How to use the calculator

To find out how much an employee worked, you need to enter the following information into the calculator:

Step 1. Indicate the time that the employee actually worked during the reporting period. Please note that hours and minutes must be entered separately: each has its own field.

Step 2. Now enter into the calculator how many hours and minutes the employee should work according to his schedule.

Step 3. It remains to indicate to the calculator whether it worked on weekends and holidays, and for how long.

Step 4. There is no need to click anywhere. Once all fields are filled in, the recycling calculator will automatically calculate the time. The result will appear directly below the last field of the calculator.

What counts as recycling?

Overtime work is not every overtime. For example, if an employee voluntarily stays late at work, then there is no point in applying for increased pay. Then what hours should be considered paid?

It is important to comply with two requirements enshrined in Article 99 of the Labor Code of the Russian Federation:

- the period of work goes beyond the standard working hours of a specialist, that is, it does not coincide with the length of the working day or shift;

- overtime has to be done at the insistence of the company management, that is, the employee’s own initiative does not apply to overtime work.

If you systematically stay late without a corresponding order from your superiors, you should not expect a double salary. It is important for both the employee and the employer to remember to observe labor discipline. Follow the rules:

- The employer notifies the subordinate of the need to engage in overtime work.

- A specialist can only be engaged with his written consent. Some employees should not be involved in non-standard work at all (pregnant women, minors). Certain categories of specialists must be notified of the right to refuse such an offer (disabled people, for example).

- Having agreed on non-standard work, the employer issues an order setting out all the necessary conditions. For example, the duration of processing, payment, working conditions, etc.

- Interested persons are familiarized with the order. Then the order is transferred to the accounting service for calculations.

The accounting employee calculates wages taking into account the actual volume of processing, payment terms and current norms of the Labor Code of the Russian Federation.

IMPORTANT!

If the employee’s employment contract states that he works on an irregular work schedule, then there should be no talk of overtime. Increased pay for overtime hours is offset by additional rest time. That is, instead of a cash payment to an employee who works irregular hours, additional days of vacation are provided. The conditions for additional rest time must be enshrined in the collective agreement.

Summarized working time recording: design features

With summary accounting, the work scheme is special when it is important to adhere to certain schedules. Most often, shifting or sliding options are used.

The reason for developing such a scheme is a situation where it is not possible to work a working week with standard hours in accordance with the norms. It often happens that shortcomings in one period of time are compensated by overwork in another. There are no violations of the established requirements for the time period. For such cases, the role of the key document is transferred to the work schedule.

Article 103 of the Labor Code helps resolve some disagreements. A schedule that includes general working hours is needed when working in shifts. For other situations, the requirement is no longer mandatory. But managers rarely give up on schedules. In another way, it is difficult to ensure that the regime complies with the laws.

It is impossible to do without recording this information in a number of local regulatory acts:

- internal labor regulations;

- basic and additional agreements drawn up with employees;

- collective agreements;

- In the case of summarized accounting, it is quite difficult to draw up a schedule.

How are processing times calculated?

The working hours for each specialist are calculated separately. For example, a 40-hour work week is considered the standard (Article 90 of the Labor Code of the Russian Federation). But for some specialists, reduced work hours are established. For example, for teachers or doctors. For them, the calculation of overworked hours is not calculated from the 40-hour week, but from the reduced norm.

The volume of processing is strictly limited by law. The following cannot be involved in overtime work (Part 6, Article 99 of the Labor Code of the Russian Federation):

- 4 hours two days in a row;

- more than 120 hours per year.

Overtime hours should be recorded on time sheets. The procedure for reflecting overtime depends on the form of the report card used in the organization.

The calculation of overtime fees depends on the duration. For the first two hours you will be paid one and a half times the standard rate. For the rest of the time - no less than double the amount. The norms are regulated in Art. 152 Labor Code of the Russian Federation.

The employer has the right to increase overtime pay rates. The specific amount of allowances is determined individually, depending on the financial situation of the company. But you cannot pay less than what is enshrined in the Labor Code. The specific amounts of payments should be fixed in a local act of the organization. The legislation does not contain a minimum or maximum amount of payments.

IMPORTANT!

An employee has the right to refuse an increased premium for overtime work, replacing the money with additional rest time. To do this, the subordinate must write an application for time off. This must be done no later than the last day of the month or billing period in which the processing took place.

Features with a 40-hour week

The easiest calculation is for citizens who maintain normal schedules with a 40-hour week. It is enough to record the time spent on processing once. B 04 or C – codes for accounting sheets during registration. The exact duration is placed next to this designation.

The code describes recycling standards for the year and day. But there are no indicators for the month. You can only carry out calculations theoretically. It is acceptable to assume that the maximum processing time per month is 84 days. But in practice, managers are rarely able to achieve agreement with such difficult conditions. Trade union bodies also do not agree with this.

Salary calculation

Salary or tariff rate is the most common form of remuneration in Russia. The employer assigns the employee a specific salary or rate for a fully worked norm. The calculation of overtime working hours at a salary is calculated based on the hourly share of the salary or rate.

First, the accountant calculates the cost of one hour of work for a specific specialist. There are several ways to calculate the hourly rate. For example, it is enough to divide the official salary by the number of working hours in the billing month. Or another option: we divide the salary by the average annual working time (standard working hours per year / 12 months).

IMPORTANT!

The method for calculating the hourly share of the salary or tariff rate must be enshrined in the local acts of the institution. Calculation based on the average annual working time is more beneficial for workers (Letter of the Ministry of Labor dated 08/09/2002 No. 1202-21).

The result obtained remains to be multiplied by the number of hours worked, taking into account the increasing factor. That is, we multiply the hourly salary by a factor of 1.5 for the first 2 overtime hours. The remaining processing time is calculated with a factor of 2.

Processing payment procedure

Payment for overtime hours is made in the following order:

- The wage system adopted at the enterprise is taken into account; Daily, shift, and hourly wages are taken into account.

- If an employee receives payment for each shift, then the amount must be divided by the number of hours of the shift. The result is that the resulting indicator will be payment for each hour worked.

- The first two hours of overtime must be paid at 1.5 times the rate, the rest - at double the rate of payment for a standard labor hour.

Expert commentary

Gorbunova Olga

Lawyer

The employer can approve its own reward system for overtime, which cannot be less than the stipulated payment for each hour. The employer is obliged to draw up shift schedules in accordance with the accounting standard of working time in production. An independent working time recording period can be developed for a specific category of employees.

Article 152 of the Labor Code of the Russian Federation

“Payment for overtime work” (more details)

A schedule must be provided at each enterprise. The document must contain the following information:

- Duration of each work shift.

- Breaks for rest and lunch - at least half an hour.

- The order of rotation of employees on shifts.

Management is required to count the time worked by each employee. Time recording is carried out according to a timesheet - according to Form T-12 or T-13, or the employer develops his own template. Overtime over 120 hours is considered at the end of the accounting period.

Calculation example

A.P. Morkovkin’s official salary — 50,000 rubles. In May 2020, the standard working hours was 144. Processing in May was 5.5 hours.

We calculate the additional payment for processing:

- We calculate the hourly salary: 50,000 / 144 hours = 347.22 rubles.

- We calculate the additional payment for the first 2 hours: 347.22 × 1.5 × 2 hours = 1041.66 rubles.

- We calculate the remaining processing time: 5.5 - 2 hours = 3.5 hours.

- Calculation of the allowance for the rest of the time: 347.22 × 2 × 3.5 = 2430.54 rubles.

Total additional payment for processing: 1041.66 + 2430.54 = 3472.20 rubles.

The employee has the right to refuse increased pay and replace it with additional rest time.

IMPORTANT!

Additional payment for work in non-standard conditions from 04/11/2019 cannot be taken into account when comparing earnings with the minimum wage (Decision of the Constitutional Court of the Russian Federation No. 17-P of 04/11/2019). Therefore, additional payment for night, holiday, weekend or overtime work is calculated in excess of the minimum wage.

Definition of the term "recycling"

Overtime includes situations where, at the request or request of a manager, an employee has to perform work duties at the end of the working day. In this case, the subordinate spends his personal time, which is intended for rest, to carry out work. Time spent on useful activities that exceeds the legally established norm is recognized as overtime, requiring additional payment.

Standards of working time according to the Labor Code of the Russian Federation

The period of time during which, as prescribed by the boss, an employee at the place of work performs his direct functions is called the standard working time. This is noted in the internal regulations of any enterprise and in other documentation regulating its work processes. When hiring a person, excess of the norms is indicated in the employment contract.

It is important! When drawing up statutory documents containing information about the daily routine, the employer needs to rely on Art. 94 and 98 of the Labor Code of the Russian Federation. These articles regulate the working hours and overtime standards established by the state.

According to the country's regulations, the working week of every Russian is normalized to 40 hours of service, regardless of how many days it lasts. Service exceeding the established time limit is counted as overtime.

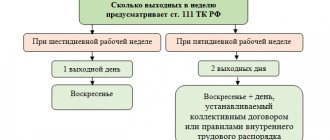

The standard working hours per week is regulated by the Labor Code of the Russian Federation

The state limit on working hours has been reduced for full-time workers in hazardous industries and employees combining work and training. In the first case, this figure is 36 hours per week, for the second - 24.

If according to the schedule, employees have two days off and five working days, then each of them should not exceed 8 hours. When working in shifts, duty may exceed the daily norm, but in general there should not be more than 40 hours worked per week.

Legal grounds for processing

The employer does not have the right to force an employee to remain in service longer than the required time, without having sufficiently compelling reasons for such a decision.

It is important! If an executive employee stays on duty on his own initiative to complete any process that is not done within the prescribed time, this is not considered as overtime. Accounting for overtime is possible only by written order of management.

In order for calling an employee to work beyond the specified limit to be correct from the point of view of the law, the employer must have the consent of the subordinate in writing. In addition, processing is permitted only in the presence of a special situation, the nuances of which are recorded in Article 99 of the Labor Code of the Russian Federation.

Involving an employee in overtime work is possible only with his written consent

These include:

- The need to complete any work process that was left unfinished within the prescribed period for reasons beyond the employer’s control. This circumstance arises under the condition that if this process is left unfinished, it will lead to the loss of the employer’s property or endanger the lives and health of employees.

- Carrying out repair work on technical equipment or structures. Allowed in circumstances where the breakdown of the latter makes it impossible for a significant number of employees to carry out work activities.

- Absence of a replacement if the production process cannot be stopped. Legal, provided that the employer has made every effort to quickly replace the processor with another employee.

Sample order for inviting employees to work overtime

In emergency cases, the law allows for involvement in processing without the consent of the employee himself. Such cases include:

- Activities necessary to eliminate emergencies or global disasters;

- Activities necessary to minimize the consequences of natural disasters or large-scale technical breakdowns;

- Fixing breakdowns that led to failures in the city’s life support systems, leaving people without heating, light, water or public transport;

- Under martial law - in the event of dangerous situations;

- To eliminate the consequences or minimize the danger during natural disasters (fire, flood, earthquake, epidemic);

- Activities to protect the population in conditions where a large number of people are at risk, and the systems that ensure their normal functioning fail.

Who can't be attracted

Not every employee can be called to duty after the end of the working day. There is a category of workers protected by law from the need to remain at their place of duty longer than the required time. Workers with a disability group, or women who have three children under three years of age, have the right by law not to stay at work longer than expected, regardless of the circumstances. It is impossible to oblige this category to work beyond the norm. Even if an employee expresses his consent to overtime, the employer is obliged to obtain from him a certificate from a medical institution, which states that the increased work will not lead to a deterioration in his health.

It is important! Among other things, employees classified as beneficiaries must be made aware of their right to refuse overtime. The designated employee must read the document and sign as proof of reading.

Notice of the possibility of refusing overtime work

Some employees are strictly not allowed to remain in the workplace after the end of their service. These include:

- Teenagers who have not reached the age of majority;

- Pregnant women;

- Students combining study and work.

Responsibility for exceeding processing requirements

Acceptable processing standards are approved by law. The total duration of work in excess of the approved standards cannot be more than 120 hours per year. Processing of no more than 4 hours within two working days is allowed. Exceeding legal standards for overtime work is unacceptable.

It is important! By violating the norms approved by the authorities, the employer risks receiving administrative punishment in the form of fines and penalties.

According to Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, exceeding working hours threatens:

- For hired employees holding responsible positions - a reprimand and a fine from 1,000 to 5,000 rubles;

- Individual entrepreneurs - a fine of 1,000 to 5,000 rubles;

- For legal entities - a fine of 30,000 to 50,000 rubles.

If the law is violated again, the fine increases significantly. In such circumstances it will be:

- Responsible employees and entrepreneurs - from 10,000 to 20,000 rubles;

- For legal entities - from 50,000 to 70,000 rubles.

Regular violations of labor laws can lead to deprivation of the enterprise’s ability to fully carry out the work process in the future.

Procedure for processing processing

Personnel documentation must be completed in accordance with government requirements for recording working hours. Otherwise, there is a high probability of labor disputes arising between employees and the employer, which may result in the latter being brought to administrative liability.

Step 1. Order

A document should be created according to a template approved by the enterprise on the need to engage personnel to perform work after the end of the established period. The document must reflect who will be involved, the processing time, payment or other compensation for it.

Step 2. Employee consent

To leave an employee at the workplace after the end of working hours, you will need to obtain his consent on paper. There are no strict requirements for document formatting. To record consent, it is enough for the involved employee to sign the relevant order, indicating the date of familiarization.

All employees affected by the order must be familiarized with the order for overtime work.

Step 3. Payment

Compensation for delays at work can include both an appropriate additional payment and additional time for the employee to rest. Replacing overtime pay on weekends is permissible only with the unconditional consent of the employee, documented.

Calculation for shift schedule

An eight-hour workday is not convenient for all companies. For example, in the manufacturing sector, businesses need to operate around the clock. Such organizations use shift work. The conditions of shift work are fixed in the employment contract.

If the employer had to hire an employee to work on a shift other than his own, he will have to pay double for the work. If shifts fall at night, specialists are entitled to an increase of at least 20%. If the shift falls on a holiday, then double pay is guaranteed. If the work shift falls on a holiday night, then the employee is entitled to two payments at once: separately for the night hours and separately for the holiday shift.

Calculation of overtime during a shift work schedule is carried out according to a similar scheme. First, the cost of an hour of work is calculated, and then multiplied by the hours worked and increasing factors. There are no exceptions for shift workers: for the first 2 hours the employer must charge a payment of no less than 1.5 times the amount. For the remaining hours - no less than double.

Summary accounting: overtime pay

In accordance with Art. 152 of the Labor Code of the Russian Federation, overtime work is paid at least one and a half times the rate for the first two hours of work and at least double the rate for subsequent hours. However, the code does not answer more detailed questions: how exactly to pay, that is, where to get one and a half sizes from?

There are other difficulties: in order to figure out how to pay for overtime hours when accounting for working hours together, you need to focus on the chosen wage system - salary or tariff.

So, for example, if an employee has a salary system and the salary is 15,000 rubles, then the employer is guaranteed to pay him this amount. And only at the end of the accounting period, if there is overtime work, he will receive payment in the form of the first two hours at one and a half times the rate, and for subsequent hours at least double the rate.

Example

Payment for January, February and March - 15,000 rubles. for every month. During the accounting period, the employee worked 10 hours overtime. The rate for 1 hour of work is 100 rubles. We calculate how much he needs to pay extra:

2 hours * 1.5 * 100 rub. = 300 rub.

8 hours * 2 * 100 rub. = 1600 rub.

Total: 1900 rub.

Please note that Rostrud experts recommend establishing a tariff system of remuneration for workers for whom summarized working hours are kept - either hourly or daily.

How should overtime be calculated in this case?

Example

The employee has a tariff system of remuneration, the rate for 1 hour is 100 rubles. The accounting period is 1st quarter. Within this period, we notice that in January the employee actually worked 150 hours, which was included in the schedule. Accordingly, at an hourly rate we pay him 15,000 rubles.

In February, instead of 148 hours included in the schedule, the employee actually worked 156 hours (reflected in the report card). It turns out 15,600 rubles. At the same time, 149 hours were planned in March, but in fact it turned out to be 151 hours. You need to pay 15,100 rubles.

Evgenia Konyukhova, an expert in the field of labor legislation and personnel records management, in the webinar “Summary accounting of working time. Registration and payment" draws attention to the fact that with the tariff system of remuneration within the accounting period at a single rate, overtime work has already been paid.

The expert believes that the norm from Art. 152 of the Labor Code of the Russian Federation works well with a salary system of remuneration. As we saw above, in this case, at the end of the accounting period, you need to take 10 hours of overtime work and calculate the amounts: the first 2 hours - at one and a half times, and the remaining 8 hours - at double.

But if the employee has a tariff system of remuneration, then the first 2 hours should be paid only in the amount of 0.5, since the single rate has already been paid. And the remaining hours are not double, but single.

So, based on the fact that we had 10 hours of overtime, we get:

2 hours * 0.5 * 100 rub. = 100 rub.

8 hours *1 * 100 rub. = 800 rub.

Total: 900 rub.

If the employee has a salary system or a monthly wage rate, then you need to figure out how to determine how much to pay for one hour of overtime work. The fact is that the Labor Code does not answer this question. There are several examples of how this can be implemented in practice.

Option 1: The salary is divided by the number of working hours in the month when the employee was involved in overtime work.

So, if the salary is 20,000 rubles, then you need 20,000 / 160 hours = 125 rubles. per hour of work.

Option 2: According to Letter of the Ministry of Health of the Russian Federation dated July 2, 2014 N 16-4/2059436, the salary is divided by the average monthly number of hours per year (for example, for workers with a 40-hour working time in 2022, the average hourly working hours is 1979 hours / 12 month = 164.9 hours), respectively, hourly rate = 20,000 rubles. / 164.9 = 121.28 rub.

Option 3: The amount of salaries accrued for the accounting period is divided by the standard working time according to the employee’s schedule for the accounting period in months.

Option 4: The entire salary (including additional payments, allowances) is divided into one of the above options. But the employer is not obliged to calculate the hourly wage rate based on all payments. The Supreme Court believes that only the salary is sufficient.

Often, in addition to salaries, employers also provide a system of additional payments and allowances, which raises the question: should the entire salary in this case be divided by the number of hours in the month when the employee was involved in overtime work or by the average monthly number of hours for the year? Only the employer himself can answer this question in local regulations (Decision of the Supreme Court of the Russian Federation dated June 21, 2007 N GKPI07-516). It is recommended to do this, among other things, to avoid problems with employees and inspectors.

The position of the Ministry of Health and Social Development is that in the case of cumulative accounting of working time, based on the definition of overtime work, the calculation of overtime hours is carried out after the end of the accounting period. In this case, work in excess of the normal number of working hours for the accounting period is paid for the first two hours of work in no less than 1.5 times the amount, and for all other hours - no less than double the amount (Letter of the Ministry of Health and Social Development of the Russian Federation dated August 31, 2009 No. 22- 2-3363).

Depending on the remuneration system - salary or tariff - payment will be either one and a half to double, or 0.5 and single.

But there is another approach, indicated by judicial practice (Review of the Supreme Court of the Russian Federation of the practice of courts considering cases related to the implementation of labor activities by citizens in the regions of the Far North and equivalent areas" (approved by the Presidium of the Supreme Court of the Russian Federation on February 26, 2014)). There are clarifications according to which overtime pay is taken at one and a half times for the first 2 hours, which falls on average for each working day of the accounting period, and at double the rate for subsequent hours of overtime work. But when using this approach, the amount of payments for overtime work will be less, and therefore conflicts with employees are inevitable.

Calculation example

Zaichikov P.B. works in shifts. The duration of 1 shift is 12 hours. The cost of a shift is 2,400 rubles. Night hours are paid at 20% of the rate. In April, the employer engaged Zaichikov to work overtime twice: on April 10 - for 3 hours and on April 15 - for 4 hours. Moreover, the overtime on April 15 fell at night.

We make the calculation:

- We calculate the cost of an hour: 2400 / 12 hours = 200 rubles.

- Additional payment for 04/10/2019: 200 × 1.5 × 2 hours + 200 × 2 × 1 hour = 600 + 400 = 1000 rubles.

- Additional payment for 04/15/2019: 200 × 1.5 × 2 hours + 200 × 2 × 2 hours = 600 + 800 = 1200 rub.

- We calculate the additional payment for night work: 200 × 4 hours × 20% = 160 rubles.

Total: 2360 (1000 + 1200 + 160) rubles.

Calculation example

The NPO Primer has established a summarized recording of working time. The billing period is quarter. Employee Kartoshkin I.N. The hourly tariff rate is set at 300 rubles. The norm for the 1st quarter of 2022 is 454 hours. In fact, Kartoshkin worked 462 hours. We make the calculation:

- We calculate the volume of processing: 462 - 454 = 8 hours.

- We calculate the additional payment for the first 2 hours: 300 × 1.5 × 2 hours = 900 rubles.

- Calculation of remaining time: 8 - 2 = 6 hours.

- We calculate the payment for the rest of the time: 300 × 2 × 6 hours = 3600 rubles.

Total amount of additional payment: 4500 (900 + 3600) rubles.

Labor Code

What is considered “recycling”?

This is the first question that arises when considering the topic of overtime work. The answer to it can be found in Article 99 of the Labor Code: “overtime work is work performed by an employee at the initiative of the employer outside the working hours established for the employee: daily work (shift), and in the case of cumulative accounting of working hours - in excess of the normal number of working hours per accounting period. period". Do not forget that it is possible to involve an employee in work after the time specified in the employment contract only with the written consent of the subordinate. In addition, this is permitted only in the cases provided for in Article 99 of the Labor Code. For example, if it is necessary to finish the work started, if failure to complete it may result in damage or destruction of any property.

On a note

Engaging an employee to work after the time specified in the employment contract is possible only with the written consent of the subordinate.

However, sometimes it is not necessary to ask a specialist’s consent to work overtime. For example, when carrying out work necessary to prevent a disaster, accident or eliminate their consequences. A complete list of cases when it is not necessary to be interested in an employee’s opinion can be found in the article mentioned above.

However, we must not forget that workers of certain categories cannot be involved in overtime under any circumstances. These include: pregnant women, teenagers under eighteen years of age, and other employees in accordance with the legislation of the country. But the involvement of disabled people and women with children under three years of age in overtime work is allowed only with their written consent and provided that this is not prohibited for them due to health reasons. At the same time, they must be informed of their right to refuse processing upon signature.

And one more thing: the duration of overtime work should not exceed four hours for each employee for two consecutive days and one hundred and twenty hours per year. the company is obliged to keep records of processing. Do not forget that there is liability for violation of labor legislation (Article 5.27 of the Administrative Code). This norm establishes sanctions up to and including suspension of the company's activities.