BASIC

Under the general taxation system, peasant farms pay:

- VAT;

- property tax (if there are taxable objects);

- land tax (if there are taxable objects and if in the area in which the peasant farm operates there are no benefits for this tax);

- transport tax (if there are taxable objects);

- Personal income tax (as a tax agent).

As for income tax, peasant farms are not exempt from it (Article 246 of the Tax Code of the Russian Federation). However, if certain conditions are met, they will not have to pay this tax. In particular, for agricultural producers who have not switched to the Unified Agricultural Tax, a reduced rate has been established - 0 percent. This rate can be applied to activities related to the sale of produced agricultural products, as well as the sale of produced and processed own agricultural products. Such rules are established in paragraph 1.3 of Article 284 of the Tax Code of the Russian Federation.

The procedure for paying personal income tax also has some features.

Thus, there is no need to pay personal income tax on income received by members of a peasant farm (including its head) from the production (processing) and sale of agricultural products for five years, counting from the year of registration of the peasant farm. Such a benefit can be applied to the income of a member of a peasant farm only if he is using it for the first time and has not used it before. The benefit is provided by default, that is, there is no need to write any statements (notifications) to the tax office.

After five years, from this income, as well as initially from other income of members of the peasant farm and hired employees, its head pays personal income tax as a tax agent in the general manner.

This conclusion follows from Articles 207 and 226, paragraph 14 of Article 217 of the Tax Code of the Russian Federation.

The remaining taxes (VAT, property tax, land and transport taxes) are paid by the peasant farm in the general manner.

This follows from Articles 143, 226, 373, 357, paragraph 2 of Article 387, paragraph 1 of Article 388 of the Tax Code of the Russian Federation.

Features of taxation of agricultural producers

According to paragraph 3 of Article 346.1 of the Tax Code of the Russian Federation, payers of the Unified Agricultural Tax do not pay:

- income tax for organizations and personal income tax for individual entrepreneurs;

- VAT;

- property tax.

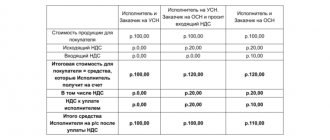

Those who chose a zero rate for income tax (clause 1.3 of Article 284 of the Tax Code of the Russian Federation) have the opportunity to present VAT to buyers who are VAT payers. Although for many types of agricultural products a reduced VAT rate of 10% is applied. They also pay property taxes.

Read also “Agricultural producers on the Unified Agricultural Tax will not face VAT”

simplified tax system

If a peasant farm applies a simplified tax regime, then there are no specific features of its taxation under this regime. Therefore, calculate taxes in the general manner.

Situation: can a simplified peasant farm with the object “income” reduce the single tax by the entire amount of mandatory insurance contributions for the head and for all members of the peasant farm without a limit of 50 percent?

Answer: yes, it can, but only if the peasant farm does not use hired labor. Moreover, this applies to both peasant farms registered as an organization and those without registration of a legal entity.

Regardless of the form in which the peasant farm is registered - as an organization or without forming one, insurance premiums for compulsory pension (social, medical) insurance are always paid by the head of the peasant farm. And the law equates him to an individual entrepreneur.

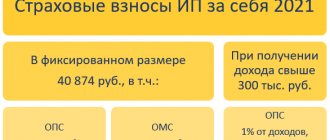

The head of a peasant farm pays mandatory insurance premiums for himself and members of the farm in a fixed amount.

This procedure is established in paragraph 3 of Article 2 and paragraph 2 of Article 14 of the Law of July 24, 2009 No. 212-FZ.

Based on these provisions, the Ministry of Finance of Russia, in letter dated December 22, 2014 No. 03-11-06/2/66200, also for simplification purposes equated peasant farms to entrepreneurs. That is, a peasant farm without hired personnel can reduce the single tax by the entire amount of insurance premiums paid for the head of the peasant farm and its members (paragraph 3, subclause 3, clause 3.1 of Article 346.21 of the Tax Code of the Russian Federation). The 50 percent limit does not apply to them.

Unified Agricultural Tax in 2022: changes in payer obligations

Let us remind you that from January 1, 2022, agricultural producers in a special regime have an obligation to pay value added tax to the budget. It is established by Federal Law No. 335-FZ of November 27, 2022, amending the Tax Code. Previously, taxpayers of the Unified Agricultural Tax of the Tax Code of the Russian Federation were provided with an exemption from VAT. The exception was the tax paid to the budget when importing imported products. Now companies and individual entrepreneurs on the Unified Agricultural Tax will have to draw up all the necessary documents as payers of value added tax. In particular, keep a book of purchases and sales and prepare invoices for counterparties. In addition, you will need to submit a VAT return.

BASIC

If the head of a peasant farm applies the general taxation system, then he pays:

- personal income tax;

- VAT;

- land tax, if in the area in which the peasant farm operates there are no benefits for this tax;

- transport tax.

The procedure for paying personal income tax has some features.

Personal income tax on the income of peasant farm members

There is no need to pay personal income tax on income received by members of peasant farms from the production (processing) and sale of agricultural products for five years, counting from the year of registration of the peasant farm. Such a benefit can be applied to the income of a member of a peasant farm only if he is using it for the first time and has not used it before. The benefit is provided by default, that is, there is no need to write any statements (notifications) to the tax office.

After five years, from this income, as well as initially from other income of members of the peasant farm, its head pays personal income tax as a tax agent in the general manner.

This conclusion follows from Articles 207 and 226, paragraph 14 of Article 217 of the Tax Code of the Russian Federation.

Personal income tax on the income of the head of a peasant farm as an entrepreneur

Since the head of the peasant farm is a member of the peasant farm, he can also use the personal income tax benefit. That is, do not pay this tax on income from production (processing) and sale of agricultural products for five years, counting from the year of registration of the peasant farm. This is possible provided that he is using such a benefit for the first time.

After five years, the head of the peasant farm pays personal income tax on such income in the general manner, like any other entrepreneur.

On income that is not income from production (processing) and sale of agricultural products, the head of the peasant farm also pays personal income tax on a general basis. There are exceptions to this.

Do not include in the personal income tax base:

- budget subsidies;

- budget grants received for the creation and development of peasant farms, home improvement for a beginning farmer, and the development of a family livestock farm.

This follows from Article 207, paragraphs 14, 14.1, 14.2 of Article 217 of the Tax Code of the Russian Federation.

Personal income tax on the income of hired employees of peasant farms

The head of a peasant farm, as an entrepreneur, can attract hired employees under employment contracts. From their income, he pays personal income tax in the general manner as a tax agent (Articles 207 and 226 of the Tax Code of the Russian Federation).

Taxation without registering an organization

When an enterprise has not registered as an organization, this means that its manager works as a businessman. In this case, he can use the general tax system (OSNO).

BASIC

If the head of the farm uses OSNO, then he pays land tax if there are no benefits for such tax in the territory where the agricultural farm operates.

The personal income tax payment procedure has its own distinctive features.

There is no need to pay personal income tax on the profit received by representatives of the farm from production activities (processing) and sale of agricultural products for 5 years.

Such a benefit can be applied to the profit of a company representative only when he applies it for the first time and has not used it before. To apply the benefit, you do not need to contact the tax authorities with an application.

When these 5 years have passed, then from such income, and at the same time initially from the remaining income of the representatives of the farm, its manager pays personal income tax in the general manner as a tax agent.

simplified tax system

If the head of a peasant farm uses a simplified tax regime, then there are no distinctive features of his taxation under such a special regime. Therefore, as a businessman, he calculates tax payments in the general manner.

Unified agricultural tax

Agricultural managers on the Unified Agricultural Tax make tax payments in the general manner, just like businessmen under this special regime.

What property is taxed?

The Tax Code outlined the scope of application of taxable property, but did not specify which of its objects are meant, did not divide it according to qualification criteria, by types of use in agricultural activities, etc. Therefore, discrepancies are possible regarding the determination of the tax base, which may cause conflicts with tax service. What to do to avoid them?

Since the law is new, the amendments came into force relatively recently, a system for its functioning has not yet been developed, and there are no precedents for the disputes that have arisen. To avoid ambiguous situations, we recommend that before dividing taxable and exempt property, you consult your territorial INFS.

IMPORTANT! It is advisable to ask tax officials for written explanations: this will save you from possible problems in the future and will become an argument in your favor in any disputes.

As a general rule, the property tax base includes all movable and immovable (accounted for at cadastral value) objects, except for land and vehicles: there are separate taxes for them (land and transport).

Dividing objects cannot be taxed

In this phrase, a comma can be before or after the word “impossible” - the expected tax base depends on this.

The criterion for distributing the property base into taxable and non-taxable is separate accounting.

IMPORTANT INFORMATION! Features of separate accounting of taxable and non-taxable property must be reflected in the internal accounting policy of the organization.

But what to do if, in fact, part of the property is used simultaneously for agricultural and other business activities? In such cases, it is usually difficult to carry out separate accounting of fixed assets. An auxiliary method for determining the taxable share will come to the rescue, based on the result of business activity, namely, revenue from sales (provision of services, work). You should compare revenue from agricultural activities with revenue from other activities carried out using this OS. The residual value of such property is determined in proportion to the share of income from other, non-agricultural activities in the total revenue of the organization.

The objects unconditionally subject to property tax under the new legislation will include:

- administrative buildings of the company;

- office rooms;

- residential and hotel stock;

- workers' dormitories;

- canteens, etc.

FOR YOUR INFORMATION! The tax is paid not only by the owner of these objects, but also by the entrepreneur or company on the Unified Agricultural Tax that leased or chartered them.

Unified agricultural tax

Most peasant farms prefer to pay the budget through the Unified Agricultural Tax mechanism (Chapter 26.1 of the Tax Code of the Russian Federation). The popularity of this tax can be explained by the fact that when introducing the regime, the legislator tried to take into account all the features of the agricultural industry, in particular small producers.

An important criterion here is the amount of income. It is limited to 70% and concerns sold agricultural products of own production and, in addition, the provision of services to agricultural producers. If the value is lower, the mode cannot be used. The rate on it is 6%, and the calculation base is calculated as the difference between income and expenses. Agricultural production is associated with significant costs and, which is beneficial, reduces the tax base. The rate is low. The main difficulty here is the correct accounting and timely and complete documentation of expenses.

For your information! Farmers can apply the Unified Agricultural Tax in any case: by registering the peasant farm as an organization or without such registration.

Exemption from taxes and other rules established by Art. 346.1 of the Tax Code of the Russian Federation apply to peasant farms in full. Currently, payers of the Unified Agricultural Tax pay VAT. They may not pay tax if restrictions on income from agricultural activities for the previous period are met (80 million rubles for 2022, 90 million rubles for the previous year). This is indicated by Art. 145-1 Tax Code of the Russian Federation.

Within a month after the creation of a farm, it is necessary to submit an application to the tax office for the transition to the unified agricultural tax. If this is not done, the default tax system will apply. If the peasant farm operated in a different mode, the application must be submitted before December 31, and the transition is possible starting next year.

Taxation of peasant farming: special regimes and reporting

12.07.2018

In this article we will talk about taxation and reporting in peasant farms (peasant farms).

What is a peasant farm?

A peasant farm is a commercial organization that produces, sells and processes agricultural products or provides services in this area (the latter came into force in 2022). The activities of peasant farms are regulated by Federal Law No. 74 “On Peasant Farming”.

A farm can be registered as a legal entity, but most often the head is registered as an individual entrepreneur.

By default, in the system for calculating taxes, pensions and insurance contributions, peasant farms operate at the individual entrepreneur level - that is, they submit the same reports and have the same benefits.

Types of taxation of peasant farms

Among farms, the Unified Agricultural Tax is most often used - an agricultural tax, which was actually introduced specifically for peasant farms. But, nevertheless, other tax systems are available to both organizations and individual entrepreneurs in the field of agriculture.

In each taxation system, LLCs (unlike individual entrepreneurs) additionally submit transport and land tax declarations (until February 1), accounting reports and information on financial results (until March 31).

Unified agricultural tax

The peculiarity of the unified agricultural tax lies in the relaxed requirements for record keeping and benefits provided specifically for peasant farms. However, farms do not use it by default immediately after registration, but must submit an application to the Federal Tax Service about their intention to use the unified agricultural tax. This can be done within a month after registering with the tax office in order to immediately begin your work on the Unified Agricultural Tax, or before December 31 - in order to begin applying the regime from January 1 of the next year.

The tax rate under the Unified Agricultural Tax is 6% of net profit (income minus expenses). Based on the decision of local authorities, the percentage is sometimes reduced to 4%.

The following have the right to use the Unified Agricultural Tax:

- Manufacturers of agricultural products, organizations processing and selling them. At the same time, income from the sale of own farm products must be more than 70% of the total.

- Agricultural consumer cooperatives, in which more than 70% of their income comes from the sale of products produced by members of the cooperative.

- Individual entrepreneurs and fishing enterprises with an average annual number of employees of less than 300, with income from the sale of catch in relation to total revenue of more than 70%.

- Organizations providing agricultural services.

To switch to the Unified Agricultural Tax, an enterprise must produce or sell agricultural products. For example, it is unacceptable to only process it.

All entrepreneurs who have chosen the Unified Agricultural Tax must maintain an accounting book (KUDiR). From 2022, it no longer needs to be certified by the Federal Tax Service, which also applies to peasant farms on the Unified Agricultural Tax.

Tax reporting is submitted in the form of a Unified Agricultural Tax declaration annually, until March 31 of the following year. Advance payment under the Unified Agricultural Tax is made until July 25, and full tax payment is due until March 31 of the next calendar year.

The deadline for submitting reports to the tax office is January 30 of the year following the reporting year, using the form “Calculation of insurance premiums.” The second section is completed.

Other possibilities of the Unified Agricultural Tax:

- Write-off of fixed assets when they are put into circulation;

- Inclusion of advance payments in the income item;

- Exemption from property tax, VAT and personal income tax.

simplified tax system

To apply the simplified tax system “Income” or “Income minus expenses”, you must submit an application to the tax office. It is better to do this immediately, when registering a company.

Peasant farms with minimal expenses prefer the “income” system (6%), and farms that have a significant share of expenses and are able to confirm them choose the “income minus expenses” system (profit tax is 15%).

Regional authorities can reduce the simplified tax rate by 1% on “income” and up to 5% on “income minus expenses.”

Accounting for peasant farms using the simplified tax system is also simplified. The farm must maintain KUDiR and provide it to the tax service upon request.

The simplified declaration must be submitted to the Federal Tax Service once a year, before April 30. The tax is paid quarterly: three times in advance before the 25th, and the final tax for the year - until April 30.

Peasant farms in most situations are equated to individual entrepreneurs, therefore, regardless of the form of the legal entity, it can reduce the tax on the entire amount of insurance premiums for the head and other members, without a limit of 50% only if the labor of hired workers is not used.

BASIC

The general taxation regime is used in peasant farms extremely rarely and only when necessary. The complexity and volume of peasant farm reporting on OSNO is inferior to other options, but the main system allows farmers to cooperate with large network partners who deal only with VAT.

OSNO employs the majority of wholesale buyers who may be of interest to farmers. The fact is that the general regime allows wholesalers to significantly reduce the VAT burden. This regime will be applied to a newly formed farm automatically if its head does not have time to submit an application for the application of the simplified tax system or unified agricultural tax.

For some peasant farms, income tax can be reduced to zero. The full list of preferential areas is reflected in Article 284 of the Tax Code.

Automatically, all participants and the head of the farm are exempt from personal income tax payments for five years on income from the production, sale and processing of agricultural products.

It is legal to use this benefit only once - intentional re-registration of peasant farms is punishable by law. Income from activities not related to agriculture and farming is taxed without special benefits. Government subsidies and grants are not taxed.

The VAT return is submitted to the tax office once a quarter (in January, April, July and October before the 25th). Every year until April 30, forms 3-NDFL and 4-NDFL are provided. These requirements apply to both individual entrepreneurs and LLCs. Form 3-NDFL must be submitted even if there was no profit.

The company's reporting on OSNO also includes quarterly submission of income and property declarations.

Peasant farms on OSNO pay:

- Property tax;

- Land tax;

- Transport tax;

- Personal income tax (withheld from the wages of all hired employees);

- VAT;

- Mandatory insurance contributions.

Reporting to government funds

For members of peasant farms there are fixed insurance rates that do not depend on the minimum wage and are relevant for individual entrepreneurs.

The head of a farm that does not have hired employees is obliged to submit to the tax office every year on January 30 the calculation of insurance premiums for himself and for members of the peasant farm, filling out the 2nd section. The report can be provided in both paper and electronic format.

Insurance premiums must be paid before the end of the calendar year. This can be done in one payment or quarterly.

In addition, peasant farms are required to report to the state statistics service:

- Peasant farms with agricultural crops report annually before June 11 using form No. 1 - farmer.

- Peasant farms with livestock of farm animals report on form No. 3 - farmer until January 6.

Reporting for employees

If a peasant farm hires workers, then new obligations arise along with them.

Employees must provide the following to the tax office:

- Form 2-NDFL for each employee (until April 1);

- Form 6-NDFL (quarterly until the end of January, April, July and October and one annual along with 2-NDFL);

- Form on the average number of employees, KND 1110018 (until January 20).

Personal income tax withheld from employees' salaries must be transferred to the state no later than the day following the date of issue to the employee.

Calculation of insurance premiums is submitted to the Pension Fund quarterly, before mid-February, May, August and November. By the 15th day of each month, information about insured persons (SZV-M) is provided.

Form 4-FSS is submitted to the Social Insurance Fund; it must be submitted before the twentieth of January, April, July and October, if in paper form and before the 25th in electronic format. Once a year, before April 15, LLCs must confirm their main activity with the Social Insurance Fund.

Contributions to the Pension Fund and Social Insurance Fund for employees are made until the 15th of the next month.

Source: kakzarabativat.ru

Which organizations are recognized as agricultural producers?

In accordance with tax legislation (Article 346.2 of the Tax Code), the category of agricultural producers includes business entities that manufacture products recognized as agricultural according to the list approved by Government Decree No. 458 of July 25, 2006.

At the same time, agricultural producers are recognized not only as organizations and individual entrepreneurs producing agricultural products, but also as business entities that:

- carry out primary and industrial processing of agricultural products;

- sell agricultural products;

- provide support services to agricultural producers (preparation for sowing fields, cultivating agricultural crops, pruning fruit trees and grapevines, harvesting, etc.)

Let us note that organizations that sell agricultural products and provide support services to producers are classified as agricultural producers, provided that the share of income received from this type of activity is at least 70% of the total income of the business entity.