“Children’s” deductions: to whom and how much

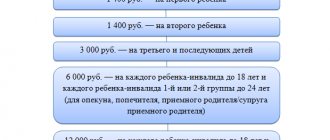

The procedure for applying standard deductions for personal income tax is regulated by Art. 218 Tax Code of the Russian Federation. The amount of the deduction depends on the type of child in the family. For the first and second child, the deduction amount is 1,400 rubles each. monthly. For the third and each subsequent child - 3,000 rubles. monthly.

The following are entitled to such a deduction:

- each of the parents (including divorced ones);

- the parent's spouse (i.e., the child's stepfather or stepmother);

- each of the guardians, trustees, adoptive parents (if there are several of them);

- each of the adoptive parents (if there are two of them);

- spouse of the adoptive parent.

The deduction is valid for each child, without exception, under the age of 18, as well as for each child under the age of 24, if he is a full-time student, graduate student, resident, intern, student or cadet.

There are also separate deductions for children who are disabled. The amount of the deduction depends on age and sometimes disability group. So, if a disabled child is under 18 years old, then the disability group does not matter. If the child is a full-time student, graduate student, resident, intern or student under the age of 24, then a deduction is possible if disability group I or II.

The size of the deduction depends on who receives it. If this is a parent, his spouse or adoptive parent, then the deduction is 12,000 rubles. per month for one child. For an adoptive parent, his or her spouse, caregiver and guardian, the deduction is 6,000 rubles. per month.

The “children’s” deduction is valid until the month in which income taxed at a rate of 13% on an accrual basis from the beginning of the year does not exceed RUB 350,000. From the month in which income exceeds 350,000 rubles, the deduction does not apply. If an employee has been working at his current place of work not since the beginning of the year, then the deduction should be provided taking into account the income received since the beginning of the current year at his previous job.

In the near future, the size of the “children’s” deductions will most likely increase. Bill No. 751335-7 is being considered, according to which they plan to increase the deduction to 2,500 rubles. for the first and second child, up to 3500 for the third and each subsequent child. For disabled children, the deduction amounts are planned to be set at 8,000 and 12,500 rubles. (depending on the status of the employee: parent, guardian, etc.) In addition, the bill proposes to increase the maximum level of employee income, from which the application of the “children’s” deduction ceases: up to 400,000 rubles.

Application of deduction

The child deduction is the part of a person’s income that is not subject to personal income tax . When calculating tax, the accountant excludes the amount of the standard child deduction from the tax base. As a result, personal income tax payable decreases.

But first the amount of the deduction . When determining it, you should take into account:

- Total number of children. This includes one’s own children, as well as wards and non-adopted children of one’s spouse from another marriage.

- What kind of a child does he have in the family? The oldest child is considered first. It does not matter whether the parent receives a deduction for it or not.

- The deduction for a disabled child is provided in addition to the deduction provided depending on the type of account in the family. In other words, the amounts of these deductions are summed up. This follows from paragraph 14 of the review approved by the Presidium of the RF Armed Forces on October 21, 2015.

- There is a threshold amount of income for a person who is entitled to the standard deduction. It is equal to 350,000 rubles. As long as the employee’s salary, calculated from the beginning of the year on an accrual basis, does not exceed this amount, he is entitled to a deduction. Once income crosses this threshold, the deduction will not be provided until the end of the year.

Supporting documents for “children’s” deductions

“Children’s” deductions are provided on the basis of a written application drawn up in any form and supporting documents. This is what it says in paragraph 3 of Art. 218 Tax Code of the Russian Federation. However, it is not explained which documents must be submitted. In general, this is a copy of the child’s birth certificate (letter of the Ministry of Finance of the Russian Federation dated October 2, 2015 No. 03-04-05/56445).

But in practice, as a rule, more documents are required. The exact list of documents depends on the specific situation. For example, if a child is over 18 years old and is a full-time student, then an additional certificate from the educational institution must be submitted.

If an employee has not been working at his current job since the beginning of the year, he may be required to provide a certificate of income and tax amounts from his previous place of work. This is necessary so that the current employer can check whether the maximum income level at which the application of the “children’s” deduction ceases has been reached (paragraph 2, paragraph 3, article 218 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated July 30, 2009 No. 3-5-04 /1133).

Notarization of copies of documents confirming the right to a standard personal income tax deduction is not required. The Federal Tax Service of the Russian Federation draws attention to this in letter No. ED-4-3/8418 dated May 23, 2012.

Let's consider another question related to documents: how often do you need to write an application for deduction to the accounting department?

It depends on how it was composed. If it indicated the deduction period (for example, “I ask for a standard tax deduction during 2022”), then in order to receive the deduction in 2022, the employee will have to write a new application. But if the period for providing a deduction is not specified in the application and at the same time the employee’s right to a standard deduction is not terminated, then there is no need to re-fill the application. Such clarifications are given by the Ministry of Finance of the Russian Federation in letter dated May 31, 2019 No. 03-04-05/39733.

What documents must be submitted to the organization to provide a tax deduction for a child?

| Employee | Documentation |

| Parent, spouse of a parent, parent deprived of parental rights but paying child support | A copy of the child’s birth certificate, a certificate of disability of the child (if the child is disabled), a copy of the marriage registration certificate (if the employee is the mother’s spouse, but not the child’s parent) |

| Adoptive parent | A copy of the child’s adoption certificate, a certificate of disability of the child (if the child is disabled) |

| Guardian, trustee | A copy of the resolution of the guardianship and trusteeship authority or an extract from the decision (resolution) on establishing guardianship (trusteeship) over the child, a copy of the agreement on the implementation of guardianship or trusteeship, a copy of the agreement on the implementation of guardianship over a minor citizen, a certificate of disability of the child (if the child is disabled) |

| Adoptive parent, spouse of the adoptive parent | A copy of the agreement on the transfer of the child to be raised in a family, a copy of the document on registration of marriage between the parents (passport or marriage registration certificate), a certificate of disability of the child (if the child is disabled) |

In addition to the above documents, depending on the situation, the following must also be submitted:

- birth certificates of older children, including those over 24 years of age;

- a writ of execution for alimony or a statement from the employee that the father is providing for the child;

- an annual certificate of full-time education if the child is over 18 years old. It must be taken into account that a certificate from an educational institution issued in September 2022 is not relevant in 2022;

- birth certificate in which the father is not indicated;

- a certificate from the civil registry office in form 25, which states that in the birth certificate the entry about the child’s father was made according to the mother’s words;

- application of the second parent to transfer the right to receive a deduction to the first parent;

- death certificate of the second parent;

- document confirming cohabitation with a child (certificate issued by the housing and communal service, HOA, housing or housing construction cooperative, township or rural administration, court decision establishing the fact of cohabitation with the child).

“Children’s” deductions if children are from different marriages

The right to a standard “children’s” deduction arises provided that the child is supported by a parent. This clearly follows from Art. 218 Tax Code of the Russian Federation. In a standard situation, when a child lives with his parents, no questions arise. But can, for example, the father of a child claim a deduction if the parents divorced and the child lives with his mother after the divorce?

Yes, maybe, if he pays alimony to his ex-wife (letter of the Ministry of Finance of the Russian Federation dated October 11, 2012 No. 03-04-05/8-1179). In this case, such an employee, along with the usual package of documents, must submit to the accounting department documents confirming the payment of alimony (letter of the Ministry of Finance of the Russian Federation dated November 7, 2018 No. 03-04-05/80099).

But not only the father can count on a deduction in this case. His new wife can also receive a deduction for her husband's child from a previous marriage. After all, property acquired by spouses during marriage is their joint property (Article 256 of the Civil Code of the Russian Federation and Article 34 of the Family Code of the Russian Federation). Including money that must be paid in the form of child support. It turns out that the spouses of people who pay alimony also participate in the maintenance of these children. This means they are also entitled to standard deductions. This conclusion is contained in letters of the Ministry of Finance of the Russian Federation dated August 10, 2016 No. 03-04-05/46762, dated March 18, 2015 No. 03-04-05/14392 and the Federal Tax Service of the Russian Federation dated September 17, 2013 No. BS-4-11/16736.

If the employee does not pay alimony, then he still has the right to a deduction if he helps his ex-wife with money and can prove this. For example, documents proving the fact of transferring money to support the child, a written statement from the ex-wife (mother of the child) that the child’s father is involved in providing for him (letter of the Ministry of Finance of the Russian Federation dated 03.03.2016 No. 03-04-05/12376).

“Children’s” deductions if a child starts his own family

Since in some cases the deduction is also given to an adult child (over 24 years old), a situation is likely when he starts his own family. Is the parent still entitled to the standard deduction? Officials from different departments give different answers to this question.

For example, in the letter of the Federal Tax Service of the Russian Federation for Moscow dated June 6, 2014 No. 20-15/055333, it is stated that a deduction for a child is provided regardless of the fact of the child’s marriage.

In letters of the Ministry of Finance of the Russian Federation dated March 29, 2019 No. 03-04-05/21857, dated March 17, 2016 No. 03-04-05/14853, dated March 31, 2014 No. 03-04-06/14217, the exact opposite position is given: after the child joins (including a student) a new family is formed by marriage, so he ceases to be supported by his parents, therefore, the taxpayer is not provided with a standard deduction for a child.

The position of the capital's Federal Tax Service seems to us more correct. In Art. 218 of the Tax Code of the Russian Federation there are no rules that prohibit giving a deduction if a child gets married. If, even after the marriage is registered, the parents continue to support the child, then the parents retain the right to a deduction. In addition, the employer is not obliged to check whether the employee’s child has started his own family. And an employee-parent is not obliged to inform his employer about the wedding of his son or daughter. Therefore, a joyful event should not interfere with receiving a “children’s” deduction.

Professional deductions for personal income tax

Similar deductions are provided for individuals (not entrepreneurs!) engaged in performing work (services) under GPC agreements, i.e.:

- providing services under contract agreements;

- inventors;

- authors of literary works, etc.

In order to take advantage of the deduction, an individual must submit an application to the tax agent who paid the income. If this is not possible, then at the end of the year you must submit an income tax return (3-NDFL) to the Federal Tax Service. Deductions provided for in Art. 221 of the Tax Code of the Russian Federation are determined in the amount of actual expenses, and if it is impossible to confirm expenses - according to standards from 20 to 40% of the amount of accrued income.

Who is entitled to the double “children’s” deduction?

Sometimes workers are entitled to double the standard deduction. There are two such situations:

- when the employee is the only parent (adoptive parent, guardian, trustee);

- when the second parent refused the deduction in favor of the other.

Let's look at the first situation first. So, who is considered a “sole parent”? Not just someone who is raising a child alone (for example, due to divorce), but someone who can document the child’s absence of a second parent.

In turn, the absence of the second parent is his death or recognition (in court) as missing or deceased (letter of the Ministry of Finance of the Russian Federation dated February 15, 2016 No. 03-04-05/8123).

The only parent is also considered to be a mother whose child was born out of wedlock and paternity has not been legally established - the father is not indicated on the birth certificate, or information about the child’s father was entered based on the mother’s application (letter of the Ministry of Finance of the Russian Federation dated 02.02.2016 No. 03-04- 05/4973, dated 04/17/2014 No. 03-04-05/17637). But if she gets married, then from the next month after the marriage is registered, she is no longer entitled to a double deduction - regardless of whether the child is adopted by her spouse or not. This follows from paragraph. 13 pp. 4 paragraphs 1 art. 218 Tax Code of the Russian Federation.

Let's consider in what other cases an employee cannot be considered the only parent:

- when one of the parents is deprived of parental rights (letter of the Ministry of Finance of the Russian Federation dated 01.02.2016 No. 03-04-05/4293, Federal Tax Service of the Russian Federation dated 13.01.2014 No. BS-2-11 / [email protected] );

- when one of the parents evades paying child support and does not participate in the maintenance of the child (letter of the Ministry of Finance of the Russian Federation dated June 16, 2016 No. 03-04-05/35111).

Now let's consider the second situation in which the employee is entitled to a double deduction - this is when the second parent refused the deduction in favor of the other. But it's not that simple. A number of nuances should be taken into account.

Firstly, the refusal of the deduction must come from a parent who has the right to a “children’s” deduction, that is, having income taxed at a rate of 13%. If the mother does not have taxable income (for example, in connection with caring for a disabled child or being on parental leave), then she does not have the right to a deduction and she cannot refuse a deduction in favor of her spouse (letters from the Ministry of Finance of the Russian Federation dated 02/06/2018 No. 03-04-05/6880, dated 04/20/2017 No. 03-04-05/23946).

Secondly, if the “refusenik”’s income since the beginning of the year has exceeded 350,000 rubles, then he loses the right to the deduction transferred to his spouse. Accordingly, the other parent stops using the double deduction.

Thirdly, if the “refusenik” at the time of refusal of the deduction has income taxed at a rate of 13%, but then their receipt ceases (for example, due to dismissal and lack of work), then the other parent also ceases to enjoy the double deduction (letter Ministry of Finance of the Russian Federation dated December 14, 2018 No. 03-04-05/91182).

For these purposes, an employee receiving a double deduction must monthly bring to his accounting department a certificate of income from the second parent’s place of work. Such clarifications are provided in letters of the Ministry of Finance of the Russian Federation dated June 22, 2016 No. 03-04-05/36143, dated May 28, 2015 No. 03-04-05/30910. The courts also attach great importance to the fact of submitting a document confirming the receipt of taxable income by the other spouse (Resolution of the Administrative Court of the West Siberian District dated 12/09/16 No. F04-5705/2016).

To receive a double deduction, the employee must write an application for a double deduction, attaching the necessary documents, which include the other parent’s application to waive the deduction (letter of the Federal Tax Service of the Russian Federation dated November 3, 2011 No. ED-3-3/3636) .

Investment tax deduction for personal income tax in 2018

With this new type of deduction, the state stimulates the activity of citizens in investment activities. It is provided upon redemption of securities traded on the market that were owned by the payer for more than 3 years and on the profits from which he paid tax. The deduction can be issued by a tax agent or when submitting a tax return for 2022 to the Federal Tax Service.

Art. 219.1 provides for the conditions for receiving an annual deduction:

- possession of an IIS (individual investment account) for at least 3 years;

- funds were invested in the development of the domestic securities market;

- preferential profit does not exceed RUB 3,000,000.

This rule has been in effect since January 1, 2014, i.e., in 2022, investors received the right to issue a refund of the funds spent. The investment deduction is calculated taking into account the amount of funds contributed to the IIS for the year, but in an amount not exceeding 400,000 rubles.

It is important to remember that an individual has the right to own only one transaction account and must confirm this fact in writing to the broker.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Birth order of children for the purposes of “children’s” deductions

Since the size of the deduction is larger for the third child, many questions arise regarding the size of the “children’s” deduction and the order of birth of children.

For example, an employee has three children, but two of them are not entitled to a deduction due to their age. The question arises: should a deduction be given for the third child in the amount of 1,400 or 3,000 rubles?

In paragraphs 4 paragraphs 1 art. 218 of the Tax Code of the Russian Federation clearly states that 3,000 rubles are given for every third and subsequent child. And there is no condition that in order to receive an “increased” deduction for a third child in relation to older children, the employee must have the right to a deduction. Therefore, in a situation where the employee is no longer entitled to a deduction for older children due to their age, for the youngest the deduction amount will be 3,000 rubles. This conclusion is confirmed by the Ministry of Finance of the Russian Federation in letter dated April 17, 2014 No. 03-04-05/17619.

What if an employee has two children, and the first child died? In this case, although the youngest child is the second in the family, for the purposes of the deduction it will be considered the third, which means that in respect of him the employee will receive a deduction in the amount of 3,000 rubles. This conclusion is contained in the letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-04-06/8-33.

The birth order of children is determined by their dates of birth. In the cases under consideration, the accounting department must have copies of the birth certificate of all children (including those for whom a deduction is not provided due to their age or death).

Let's consider another situation. An employee in a new marriage has two children, but from a previous marriage he has one child for whom he pays child support. This employee receives deductions for all three children (for the third - in the amount of 3,000 rubles). His current wife also receives the same amounts.

But as soon as a child from a previous marriage turns 18, he ceases to be supported by his father and the payment of alimony stops. That is, the father and his new wife stop receiving a deduction for this child. For two children from a current marriage, the employee still receives 1,400 and 3,000 rubles. But his current wife is changing the amount of deductions for her own children. If earlier she received a deduction for them in the amount of 1,400 and 3,000 rubles, now her deduction will be 1,400 and 1,400 rubles. This conclusion is contained in the letter of the Ministry of Finance of the Russian Federation dated January 21, 2016 No. 03-04-05/1999.

Social deductions for personal income tax in 2022

Social deductions are regulated by Art. 219 of the Tax Code of the Russian Federation and allowing to reduce the actual costs of the payer for their needs. Circumstances that allow you to return the personal income tax amount are:

- donations to religious, non-profit or charitable organizations (in the amount of actual costs, but not more than 25% of the amount of taxable income received);

- payment for your own education (in the amount of expenses incurred, but not more than the limit of 120,000 rubles per year), as well as for full-time education of your children, sisters, brothers under 24 years of age (in the amount of no more than 50,000 rubles for each within the established limit);

- expenses incurred for your treatment or the treatment of your spouse, parents, children under 18 years of age (in the amount of actual costs, but not more than 120,000 rubles). Deductions for expensive treatment with drugs listed in list No. 201, approved. The Government of the Russian Federation dated March 19, 2001 is provided in the amount of real expenses. In particular, this applies to the implantation of dentures. A personal income tax refund can be made if the conditions are met - if the treatment was carried out at the applicant’s own expense, and the medical institution has the appropriate license;

- insurance costs (in the amount of expenses incurred, but not exceeding the limit of 120,000 rubles). These include the costs of non-state pension provision (NGPO), voluntary pension insurance (VPE) and life insurance (LI), concluded for a period of at least 5 years, as well as the payment of insurance premiums for a funded pension;

- conducting an independent assessment of qualifications (in the amount of actual costs, but not more than 120,000 rubles).

Is the right to a “children’s” deduction retained in the absence of income?

It happens that in certain months an employee does not have income subject to personal income tax (for example, due to being on long-term leave at his own expense or maternity leave). Is the right to a “children’s” deduction retained during “no-income” periods, and does the tax agent have to accumulate deductions and then provide them to the employee?

Situation 1.

At the beginning of the year, the employee had taxable income, but then the accrual and payment of taxable income stopped until the end of the year.

Under such conditions, deductions for “non-income” periods are not provided by the employer (letter of the Ministry of Finance of the Russian Federation dated October 30, 2018 No. 03-04-05/78020). However, an employee can obtain them independently through the tax office by submitting a 3-NDFL declaration there.

Situation 2.

In certain months of the calendar year, taxable income was absent, but appeared before the end of the year. In this case, deductions are “accumulated”, summed up, and then - when taxable payments arise this year - provided (letters from the Ministry of Finance of the Russian Federation dated December 25, 2018 No. 03-04-05/94556, dated February 15, 2018 No. 03-04-05/ 9654, dated 04.09.2017 No. 03-04-06/56583, Federal Tax Service of the Russian Federation dated 29.05.2015 No. BS-19-11/112, Resolution of the Supreme Arbitration Court of the Russian Federation dated 14.07.2009 No. 4431/09).

Special case of situation 2

: from the beginning of the year, an employee who has an employment relationship with the company had no taxable income, but then appeared (for example, an employee was on maternity leave, but left it within a year).

The same rules apply here as above: the right to deduct for previous months is not lost. However, regarding precisely this situation, the Ministry of Finance of the Russian Federation previously had a position that there is no deduction for “non-income” months (letters dated December 26, 2014 No. 03-04-05/67642, dated June 11, 2014 No. 03-04-05/28141). Officials believed that in this case the tax base for personal income tax should be determined not on an accrual basis from the beginning of the year, but starting from the month when the employee’s first income was accrued. The Supreme Arbitration Court of the Russian Federation clarified that this approach is illegal, since it does not follow from the Tax Code of the Russian Federation (Resolution No. 4431/09 dated July 14, 2009).

Situation 3.

There is no taxable income during the entire tax period, that is, the calendar year (for example, an employee is on maternity leave).

In this case, the employee does not have the right to a standard deduction (letter of the Ministry of Finance of the Russian Federation dated September 4, 2017 No. 03-04-06/56583, dated January 13, 2012 No. 03-04-05/8-10). This is explained by the fact that the tax base for calculating personal income tax in such situations is not determined in principle (for a specific year).

TAX DEDUCTIONS WHEN CARRYING LOSSES FORWARD TO FUTURE PERIODS

When carrying forward losses from transactions with securities and transactions with derivative financial instruments, tax deductions are provided:

- in the amount of losses received from transactions with securities traded on the organized securities market;

- in the amount of losses received from transactions with derivative financial instruments traded on the organized market.

Notes

- The taxpayer can take into account the resulting loss within 10 years following the year in which it was received. If losses were incurred in more than one period, they are carried forward to future periods in the order in which they were incurred.

- To confirm the right to tax deductions when carrying forward losses to future periods, the taxpayer submits documents confirming the amount of losses incurred during the entire period when he reduces the tax base of the current tax period by the amounts of previously received losses.

When carrying forward losses from participation in an investment partnership, tax deductions are provided in the amount of losses received from:

- transactions of investment partnerships in which the taxpayer participates with securities traded on the organized securities market;

- transactions of investment partnerships in which the taxpayer participates with securities not traded on the organized securities market;

- transactions of investment partnerships in which the taxpayer participates with derivative financial instruments not traded on the organized securities market;

- operations of investment partnerships in which the taxpayer participates, with participation shares in the authorized capital of organizations;

- other operations of investment partnerships in which the taxpayer participates.

To confirm the right to tax deductions when carrying forward losses to future periods, the taxpayer submits documents confirming the amount of losses incurred during the entire period when he reduces the tax base of the current tax period by the amounts of previously received losses.

EXAMPLE 5

Ivanov A.I. at the end of 2016 received a loss of 10,000 rubles. from transactions with securities traded on the organized securities market.

In 2022, he made a profit of RUB 50,000. on transactions with securities traded on the organized securities market.

Taking into account the loss in 2016, the amount of personal income tax payable in 2017 will be:

(50,000 rub. – 10,000 rub.) × 13% = 5,200 rub .