From the 1st quarter of 2022, new forms of declarations on the volume of retail sales of strong alcohol and beer drinks will be in effect. What has changed and why it is important for the owner of every retail store to know about it - read in this article.

From the beginning of this year, FSRAR order No. 396 dated December 17, 2020 came into force. According to the order, the numbers of the declaration forms are changing - now the report for strong alcohol is number 7, and for beer is number 8 (instead of 11 and 12, respectively).

Along with the numbers, the requirements for the content of declarations have also changed. The innovations will affect everyone who is required to submit reports to FSRAR, regardless of the “strength” of the alcohol sold.

What is needed to submit a beer declaration in 2022

To submit a beer declaration in 2022, you will need to withdraw balances in the Unified State Automated Information System at the end of the quarter . How to withdraw the balances in the Unified State Automated Information System at the end of the quarter to submit a beer declaration is written here.

Upload your receipts into your EGAIS program , or order data on your receipts (data by deciliter) from your suppliers .

Has the declaration form for beer sales changed in 2022?

Yes, the beer declaration form has changed from form 12 to form 8 in accordance with Order 396 of 12/17/2020. Now, starting from the 1st quarter of 2022, beer declarations are submitted in form 8. Beer declarations form 12 and form 8 are almost the same, only in the new beer declaration form section 3 (returns) has appeared, and movement columns have been added in section 1. Everything else remains the same.

Data on the volume of turnover of ethyl alcohol, alcoholic and alcohol-containing products

Filling out the declaration begins with the transfer of product balances from the report for the previous period. To do this, in the “Product Movement” , click on the “Fill in balances” . If the organization had balances at the end of the previous reporting period, they will automatically be transferred to the section ( column 6 ).

The numbering of the columns is indicated in accordance with the numbering in the printed form of the declaration.

Receipt invoices

Next, fill out information on the receipt of products in the reporting period. To do this, go to the “Invoices” , in which data on purchases from manufacturing organizations, wholesale trade organizations, imports, as well as returns from customers is filled in ( columns 7-9, 11 ).

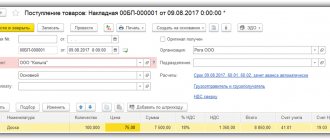

To fill out information on invoices, you need to “Add invoice” and indicate:

- invoice number and date;

- information about the supplier;

- information about the manufacturer: type and code of the type of product purchased from the supplier, selected from the corresponding directory ( columns 1-2 ), name of the product manufacturer, his tax identification number and checkpoint ( columns 3-5 ), volume of purchased products ( columns 7-9 ), customs declaration number and license details.

The customs declaration number is indicated only in the case of purchasing products for import.

If the TIN and KPP of the supplier coincide with the manufacturer’s data, then the information will be automatically reflected as purchases from manufacturing organizations ( column 7 ). If the supplier’s data is different from the manufacturer’s data, then - as purchases from wholesale trade organizations ( column 8 ). Import purchases ( column 9 ) are completed if the reporting organization is indicated in the invoice as both the supplier and the manufacturer.

To fill in the data on returning products from customers ( column 11 ), you need to “Add a return” and provide information in the same way as described above.

Invoices

The section “Consumable invoices” reflects information on the consumption of products in the reporting period by wholesale trade organizations, as well as the volume of products returned to suppliers ( columns 15, 21 ).

To fill in the information, you need to “Add an invoice” and indicate:

- sales invoice number and date;

- information about the buyer;

- information about the manufacturer: type and code of the type of products sold, selected from the corresponding directory ( columns 1-2 ), name of the product manufacturer, his Taxpayer Identification Number (INN) and checkpoint ( columns 3-5 ), volume of products sold ( column 15 ), details of the seller’s license.

To fill out data on product returns to suppliers ( column 21 ), you need to “Add a return” and provide information in the same way as described above.

To fill out information on the sale of products to retail organizations ( column 16 ), other organizations ( column 17 ) and for export ( column 18 ), you need to go to the “Product Movement” and enter data in the appropriate fields for a specific organization.

Moving

“Movement” section reflects the movement of products between the structural divisions of the organization (for example, the movement of products from one separate division to another, etc.).

To fill in data on internal movements of products, you need to “Add an invoice” and indicate:

- number and date of the movement invoice;

- from where and where the products are moved: name of the organization (separate division);

- information about the manufacturer: type and code of the type of product sold, selected from the corresponding directory ( columns 1-2 ), name of the product manufacturer, his Taxpayer Identification Number (TIN) and checkpoint ( columns 3-5 ), volume of transported products ( columns 13, 22 ).

Write-off

“Write-off” section reflects other consumption of products, with the exception of deliveries to wholesale and retail organizations, for export, returns and transfers (for example, shortages of products identified during the inventory, consumption of products for laboratory needs, etc.) ( column 20 ).

To fill out the data for this section, you need to “Add write-off” and indicate:

- number and date of the invoice for write-off;

- where the products are written off from: name of the organization (separate division);

- information about the manufacturer: type and code of the type of product sold, selected from the corresponding directory ( columns 1-2 ), name of the product manufacturer, his Taxpayer Identification Number (INN) and checkpoint ( columns 3-5 ), volume of products written off ( column 20 ).

Posting

“Capitalization” section is intended to reflect other receipts of products, with the exception of purchases from manufacturers, wholesale organizations, imports, returns and internal movements (for example, surplus products identified during inventory, etc.) ( column 12 ).

To fill out data on other product receipts, you need to “Add capitalization” and indicate:

- number and date of the invoice for posting;

- place of receipt of products: name of organization (separate division);

- information about the manufacturer: type and code of the type of product sold, selected from the corresponding directory ( columns 1-2 ), name of the product manufacturer, his Taxpayer Identification Number (TIN) and KPP ( columns 3-5 ), volume of registered products ( column 12 ).

What does the 8th Beer Declaration look like in 2022?

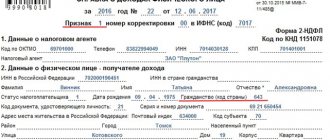

This is what the title page of the Form 8 beer declaration looks like. It contains information on the organization by place of activity

Declaration 8 beer (declaration of retail sale of beer) includes 3 sections:

Section 1 of the beer declaration includes a generalized table broken down by the manufacturer’s product codes, its tax identification number, checkpoint, your balances at the beginning of the quarter, how much was received, what beer sales were, returns and the balance at the end of the quarter of beer, beer, drinks, cider, poiret, mead .

The beer declaration is filled out with 261 cider, 262 poiret, 263 mead, 500 , 510 beer, 520 beer drinks in accordance with the FSRAR product type classifier.

Section 2 of the beer declaration includes data on receipts broken down by product codes, manufacturers of checkpoint tax identification number, checkpoint tax identification number suppliers, date and number of invoice by receipt and number of deciliters.

Section 3 of the beer declaration of Form 8 includes data on returns to the supplier by product codes, manufacturers of checkpoint tax identification number, checkpoint tax identification number suppliers, date and invoice number by receipt and number of deciliters.

Example of filling out a declaration

Section I

| No. | Product type | Product type code | Information about the manufacturer/importer | Product supplier information | Date of purchase (date of shipment by supplier) | Date of purchase (date of shipment by supplier) | Bill of lading number | Number of customs declaration | ||||

| name of manufacturer/importer | TIN | checkpoint | name of company | TIN | checkpoint | |||||||

| A | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 1 | Beer with a volume fraction of ethyl alcohol over 0.5% and up to 8.6% inclusive | 500 | IP Ivanov Stepan Vasilievich | 1111111112511 | Alkotel LLC | 333325333333 | 444301001 | 11.098.2022 | TN No. 153 | TD No. 284 | 100 | |

| TOTAL | ||||||||||||

Section II

| Admission | Consumption | Balance at the end of the reporting period | |||||||||||||||

| No. | Product type | Product type code | Information about the manufacturer/importer | Balance at the beginning of the reporting period | Procurement | Total | return from buyer | other receipts | Total | retail sales volume | other expense | return to supplier | Total | ||||

| name of manufacturer/importer | TIN | checkpoint | from manufacturing organizations | from wholesale trade organizations | on import | ||||||||||||

| A | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 1 | Beer with a volume fraction of ethyl alcohol over 0.5% and up to 8.6% inclusive | 500 | IP Ivanov Stepan Vasilievich | 1111111112511 | 10 | 100 | 0 | 0 | 100 | 0 | 0 | 100 | 70 | 20 | 0 | 90 | 20 |

| TOTAL | 10 | 100 | 0 | 0 | 100 | 0 | 0 | 100 | 70 | 20 | 0 | 90 | 20 | ||||

What you need to fill out and submit a beer declaration

To submit a beer declaration in a year you need:

1. Fill out a beer declaration (form here are instructions. If you are unable to do this yourself, you can contact us, we will prepare a beer declaration for you using the new form 8

2. Sign the beer declaration with an electronic signature and encrypt it with encryption certificates from Rosalkogolregulirovaniya - here are the instructions (how to sign a beer declaration)

3. Submit an alcohol declaration for beer to Rosalkogolregulirovanie on the FSRAR portal service.fsrar.ru - here are the instructions (how to submit a declaration for beer to Rosalkogolregulirovanie)

If you find it difficult to figure out how to prepare and submit a declaration for beer to FSRAR, or you don’t have enough time filling out and drawing up a beer report.

Then we can prepare a beer declaration for you! We offer a service for filling out and drawing up beer declarations. Our specialists will quickly and efficiently and in accordance with all the rules prepare a declaration file for you, cheaply for a low price!

How to create declarations

Stage 1. Balance update

First you need to update your EGAIS balances in Kontur.Market. It is best to do this a few hours after the last shift is closed . In this case, the system is guaranteed to download current data from EGAIS. To update your balance, you need to click the corresponding button in the “My Products” section:

Stage 2. Creating a draft in the Contour.Alcodeclaration

For those who have not worked with Kontur.Alcodedeclaration before, the algorithm is as follows:

In the “Declarations” section, you need to click the “Fill out the declaration” button:

A window will open with 6 tabs. You need to start with the first one:

After filling out the tab, you need to click the “Next” button. A second tab will open in which you can download a declaration for the past period generated in a third-party program:

After loading, click the “Next” button again.

And the last tab that needs to be filled out at this stage is the “Details and Licenses” tab.

When everything is ready, you need to go to the main page of the service (upper left corner, link “Alcohol Declaration”).

Stage 3. Obtaining information from EGAIS

To load data into the Kontur.Alcode Declaration, you need to enter the “Declarations” section and click the “Download from Kontur.Market” button:

Now you need to decide which declaration you need to upload , namely:

- for what reporting period;

- what type - for strong alcohol or beer products;

- primary or corrective:

In the “Details and balances” tab, you need to select a declaration from which the system will take the organization’s parameters and balances at the beginning of the reporting period:

After clicking the “Next” button, the information will be downloaded from EGAIS:

The download process will be visible on the “Data from EGAIS” tab. When the download is complete, in the same window the service will show how many documents have been downloaded. At the same time, all volumes will be recalculated in deciliters:

Sometimes it happens that some information from EGAIS is not loaded. The system will inform you about this and offer to make changes:

When all the information has been loaded, click “Next” again. The last tab - “Data distribution” - is intended for verification. Here you should make sure that the sales points from the Unified State Automated Information System and the declaration are compared correctly:

Now, for Form 11 for labeled alcohol, you can reconcile the EGAIS balances and the balances in the declaration. To do this, you need to use the “Load balances” button (see the image above and the next step).

If all the data is correct, you should click the “Generate declaration” button.

Stage 4. Reconciliation of balances

When all the information has been distributed, you need to click the “Download balances” button. Please note again that this only works for Form 11.

The system will transfer the user to the “Loading balances” tab. Here you can specify importers, and then click the “Save and go to balances” button:

You should make sure that the correct date is selected in the “Remaining in EGAIS” column:

By default, the date closest to the end of the reporting period is set, but you can set a different one. However, the difference in balances between the end of the reporting period and the date set by the user must be taken into account manually.

Distribution of unaccounted balances . Information for the column “Balances not included in the declaration” is generated by comparing the parameters of the Unified State Automated Information System and the declaration. The tax identification number and checkpoint of manufacturers or importers, as well as the product code, are compared.

The information in the declaration is reflected in deciliters, and in the Unified State Automated Information System - in liters, so the system automatically converts it into deciliters.

In practice, the data often does not match . This can happen for various reasons:

- The Unified State Automated Information System contains outdated information. This happens if you maintain your EGAIS balance incorrectly.

- There are documents left in the system for which circulation has not been completed.

- For the past months, the declaration was drawn up incorrectly.

- Until balances were reconciled, the service did not take into account EGAIS inventory data, as well as registration and write-off acts.

The last two reasons can be eliminated during the reconciliation process. Up-to-date data on actual balances can be included in the declaration based on the results of the Unified State Automated Information System inventory. The following table shows how mismatches are resolved.

Table. Correcting inconsistencies between data from the Unified State Automated Information System and the declaration

| Select one of the items if there are more balances than in EGAIS | |

| Select one of the items if the balance in the declaration is less than in EGAIS | |

Explanation:

| |

After all balances have been distributed, click the “Upload balances and go to declaration” button:

As a result, the system will transfer the user to the final stage of report generation.

Deadlines for submitting corrective declarations for beer

If you need to submit a corrective beer declaration, here are the deadlines for submitting a corrective beer declaration in 2022.

- for the 1st quarter, the adjustment is due until July 20, 2022.

- for the 2nd quarter, the adjustment is due until October 20, 2022.

- for the 3rd quarter, the adjustment is due by January 20, 2023.

- for the 4th quarter, the adjustment is due until April 20, 2023.

For those who do not have time to understand all the nuances of the rules for filling out declarations. We offer a service for filling out and drawing up beer declarations, as well as service in the Unified State Automated Information System. Our specialists will quickly and efficiently and in accordance with all the rules prepare a declaration file for you, cheaply for a low price! Special offer for our clients! Signing encryption of beer declarations for free!

| Beer declaration (form | Converting an XML declaration file for beer from 12 to 8 form for alcohol from 11 to 7 form | Program for preparing a declaration for beer, form 8, analogue of Declarant Alco | Correcting errors in the XML beer declaration file |

| from 1000 rub. | 500 rub. for organizing | the first 30 days are free, then 1200 rubles / year | 800 rub. |

Attention! Forms for submitting declarations have been changed since 2022

This article is relevant for 2022. The Alco Declarant program works and creates Form 12 declarations. We just need to reformat it into the current 8th form. To do this, we use a free service from Egaisik.RF.

The entire process of preparing a declaration in Form 8 is described in this article.

Let me describe our situation a little - we have several stores and one individual entrepreneur. We accept trade invoices through the Egaisik.rf service (described in this article below) and from it we download data for the declarant alcohol program.