The amount of income tax is determined depending on the type of income received. In total, in 2022 there are four personal income tax (personal income tax) rates: 30%, 35%, 15% and 13%. They vary depending on whether the taxpayer is a resident of the Russian Federation or a non-resident. To avoid making mistakes in calculations, contact a specialist. An accountant may receive a fine for incorrectly withholding income taxes from employees.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

63 lawyers on RTIGER.com can help with this issue

Solve the issue >

General principles of taxation

All individuals pay income tax on their income.

Taxpayers include not only Russian citizens, but also representatives of other states who receive any type of earnings or remuneration in our country. In most cases, the citizen himself does not pay the tax; the employer does it for him. The organization acts as a tax agent when calculating and paying wages, benefits and other remuneration. Established in paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the deadlines for paying personal income tax on wages and bonuses in 2022 will remain the same: no later than the next day after payment, and for vacation pay and sick leave - no later than the last day of the month in which they were paid.

For some types of income, taxpayers are required to independently calculate and pay fees to the Federal Tax Service. An exhaustive list of this type of income and income is approved in Article 228 of the Tax Code of the Russian Federation. These should include:

- Money from the sale of property and some assets. For example, selling an apartment or a share in it.

- Funds received as payment under lease agreements.

- Personal income tax on winnings and prizes in 2022: winnings up to 15,000 rubles received from lottery organizers and bookmakers.

- Amounts received from organizations, entrepreneurs, individuals who are not tax agents.

- Income from which personal income tax was not withheld.

- Earnings received outside the territory of our state.

- Money, rights and assets received as inheritance from authors (literature, art, science).

Income tax amount

Article 224 of the Tax Code of the Russian Federation establishes the percentage of income tax for individuals.

The standard tax rate is 13%. This is exactly the percentage of income tax that the employer transfers to the Russian budget from each salary of each employee.

A reduced percentage tax rate of 9% is established for income in the form of interest on mortgage-backed bonds.

An increased tax rate of 30% is established for income from securities.

A tax rate of 35% is levied on lottery winnings.

An interest rate of 30% is established on all income for citizens who are not tax residents of the Russian Federation. With the exception of certain types of income for which a different rate is established.

For example, 15% is required to be paid to the treasury from dividends from equity participation in the activities of Russian organizations. 13% of wages (Tax Code of the Russian Federation Article 227.1).

Increase in personal income tax rate in 2022: what to expect from officials

Most of the income received is subject to 13% tax. Previously, officials planned to increase the figure by 2%. Then the income tax would be 15% of all revenues. The proposals were justified by the fact that the budget does not have enough funds to carry out all the functions and tasks of the state. There have been no changes in tax rates, and the latest news about changes in personal income tax in 2022 is as follows:

- all rates will remain at the same level;

- reporting forms will not change.

There are no plans to increase the income tax in the near future, since in the budget state tax revenues were planned based on the current value of rates.

Are there any innovations in the 2019 personal income tax rates?

The issue of personal income tax rates has been one of the most discussed in Russia in recent years. Various options for changes are proposed: from tax exemption for persons with low incomes to the introduction of a progressive scale, providing for a reduction in the rate for low-income persons and its increase and differentiation for those people whose income reaches significant amounts. It is assumed that for the majority of the population, income will continue to be taxed at a rate of 13%, although there has been a proposal to raise it to 15%.

However, despite such a high interest in this topic, no changes have yet been made in the procedure for calculating income tax. That is, at the beginning of 2022 the same rates are valid as in 2018. And there are no updates planned for them in the near future. Therefore, there is no basis yet for compiling a table of changes in personal income tax rates in 2022.

However, a number of changes affecting the calculation of this tax did begin to take effect in 2022:

- the list of income classified as dividends and income received in kind has been expanded;

- the list of expenses that reduce income from the sale of securities has been added;

- The list of tax-free income includes: field allowance in an amount not exceeding 700 rubles. per day;

- proceeds from the sale of waste paper generated by the person who sold it;

- social payment for the purchase of housing and the cost of housing provided as part of such payment;

Thus, although personal income tax rates will remain the same, the base to which they apply may change compared to the previous year.

Non-taxable income

Not all payments are subject to income tax. Let's consider income not subject to personal income tax in 2022:

- monetary or in-kind compensation for the birth of a child;

- financial assistance to students from educational organizations;

- payments to honorary donors;

- some types of social support for citizens;

- reimbursement of costs for housing and communal services;

- monetary compensation for a land plot provided as assistance from the state;

- compensation for teachers and health workers within the framework of the state program;

- payment for additional days off allocated to care for a disabled child;

- compensation for travel to and from vacation destinations for workers in the Far North.

Let's sum it up

- At the proposal of the President of the Russian Federation, a progressive personal income tax rate of 15% will be applied from 2022 to citizens’ incomes exceeding RUB 5,000,000.

- The tax on the rich will affect those citizens who have a high income, as well as entrepreneurs using OSNO if their annual income is above 5 million rubles. Most citizens, given the average salary in the country, will not be affected by this innovation.

- Additional funds received into the budget from the introduction of an increased personal income tax rate are planned to be used for specific purposes - the treatment of children with rare serious diseases.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

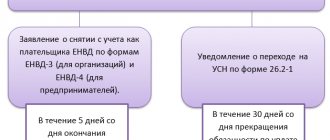

Innovations from 2022

Rates will not change in the near future. But as of January 1, 2020, other innovations came into force. Here are the personal income tax changes expected for legal entities in 2020:

- Changing the deadline for submitting reports. Now the final report is submitted to the Federal Tax Service by March 1 of the next year. The last date for submitting the report for 2022 is 03/02/2020 (March 1 falls on a Sunday).

- Obligation to submit reports electronically. Those employers with 10 or more people on staff will have to send tax reports electronically.

- Collection of unwithheld personal income tax from the employer following an inspection by the Federal Tax Service. Allowed from 01/01/2020.

Reporting in a new way

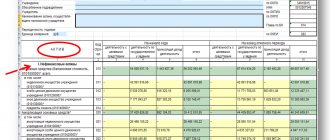

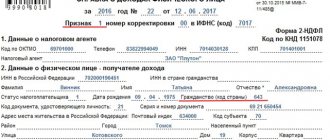

Important innovations in tax reporting. They relate primarily to the work of accountants:

- Deadlines for submitting annual reports 2-NDFL and 6-NDFL. The usual deadline until April 1 has been shortened by a month. By the end of 2022, forms must be submitted by March 1, 2020.

- Electronic reporting. An organization with more than 10 employees is required to submit reports electronically. Information on paper will be considered not provided. Federal Tax Service officials promise to apply sanctions for the incorrect way of drawing up a document in accordance with Art. 119.1 of the Tax Code of the Russian Federation – 200 rubles for each document (calculation, certificate). Let us recall that previously the “threshold” for the application of mandatory electronic reporting was 25 people.

- Changing control ratios. The innovations concern the same forms of 2-NDFL and 6-NDFL. The control tools embedded in them will be linked to data on the minimum wage and regional averages in the context of OKVED. It must be said that if the requirements for payments not lower than the minimum wage are already included in the Labor Code of the Russian Federation (Article 133), then the requirements relating to industry wage indicators are an innovation. Employers are afraid that they will become a new “punitive” instrument of the Federal Tax Service, because the specifics of doing business are individual and, for one reason or another, may violate certain average indicators. Officials promise to be flexible and remind that the request for explanations (which must be answered within 5 days) does not mean an automatic admission of guilt of the tax agent. In addition, according to Federal Tax Service specialists, all calculations will be carried out using the arithmetic average for the year in order to exclude “differences” in accruals for a particular month (for example, if employees are sick and have just been hired).

- Separate units. If an organization has several separate divisions located geographically within one OKTMO, it will be able to transfer all personal income tax amounts and submit reports at the place of registration of either the organization itself or one of the divisions. Tax authorities must be notified of the decision made. Let us recall that until this moment, each separate division and parent organization submitted separate reports at the place of registration. In connection with the innovation, the Federal Tax Service promises to extend at the initial stage the time frame within which the tax agent must make a choice, but they recommend that if the decision has already been made in January, the tax must be transferred in accordance with it. Otherwise, if transfers are done “in the old way” and reporting is done “in the new way”, difficulties may arise for the tax agent.

On a note! 1/03/2020 is a day off according to the calendar. According to the law, the deadline is postponed to the next working day after the day off - 03/2/2020. This is confirmed by the Federal Tax Service (see document No. BS-4-11 / [email protected] dated 11/15/19).

What should accountants expect? Changing the reporting deadlines is not a random step. The ultimate goal of this work is to simplify income tax reporting. Already this year in the spring it is planned to make corresponding changes to the legislation. Forms 2 and 6 for personal income tax will be combined into one document provided at the end of the year. As officials explain, form 2-NDFL will be “absorbed” by form 6-NDFL and will become its integral part. Real changes are scheduled for 2022, but it is advisable to prepare for them now.

Important! A decision has been made at the highest level, and a bill is being prepared to reduce the tax rate for non-residents. The document should be released in March. The rate will be reduced to 13%, so the income of residents and non-residents will be taxed equally by default. The prepared changes should come into force in 2022.

Personal income tax rates in 2022

The size of the tax burden on household income depends on the type of income. For example, the personal income tax rate on dividends in 2020 is similar to the value of deductions from wages and benefits and is equal to 13%. But if you receive winnings from an advertising lottery, you will have to pay the state 35% of the money received.

The status of the taxpayer is important: whether he is a resident or not. Tax residents are citizens who stay in our country for at least 183 days a year. Moreover, the status is assigned regardless of citizenship.

Let's determine the current values for individual types of income. Here is the current table of personal income tax rates in 2022.

| Type of income | Bet size |

| For residents of Russia | |

| Winnings or prizes received as a result of competitions, lotteries and other types of events held for the purpose of advertising goods, works or services - these are the cases in which personal income tax is 35 percent | 35% |

| Savings on interest when receiving borrowed funds, if the fee for using loan capital is less than 2/3 of the refinancing rate | |

| Receipt of income from interest on bank deposits, bonds and other types of investments, if the amount exceeds the amount established in Art. 214.2 and 214.2.1 Tax Code of the Russian Federation | |

| All other types of income | 13% |

| Personal income tax rate for non-residents in 2022 | |

| Wages and other payments regarding remuneration of highly qualified specialists | 13% |

| Remuneration for the work of hired workers, working for individuals, in private subsidiary plots, household and other personal needs, but not related to entrepreneurship | |

| Remuneration for crew members of ships operating under the Russian flag | |

| Salaries of refugees and (or) voluntary migrants who received permanent residence in Russia under a special program | |

| Dividends | 15% |

| All other types of income | 30% |

What is this tax and what does it depend on?

Personal income tax is a direct deduction to the state, withheld from any official income (in cash and in kind) of individuals and legal entities that make a profit as a result of their business activities. Its rate is calculated depending on the status of the entity receiving the income:

- residents - living and working in our country for more than 183 days a year, as well as receiving income from foreign sources;

- non-residents are entities staying in the Russian Federation for less than the specified period, whose income comes exclusively from sources located in our country.

What is subject to taxation (Article 41 of the Tax Code of the Russian Federation):

- wage;

- incentives for some work performed and services provided;

- dividends and interest paid by Russian companies;

- cash income from the sale or rental of your property;

- profits coming from foreign resources;

- scholarships, pensions and other payments;

- income received as a result of any winnings.

The following income is exempt from tax (Articles 215 and 217 of the Tax Code of the Russian Federation):

- various government subsidies, except for sick leave;

- compensation payments upon dismissal and reimbursement of travel expenses;

- funds received from the sale of real estate owned for more than 5 years;

- money received by inheritance;

- income received from donated items or various types of rights.

A more complete list can be found in Chapter 23 of the Tax Code of the Russian Federation.

Tax payment deadlines

The deadlines for transferring personal income tax payments are set individually, depending on who is obliged to make the payment. For example, tax agents have several deadlines for paying income taxes. And for the taxpayers themselves there is one deadline. For the convenience of users, we have prepared a table of deadlines for transferring personal income tax in 2022:

| Type of income | Personal income tax payment deadline for tax agent |

| Salary and advance for the first half of the month | No later than the next day after the day of payment of wages for the second half of the month |

| Calculation upon dismissal of an employee | The next day after payment of the final payment |

| Payment of vacation pay, sick leave benefits and other benefits | No later than the last day of the calendar month in which vacation pay or benefits were paid |

| Other types of payments, additional payments and compensations for which the employer acts as a tax agent | No later than the day following the day of payment transfer |

| For the taxpayer | No later than July 15 of the year following the one in which the payer received income |

How is personal income tax calculated?

When calculating income tax, you should focus on Article 225 of the Tax Code of the Russian Federation.

The algorithm will be as follows:

- The income part is summarized by summing up all profits subject to taxation (for the reporting period).

- For each type of income, the corresponding rate is indicated.

- Calculate the tax base (TB). It is taken into account that in case of personal income tax with different rates, the national income tax is calculated separately for each type of income.

- The total amount is calculated using a specially derived formula (clause 6 of Article 52 of the Tax Code of the Russian Federation).

The personal income tax tax base refers to the income of individuals in monetary terms. It includes all forms of income: ruble, natural, material benefits.

Formula for calculating personal income tax

:

Personal income tax = NB × NS,

where: NB – tax base; NS – Central Bank rate.

NB can be reduced through tax deductions.

To derive the final amount of tax that needs to be transferred to the state budget, you need to add up the amounts for each national bank.

Example:

for February 2022, the total salary of manager R.P. Platonova at Intercom LLC is 59,000 rubles. She is entitled to a standard deduction for one child of five years of age based on the written application. Intercom LLC acts as a tax agent, therefore it is obliged to calculate personal income tax for February 2022 and transfer it to the state budget no later than the day following the date of payment of salaries.

Sequencing:

- Tax is withheld from R.P. Platonova’s salary at 13%.

- Tax base = 59,000 - 1,400 = 57,600 rubles.

- Personal income tax = 57600 x 13% = 7448 rubles.

Tax deductions for taxation

The current fiscal legislation provides for five types of tax deductions, which significantly reduce the amount of personal income tax. Taxpayers have the right to claim the following types of payments:

- Standard.

- Social.

- Property.

- Investment.

- Professional.

There is an income limit for each type of deduction. For example, the property tax deduction is limited to 260,000 rubles. (limit amount of housing cost 2,000,000 × 13%) - this is the amount of personal income tax of 13 percent in 2022 that the Federal Tax Service will return when purchasing an apartment or house. If a taxpayer purchased residential property on credit or a mortgage, he will be compensated another 390,000 rubles.

Payers receive most of the deductions directly from the employer. To do this, you will need to write an application and send it to the employer. In addition to the written application, you will have to document the possibility of obtaining a tax benefit.

If the employer does not provide a tax deduction in the reporting period, the taxpayer has the right to apply to the Federal Tax Service for a refund of income tax. To do this, you will need to fill out an application for personal income tax deduction.

Determination of the tax base for personal income tax by the employer

If the object of taxation is the income of an employed person (his earnings at his place of work), the employer (tax agent) bears responsibility for the correctness and completeness of the tax calculation. If the income came from a person who is not a tax agent, the taxpayer independently calculates the tax and pays it to the budget.

The tax base for personal income tax is determined on an accrual basis from the beginning of the year by summing up all income accrued in favor of the taxpayer, subject to taxation at one rate, with a subsequent reduction of the resulting amount by the amount of the tax deduction (if the taxpayer has the right to it).

For example, after calculating the salary for the month worked (for example, 44,000 rubles in January 2019), the employer must withhold tax from it. The tax base in the form of wages can be derived in several ways:

- If there is no right to deductions, the entire amount of accruals is equal to the taxable amount. With a salary of 44,000 rubles. the tax base is 44,000 rubles.

- An employee has the right, for example, to a standard “children’s” deduction in the amount of 2,800 rubles. monthly. With earnings of 44,000 rubles. the tax base will be 41,200 rubles. (44,000 – 2800).

- The employee confirmed his right to a social (or property) deduction. In this case, the tax base may be zero if the amount of the deduction is equal to or exceeds the amount of current charges. When the estimated income is greater than the required benefit amount, the personal income tax tax base will be calculated by finding the difference between the income and the amount of the deduction.

If the income is received by a person in kind, the tax is calculated on the amount of the valuation determined at current market prices.