How does a penalty differ from a fine?

These are two different types of penalties. They both impose a fee for failure to fulfill obligations, but the accrual mechanism is different. So, the fine involves a fixed amount of money. For example, for late payments on a credit card, the bank imposes a one-time fine of 590 rubles.

A penalty is a certain percentage that is charged on the amount of debt. Let’s say the penalty for the supply of some goods is 0.1% per day of its cost. Most often, one type of penalty is applied, less often both at once, when, according to the contract, a fine must be paid, and the penalty accrues every day.

As for consumer lending agreements, banks can only impose penalties on them, and in the amount limited by law to 20% per annum. But fines may apply to credit cards.

The penalty is legal and contractual

The penalty may be established by law: for example, in the field of compulsory motor liability insurance or housing construction. It is established by law what amount the client will pay in case of default on a loan or insurance, regardless of what is specified in the agreement of the parties. In other cases, the parties to the contract themselves determine the amount of the fine or the percentage of penalties, as well as the type of penalty for late payment.

In some cases, the amount of the penalty may be reduced by the court (Article 333 of the Civil Code of the Russian Federation). A decrease may occur if:

- the amount of compensation clearly exceeds the consequences of failure to fulfill obligations;

- the violation was committed by an individual entrepreneur, and he wrote a statement with a request to reduce the penalty for late payment;

- collection of a contractual penalty may lead to unjustified benefits for the creditor.

The agreement on a penalty must be concluded in writing, otherwise it will be considered invalid (Article 331 of the Civil Code of the Russian Federation). Then the party that violated the obligations has the right not to pay any interest or penalties. At the same time, if a penalty for delay is provided for by law, but is not specified in the contract, the violator is still obliged to pay it (Article 332 of the Civil Code of the Russian Federation).

Tax penalties

The Federal Tax Service is the body that very actively charges penalties. Many Russians do not particularly pay attention to tax payment deadlines and often do not know about them at all. And there is a transport tax, land tax, real estate tax, income tax, etc. And each must be paid on time.

It’s good if you receive a receipt from the Federal Tax Service, which you can pay. But often it is not there, and a citizen learns about delays and penalties only from the corresponding letters or on the State Services portal.

The amount of penalties for tax fees is indicated in Article 75 of the Tax Code of the Russian Federation, which is dedicated to this point. Here's what the law says:

- for individuals, a penalty is applied in the form of 1/300 of the refinancing rate of the Central Bank of the Russian Federation, current at the moment;

- for organizations in the first 30 days of delay, a penalty of 1/300 of the refinancing rate of the Central Bank of the Russian Federation is provided. Starting from the 31st day, another 1/150th is added to it.

At the same time, the law determines the moments at which the taxpayer can cancel the penalty. They are not accrued if, as part of judicial proceedings, the property of a person or company was seized, if a decision was made to suspend operations on his accounts. In this case, you need to contact the Federal Tax Service and write a corresponding application.

The procedure for collecting penalties from the supplier

The customer can recover a penalty from the supplier in 4 ways:

- Withhold from contract performance security if the corresponding security is transferred in cash.

- Withhold from the amount due to the supplier for payment under the contract.

- The supplier may voluntarily transfer the penalty to the customer's account.

- Collect in court.

It should be noted that the withholding of a penalty from the amount of contract security or the amount of payment under the contract should be qualified as one of the methods of terminating obligations - offsetting counter-similar claims (in accordance with Article 410 of the Civil Code of the Russian Federation). Set-off in the cases under consideration will undoubtedly be legal if the counterparty recognizes such a debt or if the possibility of appropriate deduction is provided for in the contract between the customer and the supplier.

These findings are consistent with the position of regulatory and control authorities. The Ministry of Finance of Russia and the Federal Treasury in a joint letter dated December 25, 2014 N 02-02-04/67438, 42-7.4-05/5.1-805 indicate that partial or full withholding of the security amount is carried out in accordance with the terms of the contract. This position is supported by the FAS Russia in a letter dated December 10, 2015 N ATs/70978/15: “...In the opinion of the FAS Russia, the inclusion in the draft contract of a condition that in the event of non-fulfillment or improper fulfillment of the obligation provided for in the contract, the customer has the right to make payment according to contract minus the appropriate amount of the penalty (fine, penalty), does not contradict the requirements of the Law on the Contract System.” Also, the Ministry of Finance of Russia, in letter dated November 2, 2020 N 24-03-08/95446, indicates: “... the customer has the right to make payment under the contract minus the appropriate amount of the penalty (fine, penalty) or has the right to return the contract security, reduced by the amount of accrued fines, pennies..."

Penalties cannot be withheld from a bank guarantee. Letters from the Ministry of Finance of Russia dated 09/14/2020 N 24-05-08/80942, dated 10/02/2020 N 24-03-08/86257 indicate: “Thus, based on the above, the penalty cannot be paid using bank guarantee funds, so as a minor obligation under a contract, the performance of which is secured by a bank guarantee...”

How to find out how many penalties have been accrued

If you received a letter, all information will be reflected in it. You can also view the amount of tax due for payment and all accrued penalties in your personal account of the Federal Tax Service. If you have an account on State Services, all relevant information will be reflected there.

If taxes are overdue, the amount due is divided into two parts. The due tax fee is formed by one receipt, and the accrued penalties by another. This is what it looks like on the Government Services portal:

Moreover, if you plan to pay off the entire debt, initially you need to pay off the tax itself, only then the accrued penalties. After payment, within 10 days the Federal Tax Service will process the payment and update information on the amount of penalties:

The fact is that penalties are charged for each day of late payment. That is, while the payment is being processed, the penalty will accrue again during these days, and the amount will be slightly different.

Supplier liability

An important point is that Part 6 of Article 34 of Law No. 44-FZ provides for the customer’s obligation to send the supplier a demand for payment of penalties (fine, penalty) in any case of violation by the latter of its obligations under the contract. That is, the customer is always obliged to send a demand if there was a violation of its obligations by the supplier. The customer does not have the right to choose whether to send a request or not.

From the procedure for calculating penalties and fines described below, exceptions are possible in cases where, in accordance with the legislation of the Russian Federation, the penalty for the supplier must be calculated in a different manner (for example, contracts for the provision of MTPL services).

Penalties for non-payment of loans

Penalties are a constant companion for those who do not fulfill their obligations under loan agreements. But if previously banks themselves regulated the amount of penalties, now at the legislative level all penalties are limited.

This was done on purpose, since some creditors set unreasonably high penalties, plus fines. As a result, borrowers who committed even a one-time delay fell into a real debt hole from which they could not get out.

So situations arose when, with an initial loan amount of 100,000 rubles, a person found himself owing 1,000,000 rubles or even more. To stop this, the Central Bank decided to limit bankers in terms of assigning penalties, which is reflected in Federal Law No. 353 On consumer credit.

Financial institutions are offered a choice of two options for calculating penalties:

- If the interest due under the agreement continues to accrue. In this case, penalties will be 20% per annum.

- If the bank stops accruing interest, then the penalty amount is 0.1% per day.

In the vast majority of cases, banks adhere to the scheme of calculating penalties in the amount of 20% per annum and at the same time continue to assign interest under the agreement. The law prohibits them from taking fines.

If you do the calculation, then 20% per annum is not so much, only 0.055% per day. For example, if the amount overdue is 10,000 rubles, then the next day it will be credited with 5.5 rubles. But these 5.5 are counted towards the unpaid amount; the next day the penalty will be calculated from 10,005.5 rubles.

If you are in arrears on your loan, it is better not to delay, but to turn to the bank for help, for example, for restructuring. Otherwise, next month, after the next payment is not made, the overdue amount will increase and the penalties will be higher. And the further, the more serious the growth of debt will be.

Accrued fines

In addition to penalties, it is also possible to impose a fine, which is a monetary amount of 20% of tax debts. By the way, if tax authorities prove intent to evade, then the fine for non-payment of property tax for individuals will increase to 40%, and they can declare a violation and collect the money within three years from the end of the reporting period. For example, if there is debt for 2022, the Federal Tax Service may impose sanctions during 2019-2021, after which the statute of limitations will expire.

The tax service must notify the payer of the need to pay a fine and provide evidence

It is imperative to keep in mind that tax authorities must provide a number of documents indicating that an offense has been committed by an individual. For example, documents confirming the legal calculation of the amount of tax, as well as confirming the sending of a notification to the payer, will be useful. It is also important that the debtor should have received the message, and if this did not happen, the decision can be challenged in court.

Penalties for loans from microfinance organizations

A slightly different situation concerns those who owe money to microfinance organizations. The penalty for the amount of debt is calculated exactly the same as in the case of a bank loan. That is, according to Federal Law-353, this is 20% per annum, plus the rate stipulated by the contract.

But it was the microcredit sector that drove borrowers into real bondage. The fact is that today the marginal rate on loans is 1% per day, which is most often prescribed by lenders, and this is 365% per annum. That is, 365% is added to 20% per annum. As a result, the debt increases dramatically quickly.

In order to protect borrowers from unreasonably high penalties, the amount that microlenders can demand in the form of penalties is legally limited. In the form of penalties and interest, the MFO is not authorized to demand from the borrower more than 1.5 times the loan amount.

Simply put, if the amount of microloans at the time of issuance was 10,000 rubles, then in the form of interest and penalties in case of delay, the microfinance organization can charge a maximum of 15,000. That is, the total amount required for repayment cannot be more than 25,000 rubles.

All legal MFOs comply with this legal norm. All companies are controlled by the Central Bank of the Russian Federation, so it is not in their interests to exceed their powers.

Penalty under the contract: the main thing

First of all, let's turn to the Civil Code of the Russian Federation. Article 330 contains a provision that the amount of the penalty is determined either by agreement or by law. The penalty itself is the amount that the violator is obliged to pay to the party affected by his failure to fulfill the terms of the contract.

Important! The law allows you to receive a penalty if your counterparty has not fulfilled its obligations under the contract (or fulfilled them incompletely) or has refused to pay (has been late). Penalties are also imposed for violation of contractual obligations in relation to third parties.

A contractual penalty can be collected in two forms - as a fine and as a penalty. If the contract provides for the first option, then it will not be necessary to count it, since the amount is established in advance and is fixed. It is necessary to engage in settlements only if the contract requires a penalty to be collected.

Penalties for non-payment of utilities

The type of utility service provided does not matter. If a person does not pay public utilities, they are legally entitled to charge penalties. This issue is regulated by Article 14 of Federal Law No. 155, which explains the issues of payment for utility services.

What ends up happening:

- for the first 30 days after the delay, no penalties are imposed;

- starting from the 31st day, penalties are imposed in the amount of 1/300 of the refinancing rate;

- starting from the 91st day, the amount of the penalty increases to 1/130 of the refinancing rate of the Central Bank of the Russian Federation.

So, the longer the delay, the higher the penalties. But in the case of public services, a penalty forgiveness mechanism is often used. For example, on the eve of the New Year, the service provider often announces a promotion according to which all penalties are written off if the debtor pays off the principal debt. And this is an excellent reason to take advantage of the situation and rid yourself of debt.

In connection with the coronavirus pandemic, the government issued a resolution according to which the accrual of fines and penalties is suspended until January 1, 2022.

We looked at what penalties are, how they work, and the amount of penalties for the most popular obligations. But each form of contractual relationship has its own rules and laws. But the calculation scheme and the principle of operation of penalties are the same everywhere.

Give your rating

Information sources:

- ConsultantPlus: Tax Code of the Russian Federation Article 75. Penalty.

- ConsultantPlus: Federal Law-353 On consumer credit (loan).

- Website of the Bank of Russia: Microfinance: new restrictions on the maximum debt and daily interest rate.

- Consultant Plus: Decree of the Government of the Russian Federation on the suspension of penalties for utilities.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

General provisions on penalties, rules for including provisions on penalties in a contract

In accordance with Article 330 of the Civil Code of the Russian Federation, a penalty is a sum of money determined by law or contract that the debtor must pay to the creditor in the event of non-fulfillment or improper fulfillment of an obligation, in particular in case of delay in fulfillment.

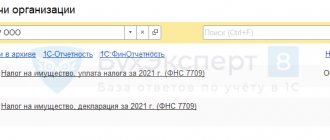

Calculators for the government customer: automatic calculation of the NMCC, accurate calculation of deadlines for auctions and other procurement methods, selection of OKPD2 or KTRU code and checking for regulations in the Economy-Expert.Online program

Law No. 44-FZ provides for 2 types of penalties: fines and penalties. The law provides for liability for violation of the terms of the contract both on the part of the customer and on the part of the supplier (contractor, performer) (hereinafter referred to as the supplier). In this case, penalties are applied only for violation of deadlines (late delivery or fulfillment of a warranty obligation on the part of the supplier; late payment on the part of the customer). For other violations a fine is applied. The procedure, dimensions, and conditions for applying each type of penalty are indicated in the Penalty Memo.

Part 4 of Article 34 of Law No. 44-FZ speaks of the mandatory inclusion in the contract of conditions on the responsibility of the customer and supplier for non-fulfillment or improper fulfillment of obligations stipulated by the contract. Thus, liquidated damages clauses are essential terms of the contract and must be specified by all customers in all contracts. Exceptions are cases of purchase from a single supplier, listed in Part 15 of Article 34 of Law No. 44-FZ. In such procurements, some essential contract terms may not apply, for example, provisions on the liability of the parties.

The conditions for the amount and procedure for calculating penalties are specified in the contract for the supplier - in accordance with Part 7 of Article 34 of Law No. 44-FZ; for the customer - in accordance with Part 5 of Article 34 of Law No. 44-FZ. The procedure for calculating the fine is specified in the contract in accordance with the Rules for determining the amount of the fine accrued in the event of improper fulfillment by the customer, non-fulfillment or improper fulfillment by the supplier (contractor, performer) of the obligations stipulated by the contract (except for delay in fulfillment of obligations by the customer, supplier (contractor, performer), approved by Decree of the Government of the Russian Federation of August 30, 2022 N 1042 (hereinafter referred to as Rules No. 1042). Rules No. 1042 provide for the calculation of the fine as a percentage of the contract price, or, if the contract provides for stages of contract execution, as a percentage of the stage of contract execution. For the supplier the amount of the fine is determined in accordance with clauses 3-8 of Rules No. 1042, for the customer - clause 9 of Rules No. 1042.

It should be noted that simply including references to the relevant paragraphs of Rules No. 1042 in the contract is not enough. FAS Russia, in a letter dated December 1, 2014 N AD/48791/14, indicated that “...inclusion in the draft contract of a reference to the rules instead of establishing the above amounts of fines and penalties is not the proper fulfillment of the customer’s obligation to establish the amount of the penalty...”. Thus, the customer must indicate in the contract a penalty in the form of a percentage of the contract price (of the contract execution stage). At the same time, we do not recommend indicating the specific amount of the fine in rubles, since the price of the contract may change during its execution (for example, in the cases specified in Part 1 of Article 95 of Law No. 44-FZ), and the corresponding rules for changing the amount of the fine in contract are not provided for by law.

Comments: 10

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Tatiana

02/07/2022 at 22:17 Do penalties apply to services? Is it legal to count funds not to pay for basic services, but to distribute them proportionally to all lines in the receipt, including penalties?

Reply ↓ Anna Popovich

02/11/2022 at 10:41Dear Tatyana, such actions are legal, since the fee for the service increases by the amount of penalties.

Reply ↓

09.09.2021 at 15:11

If the main debt for utilities (telephone) has been paid. but the penalties remain, tell me about the unpaid penalties, penalties will be charged

Reply ↓

- Anna Popovich

09.09.2021 at 20:30

Dear author, no, as a general rule, such an accrual is impossible.

Reply ↓

09/04/2021 at 00:26

Which executive body controls the correct calculation of penalties for late payments for major repairs?

Reply ↓

- Anna Popovich

04.09.2021 at 19:53

Dear Vasilisa, its accrual for non-payment or late payment is enshrined in clause 14.1 of Article 155 of the Housing Code of the Russian Federation.

Reply ↓

04/19/2021 at 21:12

How long does it take to pay penalties on taxes? Are such deadlines legally established?

Reply ↓

- Anna Popovich

04/20/2021 at 02:29

Dear Sergey. As a general rule, penalties on demand must be paid within eight working days after receipt, unless the tax office has set a different deadline. Legally, this is regulated by the Tax Code of the Russian Federation.

Reply ↓

03/10/2021 at 14:54

“starting from the 31st day, penalties are assigned in the amount of 1/300 of the refinancing rate; starting from the 91st day, the amount of the penalty increases to 1/300 of the refinancing rate of the Central Bank of the Russian Federation.” - so what's the difference?

Reply ↓

- Anna Popovich

03/10/2021 at 15:56

Dear Vladimir, the penalty is calculated in the amount of 1/300 of the Central Bank refinancing rate in effect on the day of actual payment of the amount not paid on time for each day of late payment, starting from the 31st day from the day of late payment, established by the payment deadline, and until the actual payment within 90 days from the date of payment established by the agreement. If payment is not made within the above period from the 91st day, the calculation is made in the amount of 1/130 of the Central Bank refinancing rate.

Reply ↓

2.2. Fine for the supplier

A fine for the supplier is assessed for non-fulfillment or improper fulfillment of obligations under the contract, with the exception of the supplier’s delay in fulfilling obligations (including warranty obligations). Penalties must be applied for each case where the supplier violates its obligations. The total amount of fines, unlike penalties, is limited by the contract price.

Let's consider cases of applying a fine to a supplier:

1. The “standard” fine for non-fulfillment or improper fulfillment by the supplier of obligations stipulated by the contract, with the exception of delay in fulfilling obligations (including warranty obligations) is established in the manner prescribed by clause 3 of Rules No. 1042. The amount of the fine depends on the amount of the contract price (stage) and is indicated in column 1 of the Penalty Memo.

2. Fine “for small businesses and SONOs” (if the customer, in accordance with clause 1, part 1, article 30 of Law No. 44-FZ, carried out a purchase in which only small businesses and socially oriented non-profit organizations could be participants). In this case, for non-fulfillment or improper fulfillment by the supplier of obligations stipulated by the contract, with the exception of delay in fulfilling obligations (including warranty obligations), the fine is set at 1 percent of the contract (stage) price, but not more than 5 thousand rubles and not less than 1 thousand . rubles (clause 4 of Rules No. 1042) (column 2 of the Memo on penalties).

3. A fine for the winner of the purchase who offered the highest price for the right to conclude a contract. Applies if, in accordance with Part 23 of Article 68 of Law No. 44-FZ, during an electronic auction, the contract price is reduced to half a percent of the NMCC or lower and the auction is held for the right to conclude a contract. This fine must always be indicated in the draft contract included in the electronic auction documentation, since at the time of placing the purchase the customer cannot predict how much the NMCC will decrease at the auction. Such a fine is established in accordance with clause 5 of Rules No. 1042, its amount is indicated in column 3 of the Penalty Memo.

4. Fine for violations that do not have a monetary value. Applies for each fact of non-fulfillment or improper fulfillment by the supplier of an obligation stipulated by the contract, in cases where the obligation violated by the supplier is not directly related to the contract price (for example, failure to provide accompanying documents with the goods), is established in accordance with clause 6 of Rules No. 1042 . The amount of this fine is indicated in column 4 of the Penalty Memo.

5. Fine for improper fulfillment by the contractor of obligations to perform types and volumes of work on construction, reconstruction of capital construction projects, which the contractor is obliged to carry out independently without the involvement of other persons (subcontractors) (column 5 of the Penalty Instructions). The amount of this fine is set at 5 percent of the cost of the specified work (clause 7 of Rules No. 1042). The types of work on the construction and reconstruction of capital construction projects on the territory of the Russian Federation, which the contractor is obliged to carry out independently without involving other persons in the fulfillment of his obligations, are established by Decree of the Government of the Russian Federation of May 15, 2022 N 570. This resolution applies only to state and (or) municipal contracts, therefore, for example, budgetary institutions do not need to include this fine in the draft construction (reconstruction) contract.

6. Fine for failure by the contractor or performer to involve subcontractors, co-executors from small businesses, socially oriented non-profit organizations in the execution of the contract (column 6 of the Penalty Instructions). Applies if, in accordance with Part 6 of Art. 30 of Law No. 44-FZ, the contract provides for bringing the contractor to civil liability for failure to fulfill the specified condition and is set at 5 percent of the volume of involvement of subcontractors established by the contract (clause 8 of Rules No. 1042).

Beginning and end of the term (clarification by the Supreme Court of the Russian Federation)

The procedure for determining the beginning and end of the period during which a penalty is accrued is subject to the general rules for calculating periods with the specifics established by Law 44-FZ. The period of delay is counted from the day following the day of fulfillment of obligations under the contract. In this case, the day when the obligation is nevertheless fulfilled is included in the calculation of the delay.

If the customer terminates the contract unilaterally, penalties must be accrued until termination.

When calculating penalties for any obligation, not only within the framework of a government contract, questions arise when an obligation can be considered violated and penalties begin to accrue.

As part of the practice on public procurement, the Supreme Court of the Russian Federation, in the Ruling in case A40-236034/2018, indicated that if the contractor met and delivered the work on time without taking into account the time for their acceptance, then it is not considered overdue. During the period of delay in fulfillment of obligations, the days that the customer needs to accept work or services and formalize the results of acceptance are not included.