What is net profit?

Net profit (hereinafter referred to as NP) is calculated at the end of the year by resetting the totals in the accounting accounts.

This indicator consists of the company's revenues and expenses, adjusted for tax payments. Moreover, if the company’s expenses exceed its income, then a loss is formed. The line-by-line occurrence of emergencies is presented more clearly in the Profit and Loss Statement.

For information on the use of accounting indicators in economic analysis, see the material “Methodology for analyzing the balance sheet of an enterprise.”

Characteristics of account 99

Account 99 in accounting is an active-passive profit and loss account, i.e. it can have both a debit and a credit balance.

The contents of account 99 are described in detail in the current Chart of Accounts, approved by order of the Ministry of Finance of the Russian Federation dated December 31, 2000 No. 94n. In accordance with this document, information is accumulated on account 99:

- about the financial results that the enterprise receives from the main type of economic activity (in correspondence from account 90);

- on other income and expenses for the reporting period (in correspondence from account 91);

- on penalties imposed on payments to the budget and extra-budgetary funds, accrued payments and recalculations made for income tax (in correspondence from account 68).

For organizations in the agricultural sector, there is a Chart of Accounts, which was approved by the Ministry of Agriculture dated June 13, 2001 No. 654. According to this plan, when taking into account debit-credit turnover when calculating the financial result on account 99, it is also necessary to take into account income and losses from force majeure and other emergencies (fire, natural disasters, etc.). Income from an emergency includes insurance compensation received by the company and income from the sale of materials during the dismantling of destroyed buildings and structures. Costs in such situations include losses that are not compensated by the insurance company.

Analytical accounting for accounting 99 is structured in such a way as to ensure the generation of information for drawing up the final report on financial results.

Net profit in form 2

PE is shown on page 2400 of the Profit and Loss Statement. It is formed from:

- gross profit/loss, which in turn is defined as the difference between “Revenue” (line 2110) and “Cost of sales” (line 2120);

- commercial (p. 2210) and administrative (p. 2220) costs;

- income from participation in other companies (line 2310), interest receivable (line 2320) and payment (line 2330), other income (line 2340) and expenses (line 2350);

- adjustments to PBU 18/02: current tax (line 2410), deferred taxes (line 2430 and 2450).

See the material on the specifics of entering information into Form 2 “Filling out Form 2 of the balance sheet (sample).”

An example of calculating profit in 1C: Holding Management

In the example considered, the amount of income from the sale of the Megapolis shopping center amounted to 573,750 rubles. (column 2. “Calculation certificates”, section “Tax base”).

The organization's expenses amounted to 483,500 rubles. (column 3. “Calculation certificates”, section “Tax base”).

Profit of TC "Megapolis" - 90,250 rubles. (column 4 “Calculation certificates”, section “Tax base”)

Amount of income tax (20%) gr. 3. “Calculation certificates”, section “Income Tax” – 18,051 rubles. (90,250 RUR * 20%).

Net profit of TC Megapolis – 72,199 rubles. (90,250 rubles – 18,050 rubles).

How to determine and view net profit in 1C: Holding Management? What transactions are involved in the formation of the financial result? Hints on these questions can be obtained by clicking on the hyperlink “Closing accounts 90, 91” and “Balance sheet reformation” by clicking on the “Show transactions” command.

Consultation on accounting for net profit in 1C

Free consultation with an expert on net profit accounting and automation based on 1C

Learn more

Let's set up net profit accounting in 1C

We will professionally set up 1C for correct accounting of net profit and other financial results.

Learn more

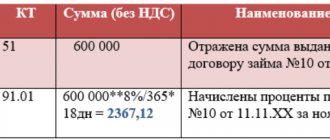

The document “Closing accounts 90, 91” reflects the amount of profit (loss) from sales on account 99.01.1.

Fig. 14 Postings for closing the account. 90, 91

During the reformation of accounts, net profit for distribution has already been determined and allocated to subaccount 84.01.

Fig. 15 Accounting entries for “Balance Sheet Reformation”

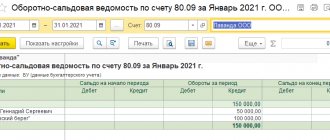

Using the standard report “Turnover Balance Sheet” (SBL) from the “Reports” section, you can also view the turnover of accounts to determine net profit and its value.

Fig. 16 OSV in 1C:UH

Subaccounts of account 90 “Sales” collect and reflect data on the amount of revenue from sales, cost, and taxes.

Fig. 17 SALT according to account 90 in 1C:UH

And after the balance sheet reformation, the month-closing data discussed above will be reflected in account 99 “Profits and losses”.

Fig. 18 SALT according to account 99 in 1C:UH

The undistributed net profit of TC Megapolis is reflected in account 84.01 “Profit subject to distribution”.

Fig. 19 SALT according to Account 84.01

This data is used to generate the “Income Tax Return” report.

Free audit and recommendations for accounting for net profit based on 1C

Let's go to the "Regulated reporting" section and create the above report - the "Create" button.

Fig.20 1C-Reporting in 1C:UH

Having selected the report, we will set its settings - we will indicate the organization for which to display data, and we will set the reporting period. Click “Create”.

Fig.21 Creating a report in 1C:UH

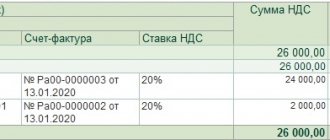

Let's fill out the report using the "Fill" button. Let's move on to "Sheet 02". The table shows the indicators for calculating profit and the amount of calculated tax.

Fig. 22 Declaration form in 1C:UH

By right-clicking on a cell and selecting "Decrypt", the user can get the details of the specified cell. For example, the detail of cell 060 is “Profit (Loss)”.

Fig. 23 Detail of the “Profit (loss)” cell in the report

How to take advantage of net profit?

Having completed the year, the company can decide to distribute profits. Options for this procedure are varied, for example:

- reduction in the amount of losses of previous periods (Kt 84);

- transfer of dividends (Kt 75);

- staff bonuses or material payments (Kt 70);

- replenishment of the Criminal Code (Kt 80);

- formation of various types of funds (Kt 82).

For options for using the state of emergency, see the material Expenses not taken into account for tax purposes in accordance with Art. 270 Tax Code of the Russian Federation.

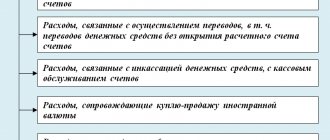

The procedure and directions for spending profits

Profits are distributed by each organization independently.

First of all, taxes on profits and certain types of income are paid - in accordance with the instructions of the State Tax Service of the Russian Federation “On the procedure for calculating and paying to the budget the income tax of enterprises and organizations” [169, 103].

Then the net profit of the construction organization is determined as the difference between the balance sheet profit and the income tax paid to the budget (formula 4.14).

Net profit is distributed by decision of the owner (considered and approved by the general meeting of owners) taking into account the needs of the workforce and the chosen strategy of the organization. Typically, the main directions for spending net profit are stipulated in the organization’s charter - the formation of a reserve fund, a financial risk fund, funds for material incentives, scientific and technical development, etc.;

Using net profit, organizations can finance the following expenses:

1) costs of financing scientific and technical activities, development, design and technological work, as well as work on the creation and development of new technological processes and types of products;

2) capital costs to improve product quality, improve technology and organize production;

3) costs of implementing measures for cooperation, specialization, saving material resources, creating new types of raw materials and supplies;

4) costs of financing the construction of new facilities, expansion, technical re-equipment, reconstruction of existing production;

5) costs of financing the increase in own working capital, as well as compensation for their deficiency;

6) payment of interest on long-term bank loans, as well as on overdue and deferred short-term loans and loans received to fill the shortage of own working capital

funds;

7) expenses for repayment of long-term bank loans provided to the enterprise;

expenses associated with the issue and distribution of shares, bonds and other securities;

9) costs of participation in the construction, reconstruction, repair and maintenance of local roads;

10) payment of all types of taxes, which, according to current legislation, are carried out at the expense of the profits remaining at the disposal of the enterprise;

11) contributions to the creation of united investment funds, as well as to the creation of joint ventures, joint-stock companies, associations;

12) costs of training and advanced training of personnel, including partial reimbursement of costs for training young

specialists;

13) capital costs for the implementation of environmental measures;

14) contributions for the maintenance of the management apparatus of intersectoral state associations, associations, concerns, as well as other non-departmental management structures;

15) expenses for voluntary insurance of the enterprise’s property;

16) expenses for the maintenance of buildings and structures (including depreciation charges and costs for all types of repairs) intended for cultural, educational, sports and recreational work among employees of the enterprise and members of their families;

17) expenses for the maintenance of premises and equipment provided to vocational schools, craftsmen’s schools and other institutions, trade unions and other public organizations, as well as clinics and hospitals serving enterprise employees;

18) expenses for the maintenance of preschool institutions, pioneer camps, labor and recreation camps for senior classes (including depreciation charges and costs for all types of repairs);

19) costs of financing the construction of housing and other non-production facilities;

20) expenses for the maintenance of higher, secondary educational institutions, vocational schools, which are on the balance sheet of the enterprise;

21) costs of providing assistance to schools, homes for the disabled and elderly, agriculture and others;

22) expenses for compensation of losses of housing and communal services included in the balance sheet of enterprises;

23) expenses to compensate for the difference in prices for fuel and purchased electricity sold to employees of the enterprise;

24) costs of organizing and developing subsidiary agriculture of the enterprise;

25) expenses for compensation of losses of dispensaries, sanatoriums, rest homes and other health organizations that are on the balance sheet of the enterprise;

26) expenses for providing benefits to workers and employees in terms of payment for their travel to their place of work by public transport, commuter trains, departmental buses and cars;

27) costs of maintaining editorial offices of mass media (newspapers, radio newspapers, other types of media) that are on the balance sheet of an enterprise for which this activity is not the main one;

28) costs of carrying out recreational activities, including

including the purchase of medicines for medical institutions that are on the balance sheet of the enterprise, vacation vouchers, as well as cultural, educational and physical training events;

29) expenses for the improvement of collective gardens, for providing gratuitous material assistance to employees for the down payment on cooperative housing construction, for partial repayment of loans provided for cooperative and individual housing construction; providing young families with free loans to improve housing conditions, start a household and other social needs;

30) costs of additional depreciation for full restoration to book value in the event of write-off of fixed assets before the expiration of their useful life (standard service life);

31) expenses for payment of penalties and compensation for damage in the following cases:

— non-compliance with requirements for environmental protection from pollution and other external influences, use of natural resources in excess of established limits, non-compliance with sanitary standards and rules;

— receiving unjustified profits due to inflated prices for products (works, services);

— concealment (understatement) of profit or other objects of taxation;

- other types of penalties that, in accordance with current legislation, are subject to inclusion in the budget;

32) payment of dividends (to JSC);

33) other expenses.

Profits are distributed by each organization independently.

First of all, taxes on profits and certain types of income are paid - in accordance with the instructions of the State Tax Service of the Russian Federation “On the procedure for calculating and paying to the budget the income tax of enterprises and organizations” [169, 103].

Then the net profit of the construction organization is determined as the difference between the balance sheet profit and the income tax paid to the budget (formula 4.14).

Net profit is distributed by decision of the owner (considered and approved by the general meeting of owners) taking into account the needs of the workforce and the chosen strategy of the organization. Typically, the main directions for spending net profit are stipulated in the organization’s charter - the formation of a reserve fund, a financial risk fund, funds for material incentives, scientific and technical development, etc.;

Using net profit, organizations can finance the following expenses:

1) costs of financing scientific and technical activities, development, design and technological work, as well as work on the creation and development of new technological processes and types of products;

2) capital costs to improve product quality, improve technology and organize production;

3) costs of implementing measures for cooperation, specialization, saving material resources, creating new types of raw materials and supplies;

4) costs of financing the construction of new facilities, expansion, technical re-equipment, reconstruction of existing production;

5) costs of financing the increase in own working capital, as well as compensation for their deficiency;

6) payment of interest on long-term bank loans, as well as on overdue and deferred short-term loans and loans received to fill the shortage of own working capital

funds;

7) expenses for repayment of long-term bank loans provided to the enterprise;

expenses associated with the issue and distribution of shares, bonds and other securities;

9) costs of participation in the construction, reconstruction, repair and maintenance of local roads;

10) payment of all types of taxes, which, according to current legislation, are carried out at the expense of the profits remaining at the disposal of the enterprise;

11) contributions to the creation of united investment funds, as well as to the creation of joint ventures, joint-stock companies, associations;

12) costs of training and advanced training of personnel, including partial reimbursement of costs for training young

specialists;

13) capital costs for the implementation of environmental measures;

14) contributions for the maintenance of the management apparatus of intersectoral state associations, associations, concerns, as well as other non-departmental management structures;

15) expenses for voluntary insurance of the enterprise’s property;

16) expenses for the maintenance of buildings and structures (including depreciation charges and costs for all types of repairs) intended for cultural, educational, sports and recreational work among employees of the enterprise and members of their families;

17) expenses for the maintenance of premises and equipment provided to vocational schools, craftsmen’s schools and other institutions, trade unions and other public organizations, as well as clinics and hospitals serving enterprise employees;

18) expenses for the maintenance of preschool institutions, pioneer camps, labor and recreation camps for senior classes (including depreciation charges and costs for all types of repairs);

19) costs of financing the construction of housing and other non-production facilities;

20) expenses for the maintenance of higher, secondary educational institutions, vocational schools, which are on the balance sheet of the enterprise;

21) costs of providing assistance to schools, homes for the disabled and elderly, agriculture and others;

22) expenses for compensation of losses of housing and communal services included in the balance sheet of enterprises;

23) expenses to compensate for the difference in prices for fuel and purchased electricity sold to employees of the enterprise;

24) costs of organizing and developing subsidiary agriculture of the enterprise;

25) expenses for compensation of losses of dispensaries, sanatoriums, rest homes and other health organizations that are on the balance sheet of the enterprise;

26) expenses for providing benefits to workers and employees in terms of payment for their travel to their place of work by public transport, commuter trains, departmental buses and cars;

27) costs of maintaining editorial offices of mass media (newspapers, radio newspapers, other types of media) that are on the balance sheet of an enterprise for which this activity is not the main one;

28) costs of carrying out recreational activities, including

including the purchase of medicines for medical institutions that are on the balance sheet of the enterprise, vacation vouchers, as well as cultural, educational and physical training events;

29) expenses for the improvement of collective gardens, for providing gratuitous material assistance to employees for the down payment on cooperative housing construction, for partial repayment of loans provided for cooperative and individual housing construction; providing young families with free loans to improve housing conditions, start a household and other social needs;

30) costs of additional depreciation for full restoration to book value in the event of write-off of fixed assets before the expiration of their useful life (standard service life);

31) expenses for payment of penalties and compensation for damage in the following cases:

— non-compliance with requirements for environmental protection from pollution and other external influences, use of natural resources in excess of established limits, non-compliance with sanitary standards and rules;

— receiving unjustified profits due to inflated prices for products (works, services);

— concealment (understatement) of profit or other objects of taxation;

- other types of penalties that, in accordance with current legislation, are subject to inclusion in the budget;

32) payment of dividends (to JSC);

33) other expenses.

Distribution directions

The directions for distribution of net profit can be mandatory and voluntary (i.e., by decision of the founders).

Mandatory contributions are made only by joint stock companies. Using net profit, they must create a reserve fund (capital). Every year, at least 5 percent of net profit must be allocated to the reserve fund (capital). Contributions may be terminated when the reserve fund (capital) reaches the amount provided for by the charter of the joint-stock company. The minimum size of the reserve fund (capital) is 5 percent of the authorized capital. This is stated in paragraph 1 of Article 35 of the Law of December 26, 1995 No. 208-FZ.

An LLC can also create a reserve fund (capital), but it is not obligated to do so. The size of the reserve fund (capital) and the procedure for its formation are determined by the company independently. This follows from Article 30 of the Law of February 8, 1998 No. 14-FZ.

By decision of the founders, the organization can direct its net profit:

– for the payment of dividends;

– to increase the authorized capital.