There is a method that allows you to obtain finished products without having the appropriate production facilities. This is a tolling work scheme in which the owner of the facilities processes raw materials provided by the customer. This is convenient and beneficial for both parties to the transaction. The only ones who most often make complaints about such cooperation are tax services. However, the risk of tax troubles can be reduced if you correctly follow all the details of work and registration under the tolling scheme.

Let us consider the features of the functioning of the tolling scheme, as well as the rules of its accounting and the nuances of taxation.

Question: How to reflect in the contractor's accounting operations under a contract for the processing of customer materials (supplied raw materials) or for the performance of work using them? View answer

How does the tolling scheme work?

A tolling scheme of work is an organization of the production process when the customer transfers his raw materials to another organization for processing in order to obtain products with specified qualities. In this case, both the raw materials and the finished product remain the property of the customer, and the organization performing the work simply fulfills the terms of the contract, providing its facilities and labor for the agreed remuneration.

REFERENCE! If any waste or surplus remains as a result of the processing of raw materials, these also belong to the customer, unless the contract provides for their provision as part of the payment.

The supplier is the owner of the raw materials and the customer of the production processing. Raw materials owned by the supplier, transferred by him for subsequent actions, can be:

- produced by the dealer himself;

- purchased from any sources;

- received under the terms of any transaction.

Question: How can a customer take into account the costs of raw materials during third-party toll processing in tax accounting? View answer

The legislative justification for such a cooperation scheme is clause 156 of the Methodological Instructions for Accounting for Inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Question: What amounts are included in the VAT tax base for the sale of services for the production of goods from customer-supplied raw materials (clause 5 of Article 154 of the Tax Code of the Russian Federation)? View answer

Differences between the tolling scheme and other forms of product manufacturing

The production of finished products can be carried out using various entrepreneurial schemes, each of which has its own pros and cons and differs in certain parameters. The main differences between the tolling scheme for processing raw materials for the production of goods are the following features:

- the seller voices and establishes in contractual form the requirements for the finished product, including its characteristics, manufacturing process, design, packaging, etc.;

- the cost of production will be lower than in conventional production, which means that the product will cost less on the market, which increases its competitiveness and promotes demand among the end consumer;

- concluding an agreement under a tolling scheme has a beneficial effect on the taxation of the customer, since he sells his own products, as it were, and does not resell the goods.

Question: Is the cost of customer-supplied materials (equipment) transferred to the contractor included in the VAT tax base when performing construction and installation work for one’s own consumption (clause 2 of Article 159 of the Tax Code of the Russian Federation)? View answer

Contract agreement and other documents for tolling scheme

Entering into a contractual relationship between the supplier and the owner of the production can be considered as the conclusion of one of the types of contract, therefore, legally, you need to focus on Chapter 37 of the Civil Code of the Russian Federation. Also, this type of cooperation is regulated in Art. 220 and 227 of the Civil Code of the Russian Federation.

How to conduct an inventory of customer-supplied materials ?

IMPORTANT! A sample report on the use of customer-supplied raw materials (materials) from ConsultantPlus is available here

There is no special form of agreement for the tolling scheme; there are no strict regulations for prescribing groups of raw materials or forms of their processing. Important points that must be recorded in the contract:

- name and volumes of raw materials transferred for processing;

- parameters of finished products;

- dates of provision of raw materials and their final processing;

- remuneration for the contractor's work;

- the procedure for making payments (payment terms and type - cash, non-cash, partially in the form of raw materials or waste from them);

- features of delivery of raw materials and then finished products;

- special requirements of the customer, if any (technological characteristics, wishes for processing methods, rates of consumption of raw materials, etc.): most often they are given in the annex to the contract;

- Unless otherwise specified, the default owner of materials, raw materials waste and residues is the seller.

In addition to the contract, an act of transfer of raw materials and an invoice (form No. M-15) are drawn up, and sometimes a receipt for transport is added. The entire time the contractor has the raw materials, he is responsible for their safety.

NOTE! The invoice must contain the details of the contract and indicate that the raw materials are provided on the basis of a tolling scheme.

Waste must be taken into account, since formally it also belongs to the customer.

All other methods of handling them must be reflected in the contract and taken into account in the documentation. If the customer simply wants to leave them with the processor, a free transfer agreement must be drawn up.

If the seller plans to return them, the Ministry of Finance in the Methodological Instructions provides an accounting procedure for this procedure: it is carried out at the possible cost of their sale or use, while the cost of the raw materials is reduced by this figure. Waste disposal is negotiated separately.

Finished products are stored in the contractor's warehouse, where they are moved using invoice No. MX-18, until they are transferred to the owner, which is carried out using invoice No. M-15.

Legal content of operations with customer-supplied raw materials

The general meaning of operations with so-called customer-supplied raw materials is as follows. An organization whose purpose is to acquire certain assets (products) purchases materials for its manufacture and instructs the organization producing the relevant products to produce a certain volume of such assets from these raw materials.

Toll raw materials are a purely accounting term. From the point of view of civil law, the operations in question are a type of contract. According to Article 702 of the Civil Code of the Russian Federation, “under a contract, one party (contractor) undertakes to perform certain work on the instructions of the other party (customer) and deliver its result to the customer, and the customer undertakes to accept the result of the work and pay for it.”

In the case under consideration, the organization entrusting the manufacture of products from its own raw materials acts as a customer under a contract, and the manufacturer of the products acts as a contractor.

The general requirement of Article 704 of the Civil Code of the Russian Federation that the work is performed at the expense of the contractor, that is, from his materials, with his forces and means, is dispositive in nature. In other words, it is valid only if “unless otherwise provided by the contract.” Thus, the customer can instruct the contractor to manufacture certain things (products) from his own materials. This type of operation is regulated by the general rules on work contracts of Chapter 37 of the Civil Code of the Russian Federation.

At the same time, the Civil Code of the Russian Federation also contains special articles devoted to operations with customer-supplied raw materials. These are Article 713 “Performing work using customer materials” and Article 714 “Responsibility of the contractor for failure to preserve property provided by the customer.”

Thus, the contractor is obliged to use the material provided by the customer “economically and prudently.” After completion of the work, the contractor must provide the customer with a report on the consumption of the material, as well as return the remainder or, with the consent of the customer, reduce the price of the work taking into account the cost of the unused material remaining with the contractor. This is stated in paragraph 1 of Article 713 of the Civil Code of the Russian Federation.

If the result of the work was not achieved, or the achieved result turned out to have shortcomings that make it unsuitable for the use specified in the contract (and in the absence of a corresponding condition in the contract, not suitable for normal use), for reasons caused by shortcomings in the material provided by the customer, the contractor has the right to demand payment for the work performed by him (clause 2 of Article 713 of the Civil Code of the Russian Federation).

Article 714 of the Civil Code of the Russian Federation specifically establishes the contractor’s liability for failure to preserve materials provided by the customer, equipment, items transferred for processing (processing), or other property that comes into the contractor’s possession in connection with the execution of the contract.

The procedure for determining the price of work with customer-supplied raw materials, acceptance of work performed and payment for it is subject to the general rules on construction contracts, contained, respectively, in Articles 709, 711 and 720 of the Civil Code of the Russian Federation.

The above norms of the Civil Code of the Russian Federation allow us to identify the following civil law characteristics of the transactions under consideration, which determine their tax and accounting interpretation:

- the materials transferred to the contractor for processing are the property of the customer, and the customer’s property, respectively, from the moment of its manufacture is the product manufactured by the contractor;

- materials accepted from the customer and products made from them are in the possession of the contractor, who is responsible for their safety, before being transferred to the customer;

- the cost of materials transferred to the contractor is not included in the price of this type of contract.

Accounting under tolling scheme

The customer recycles the materials, while retaining ownership of them. Therefore, they are stored on the seller’s balance sheet, but their dynamics must be reflected in the “Materials Accepted for Processing” account specially provided for this purpose. In accounting, it is not customary to mix accounts to reflect materials in-house and third-party production.

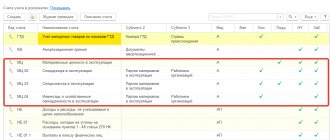

The Ministry of Finance recommends recording transactions with customer-supplied raw materials on synthetic account 003 for material assets, using additional sub-accounts, such as “Materials and raw materials in warehouse”, “Materials and raw materials in processing”. When raw materials are used for production, these materials are “transferred” from one subaccount to another.

Such materials cannot be written off - this is a violation, since they continue to be the documented property of the seller. Write-off will automatically put the finished product in the category of not produced, but resold, which will significantly increase the tax expenses of the seller.

The Contractor keeps records of products made from customer-supplied raw materials in off-balance sheet account 002 “Inventory assets accepted for safekeeping.” Upon completion of processing, he issues an invoice to the seller. At the same time, the cost of raw materials for the contractor does not affect taxation in any way, because it belongs to the supplier. The tax is paid only on the provision of services, and the base is the amount for processing: the contractor’s income includes the remuneration for the work specified in the contract.

Tax treatment of transactions with customer-supplied raw materials

The requirements of the first part of the Tax Code of the Russian Federation, which form the tax content of transactions with raw materials supplied by customers, are largely determined by their civil legal interpretation, which we discussed above.

The absence of the fact of sale of products to the customer organization, that is, the fact of transfer of ownership of the product from the contractor to the customer, allows us to classify operations for the manufacture of products from customer-supplied raw materials as work for tax purposes. Let us recall that according to paragraph 4 of Article 38 of the Tax Code of the Russian Federation, work is understood as “activity, the results of which have a material expression and can be implemented to meet the needs of the organization and (or) individuals.”

Accordingly, according to Article 39 of the Tax Code of the Russian Federation, the implementation of work on the production of products from customer-supplied raw materials is recognized as the transfer on a reimbursable basis (including the exchange of goods, work or services) of the results of work performed by the contractor to the customer, and in cases provided for by the Tax Code of the Russian Federation, the transfer of the results of work performed contractor to customer - free of charge.

The fact of transfer of products manufactured from customer-supplied raw materials is formalized by the corresponding act of acceptance of work performed (Article 720 of the Civil Code of the Russian Federation).

The transfer by the customer to the contractor of materials for processing and the transfer by the contractor to the customer of finished products, as not entailing a transfer of ownership of this property, do not constitute a sale of goods in accordance with Article 39 of the Tax Code of the Russian Federation. Therefore, these transactions are not subject to VAT.