By level of legislative power

The fundamental classification of taxes in the Russian Federation is the fragmentation of fiscal payments by levels of government, which are empowered to establish exclusive norms and rules of taxation for a specific fee.

In simple terms, the terms of calculation and payment for each tax payment can be regulated. The person who approves these rules determines the main types of taxes in Russia.

According to the level of legislative power, tax classification is briefly divided into three levels. Let us define these concepts and types of taxes and fees in the Russian Federation:

- Federal. They are established exclusively by the Government of the Russian Federation and enshrined in the Tax Code of the Russian Federation. Cannot be adjusted by regional or municipal authorities. For example: VAT, personal income tax, on corporate profits.

- Regional. They are regulated in the Tax Code of the Russian Federation, but the rights to regulate norms, rates, periods and other tax rules are transferred to the authorities of the constituent entities of the Russian Federation. For example: transport, gambling, property of organizations.

- Municipal or local. General rules of taxation are established in the Tax Code of the Russian Federation, but are detailed by local authorities, for example, administrations of municipalities or rural settlements. For example: land, for the property of citizens.

This tax system (classification of taxes and fees) is not the only one. Consider the following groupings.

Meetings

Income tax

In accordance with Article 284 of the Tax Code of the Russian Federation, the tax rate for income tax is set at 20%, while:

— the amount of tax calculated at a tax rate of 2 percent is subject to credit to the federal budget;

— the amount of tax calculated at the tax rate of 18 percent is credited to the budgets of the constituent entities of the Russian Federation.

In the Khanty-Mansiysk Autonomous Okrug - Ugra, the amount of corporate income tax, calculated at a rate of 18%, is distributed as follows:

— 70.5% goes to the budget of the Autonomous Okrug;

- 29.5% goes to the budget of the Tyumen region (Article 2 of the Law “On the budget of the Khanty-Mansiysk Autonomous Okrug - Ugra for 2011 and for the planning period 2012-2013”).

The share of this tax in the total tax revenue of the budget of the Autonomous Okrug is about 55.7%.

Organizational property tax

In accordance with the Tax Code of the Russian Federation (Article 372) and the Law “On the budget of the Khanty-Mansiysk Autonomous Okrug - Ugra for 2011 and for the planning period 2012-2013”, the property tax rate for organizations in the Autonomous Okrug is set at 2.2% and is subject to credit to the budget of the Autonomous Okrug in the amount of 100%.

The share of property tax in total tax revenue is about 23%.

Personal income tax (NDFL)

In accordance with the norms of the Budget Code of the Russian Federation, the distribution of personal income tax between the budgets of the budget system of the Russian Federation is carried out as follows:

1. Budget of a constituent entity of the Russian Federation – 70% (Article 56 of the Budget Code of the Russian Federation);

2. The budget of urban districts – 30% (Article 61.2 of the Budget Code of the Russian Federation), of which:

2.1. Municipal district budget – 20% (Article 61.1 of the Budget Code of the Russian Federation);

2.2 Budget of settlements – 10% (Article 61 of the Budget Code of the Russian Federation).

In pursuance of the provisions provided for in Article 58 of the Budget Code of the Russian Federation, the Law of the Autonomous Okrug “On interbudgetary relations in the Khanty-Mansiysk Autonomous Okrug - Ugra” established an additional standard of 15% for crediting to the budgets of city districts and municipal districts of the Autonomous Okrug.

As a result, in the territory of the Khanty-Mansiysk Autonomous Okrug - Ugra, personal income tax is distributed as follows:

1. Budget of the Autonomous Okrug – 55%;

2. Budget of urban districts – 45%, of which:

2.1. Municipal district budget – 35%;

2.2. Settlements budget – 10%.

The share of personal income tax in the revenue side of the budget of the Autonomous Okrug is about 18.5%.

Head of Department

O.N. Solodskaya

Classification by object of taxation

In this system, all obligations are divided into two large groups: direct and indirect. Let us define the concepts of these types of taxes and fees in the Russian Federation.

Direct are those fiscal fees that are calculated directly to the income or value of the taxpayer’s property. Moreover, settlements with budgets are carried out exclusively at the expense of the payer himself, that is, at the expense of his own income, funds, and money. For example: personal income tax, property, land, transport.

Indirect are those fees that are levied on the consumer of a product, work or service and represent a special markup on the cost. In this case, companies that pay indirect fiscal payments act as tax agents between consumers and the state, since they are the ones who calculate and pay funds to the budget. For example: VAT or excise taxes.

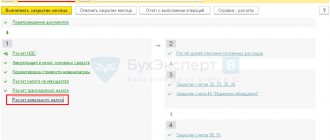

Payment procedure and terms

The property tax of organizations is calculated based on the results of the tax period as the product of the corresponding tax rate and the tax base determined for the tax period.

Based on the results of each reporting period, advance payments for the property tax of organizations are calculated and paid to the budget. The amount of the advance tax payment is calculated at the end of each reporting period in the amount of one-fourth of the product of the corresponding tax rate and the average value of property determined for the reporting period.

Advance payments based on the results of the reporting period are paid no later than 30 days from the end of the corresponding reporting period (April 30, July 30, October 30), but regions can set their own deadlines.

The tax amount calculated for the year must be paid no later than March 30 of the year following the expired tax period.

The amount of tax payable to the budget at the end of the tax period is determined as the difference between the amount of tax calculated for the year and the amounts of advance tax payments calculated during the tax period. The property tax of organizations is credited to the budget of the region in whose territory the taxpayer’s property is located. Therefore, according to Article 382 of the Tax Code of the Russian Federation, the amount of tax payable to the budget is calculated separately in relation to property subject to taxation at the location of the organization (the place of registration with the tax authorities of the permanent representative office of a foreign organization), in relation to the property of each separate division of the organization that has a separate balance sheet in relation to each piece of real estate located outside the location of the organization, a separate division of the organization that has a separate balance sheet, or a permanent representative office of a foreign organization, as well as in relation to property taxed at different tax rates.

An enterprise, which includes separate divisions that have a separate balance sheet, pays tax (advance tax payments) to the budget at the location of each of the separate divisions in relation to property recognized as an object of taxation, located on a separate balance sheet of each of them, in an amount determined as the product of the tax rate in force in the territory of the corresponding constituent entity of the Russian Federation in which these separate divisions are located and the tax base (average value of property) determined for the tax (reporting) period.

An organization that takes into account on its balance sheet real estate objects located outside the location of the organization or its separate division that has a separate balance sheet, pays tax (advance tax payments) to the budget at the location of each of these real estate objects in an amount determined as the product of the tax rate in force on the territory of the relevant constituent entity of the Russian Federation on which these real estate objects are located, and the tax base (average value of property) determined for the tax (reporting) period in accordance with Article 376 of the Tax Code of the Russian Federation in relation to each real estate object.

By taxpayer status

Types of taxes and methods of their classification by category of payers are as follows:

- For individuals. These are the payments for which ordinary citizens are taxpayers. And not only citizens of our country, but also representatives of foreign states who receive income or own property in Russia. Note that this group should also include obligations provided for individual entrepreneurs. For example: personal income tax on the property of individuals.

- For legal entities. Fiscal encumbrances that are paid exclusively by companies, organizations or firms that have the status of a “legal entity”. For example: fees, taxes of an enterprise (types of taxes in the Russian Federation, table below) on profit and property.

- Mixed payments are those amounts that are required to be paid by all categories of taxpayers, regardless of their status. For example: VAT, excise taxes. This category of fiscal obligations also includes payments to the budget under simplified taxation systems. For example: payment of unified agricultural tax, UTII, simplified tax system or PNS. Such obligations are provided for both legal entities and individual entrepreneurs.

Nuances

Property tax is not paid for:

- land plots, water bodies and other natural resources;

- objects of cultural heritage (historical and cultural monuments) of federal significance;

- nuclear installations used for scientific purposes, storage facilities for nuclear materials and radioactive substances and radioactive waste storage facilities;

- icebreakers, ships with nuclear power plants and nuclear technology service ships;

- space objects;

- and etc.

Payment upon reorganization

When reorganizing, transport tax must be paid by:

- organization that arose during the merger (clause 4 of article 50 of the Tax Code of the Russian Federation);

- organization that arose during the transformation (clause 9 of article 50 of the Tax Code of the Russian Federation);

- an organization that has annexed another organization (clause 5 of article 50 of the Tax Code of the Russian Federation);

- organizations that were formed during division (clause 6 of article 50 of the Tax Code of the Russian Federation).

In the latter case, the amount of transport tax must be transferred by the organization that is responsible for paying this tax by the separation balance sheet. If the separation balance sheet does not allow it to be determined, then, by a court decision, the organizations that arose during the reorganization in the form of separation pay the tax jointly. This procedure follows from paragraph 7 of Article 50 of the Tax Code of the Russian Federation.

The tax period for transport tax for a reorganized organization is the period from the beginning of the year until the day the reorganization is completed (clause 3 of Article 55 of the Tax Code of the Russian Federation). Therefore, the amount calculated according to the final declaration is recognized not as an advance payment, but as a tax. Since during reorganization the deadlines for paying taxes do not change (clause 3 of Article 50 of the Tax Code of the Russian Federation), the assignee must transfer the transport tax within the period established by the regional law (clause 1 of Article 363 of the Tax Code of the Russian Federation).

Reporting forms

According to Article 386 of the Tax Code of the Russian Federation, taxpayers are required, at the end of each reporting and tax period, to submit to the tax authorities at their location, at the location of each of their separate divisions that have a separate balance sheet, as well as at the location of each piece of real estate (for which a separate calculation procedure is established). and tax payments) tax calculations for advance tax payments and tax returns.

The deadline for submitting tax calculations for advance payments of corporate property tax is established by federal legislation - no later than 30 days from the end of the corresponding reporting period, on the basis of Article 386 of the Tax Code of the Russian Federation. The deadline for filing tax returns based on the results of the tax period is established by federal legislation, in particular Article 386 of the Tax Code of the Russian Federation - no later than March 30 of the year following the expired tax period.