Income tax is the main payment for large and medium-sized businesses, as well as some small companies that have not switched to special regimes. This is a direct tax that legal entities pay on what they earn. Let's look at the nuances of determining the base for its calculation, the payment procedure and the rates in force in 2022.

Who pays income tax

Tax payers are:

- Russian organizations applying the main taxation system.

- Foreign companies that have representative offices here, receive income, are residents or are actually managed from the Russian Federation.

Do not pay corporate income tax:

- companies on the simplified tax system and unified agricultural tax;

- organizations from the gambling business;

- Skolkovo residents.

Companies from the first two groups pay other taxes, and the income of Skolkovo participants is completely exempt from taxation.

For legal entities from Russia and foreign companies with representative offices here, taxable profit means the difference between income and expenses. Other foreign organizations do not take into account their expenses, that is, all income they receive in Russia is taxed.

Free tax consultation

How to calculate tax

The tax calculation formula is standard: Tax base * Tax rate.

But the income tax base is not easy to determine. The algorithm is like this:

- profit or loss from sales is calculated;

- profit or loss from non-operating transactions is calculated;

- final tax base: profit (loss) from sales + profit (loss) from non-operating transactions - losses from previous years that can be carried forward to the current period.

If past periods ended in negative territory, losses can be fully or partially deducted from the tax base.

The main task in calculating income tax is to correctly determine income and expenses.

Regional taxes

Mandatory for payment in the territories of the constituent entities of the federation. The general part is described by the Tax Code of the Russian Federation, individual elements of taxation are described by regional laws. Moscow has entrusted the regions with determining tax rates within the established corridor, the procedure and deadlines for paying taxes. Therefore, for example, the transport tax in the Chelyabinsk region can be twice as high as in the Chechen Republic. All regional taxes go entirely to the regional budget and are paid only by those who have certain property or are engaged in a certain type of activity. These taxes are:

- transport tax;

- gambling tax;

- corporate property tax.

Income that is included in tax calculations

Income for this purpose is divided into two groups: from sales and non-sales. The organization receives income from sales as follows (Article 249 of the Tax Code of the Russian Federation):

- from the sale of their goods, works, services, property rights;

- reselling previously purchased goods.

All other income is considered non-operating income. This is, for example, income from equity participation in other companies, from leasing property, interest on deposits, and others.

Not all profits are subject to tax - a list of exceptions is given in Article 251 of the Tax Code of the Russian Federation. It is exhaustive, that is, if some type of income is not included in this article, then it is taxed. There are quite a lot of non-taxable incomes, here are just a few:

- prepayment;

- property received as collateral or deposit;

- credit and borrowed funds;

- everything that is transferred in the form of a contribution to the authorized or share capital.

Income and their “profitable” classification

So, profit is the positive difference between the income received by the organization and the expenses incurred.

To income for “profitable” purposes, according to paragraph 1 of Art. 248 of the Tax Code of the Russian Federation, include:

- Income from sales.

This is revenue from the sale of goods/work/services (including those received in kind) both of one’s own production and those previously acquired, as well as from the sale of property rights.

- Non-operating income.

This includes all other income other than revenue. For example (Article 250 of the Tax Code of the Russian Federation):

- exchange rate differences ( see “From January 1, 2015, only exchange rate differences arise in accounting” );

- fines, penalties, other sanctions for violation of contractual obligations, amounts of compensation for losses or damages ( see “If the creditor does not require payment of penalties provided for in the contract, should they be included in income?” );

- rental payments, if leasing property is not the main activity;

- interest on loan agreements, bank accounts, bank deposits, as well as on securities and other debt obligations;

- property received free of charge, with some exceptions (Article 251 of the Tax Code of the Russian Federation);

- income from previous years identified in the current period;

- the cost of inventories received during dismantling or disassembly during the liquidation of fixed assets (except for cases from subclause 18, clause 1, article 251 of the Tax Code of the Russian Federation);

- accounts payable written off due to statute of limitations or for other reasons;

- surplus inventories identified during inventory, etc.

Attention! The list of non-operating income given in Art. 250 of the Tax Code of the Russian Federation, is open, i.e., receipts not specified in this article can be recognized as income (letters of the Ministry of Finance of Russia dated 05/07/2010 No. 03-03-06/1/316 and 04/19/2010 No. 03-03-06/ 1/277).

See “How to take into account non-operating income when calculating income tax?”

The amount of income received is confirmed by:

- primary documents ( see “Primary document: requirements for the form and the consequences of its violation” );

- other documents confirming income received;

- tax accounting documents ( see “How to independently develop tax registers for income tax?” ).

Taxable income does not include taxes imposed on the buyer, i.e. VAT and excise taxes (clause 1 of Article 248 of the Tax Code of the Russian Federation).

There is no need to take into account when taxing income from the list given in Art. 251 Tax Code of the Russian Federation. For example, receipts such as:

- advance payment for goods (works, services) from taxpayers using the accrual method;

- pledge or deposit received as security for obligations;

- contributions received to the authorized capital;

- amounts received by the intermediary in connection with the execution of the intermediary agreement or on account of reimbursable expenses incurred for the principal;

- loans or borrowings received by an organization, as well as funds received to repay loans issued by it, and some others.

Costs involved in calculating the base

Expenses are considered expenses supported by documents, as well as losses. Expenses are also divided into 2 groups:

- related to production and sales;

- non-operating.

“Production” expenses include everything that an organization spends on the production of its goods, works or services, as well as on their sale. Such expenses may be:

- direct - these are material costs, labor costs, depreciation;

- indirect - these are other costs associated with sales.

Non-operating expenses are listed in Article 265 of the Tax Code of the Russian Federation. For example, these are the costs of maintaining leased property, interest on debt obligations, negative exchange rate differences, and others. If any type of costs not related to sales is not listed in the article, then it cannot be deducted from income.

In addition, there are expenses that do not reduce the tax base. Article 270 of the Tax Code of the Russian Federation provides a closed list of them. For example, these are dividends to owners, penalties to the budget, contributions to the authorized capital, expenses for voluntary insurance and many other costs.

Not all expenses are profit expenses

In order to take expenses into account as a reduction in income, and, accordingly, profit, they must meet certain requirements. These requirements are established by Art. 252 of the Tax Code of the Russian Federation.

So, the expenses should be:

- Justified, that is, economically justified and valued in monetary terms.

Attention! The taxpayer assesses the justification and expediency of expenses independently. In this case, all expenses incurred are initially assumed to be justified. The tax authorities must prove their groundlessness. The assessment of the validity of costs must be carried out taking into account circumstances indicating the taxpayer’s intentions to obtain an economic effect as a result of real business or other economic activity (definition of the Constitutional Court of the Russian Federation dated 06/04/2007 No. 320-O-P, letter of the Ministry of Finance of Russia dated 02/06/2015 No. 03-03 -06/1/4993).

- Confirmed by documents drawn up:

- or in accordance with Russian legislation,

- or in accordance with the customs of business practice in the state where the expense was incurred.

You can also confirm expenses with documents that indirectly confirm the expenses incurred (for example, a customs declaration, a business trip order, travel documents, a report on work performed in accordance with the contract).

See “Primary document: requirements for the form and consequences of its violation.”

- Produced to carry out activities aimed at generating income.

Attention! What matters is only the purpose and direction of such activity, and not its result (definition of the Constitutional Court of the Russian Federation dated June 4, 2007 No. 320-O-P). Simply put, expenses cannot be considered unreasonable only because they did not produce a positive effect, and can be taken into account regardless of the presence or absence of income from sales in the corresponding tax period (letter of the Ministry of Finance of Russia dated September 5, 2012 No. 03-03-06/ 4/96).

In addition, the costs should not be indicated in Art. 270 of the Tax Code of the Russian Federation as not taken into account for taxation. For example, such expenses include penalties, fines, sanctions transferred to the budget, contributions to the authorized capital of other organizations, loans issued, property transferred free of charge, etc.

Date of determination of income and expenses

The dates on which income and expenses are recognized are important for tax calculation. This determines whether the taxpayer can take them into account in the period for which corporate income tax is calculated. There are two methods for determining when income and expenses are recognized:

- Accrual method. Income/expenses are accepted in the period in which they occurred. It does not matter when the funds for them were actually received or spent on them.

- Cash method. Income/expenses are recognized on the day they are actually received or written off.

By default, the accrual method is used. In this case, direct and indirect expenses are taken into account when calculating income tax in different ways:

- Direct costs are divided between the cost of goods in process and goods that are manufactured. It is possible to reduce the tax base due to direct expenses only as the finished products are sold;

- indirect expenses of the current period are written off in full, without any distribution.

There is no such division under the cash method. But it can only be applied to organizations whose average sales revenue over the previous four quarters did not exceed 1 million rubles for each quarter.

Expenses and income of the organization

Income is the proceeds from the main types of financial and economic activities of the institution. Income is the enterprise's revenue from third-party resources. Such sources will be funds received from leased property, loans provided, etc.

Here is an example of how to calculate income tax in 2022. When calculating the payment, net income is accepted - without deductions for value added, excise taxes, etc. Accompanying documentation must be attached to the indicated income - payment orders, invoices, accounting data from the book of income and expenses.

Expenses are costs aimed at satisfying the production, general economic and basic needs of the organization (wages, materials, equipment, etc.). Expenses can also be indirect, for example, expenses aimed at paying off interest on loans. All costs must be reasonable and documented.

Tax rates

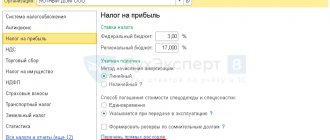

The main, but not the only, income tax rate is 20%. It is distributed between the budgets of two levels. The 2022 income tax is divided as follows: 3% - to the federal budget, 17% - to the regional budgets. After 2024 the distribution will change. Below is a detailed table of rates.

| What does the rate apply to/when does it apply? | Bet size |

| Basic rate (applies unless otherwise stated) | 20%, which is divided this way:

By decision of the authorities of the subject, for certain organizations the rate can be reduced to 12.5% (after 2024 - to 13.5%) |

| Profit on certain securities of Russian companies | 30% |

| Profit from hydrocarbon production from a new offshore field | 20% goes entirely to the federal budget |

| Some income of foreign organizations | |

| Income from state, municipal and other securities | 15% (for some municipal securities 9%) |

| Dividends of a foreign company on Russian shares or from participation in a company from the Russian Federation | |

| Dividends of a Russian organization | 13% |

| Income from depositary receipts | |

| Selected rental income from foreign organizations | 10% |

| Income of agricultural producers, medical and educational organizations, social services and more. The full list is in Article 284 of the Tax Code of the Russian Federation | 0% |

The tax period for this payment is a calendar year. Organizations must calculate and pay advances on income tax monthly or quarterly.

Quarterly payment of advances

Taxpayers whose sales income over the previous four reporting periods did not exceed an average of 15 million rubles per quarter have the right to pay an advance on income tax once a quarter. Payments are made no later than the 28th day of the month following the end of the quarter. If this day falls on a weekend, the deadline will be postponed. For legal entities falling under the terms of quarterly payment, the calculation is made as follows:

- at the end of the first quarter, the advance payment is calculated and paid - until April 28;

- at the end of 6 months, the advance payment for six months is calculated, from the amount received, what was paid at the end of the first quarter is subtracted - until July 28.

At the end of 9 months, the calculation is made in the same way.

For example, in the first quarter the company earned 100,000 rubles, and in the second quarter - 140,000 rubles. Let's calculate advance payments:

- advance for the first quarter: 100,000 * 20% = 20,000 rubles;

- half-year base: 100,000 + 140,000 = 240,000 rubles;

- advance payment for six months: 240,000 * 20% = 48,000 rubles;

- the taxpayer must pay by July 28: 48,000 - 20,000 = 28,000 rubles.

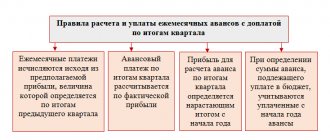

Monthly payment of advances

For legal entities that do not have the right to quarterly payments, there are 2 options for calculating monthly payments:

- based on the profit for the previous quarter with an additional payment based on the results of the period;

- based on actual profit.

By default, the first method will be used. In order to calculate advance payments based on actual profits, you must submit a free-format notification to the Federal Tax Service no later than the end of the year.

The essence of the first method is as follows. In the current quarter, you need to pay as much in advance as was accrued for the previous one. This amount is divided into three parts and paid in each month of the quarter. When it ends, you should calculate the amount of tax based on how much profit was made and make an additional payment.

Let's give an example. Let the tax accrual for the fourth quarter of last year amount to 30,000 rubles. In January, February and March of this year, the company had to pay 10,000 rubles. At the same time, in the first quarter she earned 160,000 rubles. The tax payable is 160,000 x 20% = 32,000 rubles. However, 30,000 of them have already been paid, so you only need to pay an additional 2,000 rubles.

With the payment method based on actual profit, the advance amount is calculated at the end of each month on an accrual basis from the beginning of the year. That is, in February the tax for January is calculated and paid, in March - for January + February, taking into account what was paid earlier, and so on.

For example, the taxable income of an organization was:

- for January - 90,000 rubles;

- for February - 150,000 rubles;

- for March - 120,000 rubles.

At the end of each month you must pay:

- in February for January: 90,000 * 20% = 18,000 rubles;

- in March for January and February: (90,000 + 150,000) * 20% - 18,000 = 30,000 rubles;

- in April - for January, February and March: (90,000 + 150,000 + 120,000) * 20% - (18,000 + 30,000) = 24,000 rubles.

Reporting

Everyone who pays corporate income tax submits a declaration to the Federal Tax Service. The frequency of filing within the reporting year depends on how advance payments are made:

- if monthly, based on actual profit, declarations must be submitted by the 28th of the next month (12 declarations per year);

- if quarterly or once a month, but based on data for the previous period, declarations must be submitted based on the results of the first quarter, half a year, 9 months. The last day of submission is the 28th of the month following the end of the quarter.

Everyone must submit their annual declaration by March 28 of the year following the reporting year. Payment of income tax calculated at the end of the year is also made before this date. That is, income tax for 2022 will need to be paid no later than March 28, 2023.

Results

The frequency of payment of income tax for an organization can be monthly or quarterly, but in any case, the deadline for payment is set as the 28th day of the month following, respectively, the next month or quarter. The exception is the payment of tax on an annual basis: it must be completed no later than March 28 of the following year. The payment deadline is subject to the rule of being postponed to a later date if it coincides with a weekend.

Sources:

- Tax Code of the Russian Federation

- PBU 18/02, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.