Payment order for the transfer of VAT by the taxpayer - 2022 - 2022

Before we talk about filling out the payment form, let us remind you of the deadlines for paying VAT.

In 2021-2022, taxpayers pay tax in three equal payments no later than the 25th day of each of the 3 months following the quarter for which the tax was assessed (clause 1 of Article 174 of the Tax Code of the Russian Federation). If the 25th is a weekend or holiday, the payment deadline is shifted to the first working day following it (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). By the way, you can pay the entire amount ahead of schedule (Clause 1, Article 45 of the Tax Code of the Russian Federation).

See also “In what cases is it possible to pay VAT in 1/3 (shares)?” .

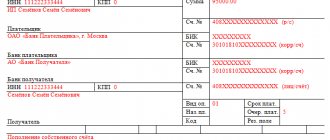

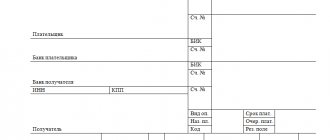

Let us dwell in detail on those details that are directly related to VAT. So, in the payment order you need to indicate:

- Payer status (field 101). When paying tax by a taxpayer - a legal entity, we enter 01, by a taxpayer - an individual entrepreneur - from 10/01/2021 we indicate 13 (code 09 for individual entrepreneurs is not used from this date).

- Your details and the recipient's. In this case, this is the Federal Tax Service, with which you are registered (clause 2 of Article 174 of the Tax Code of the Russian Federation).

See also “Where to pay VAT and how and where to find the correct details for payment?”.

- Type of operation (field 18). This is payment order code 01.

- Payment order (field 21). For self-pay taxes it is 5.

- Universal payment identifier (field 22). We set it to 0, because it is not set for current tax payments.

Read this article about filling out this field.

- Field 105 "OKTMO". We indicate your OKTMO.

The article “OKTMO in a payment order (nuances)” is devoted to filling out the OKTMO field.

- KBK. In 2021-2022 it is as follows: 182 1 0300 110.

For more information about the BCC for VAT penalties, see the article “KBK for paying VAT penalties for 2022 - 2022.”

- Basis of payment. We set TP, i.e. payments for the current year.

How to fill out the “Base of payment” field, read this article.

- Taxable period. You must indicate the quarter for which VAT is paid. For example, for the tax for the 4th quarter of 2022 we set: KV.04.2021.

This article is devoted to filling out field 107 “Tax period”.

- In field 108 “Document number” we put 0, and in field 109 “Document date” - the date of signing the declaration in which the tax was calculated.

Read about field 109 here.

- Field 110 is not filled in.

- The purpose of payment can include the standard phrase: “1/3 VAT, for the 4th quarter of 2022 (due for payment on January 25, 2022).”

In 2022, changes were made to the details of the payment order for the payment of taxes. From 05/01/2021, be sure to fill out field 15: the number of the bank account that is part of the ESC. In addition, the Treasury account and the name of the bank have changed. The period from 01/01/2021 to 04/30/2021 was transitional, i.e. the payment was correctly credited to your personal account even if you issued a payment using the old details. As of 05/01/2021, banks no longer accept old payments. We have provided the details here. And from October 1, 2021, fields 106, 108 and 109 will be filled out in a new way when repaying debts for previous periods.

ConsultantPlus experts provided detailed explanations on filling out all payment details for VAT transfer. Get trial online access to K+ for free and go to the Ready-made solution.

A completed sample VAT payment form can be downloaded from our website, following the link below.

Rules for making VAT payments

The document in which VAT is calculated is the declaration. It is compiled (if we are not talking about taxes arising on imports from EAEU member states) quarterly, covering data for a period equal to the quarter just ended.

Since VAT is a tax that is subject to deductions, a situation may arise where the amount of deductions exceeds the tax on transactions requiring tax to be paid. This situation is quite common for exporters. For other payers, as a result of the calculations made in the declaration, tax, as a rule, turns out to be accrued for payment.

Since VAT is one of the transfers that forms the bulk of tax revenues to the budget (its amount for the taxpayer can be quite a significant amount), a special payment procedure has been established for this tax.

It is allowed to transfer it not at once, but by dividing the accrued amount into 3 parts, paid monthly during the quarter occurring after the period in respect of which the accruals were made (clause 1 of Article 174 of the Tax Code of the Russian Federation).

The payment deadline in each month of the payment quarter expires on the same day - the 25th. But it may be shifted to a later date if it falls on a weekend (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Taking into account these rules, the deadlines for paying VAT 2022 are presented in the table:

| Period | payment date |

| 4th quarter 2022 | 27.01.2020 |

| 25.02.2020 | |

| 25.03.2020 | |

| 1st quarter 2022 | 27.04.2020 |

| 25.05.2020 | |

| 25.06.2020 | |

| 2nd quarter 2022 | 27.07.2020 |

| 25.08.2020 | |

| 25.09.2020 | |

| 3rd quarter 2022 | 26.10.2020 |

| 25.11.2020 | |

| 25.12.2020 | |

| 4th quarter 2022 | 25.01.2021 |

| 25.02.2021 | |

| 25.03.2021 |

If it is convenient for the taxpayer to make a one-time payment, he can make such a transfer, but only in the first of the months of the quarter allotted for payment, in compliance with the deadline established for payment.

What's special about the tax agent's VAT payment?

The tax agent's payment order actually differs from the taxpayer's payment order only in the status of the payer (in field 101 the agent puts code 02) and the purpose of the payment (you need to make a note that “agency” VAT is paid).

To avoid mistakes, get a free trial access to ConsultantPlus and proceed to the Ready-made solution for preparing a VAT payment by a tax agent. You will also find a completed sample there.

Payment order for VAT penalties - 2021-2022

If you have calculated and paid the penalties yourself, in the payment order for VAT penalties for 2021-2022, unlike the tax payment, you need to indicate:

- BCC for VAT penalties 182 1 03 010 0001 2100 110.

- The basis of payment is ZD, that is, voluntary repayment of debt.

- And of course, in the purpose of payment it is necessary to explain that this is a penalty.

“How to correctly calculate VAT penalties?” will help you .

If payment is made on the basis of a request, then indicate:

- UIP in field 22. We take it from the requirement, and if it is not assigned, set it to 0.

- Basis of payment - from 10/01/2021 also ZD.

- In field 107 - the payment deadline set in the request in the format DD.MM.YYYY (for example, 11/19/2021).

- In field 108 - the claim number without the sign No. and indicating that this is a payment on demand - “TR0000000000000”.

- In field 109 - the date of the request.

Check whether you have filled out the payment form for VAT penalties correctly. To do this, get a free trial access to K+ and proceed to the expert recommendations and completed sample.

News

When paying for products or services, in the payment order in the “Payment Purposes” section, you must indicate value added tax (VAT) or a link to the fact that this tax is not paid. For example: “Payment under invoice No. 5 dated May 12, 2017, including VAT 18000-00” or “Payment under invoice No. 1 dated May 12, 2017, not subject to VAT.” In this case, information about VAT must be recorded on a separate line. This execution of the document is based on clause 4 of Art. 168 of the Tax Code of the Russian Federation, which states that “in settlement documents, including registers of checks and registers for receiving funds from a letter of credit, primary accounting documents and invoices, the corresponding amount of tax is allocated as a separate line.” The “Regulations on non-cash payments in the Russian Federation” of the Bank of Russia No. 2-P dated October 3, 2002, as well as from July 9, 2012 in the “Regulations on the rules for the transfer of funds” No. 383-Pot 06/19/2012 says this : “a payment order, collection order, payment request shall indicate the purpose of payment, the name of goods, works, services, numbers and dates of contracts, commodity documents, and may also indicate other necessary information, including in accordance with the law, including value added tax price".

Now let’s consider what consequences may arise for organizations that neglect this requirement and indicate incorrect VAT information in the payment order. Firstly, it is necessary to take into account the remaining documents on the transaction, for example, an agreement in which there is a mention that the transaction price contains VAT, there is an invoice and a signed invoice, where the amount of VAT is also highlighted. In such a situation, if VAT is not highlighted only in the payment document, you don’t have to worry too much; there are unlikely to be any claims. But if in the contract, due to, for example, a typo, the price does not contain VAT, then, firstly, there will be a basis for charging VAT on top of the price paid, which will increase the tax amount, and secondly, for the payer there will be a basis for additional payment of VAT, there were such court precedents. In such a situation, it is necessary to make an additional agreement to the contract and ask the counterparty who indicated incorrect information in the payment order to write a letter clarifying the purpose of the payment.

Thus, the payment order must be filled out strictly in accordance with the documents received from the supplier. The basis for the entry must be an invoice issued by the seller of the goods or service provider (this is the main document).

Head of the column: Svetlana PENTEGOVA, professional tax consultant, practicing accountant

If the tax is transferred by a defaulter

As is known, persons who are not VAT payers, for example, “simplified people”, in the case of issuing an invoice with the tax allocated in it, are obliged to pay it to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). When making a payment, these persons may be asked what payer status to indicate in field 101.

There is no special code specifically for this situation in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, which determines the procedure for filling out this detail. In this regard, we believe that it is possible to set status 01, corresponding to the category “taxpayer-legal entity” or status 13 if VAT is paid by an individual entrepreneur. The remaining details must also be filled out according to the rules established for VAT taxpayers.

NOTE! These persons do not have the right to pay tax in installments (clause 4 of Article 174 of the Tax Code of the Russian Federation).

If VAT is transferred for a third party

The procedure for filling out a payment order in case of payment for another person is described in the information of the Federal Tax Service of Russia “On tax payments transferred by another person.” When paying VAT for another person in the field:

- 101 “Payer status” indicates the status of the person for whom the tax is transferred.

- 60 “TIN of the payer”, 102 “KPP of the payer” indicates the TIN and KPP of the payer for whom the tax is transferred.

The payer's details indicate the details of the person who fills out the payment order for the transfer of tax to the budget.

The recipient's details indicate the details of the tax authority - the recipient of the VAT.

Fields 22, 104–109 are filled in with data provided by the person whose tax obligation is being fulfilled.

In the “Purpose of payment” field, you need to indicate your INN, KPP, then through the “//” sign the name of the organization for which you are transferring the tax, and through the “//” sign the purpose of payment.

A payment order to pay tax for a third party can be sent to ConsultantPlus. If you do not have access to the K+ system, sign up for a trial demo access. It's free.

Payment of VAT to the budget

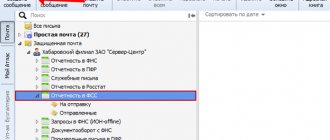

After paying VAT to the budget, based on the bank statement, you need to create a document Write-off from current account transaction type Tax payment . A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order .

Or it can be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service .

It is necessary to pay attention to filling out the fields in the document:

- from – date of tax payment, according to the bank statement;

- In. number and input date – number and date of the payment order;

- Tax - VAT , selected from the Taxes and Contributions directory and affects the automatic completion of the Debit Account ;

- Type of liability – Tax .

- Reflection in accounting : Debit account - 68.02 “Value added tax”;

- Types of payments to the budget - Tax (contributions): accrued / paid .

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt - debt to the budget for VAT decreased by the amount of payment.