Why do inspectors need information about the average number of employees?

Submitting information on the average number of employees to the Federal Tax Service is required by clause 3 of Art.

80 Tax Code of the Russian Federation. Why is this information necessary for tax authorities? First of all, this indicator directly determines how you will submit your tax reports.

If last year's number of employees exceeds 100 people (and in some cases 10 or 25 employees), the only acceptable way to submit declarations is electronically, according to TKS through an EDI (electronic document management) operator. For failure to comply with this requirement of Art. 119.1 of the Tax Code of the Russian Federation provides for a fine of 200 rubles.

Taxpayers with 100 employees or fewer can choose between electronic and paper filing.

An exception is the submission of VAT reports. As a general rule, it should be electronic for any size of staff, but there are nuances in terms of its practical implementation.

In addition, the number affects the right to apply special tax regimes. For example, for simplifications of 6% and 15%, the average number cannot exceed 100 people, and for PSN - 15 people.

There is also a new simplified system with rates of 8% and 20%. In relation to it, the maximum indicators for the average number are set differently.

Questions and answers

Question No. 1. Our current account has been blocked. Can they do this because we have not submitted the KND form 1110018?

Answer: No, failure to provide KND form 1110018 is not grounds for seizure of a current account.

Question No. 2. In the period from June to August, the number of employees in our organization exceeded 100 people. Could this somehow affect the change in the tax regime?

Answer: If the average headcount for a calendar year exceeds 100 people, this will be a reason to change the tax regime. Otherwise, you retain the right to apply special tax regimes.

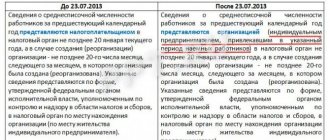

Who is required to submit a certificate of average number of employees?

The obligation to submit information on the average headcount applies to both organizations and individual entrepreneurs. Moreover, this responsibility is not removed from the entrepreneur upon closure.

Meanwhile, there is a certain relaxation for individual entrepreneurs: they must provide information on their headcount only if they used hired labor in the past year. This is directly stated in paragraph 3 of Art. 80 Tax Code of the Russian Federation. That is, an individual entrepreneur who did not have employees does not provide information on the average number of employees, just like the ERSV, in 2021. Companies provide information regardless of the presence or absence of employees (letter of the Ministry of Finance dated 02/04/2014 No. 03-02-07/1/4390).

As we already said in the announcement, a separate report with information on the average salary, which was previously submitted before January 20, no longer needs to be submitted. By order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] it was cancelled.

Starting with reporting for 2022, information on the average composition of employees is included in the calculation of insurance premiums (ERSV). This indicator must be recorded on the cover page of the calculation. The corresponding changes were approved by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

The ERSV form, edited by Order No. ED-7-11/ [email protected] , becomes invalid starting with reporting for the 1st quarter of 2022. The provisions of the order of the Federal Tax Service of Russia dated October 6, 2021 No. ED-7-11 / [email protected] approved a new form of the DAM, to be used from the specified period.

You can learn more about the relevant innovation by receiving free trial access to the news feed for an accountant in the ConsultantPlus system. ConsultantPlus experts also explained the procedure for filling out the ERSV for 2022. Study the material for free by getting trial demo access to the K+ system.

What is the deadline for submitting information?

The deadline for submission for existing companies and individual entrepreneurs coincides with the date of filing the ERSV: January 30, 2022 for reporting for 2022. But the ERSV for 2022 can actually be submitted later: before 01/31/2022, since 01/30/2022 is a Sunday.

Let us remind you! If any of the specified deadlines fall on weekends or holidays, they are generally transferred to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

If the company was created within a year, it must submit information along with the first report in the ERSV form. If it is reorganized, then with the latter.

An example of calculating the number of employees for individual entrepreneurs

The indicator is calculated in two stages:

- For each calendar month.

- For the year as a whole.

Using an individual entrepreneur as an example, the calculation looks like this:

In January 2022, the individual entrepreneur had 6 employees. 4 of them worked 20 working days in accordance with the standard. One employee was on vacation and only worked 12 days, and one employee was sick and only worked 3 days.

The average number of individual entrepreneur employees for January 2021 is:

(4 × 20) + (1 × 12) + (1 × 3) = 95 / 22 = 4,31.

The result obtained for each month is not rounded.

To determine the annual indicator, it is necessary to sum up the average for each month and divide by 12. The final total is rounded to a whole number according to the usual rule: values less than 0.5 are discarded, values of 0.5 or more are taken as one.

Example:

4.31 + 5 + 4.35 + 5.2 + 4.13 + 4.0 + 5.0 + 6.0 + 4.25 + 4.45 + 5.2 + 3.8 = 55.69 / 12 = 4.64 = 5 people.

Thus, our entrepreneur has an average annual headcount of 5 employees. This is the information for 2021 that should be included in the report.

How to calculate the average headcount

The rules for calculating the number of people from January 15, 2021 govern the instructions from Rosstat order No. 412 dated July 24, 2020.

In general, the calculation formula looks like this:

Average year = (Average 1 + Average 2 + … + Average 12) / 12,

where: Average year is the average headcount for the year;

Average number 1, 2, etc. - the average number for the corresponding months of the year (January, February, ..., December).

Read more about the calculation procedure in the article “How to calculate the average number of employees.”

The information is certified by the signature of the entrepreneur or the head of the company, but can also be signed by a representative of the taxpayer. In the latter case, it is necessary to indicate a document confirming the authority of the representative (for example, it may be a power of attorney), and a copy of it must be submitted along with the ERSV.

NOTE! The power of attorney of the individual entrepreneur must be notarized. Either be a document equivalent to a notarized power of attorney under civil law, or an electronic power of attorney signed with an electronic signature (Article 29 of the Tax Code of the Russian Federation).

ConsultantPlus experts spoke in detail about issuing a power of attorney for an individual entrepreneur. Get a free trial of material on this topic.

Why and when to give up

Inexperienced businessmen have a question: where to send the average number of individual entrepreneur employees, to which department? The answer is simple: this data is necessary for the tax service to properly organize control over a business entity and determine its status. Consequently, the recipient of this reporting form is the Federal Tax Service. Information is submitted based on the results of the year until January 20, 2020.

However, newly registered entrepreneurs must perform this duty differently: the form must be submitted by the 20th day of the month following the one in which registration as an individual entrepreneur took place.

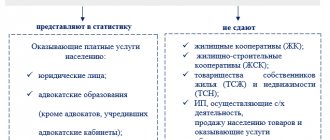

How and where to submit information

The completed ERSV form can be submitted in person or through a representative to the Federal Tax Service, or sent by mail with a list of attachments, provided that the average number of employees of the company does not exceed 10 people. If this indicator is higher, the report will be accepted only in electronic format.

The form is submitted to the inspectorate at the place of registration of the company or at the place of residence of the individual entrepreneur. Organizations with separate divisions report the number of all employees at the place of registration of the head office.

You can find out about the current deadlines for submitting the ERSV in a special material.

Filling rules

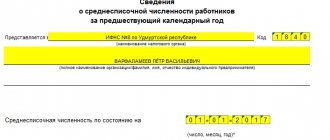

The rules for filling out the form are contained in Letter No. CHD-6-25 of the Federal Tax Service of the Russian Federation dated April 26, 2007. According to the Letter, all information in the form is entered by the taxpayer himself, except for the section “To be filled out by a tax authority employee.”

So, the following sections must be completed:

- information about the taxpayer himself (TIN, KPP, full name - for organizations; TIN and full name of the entrepreneur - for individual entrepreneurs);

- name of the tax authority and its code;

- the date on which the average number of employees was determined;

- information on the number and wages of employees;

- personal signature and seal of the head of the company.

The tax inspector also enters information into the form received from the taxpayer. It records: the date of receipt of the completed document; report number; your personal data: Full name and signature.

Will they be punished for failure to submit ERSV with information on the number of employees?

Of course they will be punished. For each case of failure to submit or delay in submitting a report in the ERSV form with information on the average number of employees, the taxpayer will be fined at least 1,000 rubles. If the contributions specified in the declaration are also not paid, the taxpayer will face a fine of 5% of the amount of arrears for each month of delay, but not less than 1,000 rubles. and no more than 30%.

Read more about possible sanctions in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Keep in mind that if you fail to submit the ERSV for more than 20 days, inspectors will block your account. For more information about sanctions for late submissions to the ERSV, see here.

Read more about blocking and unblocking accounts here.

Responsibility for violations

Current legislation provides for administrative liability for violation of reporting deadlines or for failure to provide a report.

Based on paragraph 1 of Art. 126 of the Tax Code of the Russian Federation and Part 1 of Art. 15.6 of the Code of Administrative Offenses of the Russian Federation, the employer faces penalties for failure to submit information. In case of such a violation, the organization will pay a fine of 200 rubles, and the official - from 300 to 500 rubles. In addition, according to Part 1 of Art. 119 of the Tax Code of the Russian Federation, for late submission of the DAM you will have to pay from 5% to 30% of the unpaid contributions, but not less than 1000 rubles.

Results

All organizations and individual entrepreneurs are required to submit information on the average number of employees to the Federal Tax Service. Starting from reporting for 2020, this information is submitted as part of the calculation of insurance premiums. A separate calculation for the average number of employees has been cancelled. The deadline for submitting the ERSV is no later than January 30 of the year following the reporting year. Moreover, if the document submission date falls on a weekend, the deadline is postponed to the next following working date.

Sources:

- Tax Code of the Russian Federation

- Code of Administrative Offenses

- Order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

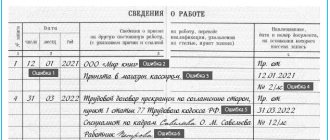

External part-time and part-time workers

There is a category of employees who are considered internal part-time workers. That is, they receive one and a half or two rates within their organization. But according to accounting, such an employee must be registered as one whole unit. The situation is different for external part-time workers. When calculating the average number of employees, they are not taken into account. Simply because they are registered at their main place of work.

The situation is a little more complicated with part-time employees. Here, accounting is proportional to the time worked. Don't forget that we should end up with rounded whole work units. Let's say the company has two employees working part-time, 4 hours a day, a full work week. The calculation here is simple: together they will give one working unit with a full day of employment.

If an employee is required by law to work less than full time, then he is counted as fully employed. This category of workers, according to clause 79.3 of the Rosstat Instructions, includes:

- workers under 18 years of age;

- workers engaged in work with harmful and dangerous working conditions;

- women who are given additional breaks from work to feed their children;

- women working in rural areas;

- women working in the Far North and equivalent areas;

- workers who are disabled people of groups I and II.

When the number of hours worked is different, the average number of part-time employees is calculated as follows. The total number of man-hours worked by this category of employees per month is divided by the length of the working day. We divide the resulting quotient again by the number of working days in a given month.

If the initial duration of the working day is not given, we calculate it based on data on the duration of the working week. Let's say the workweek contains forty hours, then the workday will last eight hours (40 / 5).