Is it necessary to submit a calculation of advances on property?

Rules for calculating and paying property tax for legal entities, described in Chapter. 30 of the Tax Code of the Russian Federation, largely depend on the provisions of the legislation of the constituent entity of the Russian Federation in which the objects subject to this tax are located. The subject has the right to independently establish (clause 2 of Article 372 of the Tax Code of the Russian Federation):

- additional (in comparison with Article 381 of the Tax Code of the Russian Federation) benefits and rules for their application;

- the procedure for calculating the tax base for individual real estate objects;

- the amount of the rate (without going beyond its upper limits indicated in Article 380 of the Tax Code of the Russian Federation);

- the procedure for making tax payments (including the availability of advances for it);

- deadlines for paying both tax and advances (if they are introduced in the region).

Thus, the rules for calculating and paying tax by region may vary significantly. Therefore, before you start calculating advance payments for property taxes, you should find out whether they have been introduced in the region. Such a decision in a legislative document of a constituent entity of the Russian Federation will be equivalent to an indication that reporting periods for taxes have not been established. This allows you to use clause 3 of Art. 379 Tax Code of the Russian Federation. The absence of a reporting period entails the right of the taxpayer not to pay advances during the year.

Moreover, the region has the right to make such a decision not in relation to all taxpayers, but only for certain categories of them (clause 6 of Article 382 of the Tax Code of the Russian Federation).

If there is no decision not to establish reporting periods in the region, then the obligation to pay advances from the taxpayer is not removed. And until 2022, he also had the obligation to submit to the Federal Tax Service the calculation of advance payments in the prescribed form and on time.

You can read about the latest calculation of advance payments for property tax here.

Starting from 2022, there is no need to submit an advance calculation to the tax office, only an annual return. At the same time, the advances themselves must be calculated and paid as before.

ATTENTION! The declaration for 2022 must include information on the average annual value of movable property (there is no need to pay movable property tax; the Federal Tax Service collects information to assess shortfalls in budget revenues).

Time limits established for advances on property

The deadline for payment of advances will vary by constituent entity of the Russian Federation (clause 1 of Article 383 of the Tax Code of the Russian Federation). You can check the deadlines for each region on the Federal Tax Service website.

In this case, the reporting periods should be considered quarterly periods of the year, equal in relation to the type of tax base (clause 2 of Article 379 of the Tax Code of the Russian Federation):

- quarter, half-year, 9 months, if the base is determined by the average (average annual) cost;

- quarter, if the base depends on the cadastral valuation.

These are the ones you need to focus on when determining the deadline for paying advances.

Procedure for making advance payments

Organizations that are subject to property tax pay advance payments:

- if they are established by a subject of the Russian Federation (clause 3 of Article 379, clause 6 of Article 382 of the Tax Code of the Russian Federation);

- within the time limits established by the legislative authorities of the region (Article 379, paragraph 1, paragraph 2 of Article 383 of the Tax Code of the Russian Federation).

Advances for 9 months of 2022 are calculated from real estate taxable:

- at average annual cost - reporting period 9 months;

- by cadastral value - reporting period 3rd quarter.

How to determine at what value to tax your property

Taxpayers using the simplified tax system calculate and pay property tax only if they have real estate taxed at cadastral value (clause 2 of article 346.11 of the Tax Code of the Russian Federation).

Differentiation of property for the purposes of calculating tax on it

When starting to calculate the amount of the advance payment for property tax, you need to keep in mind that the result of this process will have to be divided depending on (clauses 1, 2, article 376, clause 3, article 382 of the Tax Code of the Russian Federation):

- places where the property is located;

- types of taxable objects;

- tax rates established for these types;

- options for applicable benefits.

These circumstances will determine the need:

- creating reports intended for different Federal Tax Service Inspectors;

IMPORTANT! From 2022, organizations have the right to report on several objects in different regions to one tax office. See details here.

- categorization of property into different sections of the report;

- creating several sheets of the same section, including this may be required for the same object;

- summing up the calculation results relating to the same area to reflect the total accrual amounts.

The distribution into different sections is predetermined, first of all, by the base from which the tax is calculated. Such a base can be either the average (average annual) value (in the general case) or the cadastral value (for real estate of certain types or a certain affiliation).

Tax return

The declaration on property tax of organizations for the year is submitted before March 30 of the following year (Article 386 of the Tax Code of the Russian Federation). For reporting periods - depending on the region. If the region has not established reporting periods, then there is no need to submit interim declarations.

There is no declaration required for personal property tax - the tax office independently calculates the amount to be paid. I think that when all real estate is assessed by Rosreestr, property tax declarations will be abolished for legal entities as well.

The deadline for paying corporate property tax for the year depends on the region (Article 383 of the Tax Code of the Russian Federation). Property tax for individuals, regardless of the location of the property - until December 1 of the following year (Article 409 of the Tax Code of the Russian Federation).

How to calculate the tax base based on the average (average annual) cost

The concept of average cost is applicable only in relation to property available in the reporting period (clause 4 of article 376 of the Tax Code of the Russian Federation). For calculations over a year, it is called the annual average (annual average). But the principles for determining the average and annual average cost are the same. This calculation is made for all taxable objects as a whole, without singling out specific units from their list. Before its implementation, those that:

- is not considered an object for taxation (clause 4 of article 374 of the Tax Code of the Russian Federation);

- exempt from tax (Article 381 of the Tax Code of the Russian Federation);

- taxed on a different basis (Article 378.2 of the Tax Code of the Russian Federation);

- refers to capital investments in certain facilities made during the period from 01/01/2010 to 12/31/2024 (clause 6 of article 376 of the Tax Code of the Russian Federation).

IMPORTANT! From 01/01/2019, movable property is not subject to tax. See details here. But information about it must be displayed in the annual declaration.

The average (annual average) value of taxable property is calculated using information about its residual value, determined on the first day of each month of the billing period and on the first day of the month following this period. That is, the calculation will use the number of indicators of this value that is 1 greater than the number of months of the billing period. And by this number of indicators you will need to divide the sum of all residual value values involved in the calculation in order to obtain the average (annual average) value for the billing period.

For example, to calculate for the 1st quarter, 4 values of residual value will be required (we will denote them by letters):

- on January 01 - a;

- on February 1 - b;

- on March 01 - from;

- on April 01 - d.

Then the average cost for the 1st quarter will be determined by the formula:

Сср = (a + b + c + d) / 4.

Moreover, even if the property is missing on some date(s) or its residual value is zero, this indicator is still included in the calculation. That is, the amount of value also includes its zero value, and in the number corresponding to the number of indicators for the period, this unit with a zero value is also taken into account.

How to determine the residual value of fixed assets, see here.

EXAMPLE of calculating an advance payment of property tax at the average annual cost from ConsultantPlus : The Sigma trading organization applies a general taxation system. The organization's balance sheet contains property, the tax base for which is determined at the average annual cost. The tax rate according to regional legislation is 2.2%. Sigma does not have any property tax benefits. Residual value... Read the continuation of the example in the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Legislative aspects of property tax

The analyzed tax falls within the purview of Chapter 30 of the Tax Code of the Russian Federation. Property assets are included in the tax base according to the conditions declared in Art. 374 Tax Code of the Russian Federation. Clause 4 of this article provides a list of objects for which this tax is not required to be paid. Art. 381 of the Tax Code of the Russian Federation considers certain types of activities that do not involve the collection of this tax from the entrepreneur.

In general, Russian organizations, as well as foreign ones with a representative office in the Russian Federation, are required to pay tax on property on their balance sheet, movable, capitalized before 2013, and/or immovable. Some categories of organizations are beneficiaries.

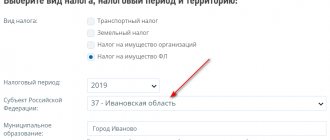

This tax is regional, which means that the constituent entities of the Russian Federation can independently reduce the tax rate of 2.2% established by the Government.

REFERENCE! If an entrepreneur wants to find out the tax rate of his region, he can refer to the official website of the Federal Tax Service, which contains background information on various rates and benefits, including property tax.

Nuances of determining the base for cadastral valuation

The tax base, depending on the cadastral valuation, arises in relation to immovable objects that have a very specific purpose (clause 1 of Article 378.2 of the Tax Code of the Russian Federation), after in a subject of the Russian Federation:

- the results of the assessment of such value were approved;

- a law was adopted on the procedure for forming the base for calculating tax on these objects;

- a list of objects subject to taxation from such a base is published no later than the beginning of the next year.

If all these conditions are met, the corresponding object in the coming year has the cadastral valuation approved for it at the beginning of this year as the basis for taxation. Throughout the year, the value of this base does not change (clause 15 of Article 378.2 of the Tax Code of the Russian Federation), but may decrease due to benefits introduced by regional law.

The tax from the cadastral valuation will have to be calculated separately for each of these objects, applying appropriate coefficients that take into account:

- share of ownership - when the taxpayer is the owner of only part of the object, which has a cadastral valuation as the basis (clause 6 of Article 378.2 of the Tax Code of the Russian Federation);

- location share - when an object is located simultaneously in two (or several) constituent entities of the Russian Federation (clause 2 of Article 378.2 of the Tax Code of the Russian Federation).

An object included in the list of subjects subject to taxation from cadastral valuation (provided that it does not belong to the property of a foreign organization) will never be included in the base depending on the average (annual average) cost (clause 2 of Article 378.2 of the Tax Code of the Russian Federation ).

ConsultantPlus experts provided step-by-step instructions for calculating property tax from the cadastral value. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

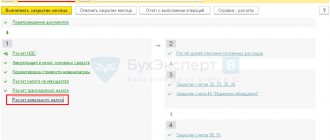

Algorithm for calculating advance payments for property tax

Despite the difference in tax bases, the amount of advance payment due for payment for the next reporting period is calculated using a single formula: as ¼ of the product of the tax base by the tax rate (subclause 1, clause 12, article 378.2, clause 4, article 382 of the Tax Code of the Russian Federation ).

That is, for the average cost, the advance calculation will be as follows:

Asr = Ssr × SNsr / 4,

Where:

Asr - the amount of the advance payment calculated for the average cost;

Ср - average value of property for the reporting period;

СНср - tax rate valid for a base calculated from the average cost.

And the advance payment from the cadastral valuation will be calculated as follows:

Akad = Scad × SNcad / 4;

Where:

Acad - the amount of the advance payment, calculated from the cadastral value;

Scad - cadastral value of property established at the beginning of the accounting year;

SNcad is the tax rate in force for the base, which is a cadastral valuation.

The key provisions of the above algorithm are enshrined in Art. 382 of the Tax Code of the Russian Federation, which prescribes compliance with a number of rules regarding property, the basis for taxation of which is the cadastral valuation. Joint reading of Art. 378.2 and 382 of the Tax Code of the Russian Federation allows these rules to include the following:

- if a cadastral valuation has not been made at the beginning of the year or such a value is established for the first time in the current year, then the basis for the object in it will be the average annual value (subclause 2 of clause 12 of article 378.2);

- if the right obliging the payment of tax (ownership or economic management) on an object with a cadastral valuation arose or was lost in the calculation period, then when determining the base, a coefficient equal to the ratio of the number of full months of existence of the right obliging the payment of tax to the total is taken into account the number of months in the calculation period (clause 5 of Article 382). In this case, the month in which rights to property arose before the 15th or were lost after the 15th will be complete.

The amount of the advance calculated using the formula can be reduced by the amount of the benefit if the region has established one that allows you to reduce the amount of the tax payment itself.

Results

The need to accrue advances on property tax is established by the legislation of the constituent entity of the Russian Federation in which the object of taxation is located.

If advances are provided in the region, then they must be transferred to the budget within the period established by the region. There is no need to submit an advance payment for them. The formula by which the amount of the advance is calculated does not depend on the type of tax base, but is used with the features established for application in relation to objects assessed at cadastral value. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Calculation rules

The objects of taxation, according to Article 401 of the Tax Code of the Russian Federation, are:

- residential premises: houses, apartments, rooms;

- non-residential premises: garages, parking spaces, single real estate complexes;

- unfinished construction projects;

- other buildings, structures, structures and premises.

Property tax is calculated based on the cadastral value of each property separately. Information about it is determined according to the Unified State Register of Real Estate as of January 1 of the year, which is the tax period. Thus, the calculation of property tax in 2022 will be based on the cadastral value established as of 01/01/2018.

The rate is determined by local governments in the relevant regulations. Payment is calculated for the period of the year in which you were the owner of the taxable property. The formula for calculating property tax looks like this: