Types of tax audits

There are two types of tax audits: scheduled and unscheduled.

A scheduled tax audit is carried out no more than once every two years according to an approved schedule, which is communicated to taxpayers.

Unscheduled inspections are carried out if there is information and facts related to violations of tax legislation, non-fulfillment or improper fulfillment of tax obligations by the payer and in other cases provided for in Art. 10 of the Law of December 26, 2008.

Tax audits are carried out desk-wise (at the inspector’s office) or on-site to the taxpayer. During an on-site inspection, the inspector has the right to personally inspect the production, make sure that the enterprise is functioning, study it on site and even forcibly confiscate all the necessary primary documentation, as well as conduct an inventory.

All types of tax audits are carried out in accordance with the paragraphs of Law No. 294-FZ. Organizations have the opportunity to learn in advance about both scheduled and unscheduled audits.

How to find out about a scheduled tax audit? Plans for conducting inspections by regulatory authorities are information that is published annually by the Prosecutor General's Office of the Russian Federation. A summary of inspections of legal entities for 2022 has been published on the department’s website. Anyone who finds their company there can begin to prepare for a visit from the tax office.

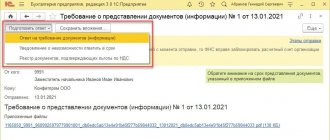

The Federal Tax Service notifies you in advance of an unscheduled on-site inspection. The notice that is sent to the enterprise, in accordance with the rules for conducting on-site inspections set out in the Tax Code of the Russian Federation, must indicate the date and period of the inspection, and provide a list of taxes, deductions for which will be controlled.

Publicly available self-assessment criteria for taxpayers

In addition to the areas in which the financial and economic analysis of the enterprise’s activities is carried out, Federal Tax Service Order No. MM-3-06/ [email protected] defines a list of criteria that serve as a guide for the tax authority when deciding to conduct an on-site audit. This list includes:

- Low tax burden on the taxpayer. When assessing this indicator, tax authorities compare the tax burden of a particular organization with the average amount of tax payments transferred by enterprises operating in the same industry. The calculation of the average level of tax burden is carried out on the basis of statistical information characterizing the total volume of cash turnover in the analyzed line of activity, as well as the amount of tax contributions paid based on the results of its implementation. If the amount of mandatory payments made by a company differs significantly from the established average values, the likelihood that tax authorities will decide to conduct an unscheduled audit is extremely high.

- Working at a loss. If tax returns submitted by a taxpayer over several tax periods contain information that the company not only does not make a profit, but also does not cover its own expenses incurred in carrying out business activities, representatives of the tax service may decide on the need to conduct an unscheduled audit. However, as practice shows, tax authorities are very loyal to unprofitable companies, since usually entrepreneurs who have recently entered the market and did not have time to cover the costs incurred at the stage of launching production work to their detriment.

Rights and obligations. How to behave when checking

During a desk inspection, all requested documents are submitted to the inspection, and the inspector checks them at his workplace. An on-site inspection is carried out at the enterprise; not only the manager and chief accountant, but also other specialists can be involved in it.

Prepare a workplace for the inspector: it is better if it is a separate office. It also makes sense to instruct all employees with whom inspectors may come into contact, to tell them about the rights and responsibilities defined by the Tax Code of the Russian Federation.

What documents does the tax office request during an audit? Everything that is related to the audited period and taxes specified in the audit decision.

— Bring the documentation into compliance with the accounting law and the requirements of other regulations.

— Pay attention to the documents you will use to confirm benefits - they are usually checked especially carefully.

— Make an inventory of documents and hand them over for signature.

Tax legislation provides for the right of inspectors to request documents outside the framework of a tax audit. So, if the audit is carried out at your counterparty, you may be asked to provide documents relating to its activities (subclause 1, clause 1, clause 12, article 89, Tax Code of the Russian Federation).

What will the tax office ask about?

Inspectors will definitely be interested in your counterparties who have signs of being shell companies. The inspector may summon the head of the alleged “one-day operation,” as well as you and your chief accountant, for questioning. You will be asked approximately the same questions about transactions that seemed “dubious” to the inspectors, but you will be questioned separately:

- How and when did you find this counterparty?

- Why did you choose him?

- How did you contact the counterparty?

- Who signed contracts and other documents?

- Contact details and details of the counterparty?

- What goods were supplied, what services were provided?

- How was the goods transferred, how was it delivered and where was it stored?

If you cannot dictate the details of the counterparty or remember how you contacted him, feel free to answer “I don’t remember.” You don't have to know every detail of every deal by heart.

Have questions? Book a free consultation and ask Finguru's experts about how to properly prepare for a tax audit.

Sign up for a free consultation

Repeated on-site tax audit

Repeated on-site inspection is regulated by clause 10 of Art. 89 of the Tax Code of the Russian Federation and is carried out according to an already verified tax period and taxes only in the following cases:

- inspection by a higher tax authority of the tax authority that conducted the inspection

- submission by the taxpayer of an updated tax return, which indicates the amount of tax in an amount less than previously declared.

If during a repeat audit the tax authority discovers violations that were not identified by the initial audit, you will have to pay the arrears. Also, your company will be fined if it turns out that tax offenses were not detected due to collusion with inspectors (paragraph 7, paragraph 10, article 89 of the Tax Code of the Russian Federation).

Additional criteria established by the Federal Tax Service

In addition to the above signs, the following may be grounds for an inspection:

- A discrepancy between the growth rate of expenses and income, leading to a decrease in profit and, as a consequence, a decrease in the amount of tax payments.

- Application of tax deductions in significant amounts. A size is considered significant when the share of VAT deductions exceeds 89% for the last year.

- Low level of earnings of employees included in the organization's staff: employees of the enterprise receive salaries, the amount of which differs significantly from the average earnings in the region for specialists in this industry.

- Repeatedly bringing the values of indicators characterizing the results of the financial and economic activities of an enterprise closer to the values established as a limitation for the use of a certain special tax regime.

- Submitting a declaration to the Federal Tax Service, the amounts of income and expenses in which differ minimally (for individual entrepreneurs).

- Establishing relationships with counterparties through several intermediaries creating a so-called chain, if there is no reasonable and substantiated confirmation of the feasibility of using such an approach.

- Failure to provide explanations and responses to requests sent by the tax authority to the taxpayer.

- Repeated deregistration in one territorial branch of the Federal Tax Service followed by registration in another.

- A significant deviation of the level of profitability from the value of a similar indicator prevailing on average in the industry.

So, an unscheduled on-site tax audit is a set of measures aimed at assessing the correctness of the calculation of tax payments and the repayment of debts incurred to the Federal Tax Service. Such an inspection is carried out on the territory of the taxpayer, except for cases in which the premises do not allow the inspectors to perform their duties. The basis for conducting an unscheduled on-site inspection may be the liquidation of the enterprise, the expiration of the period allotted for correcting previously identified violations, or the request of the prosecutor's office, on the basis of which the management of the tax authority decided on the need for inspection measures.

Extension of tax audit

In general, an on-site inspection lasts 2 months. In some cases, this period can be increased to 4 months, and in accordance with paragraph 6 of Art. 89 of the Tax Code of the Russian Federation – up to 6 months. But there must be good reasons for this.

The Federal Tax Service of Russia dated December 25, 2006 N SAE-3-06/ [email protected] names the following circumstances as grounds for extending the inspection period:

- conducting audits of major taxpayers

- obtaining, during an on-site (repeated on-site) inspection, information that indicates that the taxpayer has violated the legislation on taxes and fees and requires additional verification

- the presence of force majeure circumstances (flooding, flooding, fire, etc.) in the territory where the inspection is being carried out.

Tax audit - concept and types

A tax audit is one of the ways the Federal Tax Service exercises control over the activities of individual entrepreneurs and legal entities. In accordance with the provisions of Art. 87 of the Tax Code of the Russian Federation, tax audits are of 2 types:

- Desk - carried out by the tax authority at its immediate location. The objects of research are tax returns and other reporting documents submitted by the taxpayer to the Federal Tax Service (Article 88 of the Tax Code of the Russian Federation). Unscheduled desk audits cannot be, since they are actually initiated by the taxpayer himself, sending a declaration to the Federal Tax Service.

- On-site visits are carried out by the tax authority on the territory of the taxpayer on the basis of a decision made by the head of the Federal Tax Service branch (Article 89 of the Tax Code of the Russian Federation).

According to paragraph 4 of Art. 89 of the Tax Code of the Russian Federation, the subjects of a tax audit are the correctness of calculation of the amount of tax payments and compliance with the deadlines for their transfer to the budget. Clause 5 of this article sets a limit on the number of audits that can be carried out against a taxpayer in one period: the tax authority does not have the right to conduct more than 2 audits for 1 tax per year. According to paragraph 6 of the same article, the maximum duration of an on-site inspection is 2 months, but this period can be extended to 4 or even (in exceptional cases) 6 months.

Tax audits can be either scheduled or unscheduled. In the first case, the tax service includes the enterprise in the prepared schedule in advance; in the second, the audit is carried out spontaneously. At the same time, the legislation does not contain a precise definition of the concept of “unscheduled inspection,” although in practice such events are carried out quite often.

Objection to the tax audit report

You have the right to file an objection to the inspection report if you do not agree with the final conclusions of the Federal Tax Service employees. This is a written appeal to the inspectorate expressing disagreement with the act drawn up based on the results of the inspection (clause 6 of the Tax Code of the Russian Federation) or the act of discovering facts indicating tax violations (clause 5 of the Tax Code of the Russian Federation). You may disagree with the entire inspection report or with individual provisions. The objection must be sent to the tax office that conducted the audit within a month from the date of receipt of the report.