Small businesses are allowed a simple accounting system (without using double entry), as well as a “cash” method of recognizing income and expenses (by payment). These methods are officially declared simplified. Is this really true? After all, there is no consistent implementation of these norms at the methodological level for practical application. The reason is the lack of a theoretical approach. In fact, there is nothing more practical than a good theory. This is an axiom to such an extent that it is impossible to reliably establish the author of this saying.

Therefore, let's start with abstract reasoning. It's not as boring and not as scary as it seems. Our material will “open the door to the kitchen” of an accountant’s professional judgments.

What are the facts of economic life

In normative sources, basic concepts are not developed in sufficient detail. Let's fill this gap by identifying the logical connections between the wording of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ).

Accounting is carried out by registering data on accounting objects in registers, and accounts are a special way of systematically grouping accounting objects (clause 3, subclauses 4 and 5, clause 4, article 10 of Law No. 402-FZ). The source of data to be registered is primary accounting documents.

The primary document is drawn up for each fact of economic life (clause 8 of article 3, clause 1 of article 9 of Law No. 402-FZ).

The accounting objects of an economic entity are:

- facts of economic life;

- assets;

- obligations;

- sources of financing activities;

- income;

- expenses.

A comparison of the listed norms leads to the conclusion that the fact of economic life is a complex object, which includes other objects. And the requirement to use double entry allows us to assert: a fact constitutes changes (including the emergence) of a pair of objects listed in clauses 2–6 of Art. 5 of Law No. 402-FZ. We will call these objects “fundamental”. It is their changes that affect the financial statements (clause 1, article 13 of Law No. 402-FZ).

Formally, an alternative to double entry can be single or even triple entry, if such an approach is allowed by the by-laws. The criterion of “multiplicity” is the number of fundamental objects that a fact unites.

This is exactly what happens in practice. Examples:

DEBIT 62 KEDIT 90

– the fact “revenue from the sale of goods to the buyer is recognized” – combines the recognition of an asset (accounts receivable) and income;

DEBIT 90 CREDIT 41

– the fact “the cost of goods sold is written off” – characterizes the simultaneous reduction of an asset and the recognition of an expense.

Law No. 402-FZ obliges us to group fundamental objects into facts if we are focused on double entry. Accordingly, the fact of economic life should be considered as a composite object.

This point of view is confirmed by the Concept of Accounting in the Market Economy of Russia (approved by the Methodological Council on Accounting under the Ministry of Finance of Russia, the Presidential Council of the IPB of Russia on December 29, 1997). The Concept (clause 7.1) lists assets, liabilities and capital as elements of financial statements. Business transactions or facts of economic life are not highlighted as independent elements in the Concept (and are not characterized at all). Moreover, the Concept (clause 7.2) defines assets in connection with the facts of economic activity. The same elements are specified in the Conceptual Framework for Financial Reporting, on which IFRS is based.

Let us limit ourselves to considering activities for which capital is the source of financing.

Let us summarize our reasoning.

A fact of economic life is a generalized name for one or more fundamental accounting objects. For the purpose of double entry, fundamental objects are combined into facts in pairs. If the requirement for double (or any multiple) entry is not made, then the fact can generate any of the fundamental objects in the singular. Our classification approach is presented in Table 1.

How to fill out a business transaction log | Do it yourself

admin · 02/15/2017

Any business transaction is reflected in the corresponding document: an incoming or outgoing cash order. The process of filling out the journal comes down to transferring data from the document to the journal of business transactions. Consequently, the journal displays control of operations with further transfer to accounting registers.

You will need

- — documents that reflect the business transaction;

- — journal of registration of business transactions.

Instructions

1. If, when registering incoming and outgoing cash orders, you use a journal drawn up in form No. KO-3, start filling it out by filling out the heading. In it, indicate the date and number of the cash document confirming the business transaction.

2. Fill in the column for the amounts for which incoming and outgoing cash orders were issued.

3. In the column labeled “Note,” describe the business transaction. It includes the amounts of income acquired, unspent accountable funds, physical assistance paid by the company, wage payments, issuance of money on account for business needs, and so on.

4. In the column under the name of the transaction, indicate the debit and loan of the business transaction.

5. If we are talking about filling out a journal for registering business transactions in a large enterprise, it is filled out according to form No. KO-Za.

This is due to the fact that, based on the entries in the journal, it is possible to control the purpose of funds received and spent and check the accuracy of the entries made by the cashier.

If you are filling out a journal for accounting for receipts of fixed assets, new columns are introduced: a synthetic accounting register and an analytical accounting register. These columns indicate the register numbers where these transactions are recorded.

Tip 2: How to fill out the cashier's journal

Every cashier must be able to fill out the cashier-operator log. This document is drawn up on a daily basis with a ballpoint pen or ink. The main requirement when filling out the journal is the absence of erasures.

In case of an error, there is a standard rule: a correction is made, the mistake is carefully crossed out and certified by the signatures of the boss, the main accountant and the cashier himself.

Filling out the journal columns is carried out according to a specific plan.

Tip 3: How to fill out a business journal

In the journal of business transactions, the activities of the organization are monitored and accounting registers are formed. The business transactions journal reflects all business transactions of the enterprise; it is central to the preparation of final reporting.

Tip 4: How to create a journal of business transactions

A journal of operations is needed to keep records of the business activities of an enterprise and create accounting registers. You can create a journal of business transactions by using standard transactions, entering transactions manually, filling out forms of primary documents, and also by copying transactions.

You can set up accounting accounts yourself

The instructions for using the Chart of Accounts (approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n) strictly warns: additional synthetic accounts can be entered only for specific transactions and exclusively in agreement with the ministry. But this instruction has no normative force, since the Instruction is not registered with the Russian Ministry of Justice.

A remarkable step towards liberalization of accounting has been made by the Institute of Professional Accountants and Auditors of Russia (IPBR). In the document he developed, “Recommendations for small businesses on the use of simplified methods of accounting and preparation of accounting (financial) statements” (Section 3.5), the names of articles of simplified reporting forms are used as accounts (Appendix No. 5 to the order of the Ministry of Finance of Russia dated 2 July 2010 No. 66n “On the forms of financial statements of organizations”). IPBR grouped these accounts in the Book (journal) of accounting facts of economic life (K-2MP). The Book itself is the only accounting register.

We described the correspondence between simplified accounting accounts and traditional accounts in Table 2.

According to the plan of the IPBR, the Book is intended for keeping records using a simple system, however, the proposed examples of filling it out indicate the use of double and even triple entry (the same amount is reflected in several account columns).

The author proposes to abandon the double entry stereotype.

A simple entry is familiar to accountants: it is used for accounting on off-balance sheet accounts and in tax accounting.

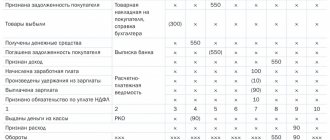

For accounting by simple recording, the author slightly modified the form developed by the IPB (Table 3).

We emphasize: IFRS does not contain requirements for the use of double entry. This is just a formal accounting technique. International standards discuss how this or that event directly in the reporting items (for example, paragraphs 39–41 of IFRS (IAS) 16 “Fixed Assets”, introduced by order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n). And specialists from the Russian Ministry of Finance announced that they intend to develop a new chart of accounts, the names of which will correspond to the reporting indicators. In fact, the IBR did just that. In Table 3, simplified accounts are also numbered (column numbers are from 1p to 18p, the letter “p” denotes a simple entry).

Details of primary documents

From the above list it is clear that the main form on the basis of which an accountant can safely capitalize, document and pay for paint is the TORG-12 invoice. When completed, the part that directly concerns the receipt of goods will look like this:

This invoice, like the rest of the “primary” document, has mandatory details, the presence and correct filling of which must be checked by an accountant before accepting the document for work. Such details include, in particular:

- the name of the form and its code according to the All-Russian Classifier of Management Activities (OKUD) in the upper right corner. This code is only required for unified forms. If the form is developed independently, this detail may not be in it;

- document number and date of its preparation. These details are important for documentation, as they allow you to accurately determine the time of the transaction. Usually the date is written in Arabic numerals: first the day and month, represented by two pairs of digits separated by a dot, then the year by four digits;

- the name of the supplier (buyer) company on behalf of which the form was compiled. As well as her address and details;

- the content of the business transaction, which must correspond to the type and name of the form. For example, the TORG-12 invoice is intended for the transfer of inventory items to third-party organizations, and with its help it is impossible to formalize any other business transaction;

- event measures that can be indicated in physical and monetary terms. The monetary meter is used more often, since it is generalizing, and it usually displays all the indicators of the company’s economic activities in accounting;

- positions and surnames, first names, patronymics of persons responsible for the transaction or event and the correctness of its execution, as well as their personal signatures.

Additional details may also be used as needed. But all the details from the list are mandatory and must be in any primary document, otherwise the principles of documentation will not be followed.

Simple recording in action

In the examples given in the IDB Recommendations, the same amount per line is reflected in two or even three account columns. The reason for this lies in the content of the facts of economic activity that the authors of the Recommendations used. Therefore, we do not see a real abandonment of double entry.

Table 4 illustrates how to formulate the content of a fact in order to obtain a simple record. In it, the columns from the Register (Table 3) are designated by numbers. For now we stick to the filling method.

As can be seen, Table 4 maintains separate accounting of assets, liabilities, income, expenses and capital. True, it is equally possible to keep records in it by double entry. The only simplification is that the use of a simple system does not require special knowledge about the correspondence of accounts. Economic logic prevails, which is inherent in small business managers who do not have an accounting education.

Cash accounting

The more compelling reason why we have placed so much emphasis on the simple system is that it opens the door to the cash method. Traditional accounting through double entry on correspondent accounts is not suitable for implementing such an accounting policy.

The use of the cash method is also interesting because tax accounting is carried out using this method “in a simplified manner” (with the object of taxation “income minus expenses”). In order to optimize accounting, we will supplement the simple entry register with columns from the book of income and expenses. The result will be a “two in one” form (Table 5) - like a universal transfer document, which many accountants liked.

Now about the main subtlety of the cash method, which eludes the understanding of many specialists. It deals with the recognition of paid income and expenses solely in the income statement. The fact of paying the costs involved in the formation of the asset will not affect its properties listed in the Concept (clause 7.2, 7.2.1). Consequently, the approach to preparing the balance sheet will not change.

Table 6 describes the same operations as in Table 5 with the difference that income and expenses are recorded by payment.

In Table 6, when determining the financial result of an activity, profit for the reporting period is calculated as the difference between income and expenses (clause 7.7 of the Concept). However, in the cash method there is no longer a link between net profit and capital. Therefore, in Table 6, capital is defined as the difference between the amount of assets and liabilities as of the reporting date (clause 7.4 of the Concept).

You probably noticed that the net profit figures displayed in tables 5 and 6 differ significantly (150 and 460 thousand rubles, respectively). However, it is the net profit that is subject to distribution among the company’s owners, regardless of the method by which it was obtained. Its amount is taken from the line “Net profit (loss)” of the financial results statement, provided for by the regulatory legal act. Once you have chosen the cash method, you should not identify net profit through additional calculations. However, when allocating dividends, it is necessary to comply with the restrictions established for net assets (Article 29 of the Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies”). So in the described situation it is impossible to pay more than 150 thousand rubles.

The author is not advocating the adoption of a simple system or cash method. These accounting policy options do not correspond to established stereotypes, and also do not exempt from the need to apply PBU. However, it is possible that the described methods will indeed seem simplified to some.

Guide for the simplified tax system

Since 2013, companies using the simplified tax system have been forced to conduct accounting. The book will help the accountant understand how to draw up a balance sheet and coordinate all reporting forms. Find out more >>