Balance sheet - what is it?

An accounting balance sheet is a tabular version of the reflection of an organization’s financial indicators as of a certain date.

In the most widespread form in the Russian Federation, the balance sheet consists of two equal parts, one of which shows what the organization has in monetary terms (balance sheet asset), and the other - from what sources it was acquired (balance sheet liability) . This equality is based on the reflection of property and liabilities using a double entry method in accounting accounts. ATTENTION! From 2022, financial statements will be submitted exclusively in electronic form. Paper forms will no longer be accepted. Read more about changes to the rules for presenting financial statements here. We also remind you that in 2022 the reporting forms have been updated.

A balance sheet compiled as of a specific date allows one to assess the current financial condition of an organization, and a comparison of data from balance sheets compiled as of different dates allows one to track changes in its financial condition over time. The balance sheet is one of the main documents that serves as a source of data for conducting an economic analysis of an enterprise's activities.

Having trouble with your balance? On our forum you can consult on any issue. For example, here you can see whether an explanatory note is needed for the financial statements of a small enterprise.

Turnover

Another very important concept for accounting is turnover . Every enterprise has a core business process.

The main business process consists of three stages: procurement, production, sales (sale) .

All commercial enterprises can be divided into three groups. The first group is manufacturing enterprises, i.e. those that produce any product. The second group is enterprises providing services. And the third group is trading enterprises. Although in life there are also commercial enterprises that combine various types of activities, we will not consider them for a better understanding. If you look closely, the activities of each of these types of enterprises contain all three stages of the main business process. Let's make sure of this.

Manufacturing enterprise

At the procurement stage, the enterprise purchases raw materials, semi-finished products or components necessary for the production of its own products. At the production stage, the direct production process takes place, based on the technological process, in order to obtain the finished product. Well, at the last stage the implementation (sale) of finished products occurs. The cycle is closed and everything repeats again.

Service provider

There are a lot of such enterprises and the types of services provided by various enterprises are quite large.

Let’s take a company that provides repair services for something. Here the stages of the main business process are more or less clear. At the procurement stage, the company purchases either raw materials, spare parts, or components. At the production stage, he directly carries out repairs of products. At the implementation stage, the company issues a repaired product to the customer and receives money for the service provided. The cycle is complete. Everything repeats itself again.

Now let’s take a company that provides legal services. This is where the situation gets more interesting. At the procurement stage, such enterprises invest money in the necessary software, in purchasing the necessary literature or journals, and in obtaining licenses to conduct certain legal activities. At the production stage, preparations are underway for certain legal acts. For example, meeting with clients, preparing for trials, direct participation in these processes, preparing the necessary legal documents, various registration activities, consultations, etc. At the implementation stage, the company receives money for services provided. The cycle is complete.

Trade enterprises

Enterprises of this type also have all three stages of the main business process in their activities. At the procurement stage, goods are purchased. At the production stage, pre-sale preparation of this product takes place (packaging, sorting, labeling, testing, etc.). And at the sales stage, this product is traded.

Thus, we see that despite the different types of enterprises, each of them contains all three stages of the main business process, which are cyclical and closed in nature. This cycle of the main business process is called turnover . A very important accounting concept.

All assets that are directly involved in turnover (or in the main business process) are called current assets . Conversely, if the assets are not involved in the main business process, they are called non-current assets.

Latest balance changes

From 06/01/2019, the balance sheet form is valid as amended by Order of the Ministry of Finance dated 04/19/2019 No. 61n. The key changes in it (as well as in other financial statements) were as follows:

- reporting can only be prepared in thousand rubles, millions can no longer be used as a unit of measurement;

- OKVED in the header has been replaced by OKVED 2;

- The balance sheet must contain information about the audit organization (auditor).

The auditor mark should only be given to those companies that are subject to mandatory audit. Tax authorities will use it both to impose a fine on the organization itself if it ignored the obligation to undergo an audit, and in order to know from which auditor they can request information on the organization in accordance with Art. 93 Tax Code of the Russian Federation.

More significant changes in 2022 occurred in Form 2. Read more about them here.

Classification of balance sheets

There are many types of balance sheets. Their diversity is determined by a variety of reasons: the nature of the data on the basis of which the balance is formed, the time of its compilation, purpose, method of reflecting the data and a number of other factors.

According to the way the data is reflected, the balance sheet can be:

- static (balance) - compiled for a specific date;

- dynamic (revolving) - compiled by turnover for a certain period.

In relation to the moment of compilation, balances are distinguished:

- introductory - at the beginning of activity;

- current - compiled as of the reporting date;

- liquidation - upon liquidation of an organization;

- sanitized - when rehabilitating an organization approaching bankruptcy;

- dividing - when dividing an organization into several companies;

- unifying - when organizations merge into one.

Based on the volume of data on organizations reflected in the balance sheet, balance sheets are distinguished:

- single - one organization at a time;

- consolidated - based on the sum of data from several organizations;

- consolidated - for several interrelated organizations, internal turnover between which is excluded when preparing reports.

According to its purpose, the balance sheet can be:

- trial (preliminary);

- final;

- predictive;

- reporting.

Depending on the nature of the source data, there is a balance:

- inventory (compiled based on the results of the inventory);

- book (compiled only according to registration data);

- general (compiled according to accounting data taking into account the results of the inventory).

By way of data reflection:

- gross - including data from regulatory items (depreciation, reserves, markup);

- net - with the exception of these regulatory articles.

Balance sheets may vary depending on the legal form of the company (balance sheets of state, public, joint, private organizations) and the type of its activity (main, auxiliary).

Based on frequency, balances are divided into monthly, quarterly, and annual. They can have either full or abbreviated form.

The balance sheet table can be of 2 types:

- horizontal - when the balance sheet currency is defined as the sum of its assets, and the sum of assets is equal to the sum of capital and liabilities;

- vertical - when the balance sheet currency is equal to the value of the organization's net assets (i.e., the amount of capital), and the net assets, in turn, are equal to the assets of the enterprise minus its liabilities.

For internal purposes, the organization itself has the right to choose the frequency, methods and methods of preparing the balance sheet. Reports submitted to the Federal Tax Service must have a certain form with comparable data as of the dates indicated in the balance sheet.

For information on how to draw up a balance sheet for a small business, read the article “Balance Sheet for Small Businesses (Features)” .

Structure of the enterprise's balance sheet

The balance sheet form used for official reporting in the Russian Federation is a table divided into two parts: the asset and liability of the balance sheet. The total amounts of assets and liabilities of the balance sheet must be equal.

A balance sheet asset is a reflection of the property and liabilities that are under the control of the enterprise, are used in its financial and economic activities and can bring it benefits in the future. The asset is divided into 2 sections:

- non-current assets (this section reflects property used by the organization for a long time, the cost of which, as a rule, is taken into account in the financial result in parts);

- current assets, data on the availability of which are in constant dynamics, accounting for their value in the financial result, as a rule, is carried out one-time.

Read more about them in the material “Current assets on the balance sheet are...” .

The balance sheet liability characterizes the sources of those funds from which the balance sheet asset is formed. It consists of three sections:

- capital and reserves, which reflect the organization’s own funds (its net assets);

- long-term liabilities, which characterize the debt of an enterprise that has existed for a long time;

- short-term liabilities showing an actively changing part of the organization's debt.

To learn about which entries are used when reflecting equity capital in accounting, read the article “Procedure for accounting for an organization’s equity capital (nuances).”

Business transactions

The time has come to understand business operations and their essence.

A business transaction is an event in the activities of an enterprise that leads to either a change in the balance sheet or a change in the structure of the balance sheet. Such transactions are reflected in accounting using the double entry principle. And an event of an enterprise that does not in any way affect the state of the balance sheet and its structure is also called a business transaction. But this event is reflected in accounting on a single entry basis.

It's not clear yet. Let's figure it out. Let's deal with the event first. The company purchased goods. Purchasing a product is an event. Have the company's assets increased? Naturally, an additional asset appeared - goods. And since there can never be more assets than liabilities, liabilities have increased accordingly. accounts payable acted as a liability . What happened? Overall the balance has increased. And since the balance has increased, therefore, this event can be called, by definition, a business transaction . Those business transactions that lead to an increase in the balance are conditionally classified as group I of business transactions.

Now the situation is different. A trading company writes off a consignment of goods from a warehouse. It doesn't matter for what reason. Writing off a batch of goods from a warehouse is also an event. What happens? At the moment the goods are written off from the warehouse, the amount of assets decreases, and, consequently, the amount of liabilities decreases. the income acts as a liability . The balance overall decreases. And if the balance has changed, therefore, writing off a consignment of goods can, by definition, be called a business transaction. Those business transactions that lead to a decrease in the balance are conditionally classified as group II of business transactions.

The following situation. The company withdrew cash from the current account and placed it in the cash register. What happened? Cash withdrawal is an event in the activities of the enterprise. Did this event somehow change the balance? There is no balance itself. The amount of assets has not changed, the amount of cash remains the same. What has changed? Non-cash funds have turned into cash. In other words, the structure of assets has changed. By definition, this event is also a business transaction. And those business transactions that lead to a change in the structure of assets are conventionally classified as group III of business transactions.

Another example. The company replenished the reserve fund from retained earnings. Retained earnings and the reserve fund are the liabilities of the enterprise. The redistribution of the volumes of these liabilities did not in any way affect the value of assets, only the structure of liabilities changed. The amount of retained earnings decreased and the amount of the reserve fund increased. Those. there is a business transaction. This type of operations, which lead to a change in the structure of liabilities, is conventionally classified as group IV of business operations.

Every day, in the course of the activities of each enterprise, dozens, or even hundreds and thousands of business transactions occur. Depending on which group each business transaction belongs to, it affects the balance sheet in its own way. Business transactions of the first group increase the balance. Business transactions of the second group reduce the balance. Business transactions of the third group redistribute assets, and business transactions of the fourth group redistribute liabilities. If you imagine the many business transactions taking place at an enterprise and how they affect the balance sheet, you get the feeling that the balance sheet is breathing.

This point is very important from the point of view of understanding the essence of accounting. The bottom line is that accounting deals with the accounting of business transactions of an enterprise, each of which affects either the state of the balance sheet or its structure.

Now, for a more complete understanding of this issue, it is necessary to note that there are business transactions that do not in any way affect the state of the balance sheet, or the state of assets, or the state of liabilities. For example, taking someone else's property for safekeeping. The company took a batch of raw materials for safekeeping. What happened? From an accounting point of view, only that someone else’s property has appeared at the enterprise. This business transaction did not in any way affect the size and structure of the balance sheet.

So we figured out what a business operation is. Now let's figure out how to reflect a business transaction in accounting. But first, let’s figure out what an accounting account is.

Contents of sections of the balance sheet

The allocation of sections in the structure of the balance sheet is mainly due to the temporary factor.

Thus, the balance sheet asset is divided into 2 sections depending on the time of use of the assets in the organization’s activities:

- non-current assets are used for more than 12 months;

- current assets contain data on indicators that will change significantly over the next 12 months.

When separating sections in the liabilities side of the balance sheet, in addition to the time factor, the ownership of the funds from which the balance sheet asset is formed (equity capital or borrowed funds) plays a role. Taking into account these 2 factors, the liability is formed from 3 sections:

- capital and reserves, where the organization’s own funds are divided into an almost constant part (authorized capital) and a variable part, depending both on the adopted accounting policy (revaluation, reserve capital) and on the monthly changing financial results of activities;

- long-term liabilities - accounts payable that will exist for more than 12 months after the reporting date;

- short-term liabilities - accounts payable, significant changes in which will occur within the next 12 months.

Read more about non-current assets in the material “What are non-current assets in accounting?”.

Example

| Period | Revenue | Net profit | Return on sales |

| 2018 | 20000 | 384 | 1,9% |

| 2019 | 28000 | 456 | 1,6% |

| Period | Assets | Net profit | Return on assets |

| 2018 | 4605 | 384 | 8,3% |

| 2019 | 4555 | 456 | 10,0% |

The tables show that, although absolute profit has increased, the percentage of return on sales has decreased slightly. Company management needs to pay attention to the cost structure.

But the return on assets has increased significantly, i.e. The efficiency of using the company's resources as a whole is growing.

- Capital structure. It is characterized by the autonomy coefficient - the ratio of equity capital to assets.

KA = SK / A

In the simplified balance sheet structure, equity is line 1300 “Capital and reserves”. Assets are the result of the balance sheet, i.e. line value 1600.

Sometimes in the economic literature you can find an indication that the normative value of CA should not be lower than 0.5. Those. business owners must finance the company with at least half of their own funds.

However, this approach in many cases resembles measuring the “average temperature in a hospital.” Much depends on the specifics of the business, primarily on the field of activity.

If we are talking about a trading company, then KA may be lower, reaching 0.3. Such companies often rent premises and equipment, and take the goods for sale.

For complex high-tech industries the situation will be the opposite. The owners of such companies usually try to acquire ownership of equipment and production premises. Indeed, in such a situation, any problems with landlords and the need to move can paralyze the business for a long time.

But in any case, the CA should not be overestimated - up to 0.7 - 0.8 or more. This, of course, increases financial stability, but deprives the company of potential income from the use of borrowed funds.

The concept and meaning of balance sheet items

Sections of the balance sheet are detailed by breaking them down into items. The itemized details recommended for submission to the Federal Tax Service Inspectorate are contained in balance sheet forms approved by Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n (as amended on April 9, 20149) in 2 versions:

- complete (Appendix 1);

- abbreviated (Appendix 5).

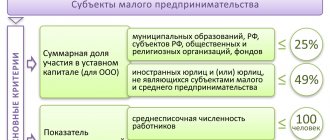

The abbreviated (simplified) form of the balance sheet allows for the combination of its articles in order to obtain aggregated indicators and simplify reporting. However, its use is available only to persons entitled to conduct simplified accounting (SMEs, NPOs, participants in the Skolkovo project).

The breakdown of sections into articles is due to the need to highlight the main types of property and liabilities that form the corresponding sections of the balance sheet.

The form of a complete balance sheet recommended by the Ministry of Finance of Russia assumes the following breakdown of sections by item:

- fixed assets:

- intangible assets;

- research and development results;

- Intangible search assets;

- tangible prospecting assets;

- fixed assets;

- profitable investments in material assets;

- financial investments;

- Deferred tax assets;

- Other noncurrent assets;

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- Other current assets;

- authorized capital (share capital, authorized capital, contributions of partners);

- own shares purchased from shareholders;

- revaluation of non-current assets;

- additional capital (without revaluation);

- Reserve capital;

- retained earnings (uncovered loss);

Find out how to calculate gross profit here .

- long term duties:

- borrowed funds;

- deferred tax liabilities;

- estimated liabilities;

- other obligations;

- borrowed funds;

- accounts payable;

- revenue of the future periods;

- estimated liabilities;

- other obligations.

When drawing up a balance sheet, an organization can use the item-by-item detailing recommended by the Russian Ministry of Finance. However, it has the right to use its own development of this breakdown if it believes that this will lead to greater reliability of reporting. In addition, if there is no data to fill out the relevant items, the company has the right to exclude such items from the balance sheet it compiles.

Look at a sample balance sheet prepared by ConsultantPlus experts. Get trial access to the system and proceed to the material. It's free.

Assets and liabilities

Assets are everything a business owns. Ownership of something implies ownership, in this case ownership of the property of a business. Those. in other words, assets are the property of an enterprise. Each unit of accounting for this property has a certain value. The value at which property (assets) is accounted for is called book value. This is more or less clear. The enterprise acquired assets, i.e. became the owner and assigned a book value to each asset. Why did you appoint it? In most cases, the value of an asset is determined by the cost of acquiring it or creating it, for example, building something. But in some cases, when there are no costs for the acquisition or creation of an asset, the accounting value is assigned in accordance with the Legislation based on the average market price for a similar asset. Thus, each asset has its own book value.

Now let's clarify what a passive . Since each asset has its own value, it can be acquired from some sources of funds. I will give examples.

A new enterprise is formed. To start its activities, a certain amount of money or certain equipment is required. A new enterprise must have founders (founders) of this enterprise. Let's say there are three of them. And let’s say that they decided to make a contribution of 100,000 rubles to the start of the enterprise. The first one said that he has a woodworking machine worth 100,000 rubles, and that he is making this machine as a contribution to the common cause. The second said that he had 100,000 in cash and that he was depositing this money into the cash register of the enterprise. The third said that he had this money in his current account, and he was an active individual entrepreneur, and he would transfer it to the current account of the new enterprise.

After each of them fulfilled the terms of the agreement, what happened in the enterprise’s activities? Here's what. The enterprise acquired assets with a total value of 300,000 rubles.

Of these, a woodworking machine as a fixed asset worth 100,000 rubles. How did this asset appear in the enterprise? From what source of funds? After all, the new enterprise has nothing yet. And this asset appeared at the expense of the authorized capital of the enterprise. Why is capital called authorized capital? Yes, because when creating a new enterprise, the Charter is written, which spells out the ownership of the enterprise, founders (founders), direction of activity, etc. Including the amount of starting capital. This is the starting capital due to the fact that its amount is necessarily indicated in the Charter of the enterprise and is called authorized capital .

The second asset that appeared at the enterprise is cash . And this asset appeared at the expense of the same source - the authorized capital. And you probably already guessed that the third asset, non-cash funds , also appeared at the expense of the authorized capital. In this example, the authorized capital acts as a source of formation of the enterprise’s property. So, all sources of formation of property (assets) of an enterprise are called liabilities .

Now let's try to understand why assets and why liabilities? The property of an enterprise is called assets because it directly participates in the activities of any enterprise. And liabilities follow changes in assets in the enterprise, indicating the source through which these assets appeared in the enterprise.

Composition of balance sheet items

Balance sheet items are filled out based on data on balances in accounting accounts as of the reporting date. When filling out a report for submission to the Federal Tax Service, you must be guided by a number of rules established for the preparation of such reports (PBU 4/99, approved by order of the Ministry of Finance of Russia dated July 6, 1999 No. 43n):

- The initial accounting data must be reliable, complete, neutral and formed in accordance with the rules of the current PBU. When reflecting them, it is necessary to comply with the principles of materiality and comparability with the results of previous periods.

- In the current report, data from previous periods must be consistent with the figures in the final accounts for those periods.

- For the annual balance sheet, the presence of property and liabilities must be confirmed by the results of their inventory.

- Debit and credit balances in the balance sheet are not collapsed.

- Fixed assets and intangible assets are shown at residual value.

- Assets are reflected at their book value (less created reserves and mark-ups).

You can see a detailed line-by-line algorithm for filling out the balance sheet in the Guide to Accounting Reports from ConsultantPlus, having received free access to the system.

And below is information about on the basis of the balances of which accounts the above balance sheet items are filled in in relation to the current version of the chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n:

- Under the article “Intangible assets”, the residual value of intangible assets is indicated, corresponding to the difference in the balances of accounting accounts 04 and 05. At the same time, for account 04, data falling in the line “Results of research and development” is not taken into account, and for account 05 - figures related to intangible search assets.

- The article “Results of research and development” is filled in if there is data on R&D costs in account 04.

- Data on the items “Intangible exploration assets” and “Tangible exploration assets” are important only for those organizations that develop natural resources if they have information on account 08 to fill out lines for these items. Tangible exploration assets include tangible objects, and intangible assets include all others. Both types of assets are subject to depreciation, recorded in accounts 02 and 05, respectively.

- For the item “Fixed Assets”, data on the residual value of fixed assets (the difference in the balances of accounting accounts 01 and 02, while account 02 does not take into account data related to material exploration assets and profitable investments in assets) and capital investment costs (account 08, excluding the figures included in the lines of the articles “Intangible search assets” and “Tangible search assets”).

- Data for the article “Profitable investments in assets” is taken as the difference between the balances of accounts 03 and 02 in relation to the same objects.

- The item “Financial investments” in non-current assets is filled in if there are amounts with a repayment period of more than 12 months in accounts 55 (deposits), 58 (financial investments), 73 (loans to employees). The balance of account 58 is reduced by the amount of the created reserve (account 59) related to long-term investments.

- Under the article “Deferred tax assets”, organizations applying PBU 18/02 indicate the balance of account 09.

- When the line item “Other non-current assets” is used, the balance sheet reflects assets that are either not included in the above lines, or those that the organization considers necessary to highlight.

- The figure for the item “Inventories” is formed as the sum of the balances on accounts 10, 11 (minus the reserve recorded on account 14), 15, 16, 20, 21, 23, 28, 29, 41 (minus account 42, if accounting for goods carried out with a markup), 43, 44, 45, 46, 97.

- The item “VAT on purchased valuables” reflects the balance of account 19.

- To obtain the data indicated under the “Accounts receivable” item, debit balances on accounts 60, 62 (both accounts minus the reserves formed on account 63), 66, 67, 68, 69, 70, 71, 73 (minus data , recorded under the article “Financial investments”), 75, 76.

- The article “Financial investments (except for cash equivalents)” in current assets shows data on accounts 55 (deposits), 58 (financial investments), 73 (loans to employees) with repayment periods of less than 12 months. In this case, the figures in account 58 are reduced by the amount of the created reserve (account 59) for short-term investments.

- The data for the item “Cash and cash equivalents” is obtained by adding the balances of accounts 50, 51, 52, 55 (excluding deposits), 57.

- The line of the article “Other current assets” includes assets that are either for some reason not reflected in the above lines, or those that the organization considers necessary to highlight. For example, this could be a bad debt from a counterparty or the value of stolen property for which investigative actions have not yet been completed. Reflection of such data on this line with a corresponding reduction in figures for those items in which they could have been reflected if there had not been a decision by the organization to allocate them, will require notes both to the article “Other current assets” and to the second article, which will be affected such an operation.

- The data for the article “Authorized capital (share capital, authorized capital, contributions of partners)” is taken as the balance of account 80.

- The figures in the article “Own shares purchased from shareholders” correspond to the balances of account 81.

- For the article “Revaluation of non-current assets”, data on balances on account 83 related to fixed assets and intangible assets is used.

- Data for the item “Additional capital (without revaluation)” is formed as balances on account 83 minus data on the revaluation of fixed assets and intangible assets.

- The item “Reserve capital” shows the balance of account 82.

- The value reflected under the item “Retained earnings (uncovered loss)” in the annual balance sheet is the balance of account 84. For interim reporting (before the balance sheet reformation carried out at the end of the year), this figure is the sum of two balances: for account 84 (financial the result of previous years) and 99 (financial result of the current period of the reporting year). The item “Retained earnings (uncovered loss)” is the only balance sheet item that can have a negative value. At the same time, it is important that for an organization that has a loss, the total of the “Capital and Reserves” section (net assets) does not turn out to be less than the amount of the authorized capital. If this circumstance occurs for two financial years in a row, then the organization must either reduce its authorized capital to the appropriate figure (and this is not always possible, since the authorized capital cannot be less than the minimum value established by current legislation), or it is subject to liquidation.

ATTENTION! With the reporting campaign for 2022, changes to PBU 18/02, 16/02, 13/2000, FSBU 5/2019 “Reserves” come into effect. And starting with reporting for 2022, the new FSBU 25/2018 “Lease Accounting”, FSBU 6/2020 “Fixed Assets”, FSBU 26/2020 “Capital Investments” should be applied. You can start applying new accounting standards earlier. This decision needs to be fixed in the accounting policy of the enterprise.

Read more about the reformation of the balance sheet in the article “How and when to reform the balance sheet?” .

- The article “Borrowed funds” in the “Long-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which exceeds 12 months (account balance 67). In this case, interest on long-term borrowed funds must be taken into account as part of short-term accounts payable.

- Under the article “Deferred tax liabilities”, organizations applying PBU 18/02 indicate the balance of account 77.

- The value under the item “Estimated liabilities” in the section “Long-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in relation to those reserves whose useful life exceeds 12 months.

- The item “Other liabilities” in the section “Long-term liabilities” shows liabilities with a maturity of more than 12 months that are not included in other lines of long-term liabilities.

- The article “Borrowed funds” in the “Short-term liabilities” section is filled in if there is debt on loans and borrowings, the repayment period of which is less than 12 months (account balance 66). At the same time, this includes interest on long-term borrowed funds, recorded in account 67, and debt on long-term loans and borrowings, recorded in account 67, if there are less than 12 months left until its repayment.

- The data for the “Accounts payable” item is formed as the sum of credit balances for accounts 60, 62, 68, 69, 70, 71, 73, 75, 76.

- For the item “Deferred income” the value is taken as the sum of balances on accounts 86 (target financing) and 98 (deferred income).

- The value under the item “Estimated liabilities” in the section “Short-term liabilities” corresponds to the balance in account 96 (reserves for future expenses) in terms of those reserves whose useful life is less than 12 months.

- Under the item “Other liabilities” in the section “Short-term liabilities”, liabilities with a maturity of less than 12 months are shown that are not included in other lines of short-term liabilities.

Read about one of the most frequently created short-term reserves in the material “Creating a reserve for vacation pay in accounting.”

Synthetic and analytical accounting

Synthetic accounting is generalized accounting. Any account reflects generalized information on a particular asset or liability. Well, for example, account “51” “Current accounts” reflects the state of the enterprise’s non-cash funds. In other words, we will have information about how much non-cash money is in the enterprise. What if a company has several accounts in different banks? And do you need to know how much money is in each of these accounts? In this case, analytical accounting .

Analytics serves to personalize the accounting of this or that asset or this or that liability.

Previously, when accounting was carried out on paper, group statements were used to maintain analytical accounting, which reflected transactions specifically for each object of analytical accounting. In our example, the object of analytical accounting is the specific current accounts of the enterprise.

With the advent of computer technology and the transfer of accounting to digital media using special accounting programs, for example the 1C Accounting program, a special object called subconto is used to maintain analytical accounting. Subconto is linked as necessary to one of the accounts. There may be several of them. As a rule, from one to five subcontos are used. In the process of creating accounting entries by the user, these sub-accounts are associated with specific values of analytical accounting objects. In our example, this is a specific current account. And when reflecting transactions on specific current accounts, the information is recorded as the value of a certain sub-account. Subsequently, an accountant can always easily obtain information about how much money is in each specific current account. I will not go into detail about the mechanism for linking a subaccount to an account; this is not the scope of this article.

In addition, maintaining analytical accounting is possible by opening second-level accounting accounts. They are called subaccounts. The number of subaccounts is not limited by current legislation. Their chief accountant opens exactly as much as is necessary to organize analytical accounting. All lower-level subaccounts are subordinate to the account within which they were created. This account is also called the parent account. Sub-accounts can be not only active, but also passive, regardless of the type of parent account. The balance on the parent account will be equal to the total balance on each sub-account. But if the parent account is active, then the balance on the parent account simply must be debit, and vice versa, on the passive account the balance must be credit. This is also an axiom. Each sub-account can also additionally organize analytical accounting using sub-account analytical accounting objects.

At the end of the story about accounting accounts, we need to talk about one more group of accounting accounts. It was said above that there are business transactions that do not in any way affect the balance sheet of the enterprise (example with safekeeping). This is the state of the assets and liabilities of the enterprise, which in their accounting sense cannot be included in the balance sheet of the enterprise, is reflected in off-balance sheet accounts. The status of assets and liabilities that relate to the balance sheet is reflected in the balance sheet accounts.

Why are accounting accounts needed? Well, firstly, we already know that the accounts reflect the state of the assets and liabilities of the enterprise. And secondly, accounts are needed to record business transactions using accounting entries .

A formalized record of a business transaction is called an accounting entry.

An accounting entry links the parties to two accounts. This is the essence of the double entry principle. The connection of two accounts using an accounting entry is called correspondence. And the related accounts are correspondent ones.

However, transactions in off-balance sheet accounts are reflected on a single entry basis. One entry is made only for debit or one entry only for credit of the off-balance sheet account.

Accounting entries

Above I have already given the definition of an accounting entry. Now let's look at how and where postings are recorded. But first we need to talk about the accounting entry details. These details are:

- Posting date or period

- Debit account

- Debit sub account 1

- Subconto debit 2

- ….

- Credit account

- Loan subconto 1

- Subconto loan 2

- …

- Quantity (if the posting uses an account with the “quantitative” attribute

- Currency (if the transaction uses an account with the “currency” attribute

- Sum

- Posting Contents

An accounting entry can be briefly written down on paper. Moreover, the accounting entry begins from the debit account. This is also an axiom. Debit on the left, credit on the right. An example of a wiring record is given below.

01/14/2017 Dt 71 [Gusev V.N.] Kt 50 [Central Cash Office] 1000, issued for reporting

This posting states that employee V.N. Gusev 1000 rubles were issued from the central cash register for reporting on January 14, 2017.

In addition, entries can be entered into a database using a computer accounting program. What types of wiring are there? Wiring can be simple or complex . If a business transaction can be described by one entry, then it is called simple. If two or more entries are required to describe a business transaction, and if the debit or credit accounts in such entries are the same, then such an entry is called complex.

An example of complex wiring is shown in the table below:

| Period | Account Dt | Subconto Dt | Kt account | Subconto Kt | Amount/Content |

| 01.03.17 | 26 | Delivery by road | 60.01 | Autoservice LLC | 6200 |

| Contract for services | Delivery services by road transport | ||||

| 01.03.17 | 19.03 | VAT on purchased services | 60.01 | Autoservice LLC | 1116 |

| Contract for services | VAT allocated on purchased services |

Other non-current assets - what are they on the balance sheet?

“Other non-current assets” - in the balance sheet, these are, as already mentioned, non-current assets that are not reflected in other lines of Section 1 “Non-current assets”.

Other non-current assets of the organization may include, for example:

- investments in non-current assets of the organization, accounted for in the corresponding subaccounts of account 08 “Investments in non-current assets”, in particular, the organization’s costs for objects that will subsequently be taken into account as intangible assets or fixed assets, as well as costs associated with the implementation of incomplete R&D, if the organization does not reflect these indicators;

- equipment for installation (equipment requiring installation), as well as related transportation and procurement costs, reflected in accounts 15 and 16;

- a one-time lump sum payment, provided that the period for writing off these expenses exceeds 12 months after the reporting date or the duration of the operating cycle, if it exceeds 12 months;

- the amount of transferred advances and advance payment for work and services related to the construction of fixed assets.

Read about the rules for accounting for investments in non-current assets in the article “Rules for accounting for investments in non-current assets”.

Example

DZ2018 = (1300 + 1500) / 2 = 1400 thousand rubles.

DZ2019 = (1500 + 1400) / 2 = 1450 thousand rubles.

KZ2018 = (1900 + 260 + 1820 + 216) / 2 = 2098 thousand rubles.

KZ2019 = (1820 + 216 + 1580 + 40) / 2 = 1828 thousand rubles.

Accounts receivable is growing, but only slightly (1450 / 1400 - 1400 = 4%). This is much lower than the revenue growth rate (40%). In addition, it is significantly lower than accounts payable. This indicates that the company's debt management system is working effectively (provided that accounts payable are repaid without delay).

Cash (p. 1250) is a very fast-moving metric. Many companies almost completely spend all the money they receive, so the figure for this item may be small. But if an organization pays its obligations on time, then the minimum account balance at the end of the period does not indicate problems with the company’s finances.

Current liabilities in the balance sheet are line 1500 of the balance sheet

Often, accountants, when filling out tables characterizing the financial condition of an organization, encounter difficulties when it is necessary to indicate current liabilities, because this concept is absent in regulatory documents on accounting and taxation.

To determine where current liabilities are reflected on the balance sheet, let us turn to the meaning of this term. The Financial Dictionary defines current liabilities as accounts payable due within the next 12 months. In other words, current liabilities are synonymous with current liabilities. Short-term liabilities are reflected in section V of the liability side of the balance sheet. Thus, current liabilities in the balance sheet are line 1500 “Total for Section V”, which is defined as the sum of lines 1510, 1520, 1540, 1550, 1530 of the balance sheet liabilities.

Find out when the balance sheet is submitted (deadlines, nuances) here .

Results

The balance sheet is the main component of financial statements, a summary of the financial performance of an organization as of a certain date. It is drawn up in a certain form and according to certain rules. It is submitted to the tax office and also presented to other interested users. Starting from June 1, 2022, you must use the form as amended on April 19, 2019.

Sources:

- Order of the Ministry of Finance of Russia dated April 19, 2019 N 61n

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.