Why keep accounting documents?

Any accountant knows that every document drawn up in a company or received from counterparties has its own value and must be preserved.

Based on the information contained in the primary documents, accounting is carried out and financial statements are prepared. Verification of accounting and accounting data by all regulatory authorities is carried out using primary documents. All primary accounting records and reports must be stored for legally defined periods.

The storage periods for accounting documents are regulated by the Law “On Accounting” dated December 6, 2011 No. 402-FZ and the approved list of storage periods.

To learn about what groups documents arising in the activities of an organization are divided into and what their storage periods may be, read the article “Basic storage periods for documents in an organization (archive).”

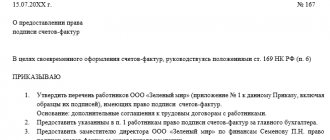

Employment contract and list of employees engaged in hazardous work

At first glance, it is difficult to discern what is common in these two documents. An employment contract is a written agreement between an employee and an employer, which defines the main responsibilities and rights of the parties to the contract, indicates the work and rest schedule, specifies payment terms, as well as other necessary conditions. It is drawn up individually for each hired employee and contains the signatures of the employee and the director.

You can familiarize yourself with a sample employment contract and download its form in the article “Unified Form No. TD-1 - Employment Contract” .

The list of employees working in hazardous work is drawn up in the form of a list and does not contain employee signatures. But with each employee indicated in the list, his employment contract must agree, for example, on such an important feature of remuneration as compensation for hard work and work in harmful and (or) dangerous working conditions (with a description of the features of working conditions in the workplace).

IMPORTANT! If a company employee works in difficult, dangerous or harmful conditions (if he has relevant experience), a pension is assigned to him in accordance with sub-clause. 1–10, 12 p. 1 tbsp. 30 of Law No. 400-FZ.

However, these documents have an important unifying feature - their shelf life is 50/75 years (depending on the date of publication of the document).

IMPORTANT! The storage period for personnel documents in an organization is determined on the basis of the List of standard archival documents approved by Order of the Federal Archive of December 20, 2019 No. 236.

For information on the storage periods for other documents generated in the activities of a legal entity, read the material “What is the storage period for documents in the organization’s archive?”

What is more important - the list or law No. 402-FZ

Comparing the storage periods for accounting documents specified in the list and Law No. 402-FZ, the following conclusions can be drawn:

- the list establishes different storage periods depending on the type and significance of documents classified as accounting;

- Law No. 402-FZ provides for a 5-year storage period for accounting documents, but does not specify the terms by type of documentation;

- in paragraph 1 of Art. 29 of Law No. 402-FZ states that the basis for determining the storage periods for documentation is a list.

Thus, when deciding the fate of an invoice, balance sheet or accounting certificate, it is necessary to proceed primarily from the deadlines indicated in the list. However, their storage period cannot be less than 5 years.

Note! The State Duma amended Art. 23 and 24 of the Tax Code of the Russian Federation, which increase the storage period for taxpayers and tax agents of accounting and tax accounting data and documents related to the calculation and payment of taxes. They will need to be retained for 5 years instead of four.

The storage period for accounting documents specified in Art. 29 of Law No. 402-FZ, also concerns the accounting policies and standards of the company, including documents existing in electronic form. The latter also cannot be destroyed within a 5-year period. The storage period begins with the year following the year of their last use (Clause 2, Article 29 of Law No. 402-FZ).

The storage period has not expired, but the document is damaged - what to do?

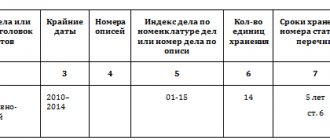

From the table presented in the previous section, it can be seen that the time sheets, the shelf life of which according to the List is 5 years, have been partially damaged. Since this data was compiled by the employer himself and information about the time worked by the employees of Premiere LLC was saved in the accounting computer, the question of restoring damaged copies does not present any difficulty.

It is impossible to simply throw away time sheets that have become unusable (without replacing them with similar ones) - then there will be an unauthorized reduction in the normatively established storage periods for this type of personnel documents. And this threatens punishment for the company’s management (Article 27 of the Law “On Archiving in the Russian Federation” No. 125-FZ).

But you can get rid of some of the vacation schedules - they need to be saved for only 3 years, and by the time the personnel documentation is sorted, it has already expired (except for the schedules for 2017-2019). There is no need to restore faded copies from 2009–2016.

Difficult-to-read lists of bonus employees for 2010–2013 can be destroyed in full - their 5-year storage period has also expired.

But the perfectly preserved profiles of applicants for jobs at Prestige LLC for 2015–2019, as well as lists of company employees who retired in 2009–2019, need to be sorted, putting aside for storage those for which the storage period continues.

Missing personal files of employees are subject to registration (or restoration), the rest - to be completed with the subsequent organization of their storage for the 50/75 years established by the List.

It should be noted that you cannot simply throw away documents with an expired shelf life. In this case, a special procedure is provided, which involves the examination of documents with the execution of a special act. Only then are the papers disposed of in a manner suitable for the company.

You can familiarize yourself with the procedure for destroying documentation in the article “Destruction of documents with expired storage periods (act)” .

Let's understand deadlines using an example

Landscape Design LLC, formed several years ago, has steadily gained a foothold in its market segment. The accounting part of the work was carried out by a team of 4 people. Each specialist was assigned specific accounting areas, and the chief accountant was in charge of reporting and interaction with controllers.

Over the past period of accounting work, countless folders with documentation have accumulated in closets and utility rooms. It's time to deal with them.

Most of the primary data were acts of work performed - on their basis, the company’s revenue was regularly determined, reflected in its financial statements.

Read about the preparation of certificates of completed work in this article .

Significant volumes of paper deposits consisted of invoices for purchased materials, payment slips, salary slips and related calculations.

A separate shelf was completely filled with accounting records, declarations, reports to the pension fund and social security, as well as statistical forms.

Each accountant compiled a list of cases with accounting documentation for his area, and the chief accountant systematized all the information in a single table, one of the columns of which was dedicated to the standard storage periods for documents taken from the list.

Table “Retention periods for accounting documents in an organization”

| Document from Landscape Design LLC | Shelf life according to the list |

| Certificates of work performed under contracts for core activities | Within 5 years after the end of the term for which the contract was concluded |

| Treaties and additional agreements thereto | Within 5 years after expiration (unless otherwise specified in specific items of the list) |

| Powers of attorney for receiving money and goods and materials | At least 5 years after the expiration of the power of attorney or its revocation |

| Statements for the issuance of salaries, benefits, financial assistance and other payments | At least 6 years (from 02/18/2020, previously the period was 5 years) In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Register of information on the income of individuals | At least 5 years (from 02/18/2020, previously the period was 75 years) |

| Employment contracts and personal cards of employees | No less than: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Time sheets, working time logs | At least 5 years (at least 75 years under dangerous, difficult and harmful working conditions) |

| Information about the income of individuals | At least 5 years In the absence of personal accounts: 50 years - if the documents were completed after 01/01/2003; 75 years old - if documents were completed before 01/01/2003 |

| Annual accounting (financial) statements | Constantly* |

| Accounting policies, chart of accounts, forms of primary accounting documents | At least 5 years |

| General ledger, turnover sheets, account cards, etc. | At least 5 years |

| Fixed asset accounting cards | At least 5 years after disposal of the object |

| Declarations (calculations) for all types of taxes | At least 5 years |

| Calculations for insurance premiums (annual and quarterly) | 50 / 75 years |

| Information submitted to the Pension Fund for individual (personalized) accounting | At least 5 years, in electronic form - 75 years |

| Reporting to statistics: – annual and more frequently, one-time; – semi-annual and quarterly; – monthly – ten-day, weekly | - Constantly*. – 5 years or permanently* in the absence of annual ones. – 3 years or constantly* in the absence of annual, semi-annual, quarterly. - 1 year |

| Correspondence about penalties and fines imposed on the company | At least 5 years |

Do not ignore the * sign in the table. It means that the document must be kept for the entire time the company operates.

All documentation indicated in the table directly or indirectly relates to accounting, therefore, the chief accountant of Landscape Design LLC increased the periods exceeding the 5-year storage period provided for by Law No. 402-FZ to the limits indicated in the list.

Considering that the company has not yet celebrated its 5th anniversary since the start of work, none of the documents presented in the table can be destroyed. To clear out the paper-cluttered premises, the accounting department allocated a special office, where they placed documents awaiting expiration.

See also “The Ministry of Finance reminded how long primary materials need to be stored.”

For more information about the storage periods for tax documentation, documents on insurance premiums, including accident insurance premiums, see the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Retention periods for personnel documents

The storage periods for such documents from February 18, 2020 are regulated by clause 8 of section II of the order of the Federal Archive. For certain documents, the retention period depends on the date they were issued. The storage period for documents issued before 2003 is 75 calendar years, starting from the year following the year of their creation. Personnel documents created after 2003 must be kept for at least 50 years. The list of personnel documentation includes employment and civil law contracts, author's contracts, personal cards of employees, as well as unclaimed originals of their work books, diplomas, military IDs, identification cards, and certificates.

For some documents, a special storage period was established that did not exist before:

Nuances of accounting for storage periods of accounting documentation

In the practical activities of Landscape Design LLC, there were cases of selling fixed assets at a loss. For the purposes of accounting and tax accounting for fixed assets, the same documents are used. The difference lies only in the recognition of expenses associated with their disposal. This fact must also be taken into account when determining the storage period for documents.

For example, 2 years ago the company purchased a VAZ-21102 car (OKOF code 15 3410010). Based on the fact that, according to the classification of the fixed asset, it belongs to the 3rd depreciation group, the useful life (USI) was set at 5 years. Due to constant breakdowns, it was decided to sell the car at any price offered. The proceeds from the sale turned out to be less than the residual value of the property, and the loss from the sale according to tax accounting standards for 3 years (the remaining SPI) will be evenly taken into account when calculating income tax.

IMPORTANT! The nuances of tax accounting for losses from the sale of fixed assets are reflected in clause 3 of Art. 268 Tax Code of the Russian Federation.

Read about the specifics of grouping expenses for tax accounting purposes in this material .

Thus, all documents related to the formation of the initial and residual value, the term of the joint venture investment, contracts and acts of sale, as well as certificates and calculations for accounting for losses from the sale of fixed assets must be preserved for at least 4 years after the end of inclusion of the specified loss in the tax base . This is due to the fact that during an audit, tax authorities have the right to examine documents for the 3 years preceding the audit. Thus, documents on the specified fixed asset will have to be stored for at least 9 years.

The case considered is not the only one where the storage period for documents is extended. In the next section we will present other situations.

Other cases of increasing the shelf life of primary products

If Landscape Design LLC operated with a loss, and then took it into account when calculating income tax, the documents would have to be kept for the entire period of transferring the loss plus 4 years after it was completely written off. In this case, it is impossible to get rid of either the primary document confirming the loss received, or other certificates and calculations on the basis of which this loss was transferred.

For example, accounting and tax documents for a loss received in 2022 and taken into account over the next 10 years will have to be stored until the end of 2035.

Read more about the nuances of accounting for losses in the article “How and for what period can losses be carried forward?” .

The storage period for accounting documents will also have to be increased in the following case. Landscape Design LLC provided services to a customer who did not promptly pay for the work performed and did not respond to letters and complaints. The company was not excluded from the state register, but did not repay its debt. Landscape Design LLC was able to take into account bad receivables only in 2022, and all documents of the organization related to this situation will have to be stored until the end of 2026.

Results

Invoices, certificates of work performed, salary payment statements, reports - taxpayers are required to keep these and many other accounting documents for the periods established by a special list. These terms cannot be reduced, but in some cases they have to be increased (when carrying forward losses, writing off bad receivables, selling fixed assets at a loss).

Sources:

- Federal Law of December 6, 2011 No. 402-FZ

- Order of Rosarkhiv dated December 20, 2019 No. 236

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why do we need a nomenclature of cases and how is it related to the storage periods of documents?

Let us analyze the storage periods for documents according to the nomenclature of cases using a practical example.

A graduate of the Financial Academy, Maria went to work at Virazh LLC, which is engaged in the renovation and construction of offices. Since the former student had no experience in financial matters, the management decided to assign her to the office for the duration of the probationary period - this way they could quickly become familiar with the structure of the company and study the specifics of its activities. This division consisted of 5 employees who dealt with various organizational issues, including responsibility for organizing the company’s document flow.

The department employee to whom Maria was assigned was developing a list of cases for the next year.

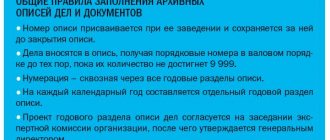

IMPORTANT! The list of cases for the next year is drawn up in the last quarter of the current year, approved by the head and put into effect on January 1 (clause 3.4.6 of the Rules for the operation of company archives dated 02/06/2002).

Maria was also involved in this work - she was tasked with setting storage periods for documents according to the nomenclature of cases opposite the names of case headings strictly according to the standard list.

IMPORTANT! The storage periods for documents are reflected in standard and departmental lists. From 02/18/2020, the basis for determining the deadlines is the List of standard documents and their storage periods, approved by order of the Federal Archive of Russia dated 12/20/2019 No. 236. The previously valid order of the Ministry of Culture dated 08/25/2010 No. 558 was cancelled.