Putin, the President of the Russian Federation, put forward a proposal to reduce insurance premiums to 15 percent in his address to Russians on March 25, 2022. Law No. 102-FZ (with appropriate amendments to Article 427 of the Tax Code of the Russian Federation) 04/01/2020. signed by the President, so we can speak with confidence about who and under what conditions will be affected by the reduction of insurance premiums from 30 to 15 percent. Let's talk about this and give examples of calculations.

Who can apply the 15% preferential tariff?

A number of enterprises can get into the register and qualify for a reduced insurance premium rate: microorganizations, representatives of small and medium-sized businesses. In this case, the type of activity and the main OKVED do not play a role.

The Federal Tax Service has updated the register of small and medium-sized businesses. The updated SMEs included those companies that met the criteria as of July 1, as well as new organizations registered in July.

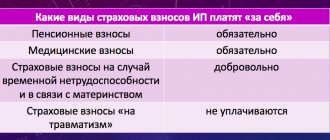

In accordance with the Federal Law of July 24, 2007 No. 209-FZ “On the development of small and medium-sized businesses in the Russian Federation”, from April 1, 2022, payers of insurance premiums recognized as small and medium-sized businesses have the right to charge insurance premiums at a reduced rate of 15 percent:

- for compulsory pension insurance – 10%;

- for compulsory social insurance in case of temporary disability and in connection with maternity – 0%;

- for compulsory health insurance – 5%.

The new procedure applies to accruals for April 2022 and subsequent months.

For March 2022, insurance premiums are calculated according to general rules. The reduced rate of insurance premiums applies only to accrued payments (remunerations) that exceed the minimum wage (hereinafter referred to as the minimum wage) established by federal law at the beginning of the billing period (year). As of January 1, 2022, the federal minimum wage is 12,130 rubles. You can find out whether an organization is included in the updated register on the Federal Tax Service website in a special section on TIN, OGRN, ORGNIP, company name or full name of an individual entrepreneur.

At the moment, the number of enterprises that are included in the SME register is 5,590,081.

- And there are 17,562 averages;

- Small - 218,477.

As the tax department explained, a number of taxpayers were not included in the SME register in August last year due to the fact that they did not submit reports for 2022 on time. Those of them who, albeit late, reported before April 1, 2022, were included in the updated register.

Submit your reports on time using the 1C-Reporting service!

Accounting in 1C

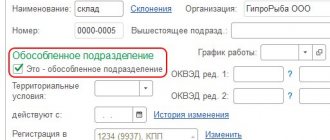

Setting up the application of reduced tariffs

Set the application of reduced insurance premium rates in the Main section - Taxes and reports - Insurance premiums tab.

Please indicate:

- Insurance premium rate - For small or medium-sized businesses .

- Apply from - April 2020 .

Click OK .

The result of the settings made can be checked using the link History of changes .

If wages for April 2022 were accrued before the settings for reduced insurance premiums were made, the Salary Accrual should be refilled using the Fill and then completed again. Simply redoing is not enough!

Calculation of contributions

In June, the Organization accrued salaries to three employees:

- Ivanov R.N. - full time, salary 20,000 rubles. accrued in full;

- Ignatov P.S. - part-time (0.5 rate), salary 20,000 rubles, accrued 10,000 rubles.

- Trifonova A.G. - external part-time worker, part-time, salary 20,000 rubles, accrued in June 10,000 rubles.

From the month specified in the Insurance premium , in the Payroll , contributions are calculated at the new rates.

If an employee receives an amount less than the minimum wage per month (for example, when working part-time), the normal insurance premium rate of 30% is used.

Reduced rates for insurance premiums are used for payments exceeding the minimum wage established by federal law at the beginning of the billing period. Adjustment of the minimum wage for the number of positions held by an employee is not provided (Clause 9, Article 2, Article 6 of the Federal Law of 04/01/2020 N 102-FZ).

However, the calculation is not detailed in the document.

It is convenient to control the accrual of contributions using the Analysis of Contributions to Funds (section Salaries and Personnel - Salary Reports), having configured it in a special way.

Checking the accrual of contributions

Create a report Analysis of contributions to funds (section Salaries and personnel - Salary reports).

By default, the report grouping is set by type of contributions by Accrual . However, the salary limit is determined for each employee, so to check, group by Employee .

To do this, click More - Other - Change report option to open the settings change form.

Accrual field Edit grouping fields form and change the grouping in it to Employee .

As a result of the settings, the data will be grouped by employees.

Let's check the calculation made by the program using the example of contributions to the Pension Fund.

Employee Accrued within the minimum wage Accrued over the minimum wage Accrued by the Pension Fund (basic tariff 22%) Pension Fund accrued (reduced tariff 10%) Ivanov R. N. 12 130 7 870 2 668,60 787 Ignatov P.S. 10 000 0 2200 0 Trifonova A. G. 10 000 0 2200 0 Our calculation coincides with the one executed by the program. The remaining contributions are calculated similarly. PDF

Saving a report

Save the report option using the Report options - Save report option button.

In the form that opens, indicate the name and availability of the report.

How to calculate insurance premiums at a preferential rate for small businesses under a GPC agreement

Step 1. Complete the settings to install a reduced tariff.

Step 2. Enable the option of accounting for civil partnership agreements in the Main - Functionality section.

On the Employees , select the Contract agreements .

Step 3. Draw up a contract agreement with the employee (Salaries and personnel - Employees - follow the link Contract or Salaries and personnel - Contract agreements - Create).

Fill out all the details of the Contract Agreement .

Step 4. Complete the accrual under the contract (Salaries and personnel - All accruals - Create - Payroll - Fill out).

Insurance premiums are calculated at reduced rates for a given employee based on all accruals for the month.

Let's check the calculation:

- Contributions to the Pension Fund = 12,130 * 22% + 2,870 * 10% = 2,955.60 rubles.

- Contributions to the FFOMS = 12,130 * 5.1% + 2,870 * 5% = 762.13 rubles.

The calculation in the program coincides with our calculation.

See also:

- Setting up accounting policies for NU in 1C: Insurance premiums

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Lowering the Central Bank refinancing rate (3.1.2.153) ...

- Checking the calculation of insurance premiums above the limit for SMEs from 04/01/2020 until 1C update You do not have access to view To gain access: Complete a commercial…

- Tariff of insurance premiums for SMEs from 04/01/2020 (ZUP 3.1.10.378 / 3.1.13.151) ...

- Zero insurance premium rate for the 2nd quarter of 2022 for affected SMEs (ZUP 3.1.10.444/3.1.13.120) ...

Who can apply the 0% preferential tariff?

In May 2022, the State Duma adopted a bill according to which especially affected small and medium-sized businesses were exempt from paying insurance premiums and paying taxes (except VAT) for the second quarter of 2022.

To apply the zero rate of insurance premiums, the main type of activity coincides with the list of particularly affected industries. And the main OKVED of the organization must be registered on a date no later than 03/01/2020.

You can familiarize yourself with the list of particularly affected industries in Decree of the Government of the Russian Federation dated April 18, 2020 No. 540.

Such organizations could pay zero insurance premiums from April to June 2022:

- in the Pension Fund – 0%

- in FFOMS – 0%

- in FSS on OSS – 0%

It also does not matter whether the accruals exceed the maximum base for insurance premiums, the rate will still be zero.

In 1C: Salaries and personnel management, a corresponding preferential zero tariff has been added.

Insurance rates for contributions to the Social Insurance Fund

In 2022, only one type of insurance premium is paid to the Social Insurance Fund - in case of industrial injuries and occupational diseases. The contribution rate depends on the main type of activity of the organization or entrepreneur - there are a total of 32 tariffs that are established for each professional risk group. The tariff can range from 0.2 to 8.5%. If your company sells goods, for example, the tariff will be minimal. But for hazardous industries, such as brown coal or ore mining, tariffs can reach 8.5%.

These contributions are paid for all employees under employment contracts, and for performers under civil contracts - only if the corresponding condition is stated in them.

You can receive a discount on the tariff; for this, the policyholder must apply for it no later than November 1, 2022. There are conditions:

- injury rates should be below industry values;

- the company must be registered before 2022;

- there should be no debt on contributions;

- There should be no fatal accidents in 2022.

Important! Once a year, the “unfortunate” tariff must be confirmed by submitting a confirmation certificate. Here we explain in detail how to do this. The tariff may change if the LLC changes its type of activity. If the tariff rate is not confirmed, the fund will set the maximum tariff by analyzing the OKVED codes declared in the Unified State Register of Legal Entities. To find out the tariff of your company, just look at the Federal Law of December 22, 2005 No. 179-FZ.

What changes in insurance premiums have occurred since July 1?

Since July 1, the SME register has been significantly updated due to the coronavirus pandemic. We recommend checking to see if your organization is included in the updated lists.

Now a company included in the SME register can apply preferential tariffs from the first day of the month in which the company was included in the register, but not earlier than April 1, 2022.

For example, Romashka LLC was included in the SME register on August 14. The company can calculate insurance premiums at a reduced rate of 15% from August 1. The payment deadline has not changed - until the 15th.

The Federal Tax Service warns organizations that have recently entered the SME register: insurance premiums paid for the period from 04/01 to 07/01/2020 at general rates are not refundable.

This support measure is intended to be long-term. The tariff is valid until the end of the year, but may also apply in 2022.

Companies and entrepreneurs who are subject to reduced tariffs for their main types of activity can choose for themselves which tariff they should use to calculate.

Preferential rules for other industries

There are other benefits and they are associated with certain industries that are supported by the state. These benefits are usually much more profitable. Let's take a look at their interest rates.

1. 7.6% of insurance premiums for IT companies; Conditions for receiving benefits:

- The company must be a registered legal entity, but not an individual entrepreneur.

- The organization develops programs and databases for further sale, installs and maintains software of its own design.

- The company has accreditation from the Ministry of Telecom and Mass Communications (an application for accreditation can be submitted in person).

- Software development brings in at least 90% of income.

- The organization has at least 7 full-time employees who work under an employment contract or GPC (for old organizations), and for new companies - all full-time employees must be registered only under an employment contract. The number of employees and income are determined based on 9 months of the previous year. If the organization was registered recently, then you can take a quarter, six months, etc. as a basis. before the benefit begins to apply.

2. A reduced rate of 20% may be applied to organizations that work on the simplified tax system and carry out the following types of activities:

- Scientific research;

- social services;

- education;

- healthcare;

- Culture and art;

- mass sport.

3. 20% of insurance premiums for charitable organizations using the simplified tax system. 4. 14% of insurance premiums for participants of the Skolkovo project. 5. 7.6% of insurance premiums for participants in priority development territories. Such participants are SEZs in Crimea and Sevastopol, residents of the free port of Vladivostok and residents of the special economic zone in Kaliningrad. 6. 0% of insurance premiums are paid when paying wages to crew members of ships that are registered in the Russian International Register of Ships.

Preferential rates of insurance premiums for SMEs

The reduced tariff applies only to those payments that monthly exceed the federal minimum wage - 12,130 rubles. For payments within the minimum wage, the previous tariff applies.

Payments for each calendar month must be compared with the minimum wage.

| Insurance premiums | For periods up to April 1, 2020 | Rate for periods after April 1, 2020 |

| Compulsory pension insurance (OPI) | 22% | 10% when the maximum base value is reached, the rate of 10% also applies |

| Compulsory health insurance (CHI) | 5,1% | 5% |

| For temporary disability and in connection with maternity (VNiM) | 2,9% | 0% |

Note! Now payments for temporary disability and in connection with maternity in excess of the amount of the norms are accrued at a 0% rate.

New codes for the DAM apply for calculations of preferential insurance premiums. All codes of the affected industries are already supported in 1C, do not forget to update your program.

Contribution benefits: business in the field of information technology

Legal entities (including those on the simplified tax system) working in the field of information technology, as well as Russian organizations designing and developing products of electronic component base and electronic (radio-electronic) products, can pay contributions in 2021–2022 (clause 3, clause 1, clause 1.1 clause 2, clause 5 article 427 of the Tax Code of the Russian Federation):

- for OPS - at a rate of 6%;

- OSS for VNiM - at a rate of 1.5%;

- OSS under contracts with foreign workers - at a rate of 1.8%;

- Compulsory medical insurance - at a rate of 0.1%.

Moreover, if a company is classified as newly created, then it must be:

- accredited as an IT firm;

- a business that receives at least 90% of its quarterly revenue from IT activities (for example, from the sale of software);

- an employer with an average number of employees in the quarter of at least 7 employees.

If the company is not newly created, then it must meet the same criteria, but in terms of income and average headcount in relation to 9 months of the year preceding the one in which the transition to reduced contributions is made.

An example of how to calculate insurance premiums at a rate of 15%

Romashka LLC is included in the SME register. Employee Petrov works at Romashka LLC for a fixed salary of 45,000 rubles. Payments to an employee since the beginning of the year do not exceed the maximum base.

Contribution payments for April for an employee are within the minimum wage at a general rate of 30%:

- pension contributions - 2,668.6 rubles (12,130 rubles × 22%)

- medical contributions - 618.6 rubles (12,130 rubles × 5.1%)

- social contributions - 351.7 rubles (12,130 rubles × 2.9%)

And payments of all federal minimum wages in the amount of 32,870 rubles (45,000 rubles – 12,130 rubles) are calculated at a preferential rate of 15%:

- pension contributions - 3,287.0 rubles (32,870 rubles × 10%)

- medical contributions - 1,643.5 rubles (32,870 rubles × 5%)

- social contributions - 0r (0%)

Total employee contributions are:

- pension contributions - 5,955.6 rubles (12,130 rubles × 22% + 32,870 rubles × 10%)

- medical contributions - 2,262.1 rubles (12,130 rubles × 5.1% + 32,870 rubles × 5%)

- social contributions - 351.7 rubles (12,130 rubles × 2.9% + 0)

When calculating an employee’s salary for each month, all payments are taken into account, incl. regional coefficients, northern bonus and other payments.

Limit base for calculating contributions

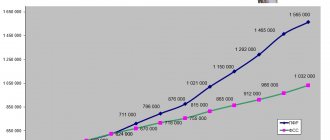

If an individual employee's salary and other taxable income exceed the established limits, contributions are paid at a reduced rate or not at all. Each year the maximum base for calculating contributions is revised. For 2022, the following standards were adopted by Decree of the Government of the Russian Federation of November 26, 2020 No. 1935:

- pension contributions - 1,465,000 rubles;

- social contributions - 966,000 rubles.

Consequently, if the base for calculating contributions to the Social Insurance Fund goes beyond 966,000 rubles, social insurance contributions do not need to be calculated. In the Kontur.Accounting web service, exceeding the maximum base is automatically monitored, and the service stops generating payment slips for contributions.

Example. Let’s say that the director of La-la-fa LLC had a total income of 966,000 rubles in August. This means that already in September, contributions to the Social Insurance Fund will not be charged on his salary, and La-la-fa LLC will be able to save money.

The situation with pension contributions is a little different. If accrued income to an employee exceeds the established limit, the LLC accountant will calculate pension contributions at a rate of 10%. Details about payers and tariffs are contained in Art. 58.2 of Law No. 212-FZ. Exceeding the maximum base is also important when calculating contributions under new tariffs for SMEs established from April 1, 2020. So, when an employee’s income reaches 966,000 rubles, then contributions to the Social Insurance Fund may not be paid even for the part below the minimum wage, and when it reaches 1,465,000 rubles, pension contributions for payments below the minimum wage are also accrued at a rate of 10%.

Example of filling out the DAM with reduced contributions

In case of a preferential, reduced tariff, the following filling procedure must be followed. In the third section on HP codes, the basic tariff is indicated. The amount subject to regular contributions does not exceed the minimum wage. For MS – a preferential tariff is indicated.

Example of filling out the DAM with zero contributions

For a zero tariff according to the KB code, a dash is placed. Those. The category of the insured person is completely tax-free.

You can check the correctness of filling out the DAM in 1C:ZUP using the Analysis of Insurance Contributions (Analysis of Contributions to Funds), where 2 tablets are clearly displayed - for each type of tariff, the main one plus the reduced one. In the Analysis, by individuals, all data is displayed to check the formation of the third section of the DAM.

Please note that the DAM is automatically generated and filled out correctly only in the latest releases of 1C: Salary and HR Management. In order for the data to be filled out correctly, it is enough to update to the latest release and specify the date from which the preferential tariff is applied in the accounting policy settings.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Contribution benefits: charitable organizations and NPOs

Charitable organizations using the simplified tax system can pay compulsory health insurance contributions at a rate of 20% in 2021–2022, but not pay compulsory medical insurance and compulsory medical insurance contributions. The main thing is that the company’s activities correspond to the goals stated in the constituent documents. The authorized federal body monitors compliance with this criterion.

Non-profit organizations (NPOs) on the simplified tax system that operate in the field of:

- social services;

- Sciences;

- education;

- healthcare;

- mass sports;

- culture and art.

These NPOs can pay compulsory health insurance contributions at a rate of 20% in 2021–2022, and not pay compulsory health insurance and compulsory health insurance contributions, provided they receive at least 70% of total income from:

- targeted financing of NPOs;

- grants;

- carrying out economic activities of those types that are reflected in paragraph. 17–21, 34–36 sub. 5 p. 1 art. 427 Tax Code of the Russian Federation.

You can learn more about the features of the work of non-profit organizations in the context of accounting in the article “Features and tasks of accounting in non-profit organizations.”