Kontur.Accounting - 14 days free!

Automated calculation of vacation pay in a few clicks.

Save your time. Try for free

Employees are provided with annual leave while maintaining their place of work (position) and average earnings. (Article 114 of the Labor Code of the Russian Federation). Moreover, some categories of workers are entitled to additional vacations in addition to the main vacation.

The average salary retained by an employee during vacation is determined by the formula:

Average daily earnings = Amount of accrued salary for the billing period / (Number of full months × Average monthly number of calendar days (29.3))

Amount of vacation pay = Average daily earnings × Number of vacation days

The amount of vacation pay will also depend on whether the tariff rates (salaries) were increased during the billing period or after.

Number of vacation days to calculate

Most often, vacations are granted in calendar days. Standard paid basic leave is 28 calendar days. Moreover, the employee can take time off not immediately, but in parts. The main thing is that at least 2 weeks of vacation should be taken off continuously.

Some categories of workers are entitled to extended basic leave (Article 115 of the Labor Code of the Russian Federation). For example, workers under 18 years of age must rest 31 calendar days, and disabled people - 30 (Article 267 of the Labor Code of the Russian Federation, Article 23 of the Federal Law of November 24, 1995 No. 181-FZ)

Labor legislation also provides for additional leaves for employees (Article 116 of the Labor Code of the Russian Federation).

For the calculation, it is important to exclude all non-working holidays from vacation days. That is, all all-Russian holidays established by Art. 112 of the Labor Code of the Russian Federation, and holidays established in a specific region by the law of the subject of the Russian Federation (part 1 of article 72 of the Constitution of the Russian Federation, article 22, 120 of the Labor Code of the Russian Federation, article 4 of the Federal Law of September 26, 1997 No. 125-FZ, clause. 2 letters of Rostrud dated September 12, 2013 No. 697-6-1). However, weekends are still included in the calculation. It’s the same with non-working days with continued pay - they are included in the calculation, vacation is not transferred to them.

Important! Non-working days to which holiday weekends are postponed are included in the calculation. If the day off coincides with a holiday, then the Government of the Russian Federation issues a resolution setting the date to which the day off and holiday is transferred. For example, in 2022, June 12 fell on a Saturday, and the day off from that day was moved to June 14. If an employee is on vacation on June 14, then this day must also be paid.

Coefficient for calculating vacation pay

An officially employed employee has the right to paid leave of 28 days. To calculate funds, a formula is used that includes the vacation pay coefficient. In 2019, it is 29.3, reflects the average number of days in a month and is used when calculating daily earnings. The billing period in most cases is a year. If an employee takes a vacation in July 2016, then the period is considered to be the period from July 2015 to June 2016. Funds paid during this time are used to calculate the total salary and vacation pay.

24 Dec 2022 marketur 314

Share this post

- Related Posts

- Loan for building a house in Sberbank conditions

- Apartment purchase and sale agreement without a transfer deed

- Benefits for selling an apartment

- Is it legal to turn off the light if there is a debt but the current payment is due?

Determining the billing period

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

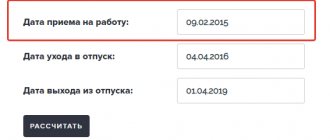

As a general rule, the billing period for calculating average daily earnings is defined as 12 calendar months preceding the month in which the first day of vacation falls (Article 139 of the Labor Code of the Russian Federation, clause 4 of the Regulations, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 , hereinafter referred to as the Regulations).

It is necessary to exclude from the billing period all the time when the employee (clause 5 of the Regulations):

- Received payment in the form of average earnings (with the exception of breaks for feeding the child in accordance with the law). For example, time of business trip or paid vacation;

- Was on sick leave or maternity leave;

- Didn’t work due to downtime through no fault of his own;

- Did not participate in the strike, but due to it could not work;

- Used additional paid days off to care for disabled children and people with disabilities since childhood;

- In other cases, he was released from work with full or partial retention of wages or without pay. For example, vacation time at your own expense or parental leave.

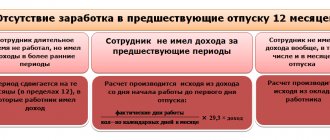

It may turn out that in the 12 months preceding the vacation there was no time at all when the employee was paid wages for the days actually worked, or this entire period consisted of time excluded from the calculation period. In this case, as the calculation period you need to take the 12 months preceding the first mentioned 12 months (clause 6 of the Regulations).

If the employee did not have actual accrued wages or actually worked days during the billing period and before it began, then the days of the month in which the employee goes on vacation are taken as the billing period (clause 7 of the Regulations).

A collective agreement or local regulatory act may provide for other billing periods for calculating average wages, if this does not worsen the situation of workers (Article 139 of the Labor Code of the Russian Federation).

Vacation pay calculation

29.3 in the formula corresponds to the average monthly number of calendar days in a fully worked billing period. Moreover, the billing period is considered to be fully worked if in each month of this period there are no days excluded from the billing period (days of temporary disability, business trips, vacations, downtime, etc.). It may turn out that in the 12 months preceding the vacation there was no time at all when the employee was paid wages for the days actually worked, or that this entire period consisted of time excluded from the calculation period. In this case, as the calculation period you need to take the 12 months preceding the first mentioned 12 months (clause 6 of the Regulations).

Please note => Change of address without making changes to the charter

Determination of earnings for the billing period

Calculate vacation pay in a few clicks in the Kontur.Accounting web service! Get free access for 14 days

All payments accrued to the employee, which are provided for by the employer’s payment system, are taken into account, regardless of the sources of these payments (Article 139 of the Labor Code of the Russian Federation). In paragraph 2 of the Regulations, approved. By Decree of the Government of the Russian Federation of December 24, 2007 No. 922, there is an open list of such payments.

The following cannot be included in the calculation of average earnings:

- All payments accrued to the employee for the time excluded from the payroll period. They are listed in clause 5 of the Regulations. For example, average earnings for days of business trips and in other similar cases, social benefits, payments for downtime;

- All social benefits and other payments not related to wages. For example, financial assistance, payment of the cost of food, travel, training, utilities, recreation, gifts for children (clause 3 of the Regulations);

- Bonuses and remunerations not provided for by the remuneration system (clause “n”, clause 2 of the Regulations).

Bonuses (other remunerations) provided for by the remuneration system are taken into account taking into account certain features established by clause 15 of the Regulations.

In the Kontur.Accounting web service, vacation pay is calculated in a few clicks:

No days worked

If the billing period consists entirely of excluded days and there is not a single day worked (for example, the employee was on a business trip), determine the average earnings based on his salary. To do this, use the formula:

| Average daily earnings = Salary: 29.3 |

This procedure is provided for in paragraph 8 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922.

An example of how to determine the average daily earnings for calculating vacation pay. There are no days worked in the pay period

A.S. Kondratyev has been working for the Alpha organization since April 1, 2016. His salary is 22,000 rubles. From April 1 to May 31, Kondratiev was on a business trip. From June 1 to June 11, Kondratiev was granted annual paid leave. The Alpha accountant calculated the average daily earnings as follows:

22,000 rubles: 29.3 = 750.85 rubles.

Calculation of average daily earnings

Knowing the billing period and the total amount of earnings for this period, you should determine the employee’s average daily earnings:

Average daily earnings = Earnings for the billing period / (12 × 29.3)

29.3 in the formula corresponds to the average monthly number of calendar days. This formula is suitable for a fully worked out billing period. Moreover, it is considered fully worked if in each month there are no excluded days (days of temporary disability, business trips, vacations, downtime, etc.).

If the billing period is not fully worked out, the formula is applied:

Average daily earnings = Earnings for the billing period / (29.3 × Number of fully worked months in the billing period + Number of calendar days in incompletely worked months of the billing period)

Moreover, for each month that is not fully worked, you need to apply the formula:

The number of calendar days in an incompletely worked month = 29.3 / The number of calendar days of the month × The number of calendar days falling within the time worked in a given month.

Example

The employee has been working for the organization since August 1, 2022. On July 15, 2021, he goes on vacation for 14 calendar days. In this case, the billing period is 11 months - from August 1 to June 30. During the billing period, the amount of earnings for calculating vacation pay amounted to 600,000 rubles. There were no salary increases in the organization during this time.

In March, the employee was on a business trip for 21 calendar days. The remaining days of March are 10 (31 − 21). Accordingly, March is an incomplete month of the billing period, from which only 9.5 days are taken to calculate vacation pay (29.3 × 10 / 31).

In October, the employee was sick for 11 calendar days. The remaining days of October are 20 (31 − 11). Accordingly, October is also an incomplete month, from which only 18.9 days are taken to calculate vacation pay (29.3 × 20 / 31).

There are 9 fully worked months left in the billing period (11 − 2). Accordingly, the average daily earnings of an employee will be:

600,000 rub. / (29.3 days × 9 months + 9.5 days + 18.9 days) = 2,054.09 rubles.

The employee must be paid the amount of vacation pay of RUB 28,757.26. (RUB 2,054.09 × 14 days).

For employees who receive vacation in working days, the average daily earnings are calculated based on the number of working days according to the calendar of a 6-day working week:

Average daily earnings = Salary accrued for the billing period / Number of working days according to the calendar of a six-day working week that fall within the time worked by the employee

If the billing period has not been worked out at all and there was no salary immediately before the vacation (for example, the employee returned from maternity leave or the employee was on a long business trip and immediately goes on vacation), then the formula is applied (clause 8 of the Regulations):

Average daily earnings = Salary (tariff rate) / 29.3

Calculation of vacation pay in 2014

Federal Law No. 55-FZ dated April 2, 2014 (hereinafter referred to as Law No. 55FZ) amended Part 4 of Article 139 of the Labor Code: a new value for the average monthly number of calendar days was established - 29.3. The changes came into force on April 2, 2014. Read more about this below. In practice, there are very rarely situations where an employee would work out the entire pay period. Time of illness, stay on business trips, vacations and other unworked periods of time are excluded from the calculation period (clause 5 of the Regulations on average earnings).

Number of working days in 2022

2020 will be a leap year - it has 366 calendar days. The number of days off per year depends on the working hours:

- with a five-day week, one day off falls on Sunday, the second can be set by the employer for any other day, in total for 2022 there are 118 non-working days (including holidays) under this regime;

- with a six-day week, the number of days of rest in 2022 is 66, but at the same time the weekly norm of hours worked remains at the standard level - no more than 40 hours.

If a non-working holiday coincides with a weekend (Saturday, Sunday), the day off is transferred to the working day following the holiday. The Government transfers two days off from the New Year holidays to other periods of the year (Article 112 of the Labor Code of the Russian Federation).

You can determine the number of working days in a year using the production calendar or by calculating this standard yourself. Monthly data on working hours in 2022 are shown in the table:

| Month | Standard working days | Note | |

| for a five-day period | for six days | ||

| January | 17 days | 20 days | The month is the richest for weekends. A large number of non-working days is due to the presence of the New Year holidays and Christmas, which last from the 1st to the 8th. The weekends of January 4 and 5, which fell during these holidays, will be moved to May 4 and 5 by Government Decree No. 875 dated July 10, 2019 |

| February | 19 days | 24 days | This month there is only one holiday - February 23 (Defender of the Fatherland Day), which falls on a Sunday, so one day off is moved to the 24th (Monday). In the case of a five-day week, there will be no shortened day before the holiday, and for those who work 6 days a week, the day before there will be a work shift shortened by an hour |

| March | 21 day | 25 days | In March, the holiday on March 8 coincided with Sunday, which led to the transfer of the non-working day to Monday, March 9; with a six-day week on the eve of the holiday there should be a shortened working day |

| April | 22 days | 26 days | A month without holidays, you will be able to rest only on regular weekends, but on the last day of the month the working day will be shortened by an hour (on the eve of the May holidays) |

| May | 17 days | 23 days | There are two holidays in May (May Day and Victory Day), in addition, the January weekend, which coincided with the holidays, has been moved to the beginning of May. As a result, the ratio of working days and holidays during a five-day week in May is 17 to 14. Long rest periods: from 1 to 5 and from 9 to 11 May, and on the eve of Victory Day there should be a shortened working day. With a six-day week, there are no long periods of rest - on May Day, days of rest and work will alternate one after another (weekends on May 1, 3, 5), and on Victory Day there will be 2 non-working days in a row - May 9 and 10 |

| June | 21 day | 25 days | This month there is one non-working holiday, June 12 - Russia Day, before which everyone will have a shortened working day |

| July | 23 days | 27 days | There are no additional non-working days from July to October |

| August | 21 day | 26 days | |

| September | 22 days | 26 days | |

| October | 22 days | 27 days | |

| November | 20 days | 24 days | One holiday - National Unity Day (November 4) and a shortened working day before it (3rd day) |

| December | 23 days | 27 days | There are no holidays, but on the eve of the New Year holidays, a shortened working day is established on December 31 |

| Total: | 248 days | 300 days | |

The transfer of weekends in the coming year 2022 is regulated by the norms of Government Decree No. 875 dated July 10, 2019. The weekends of January 4 and 5 (Saturday and Sunday) are postponed to May 4 and 5 (Monday and Tuesday) in order to extend the rest for the May holidays.