Insurance premiums in 2022 came under the authority of the Federal Tax Service. Now employers will calculate insurance premiums according to new rules and submit reports using new forms and within different deadlines than in 2016.

No time to read? Cheat sheet on the contents of the article:

- Changes in insurance premiums in 2022

- Which contributions will go to the Federal Tax Service in 2022, and which will remain with the Pension Fund and the Social Insurance Fund

- Penalties and fines on contributions: who to pay in 2017

- Payment of insurance premiums by separate divisions

- Travel insurance premiums in 2022

- Insurance premium rates in 2022: increase in the tax base

- Calculation of insurance premiums to the Federal Tax Service

- Changes in reporting for the Pension Fund and the Social Insurance Fund

Changes for 2022

On January 1, 2022, Chapter 34 of the Tax Code of the Russian Federation was introduced, regulating the rules for calculating and paying insurance premiums. The following are transferred to the department of the Federal Tax Service of the Russian Federation:

- insurance premiums for compulsory pension insurance, including insurance premiums for additional social security for flight crew members of civil aviation aircraft and certain categories of coal industry workers and insurance premiums paid at additional tariffs;

- insurance contributions for compulsory social insurance for temporary disability and in connection with maternity;

- insurance premiums for compulsory health insurance.

At the same time, Federal Law No. 212-FZ dated July 24, 2009 completely lost force on January 1, 2022.

The administration of insurance premiums for compulsory insurance against industrial accidents and occupational diseases remains assigned to the Social Insurance Fund. Contributions to the Social Insurance Fund for NS and PZ in 2022 will also be regulated by Federal Law No. 125-FZ of July 24, 1998.

Who pays premiums at additional interest rates?

The following are required to pay insurance premiums for compulsory health insurance using additional rates:

1. In accordance with Art. 428 Tax Code of the Russian Federation:

- employers with “harmful” jobs (for them the rate is set at 9%);

- employers with “heavy” jobs (for them the rate is set at 6%).

At the same time, the definition of workplaces with harmful or difficult conditions is determined based on the criteria established by law, that is, if a special assessment of working conditions in the company has not been carried out.

In turn, if a special assessment is carried out and, based on its results, in or “hazardous” workplaces with subclasses not lower than 3.1 (in terms of harmfulness), then in this case employers pay additional contributions at rates based on the corresponding subclasses. The minimum value of such rates is 2% (for subclass 3.1 hazardous working conditions), the maximum is 8% (for subclass 4 hazardous working conditions).

2. In accordance with the provisions of Art. 429 Tax Code of the Russian Federation:

- firms that are employers of airplane and helicopter crews (for them an additional contribution rate for OSS is set at 14%).

- firms that are employers in the coal industry (for them the OSS rate is set at 6.7%).

In both cases, insurance payments at the given rates are transferred to the Federal Tax Service as part of additional social insurance charges. Which specific employers are required to list them is determined by the provisions of the Law “On Additional Support for Flight Crews” dated November 27, 2001 No. 155-FZ and the Law “On Additional Support for Coal Industry Workers” dated May 10, 2010 No. 84-FZ.

Division of powers between funds and the Federal Tax Service

Let's consider the division of powers between the Federal Tax Service and the funds when transferring the administration of insurance premiums.

The bodies of the Pension Fund of the Russian Federation and the Social Insurance Fund remain responsible for accepting from payers of insurance premiums, calculations (updated calculations) for insurance premiums for reporting (settlement) periods that expired before January 1, 2022. That is, reporting to the funds, 4-FSS and RSV-1 for the reporting period the period of 2016 will be provided using the same forms and formats that were previously in effect when submitting reports to state extra-budgetary funds.

Control activities such as desk and on-site audits of insurance premiums for reporting periods starting from 2010 to 2016 inclusive will be carried out by state extra-budgetary funds.

Control over the correctness of calculation, completeness and timeliness of payment of insurance premiums in accordance with the provisions of the Tax Code of the Russian Federation, as well as the acceptance of insurance premium payments from payers of insurance premiums is transferred to the Federal Tax Service, starting with the submission of the Calculation of insurance premiums for the reporting period - the first quarter of 2022.

In 2022, payment of insurance premiums will also occur by the 15th of each month. If the payment deadline coincides with a holiday or weekend, it will be postponed to the first working day.

Note,

that from 2022 contributions will be transferred not to the funds, but to the Federal Tax Service. Accordingly, the BCC for the payment of insurance premiums, penalties and fines will be changed (the BCC with Chapter 392 for the Pension Fund and Compulsory Medical Insurance Fund and with Chapter 393 for the Social Insurance Fund will be replaced with Chapter 182). Therefore, if employers intend to pay the contributions calculated for December in 2022, this will need to be done on new BCCs.

The transfer of arrears on insurance premiums in 2022 must also be paid for budget classification codes open to the Federal Tax Service with chapter 182.

The BCC for insurance contributions to the Social Insurance Fund against industrial accidents and occupational diseases for employees (for contributions for injuries) has not changed since January 1, 2022 and remains the same, since contributions for injuries are paid to the Social Insurance Fund.

The FSS will continue to administer contributions for injuries

Starting next year, the payment of contributions for insurance against industrial accidents and occupational diseases will be controlled, as now, by the bodies of the Federal Social Insurance Fund of the Russian Federation.

The legislation on contributions “for injuries” contains reference provisions to Law No. 212-FZ. Since the latter ceases to be in force next year, Federal Law No. 125-FZ dated July 24, 1998 (hereinafter referred to as Law No. 125-FZ) is supplemented with provisions from Law No. 212-FZ, which regulate, in particular:

- settlement and reporting periods for contributions;

- the procedure for granting deferrals and installment plans for contributions;

- ensuring the fulfillment of the obligation to pay contributions (collection of arrears in contributions, offset and return of overpaid or collected contributions);

- conducting desk and on-site inspections;

- conditions for bringing to responsibility.

What will the above innovations lead to for policyholders? Let's talk about this in more detail.

Penalties and fines

Refunds of overpaid or collected amounts of contributions, penalties and fines incurred in previous periods before January 1, 2022 will be carried out according to an application written by the policyholder to extra-budgetary funds for the return of the overpayment (Part 1 of Article 21 of Law No. 250-FZ). If, after the policyholder submits an application, the Pension Fund or the Social Insurance Fund makes a positive decision on it, this data will be forwarded to the tax office, and the tax authority will have to make a direct refund to the policyholder.

Information on the amounts of arrears, penalties and fines on contributions generated for reporting periods before January 1, 2022 will be transmitted to the tax authorities by the Pension Fund of the Russian Federation and the Social Insurance Fund of the Russian Federation. If the debt cannot be collected for any reason, it will be written off from the payer of insurance premiums (Parts 2, 3, Article 4 of Law No. 243-FZ).

Arrears, penalties, and fines on contributions are subject to write-off (that is, they cannot be collected from the policyholder) (Part 3 of Article 19 of Law No. 250-FZ):

- which cannot be recovered on the grounds listed in Art. 23 of Law No. 212-FZ, and which arose before 01/01/2017;

- the period for collection of which by the fund authorities will expire as of 01/01/2017.

The bodies of the Federal Social Insurance Fund of the Russian Federation retain the functions of verifying expenses incurred by payers (who are not participants in the pilot project) for the purposes of social insurance in connection with temporary disability and reimbursement of the excess of expenses incurred over accruals.

The PFR bodies retain the functions of maintaining personalized records and monitoring the payment of insurance premiums for voluntary pension insurance.

What are the consequences of administering contributions according to the rules of the Tax Code of the Russian Federation?

The consequence of classifying insurance premiums as payments subject to the rules of the Tax Code of the Russian Federation was the creation for them of the same conditions as for taxes, in relation to:

- preparation of documents for payment;

- reporting;

- procedures for conducting desk and on-site inspections;

- requesting data confirming the information included in the reporting;

- taking measures to ensure receipt of payments. Thus, amendments to Art. 76 of the Tax Code of the Russian Federation, according to which failure to submit calculations of contributions will officially become the basis for blocking the policyholder’s accounts;

- refund of overpaid amounts;

- applying penalties for violations.

From 01/01/2017, payments for contributions (still made separately for each type of insurance) began to be processed in the same way as tax transfers, and BCCs were acquired that correspond to the codes of budget payments. Moreover, 2 types of KBK were put into circulation:

- transitional, applied to contributions accrued before 2022, but paid already in 2022;

- final, valid for contributions accrued after 01/01/2017.

Read more about these KBK in the article “Deciphering the KBK in 2022 - 18210102010011000110, etc.”

The deadlines for payment of contributions have not changed (clause 3 of Article 431, clause 2 of Article 432 of the Tax Code of the Russian Federation). But the possibilities for making payments have changed due to the extension to contributions of the rule allowing payment for a third party (Clause 1 of Article 45 of the Tax Code of the Russian Federation).

Payments of contributions received to the budget are subsequently transferred to the accounts of each fund. Therefore, the return of overpaid contributions will occur, albeit according to the rules of the Tax Code of the Russian Federation, but at the expense of the fund. In this regard, the Pension Fund of the Russian Federation has been given the right not to make a refund if the corresponding amounts, according to the submitted reports, have already been accounted for in the individual accounts of the insured persons (clause 6.1 of Article 78 of the Tax Code of the Russian Federation).

The transfer of contributions to the tax service did not relieve payers from control by extra-budgetary funds, although it led to a reduction in the scope of these checks:

- the Pension Fund remained in control of information about the length of service;

- The Social Insurance Fund continues to control social insurance costs in terms of payments for disability and maternity.

The funds will conduct checks on the correctness of the calculation and payment of contributions scheduled after 01/01/2017 for periods up to 2022, but the tax authorities will punish based on the results of these checks, applying for this purpose the rules of the Tax Code of the Russian Federation established by Art. 119, 119.1, 120, 122, 126.

The funds also have the right to punish:

1. The Pension Fund of the Russian Federation (Article 17 of Law No. 27-FZ dated April 1, 1996):

- for failure to submit information about the length of service of the insured person (500 rubles);

- for failure to comply with the electronic reporting format (RUB 1,000).

2. For the Social Insurance Fund - in relation to “unfortunate” contributions (Articles 26.29–26.31 of Law No. 125-FZ of July 24, 1998).

Read about how the functions of tax authorities and funds are differentiated in the material “Attention - a reminder for payers of contributions from the Federal Tax Service.”

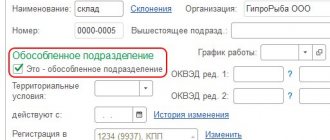

Separate units

An important change was that from January 1, 2022, all separate divisions (including branches and representative offices) that issue payments and rewards to individuals will be required to independently calculate and pay insurance premiums, as well as submit calculations for them to the Federal Tax Service.

Therefore, parent organizations are required to notify the Federal Tax Service at their location that their separate divisions, starting from January 1, 2022, received the right to accrue payments and remunerations to individuals or lost the authority to accrue payments and remunerations to individuals. This rule is valid for created separate divisions only from 01/01/2017 (subclause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). There is no need to transfer data about separate divisions that accrued payments and rewards before January 1, 2022. Extra-budgetary funds will independently transfer this data to the Federal Tax Service.

The tax authority must be notified of the creation of separate divisions

Starting next year, organizations are required to notify tax inspectorates at their location about all cases of the creation of separate divisions in Russia that make payments to individuals. This must be done within one month from the moment of creation of the unit (subclause “b”, paragraph 17, article 1 of Law No. 243-FZ). This requirement applies to those units that will be formed after 01/01/2017 (Part 2 of Article 5 of Law No. 243-FZ).

Please note that organizations currently do not submit such information to foundation authorities. The obligation to report the creation and closure of separate divisions has been canceled since 01/01/2015 (clause “c”, paragraph 17, article 5 of the Federal Law of June 28, 2014 No. 188-FZ). Amendments to the Tax Code of the Russian Federation partially restored this obligation.

Business trips

A provision was established that daily allowances for paying business trips are not subject to insurance contributions within the limits established for personal income tax purposes (clause 2 of Article 422 of the Tax Code of the Russian Federation).

Please note that personal income tax is not withheld from daily allowance in the amount of no more than (clause 3 of article 217 of the Tax Code of the Russian Federation):

- 700 rub. – on business trips around Russia;

- 2,500 rub. - on business trips abroad.

Previously, daily allowances were fully exempt from insurance premiums in accordance with Part 2 of Art. 9 of Law No. 212-FZ.

Additional contributions to the Pension Fund

If employees work in harmful, dangerous or other production that gives them the right to early retirement, additional amounts are paid for pension insurance from the income accrued to such employees. The amount of insurance contributions to the Pension Fund in 2022 for such payers did not change; the amount of the tariff depends on the hazard class established as a result of a special assessment (Article 428 of the Tax Code of the Russian Federation).

Table 4. Amount of additional tariffs

| Established hazard class | Subclass of working conditions | Rate of additional contributions to the Pension Fund, % |

| Dangerous (class 4) | 4 | 8 |

| Harmful (class 3) | 3.4 | 7 |

| 3.3 | 6 | |

| 3.2 | 4 | |

| 3.1. | 2 | |

| Acceptable (class 2) | 2 | 0 |

| Optimal (class 1) | 1 | 0 |

In the absence of a special assessment, rates will be higher:

- 6% - for the work listed in clause 2-18, part 1 of Art. 30 of Law No. 400-FZ of December 28, 2013 (List No. 2, “small” lists);

- 9% - for the work listed in clause 1, part 1 of art. 30 of Law No. 400-FZ of December 28, 2013 (List No. 1).

Rates

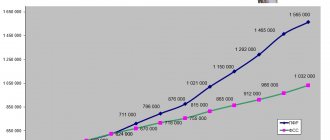

Insurance premium rates in 2022 have not changed. The limits of the contribution base were only increased:

- For compulsory pension insurance: 22% within the established amount of the contribution base (in 2016 - 796,000 rubles, in 2022 - 876,000 rubles); 10% above the limit;

- For OSS in case of temporary disability and in connection with maternity: 2.9% of the amount of payments within the established amount of the contribution base (in 2016 - 718,000 rubles, in 2022 - 755,000 rubles); 1.8% on payments in favor of foreign citizens temporarily staying in the Russian Federation, within the limits of the contribution base;

- For compulsory medical insurance: 5.1% of all payments per year, regardless of their size.

What will happen to the periods until 2022:

Reporting for 2016 will be presented according to the old rules and forms, i.e.

to the Social Insurance Fund and the Pension Fund. Control over the correctness of calculations of contributions for periods before January 1, 2022 remains with the funds, however, they will no longer be able to collect additional accruals (with some exceptions). All data on existing arrears will be transferred to the tax authorities. Information about newly identified arrears during inspections will also be transferred to the Federal Tax Service for collection.

Funds will also not be able to return (offset) overpayments. They will make the decision on the refund (offset), but this decision will be transferred to the tax authorities.

Reporting to the Federal Tax Service

In 2022 the following remained the same:

- Form SZV-M (submitted to the Pension Fund of Russia) - individual personalized accounting information, which will be submitted monthly, as in 2016;

- Form DSV-3 (submitted to the Pension Fund of Russia) - information provided by the policyholder transferring additional insurance contributions to the employee's funded pension - quarterly;

- Form SPV-3 (submitted to the Pension Fund of Russia) - a form that the policyholder submits within three calendar days from the date of application upon retirement.

However, forms RSV-1 (quarterly), RSV-2 (annually), RV-3 (quarterly) and 4-FSS (quarterly) were modified into the reporting form Calculation of insurance premiums, approved by order of the Federal Tax Service of the Russian Federation dated October 10, 2016 No. MMV - 7 -11/55.

This order comes into force on January 1, 2022, the first calculation in the form must be submitted for the first quarter of 2022. The deadline for submitting the quarterly report to the Federal Tax Service is no later than the 30th day of the month following the reporting (settlement) period (clause 7 of Art. 431 of the Tax Code of the Russian Federation). This period is the same for all policyholders and does not depend on the form of reporting - on paper or electronically. For the first quarter of 2022, the form must be submitted no later than May 2, 2017 (April 30, 2022 is a Saturday). Organizations with an average number of employees exceeding 25 people for the previous year are required to submit reports only in electronic form.

Have the rules for calculating compulsory social insurance contributions changed?

There are no fundamental changes in the rules for calculating contributions. The innovations boil down to the following:

- The amount of daily allowance that is not subject to contributions is limited to the amounts used for similar purposes under personal income tax: 700 rubles. per day in the Russian Federation and 2,500 rubles. abroad (clause 2 of article 422 of the Tax Code of the Russian Federation);

- the base for income issued in kind began to be determined from the market value of the income issued, including VAT (clause 7 of Article 421 of the Tax Code of the Russian Federation);

- an obligation has arisen to pay contributions and submit reports on them for separate payer structures that independently accrue and pay income to individuals (clause 11, article 431 of the Tax Code of the Russian Federation), as well as the obligation to report the assignment/loss of such powers (subclause 7, clause 3.4 Article 23 of the Tax Code of the Russian Federation);

- Individual entrepreneurs who pay contributions, when establishing the amount of income that determines the final formula for calculating payments for contributions, were given the opportunity to reduce this income by professional deductions (letter of the Federal Tax Service of Russia dated February 10, 2017 No. BS-4-11 / [email protected] );

- Individuals - not individual entrepreneurs - who earn money by caring for people in need, tutoring, cleaning and housekeeping can take advantage of an exemption from paying contributions in the period 2017–2018 (subclause 3, clause 3, article 422 of the Tax Code of the Russian Federation).

In other aspects, the procedure for calculating contributions has been preserved both for persons who make payments as an employee (Article 421 of the Tax Code of the Russian Federation) and for persons who do not make such payments (Article 430 of the Tax Code of the Russian Federation).

Calculation of insurance premiums

Let's look at the structure of the Calculation of Insurance Premiums report. The calculation consists of three sections:

Section 1 “Summary of the obligations of the payer of insurance premiums”

– this section is filled out by contribution payers who make payments to individuals. It contains summary data on the amounts of contributions payable (for each type of contribution).

Separate appendices of this section reflect calculations of the amounts of contributions for compulsory pension, medical and social insurance (number of insured persons, amount of accrued payments, amount of payments not subject to contributions, contribution base).

In a separate subsection it is also necessary to reflect data on contributions for additional social security - previously this data was submitted in the reporting form RV-3 of the Pension Fund of the Russian Federation.

Also, individual applications of the Calculation reflect information on compliance with the conditions for applying reduced contribution rates.

Section 2 “Summary data on the obligations of insurance premium payers of heads of peasant (farm) farms”

contains the calculation of the amounts of insurance premiums for the head and members of the peasant farm.

Section 3 “Personalized information about insured persons”

contains information on accrued insurance contributions for compulsory pension insurance for each insured person (previously in the RSV-1 calculation, Section 6).

Sections 1 and 3 are completed by insurance premium payers making payments to individuals and are submitted quarterly. Section 2 is filled out by insurance premium payers - heads of peasant (farm) households annually.

Please note that the reporting form “Calculation of insurance premiums” does not include:

- sections of settlements with funds - there will be no data on the payment of insurance premiums and debts/overpayments in the report;

- section for recalculation of insurance premiums;

- sections of information about length of service and calculations of contributions to NS and PZ.

However, the following have been added to this form:

- personnel data of the insured persons;

- the amount of accrued contributions for “harmful” additional tariffs for each insured person;

- the amount of accrued contributions to the Social Insurance Fund for foreigners for each insured person.

Now the primary report for Calculation of Insurance Premiums will not contain corrective personalized information from previous periods.

Corrective personal information will be included in corrective calculations containing the same set of data as the original data. Now report adjustments will be submitted separately from the original data of the calculation of insurance premiums.

The calculation will be considered not submitted if:

- Information on the total amount of insurance contributions for compulsory pension insurance does not correspond to information on the amount of calculated insurance contributions for each insured person for the specified period: Line 061 in columns 3,4,5 of Appendix 1 of Section 1 of the Calculation must coincide with the amounts of lines 240 of Section 3 of the Calculation for every month accordingly.

- False personal data identifying insured individuals is indicated: Full name – SNILS – Taxpayer Identification Number (if available).

What will happen to the reporting:

Reporting on insurance premiums, with the exception of contributions from industrial accidents and occupational diseases, will be submitted every quarter to the tax authorities no later than the 30th day of the month following the billing (reporting) period.

Payers of contributions with an average number of more than 25 people are required to submit calculations only electronically through TKS. Please note that a completely new reason for not accepting settlements appears in the code:

“If in the submitted calculation the information on the total amount of insurance contributions for compulsory pension insurance calculated by the payer for the billing (reporting) period does not correspond to the amount of calculated insurance contributions for compulsory pension insurance indicated in this calculation for each insured individual, such calculation is considered not submitted, about which the payer is sent a corresponding notification no later than the day following the day the calculation is submitted.”

to the Pension Fund once a year - no later than March 1 of the year following the reporting year (with the exception of some situations).

Monthly reporting in the form of SZV-M is retained; it will still need to be submitted to the branches of the Pension Fund, but the deadline for submission has changed - instead of the 10th day it became the 15th day of the month following the reporting one.

However, there may still be changes in terms of personalized reporting, since the State Duma has a bill that was prepared by the Ministry of Labor before the draft transfer of administration of contributions to the Federal Tax Service was submitted to deputies for consideration. This project, in addition to replacing SNILS cards with an electronic version, also includes monthly reporting in the form of RSV-1 to the Pension Fund. The ministry and the Pension Fund have been trying to introduce this monthly reporting for several years now, so it is possible that they will achieve their goal.

Reporting to the Social Insurance Fund will remain , in a reduced form, only for insurance premiums for compulsory social insurance against industrial accidents and occupational diseases. The deadline for its submission does not change.