Without breaking the law

The cost of paying fiscal payments to the budget is a fairly significant part of the costs of any enterprise.

An unbearable load on an enterprise will lead to fatal factors in doing business and, accordingly, to the bankruptcy of an economic entity. Consequently, each taxpayer independently conducts tax planning to resolve issues of optimizing the taxation of their business. You should not think that optimization means evading the payment of fees, taxes and contributions to the relevant budgets. Of course, the easiest way is not to spend money to reduce it. But this comes with administrative and criminal liability. It is much more profitable to reduce the amount of payments to the Federal Tax Service using legal methods: “both the sheep are safe and the wolves are fed.”

To minimize taxation, it is not at all necessary to break the law, for example, to enter into fictitious contracts, open shell companies, deliberately understate the tax base, or conduct “black” accounting. It is enough to analyze the current state of affairs of the company, study the current legislation and choose the optimal and legal way to reduce the fiscal burden.

Key points

When choosing effective methods, you need to remember three important things:

- Selection of OPF. For all entrepreneurs, regardless of their status and category, there is a choice of organizational and legal form. That is, the taxpayer independently chooses in what form to conduct business activities.

- Selection of aids to navigation. The taxation system is a key factor in determining the size of the fiscal burden on an economic entity. Current legislation provides for the choice of SNO for all taxpayers.

- Selecting an accounting method. A businessman has the right to independently choose the method of keeping records of business transactions and other facts of financial and economic activity. This choice is fixed in the accounting policy.

If the choice is made correctly, then optimizing the tax burden for an institution is not always relevant. But even a wrong choice can be corrected. For example, to reorganize an enterprise or switch to a special taxation regime.

However, the most effective way to minimize fiscal payments is to carry out tax optimization and tax planning at the stage of creating an economic entity, if the businessman analyzes and evaluates financial capabilities in advance even before registering with the Federal Tax Service. For example, read the special material “How to choose a taxation system for individual entrepreneurs in 2022.”

STS "Income"

Among the tax systems that we will consider, simplified taxation is traditionally considered the most cost-effective, but even it can be made even more accessible. The tax amount cannot be reduced by closing documents, but you can try to get benefits or fall into the tax holiday .

For those who registered an individual entrepreneur for the first time, a 0% rate is provided for certain types of entrepreneurial activity. Each region sets its own conditions, which can be found in the link after the “Frequently Asked Questions” section. Don't forget to indicate your subject at the top if the system does not automatically detect it.

It also makes sense for individual entrepreneurs to consider the patent taxation system . Its advantage is a fixed tax for the entire period of validity of the patent. For whom it is suitable, the validity period and document templates for registration can be found on the Federal Tax Service website. And to learn more about the patent, read our article, there is also a lot of useful information there

LLCs and individual entrepreneurs with employees can reduce the tax under the simplified tax system by half due to the amount of insurance premiums , and individual entrepreneurs without employees by the entire amount of mandatory payments. In the first case, if you paid all contributions on time, and the tax amounted to 20,000 rubles, then the payment will be 10,000 rubles, that is, half of the amount. In the second, if the tax amount was initially 10,000 rubles, and you spent 6,000 rubles on insurance premiums, then you will only need to pay 4,000 rubles.

Important! To use this method, contributions must be paid in the same period as the tax.

Types of tax optimization

The classification of tax minimization by type provides for distribution according to the following key characteristics:

- By types of taxes, fees, contributions. This group provides options for optimizing and minimizing taxes for each specific type. For example, benefits or deductions, they are determined separately for each fiscal fee.

- By type of activity. Fragmentation provides for a reduction in the fiscal burden for a certain type of activity. An example of this type of tax optimization in 2022 will be budgetary institutions exempt from paying certain types of obligations.

- By taxpayer category. This type provides tax optimization methods separately for each category of taxpayers. For example, personal income tax deductions are used only by individuals.

Current schemes for optimizing taxation in organizations

In order for tax optimization to be successful, both generally accepted and individual up-to-date methods are used. Generally accepted methods and schemes for tax optimization 2022 are used by almost all categories of taxpayers without exception. But individual methods are not suitable for everyone. Such methods are determined separately and take into account the exceptional characteristics of the enterprise or business.

The most common tax optimization methods:

- Application of benefits, exemptions, deductions and other concessions provided for by current fiscal legislation.

- Restructuring, installment or deferment of mandatory payments, which allows you to defer the payment of fees to the budget for a certain period of time.

- Changing the fiscal burden regime or optimizing the taxation system, for example, switching from OSNO to special, more lenient regimes.

- Carrying out activities in offshore zones and other legal means.

All of the above schemes are generally accepted and are used by almost all subjects.

What methods can be used when carrying out tax planning?

Relationship Replacement Method

As a rule, the same economic goal (purchase of property, generation of income, etc.) can be achieved in several ways. Current legislation does not limit a business entity in choosing the form and individual terms of a transaction, choosing a counterparty, etc. An operation that involves burdensome taxation is replaced by an operation that allows you to achieve the same or as close as possible to the goal, and at the same time apply a more preferential taxation procedure.

Relationship separation method

The relationship separation method is based on the replacement method. In this case, not the entire business transaction is replaced, but only part of it, or the business transaction is divided into several. The separation method is used, as a rule, in cases where a complete replacement does not allow achieving a result that is closest to the goal of the original operation.

Tax deferment method

The deadline for paying taxes is related to the moment of occurrence of the object of taxation (the moment of occurrence of taxable turnover, the moment of acquisition of property, etc.) and the tax period (month, quarter, year). The deferral method, using elements of other methods (replacement, division, etc.), allows you to postpone the moment of occurrence of the taxable object (and, accordingly, tax payment) to the subsequent tax period.

In modern economic conditions and with significant amounts of tax payments, deferment of tax payments to the budget allows, first of all, to save working capital, and in some cases avoid the accrual of penalties.

Method of direct reduction of the taxable object

The method involves getting rid of (abstaining) from the object of taxation, as one of the ways to evade taxes. The object of taxation can be property and transactions. Abstinence from carrying out certain types of activities, operations, lack of property, etc. This method aims to get rid of a number of taxable transactions or taxable property, and at the same time not have a negative impact on the business activity of the entrepreneur.

Individual ways to optimize the tax burden

Let's look at several individual tax optimization methods for organizations.

Scheme No. 1. Withdrawal of property assets

The company creates a new legal entity using the simplified tax system. Part of its property is transferred to the ownership of the new company as a contribution to the authorized capital. The transfer is also formalized by installment sale. Then a lease agreement is concluded between these organizations. As a result, the company is cutting:

- Payments for property fees, since this obligation is not paid under the simplified tax system.

- The tax base for profit is reduced due to rental payments on property.

Scheme No. 2. Loan agreement

The company draws up fictitious loan agreements to receive funds from its own founders or management. Of course, in fact, no financial injections are taking place; the company is simply legalizing money that was not reflected in the accounting and fiscal statements.

Borrowed capital in this case is not income and is not subject to income tax. Also, payments or interest for the use of borrowed funds are taken into account as expenses when determining the tax base for profits. And these amounts are already deductible for VAT on goods purchased with borrowed funds.

IMPORTANT!

This method is semi-legal. That is, for concealing income, the taxpayer faces criminal liability.

Scheme No. 3. VAT deferral

VAT should be paid to the budget in the reporting period in which the goods were shipped. Moreover, if there were several of them (deliveries were carried out in parts), then the payment deadline falls on the last, final delivery. In this case, the counterparties agree to split supplies. For example, deliver the bulk of the goods in the first quarter, and deliver a small balance only in the second quarter. In this case, the payment of VAT can be deferred for the 2nd quarter, and for the amount of the entire supply.

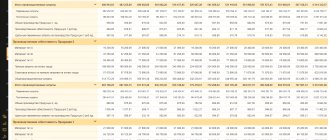

Methods of periodic regulation of income tax

In order to optimize income tax, an organization can also pay attention to the following methods, which may be one-time in nature.

- By agreement with the counterparty, documents for the supply of any goods (work, services) in the next reporting period can be issued in the current reporting period.

- By agreement with the counterparty, penalties may be assessed for failure to comply with the terms of the agreement. It is important that the imposition of sanctions is provided for in the contract and that there is confirmation of their acceptance by the other party.

See also “What actions of the debtor confirm his recognition of sanctions?”

- By agreement with the counterparty, a premium stipulated by the contract may be charged for excess sales volume.

- Provided that the appropriate documents are completed, overdue or bad receivables or payables can be written off.

See also materials:

- “How to write off a bad debt with an expired statute of limitations”

- “In what period are overdue accounts payable included in income?”

- To increase profits, surpluses identified as a result of inventory can be capitalized.

Recommendations for the use of current schemes

Let us outline several important tips when choosing the optimal method of tax planning and tax optimization:

- Analyze and study legislation. It is impossible to competently minimize budget payments without understanding the rules of fiscal legislation.

- Stay tuned for changes. Officials systematically update existing rules and regulations, take into account all innovations.

- Plan. Carry out systematic calculations for the planning period, evaluate the results obtained in order to adjust the current policy.

- Compare. It is impossible to choose the best option without comparing all available methods and forms.

And most importantly: obey the law. Use only legal methods, no matter how attractive illegal schemes may seem, you will have to bear responsibility for them. Sooner or later.