What kind of indicator is this, where is it used, what do the numbers in its code mean and additional information needed by an entrepreneur is contained in the article.

| For reference | |

| Abbreviation | OKTMO |

| Designation | OK 033-2013 |

| Introduction | 01/01/2014 (Order of Rosstandart dated 06/14/2013 No. 159-st) |

| In English | Russian Classification of Territories of Municipal Formations |

How to find out OKTMO

There are several options for correctly determining the current OKTMO code.

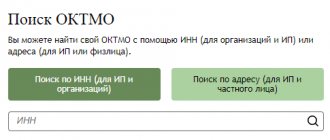

The simplest one: We go to the service of the official website of the Federal Tax Service, for which we click HERE. There you can enter your OKATO, click “Find” and the system will immediately display the required code. However, often, a person looking for OKTMO also has no idea about his OKATO. Personally, I am one of those. If you do too, go below.

In the field “Subject of the Russian Federation” we find ours. The example is the Republic of Tatarstan. The easiest way to navigate is by the region number (most likely it is marked on your car next to the Russian flag). To start selecting a region, you need to click on this nice button, pointed to by the red arrow:

Have you chosen? Great. Now in the “Municipal entity” field we enter not your registration or residence address! A city or place of settlement. Our example is Naberezhnye Chelny. We just start typing and the service itself will offer to choose from the list.

Attention! Selecting from the list provided is a necessity in this case! If you enter your locality and the system does not offer you a choice in the automatic list, you will not recognize OKTMO, or you will recognize it incorrectly.

Next, click the “Find” button and get your OKTMO:

We won’t talk about how you can make a request to local territorial authorities to provide information about your OKTMO. According to the scheme outlined above, this information is obtained a hundred times easier than working with any official requests to different departments.

Object name code in 3-NDFL

The object name code (010) in 3-NDFL is filled out in Sheet D1 “Calculation of property tax deductions for expenses on new construction or acquisition of real estate.” Indicate the numerical designation of the purchased property.

| 1 | House |

| 2 | Apartment |

| 3 | Room |

| 4 | Share in a residential building, apartment, room, land plot |

| 5 | Land plot for individual housing construction |

| 6 | Plot of land with purchased residential building |

| 7 | Residential building with land |

Was OKATO, became OKTMO

Until 2014, entrepreneurs had to enter a special code – OKATO – in financial documents and tax reporting. It meant the code of a certain area from the All-Russian Classifier of Objects of Administrative-Territorial Division . A sequence of numbers instead of indicating an address, often long and consisting of several words, including region, district, etc., significantly facilitates automated accounting, speed of data processing and accuracy of their grouping.

In order to enter the correct OKATO code in the appropriate field of the payment order or in the text of the declaration, you needed to know:

- what locality does the municipality belong to, where the entrepreneur lives or the organization is registered;

- which tax office is responsible for your business activities (for declarations);

- where the payment order or financial document is addressed (for filling out payment slips).

IMPORTANT! 2014 was considered a “transitional” year from OKATO to OKTMO. In the relevant documentation, the OKATO code indicated instead of the required OKTMO did not make the payment “impossible”; the federal treasury automatically transferred one code to another. But since 2015, such soft measures have ended, and you need to worry about the correct indication in the corresponding field of the OKTMO code.

Income type code in 3-NDFL

The type of income code (020) in the 3-NDFL declaration is filled out on Sheet A “Income from sources in the Russian Federation”. The list of designations is given in Appendix No. 4 to the procedure for completing the declaration.

For example, when selling a car, the income code in 3-NDFL is “02”. For other cases, see the table:

| 01 | Income from the sale of real estate and shares in it, determined based on the price of the object specified in the agreement on the alienation of property |

| 02 | Income from the sale of other property (including a car) |

| 03 | Income from transactions with securities |

| 04 | Income from renting out an apartment (other property) |

| 05 | Cash and in-kind income received as a gift |

| 06 | Income received on the basis of an employment (civil) contract, the tax from which is withheld by the tax agent |

| 07 | Income received on the basis of an employment (civil) contract, the tax from which is not withheld by the tax agent (even partially) |

| 08 | Income from equity participation in the activities of organizations in the form of dividends |

| 09 | Income from the sale of real estate and shares in property, determined based on the cadastral value of this property, multiplied by a reduction factor of 0.7 |

| 10 | Other income |

What does the OKTMO code consist of?

Rosstandart issued order No. 159-st OK 003-2013 on approval of the OKTMO classifier on June 14, 2013; it came into force at the beginning of 2014 and is in effect to this day. It was on January 1, 2014 that the tax service software was reconfigured to read new codes.

The code is 11-digit, a shortened version of 8 digits is provided for federal cities (Moscow, St. Petersburg, Sevastopol), but it should be remembered that within these entities there are territorial units that are also encrypted with 11 characters. The classifier is divided into 8 subjects of the Russian Federation (territorial districts):

- Central;

- Northwestern;

- North Caucasian;

- Ural;

- Siberian;

- Far Eastern;

- Privolzhsky;

- Southern.

Within these large municipal units, the elements decrease in importance: region - district - regional center - city - village - town - railway station, etc. Each object in the list corresponds to a specific sequence of numbers.

NOTE! The documents must indicate the OKTMO code that belongs specifically to the entrepreneur at his registration address (for individual entrepreneurs - registration), and not to the tax inspectorate or social fund.

Document type code in the 3-NDFL declaration

On the title page of the declaration, in the section about the identity document, indicate its code value. The full list is contained in Appendix No. 2 to the procedure for filling out 3-NDFL and in the following table.

| 21 | Russian citizen passport |

| 03 | Birth certificate |

| 07 | Military ID |

| 08 | Temporary certificate issued in lieu of a military ID |

| 10 | Foreign citizen's passport |

| 11 | Certificate of consideration of an application for recognition of a person as a refugee on the territory of Russia on the merits |

| 12 | Residence permit in the Russian Federation |

| 13 | Refugee ID |

| 14 | Temporary identity card of a Russian citizen |

| 15 | Temporary residence permit in the Russian Federation |

| 18 | Certificate of temporary asylum on the territory of the Russian Federation |

| 23 | Birth certificate issued in another state |

| 24 | Identity card of a Russian military personnel, military ID of a reserve officer |

| 91 | Other documents |

We enter it correctly

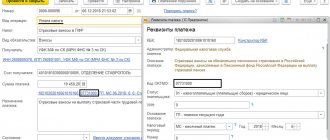

In payment orders for OKTMO, a special field is provided (the same field in which the OKATO code was previously placed).

To fill out declarations, this code must be entered 1 character into each box intended for this: the system recognizes the numbers this way.

Difficulty may arise here if you need to enter the code of an object in Moscow or St. Petersburg, consisting of 8 digits, because the “box” for the numbers is 11. The order of the Federal Tax Service of the Russian Federation dated November 14, 2013 provides an explanation: in such cases, the free cells must be filled in with dashes. Putting zeros in empty spaces may prevent the program from recognizing the code, but leaving empty cells most likely will not create problems. But it is better to act in accordance with the instructions of regulatory documents.

Taxpayer category code in the 3-NDFL declaration

On the title page of the form you will also find the payer category code for 3-NDFL. The categories are listed in Appendix No. 1 to the procedure for filling out reports. For ordinary citizens, the appropriate 3-NDFL taxpayer category code is “760,” and the 3-NDFL taxpayer category code “720” is allocated for individual entrepreneurs.

| 720 | An individual registered as an individual entrepreneur |

| 730 | Notary engaged in private practice and other persons engaged in private practice |

| 740 | Lawyer who established a law office |

| 750 | Arbitration manager |

| 760 | Another individual declaring income in accordance with Articles 227.1 and 228 of the Tax Code, as well as for the purpose of obtaining tax deductions in accordance with Articles 218-221 or for another purpose |

| 770 | Individual entrepreneur - head of a peasant (farm) enterprise |

What kind of error will it be?

If the OKTMO code is indicated with an error in the payment order (OKATO is entered instead or there are inaccuracies in the numbers), this will not lead to taxes not falling into the required budget. After all, there are also fields “KBK”, “Purpose of payment”, “Account number”, etc. with duplicate information. Therefore, an error in specifying OKTMO will not lead to the taxpayer’s obligation being unfulfilled, and therefore no fine will follow.

However, if an error was noticed, in order to avoid misunderstandings with the transfer of payments, you should submit an application to the tax office to clarify the details. You will have to go through the procedure of clarification and joint reconciliation of contributions. In this case, there will be no late fees or they will be written off, since the tax is considered paid on the day of its actual transfer, and not the payment confirmation.

But a declaration with an incorrect OKTMO will certainly require clarification: it will be considered erroneous.

Budget classification code – KBK

KBK is a code for a specific budget item, income or expense. Since tax calculations are made specifically with the budget (Federal Treasury), and not with the Federal Tax Service, the BCC in tax documents must be indicated wherever it is required and indicated correctly. Otherwise, your tax or refund from the budget will not immediately go where it is needed, but will “hang” somewhere in the system while you prove to all authorities that you actually paid it (or should receive it).

For ordinary citizens submitting the 3-NDFL declaration for 2022, it is enough to know only two BCCs:

- “Revenue” KBK - identifies the revenue line of the budget where the paid personal income tax falls: 18210102030011000110 (indicate this code in line 020 of Section 2 of the 3-NDFL declaration if you must pay tax to the budget according to the declaration);

- “Expense” KBK - identifies from which budget item funds should be taken for a tax refund: 18210102010011000110 (indicate this code in line 020 of Section 2 if the tax back to you . Do not forget to indicate it in the application for a refund when you submit such statement.

How to create two sets of annual 6-NDFL

The first set should contain income before the change of address and the old OKTMO, the second set should contain the amounts after the change of address and the new OKTMO. The principle is the same as with the quarterly 6-personal income tax:

- Generate 6-NDFL in Elba, save the file for the Federal Tax Service. Keep in mind: the challenge opens in January.

- Open certificates in the Taxpayer, edit accruals by month, check OKTMO. Save the files in xml format.

- Send both files to technical support at

The article is current as of 02/03/2022

How and where to look for the OKTMO code

The current code directory can be found on our website here.

Enter the desired code or locality in the search box and get the result.

OKTMO in the simplified taxation system declaration when changing address

The Federal Tax Service explains that the code in lines 010, 030, 060, 090 indicates the municipality where the tax is paid.

In paragraph 6 of Art. 346.21 of the Tax Code of the Russian Federation states that the simplified tax and advance payments are paid at the place of residence of the individual entrepreneur and the location of the organization.

So which OKTMO should I indicate in the declaration under the simplified tax system for an individual entrepreneur or an organization that has changed its address?

Using the example of an individual entrepreneur, we will consider how to correctly fill out the OKTMO code in the declaration under the simplified tax system.

Example:

An individual entrepreneur lived in the Krasnodar region. When filling out the declaration, he used OKTMO code 03701000. In August, he moved to Veliky Novgorod. On August 20, 2021, an entry was made in the Unified State Register of Entrepreneurs regarding the registration of an entrepreneur in a new region. Rosstat assigned the code 49701000.

How to fill out OKTMO in the declaration under the simplified tax system:

When filling out information for the 1st quarter and half of 2022, the individual entrepreneur must indicate OKTMO in lines 010 and 030 at the old place of residence - 03701000.

In the reporting period for 9 months and in the annual declaration, you must enter OKTMO in lines 060 and 090 at the new address - 49701000.

Which OKTMO code (new or old) must be indicated in line 030 of section 1.1 of the tax return paid in connection with the application of the simplified tax system, and in the payment order if there was a change of legal address after the advance payment was made? The answer to this question was given by ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

OKTMO in the simplified taxation system declaration when clarifying information

Taxpayers are required to submit updated declarations if they discover inaccurate information and errors in filling out the declaration. The procedure for provision is enshrined in Art. 81 Tax Code of the Russian Federation.

Help: an updated declaration is submitted if the entrepreneur discovers errors on his own. If incorrect information is determined by the tax authority, a tax audit report is issued.

Since an incorrectly specified OKTMO code in the simplified taxation system declaration entails distortion of information about taxes in the budget settlement cards, it is necessary to clarify the data. Otherwise, the tax authority will charge penalties on the amount of arrears.

If an updated declaration is submitted for previous periods after an individual entrepreneur or organization has changed its address, OKTMO must be indicated at the old address. And submit the declaration to the current tax authority.f

In addition, the Procedure for filling out the declaration for 2022 states that when clarifying past periods, it is necessary to use the declaration form that was in force in that period.

When clarifying information, you need to pay attention not only to the declaration form, but also to the edition of the code classifier OK-033-2013. When filling out the declaration, you should use the codes that were valid in the specified period.

OKTMO in the declaration under the simplified tax system during reorganization

The reorganized organization must submit a declaration under the simplified tax system in the last reporting period before making an entry about the termination of activities in the Unified State Register of Legal Entities. If this was not done, the legal successor is obliged to report.

In accordance with the Procedure for filling out a declaration under the simplified tax system, the OKTMO code is indicated for the region where the reorganized organization was located.

***

The OKTMO code determines the place of business of entrepreneurs and allows for accurate accounting of taxes paid in the territory of a specific subject of the Russian Federation.

In the declaration under the simplified tax system and in the payment order, the code must be identical. The directory of codes is maintained by the Federal Tax Service of Russia and reflects them in the information address system. When changing the address or clarifying information in the declaration, a code corresponding to the old indicators is indicated - the old address or the old period. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Taxpayer identification in 3-NDFL

In Sheet D1, you must also select the taxpayer attribute (030).

| 01 | The owner of the property in respect of which a property deduction for personal income tax is claimed |

| 02 | Property owner's spouse |

| 03 | Parent of a minor child - owner of the property |

| 13 | A payer claiming a property deduction for expenses related to the purchase of housing in the common shared ownership of himself and his minor child (children) |

| 23 | A payer claiming a property deduction for personal income tax for expenses related to the purchase of housing in the common shared ownership of the spouse and his minor child (children) |