Kontur.Accounting - 14 days free!

Friendly, simple and functional online service for small businesses.

Clear for the director, convenient for the accountant! Try it

The trade tax appeared in the Tax Code back in 2015. This is a payment for entrepreneurs and organizations engaged in retail, wholesale and small wholesale trade. In Moscow it has been in effect since July 1, 2015. Other cities of federal significance (Sevastopol and St. Petersburg) decide to introduce a trade tax on their own; they have not yet exercised their right. In other cities of Russia, a trade tax can be introduced only after the adoption of the corresponding federal law, which does not exist to this day.

We will tell you what the essence of the trade tax is and what you need to do if it is carried out in your city.

- Trade tax changes in 2022

- Who pays the trading fee

- Who doesn't have to pay the trade tax

- What to do if a trading fee has been introduced

- Where to submit a notification

- How much and when to pay

- How to reduce trade tax taxes

- How to stop paying trading fees

Trade tax changes in 2022

Changes in the trading fee in 2022 compared to 2021 are small:

1. In St. Petersburg and Sevastopol, a trade tax has not yet been introduced in 2022.

2. The deflator coefficient has been increased from 1.420 to 1.508 for activities related to organizing retail markets.

3. The rates of the trade tax have not changed since 2022; they are listed in the Law of the city of Moscow dated December 17, 2014 No. 62 “On the trade tax”. However, retail trade, which previously had to pay 40,500 rubles per quarter, was exempted.

4. Exemption from trade tax has been cancelled:

- retail trade through vending machines;

- retail retail trade through premises, buildings, structures under the operational management of autonomous, budgetary and government institutions;

- retail trade on the territory of the property complex of the managing organization of the agri-food cluster.

5. The benefits for federal postal organizations have been clarified. Now such companies are exempt from paying the trade tax only in relation to the trade in postal envelopes, postcards, postal containers used for the provision of postal services, government postage stamps, and office supplies.

6. Interregional fairs were exempted from the trade tax.

7. The trade exemption was extended until January 1, 2026:

- in cinemas, theaters, circuses, planetariums, museums;

- in religious organizations;

- at “Print” kiosks;

- in some hairdressing salons, salons, laundries, dry cleaners, shoe and clothing repairs, watches, jewelry, salons for the manufacture and repair of metal haberdashery, keys;

- some organizations and entrepreneurs selling books, newspapers and magazines.

How to calculate vehicle

Let's look at examples of how to calculate trading fees.

EXAMPLE 1

Let Principle LLC conduct trade in a store with a sales area of 120 square meters. m, which is located in the Central Administrative District of Moscow. Let's calculate the rate using the formula:

Thus, Principle LLC will pay a quarterly fee amount of 58,200 rubles.

EXAMPLE 2

Let IP Fomin A.V. trades through a non-stationary retail chain facility located in the Novokosino area of the Eastern Administrative District.

He will pay the vehicle on a quarterly basis in the amount of RUB 28,350. (in this case, it is enough to check the table of trading tax rates).

Who pays the trading fee?

The trade fee is regulated by Chapter 33 of the Tax Code and regulations of local governments and laws of federal cities. For Moscow, this is Law No. 62 “On Trade Fees” dated December 17, 2014. In other constituent entities of the Russian Federation, trade fees have not been introduced in 2022.

An object through which trade is conducted is a building, structure, premises, stationary or non-stationary retail facility or retail outlet, through which the payer carries out activities in respect of which a fee is established (clause 4 of Article 413 of the Tax Code of the Russian Federation).

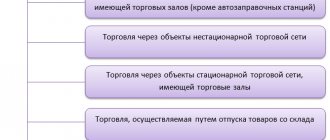

Trade tax is paid by companies and individual entrepreneurs who trade in Moscow:

- through stationary retail chain facilities without sales areas (except gas stations).

- through objects of a non-stationary trading network,

- through stationary retail chain facilities with trading floors,

- through the release of goods from the warehouse.

A trading network is a combination of two or more objects, but for the purpose of imposing a trade tax, the number of points does not matter. The fee must be paid even from one store or kiosk.

We enter data into the TS-1 form correctly

The notification form for the trade fee is the same for individual entrepreneurs and organizations. It consists of 2 (or more if necessary) sheets.

Title page

As usual, on the title we indicate general information about the fee payer:

Sheet with data about the object of trade

If the notification is submitted to several objects, then the appropriate number of sheets should be filled out.

When filling out the notification, special attention should be paid to calculating the amount of the fee in order to enter the correct data in the document:

What should you do if a trade tax has been introduced?

Companies that begin trading activities after the Law “On Trade Fees” comes into force must submit a notification in Form No. TS-1 within 5 business days from the date the subject of the fee arises.

In the notification, provide information about the subject of the levy:

- Kind of activity,

- object of trade: fixed network, delivery or carry-out trade,

- characteristics: number of retail facilities and (or) area of premises.

You also need to notify the inspectorate every time your operating conditions change that affect the amount of the sales fee. The deadlines are the same - 5 working days from the date of changes.

If you do not submit a notification on time, you face a fine of 200 rubles under clause 1 of Art. 126 of the Tax Code of the Russian Federation, and the inspectorate can fine officials in the amount of 300 to 500 rubles (Part 1 of Article 15.6 of the Administrative Code).

How to fill out page 001

In the “TIN” and “KPP” fields at the top of each page of form No. TS-1 indicate:

- by a Russian organization - INN and KPP assigned to it upon registration with the tax authority at its location;

- by a foreign organization - INN and KPP assigned to a foreign organization at the place of activity in the territory of a municipal district (urban district, federal city of Moscow, St. Petersburg or Sevastopol) through a separate division of the foreign organization;

- individual entrepreneur - TIN assigned to him by the tax authority at his place of residence.

When filling out the TIN field, for which twelve acquaintance spaces are allocated, by a Russian or foreign organization, the free acquaintance spaces to the right of the TIN value are not subject to filling in with additional symbols (they are filled in with dashes).

When specifying the type of form No. TS-1, the corresponding number is entered in the field consisting of one acquaintance:

“1”—the emergence of a levy subject;

“2” - change in indicators of the trading object;

“3” – termination of the object of taxation.

Sign “2” is added if the indicators of the trading object change or errors are detected that lead to incorrect calculation of the amount of the fee.

When changing the indicators of the object of trade (sign “2”), or the number of objects subject to trade tax (sign “3”), the Notification indicates only those objects of taxation in respect of which the change (cessation) occurred.

In the “Organization/individual entrepreneur” field of form No. TS-1, when filling out the name of the organization, indicate the full name of the organization corresponding to the name specified in its constituent documents.

The last name, first name and patronymic (if any) of the individual entrepreneur are indicated in full.

Where to submit the notification?

Owners of stationary stores with and without sales floors and owners of retail markets submit a notification to the Federal Tax Service at the location of the store.

Owners of mobile stores, tents and other movable retail outlets inform the Federal Tax Service at the place of registration of the company or place of residence of the individual entrepreneur.

If there are several points of sale, send a notice of registration to the address of the facility that comes first in the list of points of sale.

If an organization or individual entrepreneur is registered in another region, but trades in Moscow, they must also register as payers of the trade tax. In this case, a notification is also submitted to the Moscow Federal Tax Service at the location of the store if trade is carried out through a real estate property. And when trading through movable property - to the Federal Tax Service of the region in which the entrepreneur or organization is registered.

Within 5 days after submitting the notification, tax authorities will register the company and send a certificate.

On what form should I submit TS-1?

Form TS-1 was approved by order of the Federal Tax Service of Russia dated June 22, 2015 No. ММВ-7-14/249. In the same order you can find explanations for filling out the form, as well as the format for submitting data in electronic form.

Next, from our website you can download the TS-1 form for free using a direct link:

NOTIFICATION FORM TS-1

How much and when to pay?

Trade tax rates are contained in the text of the municipal law. They are different for stationary and non-stationary trading. Rates for stationary trading depend on the type of activity, the area of the trading floor and its location. They can be found in Art. 2 of the Law of Moscow dated December 17, 2014 No. 62.

The trading fee must be calculated and paid for each object that an organization or entrepreneur uses in trading activities.

Trade Fee = Trade Fee Rate - for the following categories:

- trade through a stationary trade facility without a sales area (except for gas stations);

- non-stationary retail facility;

- a stationary retail facility with a hall area of up to 50 m2;

- delivery retail trade;

- retail trade through vending machines.

Trade fee = Sales fee rate per 1 m2 of area × area - for the following categories:

- trade through stationary retail network facilities with an area. hall more than 50 m2;

- organization of trade through retail markets.

Experts from the Ministry of Finance propose to determine the retail space, guided by the chapter of the Tax Code on the patent taxation system (clause 5 of Article 415 of the Tax Code of the Russian Federation).

The trade fee must be paid quarterly no later than the 25th day of the month following the end of the tax period. The deadlines for payment of the trade tax in 2022 are April 25, July 25, October 25 and January 25, 2023.

Has the deadline for submitting the TS-1 form and paying the TC in Moscow been extended?

In connection with measures taken to combat coronavirus, the Moscow Government issued Resolution No. 212-PP dated March 24, 2020. In accordance with it, the deadline for paying the trade fee for the 1st quarter of 2022 has been extended until 12/31/2020 inclusive. It is expected that the deadline for payment of the vehicle will be extended for the 2nd quarter of 2022.

The general procedure for registering a vehicle as a payer has not been changed. Thus, forms TS-1 and TS-2 should be submitted in the order described in the article.

Please note that deregistration as a vehicle payer in April-May 2022 does not make practical sense. Since TC is paid even if an organization or individual entrepreneur worked as a TC payer for at least 1 day in a quarter (Article 412, Article 414 of the Tax Code of the Russian Federation).

If the “coronavirus” restrictions continue until the 3rd quarter of 2022, and it becomes clear to the business owner that his retail facility will most likely not be open in July-September, then you can deregister as a vehicle payer until 07/01/2020.

How to reduce taxes on trade duty?

Taxpayers on OSNO reduce the income tax in the regional part by the amount of the trade fee. But the Fee is not included in expenses like other taxes, but reduces the income tax itself or the advance payment on it. To reduce income tax, you need to pay the fee before the tax payment deadline (advance payment) established by law. For example, if you paid a fee for the 4th quarter of 2022 in January 2022, then the tax for 2022 or the advance payment for the 1st quarter of 2022 can be reduced by the amount of the fee.

If the amount of the fee turns out to be more than the income tax, then the fee can be taken into account only within the limits of the tax amount. In this case, you will not have to pay tax, and the unaccounted amount of the fee can be transferred to future reporting periods, as well as reduce the tax for the year. The fee cannot be transferred to the next year (Article 286 of the Tax Code of the Russian Federation).

The simplifiers on “Revenue” subtract the trade fee from the amount of the single tax if the trade fee and the tax are paid in the same region. The fee is included in the tax deduction along with insurance premiums, sick leave, etc. The fee can be taken into account only within the amount of tax (advance) for trading activities, which has already been reduced by insurance premiums and other deductions. It is impossible to receive compensation from the budget if the fee exceeds the amount of tax after deductions. Also, the difference cannot be deducted from taxes on other types of activities. At the same time, the 50% limit, which prohibits organizations and individual entrepreneurs with employees from reducing the tax under the simplified tax system by more than two times, does not apply to the trade tax.

For simplifiers with the object “income minus expenses,” the list of expenses includes “fees paid in accordance with the legislation on taxes and fees . The trade tax satisfies this condition, so it can be included in expenses when calculating the single tax. The single tax will not be reduced by the amount of the trade tax, but the costs of calculating it will increase. Take it into account when you actually paid the fee.

An individual entrepreneur reduces personal income tax by the amount of trade tax if trading activities were carried out in the region where he is registered as an individual entrepreneur. When calculating personal income tax at the end of the year on income taxed at a rate of 13%, you can reduce the tax by the amount of the trade tax paid. Keep in mind that you need to reduce the entire amount of personal income tax without deducting advance payments. They must be subtracted from the amount of tax remaining after the reduction by the amount of the fee. If the fee exceeds the personal income tax, the balance is not returned and is not carried forward to future tax periods.

If a company paid 100,000 rubles in profit tax and now has to pay 10,000 rubles in trade tax, then it will pay 90,000 rubles in profit tax and 10,000 rubles in trade tax. In this case, the tax burden of a bona fide taxpayer will not change.

Cases when you need to submit TS-1 to the tax office

Form TS-1 is submitted to the Federal Tax Service not only during registration, but also for other reasons. The reason code is reflected on the title page of the application form. We will describe the rules for entering data into this form below. Now we will give a list of reasons why a businessman must report to the tax filing form TS-1.

The legislation allows that if a TS-1 notification is submitted incorrectly, it can be canceled. To do this, write a free-form tax application with explanations (letter of the Federal Tax Service dated August 20, 2015 No. GD-4-3/14721).