Most accountants are aware that in tax accounting, income and expenses on long-term transactions are subject to distribution. Their one-time recognition will entail an understatement of income tax in one of the periods. As a result, the company faces a fine under Article 122 of the Tax Code, and if there is arrears, a penalty.

Meanwhile, approaches to distribution are formulated by the legislator very vaguely. It is problematic to draw unambiguous conclusions based on them. However, for practice this is not so bad. After all, your decisions are protected by paragraph 7 of Article 3 of the Tax Code. In accordance with it, all ambiguities of tax legislation are interpreted in favor of the taxpayer.

Expenses are not expenses yet

In Chapter 25 of the Tax Code there are two terms - “costs” and “expenses”. The first of them is intuitive to us. It characterizes real economic processes in the company’s economic activities and indicates an outflow of resources. The second is, strictly speaking, a special indicator intended for calculating the tax base (Article 252 of the Tax Code of the Russian Federation). Its purpose is illustrated by the diagram:

| PROFIT for the period | |

| INCOME > EXPENSES | INCOME < EXPENSES |

| INCOME - EXPENSES | 0 |

Meanwhile, according to the text of the Tax Code, the concepts of “costs” and “expenses” are used inconsistently:

- sometimes as synonyms - “material expenses... include... the costs of the taxpayer” (clause 1 of Article 254 of the Tax Code of the Russian Federation);

- sometimes they are contrasted - “expenses are recognized as justified and documented expenses” (Clause 1 of Article 252 of the Tax Code of the Russian Federation);

- and most importantly, expense does not always mean an indicator involved in calculating the tax base of the current period - “the amount of distribution costs includes... the expenses of the taxpayer-buyer of goods for the delivery of these goods” (Clause 1 of Article 320 of the Tax Code of the Russian Federation).

The unsystematic conceptual apparatus makes it especially difficult to understand approaches to the distribution of income and expenses. Therefore, in this article, by expense we will understand the indicator used in calculating the tax base for the corresponding period. Expenses are formed from the costs incurred.

note

The Tax Code (Clause 6, Article 3) proclaims: the rules must be formulated in such a way that everyone knows exactly when and in what order they must pay taxes. Alas, the requirements for the distribution of income and expenses for profit tax purposes (clause 2 of Article 271, clause 1 of Article 272, Article 316 of the Tax Code of the Russian Federation) do not meet this criterion.

The discussion about the relationship between costs and expenses is also relevant in accounting - when comparing the texts of PBU 10/99 and the Instructions for the Application of the Chart of Accounts. But Federal Law No. 402-FZ dated December 6, 2011 “On Accounting” gave expenses a special status: they relate to accounting objects. But a company’s expenses can generate both assets (this is a “static” element of the balance sheet) and expenses (this is a “dynamic” element of the income statement). We will not delve into this problem; it is solved on the basis of clause 8.3.6 of the Concept of Accounting in the Market Economy of Russia (approved by the Methodological Council on Accounting under the Ministry of Finance of the Russian Federation, the Presidential Council of the IPB of the Russian Federation dated December 29, 1997).

Income and expenses. Financial results. Tax Basics

Purpose of the lecture:

consider the basics of tax accounting and issues of identifying profits.

General provisions

We have already mentioned above that the introduction of Chapter 25 of the Tax Code of the Russian Federation “Organizational Income Tax”, in fact, led to the fact that organizations are forced to maintain tax accounting along with accounting. In particular, Art. 313 of the Tax Code of the Russian Federation, gives the following definition of tax accounting:

“Tax accounting is a system for summarizing information to determine the tax base for a tax based on data from primary documents, grouped in accordance with the procedure provided for by this Code”

According to the same article:

“Tax accounting is carried out in order to generate complete and reliable information on the accounting procedure for tax purposes of business transactions carried out by the taxpayer during the reporting (tax) period, as well as to provide information to internal and external users to monitor the correctness of calculation, completeness and timeliness of calculation and payment to the tax budget."

As you can see, a separate accounting system is provided specifically for corporate income tax.

The classification of income and expenses in accounting and for the purposes of Chapter 25 of the Tax Code of the Russian Federation differs. As a result, it turns out that the profit calculated in accounting, which reflects the real state of affairs, and the profit on which income tax is levied are different amounts. Let's consider the details of accounting for income tax calculations, features of the classification of income and expenses in accounting and tax accounting, and also talk about PBU 18/02 “Accounting for income tax calculations of organizations.” This PBU is designed to bring together tax and accounting, ideally, turning them into a single accounting system.

Let's start with the classification of income and expenses in accounting.

Income in accounting

Features of the classification and accounting of an organization’s income in accounting are established in PBU 9/99 “Organizational Income”. In particular, PBU divides income into two types - income from ordinary activities and other income. What is considered income from ordinary activities depends, in fact, on the type of activity of the organization. As a rule, income from the ordinary activities of an organization is represented by revenue for the sale of goods, provision of services, and other income is, for example, income from the sale of fixed assets unnecessary to the organization, fines in favor of the organization, valuables donated to the organization, and so on.

In accordance with PBU 9/99, revenue can be recognized in accounting if the following conditions are met:

- the organization has the right to receive this revenue arising from a specific contract or otherwise confirmed in an appropriate manner;

- the amount of revenue can be determined;

- there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the organization;

- the right of ownership (possession, use and disposal) of the product (goods) has passed from the organization to the buyer or the work has been accepted by the customer (service provided);

- the expenses that have been or will be incurred in connection with this operation can be determined.

If at least one of the above conditions is not met in relation to cash and other assets received by the organization as payment, then the organization’s accounting records recognize accounts payable, not revenue.

Expenses in accounting

Features of the classification of expenses in accounting are regulated by PBU 10/99 “Organizational Expenses”. In particular, the classification of expenses is very similar to the classification of income. These are expenses for ordinary activities and other expenses. Expenses for ordinary activities are expenses associated with the manufacture and sale of products, the acquisition and sale of goods, expenses the implementation of which is associated with the performance of work and the provision of services. Expenses that are not expenses from ordinary activities are recognized as other expenses.

In accordance with PBU 10/99, expenses are recognized in accounting if the following conditions are met:

- the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

- the amount of expenditure can be determined;

- there is certainty that a particular transaction will result in a reduction in the economic benefits of the entity. There is certainty that a particular transaction will result in a reduction in the entity's economic benefits when the entity has transferred an asset or there is no uncertainty about the transfer of an asset.

If at least one of the above conditions is not met in relation to any expenses incurred by the organization, then receivables are recognized in the organization’s accounting records.

Financial result, balance sheet reformation

We mentioned above that two accounts are used to record the organization’s income and expenses - account 90 “Sales”, which reflects income and expenses from main activities, and account 91 “Other income and expenses”. The names of the accounts correspond to the classification of expenses adopted in accounting. The final identification of the organization’s profit or loss is made on account 99 “Profits and losses”. It is to this account that the amounts of profits or losses identified on accounts 90 and 91, as well as, in some cases, with other accounts are transferred.

Above, in lecture 15, we looked at the details regarding accounting for sales and identifying financial results.

Let us recall that the financial result from ordinary activities (after internal transactions between the subaccounts of account 90) is reflected in one of two entries:

D99 K90 - for the amount of loss from ordinary activities D90 K99 - for the amount of profit from ordinary activities

Similar entries are made in correspondence with account 91:

D99 K91 - loss is reflected after comparing other income and expenses D91 K99 - profit is reflected after comparing other income and expenses

After a profit or loss is identified on account 99, and this is done at the end of the year, this account is closed to account 84 “Retained earnings (uncovered loss).”

Accordingly, when identifying profit, an entry is made:

D99 K84 - profit is reflected at the end of the reporting year (balance sheet reformed)

When a loss is identified, a reverse entry is made:

D84 K99 - the loss of the reporting year is reflected (balance sheet reformed)

Accounting entries in the correspondence of accounts 99 and 84 are called balance sheet reformation.

Account 84 stores the history of the company's activities, while account 99 serves only to temporarily store information about profits and losses.

Having familiarized yourself with the classification of income and expenses for accounting purposes, it can be noted that it is designed to reflect the real state of income and expenses in the organization. It should be noted that earlier PBUs provided for a more complex classification of income and expenses, which was eventually abolished, reducing the division of income and expenses into two groups.

As already mentioned, in accounting for the purposes of calculating income tax, a different classification of income and expenses has been adopted. Let's take a closer look at this tax.

Corporate income tax

Chapter 25 of the Tax Code of the Russian Federation examines the features of the Corporate Income Tax as applied to Russian and foreign organizations. Below we will talk only about Russian organizations. So, Russian organizations are recognized as income tax payers.

The object of taxation is income reduced by the amount of expenses, which are determined in accordance with Chapter. 25 Tax Code of the Russian Federation. This is a key feature of calculating the tax base for corporate income tax. Not everything that is income or expense from an accounting point of view is recognized as income or expense for the purposes of Chapter 25 of the Tax Code of the Russian Federation.

"Continuing" income

Income is an economic benefit taken into account if it is possible to assess it and to the extent that such benefit can be assessed (Article 41 of the Tax Code of the Russian Federation). Income should be recognized in tax accounting in the reporting (tax) period in which it occurred (Clause 1, Article 271 of the Tax Code of the Russian Federation). But there are exceptions to this general rule. They are concentrated in paragraph 2 of Article 271 of the Tax Code. It consists of two paragraphs, then Paragraph 1 and Paragraph 2, relating to different business situations.

On a note

In accounting, costs are recognized as an expense of the reporting period when it is obvious that they will not bring future economic benefits to the company or when future economic benefits do not meet the criterion for recognizing an asset on the balance sheet.

Paragraph 1 discusses income related to several reporting (tax) periods. Paragraph 2 concerns income from the sale of work or services in industries with a long (more than one tax period) technological cycle. From a comparison of Paragraphs 1 and 2, we can conclude that Paragraph 1 refers to non-operating income.

Non-operating income

The dates for recognition of non-operating income are described in paragraph 4 of Article 271 of the Tax Code. At the same time, subparagraph 3 presents date options for the taxpayer to choose from. It applies in particular to income:

- from leasing property;

- in the form of license payments (including royalties) for the use of intellectual property;

- from granting rights under a commercial concession (franchising) agreement.

As a rule, these agreements are concluded for several reporting (tax) periods, but payments by the parties are made monthly. And the economic benefits of these transactions are increasing daily. Moreover, the connection between such company income and its costs cannot be clearly defined or is determined indirectly.

By virtue of Paragraph 1, these incomes require recognition during the execution of the contract, before its completion. The distribution should be made “taking into account the principle of uniform recognition of income and expenses

" The legislator does not disclose the content of the principle of uniformity itself. However, it does mention costs. Therefore, for clarification, it is logical to turn to Article 272 of the Tax Code. But we won’t find any specific instructions in it either. In paragraph 1 (paragraph 3), the legislator refers to the same principle: if the taxpayer derives economic benefits from the agreement for more than one reporting period, then expenses must also be distributed - “taking into account the principle of even recognition of income and expenses.” The circle is closed.

It remains to be assumed that the “evenness principle” consists of regular (periodic) recognition of income. Possible dates:

- date of settlements in accordance with the terms of the concluded agreement;

- date of presentation by the counterparty of documents serving as the basis for settlements;

- the last day of the reporting (tax) period.

In the accounting policy, it is advisable to establish that this principle, as applied to expenses, does not allow for the unreasonable transfer of costs to subsequent reporting (tax) periods. The fact is that the costs of such activities are semi-fixed. And the corresponding expenses will be indirect or non-operating (clause 2 of Article 318 of the Tax Code of the Russian Federation).

Please note: uniformity does not necessarily imply uniform distribution of the contract price over the duration of its validity.

Example 1

The leasing agreement provides for an uneven payment schedule. The lessor will recognize income on the settlement dates established by the schedule, and in the amounts specified in it. This procedure is explained by letter of the Ministry of Finance of Russia dated April 17, 2009 No. 03-03-06/1/258 and supported by the ruling of the Supreme Arbitration Court of the Russian Federation dated April 15, 2009 No. 4219/09 in case No. A76-4062/2008-39-107. To be fair, we note that previously the regulatory authorities had a different opinion. The letter of the Federal Tax Service of the Russian Federation for Moscow dated September 22, 2008 No. 20-12/089128 states: the lessor takes into account leasing payments as part of its income evenly throughout the term of the leasing agreement, regardless of their actual payment by the lessee.

The moment of recognition of individual income and expenses for income tax using the accrual method

Income:

- from sales

- non-operating

Expenses:

- material

- for wages

- depreciation

- other related to production and sales

- non-operating

| Type of income/expense | Date of recognition in tax accounting | Base | |

| Income | |||

| Income from sales | Income from the sale of property (work, services, property rights) | The date of transfer of ownership upon the sale of property (except for real estate) or the date of transfer of the results of work performed, services provided, as well as property rights Date of transfer of real estate specified in the transfer deed upon sale of real estate Date of termination of obligations by offset upon sale of securities The date of receipt of partial redemption of the par value of a security during its circulation period | clause 3 art. 271 Tax Code of the Russian Federation |

| Income from the sale of work, services, property rights related to several reporting (tax) periods | Recognize income in installments over the entire period to which it relates. The organization develops its own income distribution procedure | clause 2 art. 271 Tax Code of the Russian Federation | |

| Non-operating income | Income from renting out property or granting intellectual property rights | One of the following dates: – date of settlements in accordance with the terms of the contracts; – date of presentation of documents serving as the basis for settlements (for example, invoices); – last day of the reporting (tax) period | subp. 3 p. 4 art. 271 Tax Code of the Russian Federation |

| Penalty (fine, penalty) due for violation by counterparties of the terms of business contracts | Date of recognition by the debtor (in case of voluntary compensation) or date of entry into force of the court decision (in case of compensation through the court) | subp. 4 p. 4 art. 271 Tax Code of the Russian Federation | |

| Amounts of compensation due for loss (damage) | |||

| Cost of property, work, services received free of charge | The date of signing the act of acceptance and transfer of property (if tangible assets are received) or the receipt of funds (if money is received) or the date of signing the act of acceptance and delivery of work, services (if services are provided or work is completed) | subp. 1 and 2 paragraphs 4 art. 271 Tax Code of the Russian Federation | |

| Income of previous years identified in the reporting (tax) period | Date of identification of income (reception and (or) discovery of documents confirming the existence of income) | subp. 6 clause 4 art. 271 Tax Code of the Russian Federation | |

| Positive exchange rate difference from currency revaluation and foreign currency debt | The earliest of the following dates: – the date of a transaction in foreign currency (for example, its transfer to a supplier, repayment of a debt in foreign currency); – last day of the current month | subp. 7 paragraph 4 art. 271 Tax Code of the Russian Federation | |

| Positive exchange rate difference from revaluation of precious metals and requirements (obligations) expressed in such metals | The earliest of the following dates: – the date of the transaction with precious metals; – last day of the current month | subp. 7 paragraph 4 art. 271 Tax Code of the Russian Federation | |

| Cost of valuables received upon liquidation of fixed assets | Date of drawing up the act of liquidation of the fixed asset | subp. 8 clause 4 art. 271 Tax Code of the Russian Federation | |

| Positive differences arising when selling or purchasing foreign currency at a rate that deviates from the official rate of the Bank of Russia | Date of transfer of ownership of the currency | subp. 10 clause 4 art. 271 Tax Code of the Russian Federation | |

| Amounts of restored reserves | Last day of the reporting (tax) period | subp. 5 paragraph 4 art. 271 Tax Code of the Russian Federation | |

| Dividends received from equity participation in the authorized capital of other organizations (in cash) | Date of receipt of money to the current account (at the cash desk) | subp. 2 clause 4 art. 271 Tax Code of the Russian Federation | |

| Non-operating income | Dividends in non-cash form | The date of receipt of real estate under a deed of transfer or other document transferring real estate, date of transfer of ownership of other property (including securities) | subp. 2.1 clause 4 art. 271 Tax Code of the Russian Federation |

| Interest due on loan agreements and debt securities, the validity of which falls on more than one accounting period | The last day of each month of the reporting (tax) period If the fulfillment of an obligation under a contract depends on the value (or other value) of the underlying asset, and during the period of validity of the contract, interest is accrued at a fixed rate:

In case of termination of the agreement (repayment of the debt obligation) within a calendar month - the date of termination of the agreement (repayment of the debt obligation) | clause 6 art. 271 Tax Code of the Russian Federation | |

| Income from participation in a simple partnership (joint activity) | Last day of the reporting (tax) period | subp. 5 paragraph 4 art. 271 Tax Code of the Russian Federation | |

| Profit of a controlled foreign company | December 31 of the year following the year in which the profit of the controlled foreign company is realized | subp. 12 clause 4 art. 271 Tax Code of the Russian Federation | |

| Expenses | |||

| Material costs | Expenses for the purchase of raw materials and (or) materials used in the production of goods (works, services) | The date of transfer of raw materials and materials into production - in terms of raw materials and materials attributable to the goods (work, services) produced. At the same time, the purchase cost of raw materials and materials can be written off as expenses only in the part released into production and used in it at the end of the month | para. 2 p. 2 art. 272, paragraph 5 of Art. 254 Tax Code of the Russian Federation |

| Expenses for the purchase of tools, devices, equipment, instruments, laboratory equipment, workwear | Date of commissioning | subp. 3 p. 1 art. 254 Tax Code of the Russian Federation | |

| Expenses for work, production services performed by third-party contractors | Date of signing the acceptance certificate for works and services. The date of recognition of expenses for ongoing services may be the last day of the month for which they are provided. In particular, this is permissible if the act of provision of services is signed next month. But to take advantage of this opportunity, two conditions must be met: – the act must be drawn up before filing the income tax return; – the act must indicate the month for which the services were provided | para. 3 p. 2 art. 272 Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated July 27, 2015 No. 03-03-05/42971 | |

| Labor costs | Labor costs | Monthly, on the last day of the month | clause 4 art. 272 Tax Code of the Russian Federation |

| Expenses for the formation of a reserve for payment of upcoming vacations and a reserve for the payment of annual benefits for long service | Date of accrual of expenses for the formation of the reserve (monthly) | subp. 2 clause 7 art. 272, paragraphs 1 and 6 of Art. 324.1 Tax Code of the Russian Federation | |

| Amounts of payments (contributions) under compulsory insurance contracts, as well as voluntary insurance (non-state pension provision) | Date of transfer (payment from the cash desk) of insurance premiums under the terms of the contract Evenly throughout the term of the agreement in proportion to the number of calendar days of the agreement in the reporting period (if the agreement is concluded for more than one reporting period and the contribution is paid as a one-time payment) Evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month), in proportion to the number of calendar days of the agreement in the reporting period (if the agreement is concluded for more than one reporting period and contributions are paid in installments) | clause 6 art. 272 Tax Code of the Russian Federation | |

| Depreciation | Amounts of depreciation charges | Monthly, on the last day of the month | clause 3 art. 272 Tax Code of the Russian Federation |

| Other costs associated with production and sales | Expenses for repairs of fixed assets | The period in which they were incurred, except in the case when expenses are made from the reserve for upcoming repairs of fixed assets | clause 5 art. 272 Tax Code of the Russian Federation |

| Expenses for creating a reserve for upcoming repairs of fixed assets | Date of accrual of expenses for the formation of the reserve (in equal shares on the last day of the reporting (tax) period) | subp. 2 clause 7 art. 272, paragraph 2 of Art. 324 Tax Code of the Russian Federation | |

| Expenses for compulsory and voluntary insurance | If the contract is valid for one reporting period, expenses are recognized at a time on the date of transfer (payment from the cash desk) of each insurance premium under the terms of the contract | clause 6 art. 272 Tax Code of the Russian Federation | |

| If the contract is valid for several reporting periods, expenses are recognized: 1) in the case of a one-time payment - evenly throughout the term of the agreement in proportion to the number of calendar days of the agreement in the reporting period 2) in case of payment of contributions in installments - for each payment evenly over the period corresponding to the period for payment of contributions (year, half-year, quarter, month), in proportion to the number of calendar days of the agreement in the reporting period | |||

| Expenses in the form of taxes and fees, with the exception of those listed in Article 270 of the Tax Code of the Russian Federation | Date of accrual of taxes (advance tax payments), fees and other obligatory payments | subp. 1 clause 7 art. 272 Tax Code of the Russian Federation | |

| Expenses in the form of commission fees and other similar expenses for work performed by third parties (services provided) | One of the following dates: – date of settlements in accordance with the terms of the contracts; – date of presentation of documents serving as the basis for settlements (for example, certificates of work performed (services rendered)); – the last date of the reporting (tax) period. The date of recognition of expenses for ongoing services may be the last day of the month for which they are provided. In particular, this is permissible if the act of provision of services is signed next month. But to take advantage of this opportunity, two conditions must be met: – the act must be drawn up before filing the income tax return; – the act must indicate the month for which the services were provided | subp. 3 paragraph 7 art. 272 Tax Code of the Russian Federation; letter of the Ministry of Finance of Russia dated July 27, 2015 No. 03-03-05/42971 | |

| Expenses for payment of work performed (services rendered) by third-party contractors | |||

| Expenses in the form of rental (leasing) payments for leased (leasing) property | |||

| Amounts of paid allowances | Date of transfer of money from the current account (payment from the cash register) | subp. 4 paragraph 7 art. 272 Tax Code of the Russian Federation | |

| Expenses for compensation for the use of personal cars and motorcycles for business trips | |||

| Costs for creating a reserve for upcoming warranty repairs and maintenance | Date of accrual of expenses (day of sale of goods, work for which the contract provides for maintenance and repair) | subp. 2 clause 7 art. 272, paragraph 3 of Art. 267 Tax Code of the Russian Federation | |

| Expenses for maintaining official vehicles | Date of approval of the advance report | subp. 5 paragraph 7 art. 272 Tax Code of the Russian Federation | |

| Travel expenses | |||

| Entertainment expenses | |||

| Non-operating expenses | Interest payable accrued on loan agreements and debt securities, the validity of which falls on more than one reporting period | The last day of each month of the reporting (tax) period If the fulfillment of an obligation under a contract depends on the value (or other value) of the underlying asset, and during the period of validity of the contract, interest is accrued at a fixed rate:

In case of termination of the agreement (repayment of the debt obligation) within a calendar month - the date of termination of the agreement (repayment of the debt obligation) | clause 8 art. 272 Tax Code of the Russian Federation |

| Non-operating expenses | Expenses for the acquisition of property leased | The day the lessee accrues payments in accordance with the terms of the agreement in an amount proportional to the amount of accrued lease payments | clause 8.1 art. 272 Tax Code of the Russian Federation |

| Negative exchange rate difference from currency revaluation and foreign currency debt | The earliest of the following dates: – the date of the transaction in foreign currency (for example, its transfer to a supplier, repayment of debt in foreign currency); – last day of the current month | subp. 6 paragraph 7 art. 272 Tax Code of the Russian Federation | |

| Negative exchange rate difference from revaluation of precious metals and requirements (obligations) expressed in such metals | The earliest of the following dates: – date of transaction with precious metals; – last day of the current month | subp. 6 paragraph 7 art. 272 Tax Code of the Russian Federation | |

| Penalty (fine, penalty) payable, accrued for violation by an organization of the terms of business contracts | Date of recognition by the organization (in case of voluntary compensation) or date of entry into force of the court decision (in case of compensation through the court) | subp. 8 clause 7 art. 272 Tax Code of the Russian Federation | |

| Amounts of compensation for loss (damage) | |||

| Expenses associated with the acquisition of securities | Date of sale or other disposal of securities, including the date of termination of obligations by offset | subp. 7 paragraph 7 art. 272 Tax Code of the Russian Federation | |

| Expenses associated with the acquisition of shares | Date of sale of shares | subp. 10 clause 7 art. 272 Tax Code of the Russian Federation | |

| Expenses for creating provisions for doubtful debts | Date of accrual of expenses (last date of the reporting (tax) period) | subp. 2 clause 7 art. 272, paragraph 3 of Art. 266 Tax Code of the Russian Federation | |

Income from sales

You have the right to consider income from the rental of property as income from sales (clause 4 of Article 250 of the Tax Code of the Russian Federation). You can do this, but it is not necessary. The fact is that the date of recognition of income from sales is the date of provision of services reflected in the act (clause 1 of Article 248 of the Tax Code of the Russian Federation). But you may not have these monthly primary accounting documents (letter of the Federal Tax Service of the Russian Federation for Moscow dated March 26, 2007 No. 20-12/027737). Recognition of income still cannot be avoided, but for the absence of a “primary income” they will be punished (Article 120 of the Tax Code of the Russian Federation).

Important

Production with a long technological cycle should be understood as production, the start and end dates of which fall on different tax periods, regardless of the number of days of production (letter of the Ministry of Finance of Russia dated January 13, 2014 No. 03-03-06/1/218).

In what cases should proceeds from sales be distributed? The Tax Code gives a very definite answer to this question - the price of a contract providing for the implementation of work or services is subject to distribution if its execution falls on several calendar years.

Nobody obliges you to distribute income under an agreement of this type, executed within a calendar year (including over several reporting periods). True, the Russian Ministry of Finance thinks differently - for the reason that it considers Paragraph 2 as a special case of Paragraph 1 (letter dated January 13, 2014 No. 03-03-06/1/218). But above we were convinced that Paragraphs 1 and 2 are talking about income of a different nature. In addition, production costs are directly determined by the technological process, so the condition of Paragraph 1 (“the relationship between income and expenses cannot be clearly defined or is determined indirectly”) is not met. The requirement to distribute income is confirmed by paragraph 8 of Article 316 of the Tax Code.

The Ministry of Finance of Russia (letter dated 06/07/2013 No. 03-03-06/1/21186) believes that income from the sale of products manufactured under a contract is not subject to distribution. But this opinion can be challenged. After all, the contract, although it ends with the transfer of the material result, provides for the execution of work (clause 1 of article 702 of the Civil Code of the Russian Federation, clause 4 of article 38 of the Tax Code of the Russian Federation).

Paragraph 2 clarifies: income is subject to distribution if the contract does not provide for phased delivery of work (services). Don't lose sight of this nuance.

Obviously, the contract price must be distributed between the tax periods in which production is carried out. The question is: how exactly, by what criterion? We won’t find a direct answer this time either:

| How to distribute the contract price for the implementation of works or services? | |

| The taxpayer distributes income from sales independently | |

| clause 2 art. 271 Tax Code of the Russian Federation | Art. 316 Tax Code of the Russian Federation |

| ...in accordance with the principle of formation of expenses for the specified works (services) | …taking into account the principle of uniformity of income recognition based on accounting data |

However, the basis for the distribution of income from the sale of income is the principle of formation of expenses (although the initial subject of accounting is expenses). And the procedure for generating expenses during production is established by Article 318 of the Tax Code. In accordance with it, it is necessary to determine direct costs that are subject to distribution between the expenses of the current period and the balances of work in progress. Moreover, taxpayers providing services are not required to create work in progress balances. They can recognize all their expenses as expenses of the current period.

So it is impossible to distribute income without regard to the formation of expenses. The conversation about expenses is ahead.

Taxation and accounting of income from the sale of non-exclusive rights to software

1. In accordance with sub. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the object of taxation is transactions involving the sale of goods (work, services) on the territory of the Russian Federation, as well as the transfer of property rights.

According to sub. 26 clause 2 art. 149 of the Tax Code of the Russian Federation is not subject to taxation (exempt from taxation) the implementation on the territory of the Russian Federation of exclusive rights to computer software and databases included in the unified register of Russian computer software and databases, rights to use such software and databases (including updates to them and additional functional capabilities), including by providing remote access to them via the Internet information and telecommunications network.

Thus, since the software in question is not included in the unified register of Russian software, there are no grounds for tax exemption for transactions involving the transfer of rights to use such software. Regarding the moment of determining the tax base, we note the following.

In accordance with paragraph 1 of Art. 167 of the Tax Code of the Russian Federation, the moment of determining the tax base for VAT is the earliest of the following dates:

- day of shipment (transfer) of goods (works, services), property rights;

- day of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Consequently, the taxation procedure directly depends on the payment procedure for transferred rights of use:

- If the agreement provides for an advance payment, the tax base is determined both on the date of the advance payment and on the date of transfer of rights on the basis of the transfer and acceptance certificate. At the same time, on the date of shipment, the seller has the right to deduct VAT calculated upon receipt of the advance payment (clause 14 of Article 167 of the Tax Code of the Russian Federation, clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Article 172 of the Tax Code of the Russian Federation).

- If an advance payment is not provided for in the agreement, the tax base is determined once - on the date of signing the transfer and acceptance certificate.

2. In accordance with paragraph 1 of Art. 271 of the Tax Code of the Russian Federation, income is recognized in the reporting (tax) period in which it occurred, regardless of the actual receipt of funds, other property (work, services) and (or) property rights (accrual method).

According to paragraph 2 of Art. 271 of the Tax Code of the Russian Federation for income relating to several reporting (tax) periods, and if the relationship between income and expenses cannot be clearly defined or is determined indirectly, income is distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses.

At the same time, sub. 3 p. 4 art. 271 of the Tax Code of the Russian Federation allows for the possibility of recognizing income in the form of license payments for the use of intellectual property on the date of making payments in accordance with the terms of concluded agreements or presenting to the taxpayer documents serving as the basis for making calculations, or the last day of the reporting (tax) period.

The provisions of Chapter 25 do not contain instructions on the procedure for recognizing income if the right to use the software for which a one-time payment was paid is valid for several reporting (tax) periods. Moreover, according to the official position of the regulatory authorities, if a license agreement is valid for several tax periods, then income in the form of a one-time payment is subject to equal distribution during the term of the agreement (see, for example, letter of the Ministry of Finance of the Russian Federation dated September 22, 2015 No. 03-03- 06/54220).

Thus, in our opinion, in the situation under consideration, the licensor has the right:

- recognize income on a straight-line basis over the term of the license agreement at the end of each reporting period;

- recognize income at a time on the date of signing the transfer and acceptance certificate or on the date of receipt of the license payment. However, this approach is most correct if the provision of rights to use software under a license agreement is not one of the organization’s activities (related to non-operating income).

3. In accordance with clause 5 and clause 7 of PBU 9/99 “Income of the organization”, income in the form of license fees can be both income from ordinary activities and other income. At the same time, in accordance with clause 12, clause 15 of PBU 9/99, revenue from the provision of intellectual property objects for temporary use for a fee is recognized if the following conditions are simultaneously met:

- the organization has the right to receive this revenue arising from a specific contract or otherwise confirmed in an appropriate manner;

- the amount of revenue can be determined;

- there is confidence that a particular transaction will result in an increase in the economic benefits of the organization. Confidence that a particular transaction will result in an increase in the economic benefits of the organization exists when the organization received an asset in payment or there is no uncertainty regarding the receipt of the asset.

If at least one of the above conditions is not met in relation to cash and other assets received by the organization as payment, then the organization’s accounting records recognize accounts payable, not revenue.

In our opinion, all the above conditions are met on the date of actual transfer of the license under the acceptance certificate, since:

- the licensor has fulfilled its obligations to transfer the rights to use the software in the form of a license, providing for the possibility of its use for a certain period;

- the amount of revenue is determined in the amount of the license payment due to the licensor;

- there is an increase in the economic benefits of the licensor due to the receipt of the license fee. If the license fee is paid after the date of signing the acceptance certificate, the licensor also has confidence in the increase in economic benefits, since the licensor has the right to demand this payment in court.

Thus, in our opinion, the entire amount of the license payment is subject to one-time recognition on the date of signing the transfer and acceptance certificate.

Get expert advice

according to your situation and get expert advice.

Ask a Question

Ask a Question

Cost Allocation

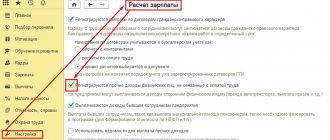

The taxpayer recognizes costs in the reporting (tax) period in which they arise based on the terms of transactions with sellers (clause 1 of Article 272 of the Tax Code of the Russian Federation). However, the tax base is formed by expenses for a certain period. When moving from costs to expenses, you need to take into account that:

- for the buyer, ongoing transactions generate accrual costs;

- costs can be included in work in progress, the cost of which is transferred to expenses according to certain rules.

Lasting deals

A transaction may generate costs over several reporting (tax) periods. And the company's income is not always directly determined by these costs. Typical long-term transactions that do not provide for specific implementation dates are rent, use of intellectual property, commercial concession, banking services (subclauses 10 and 37 clause 1 of article 264, subclause 15 clause 1 of article 265 of the Tax Code of the Russian Federation).

Reference

If the contract is executed simultaneously, then it is not a continuing transaction.

In such cases, expenses are recognized in tax accounting (subclause 3, clause 7, article 272 of the Tax Code of the Russian Federation):

- on the settlement date in accordance with the terms of the concluded agreements;

- on the date of presentation to the taxpayer of documents serving as the basis for making calculations;

- on the last day of the reporting (tax) period.

The selected date option for each contract is fixed in the accounting policy.

Example 2

The lease agreement provides for an uneven schedule of lease payments. The lessee recognizes expenses based on the amount of lease payments and payment terms approved by the schedule (letter of the Ministry of Finance of Russia dated October 15, 2008 No. 03-03-05/131).

People often ask: in what order should expenses for the acquisition of non-exclusive rights to computer programs be recognized? We answer:

- if the agreement with the copyright holder establishes a period for using the program, then the cost of the program is distributed evenly over this period (letter of the Ministry of Finance of Russia dated August 31, 2012 No. 03-03-06/2/95);

- if the contract does not specify the period for using the program, then the costs incurred are taken into account at a time (determination of the Supreme Arbitration Court of the Russian Federation dated February 13, 2014 No. VAS-271/14, letter of the Federal Tax Service of Russia dated November 26, 2013 No. GD-4-3/21097).

But we warn you: costs may be related to work in progress, so costs are not expenses yet!

"Consuming" work in progress

It remains to figure out how to recognize expenses, and along with them, income, if the company performs work under a rolling production contract.

In the process of executing the contract, direct costs for it accumulate in the form of refineries - work in progress (clause 1 of Article 319 of the Tax Code of the Russian Federation). Work in progress includes work (services) completed but not accepted by the customer. WIP also includes balances of unfulfilled production orders. The taxpayer determines the procedure for distributing direct costs for work in progress and for work performed (services rendered). But so that the resulting costs correspond to the work performed (services provided).

These formulations do not contain conditions regarding the transfer of the results of completed work to the customer. Therefore, the contractor has the right to recognize expenses (reduction of work in progress) upon the interim acceptance by the customer of the work performed.

In construction, it is certified by acts of acceptance of work performed in form No. KS-2 and certificates of the cost of work performed and expenses in form No. KS-3. These documents determine the “mastered” part of the contract price, that is, they confirm income for the corresponding period.

At the same time, only those costs that fall on the volumes indicated in form No. KS-2 are subject to write-off from work in progress as expenses. For tax accounting, this is a very labor-intensive task. It is further complicated by the fact that the last form of the year, No. KS-2, is not necessarily drawn up on the date “December 31”. In practice, work is not activated on the day before the holiday. At the same time, a number of costs are recognized monthly (depreciation, wages and contributions to compulsory social insurance). Because of this, accounting policies become even more complicated.

The procedure for recognizing revenue under contracts with a long technological cycle, provided for in Article 271 of the Tax Code, is similar to the method for recognizing revenue “as ready”, provided for by PBU 2/2008. Therefore, revenue from actually completed construction work can be determined on the basis of acts KS-2 (Resolution of the Federal Antimonopoly Service of the Ural District dated October 17, 2013 No. F09-9955/13).

Fortunately, the Russian Ministry of Finance offers simpler solutions. The main idea is that there should be no work in progress at December 31st. This means that all direct costs incurred during the year should be written off as expenses. These expenses should be compared with income

. Financiers offer two ways:

- income under the contract is distributed evenly over the time of its execution;

- income under the contract is determined based on the share of costs incurred in the total amount of estimated costs under the contract.

Let us explain these methods with examples.

First method: Example 3

The price of the contract is 3 million rubles excluding VAT. The start of work is November 2, the planned completion is January 30 next year. Direct costs under the contract: as of December 31 - 1.5 million rubles, and total costs amount to 2.2 million rubles. The total number of execution days is 90, of which 60 days fall within the past year. Last year:

- income under the contract is equal to 2 million rubles (3 million rubles x 60 days / 90 days);

- taxable profit will be 0.5 million rubles (2 – 1.5).

Next year:

- income is 1 million rubles (3 – 2);

- the expense will be 0.7 million rubles (2.2 – 1.5);

- then taxable profit will be equal to 0.3 million rubles (1 – 0.7).

The total taxable profit under the contract will be 0.8 million rubles (0.5 + 0.3).

The second method will require an estimate of direct costs under the contract:

Example 4

Let's add the conditions of example 3. As of December 31, the direct costs required to complete the work next year were estimated at 0.9 million rubles. Last year:

- income calculated based on the share of expenses incurred will be 1.9 million rubles (3 million rubles x 1.5 million rubles / (1.5 million rubles + 0.9 million rubles));

- taxable profit will be equal to 0.4 million rubles (1.9 - 1.5).

Next year:

- income will be 1.1 million rubles (3 – 1.9);

- taxable profit will be equal to 0.4 million rubles (1.1 – 0.7).

The total taxable profit under the contract will be 0.8 million rubles (0.4 + 0.4).

Whatever distribution method you use, the total profit under the contract as a whole will remain unchanged.

Elena Dirkova

, for the magazine “Practical Accounting”

Looking for a solution to your situation?

This article is taken from the closed paid section of the Practical Accounting magazine. “Practical Accounting” is an accounting journal that will simplify your work and help you keep your books without errors. The publication is also available in electronic form. Get full access to all materials >>

If you have a question, ask it here >>

Calculation of corporate income tax

Corporate income tax is calculated in the following form:

Tax payable to the budget = Tax base x Tax rate – Advance payments – Trade tax

The tax base

The income tax base is determined as the difference between income and expenses (profit). If expenses exceed income, the base is recognized as zero. And no tax is paid to the budget.

note

, profit is determined by the cumulative total from the beginning of the year.

Note

: if profits are taxed at different rates, then the tax base is calculated separately for each rate.

If an organization has a loss to be carried forward, it also reduces the tax base.

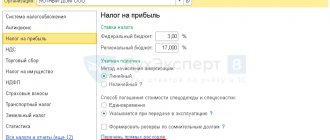

Tax rate

Basic rate – 20%

. The tax paid at this rate is distributed to budgets in the following proportions:

- 3% - to the federal budget.

- 17% goes to the budget of a constituent entity of the Russian Federation.

Special tax rates

| Tax rate | Type of income |

| 30% | Income from the turnover of securities (except for dividend income) recorded in securities accounts in case of violation of the procedure for submitting information to the tax agent |

| 20% | Income of foreign organizations not related to activities through a permanent representative office (except for income specified in clauses 2,3,4 of Article 284 of the Tax Code of the Russian Federation) |

| Income from activities for the extraction of hydrocarbons in relation to organizations that meet the requirements of clause 1 of Art. 275.2 Tax Code of the Russian Federation | |

| 15% | Income in the form of interest on state and municipal securities |

| Income of foreign organizations received in the form of dividends from Russian companies | |

| 13% | Income of Russian organizations in the form of dividends from Russian and foreign companies |

| Income from dividends received on shares, the rights to which are certified by depositary receipts | |

| 10% | Income of foreign organizations not related to activities in the Russian Federation through a permanent establishment, from the use, maintenance or rental of mobile vehicles or containers in connection with international transportation |

| 9% | Income in the form of interest on municipal securities issued for a period of at least three years before January 1, 2007, as well as other income specified in paragraphs. 2 clause 4 art. 284 Tax Code of the Russian Federation |

| 0% | The list of organizations that have the right to apply a zero rate is named in Art. 284 Tax Code of the Russian Federation. |

Advance payments

Advance payments are paid in one of three ways:

- Every quarter with monthly payments.

- Every quarter without paying monthly payments.

- Monthly based on actual profit.

Learn more about the calculation procedure, terms and methods of making advance payments.

An example of calculating income tax at the end of the year

The taxable income of Romashka LLC for 2022 amounted to 35 million rubles.

Expenses included in the reduction of income amounted to 15 million rubles.

The tax base will be 20 million rubles.

(35 million rubles – 15 million rubles)

Bid - 20 %

.

The tax calculated based on the results of 2022 will be equal to 4 million rubles.

(20 million rubles x 20%).

Advance payments paid during the year amounted to 3 million rubles.

The tax payable to the budget will be 1 million rubles.

(4 million rubles – 3 million rubles), of which:

- 30,000 rub. to the federal budget.

- 170,000 rub. to the budget of a constituent entity of the Russian Federation.

Free tax consultation