From 2022, sick leave benefits will be transferred to direct payments from the Social Insurance Fund

The government will change the procedure for paying benefits for temporary disability and pregnancy and childbirth from 2022.

All sick leave payments will be made by the Federal Social Insurance Fund of Russia, and not by employers. Prime Minister Mikhail Mishustin announced this at a government meeting. Now the Social Insurance Fund is already paying sick leave benefits directly as part of a pilot project in 77 constituent entities of the Russian Federation (as of November 2020). Without the participation of employers they pay:

- temporary disability benefits;

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance;

- temporary disability benefits due to an accident at work or an occupational disease;

- compensation for sanatorium treatment in addition to annual paid leave and travel to the place of treatment for those injured at work.

As Mikhail Mishustin explained:

From 2022, we will extend this practice throughout the country. Moreover, we will switch to a proactive format of work: benefits for temporary disability, pregnancy and childbirth will be issued automatically on the basis of an electronic certificate of incapacity for work, there will be no need to write any applications.

Data on sick leave will be sent to the Social Insurance Fund automatically. Employers and employees will not have to take any additional actions. According to the Prime Minister:

This procedure for assigning payments will reduce the amount of paperwork for employers and speed up the transfer of funds. There will simply be no need to write any statements. And in general, obtaining information for the appointment of such benefits will take place electronically. This will help save a person time, energy, and - as often happened when preparing documents - nerves.

Organizations will no longer withdraw funds from circulation to pay for sick leave and then expect reimbursement from the Social Insurance Fund.

How an employee can control the payment of sick leave benefits

Benefits changes from 2022 have a positive effect for employees - they can control their sick leave amounts online.

To do this, you can use free services provided by the Social Insurance Fund. With their help, a citizen can find out at what stage the processing of sick leave and the payment of benefits for it are and when the funds will be received.

For example, you can use your personal account on the FSS website for this. To enter it you need to use the login and password from your personal account in the State Services service. This contains complete information on a specific payment, incl. whether the documents were received by the Social Insurance Fund, whether the benefit was calculated and paid according to the details specified in the application.

Attention! You can use this opportunity of your personal account only if you have issued an electronic certificate of temporary incapacity for work.

Another option for checking the payment status is the Social Navigator mobile application. Through it, you can get free advice from a fund employee on the issue of calculating and paying temporary disability benefits.

In addition, to communicate with specialists, you can use the hotline in a specific constituent entity of the Russian Federation.

Employer's obligation to pay

Every employer is responsible to employees for sick leave payments. When calculating the amount of temporary disability benefits, accounting must be guided by the norms that were adopted in the previous reporting period - this is 255-FZ; sick leave is calculated and paid strictly according to the rules of this law. Apply the provisions of Government Decree No. 375 of June 15, 2007 and Order of the Ministry of Social Development No. 624n of June 29, 2011, which determines the procedure for making such payments. Order No. 624n establishes a strict reporting form for a temporary disability sheet.

According to Part 1 of Art. 13 255-FZ the employer calculates and assigns temporary disability benefits. Then the territorial Social Insurance Fund reimburses the organization for the payment made, subtracting the first three days of the employee’s illness from the benefit amount. The procedure itself is as follows: upon completion of treatment, an employee who was absent from work due to illness is issued a certificate of temporary incapacity for work of the established form. Before starting work, the employee submits sick leave to the accounting department, and then the accountant checks that the form is filled out correctly.

The employer counts the amount of money, draws up and pays sick leave benefits. After the employee receives the funds, the accountant sends an application to the Social Insurance Fund to receive compensation for the benefits paid. Organizations must reimburse the transferred funds not in full, but with the exception of the first three days of illness, which, according to the rules, are paid at the expense of the employer.

IMPORTANT!

In many regions of the Russian Federation, there is a pilot project under which the Social Insurance Fund makes payments from the fourth to the last day of treatment. In 2022, more and more regions joined the pilot project. From 2022, the Ministry of Labor will oblige all constituent entities of the Russian Federation to work on a pilot project.

The territorial body of the Social Insurance Fund pays full benefits for pregnancy and childbirth and for caring for a disabled family member (Order of the Ministry of Health and Social Development No. 1021n). The basis for such payments is a correctly completed sick leave certificate.

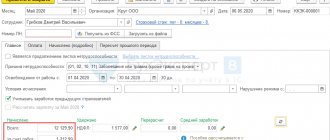

Sick leave in 1C 8.3 Accounting - accrual

Creating sick leave in 1C

When switching to direct benefit payments, make preliminary settings in 1C 8.3 Accounting.

From January 1, 2022, all regions switched to direct benefit payments. Therefore, even if the salary settings are set to Performed by the policyholder (organization), the calculation of benefits for 2022 is carried out in accordance with the direct payment mechanism.

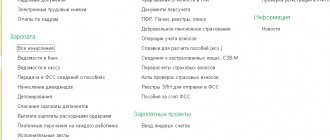

Having received sick leave from the employee, fill out the Sick Leave document in the Salaries and Personnel section - All accruals - Create button - Sick Leave (or from the Benefits at the expense of the Social Insurance Fund in the Salaries and Personnel section - Benefits at the expense of the Social Insurance Fund - Create Sick Leave button).

For direct payments, the block Direct payments to the Social Insurance Fund .

Fill out the sick leave information as usual. Learn more about filling out the Sick Leave document

In contrast to the credit system, the FSS pilot project in 1C 8.3 Accounting provides for the accrual of benefits to the employee using the Sick Leave only at the expense of the employer - for the first 3 days. The rest will be paid by the fund itself.

Postings according to the document

The document generates transactions:

- Dt Kt - calculation of benefits for the first 3 days of illness;

- Dt Kt 68.01 - withholding personal income tax from benefits.

Expenses for the first 3 days of sick leave are automatically taken into account under the expense item Payment of sick leave and are classified as other expenses.

More details Other expenses at NU Payment for the first 3 days of incapacity for work

Filling out the data on the certificate of incapacity for work

Using the Fill in personal information , fill in the data from the sick leave certificate. If you uploaded an electronic sick leave sheet into 1C 8.3 Accounting, the data will be filled in automatically.

What is important for state employees to remember in 2022

Budgetary organizations are obliged to pay their employees on time and make correct accruals. This also applies to the payment of temporary disability benefits. The main changes to the payment of sick leave in 2022 affected the calculation procedure. Here's what's changed since the new year:

- Minimum wage. From January 1, 2020, the minimum wage amounted to RUB 12,130. The minimum average daily earnings in 2022 is 398.79 rubles, the maximum is 2301.37 rubles.

- Billing period. When calculating social benefits, the two previous calendar years are taken. The limit of taxable insurance premiums for 2018 is RUB 815,000.00, for 2022 - RUB 865,000.00. For 2020, the limit on OSS is RUB 912,000.00.

- New KOSGU. Compensation for the first 3 days for temporary disability and maternity is reflected in subarticle 266 “Social benefits and compensation to personnel in cash.”

All social payments of budgetary institutions must be carried out within the established limits of budgetary obligations.

How to check an electronic sick leave on the FSS website for an employer

To check the sick leave on the FSS website (and at the same time add the necessary information to it for subsequent sending to the department), the employer needs:

- First obtain an electronic signature for document flow with the Social Insurance Fund and create an enterprise account on the State Services website. The signature is issued at an accredited certification center for the head of the organization. Creating a profile.

- Receive from the employee a unique electronic sick leave number, which is communicated to him by the medical organization after his appointment with the doctor.

- Log in to the “Policyholder's Account” on the page https://cabinets.fss.ru.

- Select the “Electronic sheets” tab, then “Request a sheet”.

- Enter the number of the certificate of incapacity for work and SNILS number of the employee.

- If necessary, select a certificate certifying the organization’s rights to make a request to the Social Insurance Fund.

- Wait for the found sheet to appear in the “List of Sheets”.

- If necessary, select the “To be completed by the employer” option.

- Fill in the appropriate area of the sick note and click “Save”.

After these steps, the completed sick leave will be sent to the Social Insurance Fund for processing of compensation for disability benefits.

From 01/01/2021, all regions joined direct payments to the Social Insurance Fund.

To make it easier to search for sick leave, an employer can use the filters provided in the web interface. For example, sick leave can be found:

- by full name patient;

- SNILS;

- sick leave number;

- document status;

- date of registration.

If necessary, you can generate a sick leave file in XML format in order to subsequently process it in a cryptographic program if it is used by the employer for electronic document management with government agencies.

A representative of the medical institution that issued the certificate of incapacity for work may also need to check the sick leave certificate online.

Get access to 35 online courses for HR and accounting professionals. Connect "Clerk.Premium". You will be able not only to take courses and receive Russian IPB certificates, but also to ask Clerk experts an unlimited number of questions . We will respond within a day. It's definitely cheaper than having third-party consultants. You will be able to collect questions from all your colleagues and even give them your username and password, and they will also be able to ask questions.

Who is not paid sick leave

In some cases, employees are not entitled to claim social benefits:

- if the employee is contracted under a contract;

- if the treatment regimen prescribed by the doctor is violated;

- in the absence of entries and appointments in the patient’s outpatient record;

- when issuing a document on temporary disability by an unlicensed medical institution;

- if the document has been extended for more than 30 days and there is no conclusion from the medical advisory commission;

- when issuing sick leave without a doctor’s prescription;

- if the date of issue is falsified;

- if the employee is under arrest;

- when an employee is suspended from work without maintaining his salary;

- during downtime at the enterprise;

- if the temporary disability was the result of a criminal violation;

- when an employee undergoes a forensic medical examination.

The procedure for calculating average earnings to pay for sick time

In order for the employee to receive the compensation due to him, the accountant must correctly calculate the payment for temporary disability. The basic rules for calculating and paying for sick leave in 2022 are as follows.

Step 1. The accountant calculates the average earnings for the billing period, then calculates the average daily earnings and the amount of the disability benefit itself. It is necessary to calculate the average salary in accordance with Government Decree No. 922 of December 24, 2007.

Step 2. Average earnings are calculated as follows: wages are determined for the two-year period preceding the accrual. When calculating average earnings, all income that the employee received from official employers and from which insurance premiums were paid is taken into account. The resulting amount is divided by 730.

Accountable income includes (Article 421 of the Tax Code of the Russian Federation):

- income that an employee receives by agreement with the employer - wages, rewards and fees, allowances, bonuses, compensation and incentive payments;

- long service payments;

- payment for an academic degree, badge and certificate of honor;

- for working night shifts, weekends and holidays;

- payment for expanding service areas, for combining job responsibilities;

- remuneration for piece work according to orders;

- salary in kind;

- payments to state and municipal employees;

- allowances to tariff rates and established salaries;

- regional coefficients and northern allowances;

- additional payments for work in difficult climatic conditions, in hazardous industries, etc.;

- allowances for working with documents and information containing state secrets.

Step 3. The formula for calculating average earnings for sick leave is as follows:

SZ = income for the previous 2 years / 730 days.

If one of the calculation years is a leap year, then the total income for 2 years is divided by 731 days. To calculate maternity leave, we take 731 days.

When calculating average earnings, payments that are not subject to FSS insurance contributions are not taken into account. Chapter 34 of the Tax Code of the Russian Federation states that when calculating average earnings, the following amounts are not taken into account (Article 422 of the Tax Code of the Russian Federation):

- Maternity leave.

- A benefit paid during parental leave.

- For other sick leave.

- Travel allowances (daily allowances) paid for business trips both within the Russian Federation and abroad.

- Vacation pay during business trips.

- Financial assistance in the amount of up to 4000 rubles. per employee for a certain billing period.

- One-time financial assistance that is paid in connection with natural disasters or emergency situations, the death of employee family members, the birth of a child, or the establishment of guardianship.

- Year-end bonuses. The final bonus for the year is included in the calculation of average earnings in direct proportion to the number of months worked.

- Compensation payments upon dismissal of an employee. The exception is compensation for unused vacation, amounts of payments in the form of severance pay and average monthly earnings for the period of employment.

- Compensation for costs of professional retraining.

- Payment for employee training for basic and additional professional programs.

- Payments to individuals under GPC agreements.

- Public utilities.

- Compensations related to the employment of laid-off employees and the employee’s relocation to another area. The exception is benefits paid in connection with difficult, harmful working conditions.

Step 4. If the average earnings for each previous period exceed the limit (815,000 rubles in 2022 and 865,000 rubles in 2022), then the limit value is taken for calculation. For 2022, the maximum value of the insurance base for calculating benefits for temporary disability and maternity will be 912,000 rubles. The updated limit value of the base for calculating insurance contributions for compulsory pension insurance from 01/01/2020 is RUB 1,292,000.

There are no excluded periods for calculating average earnings for temporary disability certificates.

Step 5. The resulting calculated result of average earnings is compared with the current minimum wage at the time the minimum wage is calculated. From 01/01/2020, the official minimum wage will be 12,130 rubles. (until the end of 2022 - 11,163 rubles).

Sick leave pay for a new employee

Special rules also apply when calculating temporary disability benefits for recently hired employees. Correct payment for sick leave at a new place of work is made according to the average daily earnings for the previous two years on the basis of a certificate of income provided by the previous employer (Part 1 of Article 14 255-FZ, Clause 3 of the RF PP No. 375 of June 15, 2007). An employee has the right to receive temporary disability benefits from the first day of the employment contract (Part 5 of Article 2 255-FZ). If a citizen falls ill before the day on which he starts work in accordance with the employment contract, then sick leave is not paid.

The basis for calculating sick leave at a new place of work is a certificate in form 2-NDFL for the previous two years or a certificate of income from the previous place of work. The income certificate is filled out in free form. The document must include the following information:

- name of the previous employer's institution;

- employee registration information;

- average monthly salary;

- accrued and actually paid wages to the employee for the specified billing period.

All information from the certificate is certified by the manager and chief accountant of the previous employer.

The most correct basis for calculating benefits is a certificate in form No. 182n. In 2-NDFL there is no breakdown of amounts subject to and not subject to income tax; the register presents generalized values. The certificate of the amount of wages and other payments for the last two years of work No. 182n indicates all transfers for which insurance premiums are calculated for a certain period.

Certificate No. 182n must be issued to the employee upon dismissal. This document is provided to the new place of work along with personal documents. Based on the amounts recorded in the certificate, the average earnings are calculated, which is used to calculate compensation from the Social Insurance Fund - sick leave, maternity leave and child care benefits for children up to one and a half years old.

How electronic interaction with the Social Insurance Fund is structured

Information about the opening, extension, closure, and cancellation of electronic sick leave is collected and stored in the Social Insurance system.

The FSS will send information about the opening, extension, closure, and cancellation of an electronic sick leave to the organization via the EDI system.

Most of the information about employees in the fund is already available. In addition, the FSS can receive data through the interdepartmental information exchange system from the Pension Fund of the Russian Federation, the Federal Tax Service, the Civil Registry Office and other government agencies.

In turn, the employer must place in the Social Insurance system the information necessary to calculate benefits for each sick leave and sign them with an enhanced qualified electronic signature (UKES):.

- insurance experience;

- the amounts of payments and rewards that were included in the base for calculating insurance premiums; if during the billing period the employee worked in another organization, then broken down by year of the billing period;

- regional coefficient;

- the amount of wages retained during the period of inactivity;

- the period of absence of the employee from work due to temporary disability;

- the number of days of sick leave, maternity or child care leave, periods of release from work with retention of salary, if contributions were not accrued for it.

The employer has only three days to provide information! If the accounting department does not have any documents, they must be obtained from the employee.

Most of the information about employees in the fund is already available. In addition, the FSS can receive data through the interdepartmental information exchange system from the Pension Fund of the Russian Federation, the Federal Tax Service, the Civil Registry Office and other government agencies.

Next, the FSS itself will calculate the amount of benefits and pay the employee to his bank card.

Information on the assignment and payment of benefits will be posted in the Unified State Information System for Social Security (USISSO) and sent to citizens in their personal account on the government services portal.

More details on the topic:

Maximum sick leave in 2022

Lists of information that the employer provides to the Social Insurance Fund

Right to postpone settlement periods for payment

If an employee does not have an income base, he has the right to write an application for calculating average earnings, taking into account the financial data of those time periods when his income was recorded (clause 1 of Article 14 255-FZ). The transfer can be made by persons who were on maternity leave or parental leave during the billing period.

A period transfer is made when such a replacement is beneficial to the employee due to the fact that his income in the billing period is lower than in the previous ones. For example, if an employee did not work for several years and got a job in an organization. Here is how sick leave is calculated at a new place of work with a postponement of the period:

- Replace either one accounting year of your choice or both periods.

- To carry out the transfer, you must submit a corresponding application to the accounting department.

- The application is drawn up in free form. Indicate the basis for the transfer, refer to the legislative norm - clause 1 of Art. 14 255-ФЗ - and indicate the periods to be replaced.

For example, Viktorova V.V. in 2022 and 2022 I was on maternity leave, and after that I couldn’t find a job. Thus, she has no income for these periods. In October 2022, she got a job. In January 2022, I provided my employer with sick leave. The duration of incapacity for work is 10 days. The employee has 15 years of experience, sick leave is paid in full.

The minimum wage for January 2022 is 12,130 rubles.

Minimum average daily earnings: 12,130 × 24 / 730 = 398.79 rubles. Sick leave based on the minimum wage is paid as follows: 398.79 × 10 = 3987.90 rubles.

The accountant raised the documents and saw that the total income of Viktorova V.V. for 2015 and 2016 equal to RUB 550,000.00.

If you calculate compensation based on income for the previous period, then the payment for a certificate of incapacity for work is as follows:

- 550,000 / 730 = 753.42 rubles;

- 753.42 × 10 = 7534.20 rub.

Accruals for the previous period from Viktorova V.V. much higher than current ones. The employee must fill out an application to postpone the pay periods.

Payment of sick leave to a part-time worker

To calculate social compensation for an employee working part-time in an institution, it is necessary to request information about income from all of his jobs. Accrual is made at the main place of work.

Such an employee submits to the organization income certificates for the previous two years from all of his jobs.

IMPORTANT!

A part-time employee who has worked for more than two years in the same institutions receives temporary disability benefits at all enterprises. In such cases, each employer is provided with an original sick leave certificate.

If a part-time worker worked on a permanent basis in two organizations, but at the time of incapacity for work he was employed in several more organizations, he has the right to receive benefits only at one enterprise. The employee chooses the company at his own discretion.

In such cases, in addition to sick leave and a certificate of income, the part-time worker provides the employer with certificates stating that he did not receive temporary disability benefits in other organizations.

Example: Vlasov V.V. has been working at the NPO “Success” for 10 years. Also, for the last two years he has been working part-time in various organizations. Vlasov V.V. provided the main employer with sick leave for 5 days. The employee provided certificates of part-time income totaling RUB 120,000.00. over the past 2 years. The average salary at the main employer is RUB 50,000.00. per month.

The payment is calculated as follows:

- 50,000.00 × 24 + 120,000.00 = 1,320,000 rub. — total income for two years;

- 1,320,000 / 730 = 1808.22 rub. - average daily earnings.

The employee's length of service is 10 years, so the leave is paid in full.

Vlasov V.V. temporary disability benefits accrued: 1808.22 × 5 = 9041.10 rubles.

Payment of sick leave through the Social Insurance Fund

Sick leave or disability benefits are provided for by Federal Law No. 255 of December 29, 2006. In accordance with Art. 3 The first three days are paid for by the employer, then payments are financed by Social Insurance (Social Insurance Fund, FSS). The current procedure provides for the calculation, accrual and payment of the benefit amount by the employer, and then he is compensated from the budget, that is, Social Insurance. There is no question of who pays, the employer or the state. The majority of benefits are paid by the state.

However, this system is quite cumbersome; employers often abused the deadlines for transferring funds. Therefore, in order to ensure the timely and full realization of their rights by workers, a “pilot project” was launched back in 2011 by Resolution No. 294 of April 21. This program provides for the calculation and transfer of funds towards benefits by the Fund's employees within a strictly limited time frame. That is, the main goal of the pilot project is to improve the situation of insured persons.

Payment of sick leave for epidemiological quarantine

In connection with the coronavirus epidemic, the Russian government has developed temporary rules for issuing and paying for sick leave for those people who are forced to be in quarantine (RF Government Regulation No. 294 of March 18, 2020). If you or your relatives with whom you live or constantly communicate have returned from countries with an unfavorable epidemiological situation, you must call a doctor at home, undergo an examination and remain in quarantine for 14 days. Two weeks is the incubation period during which symptoms of the disease may appear. For this period, you will be issued an electronic sick leave certificate.

Here's what quarantined people should do to apply for and receive temporary disability insurance:

- Log in to your ESIA personal account. Unregistered persons must obtain consent for a registered relative to submit an application on their behalf.

- Submit an application for an electronic sick leave. Attach to your application documents confirming your stay in a country with an epidemic (scanned copy of the relevant pages of your international passport, electronic plane ticket). If you live with a citizen who returned from countries with unfavorable conditions, attach the relevant documents.

- Check the issued electronic sick leave in the FSS information system. Notify the employer about the two-week quarantine and send him the details of the electronic certificate of incapacity for work.

Such sick leave is calculated according to general rules (depending on the employee’s length of service), but it is paid differently. You will receive the first payment from the Social Insurance Fund for the first 7 days of quarantine the next day after the employer transmits the information to the territorial body of the Social Insurance Fund. The maximum payment period is 7 calendar days. The second part of the quarantine (the remaining 7 days) will be paid on the next working day after its end, but no later than this date.

IMPORTANT!

The sooner you notify your employer of forced isolation, the sooner he will transmit the information to the territorial Social Insurance Fund and the sooner you will be paid the proper insurance benefits.

Electronic sick leave: what should an employer do now?

From January 1, 2022, sick leave will be issued and paid in a new way. Now the Social Insurance Fund pays benefits to employees directly. The timing and procedure for employers to submit documents to the Social Insurance Fund have changed. Electronic sick leave in paper form can only be obtained in the form of an extract (printout). And the original, as a general rule, is an electronic sick leave certificate ( Federal Law of April 30, 2022 No. 126-FZ ). In addition, in Russia the minimum wage has been increased, which is reflected in the minimum and maximum amount of benefits. In addition, the employer faces new fines, and the liability for officials remains high.

Content

- What is the employer responsible for in 2022?

- The employer is a participant in electronic document management with the Social Insurance Fund

- Algorithm of actions when working with sick leave 2022

What is the employer responsible for in 2022?

The employer was responsible for the delay and refusal to pay benefits, as well as for amounts paid in excess to the Social Insurance Fund before 2022 (Articles 5.27, 15.33 of the Code of Administrative Offenses of the Russian Federation, Part 2 of Article 15.1 of Law No. 255-FZ , Article 145.1 of the Criminal Code of the Russian Federation, Article 236 of the Labor Code of the Russian Federation). But now he faces new fines ( Article 15.2 of Law No. 255-FZ ). Let’s look at them and establish what features are important to take into account when registering and paying for sick leave. We will also build an algorithm for working with these documents.

New FSS fines for employers (Article 15.2 of Law No. 255-FZ)

| Base | Fine |

| Submission of false information and documents (which are necessary for the assignment and payment of benefits) or their concealment when this led to unnecessary expenses incurred by the Social Insurance Fund | 20 percent of the overpayment amount, but not more than 5,000, and not less than 1,000 rubles |

| Violation of the deadline for submitting information that is necessary for the appointment and payment of sick leave | 5,000 rubles |

| Refusal to provide or failure to submit documents (copies thereof) on time at the request of the Social Insurance Fund, which are necessary to control the completeness and accuracy of information and documents when assigning and paying benefits | 200 rubles for each document not submitted |

| Important! In 2022, high fines remain for an official of an organization (300,000–500,000 rubles) if, during an inspection, he refuses to present documents confirming the accuracy of the appointment, calculation and payment of Social Security benefits, and also provides information in incomplete or distorted form (h 4 Article 15.33 Code of Administrative Offenses of the Russian Federation) |

Payments by the employer for violation of the deadline and amount of payment of benefits to the employee

| Financial liability (Article 236 of the Labor Code of the Russian Federation) | Administrative responsibility (part 6 of article 5.27 of the Code of Administrative Offenses of the Russian Federation) | Criminal liability (parts 1 and 2 of article 145.1 of the Criminal Code of the Russian Federation) |

| Cash compensation in excess of unpaid amounts - not less than 1/150 of the current key rate of the Central Bank of the Russian Federation of amounts not paid on time for each day of delay | Fine: – for the employer – 30,000 – 50,000 rubles; – for a manager – 10,000–20,000 rubles (organization), 1,000–5,000 rubles (individual entrepreneurs) | Penalty for the manager: – up to 120,000 rubles or earnings for a period of up to one year (in case of partial non-payment for more than three months); – up to 500,000 rubles or earnings up to three years (with complete non-payment for more than two months) |

As you can see from the above tables, it is important for the employer to monitor and check:

1) terms:

- submitting information to the Social Insurance Fund;

- payments of that part of the benefits that he himself provides;

2) the reliability of the information when applying for sick leave, as well as the information submitted for it to the Social Insurance Fund.

| You will learn everything about the procedure for registering an electronic document in EDF, as well as about the types of electronic signatures, from the new practical course on our website |

The employer is a participant in electronic document management with the Social Insurance Fund

Since the basis for payment of benefits is an electronic sick leave ( Law No. 126-FZ ), the employer and the Social Insurance Fund also interact electronically (hereinafter referred to as EDI, Rules approved by the RF Government of December 16, 2022 No. 1567).

For this, your own modified software is suitable, or software that is available for download on the FSS website, as well as through your Personal Account (recommendations of the FSS of Russia).

The interaction takes place in the information system “EIIS “Sotsstrakh”. In particular, thanks to the new service “Social Electronic Document Management” (hereinafter – SEDO). It receives and processes information about sick leave, and also works using the “Direct Payments” method. You can join the EDMS through the reporting system. The same electronic signature can be used as when submitting it. You must confirm the information on sick leave with an enhanced, qualified electronic signature.

Programs for accounting (1C, PARUS, etc.), EDF operators (VLSI, Kontur, Taxcom, etc.) or a free automated workplace program “Preparation of calculations for the Social Insurance Fund” are suitable for work.

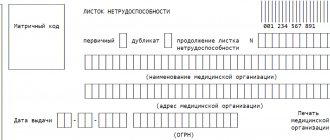

| Important! The usual paper sick leave is issued in exceptional cases: for example, to employees whose information constitutes a state secret or who are under state protection (Part 28 Art. 13 of Federal Law No. 255-FZ of December 29, 2006, hereinafter referred to as Law No. 255-FZ ). Note! As such, a sample of an electronic sick leave is not specified in the law, but there is a similar form of a paper form ( approved by Order of the Ministry of Health and Social Development of the Russian Federation dated April 26, 2011 No. 347n ), as well as rules for filling out the electronic form ( approved by Order of the Ministry of Health of Russia dated November 23, 2022 No. 1089n, hereinafter – Order – No. 1089n ) |

Algorithm of actions when working with sick leave 2022

Work with electronic sick leave is carried out in a clearly established manner and within a time frame ( Part 1 of Article 15 of Law No. 255-FZ , Rules approved by the RF Government of November 23, 2021 No. 2010, hereinafter referred to as the Rules ). Also, the employer is obliged to correctly assign and pay benefits for the first three days of incapacity in cases where he must do this himself (except for clauses 2 - 5, part 1, article 5 and article 9 of Law No. 255-FZ).

A brief algorithm for working with electronic sick leave can be found below.

Detailed version with explanations

You will learn about what actions the employer must take in order to have access to information from the electronic sick leave from the article on our website.

A brief algorithm of employer actions when working with sick leave 2022:

1. Become a participant in electronic document management with the Social Insurance Fund

2. Receive a notification from the Social Insurance Fund about the opening of an electronic sick leave (clause 19 of the Rules)

3. Wait until the medical organization closes the certificate of incapacity for work and receive a request from the Social Insurance Fund for the missing information (clauses 12, 17, 22, 23, 44 of the Rules)

4. Check the “pre-filled information” for accuracy and completeness.

5. Enter the necessary information for the assignment and payment of benefits (from the list of clause 22 of the Rules, but only those that are requested by the FSS - clause 23 of the Rules):

- duration of insurance period;

- payments included in the base for calculating insurance premiums for the billing period;

- replacement of calendar years at the request of the employee;

- regional coefficient;

- working hours;

- periods of release/suspension/incarceration;

- periods of illness in the billing period;

- information about the start date of maternity leave, etc.

6. Send information to the Social Insurance Fund (clauses 22, 23 of the Rules)

7. Wait for the FSS information to be checked for accuracy and completeness (clauses 10, 12, 44 of the Rules)

| Note! Workers are worried about how to close electronic sick leave. Explain that this is done by the attending physician of the medical organization, and the employer only provides information at the request of the Social Insurance Fund (Order of the Ministry of Health No. 1089n) Important! If the period of incapacity for work is less than four days, the Social Insurance Fund will notify the employer only about the opening and closing of electronic sick leave (Article 14.1 of Law No. 255-FZ) |

Share this article:

Insurance period and sick leave payment

The insurance period is understood as the duration of work of an employee, during which income was recorded and insurance premiums were transferred.

The insurance period includes periods of work of the insured person on the territory of the Russian Federation or abroad on the basis of international treaties of the Russian Federation and in accordance with Russian legislation. The insurance period includes periods of temporary disability, the care of one of the parents for children, the time of receiving unemployment benefits, etc. To include these periods in the insurance period, they must be preceded or followed by periods of work.

The insurance period is not taken into account in the following cases:

- when working without registration;

- from individual entrepreneurs who have evaded paying fees to the social fund;

- during vacations not paid by the employer.

When calculating the insurance period for sick leave, all insurance periods are taken into account, regardless of work breaks.

The insurance period is calculated on a calendar basis based on a full year. Every 30 days of work and other periods are converted into months, and every 12 months - into full years.

The amount of sick leave payments directly depends on the length of insurance coverage. Here's how sick leave is calculated at a new place of work: if the employee's work experience is less than six months, then no more than one minimum wage is calculated for each month of incapacity for work.

Payment depending on length of service is made as follows:

- if the employee’s length of service is 8 years or more, then sick leave benefits are paid in full (100%);

- from 5 to 8 years - payment will be 80%;

- from 3 to 5 years - 60%.

When paying maternity benefits, the length of service coefficient is not taken into account; sick leave is paid in full.

Duration of sick leave

Based on Art. 11 of Order No. 624n, the duration of one sick leave does not exceed 15 days. The maximum period of a certificate of incapacity for work is 10 months, but is extended to 12 months for the following diagnoses:

- injury requiring long healing;

- tuberculosis;

- postoperative period.

For citizens who have been recognized as disabled, the following maximum periods of sick leave are established (clause 3 of Article 6 255-FZ):

- continuously - 4 months;

- in total for the year - 5 months.

From April 10, 2018, sick leave for caring for a child under 7 years old is issued without a time limit; the same rule applies to caring for disabled children.

Sick leave for maternity leave is issued for a period of 140 days in the case of a singleton pregnancy, 156 days in the case of a complicated birth, and 194 days in the case of a multiple pregnancy.

Deadlines for payment of benefits and personal income tax

Temporary disability benefits are assigned only after the strict reporting form has been checked for authenticity and correct completion. The employer checks the sick leave and assigns temporary disability benefits. The deadline for paying sick leave in 2022 is 10 days from the date of receipt of the document from the employee. The transfer of funds is made in the next period of payment of advance payment or wages (Part 1 of Article 15 255-FZ).

In those subjects of the Russian Federation in which the certificate is paid directly by the Social Insurance Fund, different deadlines apply: after the timely submission (within 5 days) of a correctly completed certificate of incapacity for work to the Social Insurance Fund, the social insurance authorities review the document and make a decision. After a positive verdict, payment is made within 15 days (RF RF No. 294 dated April 21, 2011).

As a general rule, personal income tax of 13% is withheld from all sick leave without division into compensation from the employer and the Social Insurance Fund. But if there is a pilot project in the region, then the employer withholds personal income tax only for those three days that are accrued at his expense. The remaining part is retained and transferred by the territorial body of the FSS. Personal income tax is transferred no later than the last day of the month in which the benefit was paid (Article 226 of the Tax Code of the Russian Federation).

In accordance with paragraph 1 of Art. 217 of the Tax Code of the Russian Federation, maternity benefits are not subject to taxation. Income tax is not withheld from compensation for child care up to 1.5 and 3 years.

Electronic sick leave 2022: how to check, supplement and pay

From January 1, 2022, as a general rule, sick leave will be issued electronically. Not only the form of this document has changed, but also the rules of interaction between the employer and the Social Insurance Fund ( Law No. 126-FZ , RF RF dated December 16, 2022 No. 1567 ). Sick leave is processed in the EIIS Sotsstrakh using the EDMS.

Now, when assigning benefits, the organization plays the role of an intermediary. She transmits to the FSS the information that is needed to pay for sick leave. Payments are made in a “proactive manner”: both according to information “pre-filled” by the Social Insurance Fund, and according to data provided by the employer (clauses 19, 22 and 23 of the Rules, approved by the RF Government of November 23, 2022 No. 2010 ). In almost all cases, benefits for certificates of incapacity for work are paid directly by the Social Insurance Fund (except for clause 1, part 1, article 5 and article 9 of Law No. 255-FZ).

However, it is important for the employer not only to provide information upon request on time, but also to ensure its accuracy and completeness in order not to fall under fines (Article 15.2 of Law No. 255-FZ , Part 4 of Article 15.33 of the Code of Administrative Offenses of the Russian Federation). In addition, the employer is still obliged to pay for the first three days of sick leave for temporary disability (except for clauses 2–5, part 1, article 5 and article 9 of Law No. 255-FZ ). The benefit must be calculated taking into account the indexation of the minimum wage for 2022, as well as the employee’s maximum income base for 2020 and 2022.

How the employer and the Social Insurance Fund interact when assigning benefits for electronic sick leave, as well as what fines the company faces in this case, you can find out in the article on our website.

Content

- How to make sure that the sick leave is genuine

- A vicious circle of checks, or everyone checks everyone

- Features when calculating and paying benefits in 2022

- Who will pay for electronic sick leave and how from 2022

How to make sure that the sick leave is genuine

The employer receives information about the opening of sick leave from the Social Insurance Fund (via the EDMS). Also, an employee can provide his sick leave number on his own initiative, but he no longer has an obligation to do so. You can check the authenticity of the electronic sick leave yourself. To do this, you need to enter the electronic sick leave number, as well as the employee’s SNILS number in the electronic system.

An employee can also check whether he has received an electronic sick leave. Each employee has a personal account on the portal of the Federal Social Insurance Fund of the Russian Federation. Notify employees of the need to register on the State Services portal. They will be able to access their personal FSS account. Electronic sick leave: its information, including processing stages, can be tracked on the website (login with login and password from the State Services portal). Thus, the HR manager will no longer need to answer the question: electronic sick leave - where to view and track this document.

| You will learn how to accurately and easily draw up and coordinate personnel documents when working remotely from our updated training course |

A vicious circle of checks, or everyone checks everyone

Since 2022, the Social Insurance Fund will pay employees benefits directly: in full or starting from the fourth day. In addition, the Fund switched to a “proactive procedure” for their payments. It frees the employer and employees as much as possible from the need to submit documents. For these purposes, departments have developed their own electronic document management system. Thus, the FSS can request from the Pension Fund: SNILS of the employee, information about his employer, the amount of insurance experience, etc. From the Federal Tax Service of Russia - it can clarify information about the employee’s salary for the period of interest (clauses 12 and 44 of the Rules ). In particular, when closing an electronic sick leave, the FSS receives information from the Pension Fund and sends “pre-filled information” to the employer.

If necessary, the employer corrects the “pre-filled information” and supplements it. For example, enters correct data for calculating benefits. This must be done within three working days from the moment the electronic sick leave is closed and the request is received (clauses 22 and 23 of the Rules ).

The FSS again has the right to check this data through interdepartmental cooperation. The Pension Fund and the Federal Tax Service provide the FSS with information no later than three working days from the date of receipt of the request (clauses 44 and 46 of the Rules ).

If the employer sent incomplete (inaccurate) data to the Social Insurance Fund, he will be given the right to correct the error. In this case, the employer will confirm receipt of the notice from the Social Insurance Fund within three working days and send the missing (corrected) information within five working days (clause 10 of the Rules ).

Features when calculating and paying benefits in 2022

The procedure for calculating benefits remained the same, but their actual amount increased. From January 1, 2022, the federal minimum wage in Russia increased to 13,890 rubles. The minimum average daily earnings in 2022 depend on it - 456.66 rubles. (13890*24/730 – part 6.1 of article 14 of Law No. 255-FZ ).

In 2022, the maximum employee income base, which is taken into account when calculating benefits, has been increased. It amounts to 1,878,000 rubles (for 2020 - 912,000 rubles (RF PP dated November 6, 2022 No. 1407 ), for 2022 - 966,000 rubles (RF PP dated November 26, 2020 No. 1935 ). Consequently, the maximum average daily earnings in 2022 – 2572.6 rubles (1,878,000/730 – Part 3.3, Article 14 of Law No. 255-FZ ).

| Advice If your region has established a minimum wage with an increased coefficient, calculate the minimum benefit taking it into account. At the same time, the maximum daily benefit cannot be increased by the regional coefficient (Article 133 of the Labor Code of the Russian Federation, Article 14 of Law No. 255-FZ ) |

The main indicators for calculating temporary disability benefits remained the same: the cause and number of days of incapacity, their maximum duration, the procedure for calculating average daily earnings (with minimum and maximum restrictions), the employee’s insurance length and his income for the billing period (Article 6, Article 14 of Law No. 255-FZ , clauses 22 and 23 of the Rules , Order of the Ministry of Health of Russia dated November 23, 2021 No. 1089n ).

| Scheme 1 Temporary disability benefit = average daily earnings * number of days of incapacity * amount of benefit established as a percentage of average earnings (Article 7, Parts 4 and 5 of Article 14 of Law No. 255-FZ ) Scheme 2 Average daily earnings = the amount of earnings for the two calendar years preceding the year of illness / 730 (parts 1–3 of Article 14 of Law No. 255-FZ ) |

What benefits are paid by the Social Insurance Fund and which by the employer, you can find out in the material on our website

Who will pay for electronic sick leave and how from 2022

The employer, as before, pays for the first three days of illness of the employee. In this case, the benefit is accrued within 10 days from the end of sick leave, and paid on the next payday. The Social Insurance Fund pays its part of the benefit within 10 days from the receipt of all necessary information about the employee. The Fund has the right to refuse payment. The decision to refuse is sent no later than one working day from the date of its adoption (Article 15 of Law No. 255-FZ ).

Benefits are transferred to a bank account, via mail or another organization specified by the employee in the “Information about the insured person.” Sick leave is paid without interest for the transfer (Parts 25, 26 of Article 13 of Law No. 255-FZ, in the form of Appendix No. 2 approved by the Order of the Social Insurance Fund of February 4, 2022. № 26).

| Important! The Social Insurance Fund itself pays for all days of maternity leave (Law No. 126-FZ), as well as sick leave for: quarantine (including for a preschool child under 7 years old), caring for a sick family member, industrial accident or occupational disease, and also – prosthetics for medical reasons in a hospital and after-care in a sanatorium after hospitalization (clause 2 – 5, part 1, article 5, article 14.1 of Law No. 255-FZ, Federal Law of July 21, 2007 No. 183-FZ, Order of the Ministry of Health and Social Development of the Russian Federation of January 27, 2006 No. 44, Federal Law of May 26, 2022 No. 151-FZ, RF PP of December 30, 2022 No. 2375). |

Share this article:

Maximum and minimum payment for sick leave

The minimum payment value is determined on the basis of the current minimum wage (Part 1.1 of Article 14 255-FZ). If necessary, the accountant determines an additional payment for the employee up to the average earnings.

IMPORTANT!

From 01/01/2020, the minimum wage in Russia increased and amounted to 12,130 rubles.

Accordingly, the minimum daily earnings will be:

(12 130 × 24) / 730 = 398,79.

In 2022, the minimum sick leave benefit is calculated as follows:

(12,130 × 24 months) / 730 × 60%.

It is 239.28 rubles.

The maximum value of temporary disability benefits is limited by a maximum value. According to the new limits, the maximum payment for sick leave in 2022 is calculated as follows:

(815,000 + 865,000) / 730 = 2301.37 rubles.

The minimum value of maternity benefits (according to the minimum wage) in 2020:

398.79 × 140 days = 55,830.60 rub.

Maximum value:

2,301.37 × 140 days. = 322,191.80 rub.

IMPORTANT!

Due to the spread of coronavirus infection, the procedure for calculating payments for temporary disability has temporarily changed. From 04/01/2020 to 12/31/2020, the slip is paid based on the minimum wage - 12,130 rubles. (Article 1 104-FZ dated 04/01/2020). The accountant is required to make two calculations: normal (using information about the employee’s income) and according to the minimum daily value according to the minimum wage (in 2022 - 398.79 rubles). All bets, odds and percentages based on length of service are applied to both amounts. The resulting values are multiplied by the number of days of illness. The results are compared - the employee is paid the largest benefit.

An example of calculating payment for caring for a sick child

Ezhova E.E. provided sick leave to care for a sick child from January 13 to January 20, 2022. The child’s age is 7 years. According to the new rules, such sick leave is paid in full for the entire duration of the child’s illness. The employee's experience is 15 years.

Income for 2022 - RUB 500,000.00.

Income for 2022—RUB 600,000.00.

SDZ = (500,000.00 + 600,000.00) / 730 = 1506.85.

The compensation will be: 1506.85 × 7 = 10,547.95 rubles.

Transferable benefits for child care up to 1.5 years

If the company, as of January 1, 2022, has employees on maternity leave and receiving benefits, the last time they need to pay benefits is for December 2020. In fact, this payment is made on the day of payment of wages to employees for December.

Then, you need to get an application and documents about the birth of the child from the employee. All documents must be submitted to the FSS. The fund will pay benefits for an employee on maternity leave for January.

The accountant’s task is to receive the child’s application and birth certificate on time, so as not to leave the employee without money.

An example of calculating maternity benefits

Alexandrova A.A. provided sick leave for pregnancy and childbirth. She is going on maternity leave on 02/05/2019. In Alexandrova A.A. singleton pregnancy, the leave for which is 140 days.

Total income for 2022 amounted to RUB 650,000.00, for 2022 - RUB 730,000.00. The employee did not take sick leave during this period. Alexandrova’s income does not exceed the maximum base.

Let's calculate the maternity benefit: (650,000.00 + 730,000.00) / 730 = 1890.41 rubles.

The benefit will be: 1,890.41 × 140 = 264,657.53 rubles.