From this article you will learn:

- What does the company's net profit indicate?

- What formula is used to calculate the net profit of any organization?

- How to correctly calculate profitability based on net profit

- How can you increase your net profit?

As you know, the main goals of any commercial enterprise are to make a profit and further business growth. Its effectiveness can be assessed using various indicators. A special place among them is occupied by net profit - the share of balance sheet profit that remains at the disposal of the company after all taxes, deductions, etc. have been paid. Knowledge of how to calculate net profit, what formulas to use for this and how to carry it out in accounting reporting is a must for any business leader.

What is net profit?

Commerce is inextricably linked with the concept of net profit. To get it, people found new enterprises, open production facilities, and constantly look for effective ways to increase the company’s income, and not only the owners and managers of companies are interested in maximizing net profit.

Net profit is one of the main final indicators of the activity of any business entity. This indicator includes the entire balance sheet profit of the company, from which the amounts of expenses (for staff salaries, managerial, production and others), taxes, fees and other contributions to the budget are subtracted.

The net profit belongs to the enterprise in full; it can be managed by renewing the company's funds from it, paying interest to shareholders, and expanding working capital. That is, this money can be spent on expanding the business, covering current needs, introducing innovations, updating equipment, etc.

Any enterprise regularly faces the need to calculate the amount of net profit, but the criteria for assessing the effectiveness of business management differ in different companies. Among them the main ones are:

- capital turnover;

- economic efficiency;

- increase in assets.

By calculating the company's net profit, we can accurately determine how much money remains in the ownership of the business entity.

Calculating the amount of net profit is also necessary for non-profit organizations (state-owned, budgetary, etc.), since the concept of operational efficiency is applicable to them as well.

A direct indication of the legislation regulating the work of Limited Liability Companies (LLC) and Joint Stock Companies (JSC) prescribes that net profit should be directed to:

- payment of dividends to shareholders (or distribution among members of the company);

- business development, increasing the volume of working capital;

- other company needs.

Thus, it is important for the accounting department of any joint stock company to know how to calculate net profit and also to pay dividends in full and correctly.

We recommend

“Calculating Enterprise Profit: A Complete Guide for Beginners” Read more

Results

Net profit is a complex indicator that includes all types of income received by the company, taking into account expenses incurred. If the company's costs exceed the total of sales revenue and additional other income, then we can talk about the absence of net profit and the company's activities are unprofitable.

Net profit allows merchants to expand their business, master new technologies and markets, which, in turn, has a positive effect on the increase in net profit.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Difference between net and retained earnings

Net income is not synonymous with retained earnings (although some believe that they are the same thing). They often differ quantitatively, are calculated differently and are recorded in accounting documents.

To reflect net profit, there is a separate line in the organization’s financial results statement. Each enterprise is required to calculate and record net profit at the end of the reporting period. Sometimes there is no profit as such, things are going badly, and then instead, a loss is reflected in the final documents.

Recommended articles on this topic:

- Pricing methods and recommendations for their use

- Doing business: from developing a plan to choosing software

- Methods for reducing costs in a company and enterprise without small sacrifices

Retained earnings are recorded elsewhere - in the liabilities side of the balance sheet.

As a rule, the term “net profit” refers to the income received by a subject of economic relations during the reporting period (usually a calendar year). Retained earnings include income not only for the current year, but also for previous periods.

Let's look at an elementary practical example of how you can calculate the net profit of a store. The balance sheet of Vasilek LLC at the very beginning of the year, January 1, contains in the “retained earnings” column the amount of 3.2 million rubles, and the net profit for this year is equal to 750 thousand rubles. Thus:

- Retained earnings at the beginning of the reporting period - 3,200 million rubles.

- Net profit for the reporting year is 750 thousand rubles.

- Retained earnings at the end of the reporting year - 3.950 million rubles.

That is, the company’s net profit is always calculated for a specific reporting period, and retained earnings (instead of which there is sometimes a loss) represents the result of the company’s work from the moment of its opening, for the entire time.

Moment of recognition of income and expenses

The moment of recognition is the period in which income or expenses are reflected in income tax accounting. There are two such points, they depend on the method of recognizing income and expenses:

- cash method;

- accrual method.

The company chooses one of the methods and, before December 31 (without waiting for the start of the next tax period), informs the territorial body of the Federal Tax Service about its choice.

When applying methods, firms take into account amounts at different times. Let's look into the nuances.

The cash method assumes that:

- income is taken into account at the time of receipt at the cash desk or in the company's current account, not earlier;

- expenses are taken into account at the time of debiting from the account or paying from the cash register, not earlier;

- When paying tax, amounts are taken into account according to the dates of receipt or write-off.

Accrual method:

- income is taken into account at the time of occurrence (under contracts or payment orders), and not upon direct payment;

- expenses are taken into account at the time of occurrence, and not when funds are written off from accounts;

- When paying tax, amounts are taken into account based on documented dates, even if payment actually occurred later.

Example:

Kolibri LLC issued an invoice for office rent in March, but payment was made only in June. Under the cash method, the accountant of Kolibri LLC reflects the expenses for renting an office in June - upon the transfer of money. In tax accounting, this expense is written off in the second quarter. Under the accrual method, the accountant of Kolibri LLC takes into account rental expenses in March, when the company should have paid it. In tax accounting, this expense is reflected in the first quarter.

All enterprises have the right to use the accrual method, but the use of the cash method is limited:

- Banks are prohibited from using it;

- firms recognize income and expenses in fact only if revenue does not exceed 1 million rubles for each of the last four quarters;

- If, when applying the method, the limit is exceeded, then the company is obliged to switch to the accrual method from the beginning of the current year.

What is the tax base if the company suffers a loss?

According to tax accounting rules, the profit of an organization is not a negative value. Even if there is a loss at the end of the year, the tax base is recognized as zero. The tax in this case is also zero. Tax accounting documents must confirm the correctness of the tax base calculation. It is mandatory to submit a declaration, even if the amount is zero.

Why calculate net profit?

The amount of net profit measures the efficiency of the entire enterprise. This parameter is required for various purposes by both external and internal stakeholders.

| User/stakeholder | Purpose and uses |

| Investor | Assess the investment attractiveness of the business. To do this, analyze the amount of net profit and the dynamics of its changes. The ability of a company to produce a large net profit at the end of the reporting period indicates its high profitability |

| Creditor | Assessing the company's creditworthiness. It is determined by the amount and dynamics of net profit, on which the solvency and creditworthiness of the organization depends. Money is the most liquid asset. The more free capital a company has after paying taxes and all inevitable costs, the easier it will be for it to pay off long-term and short-term obligations |

| Business owner or shareholder | Assess the effectiveness of the organization as a whole. An integral characteristic of an organization’s activities is net profit, which reflects the effectiveness of all management decisions made in the reporting period. The larger it is, the more efficient the management, the greater the dividend payments and the easier it is to attract new shareholders and sell company shares. |

| Provider | Assess the stability of the organization's functioning. Suppliers are interested in net profit as a marker of the sustainable development of the client company: the more significant net income it received during the reporting period, the more it can be counted on to pay suppliers on time for purchased materials and raw materials, as well as fulfill obligations to contractors |

| Top manager | Assess the stability of the company's financial development. The manager of an enterprise is interested in the amount of net profit and its dynamics as guidelines for developing strategies and planning further activities - from global to very specific plans and schedules. It is also necessary to calculate net profit to distribute contributions to various funds: production, salary, reserve |

We recommend

“Types of company profit: what are they and how to calculate” Read more

How to calculate the net profit of an enterprise: formulas

The formula by which the enterprise's net profit is calculated (from sales or manufacturing of products) does not change its economic meaning, although various initial data can be used in it.

There are several ways to calculate net profit (NP):

- PE = revenue – taxes – expenses (administrative, production, transport, etc.) – cost of goods.

- PE = profit (before taxes) – taxes.

- PE = total profit (gross, financial, operating) – tax deductions.

- PE from sales = gross profit – selling expenses – administrative costs for selling goods.

The value of this indicator is determined by a number of factors:

- total company revenue;

- cost of production;

- the amount of taxes;

- the size of other costs and income.

In addition to net profit, accounting also uses the opposite indicator - net loss, or negative profit. Many enterprises are unprofitable at the end of the reporting year, although during this time they function quite successfully. It also happens that even in the absence of a large turnover, a business brings a huge net profit.

No matter what formula you use to calculate net profit, you end up with the same number. Typically, in practice, PE is calculated using a simplified formula, filling out the financial activity report line by line and receiving the required net profit in the final line.

How to calculate net profit using a simplified formula? Like this:

PP = B – SS – UR – KR + PD – PR – NP

In this formula:

- B - revenue;

- CC - cost of sales;

- UR, KR - administrative, commercial expenses;

- PD, PR - other income and expenses;

- NP - income tax.

All required source data is contained in the organization's financial performance report for the period of interest.

Thus, having access to data from financial statements, calculating net profit is not difficult at all. By this indicator you can judge how productive the company is. Of course, business owners and top managers are interested in any ways to increase net profit: expanding production volumes, reducing costs, etc. The sharp dynamics of this indicator (by large leaps) may arouse suspicion among potential investors and partners.

We recommend

“Profit maximization: the golden rule and methods of implementation” Read more

Net profit indicator: who, where and why calculates it

Net profit and commercial activity are inextricably linked concepts.

For the sake of profit, new production facilities are created, material and labor resources are intensively used, and effective ways are sought to increase the profitability of commercial activities. Net profit is one of the important final performance indicators of any company. Not only the management and owners of companies are interested in obtaining net profit. Good net profit indicators attract new investors, contribute to making positive decisions on issuing loans to the company, as well as strengthening the company’s authority in market conditions.

It is net profit that allows firms to develop their material base, invest in expanding production, improving technology and mastering advanced techniques and methods of work. All this leads to the company entering new markets, expanding sales volumes and, as a result, an increase in net profit.

Find out how to analyze net profit from the article “Procedure for analyzing net profit of an enterprise.”

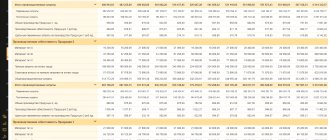

Many financial indicators take part in calculating net profit, and the formula for calculating it is not as simple as it seems at first glance. In the accounting records of any company, net profit is reflected in line 2400 of the financial results statement (OFR), and all indicators in column 2 of this report are involved in determining net profit .

Learn about the structure and purpose of the ODF from this publication.

A detailed algorithm for calculating net profit is given in the next section.

The impact of the company's main performance indicators on net profit

The net profit indicator consists of several components, which is reflected in various formulas for its calculation. Each of these components is also complex in itself. Thus, revenue may consist of several geographic segments or areas of work, but be that as it may, it all must be reflected in the formula by which net profit is calculated.

The cost structure varies greatly in different sectors of the economy and at specific enterprises. High costs, comparable to or exceeding revenue (due to expensive raw materials, labor-intensive production or obsolescence of equipment), exclude the possibility of obtaining a significant emergency.

Commercial and administrative expenses affect net profit quite predictably: the higher they are, the less emergency (how much less depends on the managerial talents of the head of the company, especially those related to the optimization of various costs).

If an enterprise has additional income in addition to its main activities, then its net profit can be significant even if sales bring zero income or even a loss. This situation will be discussed further.

Unsatisfactorily low profits from core activities are a common occurrence, especially at the initial stages of business development. Therefore, additional income is a serious help.

This could be, for example, investing in other enterprises or wisely investing free money in securities. The income received in such ways increases the amount of net profit of the enterprise. You can even improve the emergency ratio using a standard agreement with a bank, allowing the latter to use the balance of money in the company’s current accounts at interest.

For businesses that use borrowed money, interest on loans can have a significant impact on their bottom line, and this should be kept in mind when considering taking out a loan. Interest on borrowed obligations, even at market rates, can not only reduce the net profit of an enterprise, but also make it unprofitable, even leading to bankruptcy.

The impact on the emergency situation of third-party costs and income that are not related to the core activities of the enterprise cannot be underestimated. For example, renting out premises that are not currently in use or unnecessary equipment is an excellent source of additional income and contribution to the bottom line. The sale of assets not used by the company also provides an increase in private equity.

However, other expenses (their volume and structure) should be constantly monitored: when they increase, this often has a negative impact on net profit. Such an expense item could be (for example) charity.

How to calculate net profit on the balance sheet?

According to Order No. 66n of the Ministry of Finance of the Russian Federation dated July 2, 2010, the financial results of the enterprise’s activities are recorded on this report form.

This form has a special column numbered 2400 to reflect net profit (loss) for the reporting period.

Separately, we note that one of the reliable ways to calculate the amount of net profit is a calculation based on information from the company’s statements.

To calculate this indicator, use the following formula, where the numbers indicate the line numbers in the form:

2110 – 2120 – 2210 – 2220 + 2340 − 2350 – 2410, Where:

- 2110 corresponds to gross revenue;

- 2120 – cost;

- 2210 and 2220 - production and administrative expenses;

- 2340 – other income ( 2350 – similar expenses);

- 2410 – income tax.

Therefore, you must have a completely completed balance sheet form. The necessary data is taken from it, from which net profit is calculated.

But you can calculate the state of emergency using a simpler algorithm, simply by subtracting line 2410, corresponding to income tax, from line 2300 (profit before taxes).

Or use the turnover on account 99 in correspondence with account 84.

We recommend

“Increasing enterprise profits: calculation, methods, examples” Read more

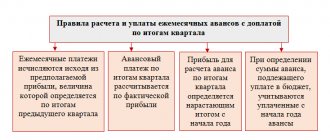

Instructions for calculating income tax

Current step-by-step instructions on how to calculate income tax in 2022:

Example: your organization operates on OSN and received an income of 4,500,000 rubles for the calendar year. Expenses amounted to 2,700,000 rubles. Your profit: 4,500,000 – 2,700,000 = 1,800,000 rubles.

Let's look at the calculation of corporate income tax using a formula with tables based on this data:

| Income | 4,500,000 rubles |

| Expenses | 2,700,000 rubles |

| Profit | 1,800,000 rubles |

The contribution is paid on the amount of 1,800,000. See below for an example of how to find income tax.

If the regional rate in your area is basic and equal to 18%, then at the end of the year you will pay the following amounts.

To the local budget:

To the federal budget:

If a reduced rate of 13.5% is applied in the region, then the calculation is as follows.

To the local budget:

To federal:

The example shows that the amount of receipts to the federal budget does not change - 3% of income goes there.

Net profit analysis methods

Currently, two effective ways of analyzing net profit have been developed.

Factor analysis

The essence of the method is to search for causes, external and internal, and assess their impact on the dynamics of profit, expressed in rubles.

External factors affecting net profit include:

- inflation;

- changes in legislation;

- natural conditions of the region;

- demand structure;

- changes by suppliers to the conditions for the provision of materials and raw materials;

- transportation tariffs;

- rising prices for electricity and raw materials;

- competitive situation in the market;

- political factors.

Internal factors are:

- change in the number of company personnel;

- rent increases;

- change in product range;

- increase or decrease in production volumes;

- revision of prices for goods (services);

- the size of the tax burden.

The main factors determining profit include:

- cost of goods (services);

- their cost;

- sales revenue;

- administrative and commercial expenses.

Factor analysis of net profit is carried out in four stages:

- The main factors influencing the emergency are selected.

- Systematize and classify them.

- Create models of relationships between them.

- The influence of each of them is calculated and assessed.

Factor analysis formula:

∆ChP = ∆B + ∆SS + ∆KR + ∆UR + ∆PD + ∆PR – ∆SNP, where:

- ∆ – symbol of change;

- PE – net profit;

- B – revenue;

- CC – cost;

- SNP – current income tax;

- KR – commercial expenses;

- UR – management expenses;

- PD – other income;

- PR - other expenses.

Conducting statistical analysis of profits

Using this method, the following problems are solved:

- Analyze the structure and initial volume of profit generation.

- Study financial relationships.

- Describe all areas of spending money.

- Explore profit dynamics.

- Assess the financial stability of the company.

- Study the dynamics of the total BP.

- Carry out an index analysis of the influence of each factor on the emergency situation.

- Analyze the structure of the BP.

Assessing the overall financial condition of a business, its payback and profitability is impossible without a profitability analysis. It demonstrates the efficiency of using all the company’s resources – financial, labor, material, etc.

We recommend

“Main factors and conditions for profit growth” Read more

How to calculate profitability based on net profit?

Indicators of economic efficiency of a business can be direct or inverse. The first are return coefficients: a conventional unit of result per conventional unit of cost to achieve it. The latter, on the contrary, start from a unit of result and demonstrate what volume of conditional costs is necessary to obtain it (capacity coefficients).

Profitability is considered one of the main characteristics of the efficiency of a company's economic activities. The influence of inflation on it is minimal; it can be expressed in the form of various ratios of income and expenses (but, as a rule, it is measured in coefficients).

Thus, profitability is an indicator of the efficiency of economic activity, characterizing how competently various resources (financial, material, human, etc.) are used.

There are two types of profitability indicators. In both cases, they are calculated as the ratio of one measure to another.

The main types of profitability for the business owner, investors, shareholders and other stakeholders are:

- Return on assets

This financial ratio reflects the profitability and performance of the company - the income that was received from each ruble of costs. Return on assets is calculated by dividing net profit by the average value of assets and multiplying the resulting result by 100%:

Return on assets = (Net profit : Average annual assets) x 100%

The initial data is taken from accounting documents: PE - from Form No. 2 entitled “Statement of Financial Results” (formerly called the “Profit and Loss Statement”), the arithmetic average of assets for the year – from Form No. 1 called “Balance Sheet”. If it is necessary to calculate the return on assets as accurately as possible, sum up the size of assets at the beginning and end of the year and divide this value in half.

Return on assets shows how much the actual profitability did not coincide with the expected one, and determines the reasons for this.

Using return on assets, you can compare the efficiency of enterprises operating in the same market niche.

Let’s say that in 2022 the company owned assets worth 2.698 million rubles, in 2022 – already 3.986 million rubles. Net profit in 2022 amounted to 1.983 million rubles.

Let's calculate the average annual value of assets by finding the arithmetic average between the amounts for both years. It is equal to 3.342 million rubles.

In 2022, the return on assets was 49.7%.

Looking at these figures, we see that every ruble spent gave the company a profit of 49.7%. This is the profitability indicator.

- Profitability of fixed production assets (OPF)

This indicator, also called return on fixed assets, is calculated by dividing net income by the cost of fixed assets and multiplying the result by 100%:

Profitability of OPF = (PE: Average annual cost of fixed assets) x 100%

It shows what the real profitability is when using the fixed assets with which products are produced. All initial data for calculating the profitability of fixed production assets can be obtained from financial statements, namely: from forms No. 2 (net profit volume) and No. 1 (average size of fixed production assets).

Let's look at a practical example. In 2022, the company’s production assets were estimated at 1.056 million rubles, and a year later – already at 1.632 million rubles. In the same 2022, the company showed a net profit of 1.983 million rubles.

Let's calculate the arithmetic average of the funds' values, it turns out to be 1.344 million rubles. Their profitability for 2022 will be 147.5% - this is the real profitability from using them.

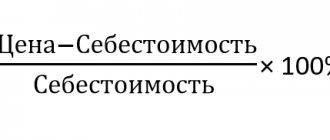

- Return on sales

With return on sales, everything is simple: it reflects the share of profit in the company’s revenue. In fact, this is the profit ratio for every ruble earned. This indicator is expressed as a percentage and calculated for a certain period.

Sales profitability is the marker that a business leader first pays attention to. Based on data on sales profitability, companies change their pricing policies and optimize costs for selling goods.

Return on sales = (Profit : Revenue) x 100%

Each enterprise has its own unique profitability indicator. There cannot be generally accepted measures here, since both the range and competitive strategies of companies vary greatly.

You can calculate the return on sales ratio based on different types of profit. This gives rise to several variations of this indicator. It is most often calculated by gross or net profit, but operating return on sales is also common.

Return on sales by gross profit = (Gross profit : Revenue) x 100%

Return on sales based on gross profit is calculated by dividing gross profit by revenue and expressed as a percentage.

In turn, gross profit can be calculated by subtracting the cost of sales of a product from its revenue. This data is contained in form No. 2.

Let's look at a specific example. In 2022, the company received a gross profit of 2.112 million rubles, and its annual revenue was 4.019 million rubles. Return on sales, calculated based on gross profit, will be 52.6% - that is, every ruble earned by the company in 2022 consisted of 52.6% gross profit.

Operating return on sales = (Profit before tax : Revenue) x 100%

Operating return on sales is the ratio of profit (before taxes) to revenue. It also has a percentage expression. All initial information for the calculation is in form No. 2.

This indicator shows the share of profit in each ruble that the company earned, after taxation of revenue.

Let's assume that the company's profit in 2022, excluding taxes, amounted to 2.001 million rubles. The company earned only 4.019 million rubles in the same year. In this case, the operating return on sales will be 49.8%. This means that every ruble of money received, after the company has paid all mandatory taxes, contains 49.8% of profit.

Return on sales based on net profit = (Net profit : Revenue) x 100%

Return on sales based on net profit is the ratio of net profit to the amount of proceeds expressed as a percentage.

All initial indicators, as in other cases, are in form No. 2.

Let’s assume that the company received a net profit of 1.983 million rubles in 2022, having earned only 4.019 million rubles during this period.

If we calculate the return on sales based on net profit, it will be equal to 49.3%: every ruble earned by the company is 49.3% net profit.

In some cases, the return on sales ratio is referred to as the rate of profitability, since it reflects the share of profit of one type or another in the proceeds from the sale of products, provision of services or work.

When analyzing profitability of sales, keep in mind that its fall indicates a decrease in demand for the company's products and its competitiveness. In such cases, care must be taken to stimulate demand, develop new market niches, or improve the quality of the product (service) offered.

In factor analysis, profitability of sales is considered from the point of view of its influence on the price dynamics of cost and the final cost of goods (services, works).

To detect trends in changes in profitability, reporting and base periods are distinguished. The base year is usually taken to be the last year or the period when the company was at the peak of success and received the highest profits. Profitability ratios for both periods are compared.

Increasing profitability of sales can be achieved by increasing consumer prices for the product range or optimizing costs. When choosing a strategy of action and the corresponding communication, price, and product levers of influence on the situation, the following factors should be taken into account: fluctuations in demand, dynamics of market conditions, actions of competitors, and the possibility of reducing production costs.

We recommend

“Sales profitability formula: calculation example” Read more