| № | Types of income | Tax rate |

| 1 | For all types of taxable income, except those specified in clause 2, clause 3 and clause 4 | 13% |

| 2 | Regarding income:

| 35% |

| 3 | In relation to income over 5 million rubles. Note: a 13% rate applies to income up to 5 million, as well as income from the sale of real estate and a car. More details - Federal Law of November 23, 2020 N 372-FZ. | 15% |

| 4 | Regarding income:

| 9% |

| 5 | In relation to all income received by individuals who are not tax residents of the Russian Federation. | 30% |

FILES

Personal income tax belongs to the category of direct, that is, not indirect, taxes levied on the basic and additional income of individuals. Personal income tax rates are calculated as a percentage of the total amount of income with the exclusion from the taxable mass of so-called deductions, that is, documented expenses for which the law provides for tax exemption.

Personal income tax: payment procedure

Income tax payers are individuals receiving income. But if you receive income only in the form of wages, the employer will withhold and remit the tax. All persons paying income to taxpayers are tax agents. Such payments include:

- wages to employees and employees under civil contracts;

- dividends to founders;

- interest on loan agreements;

- other payments recognized as an object of taxation.

On some income, the taxpayer is required to calculate and remit the tax himself. They are listed in Article 228 of the Tax Code of the Russian Federation. These include receipts:

- from the sale of property;

- received from individuals and organizations that are not tax agents (for example, under lease agreements);

- from which tax was not withheld by the tax agent;

- received from sources outside the Russian Federation;

- received by the heirs of the authors of works of literature, art, science;

- winnings less than 15,000 rubles, paid by lottery organizers and bookmakers.

The tax base

The income of individuals received by:

- as a result of alienation of property, provided that this property was owned by an individual for less than 3 years;

- as a result of activities related to the transfer of property for rent;

- from sources located outside the Russian Federation;

- as a result of winnings in the lottery, gambling, competitions, etc.;

- as a result of official work activity;

- as a result of other activities or as a result of a combination of circumstances.

The following types of income are not subject to taxation:

- received in connection with the alienation of property, provided that the property was in the property of the seller for more than three years;

- received as a result of the exercise of inheritance rights;

- received as a gift from close relatives or family members;

- obtained as a result of other circumstances that the law regards as grounds for exemption from personal income tax.

Personal income tax in 2022: what changes

The tax rate has not been revised for a long time. The country's leadership has decided that changes in the area of income tax are inappropriate. There was no change in the personal income tax rate in 2022, but minor changes were made to the procedure for calculating tax.

The procedure for taxing material benefits from savings on interest for the use of borrowed money has changed (clause 1, clause 1, article 212 of the Tax Code of the Russian Federation). Now the benefit is recognized only if the organization (or individual entrepreneur) and the individual are interdependent or have an employment relationship.

The list of non-taxable payments has been added (Article 217 of the Tax Code of the Russian Federation). It includes compensation payments from the fund for the protection of the rights of shareholders (clause 71), the amount of payment of part of the first installment on preferential lending with state support for the purchase of a car (clause 37.3), as well as interest on government bonds (clause 25).

A written off bad debt is recognized as income only if the company and the citizen were interdependent (clause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

In the event of a company reorganization, all responsibilities for reporting personal income tax are transferred to the legal successor. That is, if reports were not submitted before the reorganization, then the successor organization will be required to submit them.

Income of residents of the Russian Federation

13%

Any resident income other than those listed below35%

The cost of winnings, prizes received in competitions, games, and other events for the purpose of advertising goods (works, services). Only income is taxed over 4000 rub. Income within the specified limit is exempt from tax. Material benefits from savings on interest for the use of borrowed funds in 2 cases. Firstly, if the loan was received from an interdependent organization (IP) or employer. And secondly, if the savings on interest are actually material assistance or a form of counter-fulfillment of an obligation to the taxpayer.Personal income tax is imposed on the difference between the amount of interest calculated on the basis of the terms of the agreement and the amount of interest calculated on the basis of:

- 2/3 of the refinancing rate on the date of interest payment - for credits (borrowings) in rubles;

- 9% per annum – on credits (loans) in foreign currency.

The exception is material benefits received:

- during the period established by the agreement for interest-free use of the loan for transactions with bank cards;

- for borrowed (credit) funds raised for new construction or purchase of a residential building (apartment, room, shares/shares in them), the land plot on which it is located, a land plot for individual housing construction (IHC) in Russia - provided that the borrower has the right to a property deduction provided for in subsection. 2 p. 1 art. 220 Tax Code of the Russian Federation;

- on borrowed (credit) funds provided by banks located in Russia for refinancing (on-lending) loans (credits) received for new construction or purchase of a residential building (apartments, rooms, shares/shares in them), the land plot on which it located, a land plot for individual housing construction in Russia, provided that the borrower has the right to a property deduction provided for in subparagraph. 2 p. 1 art. 220 Tax Code of the Russian Federation.

Material benefits from a preferential loan at 2% for affected industries due to coronavirus are not subject to personal income tax.

Payment for the use of funds of members (shareholders) of consumer credit cooperatives, as well as interest on loans issued by an agricultural credit consumer cooperative to its members (associate members).Personal income tax is levied on the difference between the amount of income calculated on the basis of the terms of the agreement and the amount of income calculated on the basis of the refinancing rate, increased by 5 percentage points, valid during the period for which the specified income was accrued.

Income in the form of fees for the use of funds of members (shareholders) is exempt from personal income tax if the following conditions are simultaneously met:

- on the date of conclusion or extension of the contract, the rate did not exceed the current refinancing rate increased by 5 percentage points;

- during the interest accrual period, the amount of interest on the deposit did not increase ;

- from the moment when the interest rate on the loan exceeded the refinancing rate increased by 5 percentage points, no more than 3 years have passed.

9%

Interest on mortgage-backed bonds issued before January 1, 2007 Income of the founders of the mortgage-backed trust management received on the basis of the acquisition of mortgage participation certificates. Provided that these certificates were issued to mortgage coverage managers before January 1, 2007.30%

Income from securities of Russian organizations (except for income in the form of dividends), the rights for which are recorded in securities accounts of foreign holders (depository programs), if such income is paid\\ to persons whose information has not been provided to the tax agent in accordance with Art. 214.6 Tax Code of the Russian Federation.Personal income tax rate in 2022

No new personal income tax rates were introduced in 2022. All current tariffs and conditions for their application are listed in Art. 224 Tax Code of the Russian Federation. The rate depends on the type of income, as well as on whether the individual is a tax resident. Tax residency does not depend on the presence or absence of Russian citizenship. A tax resident of the Russian Federation is an individual who has been in the Russian Federation for at least 183 days over the past 12 months.

Personal income tax rates in 2022, table.

| Type of income | % | Article of the Tax Code of the Russian Federation |

| Tax resident rate | ||

| Any income other than those listed below | 13 | Clause 1 Art. 224 |

| Winnings paid by lottery or gambling organizers | 13 | Clause 1 Art. 224 |

| Winnings and prizes in competitions and other events held for the purpose of advertising goods and services | 35 | Clause 2 Art. 224 |

| Personal income tax rate on dividends in 2022 | 13 | Clause 1 Art. 224 |

| Receipts from interest on bank deposits, bonds, investments in CPCs if they exceed the amounts established by Art. 214.2 and 214.2.1 of the Tax Code of the Russian Federation (refinancing rate plus 5%) | 35 | Clause 2 Art. 224 |

| Savings on interest for using borrowed funds if the rate does not exceed 2/3 of the refinancing rate | 35 | Clause 2 Art. 224 |

| Non-resident personal income tax in 2022: rate | ||

| Any income other than those listed below | 30 | Clause 3 of Art. 224 |

| Dividends | 15 | Paragraph 2 p. 3 art. 224 |

| Remuneration of highly qualified foreign specialists | 13 | Paragraph 4 p. 3 art. 224 |

| Payments to workers from individuals for personal, household and other needs not related to business | 13 | Paragraph 3 p. 3 art. 224 |

| Remuneration of crew members of ships sailing under the State Flag of the Russian Federation | 13 | Paragraph 6 clause 3 art. 224 |

| Salaries for refugees and voluntary migrants for permanent residence in the Russian Federation within the framework of the relevant state program | 13 | Paragraph 5 and 7 paragraph 3 art. 224 |

Example 1

Semenov S.S. For January, a salary of 20,000 rubles was accrued. and a bonus of 10,000 rubles. He will have personal income tax withheld at a rate of 13% in the amount of:

The amount of salary to be paid will be:

Example 2

Semenov S.S. In a prize draw at an electronics store, I won a vacuum cleaner worth 10,000 rubles. Semenov S.S. You will have to pay personal income tax at a rate of 35% on the winnings. At the same time, 4000 rubles. are not taxed:

Current tax rates

Currently, Russia has a flat tax scale established for the purpose of equal taxation. Each tax resident pays mandatory contributions on income received in the Russian Federation. These include wages, dividends from securities, material rewards, profits from the sale or rental of property and other income. Let's consider what percentage of personal income tax is from wages or other income in our country.

For the current year, the following income tax rates apply:

- Working citizens pay a 13% tax on their salaries. But not only the employee’s salary is subject to taxation. Accounting makes deductions if employees receive bonuses or vacation pay.

- A person who owns securities and receives dividend income is required to pay 13% of the proceeds.

- Residents of countries that are part of the EAEU and working in the Russian Federation pay 13% of their earnings.

- Refugees and emigrants also report to their host country and, in case of financial gain, pay income tax of 13%.

- 15% is paid from dividend income received by non-residents from investing money in Russian securities.

- Foreign citizens operating in the territory of our state are required to pay 30% of any financial receipts.

- Winnings and valuable prizes over 4,000 rubles are taxed at a rate of 35%.

Personal income tax payment deadline in 2022: table

The payment deadlines for taxes paid by the taxpayer themselves and those of tax agents are different. As a general rule, the tax agent transfers funds no later than the next day after the day of issuing remuneration to the employee or other payment. But there are exceptions. To avoid confusion, use our reference material.

Deadlines for transferring personal income tax in 2022 (table).

| Income | Transfer deadline |

| Salary, including advance for the first half of the month | No later than the day following the day of transfer of wages for the second half of the month to the employee |

| Final settlement | The next day after payment of the payment upon dismissal |

| Vacation pay, sick leave and other benefits | No later than the last day of the month in which the payment was made to the employee |

| Other transfers for which the employer is a tax agent | No later than the day following the payment date |

| Income on which tax is paid directly by the taxpayer | Until July 15th following the year of receipt of income |

Has the amount of personal income tax changed in 2022?

The personal income tax percentage in 2022 and, accordingly, the amount of this tax have not changed. Certain tax changes occurred in prior periods.

Thus, the changes in 2022 affected the fee for an independent assessment of an employee’s qualifications:

- it does not fall under the personal income tax withheld from the employee if it is paid by the employer (clause 21.1 of article 217 of the Tax Code of the Russian Federation);

- a social deduction can be claimed for its amount if it was paid by the employee himself (subclause 6, clause 1, article 219 of the Tax Code of the Russian Federation).

In 2022, changes were adopted to paragraph 60 of Art. 217 of the Tax Code of the Russian Federation, which allows not to tax, subject to certain conditions, income received by an individual during the liquidation of a foreign company (Law No. 34-FZ dated February 19, 2018). These changes apply to legal relations arising from 01/01/2016.

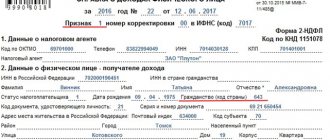

Deadlines for submitting personal income tax reports in 2022

Personal income tax payers and tax agents must not only calculate and pay tax at the correct rates, but also prepare and submit reports to the Federal Tax Service. Taxpayers who are obliged to calculate and pay personal income tax themselves submit a declaration at the end of the year in form 3-NDFL.

Tax agents submit the following reports:

- certificates in form 2-NDFL - once a year;

- report 6-NDFL - quarterly.

The deadlines for submitting reports in 2022 are presented in the table:

| Report | Period for which it is provided | Delivery date 2022 |

| 6-NDFL | 2018 | 01.04.2019 |

| 1st quarter 2020 | 30.04.2019 | |

| half year 2020 | 31.07.2019 | |

| 9 months 2020 | 31.10.2019 | |

| 2020 | 01.04.2019 | |

| 2-NDFL with sign 1 | 2018 | 01.04.2019 |

| 2020 | 01.04.2019 | |

| 2-NDFL with sign 2 | 2018 | 01.03.2019 |

| 2020 | 02.03.2019 | |

| 3-NDFL | 2018 | 30.04.2019 |

| 2020 | 30.04.2019 |

Let's go back to example 2

Since Semenov S.S. receives the winnings in kind, then the store cannot fulfill the duty of a tax agent and withhold personal income tax from him. In accordance with the rules of Russian tax legislation, the store will have to notify the Federal Tax Service by 03/02/2019 about the impossibility of withholding tax at a rate of 35% by submitting a 2-NDFL certificate with sign 2. A Semenov S.S. will have to submit a declaration in form 3-NDFL to the Federal Tax Service by April 30, 2019 and pay personal income tax in the amount of 2,100 rubles by July 15, 2019.

More about personal income tax

- recommendations and assistance in resolving issues

- regulations

- forms and examples of filling them out

ConsultantPlus TRY FREE

Basic personal income tax rates in 2021

For tax residents of the Russian Federation

- 13% – salary and other income, except those taxed at rates of 15% and 35%;

- 15% – salary and other income in part of the tax base exceeding 5 million rubles. per year , except those taxed at a rate of 35% or specified in clause 1.1 of Art. 224 Tax Code of the Russian Federation;

- 35% – winnings, prizes and material benefits.

For non-residents of the Russian Federation

- 13% – salary no more than 5 million rubles. per year for foreigners with a patent, citizens from the EAEU, highly qualified specialists, refugees and those who received temporary asylum in the Russian Federation (letters from the Ministry of Finance dated 08/25/2020 No. 03-04-06/74275, dated 01/24/2018 No. 03-04-05/3543);

- 15% – salary in excess of 5 million rubles. per year , foreigners with a patent, citizens from the EAEU, highly qualified specialists, refugees and those who have received temporary asylum in the Russian Federation;

- 30% – other income of non-residents.

Residents' dividends are no more than 5 million rubles. tax per year 13% , and in part of the excess - at 15% . For non-residents, the entire is taxed 15% .

Examples of calculating personal income tax in 2022 are available in the Consultant Plus system

Full and free access to the system for 2 days.

How can you reduce personal income tax 2022

Every taxpayer has the right to reduce the income tax payment paid through the use of tax deductions:

- standard;

- social;

- property;

- investment.

Now it is possible to obtain most of them directly from the employer. To do this, you need to write an application and collect documents confirming the right to deduction.

In addition, at the end of the year, you can submit a 3-NDFL declaration to the tax office to apply the deduction. It will be checked, after which a refund of the overpaid tax will be made.

Personal income tax rates for residents in 2022: table

A tax resident is a person who, on the date of receipt of income, has been in the Russian Federation for at least 183 calendar days for 12 consecutive months.

- for ruble deposits - in excess of the refinancing rate, increased by 5 percentage points**, valid during the period for which the specified interest was accrued;

- on deposits in foreign currency - in excess of 9 percent per annum;

- for bonds denominated in rubles and issued after January 1, 2022 - in excess of the refinancing rate, increased by 5 percentage points, valid during the period for which the specified interest was accrued.

Rate changes in 2022

Income tax interest rates in 2022 in Russia did not increase. However, changes were made in the procedure for calculation, payment, and reporting of personal income tax:

- Non-residents are exempt from paying tax on the sale of real estate owned for more than three or five years. Individual entrepreneurs have a similar right. Previously, such a benefit was provided only to resident individuals.

- The list of non-taxable income has been increased: you no longer need to pay tax on the sale of waste paper generated in everyday life.

- The procedure for determining income when selling bonds in foreign currency has been changed: conversion into rubles is carried out at the exchange rate on the maturity date.

- When working in the field, personal income tax is assessed only on amounts exceeding 700 rubles.

- A one-time social payment for the purchase or construction of residential premises is exempt from taxation.

- Until the end of 2022, citizens carrying out activities in caring for children and the elderly, tutoring, and cleaning premises have the right not to register as individual entrepreneurs, but are required to notify the Federal Tax Service about their activities.

- Now two income certificates have been established: form 2-NDFL is submitted to the Federal Tax Service, and a new income certificate is issued to the employee.

What is the income tax in Russia and who should pay it?

Personal income tax is a direct tax, which is calculated from the difference between all income received by individuals and expenses that are confirmed by documents drawn up in accordance with current legislation, or tax deductions.

Read about the objects falling under this tax in the articles in the personal income tax section:

Personal income tax payers are individuals who, for tax calculation purposes, are divided into 2 groups:

- Residents of the Russian Federation are those who receive income and are in Russia for at least 183 calendar days during the year without interruption. They pay a tax of 13% of their salary (the amount of personal income tax on other income will be discussed below).

- Non-residents of the Russian Federation are those who stay in the Russian Federation for less than 183 days and receive income on its territory. The income tax on their income is generally 30%. However, for some types of non-residents the personal income tax rate is 13%. Non-residents whose income from their main work activities are taxed at a rate of 13% include (clause 3, article 224 of the Tax Code of the Russian Federation):

- workers from EAEU countries (see important nuance here);

- working under a patent;

- highly qualified specialists;

- foreigners who are refugees or have received asylum in Russia;

- participants in the State Program to Assist Voluntary Resettlement in the Russian Federation;

- crew members of ships flying the State Flag of the Russian Federation.