Tax agents are required to calculate, withhold from the taxpayer and pay the amount of personal income tax to the budget.

There are some exceptions to this rule. For example, when selling property and property rights, tax is paid by individuals themselves. Peculiarities of tax withholding for transactions with securities are provided for in separate articles of the Tax Code of the Russian Federation.

An interview with Sergei Razgulin, Actual State Advisor of the Russian Federation, 3rd class, is devoted to the issues of fulfilling the duties of a tax agent.

What deadlines are established for the tax agent to fulfill its obligations to pay personal income tax?

Since 2016, tax is calculated on the date of actual receipt of income (clause 3 of Article 226 of the Tax Code of the Russian Federation).

Tax is withheld upon actual payment of income in cash (clause 4 of Article 226 of the Tax Code of the Russian Federation).

Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Exceptions to the general rule on the timing of tax remittance are provided for payments of temporary disability benefits and payment of vacations.

When to transfer taxes to the budget

Before amendments were made to Article 226 (6) of the Tax Code of the Russian Federation, there was one general principle for the transfer of personal income tax by tax agents:

- no later than the day of issue when receiving cash at a bank cash desk or transferring it to an individual’s account;

- no later than the next day after the date of actual receipt of income, if they were paid in another way, for example, from cash proceeds.

Difficulties in the question of when to transfer personal income tax from vacation pay were explained by the fact that previously the legislation did not clearly define this point. The fact is that the norms of the Labor Code include vacation pay as part of the employee’s salary. Thus, Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages” determines that payment for vacation is made no later than three days before its start.

However, the fact that vacation pay belongs to the category of employee remuneration does not mean that the deadlines for transferring personal income tax from vacation pay to the Tax Code of the Russian Federation are given in paragraph 2 of Article 223. This provision applies only to the withholding of tax from wages, but not vacation pay. And the deadlines for paying personal income tax on vacation pay in 2022 are indicated separately, in Article 226 of the Tax Code of the Russian Federation.

| Type of income | Personal income tax payment |

| Wage | No later than the day following the payday |

| Income in kind | No later than the next day after the day of payment of income in kind |

| Disability benefits (sick leave) | No later than the last day of the month in which the benefit was paid |

| Vacation pay | No later than the last day of the month in which vacation pay was paid |

Thus, to the question of when to pay personal income tax on vacation pay in 2022, there is a clear answer: no later than the end of the month in which they were paid . The timing of the transfer of personal income tax from vacation pay this year allows the accountant to pay income tax from several employees at once. This is especially true in the summer, when people go on vacation en masse. In addition, personal income tax on sick leave can be paid in one payment order with income tax on vacation pay if they were paid in the same month.

Please note: Article 226 only determines the deadline for paying personal income tax on vacation pay in 2022, i.e. transferring it to the budget. And the calculation and withholding of income tax on vacation pay occurs upon actual payment (Article 226 (4) of the Tax Code of the Russian Federation).

How is the date of receipt of income in the form of salary determined?

According to Article 136 of the Labor Code, wages are paid at least every half month.

From October 3, 2016, the date of payment of wages cannot be established by internal labor regulations, collective agreement or employment contract later than 15 calendar days from the end of the period for which it was accrued (Part 6 of Article 136 of the Labor Code).

Before the end of the month, it is impossible to determine the income received in the form of wages for the month and calculate personal income tax when paying wages for the first half of the month.

Therefore, in accordance with paragraph 2 of Article 223 of the Tax Code of the Russian Federation, when receiving income in the form of wages, the date of actual receipt by the employee of such income is the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement (contract).

Calculation of income tax on wages is made on the last day of the month. It is this date - the last day of each month - that should be reflected in the personal income tax registers as the date of receipt of income in the form of wages.

Taxation of advances

The Labor Code establishes that all employers are required to pay wages at least every 15 calendar days. Therefore, in one month the employee must receive at least two payments: an advance payment and a final payment. In this case, the natural question is: when is personal income tax paid from a salary, and when from an advance payment?

Officials determined that the obligation to pay income tax on the advance portion of wages depends on the date of payment:

- If the advance payment is credited before the last day of the calendar month, then income tax on the advance payment is not paid to the budget.

- If the advance share is transferred on the last calendar day of the month, then income tax from individuals is withheld and paid to the Federal Tax Service in the general manner.

Please note that at the end of the month, all payments transferred in favor of hired specialists must be recognized as income. And income tax must be calculated on income amounts, that is, on both advance and final payment of wages. If the advance is transferred before the last day of the month, then ND from individuals does not need to be withheld from the advance itself. The tax liability will be calculated from the final settlement amount. But if the advance is credited to employees on the last day, then the fiscal payment will have to be withheld from the advance and credited to the budget. And when transferring salary balances, repeat the procedure.

When should a tax agent remit payroll taxes?

The date of receipt of income in the form of wages and the moment of tax withholding may not coincide.

The tax agent withholds and transfers to the budget payroll tax (including for the first half of the month) once a month upon the final calculation of the employee’s income based on the results of each month for which the income was accrued to him.

Since 2016, withheld personal income tax must be transferred no later than the date following the day of payment of income in cash.

This means that when an organization pays wages on the 15th day of the current month for the second half of the previous month, namely when transferring funds from the organization’s current account to the accounts of employees, it is necessary to withhold the calculated tax on the same day and transfer it to the budget no later than the next day.

It is also necessary to withhold tax on the day of payment and transfer it to the budget no later than the next day if, for example, wages are paid before the last day of the month.

In a situation where an organization pays an advance on the last day of the month, personal income tax upon payment of such an advance is subject to calculation, withholding and transfer to the budget (Decision of the Supreme Court dated May 10, 2016 No. 309-KG16-1806). In other words, personal income tax on income paid in the form of wages is payable at the end of the month.

When issuing wages from the organization's revenue received in the form of cash, the tax must also be transferred by the tax agent to the budget no later than the day following the day of payment.

If part of the salary is paid in kind, personal income tax is transferred no later than the day following the day of actual deduction of the calculated amount of tax from income paid in cash.

Calculation of personal income tax from sick leave and vacations in 1C

To transfer personal income tax at the end of the month from all sick leave and vacation payments accrued for this month, it is wise to use automatic algorithms - complex manual calculations take a lot of time.

What programs should I use? For example, the 1C configuration: Salary and personnel management. It automatically generates a report Controlling the timing of personal income tax payment, which indicates the dates of transfer and the amount of income tax for the month from vacation and sick leave. In another program - 1C: Accounting - personal income tax on vacation and sick leave is also calculated automatically. The amounts can be viewed in the tab of the same name.

Now you can rent 1C with the maximum benefit - a 50% discount for new users. Find out more

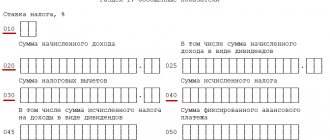

How is the deduction and transfer of wages reflected in certificate 2-NDFL?

If wages for December 2016 are accrued to employees and paid in January 2022, when filling out the Certificate in section 3 “Income taxed at the rate of __%”, all income accrued and paid to the employee for performing labor duties, including income for December, paid in January. Line 5.5 “Amount of tax transferred” indicates the amount of tax transferred for the tax period, including the amount of tax for December transferred in January (letters of the Federal Tax Service dated 02/03/2012 No. ED-4-3 / [email protected] , No. ED-4-3 / [email protected] ).

In the event that the amount of personal income tax is withheld after the end of the tax period and the submission of certificate 2-NDFL to the tax authority, it is necessary to submit an adjusted certificate (letter of the Federal Tax Service dated March 2, 2015 No. BS-4-11/3283).

If the deduction of the amount of personal income tax from wages accrued for December 2016 was made by a tax agent in January 2022 directly when paying wages, this tax amount is reflected only on line 040 and is not reflected on lines 070, 080 of section 1 of the calculation in form 6- Personal income tax for 2016. In this case, this tax amount should be reflected on line 070 in section 1, and the transaction itself should be reflected in section 2 of the calculation in form 6-NDFL for the first quarter of 2022 (letter of the Federal Tax Service dated November 29, 2016 No. BS-4-11/ [email protected] ).

In my opinion, if the salary for December 2016 was accrued and actually paid in December, say, on the 30th, then this transaction can be reflected in the calculation using Form 6-NDFL for 2016. This corresponds to the deadlines specified in paragraphs 4, 6 of Article 226 of the Tax Code of the Russian Federation.

At the same time, in relation to another similar situation, the Federal Tax Service states that regardless of the date of direct transfer of tax to the budget, the operation should be reflected in section 2 of the 6-NDFL calculation for the next period (letter dated December 15, 2016 No. BS-4-11 / [email protected] ). The only reassuring thing is that, in the opinion of the Federal Tax Service, if the reflection of the transaction in Form 6-NDFL did not lead to an understatement or overstatement of the amount of tax to be transferred, then the submission of an updated calculation is not required (letter dated December 15, 2016 No. BS-4-11/ [email protected] ).

What day is recognized as the date of receipt of income for bonuses accrued simultaneously with salary?

Based on Article 129 of the Labor Code, wages (employee remuneration) include remuneration for labor depending on the employee’s qualifications, complexity, quantity, quality and conditions of work performed, as well as compensation payments (additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal ones, work in special climatic conditions and in areas exposed to radioactive contamination, and other compensation payments) and incentive payments (additional payments and incentive allowances, bonuses and other incentive payments).

Incentive payments can be made within the time limits established by the employer’s local regulations.

If we are talking about a bonus related to the employee’s performance of labor duties, provided for by a collective agreement, agreement or local regulations of the employer, then the date of receipt of income in the form of such a monthly bonus may be recognized as the last day of the month for which the bonus was accrued to the employee (the same date as and for salary). This conclusion confirms the ruling of the Supreme Court dated April 16, 2015 No. 307-KG15-2718.

Then the date of receipt of quarterly and annual bonuses will be considered the last day of the month to which the order to pay bonuses based on the results of work for the quarter or year is dated (letter of the Federal Tax Service dated January 24, 2017 No. BS-4-11/1139).

At the same time, indicating in the calculation of 6-NDFL the date of actual receipt of income in the form of a bonus as the day the income in the form of a bonus was paid to the employee should not be considered as unreliable information that entails holding the tax agent liable under Article 126.1 of the Tax Code of the Russian Federation.

Personal income tax rates in 2022

The size of the tax burden on household income depends on the type of income. For example, the personal income tax rate on dividends in 2020 is similar to the value of deductions from wages and benefits and is equal to 13%. But if you receive winnings from an advertising lottery, you will have to pay the state 35% of the money received.

The status of the taxpayer is important: whether he is a resident or not. Tax residents are citizens who stay in our country for at least 183 days a year. Moreover, the status is assigned regardless of citizenship.

Let's determine the current values for individual types of income. Here is the current table of personal income tax rates in 2022.

| Type of income | Bet size |

| For residents of Russia | |

| Winnings or prizes received as a result of competitions, lotteries and other types of events held for the purpose of advertising goods, works or services - these are the cases in which personal income tax is 35 percent | 35% |

| Savings on interest when receiving borrowed funds, if the fee for using loan capital is less than 2/3 of the refinancing rate | |

| Receipt of income from interest on bank deposits, bonds and other types of investments, if the amount exceeds the amount established in Art. 214.2 and 214.2.1 Tax Code of the Russian Federation | |

| All other types of income | 13% |

| Personal income tax rate for non-residents in 2022 | |

| Wages and other payments regarding remuneration of highly qualified specialists | 13% |

| Remuneration for the work of hired workers, working for individuals, in private subsidiary plots, household and other personal needs, but not related to entrepreneurship | |

| Remuneration for crew members of ships operating under the Russian flag | |

| Salaries of refugees and (or) voluntary migrants who received permanent residence in Russia under a special program | |

| Dividends | 15% |

| All other types of income | 30% |

How is the date of receipt of income for vacation pay determined?

Tax is withheld from vacation pay amounts based on the date of payment of vacation pay (subclause 1 of clause 1 of Article 223 of the Tax Code of the Russian Federation).

Until 2016, there was no deferment in the transfer of tax, since the Tax Code of the Russian Federation did not provide for the specifics of determining the date of receipt of this type of income (Resolution of the Presidium of the Supreme Arbitration Court dated 02/07/2012 No. 11709/11).

But since 2016, personal income tax withheld from vacation pay can be transferred to the budget no later than the last day of the month in which they were paid.

The same payment deadline is established for personal income tax withheld from temporary disability benefits (including benefits for caring for a sick child).

During the period from the day the tax was withheld until the last day of the corresponding month, the withheld amounts are at the disposal of the tax agent.

The tax calculated and withheld from the indicated income of all employees for the month can be transferred on the last day of this month (as amended in paragraph 6 of Article 226 of the Tax Code of the Russian Federation, the phrase “last day of the month” is used, which is, apparently, an error in legal technique).

Transferring withheld personal income tax earlier than the specified period is not a violation.

Table with all personal income tax payment deadlines in 2022

| Type of income | When to recognize income | When to withhold tax | When to transfer personal income tax | Base |

| Salary and bonuses | ||||

| Prepaid expense | Last day of the month in which the advance was paid | On the day of payment of the second part of the salary | The next working day after the payment of the second part of the salary | Clause 2 Art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Final payroll | Last day of the month in which income was accrued | At the time of payment after income recognition | Next business day after payment of money | Clause 2 Art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Salary in kind | Last day of the month in which income was accrued | From the first cash payment after income is recognized | Next business day after payment of cash income | Clause 2 Art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Bonuses for holidays, such as anniversaries | The day the bonus was paid | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Quarterly or annual bonus for performance | The day the bonus was paid | At the time of payment after income has been recognized | Next business day after payment of money | Clause 2 Art. 223, para. 1 clause 6 art. 226 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia 10/05/2017 No. GD-4-11/20102 |

| Payments to contractors | ||||

| Payments to contractors under civil contracts | The day the money was paid | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Royalties under copyright agreements | The day the fee was paid | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Vacations and sick leave | ||||

| Vacation pay | The day on which vacation pay was paid | At the time of payment | Last day of the month in which vacation pay was paid | Subp. 1 clause 1 art. 223, para. 2 clause 6 art. 226 Tax Code of the Russian Federation |

| Hospital benefits, including for caring for a sick child | The day sick leave was paid | At the time of payment | Last day of the month in which sick leave was paid | Subp. 1 clause 1 art. 223, para. 2 clause 6 art. 226 Tax Code of the Russian Federation |

| Compensation for unused vacation | The day the compensation was paid | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Financial assistance and gifts | ||||

| Financial assistance in the amount of over 4,000 rubles. in year | The day the financial aid was paid | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| A cash gift in excess of RUB 4,000. in year | The day the gift was given | At the time of payment | Next business day after payment of money | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| A non-monetary gift that costs more than 4,000 rubles. in year | The day the gift was given | From the first cash payment after income is recognized | Next business day after payment of cash income | Subp. 1 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Travel allowances | ||||

| Over-limit daily allowance: - more than 700 rubles. on business trips around Russia; — more than 2500 rub. on business trips abroad | The last day of the month in which the advance report was approved | From the first cash payment after income is recognized | Next business day after payment of money | Subp. 6 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Compensation for travel and accommodation on a business trip when there are no supporting documents | The last day of the month in which the advance report was approved | From the first cash payment after income is recognized | Next business day after payment of money | Subp. 6 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Other compensation without documents | The last day of the month in which the advance report was approved | From the first payment after income is recognized | Next business day after payment of money | Subp. 6 clause 1 art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Average earnings during a business trip | The last day of the month for which earnings were accrued | At the time of payment after income has been recognized | Next business day after payment of money | Clause 2 Art. 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Material benefit | ||||

| Saving on loan interest | The last day of the month during the term of the loan agreement | From the first payment after income is recognized | Next business day after payment of money | Subp. 7 clause 1 art. 223, clause 4 and clause 6 226 Tax Code of the Russian Federation |

| Benefit from purchasing goods and securities for an employee | The day on which goods or securities were purchased | From the first cash payment after income is recognized | Next business day after payment of money | Subp. 3 p. 1 art. 223, clause 4 and clause 6 226 Tax Code of the Russian Federation |

| Payments to the founders and participants of the company | ||||

| Dividends from equity participation | The day the money was transferred to the founder's account | At the time of payment | Next business day after payment of money | Clause 1, Article 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Interest on a loan from the founder | The day the money was transferred to the founder's account | At the time of payment | Next business day after payment of money | Clause 1, Article 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Payment of shares upon exit from the company | The day the money was transferred to the founder's account | At the time of payment | Next business day after payment of money | Clause 1, Article 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

| Payment to a member of the board of directors | The day the money was transferred to the recipient's account | At the time of payment | Next business day after payment of money | Clause 1, Article 223, para. 1 clause 6 art. 226 Tax Code of the Russian Federation |

Does remitting tax before paying income have negative consequences for the tax agent?

Strictly speaking, the Tax Code of the Russian Federation does not provide for early transfer of personal income tax; moreover, it prohibits it, since in this case the tax is paid at the expense of the tax agent in violation of paragraph 9 of Article 226 of the Tax Code of the Russian Federation.

In the case of “early” tax transfer, it may be necessary to go through the procedure of returning such an amount as unidentified revenues (letter of the Ministry of Finance dated September 16, 2014 No. 03-04-06/46268). At the same time, the obligation to withhold tax remains.

But it should be noted that in specific cases there is judicial practice, according to which, if the tax is calculated correctly, withheld and received by the budget, then payment of personal income tax before payment of income is not recognized as a violation, entailing a fine for the tax agent under Article 123 of the Tax Code of the Russian Federation and penalties under Article 75 of the Tax Code of the Russian Federation. Similar conclusions were made, for example, in the Resolution of the Federal Antimonopoly Service of the North-Western District dated December 10, 2013 in case No. A56-16143/2013. This approach is also supported in the letter of the Federal Tax Service dated September 29, 2014 No. BS-4-11/19716.

What are the specifics of transferring personal income tax by an organization that has separate divisions?

Russian organizations that have separate divisions are required to transfer calculated and withheld tax amounts to the budget both at their location and at the location of each of their separate divisions.

If an organization that has several separate divisions in one municipality in territories under the jurisdiction of different tax authorities is registered in accordance with paragraph 4 of Article 83 of the Tax Code of the Russian Federation at the location of one of such separate divisions, then personal income tax for all separate divisions is transferred to the budget at the place of registration of such a separate division. In this case, the payment order is issued for each separate division with its corresponding checkpoint (letter of the Ministry of Finance dated June 22, 2012 No. 03-04-06/3-174).

According to paragraph 7 of Article 226 of the Tax Code of the Russian Federation, tax payment at the location of a separate division must be carried out based on the amount of income of individuals under all contracts concluded with them by this separate division (and not just under employment contracts).