Legal regulation

A sick leave certificate is a legal document, so its execution must be strictly in accordance with current legislation.

Payment of sick leave (SL) is carried out in accordance with the following documents:

- Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 N 255-FZ.

- Regulations on the specifics of the procedure for calculating benefits for temporary disability, pregnancy and childbirth, monthly child care benefits for citizens subject to compulsory social insurance in case of temporary disability and in connection with maternity (approved by the Government of the Russian Federation of June 15, 2007 N 375) .

Calculation of sick leave based on the minimum wage

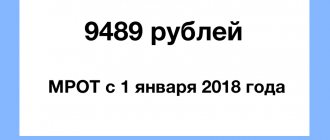

If temporary disability benefits, calculated according to the usual rules, calculated for a full calendar month are less than the federal minimum wage, the benefit will be paid based on the minimum wage.

In such a situation, the amount of daily sick leave benefits is determined as follows: the minimum wage must be divided by the number of calendar days in the month during which the period of temporary disability occurs. And in order to determine the amount of benefits to be paid, the resulting amount must be multiplied by the number of days of incapacity for work in a specific calendar month.

In regions and localities where regional coefficients are applied, the minimum wage for calculating sick leave benefits is determined taking into account these coefficients.

When to calculate according to the minimum wage, and when to calculate according to the actual salary?

The above-mentioned Federal Law No. 255-FZ of December 29, 2006 and Regulation No. 375 of June 15, 2007 spell out the specifics of calculating benefits depending on length of service, salary level and some other nuances.

Application of coefficient 0.5

There is an opinion that when calculating the BL for a part-time employee, it is necessary to multiply the actual income by a factor of 0.5. This fact is erroneous and violates the rights of working citizens.

If there are grounds for calculating sick leave based on actual income, the calculation is made depending on the salary and length of service of the employee, and the coefficient of 0.5 is applied only for calculating benefits at the minimum wage (clause 1.1. Article 14 of Federal Law No. 255).

According to the minimum wage

The following grounds exist for calculating disability benefits according to the minimum wage:

- the employee’s work experience is less than six months;

- lack of income for the previous 2 calendar years;

- actual income for the 2 previous calendar years is less than the minimum wage.

In such a situation, to calculate sick leave for part-time work, a coefficient of 0.5 is applied and the calculation occurs according to the formula (Article 7 of the Federal Law of December 29, 2006 N 255-FZ):

Minimum wage (depending on region of residence) * 24 months * 0.5 / 730.

This formula calculates the cost of one working day. To calculate the BL benefit, you need to multiply the resulting number by the actual number of days of incapacity. In addition, it is necessary to introduce a correction factor depending on the length of total work experience:

- up to 5 years of experience - 60% of the minimum wage;

- from 5 to 8 years - 80% of the minimum wage;

- more than 8 years - 100% minimum wage.

For example, in the city of N. the minimum wage is 18,250 rubles. If an employee Ivan Ivanovich Ivanov works at 0.5 rate, and with an incomplete year of work (total work experience of 7 months) his income is less than the minimum wage, how to calculate his BL for 10 days? We calculate the cost of one day of disability when working part-time using the formula: 18250*24*0.5/730=300 rubles.

Then we multiply the cost of one day by the number of days on sick leave and the length of service coefficient (in this case 0.6) and get the amount of disability benefits: 300 rubles * 10 days * 0.6 = 1800 rubles.

Based on actual salary

The cost of the BL is calculated based on the actual salary if there is a total work experience of more than six months and income for the previous two calendar years.

The calculation is made using the following formula: total salary for the previous two calendar years/730 .

We get the cost of one day of disability, which must be multiplied by the number of days of sick leave. At the same time, depending on the amount of total work experience, payment for BL occurs in full or in part.

For example, Ivan Ivanovich Ivanov works part-time and was sick for 10 days this year. He has a total work experience of 7 years, and over the previous 2 calendar years he received a salary of 730,000 rubles. We calculate the cost of one day of BC as follows: 730000/730=1000 rubles. We multiply this figure by 10 days of sick leave and the correction factor for less than 8 years of experience and get the full cost of the certificate of incapacity for work: 1000 * 10 * 0.8 = 8000 rubles.

It should be remembered that there are restrictions on the maximum cost of the BL, which are established by the Social Insurance Fund (SIF) . For example, the maximum salary from which disability benefits can be calculated was 755,000 rubles in 2022, and 815,000 rubles in 2022.

Thus, if the actual salary is higher than the maximum established by the Social Insurance Fund, then the calculation will be made according to these restrictions. For example, Ivanov Ivan Ivanovich, who has 10 years of experience and works part-time, went on sick leave for 10 days in 2019. His income for 2022 was 800,000 rubles, and for 2022 - 900,000 rubles.

The cost of the BL will be calculated according to the formula presented above, but using the maximum figures: ((755,000 rubles + 815,000 rubles)/730 days) * 10 days = 21,506.85 rubles.

Calculation of sick leave benefits

To correctly pay temporary disability benefits, you need to know:

- the billing period and the amount of payments for the billing period taken into account when calculating benefits;

- the employee's daily benefit and the number of days for which the benefit is calculated;

- minimum wage in effect at the time of the insured event.

The calculation period for paying sick leave is two calendar years preceding the year of temporary disability.

Please note: the number of calendar days for which wages or other remunerations are accrued in the billing period does not matter. Their number for calculating temporary disability benefits due to illness or injury of the employee himself is always taken to be 730 days.

Actual earnings must be taken into account for each calendar year in an amount that does not exceed the maximum base for calculating insurance premiums.

The average daily earnings for calculating temporary disability benefits are determined by dividing the amount of contributions subject to OSS payments accrued for the two calendar years preceding the year of sick leave by 730.

The daily allowance is calculated as follows:

| Employee earnings subject to OSS contributions for two accounting years | : | 730 days | × | 100, 80, 60% (depending on the insurance period) |

Remember the maximum average daily earnings:

- in 2022: (RUB 865,000 + RUB 912,000): 730 days. = 2434.25 rub.

- in 2022: (RUB 815,000 + RUB 865,000): 730 days. = 2301.37 rub.;

- in 2022: (RUB 755,000 + RUB 815,000): 730 days. = 2150.68 rub.

Part-time pay during pregnancy

Employees working part-time on maternity leave are in a special position. In some organizations, employers refuse to pay for sick leave, citing the fact that a woman on maternity leave already receives benefits, so if an illness occurs, sick leave cannot be paid.

However, in accordance with current legislation, parental leave and temporary disability are different insured events , therefore the employer is obliged to accept BL, which is paid in accordance with available income in proportion to working hours.

In addition, a woman on maternity leave has the right to replace years of work experience to calculate the cost of BL to increase payment for the period of temporary disability.

The procedure for paying sick leave when working part-time has its own characteristics. If you don’t know how to calculate the BC when an employee works part-time, and also to avoid mistakes, follow the current legislation.

Documents regulating the procedure for calculating sick leave for part-time work

When determining the amount of benefits, employers must be guided by the documents regulating the calculation procedure. These include:

- Federal Law No. 255-FZ dated December 29, 2006 (as amended on June 8, 2020);

- Decree of the Government of the Russian Federation dated June 15, 2007 No. 375 (as amended on January 19, 2019).

In addition, when calculating sick leave for part-time work in 2020, the requirements given in Art. 1 of Federal Law No. 104-FZ dated 04/01/2020, which stipulates that from 04/01/2020 until the end of 2022, the benefit should not be lower than the minimum wage level (for areas with climatic conditions - taking into account the regional coefficient). But for people working on a reduced schedule, a special calculation procedure applies.

Birth allowance in the absence of income in the billing period

When a worker had no earnings in the years preceding the year of maternity leave, maternity benefits must be calculated based on the minimum wage (Part 1.1, Article 14 of Law No. 255-FZ).

EXAMPLE

Accountant Efremova E.P. just got a job in January 2021 and in May 2022 she goes on maternity leave lasting 140 calendar days. Before this, the woman had not worked anywhere for 3 years.

How to calculate maternity payments in this case?

- We determine the average daily earnings from the minimum wage: 12,792 × 24 / 730 = 420.56 rubles.

- We calculate the amount of the benefit: 420.56 × 140 = 58,878.4 rubles.

Procedure for calculating the payment amount

To determine whether working part-time affects the amount of sickness benefit, you must:

- Calculate the sum of all official incomes of a citizen 2 years before illness.

- Determine the average monthly income for a two-year period before illness ; to do this, you need to multiply the sum of all official income of the employee for a given period by 30.4 and divide by 730.

- Compare the result with the minimum wage.

It is important to take into account that for calculations, the minimum wage established on the date of opening of sick leave is taken, taking into account regional allowances.

If the result obtained is greater than the minimum wage, then the amount of sick leave is calculated using the formula:

D*B*30.4/730,

where D is the amount of income for the two-year period before the illness (regional allowances are already included in this amount), and B is the number of days spent on sick leave.

If the result obtained is less than the minimum wage, then the amount of sick leave benefits is calculated using the formula:

M*RK*B*24 /730*(B/P),

where M is the minimum wage, RK is the regional coefficient (increment), H is the duration of the shift (in hours), P is the duration of a full shift at a given rate. If an employee works part-time, regardless of the length of the working day, then instead of the multiplier (B/P), the fractional part of the rate is substituted into the formula, for example, when working part-time, the multiplier is 0.5.

It must be taken into account that the amount of income for 2 years does not include vacation days, days of production downtime, as well as periods for which the employee was detained or suspended from work at the initiative of the employer.

B&R benefit if the employee’s insurance experience is less than six months

In practice, there may be cases where a working woman’s insurance coverage at the time of pregnancy does not exceed 6 months . In this situation, the amount of maternity leave is calculated in an amount no more than the minimum wage per calendar month of vacation.

That is, if the benefit from actual earnings is less than the minimum monthly wage, it is paid, and if it is more, the minimum wage is calculated.

When calculating average actual earnings per day, the following are excluded from the number of days in the billing period:

- sick leave period;

- maternity and child care leave;

- periods of release from work while maintaining a salary for which contributions are not charged.

Important

If you need to calculate maternity benefits based on your salary in regions where regional coefficients and northern bonuses are used, the minimum wage for comparison is increased by them.

EXAMPLE

In October 2022, cleaner E. S. Malysheva was hired by the company, and from February 6, 2022, she goes on maternity leave for 140 days. The amount of accruals to her for 2022 amounted to 216,859 rubles. The employee had never worked anywhere before. It is necessary to calculate maternity benefits for the employee.

- Actual average daily earnings for 2022 and 2022: 216,859 / 731 = 296.66 rubles.

- The minimum wage from 2022 is 12,792 rubles.

The actual benefit will be:

- in February 2022: 296.66 × 19 = 5636.54 rubles. The minimum wage for this period is 12,792 / 28 × 19 = 8,680 rubles. The actual benefit is less than the minimum wage, which means that the amount to be paid in February 2022 is 5,636.54 rubles;

- in March 2022, the benefit will be 296.66 × 31 = 9196.46 rubles. This is less than the minimum monthly wage, which means that the benefit amount is due from actual earnings.

Using the same algorithm, calculations are made in subsequent months - until the day when the employee uses all 140 calendar days of vacation.

How to calculate sick leave when working part-time

The benefit is calculated based on the amount of earnings subject to Social Insurance contributions for the previous 2 years. In 2022, income for 2022 and 2022 is taken into account. To determine the amount to be paid, the accountant should adhere to the following algorithm:

- take into account all payments subject to contributions in case of illness and maternity for the billing period;

- calculate average daily earnings (ADE) by dividing the amount of income by 730 days;

- determine the amount of benefits taking into account the total accumulated length of service (insurance period):

- with work experience of more than 8 years, 100% of average earnings are paid;

- from 5 to 8 years - 80%;

- up to 5 years - 60%;

- if the work experience is less than 6 months, the calculation is made from the minimum wage (the calculation procedure is described below);

- compare the calculated amount:

- with the maximum amount of daily benefit (in 2022 - 2301.37 rubles);

- with a minimum benefit amount (taking into account the regional coefficient and part-time);

- choose SDZ (within the maximum, but not lower than the minimum amount calculated from the minimum wage, if the benefit amount is less);

- determine the amount of benefit by multiplying the SDZ by the number of days of illness.

When paying sick leave, personal income tax is withheld from it.

Example

In June 2022, an employee working 4 hours a day at 0.5 rate brought sick leave for 10 days. His salary for 2022 is 216,000 rubles, for 2022 – 198,000 rubles, there were no excluded periods. Total experience 9 years. How the benefit will be calculated:

- SDZ = (216000 + 198000)/ 730 = 567.12 rubles;

- since the experience is more than 8 years, the SDZ for calculating benefits will be 100% - 567.12 rubles;

- SDZ is compared with the maximum: 567.12 < 2301.37 rubles;

- For comparison, the minimum wage is also taken: 12,130 rubles. x 0.5 rate x 24 months. / 730 = 199.40 rubles;

- since the minimum wage is lower than the calculated amount (199.40 rubles < 567.12 rubles), payment for sick leave for part-time work is made according to the actual SDZ:

RUB 567.12 x 10 days = 5671.20 rub.

When issuing benefits, the accounting department will withhold personal income tax at 13%: 5671.20 – (5671.20 x 13%) = 4934.20 rubles.

As can be seen from the example, part-time work does not affect the calculation of sick leave if the employee’s income is above the minimum wage level - the calculation is made from actual earnings.