Possible VAT recovery situations

The list of cases when tax restoration is required is contained in paragraph 3 of Art. 170 Tax Code of the Russian Federation. So, you must restore VAT if:

- switched to tax exemption under Art. 145 Tax Code of the Russian Federation;

- switched to special modes of the simplified tax system, UTII, PSN - completely for all activities or in part (you combine the special mode with OSNO);

- carry out VAT-free transactions - exempt from tax under Art. 149 of the Tax Code of the Russian Federation, which do not form an object of VAT taxation (clause 2 of Article 146 of the Tax Code of the Russian Federation), or with a place of implementation outside the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation);

- received goods, works, services for which an advance was previously transferred, VAT on which was deducted;

- received a refund of the advance if the contract was terminated or its terms were changed;

- received an adjustment invoice to reduce the cost of previously purchased GWS;

- transferred property as a contribution to the charter, etc. capital;

- received budget investments or a subsidy to compensate for the costs of purchasing goods and equipment, fixed assets, intangible assets and property rights, as well as to reimburse the costs of paying tax when importing goods;

- do not keep separate records of costs provided for in clause 2.1 of Art. 170 Tax Code of the Russian Federation;

- you are the legal successor of the reorganized organization - in the cases specified in clause 3.1 of Art. 170 Tax Code of the Russian Federation.

This list is considered closed. However, there are a number of situations that are not named in it, but in which officials also demand that VAT be restored. For example, when writing off defective goods, shortages, disposal of fixed assets, etc. There is no need to blindly follow these explanations. First, look at the recommendations and arguments of ConsultantPlus experts. They will help you save money. You can get trial access to K+ for free.

Commentary to Art. 170 Tax Code of the Russian Federation

According to the general rule, tax amounts presented to the taxpayer upon the acquisition of goods (work, services), property rights, or actually paid by him when importing goods into the customs territory of the Russian Federation, unless otherwise established by the provisions of Chapter 21 of the Tax Code of the Russian Federation, are not included in expenses accepted for deduction. when calculating corporate income tax (personal income tax).

At the same time, paragraph 2 of Article 170 of the Tax Code of the Russian Federation provides for exceptions, i.e. cases are indicated in which tax amounts presented to the buyer when purchasing goods (work, services), including fixed assets and intangible assets, or actually paid when importing goods, including fixed assets and intangible assets, into the territory of the Russian Federation are taken into account in the cost of such goods (works, services), including fixed assets and intangible assets.

According to letters of the Ministry of Finance of Russia dated 08/11/2004 N 03-1-08/1780/15 and dated 07/30/2004 N 03-1-08/1711/ [email protected] paid by the taxpayer and accepted for deduction in accordance with Articles 171 and 172 of the Tax Code RF VAT on fixed assets acquired to carry out taxable transactions, in the event of disposal due to the transfer of this property as a founder to the authorized capital of the company, is subject to restoration and payment to the budget in the share of the under-depreciated part, since these fixed assets cease to participate in the implementation of operations recognized as objects taxation.

This point of view is also stated in letters of the Office of the Federal Tax Service of Russia for Moscow dated May 14, 2005 N 20-12/34502, dated 02/02/2005 N 19-08/55223.

The Presidium of the Supreme Arbitration Court of the Russian Federation in decision dated June 15, 2004 N 4052/04 noted that the Tax Code of the Russian Federation does not establish the taxpayer’s obligation to restore the amount of value added tax in the declaration and pay them to the budget in relation to property previously acquired for carrying out transactions subject to value added tax , and subsequently transferred as contributions to the authorized capital of newly formed legal entities.

According to the letter of the Ministry of Finance of Russia dated March 22, 2004 N 04-05-12/14, the amounts of VAT paid on fixed assets acquired by an organization before the transition to UTII and used after such a transition are subject to restoration if such a transition occurred before 01/01/2006. At the same time, the amount of VAT subject to recovery on under-depreciated fixed assets used in operations, both subject to VAT and not subject to this tax, in the part of activities transferred to the payment of UTII, is calculated on the basis of the proportion specified in paragraph 4 of Article 170 of the Tax Code of the Russian Federation with taking into account the residual value of such fixed assets, formed according to accounting data at the time of the organization’s transition to paying UTII.

According to letters of the Ministry of Finance of Russia dated March 23, 2007 N 03-07-11/67, dated December 28, 2005 N 03-11-04/2/163, the amount of VAT on fixed assets acquired before the transition to a simplified taxation system, if such a transition occurred before the entry into force of Federal Law No. 119-FZ of July 22, 2005, which introduced the corresponding changes to paragraph 3 of Article 170 of the Tax Code of the Russian Federation, are also subject to restoration to the budget.

A similar point of view is contained in letters of the Ministry of Taxes of Russia dated 08/11/2004 N 03-1-08/1780/15 and dated 07/30/2004 N 03-1-08/1711/ [email protected] , letters of the Office of the Federal Tax Service of Russia for Moscow dated 04/21/2006 N 18-11/3/ [email protected] , from 03/16/2004 N 21-09/17090, from 08/29/2003 N 21-09/47124.

According to the Ministry of Finance of Russia, set out in letter dated August 14, 2007 N 03-07-15/120, if the perpetrators are not identified, then upon disposal of property due to loss, damage, battle, theft, natural disaster and other similar reasons, tax There is no need to pay for added value. In this case, the tax amounts previously accepted for deduction are restored in the tax period in which the missing property is deregistered.

The Russian Ministry of Finance came to similar conclusions earlier. Thus, in letters dated 07/31/2006 N 03-04-11/132 and 05/06/2006 N 03-03-04/1/421, the Ministry of Finance of Russia explained that since inventory items disposed of as a result of shortages in taxable transactions for value added were not used, the amounts of this tax previously accepted for deduction on such values must be restored.

And in a letter dated November 18, 2005 N 03-04-11/308, the Russian Ministry of Finance explained that the disposal of goods due to theft is not subject to taxation for value added tax. In this regard, amounts of value added tax previously accepted for deduction on goods identified as missing during the inventory of property are subject to restoration.

The Russian Ministry of Finance adhered to a similar position in letter dated September 20, 2004 N 03-04-11/155.

It is precisely this point of view of the Russian Ministry of Finance that is actively used by local tax authorities.

The courts do not share the approach of the tax authorities regarding the need to restore the value added tax in the event of a shortage (damage) and support the taxpayer. One of the arguments substantiating this position by the courts is the fact that, in their opinion, the list of cases the presence of which is necessary for the restoration of value added tax is exhaustive.

Thus, the Federal Antimonopoly Service of the Ural District, in Resolution No. Ф09-4997/07-С3 dated July 3, 2007, considered a situation in which the tax authority assessed additional value added tax as a result of the fact that the taxpayer wrote off from the balance sheet the value of the stolen goods, as well as those that came to the unsuitability of products without restoration and payment to the budget of tax amounts previously accepted for deduction. The court, recognizing the decision of the tax authority as invalid, pointed out that the shortage of goods discovered during the inventory of property, or the theft of goods that took place, are not mentioned in paragraph 3 of Article 170 of the Tax Code of the Russian Federation as grounds for the restoration of value added tax.

It should be noted that the Supreme Arbitration Court of the Russian Federation, by decision of October 23, 2006 N 10652/06, invalidated paragraph 13 of section “For the purpose of applying Article 171 of the Tax Code of the Russian Federation” of the appendix to the letter of the Federal Tax Service of Russia dated October 19, 2005 N MM-6-03 / [email protected] and pointed out that Article 170 of the Tax Code of the Russian Federation does not provide for the restoration of taxation previously accepted for deduction in cases of theft of goods or their shortage discovered during the inventory process. The taxpayer was also supported in Resolutions, for example, FAS of the East Siberian District dated 05/03/2007 N A19-19165/06-F02-2618/07, dated 02/16/2006 N A19-21458/05-20-F02-332/06-S1 , FAS Volga District dated 03/17/2005 N A49-13280/04-398A/11 and dated 09/14/2004 N A57-1124/04-33, FAS Northwestern District dated 03/01/2006 N A26-4963/2005-29, dated 02/09/2006 N A56-9808/2005, dated 01/17/2005 N A05-6493/04-12, FAS of the Ural District dated 07/03/2007 N F09-4997/07-S3, dated 03/06/2006 N F09-509/06 -C7, FAS of the Central District dated 02/16/2006 N A54-2798/2005-C18, dated 04/06/2005 N A48-7767/04-15.

Thus, according to the courts, the Tax Code of the Russian Federation does not provide for the taxpayer’s obligation to restore and pay to the budget amounts previously claimed for deduction in accordance with Articles 171 and 172 of the Tax Code of the Russian Federation for material assets acquired for carrying out taxable transactions and subsequently written off to account 94 “Shortages and losses from damage to valuables.”

However, it should be taken into account that in judicial practice there are decisions in which the courts supported the position of the tax authorities (see, for example, Resolutions of the FAS Moscow District dated 03.03.2005 N KA-A41/839-05, FAS North Caucasus District dated 28.04 .2006 N F08-1521/2006-644A, Federal Antimonopoly Service of the Ural District dated November 12, 2003 N F09-3784/03-AK).

At the law enforcement level, there are also disputes regarding the taxpayer’s obligation to restore the amounts of value added tax previously accepted for deduction on internal turnover (domestic market) at the time of shipment of goods for export.

Paragraph 3 of Article 173 of the Tax Code of the Russian Federation establishes a special procedure for applying tax deductions in relation to operations for the sale of goods specified in paragraph 1 of Article 164 of the Tax Code of the Russian Federation. In particular, these goods are understood as goods exported under the customs export regime, subject to the submission of documents provided for by Article 165 of the Tax Code of the Russian Federation to the tax authorities.

In accordance with paragraph 9 of Article 167 of the Tax Code of the Russian Federation, when selling goods provided for in subparagraphs 1 - 3 and 8 of paragraph 1 of Article 164 of the Tax Code of the Russian Federation, the moment of determining the tax base for these goods (works, services) is the last day of the month in which the full package of documents is collected provided for in Article 165 of the Tax Code of the Russian Federation.

As evidenced by judicial practice, taxpayers consider the arguments of the tax authorities about the need to restore in this situation the amounts of value added tax accepted for deduction to be unfounded with reference to the provisions of paragraph 1 of Article 172 of the Tax Code of the Russian Federation, according to which deductions of tax amounts provided for in Article 171 of the Tax Code of the Russian Federation in relation to operations for the sale of goods specified in paragraph 1 of Article 164 of the Tax Code, are carried out only upon submission to the tax authorities of the relevant documents provided for in Article 165 of the Tax Code of the Russian Federation.

The courts support taxpayers and note that the current tax legislation does not link the restoration of value added tax in the domestic market with the fact of shipment of goods under an export contract. At the same time, the courts recognize as contrary to the current legislation the demands of the tax authorities on the need to restore the value added tax paid to suppliers, previously accepted for deduction, relating to goods shipped for export.

From the meaning of paragraph 1 of Article 164, Article 165, paragraph 3 of Article 172, paragraph 1 of Article 173 of the Tax Code of the Russian Federation, it follows that for tax purposes, an operation to export goods outside the customs territory of the Russian Federation is recognized as export not at the moment of crossing the border, but at the moment of presentation to tax authority for documents provided for in Article 165 of the Tax Code of the Russian Federation. Otherwise, in accordance with paragraph 9 of Article 165 of the Tax Code of the Russian Federation, taxation of this operation is carried out in the general regime for the sale of goods on the domestic market.

Such conclusions are set out in the Resolution of the Federal Antimonopoly Service of the Moscow District dated July 12, 2006 N KA-A41/6325-06.

In practice, there are also disputes regarding the need to restore the amounts of value added tax in a situation where transactions, the implementation of which was previously recognized as an object of taxation, are then not recognized as such an object as a result of changes in legislation.

It should be noted that in the list of cases listed in Article 170 of the Tax Code of the Russian Federation as grounds for the restoration of value added tax amounts, this situation is not mentioned.

The Federal Antimonopoly Service of the North-Western District, in Resolution No. A56-38647/2006 dated July 3, 2007, considered a situation in which the tax authority demanded the restoration of the amount of value added tax on a land plot owned by the taxpayer in connection with its sale. The taxpayer accepted value added tax for deduction in the second quarter of 2004, and from January 1, 2005, operations on the sale of land plots (shares in them) ceased to be recognized as an object of taxation (subclause 6 of clause 2 of Article 146 of the Tax Code of the Russian Federation).

The court explained that the tax authority did not provide evidence of the use of the land plot for operations for the production and sale of goods that are not subject to taxation (exempt from taxation) or are not recognized as sales by virtue of Article 146 of the Tax Code of the Russian Federation. Moreover, the court established and the case materials confirm that the taxpayer leased out the land plot and the buildings located on it, that is, he carried out transactions subject to value added tax.

Taking into account the above, the court came to the conclusion that since the taxpayer had the right to deduct the disputed amount of tax in the second quarter of 2004, and lawfully exercised this right, he, therefore, is not obliged due to the fact that the above transactions are not recognized from 01.01.2005 object of taxation, to restore the amounts of value added tax legally claimed for deduction under the declaration for the second quarter of 2004.

The FAS of the North-Western District has previously come to the conclusion that the specified list established by Article 170 of the Tax Code of the Russian Federation is exhaustive (see, for example, Resolution of the FAS of the North-Western District of July 14, 2005 N A42-5440/04-27). A similar situation was considered by the Federal Antimonopoly Service of the West Siberian District in Resolution No. F04-176/2007 dated February 13, 2007 (31031-A27-31).

It should be noted that such conclusions are consistent with established judicial practice. When interpreting the norm of paragraph 3 of Article 170 of the Tax Code of the Russian Federation, the Presidium of the Supreme Arbitration Court of the Russian Federation, in Resolutions No. 2565/04 and No. 2300/04 of June 22, 2004, came to the conclusion that the restoration of value added tax amounts previously accepted for deduction should be carried out only in cases where tax deductions were unlawfully applied during the period of purchase of goods (works, services).

What is required during restoration?

First of all, it is necessary to establish the amount of the tax to be restored and the list of documents.

There can be no talk of tax restoration:

- if it was not accepted for deduction (letter of the Ministry of Finance of the Russian Federation dated February 16, 2012 No. 03-07-11/47);

- for expenses that, before the recovery situation arises, are already included in the costs related to taxable operations (letter of the Ministry of Finance of the Russian Federation dated October 8, 2015 No. 03-07-11/57730).

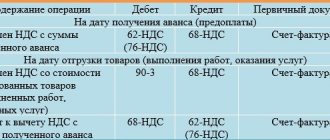

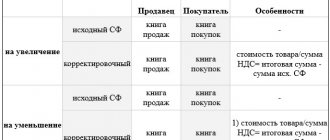

The refundable tax must be entered in the sales ledger. This is done by registering the required amount in it with reference to the data:

- invoice - the main one, on the basis of which the deduction was made at one time, or an adjustment one (clause 14 of section 2 of Appendix 5 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137); instead of an adjustment invoice, the original calculation document may be entered, recording the reduction in value (subclause 4, clause 3, article 170 of the Tax Code of the Russian Federation);

- accounting certificate, if there is no invoice (letter of the Ministry of Finance of the Russian Federation dated 02.08.2011 No. 03-07-11/208).

If the restoration operation is associated with a partial change in the tax conditions, implying their subsequent combination, then in the future you will need:

- organization of separate accounting of costs related to combined taxation conditions (clause 1 of Article 153, clause 4 of Article 170, clause 3 of Article 172 of the Tax Code of the Russian Federation). An exception is possible for situations where the costs of non-taxable activities do not exceed 5% of the total costs (clause 4 of Article 170 of the Tax Code of the Russian Federation);

- regular distribution by calculation of a tax that cannot be directly correlated with a specific activity (clause 1 of article 153, clause 4 and clause 4.1 of article 170 of the Tax Code of the Russian Federation);

- accepting for deductions only that part of the tax that corresponds to the taxable activity (taking into account the discrepancy in the timing of deduction when taxed at different rates), and in relation to the non-taxable part - including it in the cost of acquisitions (clause 4 of Article 170 of the Tax Code of the Russian Federation) or in costs (clauses 5, 7, 9 of Article 171.1 of the Tax Code of the Russian Federation).

For information on how to organize separate accounting, read the article “How is separate accounting for VAT carried out (principles and methods)?”

Write-off of assets: fixed assets, goods, materials

Until 2022, the issue of restoring VAT when writing off fixed assets, goods, and materials remained acute and controversial. But under the pressure of court decisions - most of them taken in favor of business - the regulatory authorities sharply changed their position to the opposite. (Bravo!). And they secured it with letters: Ministry of Finance dated March 2, 2022 No. 03-03-06/1/13389 and Federal Tax Service dated April 16, 2022 No. SD-4-3 / [email protected]

Arbitration practice over the years has clearly confirmed that when fixed assets are liquidated before the end of their useful life due to physical or moral wear and tear, or when goods or materials are written off, there are no grounds for VAT recovery. Since this is not provided for in paragraph 3 of Article 170 of the Tax Code.

The controllers butted heads for a long time, but finally agreed to this: Paragraph 3 of Article 170 of the Tax Code establishes cases in which tax amounts are subject to restoration. In cases not listed in paragraph 3 of Article 170, VAT amounts are not subject to recovery. (Quote from a letter from the Ministry of Finance)

You will not have to recover VAT in the event of an accident, fire, natural disaster or other loss of property due to circumstances beyond the control of the company. And also when the shelf life expires or due to natural loss.

It does not matter on what basis the assets were written off. The main thing is that they were purchased for VAT-taxable activities.

Also catch current letters from the Ministry of Finance of Russia dated May 15, 2022 No. 03-07-11/34572, dated March 15, 2022 No. 03-03-06/1/15834 and the Federal Tax Service dated May 21, 2015 No. GD-4- 3/ [email protected] /.

This is the general case, but the specifics may be different.

In the recent ruling of the Supreme Court dated December 21, 2022 No. 306-KG18-13567, a special clause was noted that the company does not lose the right to deduct VAT if the inability to use fixed assets is due to the occurrence of unfavorable events, and not the taxpayer’s refusal to conduct business.

For example, if fixed assets were liquidated voluntarily - for example, in connection with the cessation of any type of activity, or in connection with the liquidation of a company - the tax office may require VAT restoration.

Restoration with a complete change in tax conditions

Here we will talk about the following situations:

- exemption under Art. 145 and 145.1 of the Tax Code of the Russian Federation;

- full transition to a special regime - simplified tax system, UTII or PSN;

Read our article about VAT restoration when switching to the simplified tax system.

- transition to conducting only non-taxable activities (exempt from tax, not recognized as an object of taxation or carried out outside the Russian Federation).

The period intended for restoration may vary:

- in the quarter preceding the start of work under new conditions, restoration is done in the event of a transition to a special regime, upon release under Art. 145 (if applied from the beginning of the quarter) and Art. 145.1 Tax Code of the Russian Federation;

- in the quarter of commencement of work under new conditions, restoration is carried out upon transition to non-taxable operations and upon exemption under Art. 145 of the Tax Code of the Russian Federation, if the exemption does not begin to apply from the first month of the quarter.

Recovery in all these situations will occur in the same order:

- restore in full the entire tax related to those expenses that will form costs already under the new taxation system;

- the amount of tax related to fixed assets and intangible assets is calculated in proportion to their residual value (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation);

An example of calculating VAT for recovery under OS when switching to the simplified tax system from ConsultantPlus An organization that uses OSN purchased a grinding machine. Its initial cost was 543,000 rubles. (without VAT). VAT in the amount of 108,600 rubles was declared deductible. The organization decided to switch to the simplified tax system starting next year. The residual value of the machine at the end of the current year is RUB 371,050. You can view the entire example in K+ by getting free trial access to the system.

- They use special restoration rules for real estate (Article 171.1 of the Tax Code of the Russian Federation), which at the date of transition to the new regime is depreciated at partial cost or has been used by the payer for less than 15 years.

Real estate should also include the costs of construction and installation works and the acquisition of vessels (sea, river and air). The restoration of such VAT is done at 1/10 of its total amount related to the object for 10 years, counted from the year of depreciation (clause 4 of Article 171.1 of the Tax Code of the Russian Federation). The full amount of tax is formed not only by the VAT of suppliers, but also by the tax applied for deduction for construction and installation work carried out on a business basis. If the use of an object in a non-taxable activity began later than the year in which depreciation began, then the actual recovery period will be less than 10 years. The estimated amount must be restored in the last quarter of each year. In the case of reconstruction, the amount of the restored tax and the restoration period are adjusted taking into account the features contained in clauses 6 and 8 of Art. 171.1 Tax Code of the Russian Federation.

The restored amount is taken into account as an expense in the calculation of income tax or simplified tax system (Subclause 2, Clause 3, Article 170, Clause 5, Clause 7, Clause 9, Article 171.1 of the Tax Code of the Russian Federation). Current VAT, received already in the process of applying the new regime, is included in the cost of acquisitions (clause 4 of article 170 of the Tax Code of the Russian Federation).

Restoration in case of partial change in tax conditions

It occurs in the following cases:

- partial transition to a special regime (i.e. combining OSNO with UTII or PSN);

- transition to combining taxable and non-taxable activities.

In this case, restoration is done during the period when the combination begins (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation).

The recovery principle will be as follows:

- The tax related to direct expenses, which in the future will form the costs of activities with a preferential tax regime, is restored in full. Among other things, they determine the tax attributable to the residual value of fixed assets and intangible assets (subclause 2, clause 3, article 170 of the Tax Code of the Russian Federation), which will be used only in this activity.

- For expenses that cannot be clearly attributed to taxable or non-taxable activities, it will be necessary to distribute the tax in the manner prescribed in clause 4 of Art. 170 Tax Code of the Russian Federation. For fixed assets and intangible assets that will be used in both types of activities, you first need to calculate the amount of VAT corresponding to their residual value, and then distribute this calculated amount according to the rules of clause 4 of Art. 170 Tax Code of the Russian Federation.

- The tax related to real estate must be restored in accordance with the procedure provided for in Art. 171.1 Tax Code of the Russian Federation. In relation to real estate that will be used only in non-taxable activities, restoration is done in the same manner as in the case of a complete change in tax conditions. If real estate is simultaneously used in both taxable and non-taxable transactions, then the tax relating to it will be required annually for the same period determined according to the rules of Art. 171.1 of the Tax Code of the Russian Federation, distribute in proportion to the volumes of the corresponding shipment for the period (clause 5, clause 7, clause 9 of Article 171.1 of the Tax Code of the Russian Federation) and restore in an amount corresponding to non-taxable activity.

The restored tax is taken into account as an expense in calculating income tax (subclause 2, clause 3, article 170, clause 5, clause 7, clause 9, article 171.1 of the Tax Code of the Russian Federation). Current VAT received in the process of work when combining activities will be subject to distribution in the manner provided for in clause 4 of Art. 170 Tax Code of the Russian Federation. The estimated part of the tax corresponding to taxable activities will be deducted, and the portion attributable to non-taxable activities will be added to the cost of acquisitions (clause 4 of Article 170 of the Tax Code of the Russian Federation).

Important! Tip from ConsultantPlus In accounting, the amount of VAT is recognized as an expense during the period of its recovery (clauses 16, 18 of PBU 10/99). It can be taken into account... You can view the wiring diagram in K+. Trial access is free.

Read more about tax distribution in the material “What is the procedure for distributing input VAT?”