information about OKTMO.

In fact, both turned out to be correct. The classifier included both 8- and 11-digit OKTMOs. However, it must be taken into account that the OKTMO code in the payment order must match the OKTMO code in the tax return.

If you have access to ConsultantPlus, check whether you filled out the payment order for taxes correctly. If you don't have access, get a free trial of online legal access.

Also you can define the code

The second section codes include these 8 characters, and 9, 10 and 11 designate a locality within a large municipality. In this case, values from 001 to 049 are assigned to cities, from 051 to 099 - to urban settlements, and from 101 to 999 - to rural settlements. The larger the settlement, the fewer signs OKTMO includes. For example, the city of Dmitrov in the Moscow region has a code of 46608000, and the village of Antropovo in the Kostroma region has a code of 34602403101.

OKTMO replaces OKATO

The state needs the OKTMO code to simplify and speed up the processing of information about business entities, create a unified database and predict economic development. In addition, it determines the territorial affiliation of the taxpayer and indicates the local budget to which the treasury will transfer the payment.

The website nalog.ru has developed a special service https://service.nalog.ru/, with which you can generate and print a receipt for paying tax. Since tax payment receipts now need to indicate OKTMO, using this service you can not only prepare a receipt, but also find out the OKTMO code of the tax office you are interested in.

How many OKTMO characters 8 or 11 are in a payment slip, declaration

Most often, the OKTMO value consists of 8 digits. This is a common situation when an organization is located in a territory that is not divided into populated areas. That is, it is located in a municipality. In this case, the OKTMO code will have 8 digits. Let us explain why this is so.

How many characters should there be in the OKTMO payment order: 8 or 11?

The fact is that now RSB (settlements with the budget) cards for each taxpayer are opened according to the KBK number for a specific tax or fee and the corresponding OKTMO code, and not OKATO (Order of the Federal Tax Service of Russia dated November 29, 2022 No. ММВ-7-1/ 530). That is, all payments will be posted according to the new code.

One of the most important advantages of paying for various services in Sberbank Online is that payments can be made any day of the week, regardless of the time of day. One of these convenient opportunities is to search for an organization and make a payment using the TIN.

Indication of OKTMO in the payment order

The OKTMO code is a special digital designation that is assigned to each municipal entity in Russia. The OKTMO code in the 2022 payment order is entered in accordance with the Order of the Ministry of Finance No. 107n of 2013, which defines the basic rules for filling out payment orders. According to his instructions, all fields and lines of the payment must be filled out accordingly. If any mandatory details are not included in the document, the bank will not accept such an order for execution. Therefore, the territory code in the form OKTMO should always be indicated on the payment slip.