Almost all employers purchase drinking water for their employees in the office. As a rule, water is supplied in supplier containers, which causes additional difficulties for accountants.

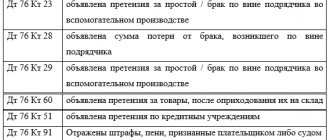

Questions arise:

- How is returnable packaging taken into account in 1C 8.3 Accounting for the buyer?

- How to take into account the cost of drinking water for employees in 1C?

Let's look at these questions using an example.

See all materials on FSBU 5/2019 RESERVES here >>

Accounting for returnable packaging in 1C 8.3 Accounting

On March 12, the Organization paid the supplier:

- drinking water in the amount of 10 pcs. for the amount of 120 rubles. (including VAT 20%);

- reusable deposit container - 19 liter water bottle in the amount of 1 pc. for the amount of 250 rubles. (without VAT).

On the same day, the supplier delivered 1 bottle of water.

According to the terms of the agreement, the bottle is a returnable collateral container.

The accounting policy stipulates that in 1C, records of collateral and other people's property are kept on off-balance sheet accounts.

Step-by-step instructions for accounting for returnable packaging in 1C 8.3 Accounting.

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Transfer of advance payment to the supplier | |||||||

| March 12 | 60.02 | 51 | 1 200 | 1 200 | Transfer of advance payment to the supplier | Debiting from the current account - Payment to the supplier | |

| 76.05 | 51 | 250 | 250 | Transfer of deposit to supplier | |||

| Accounting for the amount of collateral on the balance sheet | |||||||

| March 12 | 009.01 | — | 250 | Accounting for the amount of collateral in an off-balance sheet account | Manual entry - Operation | ||

| Purchasing water | |||||||

| March 12 | 60.01 | 60.02 | 120 | 120 | 120 | Advance offset | Receipt (act, invoice, UPD) - Goods |

| 10.01 | 60.01 | 100 | 100 | 100 | Acceptance of materials for accounting | ||

| 19.03 | 60.01 | 20 | 20 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| March 12 | — | — | 120 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 20 | Acceptance of VAT for deduction | ||||

| — | — | 20 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Receipt of returnable reusable packaging | |||||||

| March 12 | 002 | — | 250 | Accounting for containers on an off-balance sheet account | Manual entry - Operation | ||

| Write-off of water for general household needs | |||||||

| March 12 | 26 | 10.01 | 100 | 100 | 100 | Write-off of materials | Requirement - invoice |

Justify and document

The employer determines a specific list of measures to improve working conditions and reduce occupational risks. In this case, they proceed from the specifics of the company’s activities. It may also provide drinking water.

In any case, this list must be justified.

How can this be ensured?

We have already partially answered this question. The acquisition must be aimed at ensuring normal working conditions for employees and reflected in the list of specific activities.

But the costs still need to be documented. This means that when purchasing water and equipment, you must have correctly executed documents:

- agreement with the supplier;

- consignment note in the form TORG-12;

- invoice.

Read in the berator “Practical Encyclopedia of an Accountant”

Documentary confirmation and justification of expenses

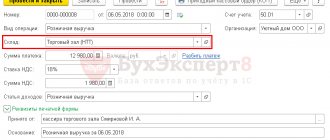

Transfer of advance payment and deposit for containers

Complete the transfer of funds to the water supplier by debiting from the current account transaction type Payment to the supplier (Bank and cash desk - Bank statements).

Break the payment into 2 lines:

- reflect the advance payment for water in the usual manner;

- on the line with the amount of the deposit for returnable packaging, indicate: Expense item - item with the type Other payments for current operations ;

- Debt repayment - Do not repay ;

- Settlement account - 76.05 “Settlements with other suppliers and contractors.”

Postings

After returning the container to the supplier and receiving the deposit amount from him, issue a Receipt to the bank account:

- Type of operation - Other receipt ;

- Settlement account — 76.05;

- Income item with the type Other receipts from current operations .

Accounting for tea and coffee in the organization

Products that a company purchases for its employees and customers must be included in the inventory. In this case, the following transactions are carried out:

- Dt 10 Kt 60 (76) – the received product was recorded as inventory.

- Dt 91-2 Kt 10 – written off.

Products are accepted for accounting at actual cost. To find out, you need to refer to the contract with the supplier. The figure indicated there will appear in other company documents. As in the case of water, VAT is not taken into account.

Features of accounting for tea and coffee depend on the presence of the corresponding clause in the collective agreement.

So, if the document contains a provision according to which the organization is obliged to provide its employees with drinks and sweets, expenses for the purchase of products are classified as expenses for ordinary activities. If the products are transferred to the person who is responsible for replenishing them, the actual cost of tea and coffee is written off from account 10 to the debit of account 26. The basis for the manipulation is the corresponding primary document.

While it is possible to include water in expenses for tax purposes, it will not be possible to perform a similar manipulation in relation to tea and coffee. Tax authorities will certainly have questions regarding the legality of the action. The absence of a clause on the provision of drinks and sweets in the collective agreement leads to changes in the accounting procedure for tea and coffee. In this situation, the accountant must include the products among other expenses.

Purchasing water

Costs for ensuring normal working conditions (including the purchase of drinking water) can be taken into account when calculating income tax (clause 7, clause 1, article 264 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of the Russian Federation 03/23/2020 N 03-03-07/22134) .

VAT on such expenses is accepted for deduction in the usual manner (clause 1 of Article 172 of the Tax Code of the Russian Federation).

Reflect the receipt of water with the document Receipt (act, invoice, UPD) document type Goods (invoice, UPD) (Purchases - Receipt (acts, invoice, UPD)).

Filling out a document in 1C is no different from the usual receipt of materials.

Postings

According to FSBU 5/2019, drinking water does not belong to reserves, therefore, to reduce the number of operations in the program, you can take it into account at the time of receipt in expenses, bypassing account 10:

- create a directory element Nomenclature for water with the Type of nomenclature Services ;

- create a document Receipt (act, invoice, UPD) document type Services (act, invoice, UPD).

Then you will not need to fill out a demand invoice.

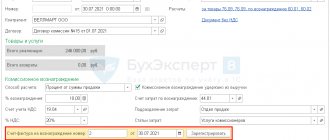

To register an incoming invoice in 1C, indicate its number and date at the bottom of the document form Receipts (acts, invoices, UPD) - Goods (invoice, UPD) and click the Register .

The document is filled in automatically.

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings

Drinking bottled water in the meeting room

How can an organization record the costs of drinking bottled water for the meeting room, as well as bottles for which the deposit price is transferred?

Situation

This month, drinking bottled water for a floor cooler was purchased on a 100% prepayment basis. According to the invoice, the organization was given water in bottles (capacity 19 liters) worth 17.40 rubles. (including VAT - 2.90 rubles), as well as bottles at a deposit cost of 30 rubles. (without VAT).

According to the terms of the agreement with the water seller: bottles are reusable returnable containers; a security deposit is charged for it, which is transferred along with payment for water in excess of its cost and is returned to the buyer at the end of the contract <*>.

———————————

<*> Returns of bottles to the seller, as well as their exchange for ones filled with water, are not considered.

The meeting room, which has a floor cooler, is used by all employees for business and management meetings. It is not possible to personalize water consumption by each employee. Based on acts of write-off of materials approved by the head of the organization, this month the purchased water was completely used in carrying out these activities.

In accordance with the accounting policy of the organization:

— materials are accounted for without using accounts 15 “Procurement and acquisition of materials” and 16 “Deviation in the cost of materials”;

— the cost of water is written off as it is transferred to the place of consumption.

Accounting for water and bottles

The prepayment transferred to the seller for water, as well as the collateral value of bottles (reusable containers) are reflected in the debit of account 60 “Settlements with suppliers and contractors” and the credit of account 51 “Settlement accounts”. In addition, the balance on account 009 “Security for obligations issued” takes into account the collateral value of the bottles transferred to the seller to ensure their return (part 3, clause 3, part 4, clause 47, clause 87 of Instruction No. 50).

Drinking bottled water and bottles received from the seller are classified as inventories and are taken into account in account 10 “Materials”. The basis for their posting in this situation is the seller’s invoice (TTN,). Since the organization does not use accounts 15 and 16 to account for materials, water is charged to account 10 at actual cost. For its analytical accounting, you can open a separate sub-account for account 10. Bottles are accounted for in subaccount 10-4 “Containers and packaging materials” at a deposit value as reusable returnable containers (paragraph 2, part 1, clause 3, clause 6, 26, 41, , part 1, clause 98 of Instruction No. 133, part 6, 17 clause 16 of Instructions No. 50).

The amount of “input” VAT presented by the seller in the cost of water is reflected in the debit of account 18 “Value added tax on purchased goods, works, services.” In this case, the amount of this tax to be deducted is shown on the credit of this account in correspondence with the debit of subaccount 68-2 “Calculations for taxes and fees calculated from proceeds from the sale of products, goods, works, services” (paragraph 4, clause 2, clause 4 Instructions No. 41).

When transferring drinking bottled water to refill a cooler, it is usually written off from account 10, which is carried out on the basis of the PUD. The organization determines the procedure for documenting and applied DMPs independently and enshrines them in its accounting policies. At the same time, the bottles themselves are not written off from subaccount 10-4, because in this situation, they are subject to return at the end of the contract (clauses 57, 60, 66 of Instruction No. 133, clauses 1 - 4 of Article 10 of Law No. 57-Z).

Let us remember that in this case the cooler is installed in the meeting room. This room is used by all employees for business and management meetings. Therefore, we can say that water costs are associated with activities, the implementation of which is dictated by production needs for the organization and within the framework of creating favorable conditions for workers in the course of their work, and not by social policy. Moreover, the target direction of water use for these activities should be clearly visible from the documents. For example, it would be advisable to provide workers with drinking bottled water during meetings in the meeting room in the order, and the cost of water in the cost estimate. In this case, we believe that economically justified and documented costs for water can be classified as management costs. Such expenses are reflected in account 25 “General production costs”, 26 “General operating expenses” or 44 “Sales expenses” (depending on the direction of the organization’s activities). When determining the financial result, they are completely written off to the debit of account 90 “Income and expenses from current activities”, subaccount 90-5 “Management expenses” (clause 10, 11, part 2, clause 35 of Instruction No. 102, part 3 of the letter of the Ministry of Finance No. 15-1-17/311).

VAT

In this situation, drinking bottled water is consumed during “business” meetings and meetings on management issues. However, it is not transferred or alienated to specific employees. Consequently, there is no object for VAT taxation (parts 1 and 3, clause 1, article 31, subclause 1.1, clause 1, article 115 of the Tax Code).

The organization accepts amounts of “input” VAT on water for deduction in the general manner (after reflecting them in accounting and the purchase book (if one is maintained), as well as after signing the ESCHF issued to it) (subclause 1.1, clause 1, paragraph 2, part. 1 clause 3, part 1 clause 4, sub-clause 5.1 clause 5, clause 6 article 132 of the Tax Code).

Income tax

The cost of drinking bottled water consumed by employees is not recognized as an object of taxation by income tax (subclause 2.4, clause 2, article 196 of the Tax Code).

Insurance premiums to the Social Security Fund and Belgosstrakh

According to the explanations of specialists from the Ministry of Labor and Social Protection, expenses (drinking bottled water, etc.) for meetings, meetings and other events related to the production process are not subject to the calculation of insurance premiums. That is, these insurance premiums are not calculated in this case.

Regarding insurance premiums in Belgosstrakh, we note the following. If it is not possible to personalize the consumption of products by a specific employee, there is no object for these contributions, and they are not calculated. This explanation was given by Belgosstrakh specialists regarding tea, coffee, and cookies for office workers. We believe that it can also be applied to drinking bottled water for employees in this case and its cost will not be subject to insurance premiums in Belgosstrakh.

Income tax

According to the explanations of the Ministry of Taxes and Taxes, when implementing measures to create favorable conditions for workers during their work activities, the organization’s expenses for the purchase of drinking bottled water to provide employees for income tax purposes are included in costs. In addition, the Tax Ministry specialist explained that the main criterion for including such expenses in the included costs is their objective necessity and justification in the process of production and sale of goods (works, services).

Based on the above, we believe that the cost of drinking bottled water for holding “business” meetings and meetings on management issues in this situation can be taken into account in the costs. To do this, such expenses must be economically justified and documented.

Accounting Entry Table

To account 10 “Materials,” a subaccount 10-13 “Drinking bottled water” has been opened.

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| The deposit value of the bottles was transferred to the seller | 60 | 51 | 30 | Payment order, bank account statement |

| The deposit value of the bottles (containers) transferred to the seller is reflected. | 009 | 30 | Accounting certificate-calculation | |

| Prepayment for drinking bottled water is listed | 60 | 51 | 17,40 | Payment order, bank account statement |

| Drinking bottled water accepted for registration (17,40 — 2,90) | 10-13 | 60 | 14,50 | Consignment note, consignment note |

| The amount of VAT presented by the water seller is reflected | 18 | 60 | 2,90 | Consignment note, consignment note |

| Input VAT accepted for deduction | 68-2 | 18 | 2,90 | ESChF, purchase book (if one is maintained), accounting certificate-calculation |

| Reusable returnable containers (bottles) are reflected at the deposit value | 10-4 | 60 | 30 | Consignment note, consignment note |

| Expenses for drinking bottled water were written off as administrative expenses | 25, 26, 44 | 10-13 | 14,50 | Material write-off act |

| Administrative expenses written off (excluding other expenses) <**> | 90-5 | 25, 26, 44 | 14,50 | Accounting certificate-calculation |

| ——————————— <**> When taxing profits, they are taken into account as expenses (Clause 1, Article 170 of the Tax Code). | ||||

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service

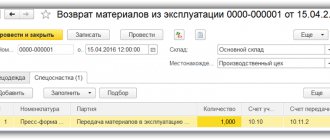

Receipt of returnable reusable packaging

Returnable packaging does not meet the definition of inventory (clauses 3, 5 of FSBU 5/2019). Ownership of it does not pass to the buyer, therefore it is recorded on the balance sheet in account 002 “Inventory assets accepted for safekeeping” at the cost indicated in the acceptance documents.

Reflect the deposit container in 1C behind the balance sheet with the document Transaction entered manually (Operations - Operations entered manually).

Fill in the information about the supplier, the quantity and cost of the deposit containers according to the invoice.

Reflect the return of the deposit container to the supplier using reverse posting in 1C.

How to document expenses

All operations related to the company’s business activities must be accompanied by primary documentation (Law No. 402-FZ). Such papers can be accepted for accounting only if they were compiled according to the form that is present in the albums of primary documentation forms. If an accountant needs to draw up a document for which a special form is not established, it is necessary to include the details specified in the law.

The papers required to record sweets and drinks purchased for employees and visitors are presented in the table.

| Type of transaction | Document's name | Form |

| Accounting after purchase | Packing list | No. TORG-12 |

| Receipt order | No. M-4 | |

| Moving products within the company | Request-invoice | No. M-11 |

| Write-off of drinking water | Act on write-off of materials for production | A form that the company specialist developed independently. It must be drawn up taking into account the requirements of Federal Law No. 402-FZ |

To confirm the validity of classifying water as an expense, experts advise drawing up internal organizational and administrative documents. An example could be an order from a manager. The company has the right to develop its own corporate standards in accordance with which workers are provided with drinking water and sweets. The action is carried out with the aim of creating favorable conditions for carrying out work activities.

Write-off of water for general household needs

On the same day, fill out the Requirement-invoice document (Warehouse - Requirements-invoices).

It is better to create it based on the receipt document, then the document header and the Materials will be filled in automatically.

Attribute the cost of water to other expenses in BU and NU.

Postings

We looked at how to keep track of packaging in 1C 8.3 Accounting.

To access the section, log in to the site.

Labor Code on working conditions

The Labor Code does not directly stipulate that a company is obliged to provide its employees with drinking water.

But at the same time, it establishes a requirement to take care of employees and provide them with normal working conditions. Providing workers with normal working conditions is stated in Article 163 of the Labor Code of the Russian Federation.

Working conditions are understood as a set of factors that influence the performance and health of an employee (Article 209 of the Labor Code of the Russian Federation).

This also includes ensuring normal working conditions, including sanitary, medical and preventive services for employees of organizations in accordance with labor protection requirements (Article 223 of the Labor Code of the Russian Federation).

In addition, the organization is obliged to provide for the everyday needs of employees related to the performance of their labor duties (Article 22 of the Labor Code of the Russian Federation).

Officials cite these requirements of the Labor Code as one of the conditions for classifying the cost of water as a profitable expense.

Drinking Water Labeling Law

The main regulatory and legal act that launches the entire system of identification of goods in the field of food products is Decree of the Government of the Russian Federation No. 841 dated May 31, 2022. This document provides comprehensive information regarding the entire further process. For example, here are the deadlines that entrepreneurs and manufacturers can rely on when introducing relevant technological standards. The paper also includes a number of information blocks regarding how exactly the types of markers being reviewed should be applied.