Concept and types of regional taxes

The Tax Code authorizes regional legislative authorities to establish regional taxes, at the same time limiting their list in order to avoid overburdening taxpayers.

The taxation system of the Russian Federation is built in a certain way and consists of a number of levels:

- Federal;

- Regional;

- Local.

This level system made it possible to assign certain tax deductions to a specific budget (local, republican, federal).

Regional taxes are taxes, the establishment of which is provided for by the Tax Code of the Russian Federation and which are put into effect when one or another federal subject adopts the relevant law.

These taxes are subject to mandatory payment only on the territory of the relevant federal subjects.

The system of regional taxes includes taxes whose effect by tax legislation extends to the entire Russian territory, as well as those established by the laws of individual subjects of the federation. Payment of both is mandatory on the territory of these respective subjects by persons recognized by law as taxpayers.

The Federal Tax Code, Article 14, provides for only three taxes that subjects of the Russian Federation have the right to introduce on their territory. Regional taxes include:

- on property collected from organizations;

- for gambling business;

- transport.

Composition of regional taxes

As noted above, regional taxes include:

- taxes that apply to the entire territory of the Russian Federation in accordance with federal laws on taxes and fees, as well as the Tax Code of the Russian Federation;

- taxes established by the legislative bodies of independent constituent entities of the Russian Federation, which are valid only on the territory of the corresponding constituent entity.

Until the modern Russian Tax Code was put into effect, the domestic tax system was characterized by the division of regional taxes into:

- mandatory;

- optional.

The essence of such a division was the possibility of limited application in regions (regions) of taxes separately established on the territory of the country. Local government authorities were empowered to impose taxes of regional significance in those quantities that they considered necessary independently without any restrictions. Some subjects of the federation, due to the exercise of such powers by the authorities, were overloaded with taxation to the maximum.

The current Tax Code of the Russian Federation was intended to limit the tax burden and bring the taxation system throughout the country into a single state. It was he who established an exhaustive (closed) list of regional taxes that have the right to be introduced in individual regions by local laws, thereby reducing the unaffordable tax burden on taxpayers.

From now on, it is prohibited to establish additional regional taxes that are not included in the Tax Code of the Russian Federation, which has a beneficial effect primarily for business entities - legal entities.

Do you need help with regional taxes?

Sign up for a consultation with the practice manager

+7

What is this

Regional taxes are gratuitous mandatory payments to the budget of certain constituent entities of the Russian Federation. They are established by regulations and laws of the relevant subjects. They must necessarily comply with the articles and chapters of the Tax Code of the Russian Federation. Regional taxes include fees for:

- Property of organizations.

- Gambling business.

- Transport.

State authorities of the regions of the Russian Federation establish the amount of payments, the procedure and timing of payment, as well as the amount of benefits and the procedure for their accrual. In all other cases, officials follow the Tax Code of the Russian Federation. There are a number of special tax regimes (STRs) which may include an obligation to pay additional levies.

The peculiarity of fees in the regions is that all the money goes to the corresponding budget. The money is spent on expenses to improve the quality of life in a specific subject of the Russian Federation. This could be the renovation of highways, repairs and construction of various government institutions, salaries of municipal workers, and so on.

Elements of regional taxes

Regional taxes are recognized as a set of taxes established throughout the territory of the Russian Federation by its laws and the Tax Code in particular, as well as on the scale of a single region, but taking into account the provisions of the current federal tax legislation.

Both levels of taxes include separate, narrower classifications; in particular, for regional taxes, the classification is represented by a list of taxes that can be established within a subject by its bodies:

- property tax;

- gambling tax;

- transport tax.

An analysis of existing regional taxes shows that for the most part, the taxpayers are legal entities - organizations engaged in economic activities, and in rare cases individuals.

Types of regional taxes

There are the following types of regional taxes, all of them are direct, that is, paid by property owners and income recipients:

- Property tax for enterprises, organizations, that is, legal entities

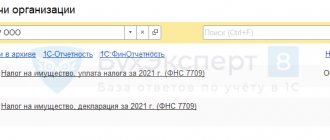

All companies that own real estate pay tax on it. It is calculated based on the cadastral value of the property as of January 1 of the year following the tax period. Also, property tax can be calculated based on the average annual value of the property.

Organizations themselves calculate the amount of tax and pay it in installments, quarterly in the form of advance payments. The balance is paid at the end of the year. However, regional authorities can cancel advance payments and set tax payment deadlines themselves.

The correctness of the payment of property tax is checked by tax inspectors on the basis of tax returns that are submitted before March 30, and the organization’s calculations. The marginal rate is 2% of the cadastral and 2.2% of the average annual value of the property. They cannot be higher. Organizations of people with disabilities, churches, participants in the Skolkovo project and bar associations are exempt from paying property taxes.

- Transport tax

Paid by everyone to whom transport is registered, including river and air. You don't have to pay just for rowing boats and special transport for the disabled. The amount of transport tax directly depends on engine power.

The base rate is set by the federal authorities; locally it can vary significantly - up to 10 times in any direction from the base rate. Citizens and individual entrepreneurs are required to pay transport tax before December 1 of the next year; tax notices are sent to them.

Organizations calculate the transport tax themselves and, as in the case of property tax, can pay it in quarterly advance payments. In 28 regions of Russia, large families are exempt from transport tax.

- Gambling tax

Paid every month by the 20th. The bet is 50 thousand rubles for one playing field, from 3 thousand rubles for a slot machine and 20 thousand rubles for one betting point, that is, a bookmaker's office.

Regional budgets also receive funds from the sale of work patents and taxes on professional income.

Characteristics of regional taxes

The characteristics of regional taxes depend on a particular tax introduced in the region. In general, each of the types allowed for introduction within the region is characterized by the following:

1. For the property tax of a legal entity, it occupies the most significant layer in the regional taxation system. On average, regional budget revenue is generated by paying this tax by 6% or more.

Taxpayers are legal entities on whose balance sheets there is property that, according to tax legislation, is regarded as an object of taxation.

The objects in this case are movable and immovable property for domestic legal entities, which, according to accounting, are accounted for as fixed assets of the organization.

For foreign legal entities engaged in economic activities in Russia through representative offices, the object is recognized as movable and immovable property, which is also fixed assets according to financial statements, as well as property received under a concession agreement.

If a foreign enterprise does not carry out its activities through representative offices in the Russian Federation, then the object is real estate in Russia, which is the property of this organization, as well as property received under a concession agreement.

2. For the tax on gambling business, taxpayers are legal entities or individual entrepreneurs whose business activities are related to generating income in the field of gambling business by charging fees for gambling, betting, etc.

The objects of taxation are tables, machines recognized as gaming, as well as betting or bookmaker's office cash desks.

Each unit of the specified object must first be registered with the territorial tax service.

In this case, the registration period is 2 or more days before the day of installation (opening of an office or betting shop) for each individual unit.

To register, the taxpayer must submit an application, after which a certificate of the appropriate uniform form is issued.

3. Transport tax is regional, with characteristic features.

Thus, the object of taxation:

- motor vehicles;

- motorcycles;

- scooters and others, including watercraft and aircraft that have been registered on the territory of the Russian Federation in the manner prescribed by its legislation.

Taxpayers are individuals in whose name the specified objects are registered. This category of regional taxes contains a fairly large list of persons who are granted benefits for paying this tax.

What taxes are regional?

Among the regional fees, several stand out; in this section, each of them will be discussed in more detail:

- For property. Taxpayers are legal entities whose balance sheet contains any property that is an object of fixed assets. The exception is land plots or property that is on the balance sheet of executive authorities.

- For transport. The fee applies to all citizens who hold vehicle registration. Among the latter are motorcycles, cars, transport by water and air, scooters, snowmobiles and so on. There are a number of features for calculating the rate for each type of vehicle.

- For the gambling business. Applies to all organizations working in the field of gambling entertainment. Taxation can affect everything - gaming tables, “one-armed bandits”, cash registers of bookmakers and sweepstakes.

Functions of regional taxes

Regional taxes are funds paid by legal entities to the regional budget, which allows the subsequent subject of the federation, represented by its governing body, to use these deductions to perform a number of functions:

- accumulation and use of funds received by the regional budget to achieve regional goals;

- the exercise by regional authorities of their representative and administrative powers;

- self-sufficiency in the implementation of programs of social significance developed and operating within the territory of the region (region);

- development of the region's infrastructure;

- maintaining the environment and natural resources, since they are the natural basis for the existence, development and prosperity of the region.

- stimulating business activity, carrying out structural reforms that will make the region (region) more attractive in terms of investment, which will subsequently have a positive impact on the future well-being of the regional budgetary and tax sphere.

The importance of regional taxes

The importance of regional taxes in the budgets of the constituent entities of the Russian Federation is colossal. This is because modern realities entrust them with the function of a lever regulating the uninterrupted formation and replenishment of the regional budget.

The main role of regional taxes is that they are designed to materially provide and nourish the regions. These material resources are subject to redistribution and direction for the benefit and development of the region, solving primary problems and implementing socially significant programs that are not financed from the federal budget or are financed in a significantly smaller amount than necessary.

The regional government, thanks to such taxes, as well as benefits and sanctions that complement the taxation system within the region, has an impact on legal entities and their economic behavior, thereby maximally leveling the conditions for all participants in social reproduction.

What are regional taxes and why are they needed?

As the name implies, the main difference between regional taxes is that they do not go to the federal budget. These obligatory payments remain in the region, region, territory.

This area, like taxation in general, is regulated by the Tax Code of the Russian Federation. However, it sets only the minimum and maximum rates of regional taxes. Within these limits, local authorities can set the rate in force in a specific subject of the federation.

For this reason, the amount of tax, for example, on property, may differ significantly in Moscow and Tatarstan. The timing of payment of contributions, as well as the categories of persons who have benefits for their calculation and payment, may vary.

Important

Elements of regional taxes are the rate, procedure and terms of payment, tax benefits.

The main function of regional taxes is to fill the local budget. These funds are not sent to the country’s budget, but are used locally.

For example: residents of Tatarstan, owners of personal cars, paid a transport tax. These funds were used to repair the bypass that goes around Kazan. The owner of a dairy production workshop in Samara paid property tax for the building he owned. The money was allocated for medical equipment for a paramedic station in one of the villages of the Samara region.

Therefore, regional taxes, or rather, the amount of money collected, significantly affect the well-being of the region, the region, and its level of development. In addition, local taxes go to the salaries of governors, the construction of schools, hospitals, their repair and maintenance.

Important

At the same time, regional taxes are set by the state. But legislative assemblies of regions, councils of republics, and regional dumas themselves decide in what amount and when they will go to the local budget. Regional benefits complement federal ones without contradicting them.

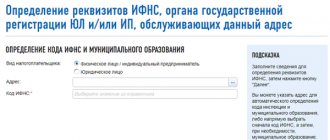

The procedure for establishing regional taxes

The introduction of regional taxes and their termination in the territories of federal subjects is carried out on the basis of the provisions of the Tax Code of the Russian Federation and the territorial laws of the subjects of the Russian Federation governing taxation issues.

Legislative bodies of state power of a federal subject, when establishing taxes for their region (region), are guided by federal tax norms concentrated in the Tax Code of the Russian Federation. They also define:

- tax rates;

- payment procedure;

- payment terms.

The remaining elements of taxation, as well as the range of taxpayers, are provided for by the Tax Code of the Russian Federation itself.

The regional legislative power, specified by the laws, taking into account the provisions of the Tax Code of the Russian Federation, can additionally provide for tax breaks (benefits) for certain categories of taxpayers, as well as the procedure and grounds for their application.