Who can claim a property deduction and when?

Property deduction is a taxpayer’s ability, established by tax legislation, to:

- return part of the personal income tax previously transferred to the budget;

- not pay tax at all or reduce its amount.

A person who has committed certain manipulations with personal property can receive a property deduction, such as:

- sale of property;

- buying a home;

- acquisition of land for housing construction and (or) implementation of this construction;

- concluding a contract for the purchase of property for state or municipal needs.

A person can count on a property deduction:

- having legal sources of income subject to personal income tax at a rate of 13%;

- being the owner of property (bought or sold);

- who paid for the purchased housing using their own or borrowed money;

- who has completed and sent the 3-NDFL declaration to the tax authorities (with supporting documents and an application for tax refund attached to it).

What personal income tax deductions can you get if you have no income? The answer to this question can be studied in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The following sections will reveal the subtleties and nuances of filling out 3-NDFL and calculating tax in the situation of receiving a property deduction.

IMPORTANT! The declaration for 2022 must be submitted using the new form from the Federal Tax Service order dated October 15, 2021 No. ED-7-11/ [email protected] you can here.

On our forum you can consult on any question you have when filling out the 3-NDFL declaration. For example, in this thread we share our experience on how to independently fill out the 3-NDFL declaration for treatment.

Types of personal income tax deductions

A deduction is the amount by which the tax base is allowed to be reduced for tax purposes. The Tax Code provides for several types of personal income tax deductions:

- standard;

- social;

- investment;

- property;

- tax deductions when carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions traded on the organized market;

- professional.

With one deduction, everything seems to be clear: if a person has a child, he can write a statement to the employer. If you purchased an apartment, you can wait until the end of the year and return the personal income tax from the purchase (or part of it) through the Federal Tax Service, or receive a deduction at your place of work during the year.

What to do if a person has purchased an apartment within a year and paid for his child’s education at the institute. Is it possible to receive two tax deductions at the same time? Yes, you can. The most important thing is that a person has a basis for receiving deductions.

However, there are several nuances when providing deductions:

- The employer has the right to provide some deductions, and you can contact the tax authorities for them. Some can be obtained exclusively through the inspection, having previously filled out the 3-NDFL declaration and collected a package of documents.

- Some deductions can be carried forward to subsequent years, others cannot.

- Most deductions have limits.

Taking into account all the listed nuances, how can you claim several tax deductions at the same time? Let's find out further.

Property deduction

Property deduction may be associated with the purchase of property and its sale. In the second case, the deduction is either the purchase price of the property or a fixed amount (1 million rubles for housing, 250 thousand rubles for other property). This deduction cannot exceed the sale price of the assets. Therefore, the deduction is provided within the year in which the transaction was made.

How to draw up 3-NDFL when selling an apartment? What sheets need to be completed? Where can I get the numbers to fill in? All these questions were answered by experts from the ConsultantPlus legal reference system in the situation “How to fill out the 3-NDFL declaration when selling real estate (apartment).” Use trial access to view the material. It's free.

Another thing is the deduction for the purchase of housing with a limit of 2 million rubles. An individual can return up to 260 thousand rubles. You can choose a deduction until you fully use it—one year, two years, or ten years, if necessary. This is the type of deduction that is allowed to be carried forward to subsequent periods.

Property deduction can be issued at the place of work. Then the employer will simply stop withholding tax. Or you can contact the tax office for it. Then funds in the amount of personal income tax from the purchase price, but within the amount paid for the year, will be returned to the taxpayer after checking the declaration and supporting documents. If the personal income tax paid for the year does not cover the amount spent on the purchase of housing, then the return procedure can be repeated in subsequent years.

Since 2022, a simplified procedure for obtaining property and investment deductions has been in effect. We wrote about the details here.

Basically, all options for choosing deductions when drawing up 3-NDFL or registering at the place of work are based on the existence of the right to a property deduction associated with the purchase of housing. After all, other types can be used only in the year in which they are due, such as standard ones, or in the year when certain expenses were incurred, such as social ones.

Social deduction

Social deduction is a reduction in the personal income tax tax base by the amount of expenses:

- expenses incurred for treatment and education of yourself and close relatives;

- spent on charity;

- contributed under voluntary insurance contracts;

- related to the funded part of the pension.

Social deductions are limited to 120 thousand rubles. Moreover, they are taken into account in the total amount, and not each separately.

The following deductions stand out:

- for the education of children - there is a limit of 50 thousand rubles. taken into account separately from other social deductions;

- for expensive treatment - they reduce the base to 0 without restrictions.

Investment deduction

The investment deduction is not yet so popular among our fellow citizens. It consists of returning the amount of money deposited into an individual investment account. It has a limit of 400 thousand rubles. You can apply for an investment deduction only through the tax office; it is not provided at your place of work.

Next, we’ll look at the most common options for getting 2 tax deductions at the same time.

Sale of property and 3-NDFL (filling example)

The need to prepare a 3-NDFL declaration arises for an individual if he:

- received income from the sale of property owned by him;

- owned the sold property less than established in Art. 217.1 and clause 17.1 of Art. 217 of the Tax Code of the Russian Federation MSVI (minimum period of ownership of property).

The Tax Code provides for 2 types of property deductions when selling property:

- 1 million rub. (when selling real estate);

- 250,000 rub. (when selling other property).

Registration of the 3-NDFL declaration:

- mandatory if the period of ownership of the property was less than the MSVI (regardless of the amount of income received from its sale);

- is not required if more than the MSVI has passed from the beginning of ownership of the property to its sale (clause 17.1 of Article 217, subclause 2 of clause 1 of Article 228, clause 4 of Article 229 of the Tax Code of the Russian Federation).

Features of the definition of MSVI are shown in the diagram:

There is also a special case of calculating MSVI. If the only home is sold, then the MSVI is considered equal to 3 years. To find out more, sign up for a free trial access to ConsultantPlus.

IMPORTANT! From 2022, families with children will be exempt from paying personal income tax when selling their only home. We wrote about this in our review.

Examples will help you figure out whether to apply for 3-NDFL or not.

Example 1

Tumanov A.A. purchased an apartment in 2013. In 2022, he sold it for RUB 5,243,000. Dates:

- acquisitions - before 01/01/2016;

- ownership - more than 3 years.

Conclusion: filing 3-NDFL and paying personal income tax to Tumanov A.A. is not required.

Example 2

Sidorova G. E. in September 2022 sold an apartment privatized in December 2022 for RUB 3,200,000. This is not the only apartment owned by G.E. Sidorova.

Deadlines:

- acquisition of property rights - after 01/01/2016;

- ownership - less than 5 years.

Conclusion: Sidorova G.E. needs to file 3-NDFL and pay tax.

Example 3

Tokarev S.G. purchased a car in December 2022, which he sold in September 2022 for 240,000 rubles.

Calculation of terms: the car was owned for 10 months. (less than 3 years).

Conclusion: Tokarev S.G. is obliged to report on the income received using the 3-NDFL declaration. There will be no need to pay personal income tax if he exercises his right to a property deduction (240,000 rubles < 250,000 rubles → personal income tax = 0 rubles).

We will tell you how Tokarev S.G. fill out 3-personal income tax in the next section.

How to fill out standard deductions in 3-NDFL

Standard tax deductions are provided to certain categories of individuals (“Chernobyl survivors”, disabled people since childhood, parents and guardians depending on the number of children, etc.).

Find out more about standard deductions here.

In 3-NDFL, information about standard deductions is provided from the data in the 2-NDFL certificate and is necessary for the correct calculation of the amount of personal income tax (its refundable part or paid to the budget).

A line-by-line algorithm for reflecting standard deductions in 3-NDFL can be found in ConsultantPlus. Get trial access to the system for free and proceed to the material.

Let's look at filling out information in 3-NDFL about standard tax deductions using an example.

Example 1

Stepanov Ivan Andreevich bought an apartment in 2022 and decided to return part of the personal income tax. To do this, he filled out 3-NDFL using the “Declaration 2021” program posted on the Federal Tax Service website.

To enter information into 3-NDFL after filling out the initial data (about the type of declaration, the Federal Tax Service code, personal data and other mandatory information), in the “Deductions” section, I. A. Stepanov ticked the following boxes:

- “provide standard deductions”;

- “there is neither 104 nor 105 deduction” (which means that Stepanov I.A. has no right to a deduction of 500 or 3,000 rubles per month provided to the categories of persons specified in paragraph 1 of Article 218 of the Tax Code of the Russian Federation);

- “the number of children per year did not change and amounted to” - from the list Stepanov I.A. chose the number “1”, which means that he has an only child.

For the Ministry of Finance’s opinion on “children’s” deductions, see the message “Child from a first marriage + child of a spouse + common: how many deductions is an employee entitled to?”.

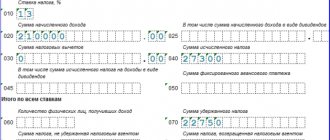

What the “Deductions” section looks like after filling out, see the figure:

In order for the program to calculate the amount of standard deductions and generate the necessary sheets in 3-NDFL, Stepanov filled out another section - “Income received in the Russian Federation” - as follows:

As a result of filling out these sections in the declaration, the program generated Appendix 5 with information about the total amount of standard tax deductions provided to Stepanov I.A. at his place of work. The program calculated the total amount of deductions taking into account the limit established by the Tax Code of the Russian Federation on the amount of income within which standard “children’s” deductions are provided.

A fragment of completed Appendix 5 with information on the total amount of standard deductions and the number of months of their provision, see below:

Explanation of information in Appendix 5:

- deductions for 1 child in the amount of 7,000 rubles. (RUB 1,400/month × 5 months);

- deductions are provided for 5 months. — the period from January to May 2021 (until the cumulative income from the beginning of the year did not exceed 350,000 rubles).

“Sample of filling out a 3-NDFL tax return” will tell you about the nuances of registering .

Filling out 3-NDFL when selling a car

We use the data from example 3 of the previous section to fill out the 3-NDFL declaration with a property deduction.

Example 3 (continued).

Tokarev S.G. studied the structure of 3-NDFL and came to the conclusion that he will need to fill out the following declaration sheets:

- title page;

- section 1;

- section 2;

- Annex 1;

- Appendix 6.

Step 1. Tokarev began filling out the declaration with the title page. Here he indicated the correction number (for the primary declaration - 0), full name, data on the date and place of birth, citizenship and passport of S. G. Tokarev and other required information in the fields proposed for filling out.

Step 2. Next, he filled out Appendix 1 “Income from sources in the Russian Federation”

To further enter data, Tokarev S.G. used information about the buyer of the car from the sales contract:

- Entered information about the source of income payment on page 060 - the buyer of the vehicle. Since the buyer is an individual, Tokarev S.G. indicated only his full name.

- Information about income received:

- on page 010 the value 10 is the code of the type of income from Appendix 3 to the procedure for filling out the declaration;

- on page 020 the value 13 is the tax rate;

- pp. 030 - 050 are filled in if information is available;

- on page 060 - full name of the buyer;

- on page 070 - 240,000 - the amount received from the sale of the vehicle.

Step 3. Next, Tokarev proceeded to filling out Appendix 6 “Calculation of property and tax deductions.” To do this, in p. 070, clause 3.1, he indicated the amount of property deduction in the amount of 240,000 rubles.

Step 4. In this step, Tokarev filled out section 2, indicating on page 010 the amount received for the car, and on page 040 - the amount of property deduction.

Step 5. Since the amount of tax payable is zero, in section 1 Tokarev indicated the value 0 on page 040, and on pages 020 and 030 KBK and OKTMO.

What documents are needed for property deduction?

For Tokarev S.G. from the example considered, the list of documents attached to 3-NDFL for obtaining a property deduction consists of 3 points:

- copy of passport (pages with personal data and registration);

- a copy of the car purchase and sale agreement;

- copies of payment documents.

When an individual applies for a property deduction when purchasing real estate, the list of documents for the 3-NDFL declaration will differ depending on the type of real estate and the form of its acquisition (see example in the diagram):

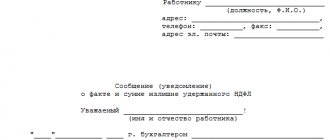

The taxpayer may need an additional document - a special notification from the tax authorities confirming the right of an individual to a property deduction (the notification form was approved by Order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11 / [email protected] ), if:

- expenses have been incurred for the purchase or new construction of real estate (including the payment of interest on repayment of targeted loans) - a property deduction for such situations is provided for in subclause. 3–4 p. 1 tbsp. 220 Tax Code of the Russian Federation;

- the individual intends to receive a property deduction at his place of work (clause 8 of Article 220 of the Tax Code of the Russian Federation).

To receive a notification, you must contact the inspectorate at your place of residence with an application and supporting documents.

Starting from 2022, you can receive a property deduction in a simplified manner. We talked about the details here.

What documents will be needed to receive notification, from what month and in what volume a property deduction will be provided at the taxpayer’s place of work, see here.

What to attach to the application for filing 3-NDFL and where to download its sample

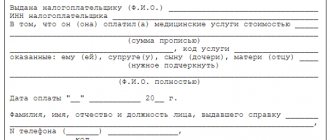

Depending on the purpose of filing 3-NDFL, the list of documents may differ. If a declaration is submitted to receive, for example, a social deduction, then the applications may be as follows:

- contract for the provision of medical services (copy);

- training contract (copy);

- certificate from the medical institution for tax authorities on the cost of services provided (original);

- license of a medical institution or educational organization (copy);

- birth certificate of the child, if the deduction is claimed for his education or treatment (copy);

- other supporting documents.

Read more about the documents required to receive a deduction for treatment here.

See also “Documents for tax deduction when purchasing an apartment.”

During a desk audit, tax authorities have the right to request additional documents, which should be accompanied by a separate inventory.

As noted above, the cover letter is drawn up in free form. On our website you can see an example of this document.

Read about one of the tax deductions in the publication “Property tax deduction when buying an apartment (nuances)” .

Formulas for calculating personal income tax when buying and selling property

Calculation of personal income tax when purchasing property

When purchasing real estate, the taxpayer can return part of the personal income tax from the budget. Standard formulas for calculating tax refunded from the budget (NDFLreturn) are as follows:

1. Property acquired without borrowing:

Personal income tax return = RN × 13%, if RN ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if pH > 2 million rubles,

where РН – taxpayer’s expenses for new construction or purchase of housing;

2 million rub. – maximum property deduction when purchasing property.

2. A targeted loan (credit) was used to purchase real estate:

Personal income tax% = RP × 13%, if RP ≤ 3 million rubles,

Personal income tax% = 3,000,000 rubles. × 13% = 390,000 rubles, RP > 3 million rubles,

where personal income tax% is the amount of personal income tax refunded when paying interest on a target loan (credit);

RP - interest expenses paid;

3 million rub. – maximum property deduction for interest (if the target loan was received before 2014, the property deduction for interest is not legally limited by an upper limit).

3. The property was partially paid for with maternity capital funds:

Personal income tax return = (RN - MK) × 13%, if (RN - MK) ≤ 2 million rubles,

Personal income tax return = 2,000,000 rub. × 13% = 260,000 rubles, if (RN - MK) > 2 million rubles,

where MK is maternity capital funds spent on the purchase of real estate.

A similar formula is used to calculate tax if the property is paid for using funds:

- employers;

- budget;

- other persons.

4. Real estate was purchased from interdependent persons - in this situation, it will not be possible to return personal income tax, regardless of the value of the real estate, since in this situation the taxpayer does not have the right to a property deduction. The following are recognized as interdependent persons with the taxpayer (Article 105.1 of the Tax Code of the Russian Federation):

- his parents (adoptive parents);

- his children (including adopted ones);

- his spouse;

- his brothers and sisters;

- his guardian (trustee) and ward.

Calculation of personal income tax when selling property

Personal income tax payable (NDFLupl) is determined by the following formulas:

1. Income is received from the sale of land plots, residential buildings, apartments, rooms, garden houses, dachas, as well as shares in the specified property:

NDFLupl = (DPT - 1,000,000 rub.) × 13%, if DPT > 1 million rub.,

NDFLupl = 0, if DPT ≤ 1 million rubles,

where DPN is income from the sale of real estate;

1 million rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling real estate.

Example 1

Soloviev A.P. sold an apartment in 2022 for 1,220,000 rubles. In the 3-NDFL declaration, he reflected income in the amount of 1,220,000 rubles. and a property deduction in the amount of 1 million rubles. Personal income tax payable was calculated using the formula:

NDFLupl = (1,220,000 rub. – 1,000,000 rub.) × 13% = 28,600 rub.

Example 2

Vasilyeva T.N. received 643,000 rubles from the buyer in 2022. under the contract of sale and purchase of the dacha. I filed a 3-NDFL declaration, indicating the income received (RUB 643,000) and a property deduction in the same amount. She will not have to pay personal income tax on this transaction (643,000 rubles ≤ 1 million rubles).

2. Income received from the sale of other property (car, garage or other items):

NDFLupl = (DPI - 250,000 rub.) × 13%, if DPI > 250,000 rub.,

NDFLupl = 0, if DPI ≤ 250,000 rub.,

where DPI is income from the sale of other property;

250,000 rub. - the maximum property deduction allowed by the Tax Code of the Russian Federation when selling other property.

Example 3

Two brothers, Stepan and Andrey Tumanov, decided to upgrade their cars in 2022. Before buying new cars, they sold their old cars:

- for 523,000 rub. (Stepan),

- 182,000 rub. (Andrey).

When calculating personal income tax payable, they used the following formulas:

Stepan: Personal income tax = (RUB 523,000 – RUB 250,000) × 13% = RUB 35,490;

Andrey: Personal income tax = 0, since 182,000 rubles. < RUB 250,000

At the end of 2022, both brothers declared their income by filing 3-NDFL. Stepan paid tax in the amount of 35,490 rubles, but Andrey did not have to pay anything.

For calculation formulas used to determine tax liabilities and for financial analysis purposes, please visit our portal:

- “Calculation of the tax burden in 2020-2021 (formula)”;

- “Calculation of the break-even point (formula and graph)”.

Study deduction

As previously mentioned, you can receive compensation both for paying for your own education and for educating your wards, children and brothers/sisters. The main thing is that the educational institution where the training takes place must certainly have a license to operate.

The specialization of educational institutions can be varied:

- Kindergartens and preschool educational centers and clubs;

- Schools and studios, clubs and developmental courses;

- Specialized schools (evening schools, driving schools, music, choreography, theater arts, etc.);

- Courses and centers for advanced training or retraining;

- Lyceums, schools, technical schools and universities.

As for the amount of the deduction, it cannot exceed 13% of 120,000 rubles spent per year on one’s own education or that of a brother/sister and 50,000 rubles on the education of children and wards.

If a child has two parents, and they both plan to apply for a deduction, then it is worth considering that you can still only count on up to 50,000 rubles. This means that individual parents will only be able to receive compensation in the amount of up to 25,000 rubles each.

But if there are two or more children, then you need to know that compensation for the amount spent on education - up to 50 thousand rubles - is due for each child.

Second year of application of the property deduction: repeated 3-NDFL declaration

The situation when a property deduction can be applied for several years is typical for real estate purchase situations. For example, if the amount of personal income tax withheld from the taxpayer’s income (taxed at 13% personal income tax) for the period of filing 3-personal income tax is less than 260,000 rubles, the right to the balance of the unused deduction does not expire, but is transferred to subsequent periods.

Example

In 2022, stamper E. B. Lakhtina bought an apartment on the secondary housing market for RUB 1,760,000. During the specified period, personal income tax = 81,120 rubles was transferred to the budget from her salary. Amount of personal income tax to be refunded from the budget:

- calculated from the purchase price: RUB 1,760,000. × 13% = RUB 228,800;

- possible return (for 2022): RUB 81,120.

The balance of personal income tax that can be returned from the budget in subsequent periods: 228,800 – 81,120 = 147,680 rubles.

In 2022, Lakhtina E.B. got an additional part-time job in another company. At the end of 2022, the personal income tax transferred to the budget from the salary she received from 2 employers amounted to 127,000 rubles. - Lakhtina E.B. can return this amount from the budget by again submitting 3-NDFL and other required documents to the inspection (2-NDFL certificate for 2022, application for personal income tax return, documents confirming the purchase of housing).

The balance of the deduction is 20,680 rubles. (147,680 – 127,000) Lakhtina E.B. will return based on the results of 2022, if she again provides the necessary documents to the tax office.

Reflection of social deductions in 3-NDFL (together with standard deductions)

The Tax Code of the Russian Federation provides for 5 types of social tax deductions (see diagram):

Let's change the conditions of the example (while maintaining the data on income and standard deductions entered into the program) described in the previous section to clarify the rules for filling out social deductions in 3-NDFL.

A line-by-line algorithm for reflecting social benefits for treatment in 3-NDFL can be found in ConsultantPlus, having received free trial access to the system.

Example 2

Stepanov I.A. paid for his advanced training courses in 2021 in the amount of 45,000 rubles. In the 3-NDFL declaration, he declared his right to a personal income tax refund in the amount of 5,850 rubles. (RUB 45,000 × 13%).

To reflect the social deduction in 3-NDFL, Stepanov I.A. filled out the “Deductions” section in the following order:

- checked the box “Provide social tax deductions”;

- in the subsection “Amounts spent on your training” indicated the amount of 45,000 rubles;

- I left the remaining fields blank.

After entering the data, the completed “Deductions” section in the program began to look like this:

Dedicated to social and standard deductions, Appendix 5 of the 3-NDFL declaration began to look like this (reflecting the amount of standard and tax deductions):

For new tax deduction codes, see the article “Tax deduction codes for personal income tax - table for 2021” .

Results

The use of a property deduction allows you to return personal income tax from the budget (when purchasing real estate) or reduce the income tax payable (when selling property).

When filling out a 3-NDFL declaration for a property deduction, an individual needs to take into account many nuances (tenure of ownership of property, maximum allowed amount of deduction, etc.), and also collect a package of supporting documents (2-NDFL certificates, real estate purchase and sale agreement, transfer and acceptance certificate completed housing construction, etc.).

Sources:

- tax code of the Russian Federation

- Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.