Important information: employers no longer submit information on the average number of employees using the KND form 1110018 (SChR). In accordance with the order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected], information about the number is included in the DAM report. The information from the article below is no longer relevant.

Information on the average number of employees (AHR) is one of the first reports of a newly created LLC. The reporting form looks simple, however, submitting the SSR raises a lot of questions, which we will answer in this article.

Free accounting services from 1C

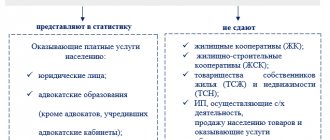

Who must submit information about the number of employees

Judging by the name, only employers must submit information about the average number of employees. But the Ministry of Finance believes that all companies must report, including newly organized ones that do not yet have employees .

From the letter of the Ministry of Finance of the Russian Federation dated February 4, 2014 No. 03-02-07/1/4390: “... there is no provision for exemption of organizations that do not have employees from submitting information on the average number of employees to the tax authorities within the prescribed period.”

Let's list who is required to submit a report on the average headcount:

- newly registered legal entities, regardless of the availability of personnel;

- individual entrepreneurs-employers;

- organizations that have entered into employment contracts;

- organizations that do not have employees on staff.

Thus, only individual entrepreneurs without employees have the right not to submit this information; all other businessmen are required to report.

Cheat sheet for calculating headcount

In order not to get lost among formulas and numbers, let’s put everything into a checklist:

1. If you need to balance the work of the company’s personnel, consider the number of employees.

2. To calculate, use the formula H = V / (FRV x VPL x KVN).

3. To calculate the number taking into account those who may get sick or go on vacation, calculate the absenteeism rate using the formula KN = 1 + DN.

4. Supplement the formula for calculating staffing levels with the absenteeism rate. The formula looks like: ШЧ = H x KN.

5. When you need to submit information to the tax office, consider the average number of employees.

6. If the numbers are not clear and you still need to fire someone, or there is no money to hire new employees, optimize work processes, identify lazy people, tighten deadlines, motivate, connect CRM.

Author: Anna Naumkina, Daria Milakova

Who to include in the headcount for the report

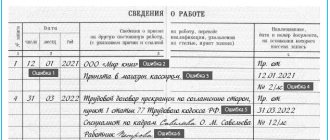

The average headcount is calculated in accordance with the Instructions approved by Rosstat Order No. 832 dated November 24, 2021. The Instructions list the categories of workers who are included in the headcount for the report, and those who are not taken into account in the calculation.

A lot of controversy arises regarding the inclusion in the SCR of information about the only founder who works without an employment contract and does not receive a salary. Should he be taken into account in the number of employees, since he performs administrative functions for the management of the LLC? No, it’s not necessary, there is a clear answer to this question in paragraph 78 (7) of the Directives.

The average headcount is calculated only for personnel hired under an employment contract. This is the main difference between this indicator and reports to funds, which also take into account employees registered under a civil law contract. In this case, the duration of work under the employment contract does not matter; everyone who performs permanent, temporary or seasonal work is included in the information of the SCH. Separately, those who are employed full-time and those who work part-time are taken into account.

Read more: How to calculate the average number of employees

In general, the average payroll number is determined by adding the number of employees on the payroll for each month of the reporting year and dividing the resulting amount by 12. The final result is indicated in whole units, because it means the number of working people in the state.

How to calculate the number of employees taking into account the human factor

Formula for calculating the absenteeism rate:

- KN—absenteeism rate. Characterizes the number of people who cannot go to work due to illness, take leave or go on maternity leave.

- DN - the share of non-working time in the total amount of time. This is the FRB figure from the previous formula (1,980 hours).

Example of calculating absenteeism rate

After the store owner considered that he could reduce the sales staff by two people, he decided to clarify the result to make sure that in case of dismissal the quality of service would not decrease. To do this, he calculated the employee absenteeism rate over a 12-month period. It turns out that each employee goes on vacation for 28 days, or 252 hours, per year. DN = 252 hours/1,980 hours (FRV indicator) = 0.13. 1 + 0.13 = 1.13 is the absenteeism rate.

Now we will calculate the number of personnel of the enterprise along with the absenteeism rate.

Formula for staffing (SH) taking into account the absenteeism rate (AB):

Let's add an example

In the calculation, it turned out that the staff of 10 people can be reduced to 8. Now let’s calculate the number along with the absenteeism rate (1.13).

8 x 1.13 = 9

This means that the store must have at least 9 employees. Therefore, you can only fire one person

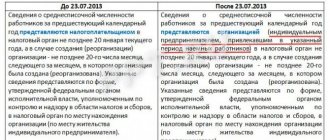

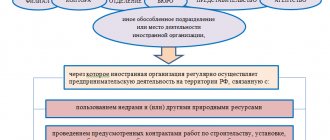

Deadline for delivery of SChR

The deadline for submitting information on the average number of employees is established by Article 80 of the Tax Code of the Russian Federation. According to it, this form must be submitted no later than January 20 of the current year for the previous calendar year. But the deadline for submitting a report on the average number of new organizations (legal entities that have just been created or reorganized) is no later than the 20th day of the month following the one in which the organization was registered or reorganized.

The last time the SChR form was submitted was in 2022, then, in accordance with the order of the Federal Tax Service dated October 15, 2020 No. ED-7-11 / [email protected] , information about the number is included in the DAM report.

For example, the creation of an LLC occurred on January 10, therefore, information on the average headcount of the newly created organization must be submitted no later than February 20, then the company reports in the general manner.

If the delivery deadline is violated, the LLC will be fined under Article 126 of the Tax Code of the Russian Federation in the amount of 200 rubles. In addition, an administrative punishment of an official (chief accountant or director) in the amount of 300 to 500 rubles is possible under Article 15.6 of the Code of Administrative Offenses of the Russian Federation.

Important: information about the average number of employees of a new organization, although submitted to the Federal Tax Service, is not a tax return, therefore tax authorities do not have the right to block the LLC’s current account due to late submission deadlines.

How to use the calculator

The number of working employees of an enterprise on a given date is officially called the payroll number. Usually, a calculation of the average number of employees for the year is required for submission to the Federal Tax Service and Rosstat. The reporting period for various purposes is the month, quarter, beginning of the year. The report includes a complete list of employees with whom employment contracts were concluded. The category of TD does not matter - unlimited, temporary - everything is recorded. When calculating, not only those employees who were directly at the workplace during the reporting period are taken into account, but also those who are absent: those on sick leave, on business trips, etc. Employees who have absenteeism are also taken into account in this list.

The following categories of employees are excluded from registration:

- external part-time workers;

- working under GPC agreements;

- on maternity leave, child care leave;

- students assigned by an organization to take a break from work and receive a scholarship;

- on study leave.

For ease of calculation, a special service has been created - an online calculator. There are small rules on how to calculate the average number of employees for the year and not get confused:

- The calculator consists of two parts: the first indicates the employees for whom the main place of work in this organization is. In the second, those who work part-time are taken into account - they are designated in accordance with the time specified in the employment agreement and the time worked. An exception will be for employees who occupy such a position at the initiative of the employer. In this case, a unit is entered.

- If a woman goes part-time during maternity leave, her working time is taken into account in the second part.

- Internal part-time workers, workers who hold more or less than one position, are counted as one unit in the first part of the online calculator.

- Weekends and holidays are not filled in or are filled in with zeros.

- If the reporting year is a leap year, check the box of the same name.

Step #1

We fill in the data: we put down a figure corresponding to the total number of employees who are registered at the enterprise. One cell corresponds to a specific day of the month. The data must be taken from the time sheet or work schedule.

Step #2

Here, on each day of the month, enter the number of part-time employees.

Step #3

You have filled out the data, now you need to calculate the average number of employees using the online calculator. There is no need to calculate anything here - the system will do everything itself. For example, we entered estimated data for three months, the result for the year is 1.43.

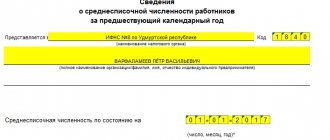

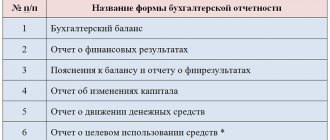

Report form

The SChR report is submitted in form KND 1110018 on the form approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ [email protected] Recommendations for filling out the form are given in the letter of the Federal Tax Service of Russia dated April 26, 2007 No. CHD 6-25/ [email protected]

The report on the average headcount for newly created organizations consists of one sheet and has a fairly simple appearance.

In the top lines of the form (the fields to fill out are highlighted in color) indicate the TIN and KPP of the legal entity. The name of the Federal Tax Service is entered in full, indicating the number and code of the tax authority. The name of the company is given in full, for example, not “Alfa LLC”, but “Alpha Limited Liability Company”.

The only significant indicator of the CHR report is the average headcount, calculated in accordance with Instructions No. 711. If information is submitted for the past calendar year, then January 1 of the current year is indicated in the date fields. The information is signed by the head of the legal entity, but this can also be done by an authorized representative. When submitting a report by proxy, you must enter the details of this document and attach a copy.

The report on the average headcount for newly created organizations differs from the usual annual report only in the date. Please note the footnote marked with (*) - the number of personnel is indicated not as of January 1 of the current year, but as of the 1st of the month following the month in which the LLC was registered. For example, if a company was registered on January 10, then the number of employees is indicated as of February 1.

We provide a sample of filling out a report on the average number of employees of a newly created LLC, in which the employment contract is concluded only with the general director.

Summary information on the average number of employees

On the “ Summary ” tab in the registration data block in the company card, there is information about the average headcount, which is located immediately below the name of the legal entity.

Average headcount indicator for 1 year

Average headcount indicator for 2 years

If the system has information for two years, then the average headcount indicators will be displayed over time.

If there is a sharp decrease in the number of personnel, this may indicate financial difficulties of the company, which had to reduce staff in order to save money. At the same time, stable indicators or their growth positively characterize a potential counterparty, because they can indicate an increase in production capacity and the effectiveness of management decisions.

In the Kontur.Focus system, the user is recommended to additionally become familiar with the following features: extract from the Unified State Register of Individual Entrepreneurs, scheduled and unscheduled inspections, trademarks and marks, inspection of buildings.

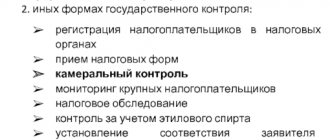

Submission methods

The number of employees under an employment contract is important not only when calculating taxes, but also when choosing the method of submitting the CHR report: paper or electronic. Typically, information about the average headcount of a newly created organization is submitted in paper form, because the number of employees hired in the first month rarely exceeds 100 people.

The rule of Article 80 (3) of the Tax Code of the Russian Federation states that only taxpayers with no more than 100 people have the right to submit tax returns and calculations in paper form. If we take it literally, then this article should not apply to the report on the average headcount, because it is not taxable. However, tax officials insist that if the number of employees exceeds 100 people, information about their number should also be submitted in electronic format.

In fact, this requirement does not cause any particular difficulties, given that since 2015, insurance premium payers are required to submit reports on insurance premiums in electronic form, starting from 25 people. That is, if the number of employees in your enterprise exceeds 25 people, you will still have to issue an electronic digital signature, which can be used to sign all reports.

A report on the number of employees is submitted to the tax office at the place of registration: at the registration of an individual entrepreneur or the legal address of an LLC. If the document is drawn up on paper, then you can submit the report in person to the Federal Tax Service or by mail with a list of the attachments.