Author of the article: Sudakov A.P.

Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production, premature wear is possible.

Disposal of unusable instruments

Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use. If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

Is it necessary to remove tools that are unsuitable for further use from the balance sheet of an enterprise?

All material assets of a business entity are taken into account in its financial documentation. Therefore, it is impossible to simply throw away an item that is unusable. At the first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting records.

Instruments that have become unusable must be removed from the register through write-off. The procedure is regulated by the norms of legal sources. Its competent implementation eliminates inconsistencies in various reporting forms.

In order to prevent theft of the enterprise's property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation. It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further use the tools due to their damage, as well as the amount of equipment that is subject to write-off.

Accounting and write-off of instruments

- STK INDUSTRY NEWS

- ABOUT COMPANY

- PHOTO GALLERY

- QUESTION ANSWER

- WE TRUST

- OPTIMIZATION OF EBITDA TAXATION

- The volume of electrical installation work performed is being analyzed

- The volume of electrical installation work performed is being analyzed

- Terms of reference for the creation of a video surveillance system

- Coordination of additional work

- April 2012 Delivery of the educational complex “Installation of external networks” ANO MASCP

- Construction documentation

- Day 1

- “Smart Grid” - a new idea or a logical development of power supply systems?

- EBITDA

- DGS OPERATION (PHOTO)

- DGS OPERATION (PHOTO)

- The volume of electrical installation work performed is being analyzed

- CROC Data Center “Compressor” (Tier III)

- CROC Data Center “Compressor” (Tier III)

- AUTOMATION

- Training course “Design, construction and operation of data center engineering systems”

How is write-off carried out?

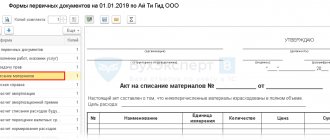

A mandatory element of the write-off procedure is the drawing up of an appropriate act indicating the fact of the event and the justified reasons for its initiation. The number of instruments and their identifying information are displayed in the receipt documentation. A correctly executed act for writing off equipment that has become unusable allows you to maintain reliable accounting records. Timely write-off reduces the tax burden on the enterprise.

Order on the creation of a commission

Responsible employees are recommended to conduct an audit of the material assets of a business entity once a month. Identified instruments that cannot be used in a future period are subject to write-off, provided that they are officially registered. If the reason for the unsuitability of the inventory is not production activity, but the impact of external circumstances on the object, then the act must display documentary evidence of the event.

Write-off of material assets for other reasons

Nowadays, several types of adjustable wrenches are used in everyday life, which are divided according to the angle of inclination of the worm axis (or rack) to the longitudinal axis of the handle (see Table 17). Keys of types I and II were painted with black varnish, keys of type III were galvanized. Most often, adjustable wrenches with a maximum jaw size of 30 mm are used for plumbing work. They are needed for fittings with a decorative coating, when installing a plastic horizontal float valve body, etc.

With modifications with the head rotated 90°, the palm places emphasis on the large plane of the head, and not on the small one.

An adjustable wrench is a regular open-end wrench, in which you can change the gap between the jaws. Most often they are used in everyday life, not in professional activities. Masters avoid them because of the following disadvantages:

- The large size of the head makes it difficult to work in hard-to-reach places.

- The play of the horns does not allow the nut to be tightly fixed, which, with little effort, leads to smoothing of the corners and breaking, and this can result in injury.

- It is impossible to generate significant torque due to low strength.

- It is necessary to constantly adjust the jaws while working.

The hardware remains suitable for lower performance programs such as word processing or email.

What kind of document is this?

The act of write-off certifies the fact of using material assets or rendering them inoperable as a result of certain events.

It indicates the deregistration of an item that subsequently cannot be used to solve production problems. Material assets are items acquired by a business entity through its own financing of the purchase operation. They can be used to implement entrepreneurial ideas when creating products, as well as to meet the needs of the enterprise.

Write-off order

A distinctive feature of material assets is the fact of their acquisition at the expense of a business entity. One of their many varieties are instruments. They are used to meet the needs of a company or to support a production process.

During operation, all tools wear out, as a result of which their further use becomes impractical, which is the reason for their write-off.

The act certifying the deregistration of material value must display information identifying it, the reason for the event, as well as the quantity and value of the items being written off. The document must reflect details that allow the document to be interpreted with a specific business entity, as well as the date of its preparation. The documentation is the basis for the accountant to issue a certificate allowing the item to be removed from the register.

Regulatory and legal sources do not provide for an approved form of the form, however, authorized bodies put forward their own requirements for its design. The standard form of the document can be taken as a sample act of writing off material assets that have become unusable. Based on it, it is recommended to develop a template that can be used by a specific enterprise in accordance with its procedure for maintaining and recording document flow.

Write-off of materials that have become unusable

Free consultation by phone Contents

What the inspectorate will be able to request from auditors From 2022

a new article will appear in the Tax Code. 93.2, which will oblige auditors to provide the tax service with information and documents relating to companies that were audited.

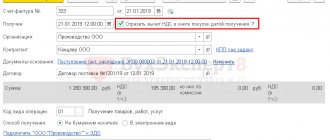

What is this innovation connected with and how does it threaten organizations? → Accounting consultations → Inventories Updated: June 6, 2022 Organizations often face a situation where their inventories or valuables become unusable or are used in production (for example, raw materials).

In this case, the law requires organizations to deregister these values.

To do this, an act of writing off material assets is drawn up, a sample of which is given in this article. The organization’s material assets include:

- raw materials;

- finished products.

- stocks;

- unfinished production;

The write-off of material assets means the documented removal of material assets from the organization’s records. The need to write off material assets most often arises in connection with the following circumstances:

- loss of quality as a result, for example, of a flood or fire;

- putting raw materials into production;

- end of service life;

- incurring losses in connection with the maintenance of material assets.

- breaking;

- wear;

These circumstances are usually identified by persons responsible for material assets in the organization. In all cases, accounting for such material assets is unprofitable for the organization and entails additional costs. In addition, failure to write off material assets can become a basis for abuse by persons directly working with the assets. Before the manager makes a decision to write off, a special commission carries out its work.

Algorithm of actions

The initiator of the action to deregister an instrument is the interested party, in whose financial responsibility it is assigned. To implement the write-off procedure, he needs to draw up a memo addressed to the head of the enterprise about the need to write off materials. It is the basis for drawing up internal administrative documentation on the creation of a commission, conducting an investigation into the feasibility of deregistering a value and, if the event is relevant, drawing up an act.

Write-off act

Defective wrenches for write-off

The reason most often lies in a worn-out nut thread that clamps the cams, or in worn-out teeth on them. For accurate determination, disassembly of the cartridge is required.

Guillotine shears, being complex technical equipment, are often subject to breakdowns. Some of the faults can be eliminated literally in a matter of minutes on site, having the necessary qualifications and knowledge. Others require professional repairs by contractors, often at a hefty cost.

Supporting documentation must be attached to the act. These may be invoices confirming receipt of the tool, documents for internal movement.

Mechanics who repair guillotine shears classify breakdowns depending on the design and type of equipment:

- with mechanical drive;

- with hydraulic drive.

Accounting for tools and devices in factory warehouses and distribution warehouses is organized similarly to accounting in material warehouses.

But the document should be drawn up in such a way that no additional questions arise regarding the reasons and grounds for the write-off.

Document Contents

The act of writing off an instrument that has become unusable must be drawn up in accordance with the standards defined by legislative norms in the field of record keeping. In this case, you should focus on the rules and procedure for completing the forms. The document must display the following information:

- Date the paper was issued.

- Title.

- Composition of the commission.

- Text part.

- Signatures of the commission members.

- Manager's signature indicating approval.

Monitoring the safety of valuables and their timely write-off

Please note that if tools and inventory are accounted for as inventories, their cost is transferred to costs immediately at the time of transfer to production. How then to control the safety of property?

IMPORTANT: even if the SPI of inventory and tools is less than 12 months, it is necessary to develop a system for monitoring their safety.

It turns out that such a procedure is not enshrined in law, which means that each company must develop and fix it independently. In practice, this is solved in the following ways:

- Accounting sheet by department

- Off-balance sheet accounting of MC

The main thing is to consolidate the chosen method in the accounting policy and strictly follow it. So in the chart of accounts there are no separate sub-accounts for such values; you need to create such an account yourself.

If everything is done according to the rules, the write-off of inventory and household supplies will not go unnoticed by the accounting service. They will have to make a reverse posting based on the relevant act.

If you find an error, please select a piece of text and press Ctrl+Enter.

Nuances

To facilitate accounting and ensure the absence of claims from the inspecting authorized bodies, in the act, the name of the written-off object should be indicated in accordance with the identification displayed in the receipt papers. It is important to indicate the purpose of the instrument being written off, as well as its analytical accounting number. The act can be generated in the form of a summary statement, in which data is displayed only upon actual write-off. The date of deregistration is determined not by the date of registration of the statement, but by its actual parameter.

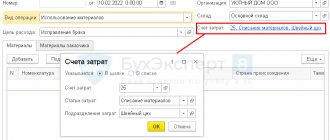

The procedure for writing off inventory items

The creation of a commission that will deal with the technical assessment of assets is a mandatory stage of the procedure under consideration. The commission includes representatives from different departments of the company. As a rule, the members of the commission are employees who are financially responsible for the company’s inventory. When conducting an inventory, not only production equipment and tools are examined, but also other objects recorded on the company’s balance sheet.

Members of the commission must document every fact related to the identified defects and malfunctions. Such documents are used as a basis for writing off objects. Many large business entities specifically develop instructions according to which the process in question is carried out. It should be noted that current laws prohibit the write-off of assets without documentary justification. Such actions are considered theft of valuables belonging to the company. To write off assets that have failed, you will need the following documents:

- Reporting containing information about the number of goods produced during a certain period of time . Such reports indicate not only the volume of products produced, but also the amount of consumables used in the production process.

- Reporting on the order of consumption of material assets . Such reports are regularly prepared by financially responsible persons. In the event that the consumption of material assets exceeds the established norm, the employee must justify the increased expenditure of resources.

- Standards regarding the costs of materials and raw materials for the manufacture of one product. Such standards are approved by the company's management.

In addition to the above documents, accounting statements and financial statements are used. Before writing off objects that are out of order, commission members must conduct a complete inventory. The results of this event are recorded in the relevant documents.

Due to the active use of equipment to ensure production of products, its premature wear is possible

Responsibility

The act of write-off indicates the legality of the procedure for deregistration of instruments that have become unusable. Since it is compiled by members of the commission, its representatives are responsible for carrying out the procedure in accordance with legal requirements and for the accuracy of the data displayed in the document.

Financially responsible persons who threw away unusable tools, but did not initiate the procedure for registering the write-off of items, may be accused of theft of valuables owned by a business entity. Its manager has the right to demand from the person who is guilty in his opinion compensation in full the cost of the goods.

Who endorses acts for writing off tools and equipment?

The form must be endorsed correctly.

It is legally regulated that the document must bear the signature of the head of the tool shop. He can also be replaced by the head of the planning department. Only in this form should paper arrive at the production CIS - the central tool warehouse. It is the CIS at the manufacturing enterprise that is responsible for issuing tools to workers and equipment to employees. The CIS has the authority to keep records of the movement of property without issuing special limit cards and invoice requirements, but the department is obliged to draw up acts. The finished document is sent to the accounting department. The accountant will write off items using this form. All this is done without passing through dispensing pantries in the company’s scattered workshops. The document must be filled out clearly according to the instructions in accordance with the assigned fields.

Features of writing off inventory and household supplies

Workwear and equipment have their own accounting rules. For example, it is necessary to regularly check the availability of all items of property. The inventory of valuables is carried out according to the rules of Order 135n. It was approved on December 26, 2002 by the Ministry of Finance and is a methodological instruction for implementation.

If these assets are recorded in accounting as fixed assets, their safety must be checked, inventoried and written off in accordance with the rules of PBU 6/01 for fixed assets accounting. If tools and special equipment are material assets, then everything will be the same as the write-off of inventory and household supplies.

Production equipment is

How to write off a set of tools reasons

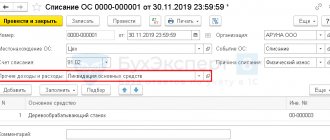

Equipment write-off act is a document that is drawn up by several persons and confirms the fact that the equipment has been written off.

All organizations are faced with the need to write off old equipment. Computers, office equipment and other property must be disposed of according to a write-off report.

Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use.

A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them.

Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act. It is recommended to write off material assets that:

- cannot be used because they have become unusable;

- do not exist based on inventory results;

- damaged when repair is impossible or economically unfeasible.

Every year, the head of the organization must issue an order appointing a commission to write off fixed assets. The chairman of such a commission is, as a rule, a deputy director, and the members of the commission are the chief accountant, economists and engineers.

Reasons for decommissioning equipment

In most cases, fixed assets are subject to write-off in the following cases:

— The property has fallen into disrepair.

— It is impossible or economically infeasible to restore the object.

— Equipment does not exist as a single object.

All three circumstances must be present, otherwise the write-off will be illegal.

For example, you cannot write off a computer on the grounds that its performance is not sufficient to run a program.

The hardware remains suitable for lower performance programs such as word processing or email.

The write-off of the printer will be considered unreasonable if the commission does not include a technical specialist who can confirm that the fixed asset cannot be repaired. It will also not be legal to write off equipment without a decision on its disposal.

If the organization does not have a technical service that can competently confirm the impossibility of restoring equipment, you should contact third-party specialists.

The list of activities of the invited organization must include an examination of the technical condition of equipment, a documented level of qualifications of specialists for conducting diagnostics of the relevant fixed assets.

An agreement is concluded with the selected organization with the wording “Diagnostics of equipment to estimate repair costs.” If the certificate of completion of work issued by the invited organization contains a conclusion about the malfunction and impossibility of restoring the equipment, the organization that owns the fixed assets will receive sufficient grounds for write-off.

To make an informed decision about the feasibility of restoring equipment, you should:

— compare the cost of repairs with the price of new equipment;

— assess the consequences taking into account the duration of the repair;

— compare the warranty period of new and repaired equipment.

When making a decision to dispose of equipment, an appropriate act must be drawn up with photographic materials documenting the disassembled (destroyed) object.

An alternative way to write off the cost of special tools

The photographs must show the brand and serial number of the equipment.

General principles for drawing up a write-off act

Drawing up a write-off act is mandatory in office work. The fact is that each item on the balance sheet has its own value, which is indicated in the relevant accounting documents.

This means, sooner or later, there will be a need to present this item, be it to tax authorities or business buyers. And in case of its absence, documents confirming its write-off are presented.

Hence the importance of its correct preparation. The first thing to note is that, like any audit act, it has the right to be drawn up by a commission.

Its members should include:

— Heads of departments in whose department the value is located.

— Competent engineering staff.

— An accountant may be present.

“And it certainly wouldn’t hurt to have a lawyer involved.”

The act must indicate all identifying information about the value being written off.

This data may include:

— Distinctive technical characteristics.

In addition, it is necessary to clearly formulate the reason for the write-off. This reason will later become the basis. In case of write-off due to breakdown, damage received, etc., it is necessary to obtain a technical examination report before write-off. This act, in turn, will become the basis for write-off.

Structure of the write-off act

The write-off act has a header that includes the name of the document, city and date of preparation. The body of the act indicates all the data that was specified in the previous section.

After the descriptive part comes the part with the reasons. It refers to the grounds that give the right to decide on the impossibility of using the value in the future.

At the end of the body of the act, the commission makes a decision on write-off, taking into account all the grounds.

After the decision is made, all members of the commission are indicated at the end of the text. The act is signed and sent to an accountant for processing.

Sample equipment decommissioning certificate

Head of the institution _________________

(title, surname)

“__” ________________ 20__

Act of write-off of furniture, inventory, equipment and household items

from _____________ 20__

Commission consisting of: _____________________________________________,

acting on the basis of order ________________________________,

examined __________________________________________________________ (name of items)

and found them to be written off based on the following:

No. — Name of items subject to write-off — Unit of measurement — Quantity — Period established by order — Time of receipt in service

Technical condition and reasons for write-off________________________________________________________________________________________________________________________________________________ Conclusion of the commission _______________________________________________

__________________________________________________________________

Chairman of the commission _______________________

Members of the commission: _______________________ _______________________

_______________________

Conclusion of the commission in the act of acceptance of the transfer of fixed assets

The act is endorsed by the head of the tool or planning department and submitted to the central tool warehouse (CIS), which issues tools (devices) to the workshop of the same name, brand and size according to the act without issuing requirements and limit cards.

After the warehouse issues the tools (devices), the act is transferred to the accounting department, where, according to these acts, the tools (devices) are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops.

Tools (devices) issued by the warehouse in the order of exchange according to acts are not reflected in the registration cards of distribution pantries.

[3] It is used to formalize the write-off of tools (devices) that have become unusable and exchange them for suitable ones at those enterprises where accounting is carried out using the exchange (working) fund method. According to the act, the unusable instrument is handed over to the storage room for scrap.

How to draw up an act for writing off materials

At his request, they collect a commission or simply attract an accounting employee to participate in the process of inventorying material assets to be written off. There is no single form of document established by law; the act is drawn up in any form, but there are also mandatory requirements for its content.

It should reflect:

- Name of the enterprise and date of registration, order number.

- Commission members participating in the write-off: their names and positions.

- List of materials to be written off: number of units or weight of each item with an indication of cost.

- Totals: total quantity and amount.

- Description of the causes of defects or damage.

- Signatures of persons participating in the process, including the financially responsible employee.

Source: https://si-center.ru/info/kak-spisat-nabor-instrumentov-prichiny/