The information you provide about the average number of employees is necessary for maintaining statistics and monitoring your business by the tax office. The local tax inspector accepts a report on the number of personnel on the average list for the previous calendar year (Article 80 of the Tax Code of the Russian Federation).

- Form and sample

- Online viewing

- Free download

- Safely

FILES

- Submit by January 20th of the current year.

- Individual entrepreneurs working without employees since 2014 have been exempted from submitting the average number of employees.

- Branches of foreign companies are also required to submit this reporting document.

Tips for filling out the form

The tax office accepts reports with legible data entered in black ink. Forms filled out with other color variations will not be considered. Write information in cells and rows as legibly as possible. Tax professionals should not feel like graphologists.

If you are an advanced computer user, feel free to fill out the form using editing software. Tax officials accept printed forms filled out in 18 Courier New font.

Deadline for delivery of SChR

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to it, this form must be submitted no later than January 20 of the current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th day of the month following the one in which the organization was registered or reorganized.

The last time the SChR form was submitted was in 2022, then, in accordance with the order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] , information about the number is included in the DAM report.

For example, the creation of an LLC occurred on January 10, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, then the company reports in the general manner.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information about the average number of employees of a new organization, although submitted to the Federal Tax Service, is not a tax return, therefore tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

INN, KPP and tax authority codes

Each company has its own accounting features. When filling out the tax payer identification number field (abbreviated as TIN), which is assigned to legal entities and individuals, start entering the code numbers from the leftmost square cell. The “Checkpoint” column is intended only for organizations. Individual entrepreneurs do not need to fill out this field.

Please note! If your code has fewer numbers than cells, you must first enter zeros and then the digital values of the TIN. The tax office code for your area always consists of four digits.

[adv2]

Calculation algorithm

The monthly average is calculated on a monthly basis by adding up the payroll number for each day of the month, dividing the resulting amount by the number of calendar days.

For working days, the payroll number is equal to the number of workers under employment contracts, for weekends and non-working holidays - the payroll number for the previous working day. In this case, an employee dismissed on Friday does not need to be included in the payroll for Saturday and Sunday. Example. As of January 1, 2022, the organization employed 10 people under full-time employment contracts and 1 external part-time worker. The organization's work schedule is standard - 8-hour working day, five-day working week. On January 18, one employee resigned, and on January 25, the employee went on maternity leave. We calculate the average headcount for January 2022:

External part-time workers are not taken into account in the calculation.

| Day of the month | Amount of workers, taken into account when calculating average number |

| 1 | 10 |

| 2 | 10 |

| 3 | 10 |

| 4 | 10 |

| 5 | 10 |

| 6 | 10 |

| 7 | 10 |

| 8 | 10 |

| 9 | 10 |

| 10 | 10 |

| 11 | 10 |

| 12(Sat.) | 10 |

| 13(Sun.) | 10 |

| 14 | 10 |

| 15 | 10 |

| 16 | 10 |

| 17 | 10 |

| 18 | 9 |

| 19 (Sat.) | 9 |

| 20(Sun.) | 9 |

| 21 | 9 |

| 22 | 9 |

| 23 | 9 |

| 24 | 9 |

| 25 | 9 |

| 26(Sat.) | 8 |

| 27(Sun.) | 8 |

| 28 | 8 |

| 29 | 8 |

| 30 | 8 |

| 31 | 8 |

| Total: | 290 |

290 / 31 = 9,35

This is how we calculate the average for every 12 months of the year.

To determine the average headcount for the year, we add up the data for all 12 months and divide by 12. We round the resulting figure to whole units and indicate it in the information form.

Other Important Details

About the population indicator. The only calculated figure in the report may be the headcount indicator for the average list for the previous year. It must be entered in whole numbers. To accurately calculate data, use the example of calculating the average number of employees.

We put down the date . The completed form must be submitted strictly before the twentieth of January of the current year . Be sure to indicate in the report that the data is submitted as of January 1st. Don't be fooled by the actual date of your report. In the case where the company is going through a reorganization process, the report is submitted by the twentieth day of the next month after completion of all processes. For example, if your company was reorganized in March, the headcount report must be submitted by April 20.

We fill out only our fields . The taxpayer should not go into the blocks intended for the inspection representative.

In what form is the SSC submitted?

The form was approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ [email protected] It can be submitted in any way - on paper (in person, by proxy or by mail) or electronically. Formally, the law does not oblige anyone to submit electronic information, regardless of the number of employees. The form in question is not a declaration or calculation, therefore the requirements of paragraph 3 of Article 80 of the Tax Code of the Russian Federation do not apply to it. In practice, companies with more than 25 employees report according to the TKS, since they have such an obligation in relation to other forms of reporting.

You can download the current form for submitting information on the average number of employees here.

How to properly submit a completed reporting form?

When all fields of the form are completed, it must be signed manually. Only under this condition will the inspector accept your annual report for consideration. You do not have to appear in person at the tax office to submit a document. Send it by mail as a valuable letter of notification, of course taking into account the postmark date.

Useful advice! Experienced businessmen who do not like to stand idle in the crowded corridors of the tax office are advised to put an inventory of the enclosed documents in an envelope, certified with a post office stamp. The tax inspector will once again make sure that all documents are in place.

Calculation method

When counting the number, specialists are usually guided by the following regulations and documents:

- Instructions for filling out statistical reporting forms. Their current version was approved by Rosstat Order No. 722 dated November 22, 2017.

- An instruction approved by the USSR State Statistics Committee back in 1987. Despite the considerable age of the document, there are no plans to cancel it; it is still in force, but only to the extent that does not contradict the current labor legislation of the Russian Federation.

- LNA of the organization: staffing table, staff book, etc.

- Orders on admission, transfer, dismissal, vacations, business trips and other similar orders.

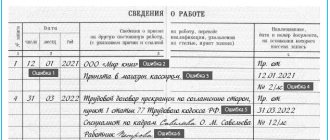

- Personal cards of employees (unified form T-2 or its replacement at the enterprise).

The roster includes:

- those working (including part-time, reduced working hours) and those who are idle;

- on sick leave;

- on business trips;

- on vacation (regular, educational, without pay, child care) or time off;

- those performing state and public duties, for example, participating in the work of election commissions or serving on jurors;

- temporary workers hired under a fixed-term employment contract;

- those under investigation or arrest;

- those who committed truancy;

- suspended from work;

- taking part in strikes;

- those who improve their qualifications if they retain their salary;

- employees are foreign citizens.

Not included in the list:

- external part-time workers (internal part-time workers are included as 1 unit, at the main place of work);

- attracted on the basis of the GPA;

- owners of the company, if they do not receive wages;

- military personnel, persons serving sentences, and others involved under special agreements with government organizations.

The actual number includes all employees of the organization who performed their duties on a specific working day and is determined on the basis of time sheets. When calculating it, persons who did not go to work are excluded, regardless of the reasons for their absence.

Calculation of average headcount

Let us remind you that according to paragraph 78 of the Instructions, the average number of employees per month is calculated using the formula:

Average number of employees per month = Sum of the number of employees for each calendar day of the month: Number of calendar days of the month

When determining the amount of the payroll number of employees, the payroll number of employees is taken into account for each calendar day of the month, that is, from the 1st to the 30th or 31st (for February - on the 28th or 29th), including holidays (non-working days) and weekends.

The number of employees on the payroll for a weekend or holiday (non-working) day is taken to be equal to the number of employees on the payroll for the previous working day.

The average number of employees is calculated on the basis of daily records of the number of employees. The latter must be clarified by orders on hiring workers, transferring them to another job, or terminating an employment contract.

The number of employees on the payroll for each day must correspond to the data of the working time sheet, on the basis of which the number of employees who showed up and did not show up for work is determined.

The average number of employees is calculated based on data on the payroll number, which is given as of a certain date, for example, the last day of the reporting period (clause 79 of the Instructions).

The payroll includes mercenaries who worked under an employment contract and performed permanent, temporary or seasonal work for one day or more.

The list of employees for each calendar day takes into account both those actually working and those absent from work for any reason, for example:

- on business trips. The condition is that they retain their salary in this organization;

- those who did not show up for work due to illness;

- absent from work due to the performance of state or public duties.

Among the employees who are not included in the payroll, in particular, are (clause 80 of the Instructions):

- hired part-time from other organizations;

- performing work under civil contracts;

- those who submitted a letter of resignation and stopped performing their job duties before the expiration of the warning period (those who stopped working without warning the administration).

Some employees are not included in the average headcount. These include (clause 81.1 of the Guidelines):

- women on maternity leave;

- persons who were on leave in connection with the adoption of a newborn child directly from a maternity hospital, as well as on parental leave;

- employees who study in educational institutions and are on additional leave without pay, entering educational institutions who are on leave without pay to take entrance exams.

Example 2

Employees of an individual entrepreneur O.P. Lapshins work on a five-day workweek schedule. The table shows data for March on the number of employees working full time.

| Day of the month | Number of employees | In particular, they are not subject to inclusion in the SSChR (clause 81.1 of the Instructions) | To be included in the USSR (group 2–group 3) |

| 1 | 5 | 1 | 4 |

| 2 (Saturday) | 5 | 1 | 4 |

| 3 (Sunday) | 5 | 1 | 4 |

| 4 | 6 | 2 | 4 |

| 5 | 6 | 2 | 4 |

| 6 | 6 | 2 | 4 |

| 7 | 6 | 2 | 4 |

| 8 (non-working holiday) | 6 | 2 | 4 |

| 9 (Saturday) | 6 | 2 | 4 |

| 10 (Sunday) | 6 | 2 | 4 |

| 11 | 8 | 2 | 6 |

| 12 | 8 | 2 | 6 |

| 13 | 8 | 2 | 6 |

| 14 | 8 | 2 | 6 |

| 15 | 7 | 2 | 5 |

| 16 (Saturday) | 7 | 2 | 5 |

| 17 (Sunday) | 7 | 2 | 5 |

| 18 | 6 | 2 | 4 |

| 19 | 6 | 2 | 4 |

| 20 | 6 | 2 | 4 |

| 21 | 6 | 2 | 4 |

| 22 | 6 | 2 | 4 |

| 23 (Saturday) | 6 | 2 | 4 |

| 24 (Sunday) | 6 | 2 | 4 |

| 25 | 6 | 2 | 4 |

| 26 | 6 | 2 | 4 |

| 27 | 6 | 2 | 4 |

| 28 | 6 | 2 | 4 |

| 29 | 6 | 2 | 4 |

| 30 (Saturday) | 6 | 2 | 4 |

| 31 (Sunday) | 6 | 2 | 4 |

| Sum | 194 | 59 | 135 |

The table shows that the sum of the number of payroll employees for all days of March to be included in the average payroll number is 135.

The calendar number of days in a month is 31. Based on this, the SSHR for March will be 4.35 people (135: 31).

The NARR for the quarter is determined as follows.

It is necessary to add up the SSChR for all months of the organization’s operation in the quarter and divide the resulting amount by three (clause 81.5 of the Instructions). Example 3

Individual entrepreneur O.P. Lapshin has the following data on the USSR: – for January – 3 people; – for February – 4.65 people; – for March – 4.35 people. Thus, the SSCR for the first quarter will be 4 people [(3 + 4.65 + 4.35) : 3].

To determine the SSChR for the period from the beginning of the year to the reporting month inclusive, it is necessary to add up the SSChR for all months that have elapsed for the period from the beginning of the year to the reporting month inclusive.

Then divide the resulting amount by the number of months for the period since the beginning of the year, that is, by 2, 3, 4, etc., respectively. (clause 81.6 of the Instructions). Example 4

Individual entrepreneur O.P. Lapshin has the following data on the USSR: – for January – 3 people; – for February – 4.65 people; – for March – 4.35 people; – for April – 6 people Thus, the SSHR for the period from January 1 to April 30 will be 4 people [(3 + 4.65 + 4.35 + 4) : 4].

Who should submit a report on the average headcount?

The rules for filling out information on the average number of employees are contained in the Letter of the Federal Tax Service of the Russian Federation dated 04/26/2007 No. CHD-6-25/ (as amended on 05/18/2007).

Officials give recommendations and explain the procedure for entering data. According to the explanations, as well as based on the meaning of the report itself, filling out the form on the average number of employees is the responsibility of all employers: organizations and individual entrepreneurs.

It is important that separate divisions do not need to submit these reports separately. A large organization must take into account its employees in all departments.

Let's sum it up

- Information on the SSC is submitted once a year - before January 20 of the year following the reporting year. You must pass the SSC 2022 no later than 01/20/2020.

- Newly created organizations must submit a report by the 20th day of the month following the month in which the company was registered.

- All organizations, regardless of the presence of employees, and individual entrepreneurs, if they have employees, submit information about the SSC.

- For missing the deadline for submitting information about the SSC, tax authorities can only impose a fine of 200 rubles. They do not have the right to block an account for being late in submitting a report for more than 10 days.

Regulatory act for calculating the average number

Specialists from the Finance Ministry indicated that the average number of employees is determined in accordance with the procedure established by Rosstat. In particular, you should follow the Guidelines for filling out Federal Statistical Observation forms (hereinafter referred to as the Guidelines):

- No. P-1 “Information on the production and shipment of goods and services”;

- No. P-2 “Information on investments in non-financial assets”;

- No. P-3 “Information on the financial condition of the organization”;

- No. P-4 “Information on the number, wages and movement of workers”;

- No. P-5(M) “Basic information about the activities of the organization.”

They were approved by Rosstat order No. 435 dated October 24, 2011.

Free program for preparing declarations

To quickly and correctly prepare a reporting form, there are many special programs. The Federal Tax Service recommends us one of these free software - Taxpayer Legal Entities. Next, we will consider the algorithm for filling out a report in this resource.

The first step is to check if there has been a new update for the program since it was installed on your computer. It is no secret that some tax changes are constantly being made, and naturally, the program is being finalized.

The most reliable way to check this is to go to the official website of the federal tax service. Here you can download the installation file of the current version of Taxpayer Legal Entity.

There is a small caveat: if you download the latest update, it may not install on your version. Therefore, the current version must be installed before updating. As of the end of 2022, the root version 4.64 and the update to it 4.64.3 are current.