| According to paragraph 1 of Art. 226 of the Tax Code of the Russian Federation, Russian organizations from which or as a result of relations with which the taxpayer received income are recognized as tax agents for personal income tax. This provision imposes obligations on tax agents to calculate, withhold and transfer taxes to the budget. | Related articles: — Cancellation of decisions of tax authorities — Pre-trial settlement of tax disputes — In whose favor the dispute will be resolved - know in advance — New in the Tax Code since 2014 |

The Federal Tax Service exercises control over the fulfillment of the duties of a tax agent. During tax control, disputes often arise between the organization and the control body, which are subsequently resolved in arbitration court. What decisions do the arbitrators make?

Status of an individual when calculating personal income tax (Article 207 of the Tax Code of the Russian Federation).

According to paragraph 1 of Art. 207 of the Tax Code of the Russian Federation, personal income tax payers are recognized as individuals:

- who are tax residents of the Russian Federation. Tax residents are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months;

- receiving income from sources in the Russian Federation who are not tax residents of the Russian Federation.

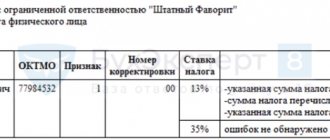

It should be noted that determining the status of a taxpayer is relevant primarily for the reason that the tax rate at which the income of an individual will be taxed depends on this fact. For persons staying in the Russian Federation for at least 183 calendar days over the next 12 consecutive months, its size will be 13% (clause 2 of Article 207 of the Tax Code of the Russian Federation).

If this condition is not met, such an employee is not recognized as a tax resident of the Russian Federation and his income from sources in the Russian Federation is subject to taxation at a rate of 30% (Letter of the Ministry of Finance of the Russian Federation dated November 15, 2012 No. 03 04 05/6-1305).

During tax audits, friction arises between the Federal Tax Service and tax agents regarding the determination of the status of an individual. Thus, in particular, it is unclear which 12 consecutive months should be taken into account by the tax agent when determining the tax status of an individual.

In the Resolution of the Federal Antimonopoly Service of the North-West District dated March 6, 2013 No. A13-18291/2011, the court noted the following. In relation to the provisions of paragraph 2 of Art. 207 of the Tax Code of the Russian Federation, when determining the 12-month period of actual stay of an individual in the Russian Federation, the circumstance whether these 12 months fall within one calendar year has no legal significance. By virtue of this provision of the Tax Code of the Russian Federation, it is necessary that these months follow one after another.

Thus, the specified period may refer not only to the 12-month period of the current calendar year, but also to any continuous 12-month period, including those that began in one calendar year and continued in another. The same legal position is set out in letters of the Ministry of Finance of the Russian Federation dated 04/26/2012 No. 03 04 06/6 123, dated 04/05/2012 No. 03 04 05/6 444, dated 07/14/2011 No. 03 04 06/6 170, which, by virtue of Art. . 32 of the Tax Code of the Russian Federation must be followed by tax authorities.

Income not subject to taxation (Article 217 of the Tax Code of the Russian Federation)

When determining the tax base, all income of the taxpayer that he received both in cash and in kind or the right to dispose of which he acquired, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation (clause 1 of Article 210 of the Tax Code of the Russian Federation). The list of income not subject to taxation is given in Art. 217 Tax Code of the Russian Federation. However, some amounts paid to individuals, despite the fact that they are not named in Art. 217 of the Tax Code of the Russian Federation, by a court decision may be recognized as income not subject to personal income tax.

An example of such payments is payment of daily allowances to employees sent on one-day business trips (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 11, 2012 No. 4357/12). Thus, the arbitrators of the highest court indicated the following. By virtue of Art. 167, 168 of the Labor Code of the Russian Federation, daily allowances are paid to employees when they are sent on a business trip to perform work functions outside their place of permanent work for a period of at least 24 hours and are intended to compensate for expenses associated with living outside their place of permanent residence. When sending workers on a one-day business trip, from where the business traveler has the opportunity to return daily to his place of permanent residence, daily allowances are not paid, and payments made are not daily allowances. At the same time, according to Art. 168 of the Labor Code of the Russian Federation, an employee may be reimbursed for other expenses related to a business trip made with the permission or knowledge of the employer. Thus, amounts paid to employees sent on one-day business trips are not daily allowances due to the definition contained in labor legislation, however, based on their focus and economic content, they can be recognized as reimbursement of other expenses associated with a business trip, made with the permission or knowledge employer, and therefore are not income (economic benefit) of the employee and are not subject to personal income tax. A similar conclusion is contained in the resolutions of the Federal Antimonopoly Service of the North-West District dated June 29, 2012 No. A05-8580/2011, the Federal Antimonopoly Service of the Moscow Region dated April 26, 2012 No. A40-83149/11 116 236 (Determination of the Supreme Arbitration Court of the Russian Federation dated September 26, 2012 No. VAS-10408/12 was left unchanged) .

The next controversial point is the norms of paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, according to which expenses for improving the professional level of employees are not subject to taxation. In accordance with the norms of the Tax Code of the Russian Federation, if the initiator of training is an individual, including an employee of an organization, payment of the final cost of his training on the basis of paragraphs. 1 item 2 art. 211 of the Tax Code of the Russian Federation is included in the tax base for personal income tax.

However, as FAS PO indicated in Resolution No. A12-16705/2010 dated May 24, 2011, if an employee’s training is carried out at the initiative of the employer in order to more effectively perform his job duties, payment for such training (regardless of its form) does not form the employee’s personal income and is not subject to personal income tax on the basis of clause 3 of Art. 217 Tax Code of the Russian Federation.

In Resolution of the FAS VSO dated May 24, 2012 No. A19-11749/2011, declaring that additional personal income tax accrual to the company on the cost of free milk provided to employees engaged in work with hazardous working conditions is unlawful, the arbitration court proceeded from the following. The distribution of milk is of a compensatory nature, and the organization had no obligation to withhold and transfer personal income tax to the budget from its cost. At the same time, labor legislation does not provide for certification as a condition for providing compensation for harmful working conditions. Failure of certification by the employer does not relieve him of the obligation to provide compensation to the employee on the days of actual employment in work associated with the presence of harmful production factors in the workplace. Tax authority reference to Art. 219 of the Labor Code of the Russian Federation, clause 13 of the Norms and conditions for the free issuance of milk or other equivalent food products to employees engaged in work with hazardous working conditions was rejected by the court, since it does not follow from this norm of the Labor Code of the Russian Federation that it is the results of certification of workplaces that are the basis for issuing free milk.

Date of actual receipt of income (Article 223 of the Tax Code of the Russian Federation).

By virtue of paragraph 1 of Art. 223 of the Tax Code of the Russian Federation, as a general rule, the date of actual receipt of income is defined as the day:

- payment of income, including its transfer to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties - when receiving income in cash;

- transfer of income in kind – when receiving income in kind;

- payment by the taxpayer of interest on borrowed (credit) funds received, acquisition of goods (work, services), securities - when receiving income in the form of material benefits.

Note. If it is impossible to withhold from the taxpayer the calculated amount of tax, the tax agent is obliged, no later than one month from the date of the end of the tax period in which the relevant circumstances arose, to notify him and the tax authority at the place of his registration in writing about the impossibility of withholding the tax and its amount.

Tax deductions when calculating personal income tax (Articles 218, 220 of the Tax Code of the Russian Federation)

When determining the size of the tax base, the taxpayer has the right to receive deductions:

- standard The list is established by Art. 218 Tax Code of the Russian Federation;

- property The list is established by Art. 220 Tax Code of the Russian Federation.

It is these two types of deductions that a taxpayer can obtain from a tax agent by presenting him with documents giving him the right to receive one or another deduction. Within the framework of this material, we will not talk about the procedure for providing deductions for personal income tax; we will only recall that the right of an individual to have a deduction provided to him by a tax agent must be documented. Otherwise, the provision of a deduction will be unlawful and will lead to incorrect calculation of personal income tax by the tax agent (Resolution of the Federal Antimonopoly Service dated December 11, 2012 No. A72-983/2012).

Commentary on Article 230 of the Tax Code of the Russian Federation

The Tax Code of the Russian Federation provides that personal income tax is transferred to the budget in a special manner.

In most cases, taxes are transferred to the budget not by taxpayers themselves, but by tax agents.

With regard to personal income tax, the following are recognized as tax agents (Article 226 of the Tax Code of the Russian Federation):

— Russian organizations;

— bar associations, law offices and legal consultations;

- individual entrepreneurs;

— permanent representative offices of foreign organizations in Russia.

This means that every time an organization or individual entrepreneur (from those listed above) pays income to individuals, this organization or individual entrepreneur acts as a tax agent. That is, he is obliged to calculate the tax, withhold it from the income of the taxpayer - an individual and transfer the withheld amount of tax to the budget.

There are exceptions to the above rule. In paragraph 2 of Art. 226 of the Tax Code of the Russian Federation states that the source of payment of income in some cases does not perform the functions of a tax agent.

Thus, the following individuals pay their own income tax:

— individual entrepreneurs — based on income from business activities;

- private notaries and other persons engaged in private practice in accordance with current legislation - based on income received from private practice.

In addition, individuals who receive, in particular, the following income must pay the tax themselves:

- under civil law agreements concluded with another individual who is not a tax agent (for example, such agreements include contracts for hiring and leasing property from another individual);

— from sources outside the Russian Federation;

- from the sale of property owned by these persons;

— in the form of winnings paid by the organizers of lotteries, sweepstakes and other risk-based games (including using slot machines).

In addition, the obligation to pay the tax themselves is assigned to those individuals, when paying income to whom the tax agent was not able to withhold personal income tax (for example, when issuing income in kind).

The above-mentioned taxpayers who pay the tax themselves are required to submit a tax return to the tax office at their place of residence at the end of the year.

The Tax Code of the Russian Federation establishes clear rules for the calculation, withholding and transfer of personal income tax by tax agents. These are the rules.

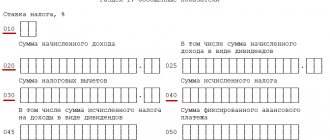

1. Tax at a rate of 13 percent is calculated on an accrual basis from the beginning of the tax period based on the results of each month in relation to all income taxed at this rate.

2. Tax at rates of 35, 30 and 9 percent is calculated separately for each amount of income accrued to the taxpayer.

3. The tax is calculated without taking into account the income received by the taxpayer from other tax agents, and accordingly, without taking into account the tax calculated and withheld from this income.

4. The tax agent can withhold the calculated tax only from the amounts actually paid to the taxpayer (transferred to his account or the accounts of third parties on his behalf). In this case, the amount of deduction cannot exceed 50 percent of the payment amount.

5. If the tax agent does not have the opportunity to withhold tax from the taxpayer’s income (for example, when issuing income in kind or when it is known in advance that the period during which the amount of the calculated tax can be withheld will exceed 12 months), he is obliged to inform in writing about this to your tax office. Such a message must be sent within a month from the moment the relevant circumstances arise. Payment of tax at the expense of the tax agent's own funds is not permitted.

6. Excessively withheld tax amounts are returned by the tax agent to the taxpayer upon his written application.

7. Taxes not withheld (not fully withheld) by tax agents are collected from individuals until the debt is fully repaid.

This article sets out the following responsibilities of tax agents:

— accounting for income received from them by individuals during the tax period;

- submission to the tax authority at the place of registration of information on the income of individuals of this tax period and on the amounts accrued and withheld in this tax period, annually, but no later than April 1 of the year following the expired tax period.

Since the tax on income received at the source of payment by individual entrepreneurs from carrying out business activities is not calculated, information about such income is not submitted to the tax authorities. It should be remembered that this rule applies only to those entrepreneurs who have presented to the tax agent documents confirming their state registration as entrepreneurs without forming a legal entity and registration with the tax authorities as payers of personal income tax on the basis of a tax return.

At the request of individuals, tax agents issue certificates about the income they received and the amount of tax withheld from this income.

Transfer of personal income tax to the budget (Article 226 of the Tax Code of the Russian Federation).

Clause 6 of Art. 226 of the Tax Code of the Russian Federation establishes the deadlines for transferring personal income tax amounts withheld by the tax agent to the budget:

- in general, tax agents are required to transfer the amounts of calculated and withheld tax no later than the day of actual receipt of cash from the bank for the payment of income, as well as the day of transfer of income from the accounts of tax agents in the bank to the accounts of the taxpayer or, on his behalf, to the accounts of third parties in banks ;

- in the case of payment of income in cash - no later than the day following the day the taxpayer actually received income;

- in the case of payment of income in kind - no later than the day following the day of actual deduction of the calculated tax amount.

In the Resolution of the Federal Antimonopoly Service of the North-West District dated January 18, 2013 No. A42-8095/2011, a dispute about violation of Art. 226 Tax Code of the Russian Federation. According to the Federal Tax Service, the tax agent unjustifiably failed to transfer to the personal income tax budget the difference between the tax withheld from the income of individuals and the amount transferred to the budget. The basis for this conclusion was a selective check of payroll and pay slips, lists of funds transferred to employees’ plastic cards, and accounting registers for accounting accounts.

Recognizing the position of the Federal Tax Service as unlawful, the FAS indicated that the presence or absence of arrears under personal income tax should be determined on the basis of primary documents confirming the circumstances that gave rise to Art. 226 of the Tax Code of the Russian Federation connects the occurrence of the obligation to transfer personal income tax in relation to each individual with the indication of the dates of payment of wages or other income for each individual.

The selective method used by the inspectorate to check the documents submitted by the tax agent does not guarantee the correct determination of the tax transferred for each employee, since in this case professional and other deductions, payment of travel allowances, vacation pay and other payments are not taken into account. Since, during the on-site tax audit, the primary personal income tax documents for each employee of the organization (tax cards for accounting income and personal income tax for each individual) were not requested or examined by the tax authority, the tax inspectorate’s demands were rejected.

Another comment on Art. 230 Tax Code of the Russian Federation

When applying Article 230 of the Tax Code, it should be borne in mind that the Tax Code does not decipher the procedure for presenting the necessary documents and does not specify which documents must be presented to the tax agent.

Primary documents confirming the purchase and payment of goods (work, services) from individual entrepreneurs that contain relevant information on state registration and tax registration.

Order of the Federal Tax Service of Russia dated October 13, 2006 N SAE-3-04/ [email protected] approved form N 2-NDFL “Certificate of income of an individual for the year 200_”, appendices “Recommendations for filling out information on income of individuals in form N 2- Personal income tax “Certificate of income of an individual for the year 200_” and “Directories”.

Order of the Ministry of Taxes of Russia dated October 31, 2003 N BG-3-04/583 approved Form N 1-NDFL “Tax Card for Accounting for Income and Personal Income Tax for 2003” and an appendix to Form N 1-NDFL “Procedure for filling out the Tax Card on accounting of income and personal income tax for 2003.”

It should be noted that for the submission of information filled in with errors, which resulted in the tax authority not accepting the information, the tax authority cannot be held liable under paragraph 1 of Article 126 of the Tax Code, since the obligation to provide information by the tax agent had already been fulfilled at the time the information was submitted. containing erroneous data. In addition, the legislation on taxes and fees does not contain deadlines for re-submitting information containing corrected data.

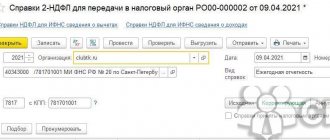

Submission of information according to Form 2 of Personal Income Tax (Article 230 of the Tax Code of the Russian Federation).

Clause 2 of Art. 230 of the Tax Code of the Russian Federation establishes the obligation of tax agents annually, no later than April 1 of the year following the expired tax period, to provide information on the income of individuals. The specified information is presented on magnetic media or using telecommunications in the manner determined by the Ministry of Finance. If the number of individuals who received income in the tax period is up to ten people, tax agents can provide such information on paper.

Since Art. 230 of the Tax Code of the Russian Federation provides for the submission of information on the income of individuals for each individual; each certificate is required to be submitted. Accordingly, the fine for failure to submit or late submission of information provided for in Art. 126 of the Tax Code of the Russian Federation, will be imposed in the amount of 200 rubles. for each unsubmitted or untimely submitted certificate of income of each individual for the corresponding year. This conclusion is confirmed in the Resolution of the Ninth Arbitration Court of Appeal dated March 29, 2012 No. 09AP-5197/2012 AK.

S. P. Korobeinikov / expert of the magazine “Tax Audit” /

Article 230. Enforcement of the provisions of this chapter

Information about changes:

Federal Law No. 327-FZ of November 28, 2015 introduced amendments to paragraph 2 of Article 230 of this Code, which come into force no earlier than one month from the date of official publication of the said Federal Law and no earlier than the 1st day of the next tax period. personal income tax

Federal Law No. 113-FZ of May 2, 2015 sets out paragraph 2 of Article 230 of this Code in a new wording, which comes into force on January 1, 2016.

See the text of the paragraph in the previous edition

2. Tax agents submit to the tax authority at their place of registration:

a document containing information on the income of individuals of the expired tax period and the amount of tax calculated, withheld and transferred to the budget system of the Russian Federation for this tax period for each individual, annually no later than April 1 of the year following the expired tax period, in the form formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees, unless otherwise provided by paragraph 4 of this article;

calculation of the amounts of personal income tax calculated and withheld by the tax agent for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, according to form, formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

Tax agents are Russian organizations that have separate divisions, submit a document containing information on the income of individuals for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of tax on personal income calculated and withheld by the tax authorities. agent, in relation to the employees of these separate divisions, to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax authority at the place of registration of the separate divisions that entered into such agreements.

Tax agents - organizations classified as the largest taxpayers, submit a document containing information on the income of individuals for the past tax period and the amounts of personal income tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax persons calculated and withheld by the tax agent, including in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil contracts, to the tax authority at the place of registration of separate divisions that have entered into such agreements, to the tax authority at the place of registration as the largest taxpayer or to the tax authority at the place of registration of such a taxpayer for the corresponding separate division (separately for each separate division).

Tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of a single tax on imputed income for certain types of activities and (or) a patent taxation system, submit a document containing information on the income of individuals persons for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent in relation to their employees to the tax authority at the place of their registration in connection with carrying out such activities.

A document containing information on the income of individuals for the past tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent, are submitted by tax agents in electronic form via telecommunications communication channels. If the number of individuals who received income in the tax period is up to 25 people, tax agents can submit the specified information and calculate the tax amounts on paper.

1. Tax agents keep records of income received from them by individuals in the tax period, tax deductions provided to individuals, calculated and withheld taxes in tax registers.

The forms of tax accounting registers and the procedure for reflecting in them analytical data of tax accounting, data from primary accounting documents are developed by the tax agent independently and must contain information that allows identifying the taxpayer, the type of income paid to the taxpayer and tax deductions provided, as well as expenses and amounts that reduce the tax base, in accordance with the codes approved by the federal executive body authorized for control and supervision in the field of taxes and fees, the amount of income and the date of their payment, the status of the taxpayer, the dates of withholding and transfer of tax to the budget system of the Russian Federation, details of the relevant payment document.

2. Tax agents submit to the tax authority at their place of registration:

a document containing information on the income of individuals of the expired tax period and the amount of tax calculated, withheld and transferred to the budget system of the Russian Federation for this tax period for each individual, annually no later than April 1 of the year following the expired tax period, in the form formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees, unless otherwise provided by paragraph 4 of this article;

calculation of the amounts of personal income tax calculated and withheld by the tax agent for the first quarter, half a year, nine months - no later than the last day of the month following the corresponding period, for the year - no later than April 1 of the year following the expired tax period, according to form, formats and in the manner approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

Tax agents are Russian organizations that have separate divisions, submit a document containing information on the income of individuals for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of tax on personal income calculated and withheld by the tax authorities. agent, in relation to the employees of these separate divisions, to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil law contracts, to the tax authority at the place of registration of the separate divisions that entered into such agreements.

Tax agents - organizations classified as the largest taxpayers, submit a document containing information on the income of individuals for the past tax period and the amounts of personal income tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax persons calculated and withheld by the tax agent, including in relation to employees of these separate divisions to the tax authority at the place of registration of such separate divisions, as well as in relation to individuals who received income under civil contracts, to the tax authority at the place of registration of separate divisions that have entered into such agreements, to the tax authority at the place of registration as the largest taxpayer or to the tax authority at the place of registration of such a taxpayer for the corresponding separate division (separately for each separate division).

Tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of the taxation system in the form of a single tax on imputed income for certain types of activities and (or) a patent taxation system, submit a document containing information on the income of individuals persons for the expired tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent in relation to their employees to the tax authority at the place of their registration in connection with carrying out such activities.

A document containing information on the income of individuals for the past tax period and the amounts of tax calculated, withheld and transferred to the budget system of the Russian Federation, and the calculation of the amounts of personal income tax calculated and withheld by the tax agent, are submitted by tax agents in electronic form via telecommunications communication channels. If the number of individuals who received income in the tax period is up to 25 people, tax agents can submit the specified information and calculate the tax amounts on paper.

3. Tax agents issue to individuals, upon their applications, certificates of income received by individuals and amounts of tax withheld in the form approved by the federal executive body authorized for control and supervision in the field of taxes and fees.

4. Persons recognized as tax agents in accordance with Article 226.1 of this Code shall submit to the tax authority at the place of their registration a document containing information about the income in respect of which tax was calculated and withheld by them, about the persons who are recipients of this income (if any relevant information), and on the amounts of taxes accrued, withheld and transferred to the budget system of the Russian Federation for this tax period in the form, in the manner and within the time limits established by Article 289 of this Code for the submission of tax calculations by tax agents for corporate income tax.

The information specified in paragraph one of this paragraph in relation to transactions recorded on an individual investment account is presented by the tax agent only based on the results of the tax period in which the tax agent calculates the tax, on an accrual basis for the period from the beginning of the agreement on maintaining an individual investment account.

5. In the event of failure by the reorganized (reorganized) organization (regardless of the form of reorganization) until the completion of the reorganization of the obligations provided for in this article, the information provided for in paragraphs 2 and 4 of this article must be submitted by the legal successor(s) to the tax authority at the place of its registration.

If there are several legal successors, the obligation of each of the legal successors in performing the duties provided for in this article is determined on the basis of a transfer deed or a separation balance sheet.