What is a social tax deduction for treatment expenses?

All dental services, including implantation and dental prosthetics, are subject to paragraph 3 of Article 219 “Social tax deductions” of the Tax Code of the Russian Federation.

In accordance with the law (Article 219, paragraph 1, paragraph 3 of the Tax Code of the Russian Federation), the tax deduction applies to:

- your treatment;

- treatment of the spouse;

- treatment of parents;

- treatment of children (up to 18 years of age).

The certificate indicates as a patient the family member who received treatment, and as the taxpayer - the one who paid for the treatment and will receive a tax deduction.

The list of medical services for which a deduction is provided is approved by Decree of the Government of the Russian Federation of March 19, 2001 No. 201.

The Russian government has divided all medical services into two lists. List No. 1 – code “1” – treatment is not expensive. List No. 2 – code “2” – expensive treatment.

List No. 1 includes any dental services: caries treatment, tooth extraction, endodontic canal treatment, gum treatment, professional hygiene, bite correction with braces and mouth guards, etc. According to this list, the Government of the Russian Federation limited the amount of tax deduction for the cost of treatment to 120,000 rubles. Even if you spent an amount exceeding 120 thousand rubles on treatment, you will not be able to take it into account when calculating your tax deduction.

List No. 2 includes dental implantation, prosthetics on dental implants, osteoplastic and reconstructive surgical operations on the jaws. According to this list, the upper ceiling of tax deductions is not limited. If you spent more than 120,000 rubles on this, you can qualify for a 13% refund of the entire treatment amount.

Filling out the 3-NDFL declaration for treatment and purchase of medicines - features of obtaining a deduction

Specialists will quickly and correctly fill out the 3-NDFL declaration for treatment, and will also collect a complete package of documents for submitting the declaration to the tax office at your place of registration. The list of medical services and medicines for which a deduction is provided was approved by Decree of the Government of the Russian Federation dated March 19, 2001 No. 201.

When paying for treatment and the purchase of medicines, the taxpayer has the right to receive a deduction in the amount of actual expenses incurred, but in total with other social deductions no more than 120,000 rubles. For the payment of expensive medical services and medications, deductions are provided for the full amount spent by the taxpayer, without restrictions. You can determine whether treatment is considered expensive by the code indicated in the “Certificate of payment for medical services for submission to the tax authorities” issued by the medical institution that provided the service.

Code classification:

- Code – low-cost treatment;

- Code is an expensive treatment.

To receive a deduction, you will need to fill out a 3-NDFL declaration for treatment and submit it to the tax office at your place of registration, attaching to it the appropriate application and a package of necessary documents.

How to apply for a tax deduction for medical services?

— Collect the necessary documents;

— Draw up a declaration and application indicating the basis for receiving a refund of the paid tax and submit documents to the tax office.

List of documents for obtaining a deduction:

1. A copy of the contract for the provision of medical services, issued to an individual - provided by the clinic;

2. certificate of payment for medical services indicating the code - provided by the clinic ;

3. copy of the license - provided by the clinic ;

4. copies of receipts for payment of medical services;

4. declaration in form 3-NDFL;

5. 2-NDFL certificate from work;

6. copy of passport;

7. copies of documents on relationship, if you paid for treatment for your close relatives (parents, children, spouses);

If you have lost receipts (one or more) for medical services or they have, say, faded, then you retain the right to receive a deduction. The document confirming the fact of payment for treatment will be a certificate of provision of medical services, or we will prepare copies of receipts for you.

After preparing all the documents, you must submit them to the tax office.

The declaration with documents is submitted for consideration to the territorial office of the tax inspectorate, to the Federal Tax Service at the place of registration. You can do it in person, by power of attorney, or through the taxpayer’s Personal Account on the Federal Tax Service Inspectorate website.

3-NDFL with documents are submitted at any time during the year following the reporting year, verified within 3 months. A deduction can be obtained for treatment costs over the past 3 years.

How many times can you use the social tax deduction for treatment?

The deduction can be received an unlimited number of times throughout your life, but not more than once a year.

Document

The form of a certificate for obtaining a social deduction for treatment is approved by Order of the Ministry of the Russian Federation for Taxes and Duties and the Ministry of Health of the Russian Federation dated July 25, 2001 No. 289/BG-3-04/256.

Required details to fill out

Filling out the certificate usually does not cause difficulties, but when filling it out the following details are required:

- data from the medical institution;

- date and certificate number;

- taxpayer data;

- cost of treatment;

- service code;

- data of the person receiving treatment;

- date of payment;

- details of the person who issued the document;

- signature and seal.

When and how much can you return?

The tax deduction is made in the amount of money that was paid by the taxpayer:

Photo: Service Agreement

- For services provided by a medical institution of the Russian Federation.

- For treatment of family members of the taxpayer: parents, spouse, children under the age of 18.

- For medications prescribed by a doctor to the taxpayer or his family members.

- For paid insurance premiums to an insurance company under a personal health insurance contract for family members or the taxpayer himself.

A social deduction is provided in the amount of treatment expenses incurred, but cannot exceed 120,000 rubles per year.

If the taxpayer spent money on his treatment, he will be able to return the specified amount.

If the money was spent on treatment of parents, children, spouse, then the tax deduction will be a maximum of 50,000 rubles.

The amount of NV is calculated as follows:

NV = cost of treatment x 13%

Example: If treatment costs amounted to 10,000 rubles, then the tax deduction amount is 1,300 rubles.

The tax authority independently decides whether to issue a refund or not.

Is dental prosthetics considered an expensive treatment?

From 01/01/2021, the List of Expensive Types of Treatment, approved by Decree of the Government of the Russian Federation of April 8, 2022 N 458, includes the following medical services:

Medical services for orthopedic treatment of the population with congenital and acquired defects of teeth, dentition, alveolar processes, jaws supported by dental implants in the absence of conditions for traditional dental prosthetics (significant atrophy or defects of the inert tissue of the jaws).

Thus, dental prosthetics is an expensive type of treatment and the actual amount of expenses is subject to reimbursement.

How to return tax deduction for dental treatment?

To apply for a tax deduction for dental implantation, you will need a package of documents that should be submitted to the tax office of the region where you are registered:

- passport

- income certificate 2-NDFL

- check/certificate of payment for implantation

- copy of the dental clinic license

- contract with dentistry

- tax return 3-NDFL

- application for tax deduction

In accordance with the legislation of our country, citizens who pay income tax on the income they receive are allowed to claim a tax deduction from expensive prosthetics. Therefore, a pensioner can receive a deduction if he is officially employed and transfers taxes on the funds he earns to the state every month.

As for non-working pensioners who receive only a social pension, such an opportunity is not provided for them. However, compensation can be obtained in another way. To do this, it is necessary that the person who paid for the procedure be one of the officially employed children of the pensioner. Indeed, in this situation, the payer will have official income, from which he transfers tax to the state.

Tax deduction is a mechanism for returning part of the paid income tax to a citizen for performing certain actions: buying a home, charity, education, health insurance, treatment. Tax deduction for dental treatment and prosthetics is a type of social tax deduction.

The tax deduction is provided to those taxpayers who have income subject to personal income tax at a rate of 13%. Thus, if you are officially employed and receive a salary, you can receive a tax deduction. If you are unemployed or an entrepreneur in a special regime (USN, UTII, PSN, Unified Agricultural Tax), you are not entitled to a deduction.

Important! If you are a businessman on a special regime and know that in the next few years you will have expenses for training, treatment, and buying a home, we recommend that you officially get a job in order to become an income tax payer. In this case, in the future you will be entitled to a refund of tax deductions for dental treatment and other social and property deductions.

Tax deduction for dental treatment and prosthetics falls into the category of deductions for treatment. A taxpayer can exercise the right to such a deduction at least every year, not only for his own treatment, but also for the treatment of family members: parents, spouse, children.

The maximum deduction amount per year is limited by two factors:

- The legally established limit for tax social deductions is 120 thousand rubles. Moreover, this is the limit for all actions of the taxpayer falling under Art. 219 of the Tax Code of the Russian Federation. That is, if a citizen was treated in 2015, studied and donated money to charity, the maximum amount by which he can reduce his expenses is still 120 thousand rubles. The taxpayer has the right to distribute it among his expenses at his own discretion.

- the amount of personal income tax paid in the year of treatment - the state will not refund you more tax than you paid.

For example, citizen Vasyukov paid 50 thousand rubles for his studies at a commercial university in 2015, bought a voluntary health insurance policy for 55 thousand rubles and had his teeth treated, spending 35 thousand rubles on it. Vasyukov’s salary is 40 thousand rubles per month. Vasyukov’s expenses are 140 thousand rubles.

Please note that the maximum amount of social tax deduction does not apply to medical procedures that are considered expensive treatment - personal income tax returns the full amount of the costs of such treatment. The list of medical services and medicines, the purchase costs of which can be reduced by social deduction, was approved by Government Decree No. 201 of March 19, 2001. Tax authorities refuse to recognize dental prosthetics as an expensive treatment, citing the letter of the Federal Tax Service dated December 25, 2006 No. 04-2-05/7.

However, the classification of treatment as expensive or ordinary is made by the Ministry of Health and Social Development of the Russian Federation. In its letter No. 26949/MZ-14 dated November 7, 2006, the Ministry indicates that operations for implanting dentures belong to item 9 in the List of expensive types of treatment. Accordingly, a citizen has the right to claim a deduction in the amount of expenses incurred for prosthetics.

In practice, the situation is like this: medical institutions have the right to issue you a certificate to provide to the tax authorities indicating that the prosthetics performed are an expensive treatment. But be prepared for disputes with inspectors - use the above explanations from the Ministry of Health and Social Development of the Russian Federation to receive a deduction in full.

To receive a deduction for dental treatment, a number of conditions must be met.

- Firstly, you can get your money back no later than three years after treatment. That is, if you put several fillings in 2013, you can receive a deduction in 2014, 2015, 2016. In 2022, you will lose the right to deduction.

- Secondly, treatment must be carried out on the territory of Russia in a clinic that has a Russian license to provide medical services. An exception is made only for Crimea and Sevastopol - there medical institutions can have a Ukrainian license.

- Thirdly, you must pay for the treatment yourself, not your employer.

We remind you: you can exercise the right to a deduction not only for your own treatment, but also for payment for medical services provided to your close relatives. In this case, all contracts with the medical institution and payment documents must be issued not to the patient, but to the one who pays for the treatment and then plans to receive a deduction for it.

How to get a tax deduction for dental treatment? The procedure is as follows:

- You had your teeth treated, for example, in 2015, at the beginning of 2016 you collect a package of documents (we have written below in detail what should be included in it) and submit them to the tax office by April 30;

- The tax authorities study your documents within three months and decide whether to reimburse you or notify you why the money will not be returned to you, for example, due to errors in the information provided;

- Within a month, the funds are returned to the taxpayer’s bank account specified in the application. The tax authorities will not return income taxes in cash.

Since 2016, citizens have the opportunity to receive a refund not only from the Federal Tax Service, but also from their employer. You need to collect a package of documents for a tax deduction for dental treatment, submit it for verification to the tax office and, if a positive decision is made, receive a notification of the right to apply a social deduction.

If at the end of the year you have a deduction amount remaining, then the employer does not have the right to transfer it to the next year - you will receive the rest from the Federal Tax Service. Thus, obtaining a deduction from the employer is more labor-intensive, since it is likely that the inspection will have to be visited twice.

Let’s say that in December 2015, citizen Oleynikova paid 50 thousand rubles for dental treatment. She collected the necessary documents, received a notification from the tax office about the right to apply the deduction, and provided it to her employer in May 2016. Oleynikova’s salary is 40 thousand rubles. There are no children or other standard deductions.

This means that starting from May, the employer stops withholding income tax from Oleynikova’s salary - 5,200 rubles. Oleynikova has the right to a refund of 50 thousand rubles * 13% = 6500 rubles. This means that already in June Oleynikova will use the right to deduction in full, and from July the employer will resume withholding personal income tax in full.

So, you have the right to a tax deduction for dental treatment - what documents are needed in order to take advantage of it? To eliminate claims from tax authorities and not waste time providing missing documents, we recommend that you prepare the following list of documents:

- passport of the citizen for whom the deduction is issued - he is also the payer of medical services;

- children's birth certificate, marriage certificate, taxpayer's birth certificate - if a family member was treated and the deduction is issued to a parent, spouse or adult child;

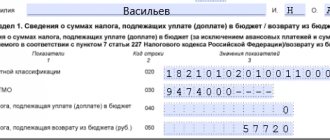

- declaration 3-NDFL;

- 2-NDFL certificates from all places of work of the taxpayer;

- application for income tax refund - in it you also indicate the details of where to transfer the money;

- contract for the provision of medical services with all additional agreements;

- a copy of the license to carry out medical activities;

- certificate of payment for treatment - if the treatment is expensive, then the service code is 2. If the treatment is not included in the list of expensive ones, then the code is 1.

- checks and other payment documents that confirm the fact of payment.

We remind you! You irrevocably provide certified copies to the inspectorate, and tax officials review the originals in your presence.

If a deduction is provided for the treatment of a relative, then payment documents, contracts, and income certificates must be issued to the recipient of the deduction, and not to the patient.

Documents for a tax deduction for dental treatment can be submitted to the Federal Tax Service in person, through an authorized person (with a notarized power of attorney) or sent by Russian Post. We recommend that you deliver the documents in person so that you are immediately aware of possible shortcomings and do not waste time correcting them.