PSN: essence and types of activities

The meaning of this special regime is that the entrepreneur receives a special document from the tax authorities - a patent.

It acts as a permit to conduct any type of commercial activity. A patent is a kind of payment for carrying out an activity. You can receive (or better yet, buy) it for any period, but not more than 12 months (clause 5 of Article 346.45 of the Tax Code of the Russian Federation) and only for one type of activity (clause 1 of Article 346.45 of the Tax Code of the Russian Federation). Different patents must be acquired for several types of business activities. The patent taxation system can only be used by individual entrepreneurs; it has nothing to do with enterprises. For entrepreneurs, the patent tax system is an excellent chance to try themselves in a small business, because a document can be purchased for at least 1 or 2 calendar months. The patent tax system does not require the preparation and submission of a tax return on it, which is another argument in favor of starting entrepreneurs switching to it.

ATTENTION! A bill has been submitted to the State Duma, according to which SMEs will be able to apply PSN. Officials also propose to set new limits for the special regime. See details here.

The types of activities that are subject to taxation using the patent method are prescribed in Art. 346.43 Tax Code of the Russian Federation. The list contains 80 types of permitted activities. At the same time, local authorities have the right to supplement it at the regional level, but not to reduce it. If we compare the types of activities of the patent tax system with UTII, we cannot help but dwell on the obvious similarities. Basically, the application of these two tax systems involves the provision of certain services and retail trade.

Production within the framework of the patent taxation system is not provided for, but it is possible to provide so-called production services that are directly related to the manufacture of something. For example, these include the production of tableware, carpets, agricultural implements, eyewear, etc.

IMPORTANT! From 2022, it is no longer possible to use PSN when selling goods that are not related to retail trade. And labeled drugs cannot be sold even within the framework of medical and pharmaceutical activities. Read more here.

What does the patent indicate?

A patent is a card with your photo on it. It contains your last name, first name, patronymic, date of birth, citizenship, identity document, TIN.

Since 2016, the labor patent has indicated the territory of validity. For example, if a patent is issued only for Moscow, then a foreign citizen has no right to work anywhere other than the capital, and even in the Moscow region the patent will not be valid. This also applies to other regions.

A profession may also be specified. In this case, the patent allows you to work only in the profession specified in it. But this restriction does not apply in all regions. In Moscow and the Moscow region, the profession is not indicated in the patent, so migrants can legally work in different jobs.

Transition to a patent tax system

In order to obtain a patent, an entrepreneur must submit an application of his intention to the tax office at least 10 days before the start of application of the PSN.

The application form can be downloaded for free by clicking on the image below:

To switch to PSN from 01/01/2022, submit the form no later than 12/16/2021. See details here.

In turn, the tax authorities are ordered to issue a patent within 5 days from the date of acceptance of such an application, provided that the payer has the right to apply this tax regime (clause 3 of Article 346.45 of the Tax Code of the Russian Federation). In this case, the entrepreneur receives the patent itself (or a notice of refusal to issue it) against receipt from tax specialists.

ATTENTION! If an entrepreneur has submitted an application for a patent through the “Individual Entrepreneur’s Personal Account” or via telecommunication channels, he will receive it electronically. In this case, it is no longer necessary to obtain a paper patent from the tax authorities.

Find out what happens if an individual entrepreneur delays filing a patent application here .

Since 2014, an entrepreneur can declare his desire to switch to a patent tax regime simultaneously with the registration of an individual entrepreneur, which is another advantage of a patent for beginning entrepreneurs.

As mentioned earlier, the patent tax system can only be used by individual entrepreneurs. But there are certain restrictions for them:

- The number of personnel - no more than 15 people engaged in activities for which the PSN is applied, for the tax period does not exceed 15 people.

When calculating the average number of employees for PSN, take into account the people who are employed by you in all types of “patent” activities, since the number limit is general, regardless of how many patents you have received (clause 5 of Article 346.43 of the Tax Code of the Russian Federation, Letter from the Ministry of Finance of Russia dated March 20, 2015 N 03-11-11/15437). Employees who are employed in your activities under other taxation regimes do not need to be taken into account. For example, if you combine PSN and simplified tax system, do not take into account workers in “simplified” activities when calculating the number for PSN (Letters of the Ministry of Finance of Russia dated March 13, 2020 N 03-11-11/19389, dated October 29, 2018 N 03-11-09/77379 ).

See also: “PSN + OSNO: how many workers can an individual entrepreneur hire without losing a patent?”; “Are maternity women included in the average number for PSN? ”

- Income exceeding 60,000,000 rubles.

It is determined incrementally from the 1st day of the calendar year in which the entrepreneur began patenting activities. In practice, situations often arise when the payer combines several tax regimes. Income is considered in aggregate for all activities. If an individual entrepreneur combines a PSN, for example, with a simplified tax system, then for the purposes of the income limit on the PSN, income from sales is taken into account both from activities transferred to the “patent” and from activities on the simplified tax system (clause 6 of Article 346.45 of the Tax Code of the Russian Federation, Letter from the Ministry of Finance of Russia dated 04/13/2021 No. 03-11-11/27580). Otherwise, the individual entrepreneur will lose the right to use the patent taxation system.

Read about the combination of PSN and simplified tax system here.

The tax authorities are not required to issue a patent to the applicant. They can issue a refusal based on several reasons (clause 4 of Article 346.45 of the Tax Code of the Russian Federation):

- The application indicates the type of activity that has nothing to do with the patent tax system.

- Submission of an application not on a standardized form or with irregularities in filling out the required elements.

- Indication in the application of an incorrect validity period of the document, for example, 18 months, which contradicts the requirements of the patent regime.

- Violation of the condition for re-transition to the patent tax regime in case of loss of the right to use it (paragraph 2, paragraph 8, article 346.45 of the Tax Code of the Russian Federation). An application for the use of a patent in relation to an activity for which it was previously used can be filed by an entrepreneur no earlier than the next calendar year.

- Failure to pay arrears that must be transferred in connection with the transition to a patent tax system.

If an entrepreneur has lost the right to use a patent, for example, if his income exceeds his income, then he must notify his tax office about this by filing an application within 10 calendar days from the date of occurrence of these circumstances. A similar application is submitted in the event of termination of activities for which the patent tax system was applied. Deregistration is carried out by tax inspectorate specialists no later than 5 days from the date of filing the application. The official date of deregistration is the day when the entrepreneur was transferred to the general tax regime.

Subject to certain conditions, entrepreneurs have the right not to pay a patent, since they are subject to a zero rate for a certain period. Check if you can avoid paying tax with the help of advice from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

Where is a patent filed?

To obtain a work patent, you need to contact the Ministry of Internal Affairs through the migration center. For example, in Moscow it is the Multifunctional Migration Center, and in the Moscow Region it is the Unified Migration Center of the Moscow Region.

Remember that only the employee himself must apply for a patent. Official services issue a work patent personally to the applicant.

Unfortunately, in Russia there are many unscrupulous intermediaries offering assistance in obtaining a patent. These can be both organizations and individuals - fellow countrymen, casual acquaintances or work colleagues. It is dangerous to use such help: as a rule, it is precisely during such requests that foreign citizens buy fake documents. Don't be fooled.

What taxes does the patent tax system replace?

The patent taxation system involves replacing the single tax with the payment of taxes only in relation to activities for which this tax regime is applied. The single tax that an entrepreneur pays for obtaining a patent replaces 3 taxes: VAT, personal income tax and personal property tax. However, if an entrepreneur imports products into the territory of the Russian Federation, then such an operation will be subject to VAT in the general manner, regardless of whether he applies a patent or not.

An entrepreneur with a patent must pay insurance premiums for himself.

Read more about them here. See also: “The individual entrepreneur was closed before the patent expired: how to calculate the percentage in the Pension Fund of Russia.”

In addition, he charges insurance premiums to the wage fund of his employees. Moreover, starting from 2022, he must do this on a general basis and at general tariffs. Until 2022, there was a benefit for individual entrepreneurs on PSN: the tariff for compulsory pension insurance was 20%, and there was no need to transfer social and health insurance contributions at all, with the exception of activities related to retail trade, public catering and leasing of premises (subclause 9 clause 1, subclause 3 clause 2 of article 427 of the Tax Code of the Russian Federation).

Read about insurance premium rates in the article “Insurance premium rates in the table.”

From 2022, individual entrepreneurs have the right to reduce the amount of PSN tax by the amount of insurance premiums paid for themselves in the amount of 100%, or paid for employees, but not more than 50% of the tax amount.

See here for details.

Russian laws allow the combination of several tax regimes. In this case, the individual entrepreneur must keep records separately for each type of activity (tax regime).

Validity period and procedure for re-registration of a patent

You must come for the document in person. It will be issued upon presentation of your passport. You will also have to pay potential income tax - personal income tax, and present a receipt. It is paid in the form of an advance (advance payment) for future periods. The time for which the fee is paid will be considered the period during which the patent will be valid. The validity period can be extended by paying a fixed price for the following months, but not more than 1 year. The total duration of a patent for foreign citizens is 1 year, the minimum is 30 days. Make sure payments are made regularly. If the personal income tax is not paid, the patent will automatically be terminated.

A foreign citizen who comes to work will have one more obligation - to inform the organization that issued the patent that he really works. It's simple - you need to present a duplicate of the contract under which he was employed. It is not necessary to come there a second time; the document can be sent by mail.

We have already found out that the patent is valid for one year. It is not at all necessary to leave and repeat the entire registration procedure again. If the validity expires, the permit can be reissued. No later than 10 days before the deadline, prepare documents and send them to the migration service. The list of documents is already familiar to you - everything is the same, but two more have been added: the contract under which you work, and a petition from your employer.

In the third year of work in Russia, this procedure does not apply. A foreign citizen will have to leave and re-issue all documents, including a patent.

The patent includes the area where the foreigner can live and work, and his specialty. He does not have the right to change the territory on his own. If a migrant decides to change his place of residence and work, he must contact the migration service in the newly chosen territory and obtain a new work patent.

Tax accounting under the patent tax system

As noted earlier, the patent tax system gives an entrepreneur the opportunity not to submit tax reports, but it does not exempt him from maintaining tax records. After all, with its help, tax authorities track income received on an accrual basis from the beginning of the calendar year. The amount of income received is important in determining the right of an entrepreneur to obtain a patent or its further use.

An individual entrepreneur must keep records of his actual income (and not possible) in the income book under the patent tax regime. If a person uses hired labor, then records of wages of his staff and insurance contributions must be organized. He can keep records himself, use hired labor (have a full-time accountant or accounting department), or contact specialized companies that carry out record keeping.

ConsultantPlus experts explained in detail how individual entrepreneurs keep records of income and expenses when combining simplified taxation system and PSN. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Although an individual entrepreneur on a PSN does not have to submit reports under the patent taxation system, he is not exempt from generating and submitting other reports. Read more about this in the article “Individual entrepreneur reporting on PSN - pros and cons.”

How long is the validity period of a patent for foreign citizens?

The period of validity of a work patent for foreign citizens ranges from 1 to 12 months. The validity period is counted from the moment the document is issued and is calculated in calendar months. That is, the validity of a patent is determined from the date of its issue, to which is added not 30 days, but a calendar month. For example, if a patent is issued on August 10, 2022, the 12 months will expire on August 9, 2022. And on August 10, the patent will no longer be valid.

Important! If a foreigner needs to re-register a patent, then he should contact the FMS at least 10 days before the expiration of its validity.

Procedure for renewing a work patent

As noted above, the validity of a patent directly depends on how much the foreigner paid for it. If, for example, 3 months are paid for a work patent, then a foreign citizen can work during this time. However, the maximum period for which it is issued is 12 months. However, this period can only be extended once and only for a period not exceeding 12 months.

You need to start renewing a patent in advance, and not wait until its validity period expires. The patent renewal process usually takes about 10 days, which means you should apply for a document renewal no later than 10 days before its expiration date. When applying for an extension, a foreigner must have a certain package of documents in hand. Collecting them will also take some time, so you should start working on the patent renewal process already a month in advance. The process of preparing for a patent renewal is as follows:

- Collection of necessary documents.

- Payment of taxes for the last month.

- Passing a medical examination.

- Preparation of related documents (for example, an employer’s petition to renew a patent).

An employer who is preparing a petition to renew his employee's patent should pay attention to what to include in this document. The application must include the following:

- the name of the employer for whom the foreign citizen works;

- position held in this company by a foreigner;

- region of work, and therefore distribution of the patent.

Important! If the application contains knowingly false information, the foreigner may be held accountable.

When can an entrepreneur lose the right to use a patent?

An entrepreneur may be deprived of the right to use a patent in the following cases:

- the number of personnel increased to more than 15 people;

- the income received from sales exceeded 60,000,000 rubles;

- from 2022 - if, within the framework of the retail patent, the sale of goods not related to retail trade was carried out.

Read about which sales are not retail and may result in invalidation of the patent, and about other changes in the PSN from 2022 in this publication.

If an entrepreneur bought a patent, for example, for 5 months, and then, after conducting business for 3 months, decided to stop it, then he can submit an application to the tax office for reimbursement of the paid cost of the purchased patent for the remaining 2 months.

Employer's obligations towards foreign workers

The legal status of foreign workers in the Russian Federation is regulated by 115-FZ of July 25, 2002 “On the legal status of foreign citizens in the Russian Federation.”

If an employer or customer of foreign workers enters into a work contract with them, then he does not need to obtain a special permit to hire them. All that needs to be done is to notify the territorial body of the FMS about the conclusion and termination of an employment contract or civil law contract with a foreign citizen within 3 working days from the date of conclusion (termination) of the contract. This notice can be provided on paper or electronically via the Internet.

The form of notifications about the conclusion and termination of the contract was approved by Order of the Ministry of Internal Affairs dated July 30, 2020 No. 536.

If you do not inform the Ministry of Internal Affairs, the organization may be punished under Part 4 of Art. 18.15 Code of Administrative Offenses of the Russian Federation. The sanctions are very strict, so you should never ignore the notification. Thus, for organizations, the fine ranges from 400 to 800 thousand rubles or a ban on conducting activities for a period of 14 to 90 days. For officials, fines range from 35,000 to 50,000 rubles. In Moscow, St. Petersburg, Moscow and Leningrad regions, fines are even higher.

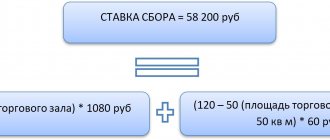

Example of calculating the cost of a patent

The valuation of a patent is fixed. The tax rate is 6%. For Crimea and Sevastopol it can be set at 4%.

Potential income for the year is used as the tax base. It is established by local authorities at the regional level. You can find out the price of a patent at the tax office or in the articles of regional laws.

The upper limit of potential income in 2022 is established by the laws of the constituent entities of the Russian Federation.

ATTENTION! The deflator coefficient is not determined, since from January 1, 2022 from clause 7 of Art. 346.43 of the Tax Code of the Russian Federation, the provision that established the maximum amount of potential income, which was previously subject to indexation by the deflator coefficient, was excluded.

In some cases, when calculating the price of a patent, the area of the rental premises, sales area, and the number of employees can also be taken into account. If during the year the number of employees decreased, for example, from 10 to 8 people, then the tax is not recalculated downward, but if it is upward, it is subject to recalculation (a new patent is purchased according to the letter of the Ministry of Finance of the Russian Federation dated April 29, 2013 No. 03-11-11/ 14921).

The tax period is considered to be the year or the number of months for which the patent was purchased.

To understand the meaning of calculating the value of a patent, consider a simple example.

Individual entrepreneur P. A. Menovshchikov decided to start providing hairdressing services in 2022 and acquire a patent for 5 months. Regional authorities of a constituent entity of the Russian Federation have established a potential income of 325,000 rubles. Let's calculate the annual cost of a patent.

It will be equal to 325,000 rubles × 6% = 19,500 rubles. The cost of a patent per month will be 19,500 rubles / 12 = 1,625 rubles. Accordingly, the cost of a patent for individual entrepreneur P. A. Menovshchikov for 5 months of 2022 will be 1,625 rubles × 5 months = 8,125 rubles.

According to local legislation, the amount of potential income increases as the number of employees increases. If the individual entrepreneur Menovshchikov has a staff of no more than 5 people, then the possible income according to the law of the subject in our example will be equal to 600,000 rubles. Then the cost of a patent for a year will be recalculated upward: 600,000 rubles × 6% = 36,000 rubles. The price of a patent per month will be 36,000 rubles / 12 months = 3,000 rubles. In total, the entrepreneur must pay for 5 months of using the patent: 3,000 rubles × 5 months = 15,000 rubles.

Consider an example where the number of employees increased in the middle of the patent.

The same individual entrepreneur P.A. Menovshchikov, having worked independently for 4 full months, decided to hire 3 people for the remaining 5th month of the patent tax system. For 3 new employees, he must additionally buy a patent for the remaining 1 month of the patent's validity period. Since he hired up to 5 employees, the price of the patent will be calculated based on our estimated 600,000 rubles.

We get the price of a patent for the 5th month of an entrepreneur’s activity: 600,000 rubles × 6% / 12 months = 3,000 rubles. It is for this amount that the individual entrepreneur Menovshchikov must purchase a new patent for 3 of his new employees.

After the expiration of 2 patents, IP Menovshchikov P.A. can purchase a new patent for the desired period, but based on a different amount of potential income accepted by the authorities of his region, for example, 900,000 rubles. The amount of this income will change due to an increase in the number of working personnel from 5 to 8 people.

The tax must be transferred in one amount if the patent term does not exceed 6 months or in two amounts if the patent is issued for 6-12 months. ConsultantPlus experts explained in detail how much tax should be transferred under PSN and what deferment entrepreneurs working in the affected industries can receive. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Find out more about calculating the cost of a patent here.

Terms of employment

When the patent is in hand, you can start looking for a job. According to clause 7 of Article 13.3 of Federal Law No. 115-FZ “On the Legal Status of Foreign Citizens in the Russian Federation,” a period of 2 months is established. During this time, it is necessary to conclude an employment contract with the employer and provide the Migration Service with a copy of it. This can be done in person, or by registered mail with acknowledgment of delivery to the territorial authority that issued the patent.

The employment contract must indicate the patent data. Having received a copy of the contract, the migration authority checks the registration of employers.

Pros and cons of PSN

Let us consider and summarize the pros and cons of using the patent tax system.

The advantages of the patent taxation regime include the following aspects:

- An entrepreneur can independently determine the validity period of a special tax regime (patent). This gives an aspiring businessman an excellent opportunity to assess the potential of the market in which he plans to operate and the income from business activities.

- There is no need to submit tax returns, which makes the life of entrepreneurs much easier. However, this does not exempt them from maintaining tax records of their income.

- Regional authorities have the right to expand the list of activities for which patents can be issued, which also provides additional opportunities for small businesses.

- A simple tax transfer scheme that does not depend on the results of final activities. The price of a patent is determined by the tax office based on potential income for the year. It is established by local authorities at the regional level.

- Possibility of acquiring patents for several types of activities and in several regions of the country.

- The price of a patent is reduced by the amount of the transferred insurance premiums, as is done under the simplified tax system “income”.

Of course, the patent tax regime is not without its drawbacks:

- The mode can only be used by individual entrepreneurs. Businesses do not fall into this category.

- Basically, patent commercial activities involve household services and retail trade.

- There is a strict limitation on the number of employees - only 15 people. All employees of the entrepreneur are subject to registration.

- The area of the service room should be no more than 150 square meters. m. (this restriction applies to retail and catering, because the area is not specified for other services).

We determine whether the foreign worker’s patent is valid.

The situation when a foreigner comes to get a job with a newly issued patent is simple and understandable to the employer. If the region where the patent was issued and the profession indicated in it meet the criteria of the proposed work, you can safely conclude an employment contract. What should you do if the patent was issued a long time ago, and the two-month period from the date of issuance of the patent has already passed?

Let's consider a situation where a foreign citizen applies for employment with a patent issued six months ago. At the same time, he cannot confirm the existence of a previous employment relationship under a patent either with his copy of the employment contract or with an entry in the work book.

In accordance with Part 4 of Clause 22 of Article 13.3 of Federal Law 115-FZ, a patent is canceled if a foreigner fails to provide a copy of the employment contract (GPC agreement) to the migration authorities within 2 months from the date of its issue.

However, such an obligation does not arise for a foreign citizen if he works for individuals. Moreover, if labor relations between individuals were formalized not by an employment contract, but by a civil law contract, then the contract itself may not exist on paper at all, since the law allows civil transactions to be concluded orally.

It remains to clarify the issue of notifying the migration authorities on the part of the employer. The legislation obliges the employer to notify the migration authorities of the conclusion of an employment (civil law) contract within three days, regardless of whether they are legal entities or individuals. However, the fact that the employer did not fulfill this obligation and did not send a notice cannot serve as a reason for revoking the patent of a foreign citizen. This is entirely the responsibility of the employer.

From the above it follows that the absence of formal confirmation of the employment relationship under a patent issued for more than two months is not a reason to consider the patent invalid.

Now you need to check whether the patent has expired.

How can this be determined based on the documents provided by the job candidate? To do this, we need all patent payment receipts, starting with the very first one. If a foreign citizen has not violated the deadline when paying fixed advance payments, you have no reason to refuse to hire him.

The issue of patent payment terms is still controversial. There are two points of view that formed the basis for the discrepancies. First, the payment date is counted from the date of the first payment. Second, the payment date is counted from the issue date indicated on the patent.

What is written in the law about this? Article 227.1 of the Tax Code of the Russian Federation states:

"4. A fixed advance tax payment is paid by the taxpayer at the place where he carries out activities on the basis of the issued patent before the start date of the period for which the patent is issued (extended) or reissued.”

The same article states that the fixed advance payment is an income tax for individuals, which is paid for the period of validity of the patent for a period of one month. In other words, the size of the fixed payment is the amount of income tax that a foreign citizen could receive for one month of work under a patent.

Let's assume that the foreign national paid the fixed advance payment on September 17 and the patent was issued on September 30. For what period did the foreigner pay the tax: from September 17 to October 16 or from September 30 to October 29?

Despite the fact that the foreign citizen paid the advance payment on September 17, he was able to start work only on September 30, since he did not have the right to work until he had a patent in hand. Consequently, he could receive income from his activities starting from the 30th. Thus, the monthly period for which income tax is paid begins on the 30th day and ends on the 29th day of the next month. This is the validity period of the patent. The next patent validity period begins on the 30th of the next month.

To ensure that the patent does not expire, a foreign citizen must make a payment no later than the 29th inclusive in order to extend the validity of the patent for a new period. What happens if the next payment is made on the 30th or later? Let's open Federal Law 115-FZ:

“The validity period of a patent is considered extended for the period for which personal income tax has been paid in the form of a fixed advance payment.

Otherwise, the validity period of the patent expires from the day following the last day of the period for which the personal income tax was paid in the form of a fixed advance payment.”

From this wording it follows that if the payment is not made on time, at 12 o’clock in the morning from the 29th to the 30th, the carriage turns into a pumpkin, and the patent into a useless piece of plastic. At the same time, even if a foreign worker makes a payment on the morning of the 30th, by that time the patent will already be considered invalid and this will not save the situation. The legislation does not provide for a mechanism for restoring the validity period of a patent when payment is renewed. According to the law, in this case it will be necessary to go through the procedure for obtaining a patent again.

Now let's look at typical mistakes associated with determining the validity period of a patent and payment for a patent. The main mistake of a migrant worker is to focus when paying for a patent not on the issue date printed on the patent, but on the date printed on the check for the first personal income tax payment. This error is largely due to incorrect information provided to foreigners by employees of migration centers. And if for migrants who have received a patent to work in the Moscow region this is not critical: the first payment there is made simultaneously with the filing of documents for a patent and in any case always before the date of receipt of the patent, then at the migration center in Sakharovo, where patents for Moscow are issued, another order.

There, the first advance payment is made at the moment when the employee arrives to receive a ready-made patent. Therefore, the date on the check is always later than the issue date previously applied to the patent. And although, in fact, a foreign citizen does first pay an advance payment and then receive a patent, from the documents that remain in his hands, it follows that he first received a patent and then paid the tax, which, according to our legislation, cannot be.

He is put in this situation by the patent registration procedure adopted at the Multifunctional Migration Center (MMC) in Moscow. It should be noted that some employees of the former Federal Migration Service are still committed to this approach - monitoring the validity of a patent based on the dates on advance payment receipts.

However, the courts think differently.

In decisions dated March 4, 2016 in case No. 7-2033/2016, dated December 22, 2015 in case No. 7-14080/2015, the Moscow City Court considers payment of a patent later than the issue date indicated on the patent to be a violation of the deadline.

The resolution of the Supreme Court of the Russian Federation dated January 11, 2016 No. 8-AD15-12 puts an end to this dispute. In its ruling, the Supreme Court indicates that the validity period of a patent is extended for the period for which the tax was paid and is calculated from the date of issue of the patent. The day the tax is paid is not the beginning of the period for which the patent is extended.

When paying a fixed advance payment, you must remember that this payment is a tax, and in accordance with Part 2 of Article 45 of the Tax Code of the Russian Federation, the taxpayer is obliged independently, i.e. on its own behalf and at the expense of its own funds, fulfill the obligation to pay tax. In other words, neither the employer of a foreign worker, nor his acquaintance, relative, etc. cannot pay tax for a foreign citizen.

How this will be done - in cash, through a bank terminal, in Internet banking - does not matter. It also does not matter for how many periods the advance payment will be made at once. You can pay for a month, for two, for six, etc., but no more than twelve months, taking into account the down payment.

It should be noted that a patent is issued not for a calendar year, but for an annual period, which almost never coincides with the calendar year, which means that the cost of the patent may change in the next calendar year. Theoretically, it can change both up and down. This depends on the odds that are accepted towards the end of the year. So, first, the Ministry of Economic Development of the Russian Federation establishes a deflator coefficient for the next year, in accordance with which all the standards within which it is included are recalculated, including the cost of a fixed advance payment for a patent.

After this, the regional coefficient is set by regional authorities at the level of the subject of the Federation. This decision is formalized by the Law of the subject of the federation, which must be adopted by the legislative assembly and signed by the governor or head of the republic no later than a month before the new year. Otherwise, it will not have time to come into force, and in this case the regional coefficient is considered not established and will be equal to one.

So it is better to postpone the decision to pay a fixed advance payment until December, when the amount of tax for the next year will already be known. At the end of 2015, the FMS issued an explanation that the fixed advance payment paid before December 31, 2015 will not be recalculated in 2016, therefore, in those regions where the cost of a patent has increased, foreign workers who paid for the patent in advance were able to save. To find out what to do this year, follow our publications.

Results

Each entrepreneur must independently assess the risks, opportunities and potential income under different taxation regimes and make a choice in favor of the most profitable one. The patent tax regime is especially suitable for entrepreneurs starting their own business, as it frees them from calculating taxes and filing tax returns.

You can find out which BCC the cost of the patent should be credited to in the article “KBK for a patent for individual entrepreneurs (nuances)” .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Answers to common questions

Question: If a work patent is issued for 12 months, will it be necessary to leave the Russian Federation to extend it for another 12 months?

Answer: No, to renew a patent for another 12 months, you do not need to travel outside the Russian Federation. But at the end of the second 12-month period, the foreign citizen will need to travel outside the Russian Federation and again receive a migration card. This card is needed to confirm the legal stay of a foreigner in the Russian Federation and to obtain a new work patent.

Question: What to do if the work patent specifies one region of work, but the foreigner wants to work in another region?

Answer: In this case, you will have to obtain a new work patent, which will indicate the region in which the foreigner plans to work.

Question: How long is a second patent issued for work in another region?

Answer: The validity period of a patent for work in another constituent entity of the Russian Federation should not be longer than the validity period of the original patent.

Question: What should I do if my last name changes during the validity period of the work patent?

Answer: In this case, the foreign citizen should contact the FMS with an application to amend the information in the patent. This must be done within 7 working days after changing this information. If this deadline is violated, the foreigner will face a fine.

How to get a patent for work?

In order to work calmly, a foreigner needs to apply for a patent, which implies a number of specific actions.

Stage 1. Filling out a migration card and registering for migration.

The migration card, which is filled out by a foreigner when crossing the border, must reflect the purpose of entry - work. This is a mandatory requirement for employment.

A foreigner has seven days from the date of entry into the country to register.