The moment of determining the tax base for VAT for export

The moment of determining the VAT base in export transactions depends on the availability of a package of customs documentation for the transaction.

For export transactions, the period for collecting documentation is set to 180 days. If the company meets this deadline, VAT at a rate of 0% is charged on the last day of the quarter when the package of documents was submitted to the Federal Tax Service. If the documents are not collected within 180 days after the customs operation, the company will have to charge VAT on the sale of goods in the usual manner on the date on which the goods were transferred to the foreign buyer.

In the future, the fate of VAT depends on the timing of the transaction. If VAT was paid at the regular rate, but the documents were collected late, then the tax paid before July 1, 2016 can be returned.

If the transaction was completed after July 1, 2022, the tax amount is deducted in the period when the package for the export transaction was collected or over the next three years.

This condition applies to transactions with buyers located in the Customs Union. There is one exception: an unconfirmed export transaction was carried out using railway transport (delivery), then the sales tax base is recognized on the date of shipment of goods.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Tax deduction for export

Export transactions are subject to VAT at a rate of 0%. Therefore, input VAT on goods and services used for export purposes can be claimed as a deduction. To make a deduction, you need a properly executed invoice from the supplier.

The specifics of the tax deduction depend on which group the exported goods belong to: raw materials or non-raw materials.

Deduction for export of non-commodity goods

If the goods were received no later than July 1, 2016, then you can submit “input” VAT for deduction in the general manner. There is no need to wait for the shipment of goods for export or confirmation of the zero export rate (Letter of the Ministry of Finance of the Russian Federation dated July 13, 2016 No. 03-07-08/41050).

The procedure is different if the goods were received before July 1, 2016. In this case, “input” VAT on them can be deducted only in the quarter in which the company determines the tax base at a rate of 0%. The date the right to deduction arises depends on whether you have collected the documents provided for in Art. 165 of the Tax Code of the Russian Federation, or not. If yes, you have the right to deduct in the quarter when the export was confirmed. If not, the right to deduction arises only after the goods have been shipped.

Deduction for export of commodities

Commodities include the items mentioned in paragraph 10 of Art. 165 of the Tax Code and established in Decree of the Government of the Russian Federation of April 18, 2018 No. 466:

- salt, sulfur, earth and stone, plastering materials, lime;

- ores, slag and ash;

- mineral fuel, oil and petroleum products, bituminous substances, waxes;

- organic chemical compounds;

- wood and wood products, charcoal;

- pearls and precious stones;

- black metals;

- copper, nickel, aluminum, lead, zinc, tin and products made of these metals;

- other base metals and cermets.

Determine whether a product belongs to a raw material group using the HS code.

“Input” VAT when exporting raw materials is deductible in the quarter in which you confirmed your right to apply the zero rate. Other methods of deducting VAT are unacceptable.

We recommend the cloud service Kontur.Accounting. In our program you can keep track of transactions with different VAT rates. In the service you can fill out and check your VAT return. We give all newbies a free trial period of 14 days.

VAT changes

Article 21 of the Labor Code of the Russian Federation.

basic rights and responsibilities of an employee We recently wrote that starting next year the VAT rate will be increased to 20%. But other changes will soon be made that will affect the taxpayers of this tax.

The period of desk inspection will be reduced

The period for a desk audit for VAT will be reduced to 2 months. The corresponding change to paragraph 2 of Article 88 of the Tax Code of the Russian Federation will take effect on September 3 of this year. Tax officials will be able to extend the period of the cameral up to 3 months if they suspect during the audit that tax violations are taking place.

The procedure for confirming the zero rate will be simplified

Exporters are entitled to 0% VAT, but they must confirm it. To do this, they submit to the Federal Tax Service, among other things, shipping and transport documents. Soon this will not be necessary - tax authorities will receive them from customs. If the customs authority does not provide the documents or they contain discrepancies, then the Federal Tax Service specialists will request them from the taxpayer. These are the rules of paragraph 1.2 of Article 165 of the Tax Code of the Russian Federation.

In addition, the deadline for sending documents requested by the Federal Tax Service when discrepancies are identified has been changed. It has been increased from 20 calendar days to 30. Documents can be sent without marks from the customs authorities of the Russian Federation. Such provisions are contained in the new wording of paragraph 15 of Article 165 of the Tax Code of the Russian Federation.

Among other things, exporters will be freed from the need to attach contracts and agreements that had previously been submitted to the inspectorate to their VAT returns. It is enough to submit a notification indicating the details of the document with which the mentioned agreements were previously submitted to the tax authority. Changes have been made to paragraph 10 of Article 165 of the Tax Code of the Russian Federation.

Among other things, the new wording contains subparagraph 1 of paragraph 1 of the same article. A rule has been introduced for exporters for transactions for which the recipients are divisions of Russian legal entities outside the Customs Union. When confirming the zero VAT rate for such transactions, a contract with a Russian organization or a copy thereof is presented. The subject of the contract must be the delivery of goods to the representative office of this organization outside the EAEU.

There is one more change - it will work from April 1, 2022. It will be introduced by a new paragraph 20 of Article 165 of the Tax Code of the Russian Federation. When providing services for the international transportation of goods, freight forwarding services and transportation by railway transport, paper copies of transport and shipping documents may not be required. Instead, their electronic analogues will be used, generated in accordance with the approved format and transmitted through the EDI operator.

VAT refunds will be simplified by application

For transactions carried out after October 1, 2022, the rules for VAT refunds by application will be simplified. Subclause 1 of clause 2 of Article 176.1 of the Code is stated in a new wording. It is expected that the amount of taxes paid for applying the application procedure will be reduced from 7 billion to 2 billion rubles. Let us remind you that the amount of VAT, excise taxes, and mineral extraction tax on profits tax paid for the three previous years is taken into account.

Also, the total amount of taxes paid for the three previous years by the company that acts as a guarantor in the application procedure was reduced from 7 billion to 2 billion rubles. At the same time, the share of net assets corresponding to the amount of obligations under guarantee agreements has been increased for guarantors. For now it is 20%, but starting from October 1, 2022 it will be 50%. In addition, the guarantor will be subject to requirements for the absence of debt not only for taxes, including penalties and fines, but also for insurance premiums.

We fill out the VAT return

Submit your VAT return along with the documents. Submit the report at the location of the organization and only in electronic format. Exporters fill out:

- title page - with information about the organization and tax period;

- section 1 - with information about the amounts of VAT to be reimbursed or paid;

- section 4 - with information on VAT amounts with a confirmed zero rate;

- section 5 - with information about tax deductions;

- section 6 - with information on VAT amounts when the zero rate is not confirmed.

When are customs stamps needed?

Article 259. Methods and procedure for calculating depreciation amounts

An important condition for confirming zero VAT is the presence of stamps from the customs authority on the customs declaration. Tax legislation provides for two types of marks:

- “Release permitted” - about the placement of goods under the customs export procedure;

- “Goods exported” - about the export of goods from the territory of the Russian Federation.

The original marks are affixed in the form of a rectangular stamp with lilac-pink-blue mastic (the shade depends on the degree of wear of the stamp pad). In addition, the mark can be indicated in the form of information and be an analogue of the original stamp for electronic customs declaration.

Let's figure out in what cases the tax office needs one or another mark and in what form.

"Release permitted"

The Federal Tax Service also clarifies that in the future it is not necessary to affix the original “Release Permitted” stamp to printed copies of customs declarations.

It happens that the accounting department of an exporting company asks for a “Release Permitted” stamp to maintain internal records. Then the stamp can be obtained at the customs post where the goods declaration was submitted. In the case of remote declaration of goods, the stamp can be placed at the customs post indicated in column 30 of the customs declaration “Location of goods”.

The customs mark in the form of information about the release of goods in a copy of the electronic customs declaration looks like this:

Documents to confirm export

The package of documents that must be collected to confirm export and justify the right to deduction includes the following documents (Article 165 of the Tax Code of the Russian Federation):

- foreign economic contract (copy of the contract) with a foreign partner for the supply of goods outside the Russian Federation;

- customs declaration or a copy thereof. The declaration must have a mark from the customs office that carried out the customs clearance, and a mark from the border customs office through which the goods were exported from the Russian Federation;

- copies of transport and shipping documents (a specific list is given in subparagraph 4 of paragraph 1 of Article 165 of the Tax Code of the Russian Federation).

Documents must be submitted no later than 180 calendar days, counting from the date of placing the goods under the customs export procedure. The moment of determining the tax base for exported goods is the last day of the quarter in which the full package of documents is collected (clause 9 of Article 167 of the Tax Code of the Russian Federation).

Refund, refund or deduction of VAT on export

Article 136 of the Labor Code of the Russian Federation. procedure, place and terms of payment of wages

All three terms meaning reduction or exemption from tax payments are often found on the Internet, and they are easy to confuse:

Paying taxes often leads to a situation where, due to deductions, the tax amount becomes negative. Further steps for tax refund:

- The company submits a declaration and an application for credit or refund of VAT. Offset on the declaration - the amount goes towards fines, arrears or future payments; If the documents indicate a return, the amount is transferred to a bank account.

- She then makes a decision within seven days about full, partial, or refusal of reimbursement. The form of compensation - offset or refund - is determined either by the Federal Tax Service to cover arrears to the budget, or according to the application.

- The Federal Inspectorate sends payment documents to the Treasury the next day after the decision on the return is made. The money is transferred by the Treasury within five days.

VAT refund when exporting from Russia

Collecting documents to confirm the zero rate is only the first step. Next, the regulatory authorities of the Federal Tax Service begin checking the authenticity of documents and reviewing compliance with all legal requirements, as well as checking whether the exporter has any debt to the budget.

The collected documents are submitted to the Federal Tax Service along with the VAT return for the period in which they were collected. Tax authorities conduct a desk audit within three months and, based on its results, make a decision on VAT refund or refusal to refund.

Postings for export VAT

If after 180 days the export is not confirmed, then the amounts of unconfirmed VAT are reflected using the following entries:

| Dt | CT | Operation description |

| 68(VAT refund) | 68 (VAT accrued) | Accrual for unconfirmed exports |

| 99 | 68 | Accrual of penalties |

| 68 | 51 | Transfer of penalties to the budget |

Postings for VAT refund upon confirmation of export:

| Dt | CT | Operation description |

| 51 | 68 | VAT refund |

The form of VAT refund can be selected from two options: return to the current account or offset against fines, arrears or future payments. The reimbursement option is chosen by the Federal Tax Service itself, or by the taxpayer in his application.

If a VAT refund is refused, the posting will look like this:

| Dt | CT | Operation description |

| 91 | 68 | The amount of VAT to be reimbursed is written off as expenses |

Despite the declared preferential benefits, the use of a zero rate can rather be considered an obligation of the organization rather than a right.

Export of goods by a foreign buyer

If the export goods are transported not by a third-party transport company, but by the buyer himself, the same list of documents is used to confirm the rate. Copies of the necessary documents are provided by the foreign partner; with these documents, the Russian exporter carries out the rate confirmation procedure in the usual manner.

Export to the EAEU

When exporting goods to the countries of the Eurasian Economic Union, which include Belarus, Kazakhstan, Armenia, and Kyrgyzstan, confirmation of the 0% rate is not required. To confirm the legality of applying this rate, it is necessary to request a certificate of payment of VAT by the buyer.

Periodic temporary declaration

If, when exporting goods of the Customs Union from the territory of the EAEU during periodic declaration in relation to such goods, accurate information about their quantity or customs value cannot be provided, temporary periodic customs declaration is allowed. To do this, a temporary customs declaration is submitted to customs (Part 1, Article 214 of Federal Law No. 311-FZ of November 27, 2010, hereinafter referred to as Law No. 311-FZ).

If a temporary declaration for goods has been submitted, then after the actual export of goods from the customs territory of the EAEU, the declarant will have to submit one or more full customs declarations for all exported goods (Part 5 of Article 214 of Law No. 311-FZ).

The Federal Tax Service of Russia allows the use of a temporary customs declaration to confirm the right to a zero VAT rate, without waiting for the exporter to complete full declarations. After all, temporary periodic customs declaration does not exempt the declarant from paying customs duties, complying with prohibitions and restrictions, as well as from complying with the conditions of customs procedures and customs control (Part 2 of Article 214 of Law No. 311-FZ).

In the commentary letter, the tax authorities indicated that the exporter can submit a temporary customs declaration in the package of documents. It, of course, must bear the marks of the Russian customs authority that released the goods in the export procedure, and the Russian customs authority of the place of departure through which the goods were exported from the territory of the Russian Federation.

VAT on export of goods

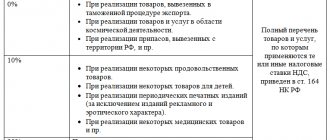

Let's start with the fact that for export operations, the legislation of the Russian Federation provides for a VAT rate of 0%. What exactly needs to be done to apply this rate:

- Export goods into the country according to the customs export procedure;

- Export provided that the goods are moved to a special economic zone of the SEZ;

- Provide services for international transportation of goods.

The customs procedure should be understood as moving goods across the borders of the country, paying the necessary duties at customs, complying with the rules of movement (requirements and prohibitions on the export of certain types of goods), submitting documents and certificates that disclose information about the origin of goods intended for export.

Goods transported to the FEZ are allowed to be warehoused, stored, processed for production, sent for repair, and other loading/unloading activities are carried out for further transportation to their destination.

Declaration of goods

So, the declaration for goods is used when placing goods under customs procedures, with the exception of the customs procedure for customs transit, and in cases provided for by the EAEU Customs Code, for the customs declaration of supplies (clause 3 of Article 105 of the EAEU Labor Code). Declarants are organizations and individual entrepreneurs.

The declaration for goods indicates the following information (clause 1 of article 106 of the EAEU Labor Code):

- about the declared customs procedure;

- about the declarant, customs representative, sender, recipient, seller and buyer of goods;

- about vehicles for international transportation and vehicles by which goods were transported (will be transported) through the customs territory of the EAEU;

- about goods (name, description, code according to the Commodity Nomenclature of Foreign Economic Activity, origin, name of the country of departure and country of destination, manufacturer, packaging, price, quantity, customs value);

- on the calculation of customs duties, special, anti-dumping, countervailing duties;>

- about the transaction with goods and its conditions;

- on compliance with prohibitions and restrictions in accordance with Article 7 of the EAEU Labor Code;

- on compliance with the conditions for placing goods under the customs procedure;

- on documents confirming the information stated in the declaration of goods;

- on documents confirming compliance with the legislation of the Member States, control over compliance with which is entrusted to the customs authorities;

- about the person who filled out the goods declaration;

- date of preparation of the declaration;

- other information.

Example of VAT when exporting to the EAEU

Let's look at a specific example of export to Kazakhstan:

Vesna LLC resells these goods under an export agreement to Kazakhstan. Delivery to a foreign counterparty is carried out on an advance payment basis, the transaction amount is RUB 2,850,000. The company confirmed the zero VAT rate for exports on time. This is reflected in the accounting as follows:

| Contents of operation | Debit | Credit | Amount in rubles |

| The receipt of the main batch of commercial products for subsequent resale to Kazakhstan is reflected | 41 | 60 | 2 000 000 |

| The accounting reflects the input tax on the purchase of goods | 19 | 60 | 400 000 |

| The receipt of 100% advance payment from the Kazakhstani partner is reflected | 51 | 62 | 2 850 000 |

| The accounting reflects the proceeds from the transaction | 62 | 90.1 | 2 850 000 |

| Commodity products were shipped for export to a foreign buyer | 45 | 41 | 2 850 000 |

| The cost of goods sold to a foreign buyer is written off | 90.2 | 45 | 2 000 000 |

| Value added tax on goods purchased for export is accepted for deduction | 68, VAT subaccount | 19 | 400 000 |

Please note that VAT should be deducted in this situation only after the products have been exported to Kazakhstan and the zero tax rate has been documented. More about VAT

More about VAT

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

Purchase and shipment of non-commodity goods in “1C: Accounting 8” when exporting to the EAEU

Let's consider the procedure for reflecting in the 1C: Accounting 8 program, edition 3.0, transactions of acquisition and shipment of non-commodity goods for export to the EAEU countries.

Example 1

The organization Trading House LLC, which applies the general taxation system, purchased on July 20, 2018 from Sofa Factory LLC (supplier):

According to the concluded contract with the foreign partner Astana LLP (Kazakhstan), the organization Trading House LLC:

The sequence of operations is given in Table 1. Table 1 No.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Setting up accounting policies and accounting parameters

In accordance with paragraph 3 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods, performing work, providing services (Appendix No. 18 to the Treaty on the Eurasian Economic Union) when exporting goods from the territory of one EAEU member state to territory of another EAEU member state:

- a zero VAT rate is applied when submitting to the tax authority the documents provided for in paragraph 4 of the Protocol;

- the right to tax deductions is exercised in a manner similar to that provided for by the legislation of the EAEU member state in relation to goods exported outside the EAEU.

If non-commodity goods are shipped for export to EAEU member states:

- the deduction of the presented amount of VAT is carried out in the generally established manner, i.e., similar to the deduction for goods (work, services), property rights acquired for the implementation of transactions subject to VAT at rates of 18% and 10% (clause 3 of Article 172 of the Tax Code of the Russian Federation) ;

- The taxpayer does not have the obligation to determine the amount of VAT relating to goods (work, services), property rights acquired for the production and (or) sale of goods using a 0% rate, i.e. there is no obligation to maintain separate accounting (paragraph 2 p. 10, Article 165 of the Tax Code of the Russian Federation).

Consequently, if the taxpayer sells only non-commodity goods for export to the EAEU and there are no other grounds for maintaining separate accounting (carrying out transactions that are exempt from taxation under Article 149 of the Tax Code of the Russian Federation, and (or) the place of sale of which is not recognized as the territory of the Russian Federation according to Articles 147 and 148 of the Tax Code of the Russian Federation, and (or) which are not recognized as an object of taxation under paragraph 2 of Article 146 of the Tax Code of the Russian Federation), then on the VAT tab of the Accounting Policy form (section Main - subsection Settings - hyperlink Taxes and reports) you need to check the absence of a flag for the values Separate accounting of incoming VAT and separate accounting of VAT by accounting methods are maintained.

According to paragraph 3 of Article 172 of the Tax Code of the Russian Federation, the procedure for deducting input VAT when purchasing goods (work, services), property rights for operations for the sale of goods for export using a tax rate of 0% depends on whether or not the exported goods are raw materials (clause 10 of Art. 165 of the Tax Code of the Russian Federation).

Codes of types of goods related to raw materials were approved by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466 in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union, approved. By decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54 (as amended on April 24, 2018).

In accordance with the approved codes, it is necessary to indicate whether or not the goods sold for export belong to the group of raw materials by placing the appropriate flag for each specific HS code.

By default, the Commodity flag is cleared, i.e. all goods sold are classified as non-commodity products.

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. By Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137, invoices issued for goods exported outside the territory of the Russian Federation to the territory of the EAEU member states must indicate the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

The corresponding HS code is automatically displayed in column 1a of the invoice when goods are exported to the territory of the EAEU member states if the following conditions are met:

- sales of goods are carried out using a tax rate of 0%;

- the HS code is indicated for the corresponding product item in the Nomenclature directory;

- the counterparty is a taxpayer of a member state of the EAEU (section Directories - subsection Purchases and sales).

Purchasing goods

The receipt of goods into the organization (operations: 2.1 “Receipt of goods”; 2.2 “Accounting for input VAT”) is registered in the program using the document Receipt (act, invoice) with the transaction type Goods (invoice) (section Purchases - subsection Purchases - hyperlink Receipts (acts , invoices)) (Fig. 1).

Rice. 1. Purchase of goods

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is checked, then in the column The VAT accounting method for non-commodity goods purchased for export should be set to Accepted for deduction.

After posting the document Receipt (act, invoice), accounting entries will be generated:

Debit 41.01 Credit 60.01 - for the cost of purchased goods excluding VAT; Debit 19.03 Credit 60.01 - for the amount of VAT presented by the supplier on purchased goods.

For the purposes of tax accounting for corporate income tax, the corresponding amounts are also recorded in the NU resources: Amount Dt and Amount Kt for accounts with the NU attribute.

An entry with the type of movement Receipt and the event Submitted by VAT by the Supplier is entered into the VAT presented register.

To register the received invoice for purchased goods in the program (operation 2.3 “Registration of supplier invoice”), you must enter the number and date in the fields Invoice No. and from the document Receipt (act, invoice) (see Fig. 1) incoming invoice and click the Register button. In this case, the document Invoice received will be automatically created, and a hyperlink to the created invoice will appear in the form of the basis document (Fig. 2).

The fields of the Invoice document received will be filled in automatically based on information from the Receipt document (act, invoice).

Rice. 2. Invoice received for receipt

Besides:

- in the Received field the date of registration of the Receipt document (act, invoice) will be entered, which, if necessary, should be replaced with the date of actual receipt of the invoice. If an agreement has been concluded with the seller on the exchange of invoices in electronic form, then the date of sending the electronic invoice file by the EDF operator, indicated in its confirmation, will be entered in the field;

- in the line Base documents there will be a hyperlink to the corresponding receipt document;

- in the Operation type code field the value 01 will be reflected, which corresponds to the acquisition of goods (work, services), property rights in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected] ;

- The Receipt Method switch will be set to Hard copy if there is no valid agreement with the seller to exchange invoices electronically. If there is an agreement, the switch will be in the Electronic position.

Since the buyer does not maintain separate accounting, in the Invoice document received there is the possibility of a simplified application for deduction of input VAT, for which the flag for the value Reflect VAT deduction in the purchase book by the date of receipt is automatically set.

Please note that if the taxpayer maintains separate accounting for VAT, i.e., on the VAT tab of the Accounting Policy form (Section Main - subsection Settings - hyperlink Taxes and reports) the flag Separate accounting for incoming VAT and Separate accounting for VAT by accounting methods is selected, then in the document Invoice received is missing a line and a flag for the value Reflect VAT deduction in the purchase book by the date of receipt. In this case, the application for a tax deduction is always carried out using the regulatory document Formation of purchase ledger entries.

If it is necessary to change the specified data, for example, to clarify the date of receipt, the document should be repeated. To do this, click the Record and close button or execute the Run command from the list of available commands, opened by clicking the More button.

As a result of posting the Invoice document received, an entry will be made in the accounting register:

Debit 68.02 - for the amount of input VAT in the amount of RUB 162,000.00. Credit 19.03

An entry will also be made in the information register of the Invoice Journal. Register entries The Invoice Register are used to store the necessary information about the received invoice.

An entry with the type of movement Expense is made in the VAT accumulation register presented.

An entry with the event VAT Claimed for Deduction is made in the Purchase VAT accumulation register to register the invoice in the purchase book.

Based on the entry in the VAT Purchases register, the purchase book is filled out for the period of acceptance of purchased goods for accounting and receipt of a supplier invoice, i.e. for the third quarter of 2022 (section Reports - VAT subsection or Purchases section - VAT subsection) (see Fig. 3).

Rice. 3. Purchase book for the third quarter of 2022

The amount of input VAT on purchased goods will be reflected on line 120 of Section 3, as well as in Section 8 of the VAT tax return for the third quarter of 2022 (section Reports - subsection 1C-Reporting - hyperlink Regulated reporting).

Shipment of goods

The shipment of goods for export to the buyer “Astana” LLP (operations: 3.1 “Shipment of goods for export”; 4.2 “Write-off of the cost of goods sold”) is registered in the program using the document Sales (act, invoice) with the transaction type Goods (invoice) (Fig. 4).

Rice. 4. Shipment of goods for export

After posting the document, the following accounting entries are entered into the accounting register:

Debit 90.02.1 Credit 41.01 - for the cost of written-off sofas; Debit 62.21 Credit 90.01.1 - for the sale price of sofas.

A record with the type of movement Receipt for the sales book is entered into the VAT register for sales of 0%, reflecting the accrual of VAT at a rate of 0%.

To create an invoice for goods shipped for export (operation 3.3 “Issuing an invoice for the shipment of goods”), you must click on the Write invoice button at the bottom of the Sales document (act, invoice) (see Fig. 4).

In this case, the document Invoice issued is automatically created in the information base, and a hyperlink to the created invoice appears in the form of the basis document.

In the new posted document Invoice issued, which can be opened via a hyperlink, all fields will be filled in automatically based on the data in the Sales document (act, invoice).

From 01/01/2015, taxpayers who are not intermediaries acting on their own behalf (forwarders, developers) do not keep a log of received and issued invoices, therefore, in the document Invoice issued in the Amount line: it is indicated that the amounts to be recorded in the journal accounting (“of which by commission:”) are equal to zero.

The Transaction Type Code field will reflect the value 01, which corresponds to the shipment of goods (work, services), property rights, including transactions taxed at a tax rate of 0% in accordance with the Appendix to the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [ email protected]

As a result of posting the issued Invoice document, an entry will be made in the information register of the Invoice Log. Register entries The Invoice Register are used to store the necessary information about the issued invoice.

Using the button Print the accounting system document Invoice issued, you can view the form of the invoice and then print it (see Fig. 5).

Rice. 5. Invoice for export goods

According to subparagraph 15 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation and subparagraph “a.1” of paragraph 2 of the Rules for filling out an invoice, approved. Resolution No. 1137, in invoices issued for goods exported outside the territory of the Russian Federation to the territory of the member states of the Eurasian Economic Union, column 1a indicates the code of the type of goods in accordance with the Commodity Nomenclature of Foreign Economic Activity.

Operations of shipment of goods for export until the validity of the application of the zero VAT rate is confirmed in the VAT tax return will not be reflected.

Receipt of payment

Receipt of payment for goods sold (operation 4.1 “Receipt of payment from buyer”) in the 1C: Accounting 8 version 3.0 program is reflected using the document Receipt to current account with the transaction type Payment from buyer, which is generated in the following ways:

- based on the document Invoice for payment to the buyer (section Sales - subsection Sales - journal of documents Invoices to buyers);

- by adding a new document to the Bank statements list (section Bank and cash desk - subsection Bank - document journal Bank statements).

As a result of posting the document, the following accounting entry is entered into the accounting register:

Debit 51 Credit 62.01 - for the amount of payment received, which is 600,000.00 rubles.

When are invoices recorded in the sales ledger when exporting goods subject to preferential VAT?

Registration of invoices is provided for by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137. Appendix No. 5 to this resolution contains Section II. This section concerns the rules for maintaining a sales book for VAT calculations. The legislation does not contain a special procedure for maintaining and registering invoices for export. This means that such registration is carried out according to the general rules:

- in chronological order within each tax period;

- regardless of the date of their issuance to buyers and their receipt by buyers;

- Compiled, issued and adjusting invoices are registered in all cases when the obligation to pay VAT arises.

VAT on exports: what is important to know?

But I wonder what really makes it God's house and not just some random building? Did the imam perform some kind of ritual that transforms the mosque from an average building into a holy place?

In contrast, Western Christianity has two main views: Protestant and Catholic. Protestants believe that "the church is just an ordinary building" and that there is nothing special or sacred about the building where they gather together to pray, read the Bible and worship - instead, the people themselves are seen as the important thing and the place where God is. While Catholics believe that churches need to be sanctified: I'm not entirely sure what this involves, but apparently a bishop or priest has to go through a ritual and bless the church - this is believed to sanctify it, turning it into " God's house and holy precinct.

Regarding mosques, do they need to be blessed and consecrated/consecrated like in Catholicism? Or is it just an ordinary building, as in Protestantism?

(If mosques really must be blessed before they can be used, I would like to know some details about the blessing. What is said? What is done?)

Medi1Saif

I don't think there are any necessary rituals to open a mosque, since one can pray anywhere as long as the piece of ground one prays on is not unclean. (This is a comment for now, as soon as I have time to write a well thought out answer, or someone else has answered this question, I will delete it).

Other taxes

Changes to the property tax of legal entities

Organizations will be exempt from paying real estate taxes. The object of taxation for the property tax of legal entities will be considered only real estate, which is taken into account on the balance sheet as fixed assets. The taxable base will be determined separately for each property, regardless of how it is calculated - based on the average annual or cadastral value.

In addition, changes are being made to the procedure for submitting property tax reports. Starting next year, you will only need to report to the tax authorities at the location of the property. This change will not affect the largest taxpayers - they will continue to submit declarations and calculations for advance payments to the Federal Tax Service at the place of registration of the largest taxpayers.

Changes in income tax rates

From the beginning of 2022, changes are being made to paragraph 1 of Article 284 of the Tax Code of the Russian Federation. According to the old version, income tax is transferred to the regional budget in general at a rate of 18%, and in 2017-2020 - 17%. At the same time, regions have the right for certain categories of taxpayers to reduce this rate in general to 13.5%, and in 2017-2020 - to 12.5%.

VAT when exporting goods from Russia

The peculiarities of the value added tax when exporting products are discussed in clause 2 of Art. 151, paragraph 1, art. 164, paragraph 1, art. 165, paragraph 9 of Art. 167 of the Tax Code of Russia. Exported goods and materials are not sold to Russian consumers, so the state returns the tax previously paid by the manufacturer. The terms “no tax paid” and “0% rate” are used synonymously. All primary documents confirming the export of goods that should be submitted to the tax office are specified in the agreement on the Eurasian Economic Union dated May 29, 2014 (Appendix No. 18) and in Article 165 of the Tax Code of the Russian Federation. Taxpayers and agents provide supporting documents in electronic format; the validity of the provisions is enshrined in the order of the Federal Tax Service dated September 30, 2015 No. ММВ-7-15/427.

Procedure and consequences of providing documents confirming export

To apply a 0% tax rate, the exporter is required to submit a tax return and the above documents to the tax authority within 180 calendar days from the date of issue of the export declaration.

After this, within 3 months the tax authority conducts a desk tax audit, during which, incl. verifies the data contained in the provided documents with information received from the customs authorities. If there are discrepancies in the information, the tax authority will require you to provide copies of documents or even recognize the application of the zero VAT rate as unfounded.

As practice shows, a desk audit is not limited to the provided set of documents:

- the audit does not cover a separate export transaction, but the entire reporting period (quarter) for which the tax return was filed;

- the tax authority will most likely conduct a counter-inspection of the supplier of the exported goods and how it reflects and pays VAT on the value of the exported goods;

- during the inspection, the actual ability of the exporter to carry out this type of activity is established (availability of staff, warehouses, licenses, office, supply chain, etc.);

- Exporters created, reorganized or changed their location less than 6 months before the export transaction are especially carefully checked.

Clause 15, Article 165 of the Tax Code of the Russian Federation

To confirm the validity of the application of the 0 percent tax rate and tax deductions for the sale of goods (work, services) provided for in subparagraphs 1, 2.1 - 2.3, 2.5 - 2.8, 2.10, 3, 3.1, 4, 4.1, 4.2, 4.3, 8, 9, 9.1, 9.3, 12 paragraph 1 of Article 164, the taxpayer can submit to the tax authority: (As amended by federal laws dated November 27, 2017 No. 350-FZ, dated November 27, 2017 No. 353-FZ, dated June 6, 2019 No. 123-FZ)

registers of customs declarations (full customs declarations) provided for in subparagraphs 3, 5 and 7 of paragraph 1, subparagraph 3 of paragraph 3.2, subparagraph 3 of paragraph 3.3, subparagraph 3 of paragraph 3.6, subparagraph 3 of paragraph 4 of this article, indicating in them the registration numbers of the relevant declarations instead copies of these declarations; (As amended by Federal Law No. 350-FZ dated November 27, 2017)

registers of documents confirming the provision of services for the transportation of oil and petroleum products by pipeline transport, provided for in subparagraph 3 of paragraph 3.2, documents confirming the provision of services for organizing transportation (transportation services in the case of import into the territory of the Russian Federation) of natural gas by pipeline transport, provided for in subparagraph 3 paragraph 3.3 of this article (in the event that customs declaration is not provided for by the customs legislation of the Customs Union or is not carried out), instead of copies of these documents;

a register of complete customs declarations or documents confirming the provision of services for the transportation of oil and petroleum products by pipeline transport, as well as transport, shipping and (or) other documents provided for in subparagraphs 3 and 4 of paragraph 3.2 of this article, instead of copies of these documents;

registers of customs declarations (full customs declarations), as well as transport, shipping and (or) other documents provided for in subparagraphs 3 and 4 of paragraph 3.6, subparagraphs 3 and 4 of paragraph 4 of this article, instead of copies of these documents; (As amended by Federal Laws No. 350-FZ dated November 27, 2017; No. 302-FZ dated August 3, 2018)

registers of transport, shipping and (or) other documents provided for in subclause 3 of clause 3.1, subclause 3 of clause 3.5, subclause 3 of clause 3.7, subclause 3 of clause 3.8, subclause 2 of clause 14 of this article, instead of copies of these documents;

register of transportation documents provided for in paragraph 4.1 of this article, instead of copies of these documents;

a register of transportation, shipping or other documents provided for in paragraph 3.9 of this article, in electronic form instead of a register of these documents on paper;

registers of transportation documents provided for in paragraphs 5, 5.1, 5.3, 6, 6.1, 6.2, 6.4 of this article, in electronic form instead of registers of these documents on paper. (As amended by federal laws dated November 27, 2017 No. 350-FZ, dated November 27, 2017 No. 353-FZ, dated June 6, 2019 No. 123-FZ)

The registers specified in this paragraph are submitted to the tax authority in the established format in electronic form via telecommunication channels through an electronic document management operator that is a Russian organization and meets the requirements approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

The tax authority conducting a desk tax audit has the right to request from the taxpayer documents, information from which is included in the registers specified in this paragraph, taking into account the following features.

The tax authority has the right to selectively request from a taxpayer who has submitted in electronic form the registers of transportation documents provided for in paragraph five of clause 5, clauses 5.1, 5.3, 6, 6.1, 6.2, 6.4 of this article, documents, information from which is included in these registers. (As amended by federal laws dated November 27, 2017 No. 350-FZ, dated November 27, 2017 No. 353-FZ, dated June 6, 2019 No. 123-FZ)

If the taxpayer submits the registers specified in paragraphs two to eight of this paragraph in electronic form of the register of transportation documents provided for in paragraph three of paragraph 5 of this article, which contain information not included in the list of information specified in paragraph 18 of this article transmitted by the federal executive body authorities authorized in the field of customs affairs, the tax authority has the right to request from the taxpayer documents, information from which is included in the specified registers.

If there is a discrepancy between the information received by the tax authority in accordance with paragraph 17 of this article, the information contained in the registers provided for in paragraphs two through eight of this paragraph, in the register of transportation documents provided by the taxpayer in electronic form, provided for in paragraph three of paragraph 5 of this article, the tax the authority has the right to request from the taxpayer documents confirming the information in which inconsistencies have been identified.

If a tax authority requests documents, information from which is included in the registers provided for in this paragraph, copies of these documents are submitted by the taxpayer within 30 calendar days from the date of receipt of the relevant request from the tax authority. The submitted documents must comply with the requirements specified in this article, unless otherwise provided by this paragraph. (As amended by Federal Law No. 302-FZ dated August 3, 2018)

If, at the request of the tax authority, the taxpayer does not submit the documents specified in this article, information from which is included in the registers provided for by this paragraph, the validity of applying a tax rate of 0 percent in the relevant part is considered unconfirmed.

When selling goods exported under the customs procedure of export (re-export) outside the customs territory of the Eurasian Economic Union, copies of the requested customs declarations, information from which is included in the relevant registers submitted electronically to the tax authority, may be submitted to the tax authorities without the corresponding marks of the Russian customs authorities of the place of departure. (Paragraph introduced - Federal Law dated 03.08.2018 No. 302-FZ)

In the event that the export of goods in the customs procedure of export (re-export) outside the customs territory of the Eurasian Economic Union according to the documents submitted by the taxpayer is not confirmed by information received from the federal executive body authorized for control and supervision in the field of customs affairs, in accordance with paragraph 17 of this article, the taxpayer is informed about this. The taxpayer has the right, within 15 calendar days from the date of receipt of the tax authority’s message, to provide the necessary explanations and any documents available to the taxpayer confirming the export of the specified goods. (Paragraph introduced - Federal Law dated 03.08.2018 No. 302-FZ)

If the export of goods in the customs procedure of export (re-export) outside the territory of the Eurasian Economic Union is not confirmed by information (information) received from the federal executive body authorized for control and supervision in the field of customs affairs, at the request of the federal executive body authorized for control and supervision in the field of taxes and fees, the validity of applying a tax rate of 0 percent in relation to transactions for the sale of goods in the relevant part is considered unconfirmed. A request from the federal executive body authorized for control and supervision in the field of taxes and duties to the federal executive body authorized for control and supervision in the field of customs must include explanations and documents if they were submitted by the taxpayer to the tax authority in accordance with paragraph eighteen of this paragraph. (Paragraph introduced - Federal Law dated 03.08.2018 No. 302-FZ)

(Clause introduced - Federal Law dated December 29, 2014 No. 452-FZ)

“Advance” VAT recovery

The rules for restoring VAT previously accepted for deduction in the event that the buyer makes an advance payment on account of upcoming deliveries of goods (performance of work, provision of services) or transfer of property rights are established in sub. 3 p. 3 art. 170 Tax Code of the Russian Federation. Now this provision of the Code states that VAT amounts are subject to restoration in the amount previously accepted for deduction in relation to prepayments for upcoming supplies (performance of work, provision of services), transfer of property rights. The buyer must restore VAT in the tax period in which the tax on purchased goods (works, services), property rights is subject to deduction or when there was a change in conditions or termination of the contract and the advance payment was returned.

But what if the buyer made an advance payment, and the seller shipped the goods for a lesser amount? In what amount should VAT be restored in such a situation?

The Tax Code in its current version does not answer this question. In letter dated July 1, 2010 No. 03-07-11/279, specialists from the Russian Ministry of Finance considered the following situation. The organization (investor, customer, developer in one person) paid an advance to the general contractor in accordance with the agreement. The amount of “advance” VAT presented by the general contractor was accepted for deduction. At the end of the work stage, the general contractor presented an invoice and a certificate of completion of work, on the basis of which VAT was also claimed for deduction in the current period. In the same tax period, the organization is obliged to restore the amount of “advance” VAT in the amount previously accepted for deduction. However, according to the terms of the agreement, the advance amount is credited throughout the entire term of the agreement in the amount of no more than 5% of the cost of each stage. How much tax should be restored?

According to the Russian Ministry of Finance, the buyer must restore the VAT previously accepted for deduction from the amounts of the transferred advance payment in the amount corresponding to the tax indicated in the invoices issued by the seller upon shipment. This position of financiers is supported by the courts (see, for example, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated 03/05/2012 in case No. A51-11444/2011 (Decision of the Supreme Arbitration Court of the Russian Federation dated 05/22/2012 No. VAS-5972/12 refused to transfer this case to the Presidium Supreme Arbitration Court of the Russian Federation for review in the order of supervision)).

However, some courts do not agree with this approach. Thus, in the decision of the Federal Antimonopoly Service of the Moscow District dated August 22, 2013 in case No. A40-4375/13-116-7, the arbitrators supported the company, which restored VAT only from those amounts of the previously transferred advance that ceased to be an advance based on the terms of the contract.

From October 1, 2014, this issue will be resolved at the level of the Tax Code. The commented law was added to subsection. 3 p. 3 art. 170 of the Tax Code of the Russian Federation corresponding changes. According to them, the amounts of VAT accepted for deduction in relation to prepayments for future deliveries of goods (performance of work, provision of services), transfer of property rights, are subject to restoration in the amount of tax accepted by the taxpayer for deduction on goods purchased by him (work performed, services provided), transferred property rights, in payment for which the amount of previously transferred payment, partial payment in accordance with the terms of the agreement (if such conditions exist) are subject to offset.

Thus, to determine the amount of VAT that needs to be restored, it will be necessary to rely not only on the invoice that the seller issues when partially closing the advance, but also on the terms of the contract.

VAT tax base for export of goods

The tax base for value added tax when selling goods for export from the Russian Federation is determined as the cost of goods under the terms of concluded agreements (clause 1 of Article 154 of the Tax Code of the Russian Federation).

Please note that the tax base should be determined exclusively in Russian rubles. If the contract is concluded in a foreign currency, then recalculate at the official ruble exchange rate of the Central Bank of Russia on the date of shipment of the goods.

But the moment of determining the tax base for an export transaction directly depends on when you collected the package of documents. Please note that when exporting goods to the EAEU, the tax base is determined in the following order:

- If documents and confirmations are prepared within 180 days from the moment the goods are determined to be subject to the customs export procedure, then determine the tax base as the last day of the reporting quarter in which the documents were collected and include the information in the declaration.

- If documents and confirmations were collected after 180 days, then determine the tax base at the time of shipment.

For transactions with partners in the EAEU, please note that the confirmation period for the 0 VAT rate for export is 180 days from the date of shipment. This affects the determination of the tax base. VAT at a rate of 0% on the advance payment is not required to be charged and paid, according to the general rules.

IMPORTANT!

In his work, the taxpayer is obliged to organize separate accounting when registering transactions of a different nature. For example, when exporting raw materials and non-commodity goods and when producing products for sale in the Russian Federation. Methods for maintaining separate accounting should find a place in the accounting policy of the entity.