What should be displayed

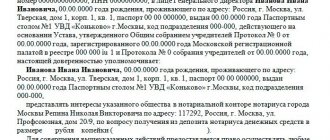

The header of the document should contain the following:

- full name of the organization;

- the date when the order was drawn up;

- registration number;

- title;

- wording: “Based on the reporting documents provided... (the full name of the employee is written here) I ORDER”;

- text;

- signature of the person responsible for the execution of the order and its transcript;

- director’s signature and its transcript;

- signature of the employee (who needs to reimburse the expenses) and its transcript in the familiarization column.

The text itself should contain the following information:

- Full name of the employee who needs to be reimbursed.

- The structural unit in which the employee works, as well as his position, rank, class, qualifications.

- Wording: “To pay as compensation for expenses in excess of the advance received in connection with the stay in ... from ... to ... year ... rubles .... kopecks ... (amount in words).”

- Basis and listing of supporting documents.

- Wording: “Control over the implementation of this order is entrusted to ... (position and full name of the responsible person).”

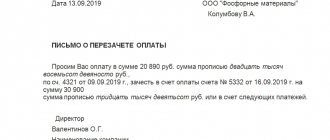

How to make a claim

The law does not establish mandatory requirements for the content of claims, but judicial practice indicates the need to comply with certain conditions, the presence of which affects the dispute process. If your dispute arose from an agreement that does not provide for a complaint form and mandatory requirements for it, then we recommend that you adhere to the drafting in accordance with the following structure.

- Introductory part: describe the reasons for the dispute; characterize the contractual relations between the parties; list what actions were taken by the parties to the disputed agreement; indicate the addresses and contact details of the parties.

- Reasoning part: refer to the legal norms that, in your opinion, the counterparty violated; make references to clauses of the contract that are not respected.

- Final part: formulate your demand to the counterparty for financial or material compensation; it will be more convincing if the claim for damage to the property of a legal entity contains an estimate of losses; fix the period during which the other party must fulfill your conditions; indicate your right to go to court if demands are ignored; put your signature, date and seal (if its presence is provided for by the charter).

When writing, adhere to a formal business style. Avoid phrases with emotional connotations. Try to formulate the requirements in such a way that the entire letter is no more than two A4 pages.

The claim refers to documents that are expected to be used in court in the event of an escalation of the dispute. In this regard, we recommend sending supporting documents that the counterparty does not have. This action will bring clarity to the dispute and help lead to a settlement at the pre-trial stage.

IMPORTANT!

We recommend that you always send along with your complaint a document confirming the authority of the signatory (power of attorney, order of appointment to a position). This will eliminate the risk of an appeal against you in court with the fact that the letter was signed by a person who does not have the appropriate authority to do so, so the pre-trial procedure may be considered not to have been followed.

Guarantees for the organization's personnel

Article 167 of the Labor Code of the Russian Federation spells out important points that are worth paying attention to when drawing up an order. If a company decides to send its employee on a business trip, then he must retain his position and average monthly salary, in addition, the organization must compensate for all costs.

From the above it follows that the following guarantees have been established for the organization’s personnel (who were sent on a business trip):

- The job is saved.

- The same salary remains.

- The director of the organization covers all expenses for the business trip.

Errors when approving expense reports

The accountable person is obliged, within a period not exceeding three working days after the day of expiration of the period for which the money was issued on account, to present an advance report with attached supporting documents.

If an employee does not timely report on accountable amounts due to absence from work (for example, in case of illness), a special procedure applies. It is necessary to count three working days from the date following the day of expiration of the period for which the money was issued, “or from the day of going to work” (clause 4.

One of the pressing questions is how long after the date of submission by the employee (accountable person) the advance report must be approved. More precisely: can an employer deliberately delay the approval of an advance report without returning the overexpenditure (if any) to the employee?

It all depends on what period of approval of advance reports and settlements with employees is specified in the employer’s internal documents. Regulation No. 373-P contains a condition that the manager sets the time allotted for these procedures independently.

If the specified period is not established and there is, indeed, an untimely implementation of settlements with accountable persons to reimburse the recalculation, the question of responsibility for these actions arises.

Administrative liability for late approval of an advance report is not established in law. It is also not prohibited not to immediately compensate the employee for overexpenditure, but to make payments in installments. However, it is necessary to take into account the rules on the financial liability of the parties to the employment contract.

The employer's financial liability in case of violation of the established deadline for payment of wages, vacation pay, dismissal pay and other payments due to the employee is provided for in Article 236 of the Labor Code of the Russian Federation, according to which if the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in the amount of not less than one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time from amounts unpaid on time for each day of delay starting from the next day after the established payment deadline for the day of actual settlement inclusive.

The concept of “other payments due to the employee” is not disclosed in this article, due to which other payments may also include expenses made by the employee from his own funds for a business trip, the purchase of property for the organization with the consent of the employer, which are subject to reimbursement to the employee upon approval by the employer advance report of an employee who incurred expenses from his own funds.

There are not many court decisions on this topic. As an example, consider the decision of the Ust-Yansky District Court of the Republic of Sakha (Yakutia) dated February 11, 2011 No. 2-13/2011, in which the court made the following conclusions:

- the inclusion of the employee’s expenses in account 71 indicates the employer’s agreement to offset the debt to the employee, the employer becomes financially liable for its actions in late payment to the employee of other payments due to the employee;

- if the advance report was never approved by the manager, interest is calculated from the date the employee submits the advance report to the employer.

It is worth noting that while there are no official explanations from regulatory agencies on this issue, as well as judicial practice at the federal level, organizations have a chance to avoid the accrual of interest under Article 236 of the Labor Code of the Russian Federation.

The following arguments can be used in court. Article 236 of the Labor Code of the Russian Federation states, as stated above, including “other payments due to the employee.” Reimbursement for overexpenditure of accountable amounts can be regarded not as payment, but as compensation. Article 236 of the Labor Code of the Russian Federation does not mention the application of interest to compensation provided for by current legislation.

In the first part of this section, we looked at the consequences of violating the procedure for approving an advance report by the employer. Let's analyze the reverse situation.

What happens if an employee does not timely submit an advance report for approval by the employer? Is it possible to bring such an employee to disciplinary liability?

A similar situation was the subject of consideration in the Decision of the Ust-Kut City Court of the Irkutsk Region dated April 10, 2013 No. 2-405. The court concluded that disciplinary action was unacceptable.

In accordance with the requirements of current labor legislation, a disciplinary sanction can be applied to an employee for violating labor discipline, that is, for a disciplinary offense.

A disciplinary offense is a culpable, unlawful failure or improper performance by an employee of his assigned job duties (violation of legal requirements, obligations under an employment contract, internal labor regulations, job descriptions, regulations, orders of the employer, technical rules, etc.).

An employee of an organization is not required to know the norms of Regulation No. 373-P (the need to report within three days) if, due to labor relations, his responsibilities do not include knowledge of this provision.

As a result of considering this case, the court also awarded moral damages to the employee.

The court's decision would have been different if the organization had had an internal document on settlements with accountable persons, which would have provided for a rule on the deadlines for submitting the advance report.

All employees should be familiarized with this document upon signature. In this case, the violation could be regarded as a disciplinary offense with the appointment of penalties provided for by law: warning, reprimand, dismissal.

Let us add that it is unacceptable to fine an employee (impose financial sanctions) for late submission of an advance report, as well as for other disciplinary offenses. Measures of financial responsibility in this case are not provided for by current legislation.

The employer can recover the amount of debt for unspent accountable amounts.

According to Article 392 of the Labor Code of the Russian Federation, the employer has the right to go to court in disputes about compensation for damage caused to the employer within one year from the date of discovery of the damage caused. If this deadline is missed for valid reasons, it may be restored by the court.

What expenses must the organization compensate?

Based on Article 168 of the Labor Code of the Russian Federation, an organization that decides to send one of its staff on a business trip must necessarily compensate for:

- Fare:

- if the employee used his personal car;

- if the employee had to rent property, for example, a car;

- if the employee had to travel by public transport or use a taxi.

- Expenses for rented residential premises under a rental agreement.

- Daily allowance (employee expenses for personal needs, for example, food).

- Other expenses:

- mobile connection;

- Internet;

- currency exchange.

Note! An order for reimbursement of expenses should be issued only after the employee has returned from a business trip.

What documents should I attach to the note?

Just one note is not evidence of expenses. Documents indicating the amounts spent should be attached to it:

- motor vehicle passport;

- registration certificate;

- power of attorney (if the employee is not the owner of the car);

- documents confirming expenses.

IMPORTANT!

The main document confirming the use of the car in the interests of the employer is a waybill. The details and procedure for filling it out were approved by Order of the Ministry of Transport No. 368 dated September 11, 2020. Gasoline costs are confirmed by gas station receipts, receipts, electronic tickets, and bank card statements.

How many years is a document kept in the archive?

Orders are stored in the archives of any organization:

- 5 years;

- 75 (50) years old.

In the first case, those orders are stored in which employees were sent by the director on international business trips and business trips within the Russian Federation, the duration of which is no more than 10 days. As for the second case, such orders for reimbursement of expenses are kept for so long, in which it was indicated that the employee is sent:

- on a business trip in the Russian Federation for a period of 10 to 60 days;

- on international business trips for a period of 10 to 60 days.

Grounds for refusal to reimburse expenses

In some cases, an employee may be denied compensation for expenses:

- the expenses were incurred without the consent or knowledge of the employer;

- documents confirming expenses are not properly executed, their authenticity is in doubt (lack of details to prove expenses were made in the interests of the employing organization, lack of a manager’s signature approving them);

- the papers attached to the note do not prove the fact that expenses were incurred for production purposes;

- the terms of the employment contract do not provide for the possibility of making payments to an employee who has incurred expenses for official purposes.

Thus, even the action of a citizen aimed at benefiting the organization, but in violation of local acts, does not oblige management to pay compensation for expenses incurred.

Mistakes that are made when filling out a document

Most often, when filling out an order, a specialist may make the following mistakes:

- spell the name of the organization incorrectly;

- omit or write incorrectly the date of the document;

- do not indicate the registration number;

- do not write the amount to be compensated in words;

- incorrectly write the name of the employee who needs to reimburse expenses;

- do not indicate the position;

- do not indicate the responsible person;

- make corrections with a simple pencil or a pen of a different color;

- write the text in illegible handwriting;

- make a lot of corrections in the document;

- make spelling mistakes;

- incorrectly indicate the amount to be reimbursed;

- artificially age a document;

- erase the text.

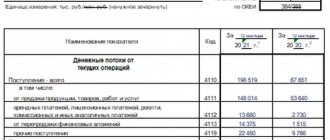

Checking settlements with an employee

To check mutual settlements with an employee, you need to create a Turnover Balance Sheet for account 73.03 “Settlements for Other Operations” section Reports - Standard Reports - Turnover Balance Sheet for an Account.

In conclusion, we would like to add that we do not recommend using this scheme all the time, preferring it to the good old reporting. The purchase of goods (works, services) by an organization with payment from the personal funds of employees may have problems:

- the acquisition may be considered by the tax authorities as expenses incurred in favor of employees with additional personal income tax (clause 2 of Article 226 of the Tax Code of the Russian Federation and subclause 2 of clause 1 of Article 228 of the Tax Code of the Russian Federation);

- in the absence of a purchase and sale agreement between the employee and the organization, the tax authority may not recognize expenses on documents issued to the employee for tax purposes.

If the documents confirming the purchase of goods and materials are issued in the name of the organization, then the organization will not have problems with recognizing costs and deducting VAT, as well as difficulties associated with settlements with employees.

See also:

- [04/06/2021 entry] Accounting policy for 2022 in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Modern report: new technologies change the usual rules...

- Do I need a code for the type of income in the payment slip for reporting? From June 1, 2020, employers must indicate in their payroll...

- The account returned to the cash desk must first go to the bank. The accountant returned the unspent funds to the enterprise's cash desk. Could it...

- The “Dismissal” document erroneously does not stop personal deductions for personal income tax...

How to correct mistakes made

If an error is found in the document, you must do the following:

- Rewrite/retype the document. You can use this method if an error is noticed:

- before the manager’s signature was affixed;

- at the time of signing.

- Issue a new order. But before you start issuing a new one, you need to create an order canceling the order, which contains various types of errors. It should contain the following:

- registration number;

- the date it was compiled;

- document's name;

- the beginning of the text, starting with the words: “Declare invalid” or “Consider invalid”;

- grounds for cancellation;

- who is responsible for corrections;

- signature.