What applies to intangible assets

Depreciable property may include intangible assets (intangible assets) - results of intellectual activity, the rights to which are owned by the taxpayer, and which he uses to generate income (in production or for management needs) for a long period of more than 12 months (clause 3 of article 256 Tax Code of the Russian Federation).

Intangible assets include (clause 3 of Article 257 of the Tax Code of the Russian Federation):

1) the exclusive right of the patent holder to an invention, industrial design, utility model;

2) the exclusive right of the author and other copyright holder to use a computer program, database;

3) the exclusive right of the author or other copyright holder to use the topology of integrated circuits;

4) exclusive right to a trademark, service mark, appellation of origin of goods and company name;

5) the exclusive right of the patent holder to selection achievements;

6) possession of know-how, a secret formula or process, information regarding industrial, commercial or scientific experience;

7) exclusive right to audiovisual works.

As you can see, the list of intangible assets is closed.

An intangible asset does not have a tangible structure, but only those intangible assets whose existence is documented are accepted for accounting - patents, certificates, agreements for the assignment (acquisition) of a patent, trademark, etc.

Note that for accounting the composition of intangible assets differs from tax accounting.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Federal Accounting Standard “Inventories”: review of guidelines for application

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

What does not apply to intangible assets

We also list what cannot be classified as intangible assets in tax accounting:

- intellectual and business qualities of the company’s personnel (clause 3 of Article 257 of the Tax Code of the Russian Federation);

- expenses for research and development work that are not completed and not documented (clause 3 of Article 257 of the Tax Code of the Russian Federation);

- intangible assets, payment for which is made in equal payments during the term of the agreement (clause 8, clause 2, article 256 of the Tax Code of the Russian Federation);

- business reputation of the company. In accounting, it is taken into account as part of intangible assets on the basis of paragraph 4 of PBU 14/2007.

Please note: intangible assets do not include computer programs to which the company does not have exclusive rights, and the costs of obtaining licenses to conduct certain types of activities.

How is the depreciation rate for intangible assets determined in accounting?

The main legislative document regulating the procedure for accounting for intangible assets with definite and indefinite private assets is PBU 14/2007. In accordance with clause 23 of the said Regulations, depreciation rates for intangible assets are established for objects with a certain period of use throughout the entire period. And if SPI cannot be determined, depreciation on such assets is not calculated and written off.

Note! Only commercial enterprises have the right to transfer the cost of intangible assets as expenses; non-profit organizations do not have this opportunity by law (clause 24 of the PBU).

SPI is determined by the company at the time the object is accepted for accounting. According to clause 25 of the PBU, the duration of the operating period is expressed in months, based on the expected profit from the use of the asset. For certain types of intangible assets, the SPI can be established from the expected volume of products/work as a result of the operation of the property. When determining the period of use in the BU, the following factors are taken into account:

- The period of validity of the company’s rights to the result of intellectual activity (patents, certificates, etc.) or the time of control over intangible assets.

- The expected period of use of the asset aimed at generating profit.

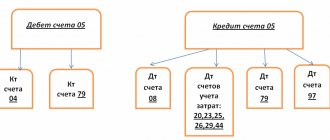

The depreciation method is chosen by the organization independently - linear, reducing balance or proportional to the volume of products/services. The monthly amounts are calculated based on the method used; established SPI and NA (depreciation rates) for each type of object. Depreciation transactions are reflected using the account. 05 (in correspondence with expense accounts) or directly to the account. 04.

Depreciable property in tax accounting

Depreciable property is property with a useful life of more than 12 months and an original cost of more than 100,000 rubles (clause 1 of Article 256 of the Tax Code of the Russian Federation).

From January 1, 2022, Federal Law of September 29, 2022 325-FZ established a clear cost criterion for intangible assets depreciable in tax accounting: more than 100,000 rubles (clause 1 of Article 256 of the Tax Code of the Russian Federation).

Thus, in order to charge depreciation on intangible assets, you need to decide:

- whether the object belongs to intangible assets and whether it is necessary to charge depreciation on it in tax accounting;

- if necessary, then correctly determine its original cost in order to calculate the amount of depreciation per month.

Read in the berator “Practical Encyclopedia of an Accountant”

General procedure for calculating depreciation on intangible assets in tax accounting

Methods for calculating depreciation on intangible assets in tax accounting

ACCOUNTING

The cost of intangible assets (IMA) is repaid in installments over the entire period of their use in the organization through depreciation (clause 14 of PBU 14/2000).

To determine the amount of depreciation charges for a month, an organization must: - establish the useful life of an intangible asset;

— choose the method of calculating depreciation for the object;

— calculate the rate of depreciation for each object.

USEFUL LIFE

When accepting an intangible asset for accounting, the organization independently determines its service life.

Due to the fact that the composition of intangible assets in accounting is heterogeneous, the organization must determine the period of use of a specific intangible asset in a differentiated manner, taking into account the conditions listed in clause 17 of PBU 14/2000. The most general criterion for determining the useful life of an intangible asset is the expected period of its use, during which the organization can receive economic benefits (income). Guided only by this criterion, it can be quite difficult for an organization to determine the optimal period of use of a particular intangible asset.

In the case when we are talking about rights to intellectual property objects certified by the relevant document (patent, certificate, etc.), the useful life in accounting is determined by the validity period of this document.

For example, the validity period of a utility model certificate in accordance with clause 3 of Art. 3 of the Patent Law of September 23, 1992 N 3517-1 cannot exceed five years from the date of filing the application with the federal executive body for intellectual property. Thus, in accounting, the useful life of the right to a utility model is set at five years.

For certain groups of intangible assets, the useful life is determined based on the quantity of products or other natural indicator of the amount of work expected to be received as a result of using this object. The useful life of such an object is a variable value that depends on a number of indicators of the organization’s functioning, for example, on the volume of products produced during the reporting period.

If there are difficulties in determining the useful life of an intangible asset (or this period cannot be determined), depreciation rates for them are established for 20 years (but not more than the life of the organization).

METHODS OF CALCULATING DEPRECIATION

Clause 15 of PBU 14/2000 provides for the following methods of calculating depreciation:

- linear; — reducing balance; — write-off of cost in proportion to the volume of products (works, services).

PBU 14/2000 allows the use of one of the methods of calculating depreciation in relation to a group of similar intangible assets.

Therefore, before choosing a method for calculating depreciation, it is advisable for an organization to divide all its intangible assets into groups united by common characteristics (for example, exclusive rights to trademarks - in the first group, for industrial designs - in the second, etc.).

The organization has the right to choose any method (methods) of calculating depreciation: one - for all groups of homogeneous objects, or different methods - for different groups of intangible assets.

One of the methods of calculating depreciation for a group of homogeneous intangible assets is applied throughout their entire useful life.

1. Linear method

With the linear method, the annual amount of depreciation for an intangible asset is determined as the product of its original cost and the annual depreciation rate calculated based on the useful life of this object.

The annual depreciation rate is calculated as a percentage as the ratio of 100% to the useful life of the asset (in years).

The linear method assumes uniform depreciation accrual both during the reporting year (in the amount of 1/12 of the annual amount) and the entire useful life of the intangible asset.

EXAMPLE 1. In December 2002, an organization registered exclusive rights to a utility model and received a patent. In the same month, the NMA facility was put into operation.

The initial cost of intangible assets was 120,000 rubles. Useful life - 5 years (60 months). The annual depreciation rate in this case will be 20% (100%: 5 years).

The annual depreciation amount will be equal to 24,000 rubles. (RUB 120,000 x x 20%); monthly depreciation amount - 2000 rubles. (RUB 24,000: 12 months).

2. Reducing balance method

When applying the reducing balance method, the annual amount of depreciation is determined based on the residual value of the intangible asset at the beginning of the reporting year and the annual depreciation rate.

In other words, with this method, the annual amount of depreciation decreases from year to year, since the base, the residual value of the intangible asset, decreases accordingly.

With this method, the amount of accrued depreciation per month is 1/12 of the annual depreciation amount.

EXAMPLE 2.

In the conditions of example 1, when using the reducing balance method, depreciation will be calculated as follows.

In the first year of operation of an intangible asset, the annual amount of depreciation charges will be 24,000 rubles. (RUB 120,000 x 20%); monthly depreciation amount - 2000 rubles. (RUB 24,000: 12 months).

Let us determine the residual value of the intangible asset at the beginning of the second year of operation: 120,000 rubles. — 24,000 rub. = 96,000 rub.

In the second year of operation, the annual amount of depreciation charges will be 19,200 rubles. (RUB 96,000 x 20%); monthly depreciation amount - 1600 rubles. (RUB 19,200: 12 months).

In the third year, respectively: the annual amount of depreciation is 15,360 rubles. ((96,000 rub. - 19,200 rub.) x 20%); monthly depreciation amount - 1280 rubles. (RUB 15,360: 12 months), etc.

How to determine the initial cost of intangible assets

The initial cost of an intangible asset is the sum of all costs associated with its acquisition. It is formed depending on how it was received:

- bought for money;

- received as a contribution to the authorized capital;

- received free of charge;

- created by the company itself.

The Ministry of Finance explained that upon purchase, the initial cost of depreciable intangible assets is determined as the sum of the costs of their acquisition (creation) and bringing them to the state in which they are suitable for use, with the exception (in some cases) of value added tax and excise taxes (see letter dated December 13, 2021 No. 03-03-06/1/101442).

Thus, the initial cost of intangible assets acquired for money in tax accounting includes (Article 257 of the Tax Code of the Russian Federation):

- amounts paid to the seller (excluding VAT, which is deductible);

- non-refundable taxes paid in connection with the acquisition of intangible assets;

- expenses for bringing the intangible asset to a state suitable for use;

- costs of registering the right to intangible assets.

And the cost of intangible assets created by the organization itself is determined as the amount of actual expenses for their creation and production, excluding the amounts of taxes taken into account as part of these expenses. Such expenses include:

- material costs;

- labor costs;

- expenses for third party services;

- patent fees associated with obtaining patents and certificates.

When is it considered that an intangible asset was created by the company itself?

Intangible assets received as a contribution to the authorized capital are reflected based on their residual value, determined according to the tax accounting data of the transferring party. The residual value is determined as of the date of transfer of ownership of intangible assets (Article 277 of the Tax Code of the Russian Federation).

Intangible assets received free of charge are reflected in tax accounting at the market price. Moreover, the value of such an intangible asset cannot be less than its residual value according to the data of the transferring party (Clause 8 of Article 250 of the Tax Code of the Russian Federation).

Purchase of intangible assets

Upon receipt by an organization, intangible assets are taken into account at their original cost, also called actual cost. Fixed assets are also taken into account in the same way. This cost consists of the cost of the exclusive right to intangible assets and its use in accordance with the contract, patent and other documents, as well as all associated costs (payment of various types of duties, customs duties, related taxes, services of third-party organizations, information and consulting services, etc. ) minus VAT. VAT is allocated from the sum of all costs and sent for reimbursement from the budget.

VAT is not subject to the sale and transfer of the exclusive right to computer programs, databases, inventions, utility models, industrial designs, topologies of integrated circuits, know-how, as well as the rights to use them.

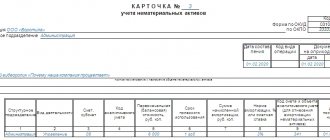

For accounting of intangible assets, account 04 “Intangible assets” is intended; the debit of this account reflects the receipt of the object, and the credit its disposal and write-off.

Just as in the case of fixed assets, before getting to account 04, all costs for the acquisition of intangible assets are collected in the debit of account 08 “Investment in non-current assets”, after which, from the credit of account 08, they are recorded in the debit of account 04 .

For these purposes, a separate subaccount 5 “Acquisition of intangible assets” is opened on account 08, the debit of which reflects all costs.

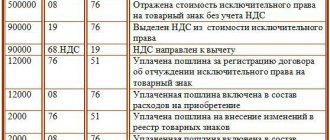

Example:

An organization acquires the exclusive right to a trademark under an alienation agreement. The costs are as follows:

- The cost, according to the agreement, amounted to 590,000 rubles, including VAT of 90,000 rubles. (the right to a trademark is subject to VAT).

- A fee of 12,000 rubles was paid for registration of the agreement.

- For making changes to the register of trademarks, a fee of 2000 rubles was paid.

How to accept an intangible asset for accounting, how should the entries be made?

Postings when purchasing an intangible asset for a fee:

When is it not necessary to charge amortization on intangible assets?

Intangible assets with a value of less than 100,000 rubles are not depreciable property. Accordingly, for income tax purposes, the costs of their creation or acquisition are taken into account at a time, that is, written off as expenses of the current period in full.

The Ministry of Finance recalled this in a letter dated December 20, 2022 No. 03-03-06/1/103534.

In accounting, exclusive rights worth up to 100,000 rubles are taken into account as part of intangible assets on the basis of paragraph 8 of PBU 14/2007.

Depreciation

There are two methods used to calculate depreciation:

- Linear. The linear method takes into account depreciation rates determined on the basis of the period of use of the object.

- Declining balance. Deductions are calculated based on the residual value at the beginning of the reporting period.

EXAMPLE. The company acquired assets in the amount of 12,000 rubles. The period of use is 4 years. To calculate annual deductions, you need to divide the amount by the terms. Get 3,000 rubles. This amount can be divided by 12. This will determine the monthly deductions.

EXAMPLE. Assets were purchased for the amount of 10,000 rubles. To determine the annual rate, you need to divide 10,000 rubles by 100%. It will be 10%. The annual depreciation amount will be 1,000 rubles (10,000 times 10%). The residual value will be 9,000 rubles (10,000 – 1,000).

Intangible assets, despite the lack of physical form, must be correctly reflected in accounting. To do this, you need to know the signs of intangible assets and the rules for calculating depreciation charges.