In accordance with Art. 54.1 of the Tax Code of the Russian Federation, the main purpose of a transaction cannot be non-payment of tax. This means that when concluding an apprenticeship contract, the company must have a business goal, which is related, for example, to the characteristics of production and the need for employees and applicants to obtain certain knowledge.

A side effect of concluding student contracts is the absence of insurance premiums for payments based on such contracts.

Therefore, the main tax risk is the re-qualification of a student agreement into an employment contract . Let's look at how to minimize the risk of claims.

What rules govern the student agreement?

The procedure for concluding a student agreement, the rights and obligations of the parties and other issues are regulated by Articles 198-208 of the Labor Code of the Russian Federation.

According to Article 198 of the Labor Code of the Russian Federation, an employer, a legal entity (organization), has the right to conclude a student agreement with an applicant or employee to receive education without interruption or without interruption from work.

The student agreement must provide (Article 199 of the Labor Code of the Russian Federation):

- names of the parties;

- the qualifications that the student acquires during the learning process;

- the employer’s obligation to provide the employee with the opportunity to study in accordance with the apprenticeship contract;

- the employee’s obligation to undergo training and work under an employment contract with the employer for the period established by the apprenticeship contract. At the same time, if a student quits after training without a good reason or does not start work, then, at the request of the employer, he returns the scholarship received during training and reimburses other expenses of the employer related to his training;

- duration of apprenticeship;

- amount of payment during the apprenticeship.

Who can become a student?

Most often, organizations send for training those who, by the nature of their activities, are obliged to improve their qualifications. These categories include, for example, employees of internal affairs bodies, government civil servants, medical and pharmaceutical workers.

The need to retrain employees may be caused by production needs, such as changing equipment or transferring an employee to another area of work. In both cases, the employer is required to pay for the training.

It happens that an employee himself expresses a desire to improve his qualifications and undergo training in one or another program. The employer can meet halfway and pay for the training in full or discuss the terms of refund with the employee. This could be, for example, partial compensation from salary or working at an enterprise for a certain period. The agreements must be recorded in the additional agreement to the employment contract.

How to pay for training under a student agreement?

During the training period, a stipend is paid, which is established by agreement and depends on the qualifications obtained, but not lower than the minimum wage (in 2022 = 12,130 rubles)

The training course may include practical exercises. Such work is paid at established rates (Article 204 of the Labor Code of the Russian Federation). Prices can be formalized in a local document for the organization or established in the student agreement.

If an employee combines training and work, he is paid a stipend for the duration of his training, and a salary for the time worked.

For example

Irina Semenova works at Company “A” as an assistant accountant with a monthly salary of 22,000 rubles.

Irina was offered the position of accountant in the same company, but with the condition of professional training for 3 months: September, October, November.

For this purpose, a student agreement was concluded, according to which:

- During each of the 3 months, it is necessary to undergo training in the amount of 10 lessons of 8 hours;

- On the days when Irina is training, she does not perform the work required by her job description;

- A monthly scholarship in the amount of 14,000 rubles is awarded for training.

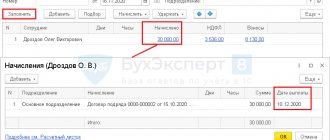

Calculate the amount that will be credited to Irina for September, if you know that there are 22 working days in September.

Solution

22,000 / 22 * (22 – 10) = 12,000 rub. – wages during the period when Irina did not undergo training

12,000 + 14,000 = 26,000 rub. – amount accrued for September

Personal income tax base = 26,000 rubles.

SV base = 12,000 rub.

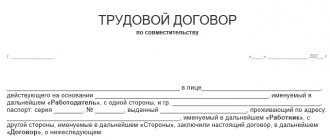

Name of the parties

In the preamble of the agreement, indicate the name of the organization, full name of the responsible person and the document on the basis of which this person acts on behalf of the organization (charter, regulations, power of attorney). The Labor Code of the Russian Federation does not allow employers - individuals or individual entrepreneurs - to conclude a student agreement - only legal entities.

The second party to the contract will be the student, that is, an employee or a person who plans to find a job in this organization. For students who are foreign citizens, please clarify the regime of their stay in the Russian Federation. The educational institution where the employee will study may act as a third party to the contract.

How to reduce the risk of retraining in an employment contract?

- Write down in the employment or collective agreement the conditions that employees undergo vocational training or receive additional education. This could be periodic refresher training or on-hire training.

- Develop local regulations: training regulations, regulations for training employees and applicants. Describe in them the objectives of training, the procedure for organizing training, training programs, the procedure for assessing learning outcomes and other issues.

- Organize training. It can be carried out under an agreement with licensed educational organizations, or by the employer’s own resources.

If a company decides to provide training in-house, then an educational license may be required (this depends on the type of training).

Thus, according to clauses 12-14 of Article 2 of the Law of December 29, 2012 No. 273-FZ “On Educational Activities” it can be:

- professional education;

- professional education;

- additional education.

If a company provides vocational education or vocational training, then it must have an educational license.

If a company provides additional education for the production needs of the employer without issuing a qualification document, a license is not required. In this case, the work book indicates a new qualification based on an order based on the results of the apprenticeship.

- Sign a student agreement.

Understand the concepts

There is no clear definition of an apprenticeship agreement in the Labor Code of the Russian Federation, but the legislation establishes with whom and in what cases an organization can enter into such an agreement, namely:

- when it comes to retraining an existing employee of an organization on or off the job;

- when a job seeker is sent for training.

In practice, HR specialists interpret the provisions of the Labor Code of the Russian Federation differently. There is, for example, a point of view that a student agreement can only be drawn up for internal forms of training, and is not suitable for attracting an educational institution.

Another controversial point is the nature of the relationship between the employer and the trainee, with whom an employment contract has not yet been concluded. A number of specialists rely on letter No. 02-18/05-3937 of the Federal Social Insurance Fund of the Russian Federation dated June 11, 2003, which states that “an apprenticeship agreement with a job seeker is civil and regulated by civil law.” To resolve the issue, it is proposed to conclude an employment contract with such a person first, and only then a student agreement.

“In my opinion, everything in the Labor Code is quite transparent. The use of the apprenticeship agreement is in no way limited to internal training. On the contrary, the result of apprenticeship should be the assignment of qualifications with the issuance of relevant documents. This can only be done by institutions and organizations that have the appropriate license.

As for the contract with a person who is not yet an employee of the company, I think it is correct to note that it is subject to the provisions of both the Civil and Labor Codes. The student agreement in this case is of a mixed nature; the Civil Code of the Russian Federation allows this (clause 3 of Article 421 of the Civil Code of the Russian Federation). When sending an existing employee for training/retraining/upgrading, companies most often conclude with him not a full-fledged apprenticeship contract, but an additional agreement to the employment contract,” explains Irina Savelyeva, head of HR projects at SKB Kontur.

Automatically issue a student agreement in the Kontur-Personnel program.

To learn more

How to take into account the costs of training under student contracts for income tax?

- If an employee is studying outside of work, then the scholarship and payment for practical training are taken into account as part of the labor costs on the basis of clause 19 of Article 255 of the Tax Code of the Russian Federation;

- If an employee is studying on the job, then the scholarship and payment for practical training are taken into account as part of other labor costs on the basis of clause 25 of Article 255 of the Tax Code of the Russian Federation;

- If the applicant is studying, then the scholarship and payment for practical training are taken into account as part of other expenses associated with production and sales on the basis of clause 49, clause 1, article 264 of the Tax Code of the Russian Federation.

Expenses are taken into account during the period of admission to the staff of applicants with whom student contracts have been concluded. If the applicant is not hired by the employer upon completion of training, then such expenses cannot be taken into account as income tax expenses.

Base:

- Letter of the Ministry of Finance dated June 10, 2016 No. 03-03-06/1/34188

- Letter of the Ministry of Finance dated March 26, 2015 No. 03-03-06/1/16621

- Letter of the Ministry of Finance dated 06/08/2012 No. 03-03-06/1/297

- Letter of the Ministry of Finance dated 06/08/2011 No. 03-03-06/1/336

Student agreement: optimization of contributions, business goals and tax risks

A student agreement in 2022 remains one of the few ways to optimize “salary” taxes (a scholarship is subject to personal income tax, but not subject to contributions), with a reasonable level of risks and a significant economic effect.

At the same time, the agreement allows solving non-tax problems: formalizing employee training, mentoring, certification, and also simplifies the expulsion of unsuitable applicants who have not completed training, and the recovery from them of funds spent by the employer on training (including the payment of scholarships). In addition, students are not taken into account when calculating the average number of employees, which may be of interest to “simplistic” workers (Resolution of the AS of the North-Western District of November 26, 2020 in case A13-21934/2017).

Just a little theory: the student agreement is regulated by Art. 198 Labor Code of the Russian Federation. The contract can be concluded both with the job applicant and with the employee (with or without interruption from production). For the duration of their studies, the student receives a scholarship, which is not subject to contributions, which the Ministry of Finance agrees with (Letter dated 06/21/2019 N 03-15-06/45624) and cannot be less than the minimum wage. In accordance with Art. 200 of the Labor Code of the Russian Federation, the student agreement is concluded for the period necessary to obtain this qualification; the form of training can be any. At the same time, for the work performed by the student during practical classes, they are paid at the rates established by the employer themselves (but again, without contributions).

There are nuances - students who have successfully completed their studies cannot enter into an employment contract with a probationary period, but the student contract can be terminated on the grounds provided for in the contract itself (for example, for poor academic performance or truancy).

Where there is a tax benefit and tax disputes, there are two main risks when using student contracts: recognition of the costs of paying a scholarship as unjustified and reclassification of the student contract into an employment contract (with the corresponding additional assessment of contributions).

The question of whether it is possible to take into account expenses under a student agreement depends on the employer’s taxation system.

In accordance with paragraphs. 33 pp. 1 tbsp. 346.16 of the Tax Code of the Russian Federation, taxpayers applying the simplified tax system for income and expenses take into account, among other things, the costs of training and retraining of personnel on the taxpayer’s staff, on a contractual basis in the manner prescribed by clause 3 of Art. 264 Tax Code of the Russian Federation. That is, if the student is not an employee of a simplified organization, then the scholarship cannot be taken into account as part of the expenses (Resolution 18 of the AAS dated 02/04/2021 in case A76-5218/2020).

If the employer applies OSN, then in accordance with paragraph 3 of Art.

264 of the Tax Code of the Russian Federation, taxpayer expenses for training in basic professional educational programs, basic vocational training programs and additional professional programs are included in expenses if training is carried out on the basis of an agreement with a Russian educational organization, scientific organization or foreign educational organization that has the right to conduct educational activities . At the same time, such training is carried out by employees of the taxpayer who have concluded employment contracts with him, or by individuals who have entered into agreements with the taxpayer, providing for the obligation of the individual, no later than three months after completing the specified training, paid for by the taxpayer, to conclude an employment contract with him and work for the taxpayer for at least one of the year.

Clause 2, clause 3, art. 12 of the Federal Law of December 29, 2012 N 273-FZ “On Education in the Russian Federation” it is established that additional professional programs include advanced training programs and professional retraining programs.

In accordance with Article 2 of the Federal Law of December 29, 2012 N 273-FZ “On Education in the Russian Federation”, qualification is a level of knowledge, abilities, skills and competence that characterizes readiness to perform a certain type of professional activity, and contains an indication of educational programs, aimed at acquiring new qualifications. At the same time, Law No. 273-FZ does not provide for the possibility of obtaining education in any organizations other than those carrying out educational activities, and such an organization by virtue of paragraphs. 18, 19, 20 art. 2 of Law N 273-FZ must have a license to carry out educational activities.

Thus, the employer at the OSN can take into account the stipend as part of the expenses if the training is provided by a licensed organization.

What does this mean in practice? Let’s assume that the organization’s income before paying salaries, personal income tax and contributions is 1 million rubles, wages (or stipend) are 30 thousand rubles:

As can be seen from the table, paying a scholarship instead of a salary is beneficial to an organization using the simplified tax system (option 4, compared to 2), as well as an organization using the simplified tax system, provided that the employee is trained in an organization that has an educational license (option 6 compared to 1).

But if an organization on an OSN (related to an SME) enters into an apprenticeship agreement and trains a student in an organization without a license (or itself conducts training without a license), the economic effect becomes negative (option 5 compared to 1), due to the inability to take into account composition of income tax expenses for scholarship payments.

Choosing a work model under a student agreement will not go unnoticed by the tax authority, since personal income tax will not correspond to contributions. There is a risk of the contract being reclassified as an employment contract, especially when the student contract is concluded by an organization that does not have an educational license.

Having analyzed the judicial practice for 2015-2021, we can conclude that the payment of scholarships is not subject to social contributions, even if the organization does not have an educational license. In this case, it does not matter whether an employment contract was concluded with the student or not (this can only affect the validity of accounting for scholarship expenses as part of income tax, but not the legality of not taxing scholarships with insurance contributions).

So the bank, without an educational license, entered into student contracts and paid scholarships to job seekers. In accordance with the position of the FSS, the training of students was carried out by the bank itself, which does not have a license for teaching activities, at the location of the bank in order to identify professional suitability for further employment. Students were subject to labor legislation requirements to comply with the bank’s internal labor regulations, labor discipline, and labor protection legislation. Payment of stipends was made according to the production calendar in proportion to the standard hours in the current month. In essence, this contract was an employment contract with a probationary period of 3 months.

But the court noted that the fund’s reference to the Bank’s lack of a license to carry out educational activities was not accepted by the court, since the training was conducted in the form of consultations, seminars, and no documents were issued upon completion of the training (Resolution 13 of the AAS dated February 17, 2017 in case No. A56 -70818/2016).

A similar position is indicated in the Resolution of the Arbitration Court of the North-Western District dated July 12, 2018 in case No. A21-5289/2017 - The Office is not vested with the authority to verify the Center’s compliance with the requirements of the Education Law and the Licensing Regulations. Provided that during the disputed period the Center carried out activities without obtaining a license, administrative liability is provided as a consequence of such a violation, the prosecution of which is not within the competence of the Office.

The possibility of concluding student contracts without a license for educational activities is also confirmed by courts of general jurisdiction. You can study this about the Decision of the Central District Court of Komsomolsk-on-Amur No. 2 5463/2019 2-681/2019 2-681/2020 2-681/2020(2-5463/2019;)~M-5354/2019 M-5354/2019 dated February 6, 2020 in case No. 2-5463/2019, Decision of the Balakhinsky City Court No. 2-935/2017 2-935/2017~M-738/2017 M 738/2017 dated September 27, 2017 in case No. 2-935/2017 and others.

If financing training by an organization on its own does not raise any questions, then options are possible when using separate training centers.

Thus, a training center can use OSN.

According to paragraphs. 14 paragraph 2 art. 149 of the Tax Code of the Russian Federation, services in the field of education (except for consulting services, services for leasing premises) are not subject to VAT if services in the field of education are provided by non-profit organizations engaged in educational activities for the implementation of basic and (or) additional educational programs specified in licenses.

Thus, in order to comply with the requirements of paragraphs. 14 paragraph 2 art. 149 of the Tax Code of the Russian Federation requires that the training center be a non-profit organization and have a license.

In accordance with paragraph 1 of Art. 284.1. The Tax Code of the Russian Federation, organizations carrying out educational activities have the right to apply a tax rate of 0% subject to the following conditions:

- availability of an educational license;

- 90% of income comes from educational activities;

- The organization has at least 15 employees (not necessarily teachers).

A nuance should be taken into account: according to clause 5 of Art. 284.1 of the Tax Code of the Russian Federation, organizations that have expressed a desire to apply a tax rate of 0 percent, no later than one month before the start of the tax period from which the tax rate of 0 percent is applied, submit to the tax authority at their location an application, copies of the license (licenses) for implementation of educational activities issued (issued) in accordance with the legislation of the Russian Federation.

Thus, in order to apply a 0% rate on income tax in 2022, training centers must submit applications and copies of licenses to the tax authority by December 1, 2021.

Financing of a training center can be carried out in at least five ways, including the following:

Whether it makes sense to use an apprenticeship agreement when structuring a business or not depends on many factors, but as always, the tax purpose cannot be the only or main one.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Apprenticeship duration

Depending on the duration of the course, the validity period of the student agreement is determined. The apprenticeship period may be extended if this is due to the trainee’s prolonged illness, military training, and in other cases provided for by the legislation of the Russian Federation.

It is also worth specifying the conditions for early termination of the contract. This may be a dishonest attitude towards training - absenteeism without a good reason, unsatisfactory results of certifications, or there may be medical contraindications to the performance of certain job functions.

If a student, on his own initiative, interrupts his studies or does not begin work upon completion, the organization has the right to demand the return of funds transferred to the educational institution and paid in the form of a scholarship.