VAT rate 10%

A rate of 10% may apply if each of the following two conditions is met.

Condition 1. The product must be included in a special list in accordance with paragraphs. 1 item 2 art. 164 Tax Code of the Russian Federation. This list includes basic foods necessary for a healthy diet, but does not include delicacies. For example, the list includes vegetables, milk and products made from it, meat and products from it, except for tenderloin, tongue, sausages, smoked meats and canned food.

The composition of the list changes frequently, inclusions and exclusions occur, and changes must be constantly monitored. For example, from October 2022 it included berries and fruits, including watermelons.

To apply a 10% rate, the product code must be present in any of the following lists:

- All-Russian Product Classifier (OKPD2) for domestic goods, in accordance with Government Decree No. 908 dated December 31, 2004 “On approval of lists of codes for types of food products and goods for children subject to value added tax at a tax rate of 10 percent”;

- Commodity nomenclature of foreign economic activity (TN FEA) - for imports, in accordance with letter of the Ministry of Finance of Russia dated July 4, 2012 No. 03-07-08/167.

If the product code is not in any of these lists, the seller has the right to apply only a tax rate of 20% when calculating VAT.

Condition 2. The taxpayer must himself confirm his right to a 10% rate. This requires any document certifying the compliance of the food product with technical regulations, according to the letter of the Federal Tax Service of the Russian Federation dated December 7, 2011 No. ED-3-3 / [email protected] and the resolution of the Federal Antimonopoly Service of the North-Western District dated February 1, 2012 No. A56-29589/2011) .

Such documents include:

- certificate of conformity;

- declaration of conformity.

Unfortunately, there is judicial practice not in favor of taxpayers who are trying to document the 10% VAT rate (Resolutions of the Federal Antimonopoly Service of the North-Western District dated 02.28.2014 No. A56-9963/2013, FAS Moscow District dated 03.13.2008 No. KA-A40/1415 -08).

In accordance with the order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] , the tax base and tax calculated at the VAT rate of 10% are reflected in line 020 (columns 3 and 5) of the VAT return.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Calculator

+ Accrue

— Select

| Price without VAT: | 0 ₽ |

| VAT 10%: | 0 ₽ |

| Value with VAT: | 0 ₽ |

VAT amount in words:

A similar VAT calculator is 20 percent on our website.

The reduced rate is necessary to ensure financially free access to goods that are socially significant. In the case of children's supplies, this rule is aimed at creating more favorable purchasing conditions for parents and special child care institutions.

In what other cases is VAT 10 percent?

There is an additional product group that is subject to a reduced tax rate. In particular, it includes medical goods and supplies, consumables, furniture and other medical products for use in specialized medical institutions or for treatment at home.

This rule also applies to printed products. Periodicals, books, magazines, etc. Exceptions include books, magazines, and newspapers containing information of an advertising or erotic nature.

A ten percent tax applies to domestic air transportation services. When providing medical and a number of other paid services of high social significance. A complete list of products and services can be clarified by contacting the Federal Tax Service office or on their website in electronic format.

Confirmation of eligibility for a 10% rate

In order to obtain the right to work at a minimum percentage of added value, you will need to provide the Federal Tax Service with appropriate documentation confirming the company’s activities in the chosen field and containing information about the services provided or product groups sold. To do this, it is necessary to clarify the classification codes from the unified register of economic activities corresponding to the products sold by the company.

Next, these codes are entered into documents submitted to the tax office; if they fall under the rule of the minimum level of taxation, the manufacturer or seller receives the appropriate permission and further calculations are made with a 10% VAT charge. If the documents are provided after sales, then the calculation will be made based on the maximum amount of accruals - 20%, since there is no possibility of checking the sold batch of products. Be careful when preparing documents; it is advisable to double-check the data and entered codes.

Reporting must be submitted strictly before starting commercial activities. This will avoid significant unexpected expenses. We recommend contacting the Federal Tax Service department for additional advice from relevant specialists.

VAT rate 0%

Zero VAT rate according to clause 1. Art. 164 of the Tax Code of the Russian Federation applies to the sale of food products outside the Russian Federation. The taxpayer must independently justify the application of this rate and, within 180 days from the date of customs clearance, provide the following documents:

- copies of customs declarations or their registers, including electronic ones, in accordance with paragraph 15 of Art. 165 Tax Code of the Russian Federation, clause 10 art. 1 of the Law of December 29, 2014 No. 452-FZ “On amendments to Art. 165 Tax Code of the Russian Federation";

- copies of shipping/transport documents or their registers, including electronic ones;

- copies of agreements with counterparties.

When applying a zero rate, the taxpayer fills out section 4 of the VAT return. If he was unable to collect the above package of documents on time, he is only entitled to apply a VAT tax rate of 20% or (if the relevant conditions described above are met) - 10%. In such cases, section 6 is filled out in the VAT return.

Transition from UTII to OSNO

For persons who have switched from UTII to OSNO, a deduction of input VAT if goods, work, services, property rights were acquired during the period of application of UTII or imported into the territory of the Russian Federation, but were not actually used before the transition to OSNO.

OSNO is still a complex and tax-expensive system. For small businesses, it is most likely more profitable to be simplified. We have prepared two useful materials - a digest on how to deal with payments and obligations during the transition period, as well as a checklist for changing UTII to simplified tax system.

Exemption from calculation and payment of VAT on food products

Companies and individual entrepreneurs are exempt from VAT in any of two cases:

- In accordance with paragraph 5. paragraph 2. Art. 149 of the Tax Code of the Russian Federation - if they produced or sold products in the canteens of educational or medical institutions. And yet, then the taxpayer is also obliged to independently justify the exemption from the calculation and payment of VAT. To do this, in accordance with the letter of the Ministry of Finance of the Russian Federation dated December 3, 2014 No. 03-07-15/61906, he must provide licenses for the provision of medical or educational services.

- If the taxpayer is in a special regime and is exempt from working with VAT. In accordance with paragraph 2 of Art. 346.11 of the Tax Code of the Russian Federation, a taxpayer using the simplified tax system is exempt from paying VAT in all cases, except for the following: products are imported into the territory of the Russian Federation or such taxpayer is a tax agent. Individual entrepreneurs on a patent are also exempt from paying VAT, unless they conduct activities that are not covered by the PSN, do not import products into the territory of the Russian Federation and do not carry out transactions taxed under Art. 174.1 Tax Code of the Russian Federation.

The cost of food products exempt from VAT is reflected under code 1010232 in section 7 of the VAT tax return.

Keep VAT records in the Kontur.Accounting web service: there is a built-in system for checking VAT calculations. The service will tell you which documents need to be added and which transactions to check in order to reduce the amount of VAT and avoid fines. In Accounting - simple accounting, payroll, reporting, integration with banks and cash desks. The first two weeks are free for all newbies.

Benefit for IT companies

The VAT benefit provided for in paragraphs will be applied in a new way. 26 clause 2 art. 149 of the Tax Code of the Russian Federation. Starting from the new year, transactions for the sale of exclusive rights to computer programs and databases included in the unified register, as well as the transfer of rights to use these programs and databases, will not be taxed.

The exemption does not apply to the transfer of rights to use computer programs and databases if these rights consist of obtaining the ability to:

- distribute or access advertising on the Internet;

- post offers on the Internet for the purchase or sale of goods, works, services and property rights;

- search for information about potential buyers and sellers or enter into transactions.

That is, now it will not matter under what contract the computer programs were purchased: licensed or not. This means that the purchase of computer programs from foreign organizations will always be subject to VAT .

Because the benefits raised a lot of questions among industry representatives, and the Federal Tax Service had to issue official clarifications.

Read explanations of IT benefits from January 1, 2022

Only developers whose revenue from software production is more than 90% can take advantage of the benefits. Do not forget that the company must also be included in the register of domestic software.

Refund of customs VAT when exporting goods

Participants in foreign trade activities have the right to deduct VAT paid by them when importing goods into the Russian Federation only if the exporter is a VAT payer. If the goods are intended for transactions that are subject to VAT, and they are accepted for accounting. A deduction can be made if the goods are intended for operations that are subject to VAT. To confirm your right to a tax deduction, the following documents may be required:

- foreign trade contract with a foreign supplier;

- invoice for payment from the supplier (invoice) invoice;

- customs declaration (copy);

- payment order, bank statements, certified duplicates of payment orders.

The listed documents must be stored for four years.

If an organization is not a VAT payer, then, according to the law, it will not be able to receive a deduction. These are organizations that have chosen tax regimes: simplified taxation system (USNO), unified tax on imputed income (UTI), unified agricultural tax (UST).

Customs VAT rates

Customs duty and VAT rates differ. Customs VAT rates apply to broader product categories and are regulated by the tax legislation of the Russian Federation (Article 164 of the Tax Code of the Russian Federation). Customs VAT rates for the year can take three values: 0%

— tax exemption,

10%

— preferential taxation,

20%

— full taxation.

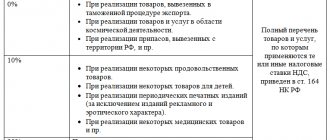

| VAT rate | Application |

| There are goods the import of which into Russia is exempt from tax, for which VAT will be 0 percent. Before calculating VAT, you need to find out whether this product is eligible for tax exemption and clarify under which customs procedure the product is placed (Article 150, 164 of the Tax Code of the Russian Federation, Government Decree No. 1042 (as amended on March 20, 2018) On approval of the list of medical goods )). To be exempt from this tax, you must provide documents confirming the intended purpose. | |

| 0% | consumables used for scientific research not produced in the Russian Federation;

When placing goods under customs procedures (Article 151 of the Tax Code of the Russian Federation): |

| In some cases, according to Article 164 of the Tax Code of the Russian Federation, the VAT rate will be 10% | |

| 10% | 1) Food products:

2) Products for children:

3) Periodicals, with the exception of periodicals of an advertising or erotic nature.

|

| 20% | In all other cases (clause 3 of article 164 of the Tax Code of the Russian Federation). |

Services for calculating VAT and customs clearance of goods

Our company “Universal Cargo Solutions” provides services for clearance of goods at any customs office of the Russian Federation, selection of HS codes, determination of the customs value of goods, calculation of customs duties required for payment, including VAT. If necessary, we have the ability to promptly pay customs duties for the client and carry out prompt customs clearance or customs clearance of goods at customs, which significantly reduces time and costs.

We are confident that we will become your reliable partner at customs!

Find out customs VAT or order a service