How to correctly prepare documents at the request of the tax service in accordance with the new requirements

Over time, the rules according to which it is necessary to certify numerous copies of original documents sent to the tax office have become somewhat simplified. Previously, it was necessary to certify a copy of each document in a single binder. In accordance with the letter of the Ministry of Finance of the Russian Federation, it has become permissible, when transferring to the tax inspectorate a stack of copies of documents formed and bound in 150 sheets, to certify the entire bound volume of documents once, and not each copy separately, as was previously the case (Letter of the Ministry of Finance of the Russian Federation dated October 29 .2015 No. 03-02-RZ/62336).

The requirements for the preparation of documents submitted to the tax office in 2022 do not conflict with the content of the letter from the Ministry of Finance of the Russian Federation given above. According to the new requirements, in 2022, all requested copies of documents should be grouped into volumes containing no more than 150 pages in each of them (Appendix No. 18 Order of the Federal Tax Service dated November 7, 2022 No. ММВ-7-2 / [email protected] ).

What does a correct entry for certification of bound copies of documents include:

– the full title of the position of the employee who confirms the authenticity of copies of the documents provided (there may also be a record of what is certified by the individual entrepreneur or any responsible person);

– signature of the person certifying the documents, with a transcript (indication of last name and initials);

– an indication of the number of sheets stitched (in words and numbers);

– the date when copies of documents were certified,

Important! There are special requirements for signatures on pasted paper, which are that the signature must extend beyond the paper and not be located entirely on the pasted paper.

Seal is not a mandatory attribute when binding documents, since there are many enterprises that do without it, i.e. if the company has a seal, it is affixed, but if it is absent, it is not, and this will not be a violation of the requirements for preparing copies of documents for tax office employees.

The requirements of the Ministry of Finance are much stricter with regard to registration, in particular, they prescribe the length of the ends of the threads that remain after stitching copies of documents, the size of the paper sticker on the last page, mandatory confirmation with a seal (Letter of the Ministry of Finance of the Russian Federation No. 03-02-РЗ/6233) .

The new requirements of the Federal Tax Service for the preparation of documents provided at their request do not contain such nuances.

Certifying the accuracy of copies of documents

Certification of copies of documents is one of the most popular notarial activities. Indeed, very often, when planning to submit a package of documents to any organization, in the list of requirements we find the wording “a notarized copy of the passport/birth certificate/marriage certificate.” This service is often used in order not to present the original document. In most cases, a copy certified by a notary has the same legal force as the original document.

Certification of copies of documents is carried out by a notary in the manner prescribed by the Fundamentals of the legislation of the Russian Federation on notaries. When performing this notarial act, the notary certifies the accuracy of copies of documents, as well as extracts from them that do not contradict the legislation of the Russian Federation. A notary can certify a copy of a document issued by a legal entity, citizen or government body.

Certification of the accuracy of an extract from a document is carried out only when the original document contains several separate decisions that are not related to each other. The extract must reflect the full text of the part of the document containing a specific question. When certifying the accuracy of a copy from a copy of a document, the copy of the document must also be certified by a notary or in another manner established by the legislation of the Russian Federation.

In accordance with the “Fundamentals of the legislation of the Russian Federation on notaries,” a notary does not certify copies of documents that:

- have additions, erasures, unspecified corrections or crossed out words in the text;

— made in pencil;

- contain unreadable or unclearly written text, as well as erased signatures and seals;

- are dilapidated or their integrity is compromised.

However, a number of requirements previously imposed on documents of citizens or legal entities when they visit a notary have been simplified since July 2015. Thus, Article 45 of the Fundamentals now includes new requirements for documents submitted to perform a notarial act. In particular, previously it was required that documents submitted for a notarial act be bound. Now the integrity of a document set out on several pages must be ensured by fastening it or in another way that excludes doubts about its integrity. In addition, a reservation appeared regarding the rule that prohibits the acceptance of documents that have unspecified corrections, erasures, additions, or crossed out words. Now there is an exception to this rule. The article states that if unspecified corrections or other shortcomings in a document are insignificant, for the purpose for which the document is presented, if the notary understands the meaning of the document, and this has nothing to do with the surname, first name, patronymic, amounts and dates of birth , then such a document is accepted.

The notary does not certify the authenticity of copies of the following documents:

— documents that are not legalized on the territory of the Russian Federation in accordance with the procedure established by law and do not comply with international law;

— documents in a foreign language (the authenticity of the translator’s signature on the translated document must be certified by a notary).

Certification of a copy of a document, the volume of which is more than one sheet, is carried out by a notary only if all sheets of the original are stitched (or fastened in another way that excludes doubts about its integrity) and numbered.

Any citizen, including those who are not the owner of the document, has the right to contact a notary to certify a copy of a document.

Before certifying copies of documents, the notary must check whether the copy fully corresponds to the original (in terms of information and external features).

The notary gives a certified copy to the applicant only after his identity has been documented.

To do this, you must present an identity document. A passport is preferable. an official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities).

An example of an assurance letter

Thirty-five (35) sheets laced and numbered

IP Taganov S.N.

06/24/2022

How do the requirements of the current GOSTs of the Russian Federation relate to the procedure for certification of documents and the tax inspectorate when providing them with the requested copies of documents?

The word “true”, required when certifying bound documents in accordance with the current GOST of the Russian Federation (GOST R7.0.97-2016), is not considered by representatives of the tax service, and therefore, we can safely assume that its absence when transferring documents to the Federal Tax Service will not be violation of order.

When submitting copies of documents to the Federal Tax Service, there is no need to mention where the originals of the requested documents are stored

Copies of documents should be bound in such a way that the entire volume (book) does not fall apart when working with them, and everything that is displayed on each page should be clearly readable, and if necessary, it can be copied.

Everything that the original documents contain - visas, inscriptions, resolutions, etc. must be clearly visible on bound copies of documents.

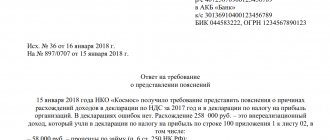

Copies of documents compiled into volumes are sent to the tax office with a covering letter, which contains information about the basis on which these documents were prepared, as a rule, this is a requirement of the Federal Tax Service. When referring to a requirement, you must indicate its details (number and date). It is important to draw up an inventory of the transferred copies of documents, which indicates the total number of volumes and pages in each of them.

If the document is multi-page

On copies of multi-page documents, a mark confirming the certification of the copy is placed on each sheet of the document or on the last sheet of a bound or otherwise bound document.

A record of the location of the original is placed on the last sheet of the document.

On the reverse side of the last sheet, a paper sticker in the form of a rectangle is pasted at the place of fastening. The sticker should cover the place where the firmware is attached. The ends of the stitching threads may extend beyond the sticker. The “certification” inscription is sealed with the seal of the organization, if available.

The procedure for certification of copies of documents provided to the Federal Tax Service by citizens on personal initiative

If it is necessary to provide copies of documents of a personal nature to the tax office, the procedure for certifying them is slightly different. So, in order for an individual to receive the deductions due to him, social or property, copies of documents must be attached to the application. Let's consider the procedure for their certification.

Something to remember! To receive a tax deduction, you must provide the tax office with not only copies of documents, but also originals, such as:

- certificate in form 2-NDFL;

- declaration 3-NDFL;

- confirmation of training;

- tax refund application;

- other.

Copies of which documents are included in the package of documents for obtaining a tax deduction?

- passports;

- payment orders;

- extracts;

- evidence;

- others.

How to certify a copy

A certified copy is the same document with special marks that give it a legal basis for action. Therefore, in order to document expenses, copies of documents can be used, but only certified in accordance with the established procedure.

Requirements for document preparation were approved by order of Rosstandart of Russia dated December 8, 2016 No. 2004-st. With this order, the new GOST R 7.0.97-2016 is in effect from July 1, 2022. According to GOST, to certify a copy of a document to the original, the “signature” requisite must be:

- the word “True”;

- position of the person who certified the copy;

- his handwritten signature;

- decryption of signature (initials, surname);

- date of certification of the copy;

- an inscription indicating the storage location of the document from which the copy was made (if the copy is issued for submission to another organization).

If the organization has a seal, its affixing is mandatory, since according to GOST, the seal certifies the authenticity of the official’s signature.

Let us remind you that from April 7, 2015, LLCs and JSCs are not required to have a seal.

A stamp may be used to mark the certification of the copy.

A sample copy certification note is presented below.

note

If a copy of a document must be sent to another organization, then the rules require indicating the place where the original copy of the document, for example, a work book, is stored.

Who has the right to certify copies of documents sent to the Federal Tax Service to receive a tax deduction?

- Copies of documents submitted to receive a tax deduction can be certified by a notary.

- Copies of documents submitted to receive a tax deduction can be certified by the citizen himself in the following order:

- each copy page must be signed separately;

- confirmation of the authenticity of the copy is made out with the words “the copy is correct”, which are located at the bottom of the page. The signature, its decoding and date are also placed here.

Documents sent to the Federal Tax Service from a private individual to obtain a tax deduction are accompanied by an inventory, which indicates all copies of documents submitted.

How to certify copies of documents sent to the tax office in electronic format

To send copies of documents to the tax office, tax office employees developed a special format, which was approved by order (Order of the Federal Tax Service dated January 18, 2017 No. ММВ-7-6 / [email protected] ).

It is also possible to provide documents in scanned form, in accordance with the requirements of the Federal Tax Service, approved by order (Order of the Federal Tax Service dated February 17, 2011 No. ММВ-7-2 / [email protected] ).

After sending the requested documents electronically to the tax office, the taxpayer receives on the next business day:

- an electronic document confirming receipt or information about refusal of admission;

- confirmation of sending documents electronically.

You should know ! If the tax office sent you an electronic confirmation of acceptance of the documents sent, then you do not need to provide them on paper. If such a document does not arrive, it is necessary to submit the requested documents in paper form to the tax office.

How to send a list of documents to the Federal Tax Service in response to a request

According to the order of the Federal Tax Service of Russia dated July 16, 2020 N ED-7-2 / [email protected] , a taxpayer can transmit documents (information) via electronic communication channels in response to a received request.

The tax office may send a request to submit documents or a request to provide explanations. In this article we will take a closer look at document presentation.

If you have received a request to provide explanations for VAT, please read the instructions. Requests on other grounds can always be responded to by adjusting the report. It is also possible to fill out the response form through the “Respond to the requirement” button in the “Explanatory letter” section (in agreement with the inspection).

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

To send a response to a request received from the tax authorities, you must:

1. On the main page of the Extern system, go to the “New” section, select “Requirements” > “All requirements”. Next, click on the desired requirement in the list. If necessary, the administrator can share the requirement with other users.

2. In the window that opens, click on the “Respond to request” button. The button becomes active after sending the acceptance receipt. Then select “Send requested documents”.

3. In the next window, you should select how documents will be added. You can add ready-made files by clicking on the “Upload from computer” link (you can also drag and drop the required files into the field that appears). If Diadoc is used to exchange documents between counterparties, then in the window that appears, you can click the “Select in Diadoc” link.

4. In the window that appears, select the files to download and click “Open”.

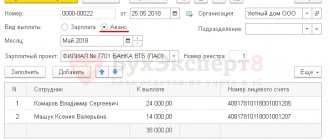

You can add documents in the form of scanned copies (files with the extension jpg, tif, pdf, etc.), as well as documents in the form of xml files (files with the xml extension), to the inventory.

You can add the missing files in the next step.

According to the inventory format approved by order dated January 18, 2017 N ММВ-7-6/ [email protected] , the following types of documents can be submitted in the inventory:

- Any document in the form of scanned images (the subscriber can indicate the name of the document independently in the appropriate field)

- In the form of an xml file, any document that has a tax return code (tax return code).

5. The downloading and recognition of the selected files will begin. At the end of the process, a list of downloaded documents will be displayed on the screen.

If necessary, you can add missing documents using the “+More documents” button. In response to a requirement, a large number of documents can be uploaded along with meta information.

To delete unnecessary files, hover your mouse over the line with the unnecessary document and click on the “Delete” button on the right side of the line.

6. After downloading, you need to start editing the added documents. To do this, click on the link with the name of the downloaded file.

Documents in the form of scanned images

In the editing window, you should select the type of loaded document. Depending on the selected type, fields will appear that must be filled out. Mandatory to fill out is the requirement item.

Clause of the requirement - this section indicates the number of the clause under which the document is indicated in the requirement in the form 1.XX or 2.XX. According to the format, the first digit of the serial number can take only one of two values - either 1 or 2. Next, XX is indicated through a dot - the two-digit serial number of the document being added.

1.XX is indicated for the documents sent in the inventory (specified in the requirement), and 2.XX is indicated for the information sent, requested in the requirement (they are not specific documents and are usually highlighted separately from the documents in the requirement).

If the downloaded document consists of several pages, you should combine them by clicking the “Connect” button

Conversely, extra pages should be separated into a new document by clicking the “Divide” button.

After all the items have been completed, click the “Next Document” button, after which the next loaded document will open. To go to the list of downloaded files, click on the button in the upper right corner or on the gray background.

Report easily and without errors. A convenient service for preparing and submitting reports via the Internet. We are giving access to Extern for 14 days!

Documents in the form of xml files

Unlike scanned copies, documents in the form of xml files require virtually no editing. After downloading them, you should fill out the requirement item - the item number under which the document is indicated in the requirement in the form 1.XX or 2.XX. According to the format, the first digit of the serial number can take only one of two values - either 1 or 2. Next, XX is indicated through a dot - the two-digit serial number of the document being added.

Together with the xml files of the invoice, adjustment invoice, work (services) acceptance certificate, as well as the delivery note (TORG-12), sgn signature files must also be transferred. Xml files and the corresponding sgn signature files should be downloaded from the program in which electronic document management with counterparties is carried out (for example, Diadoc).

The remaining documents that can be transferred to the inventory in the form of xml files (purchase book, sales book, journal of received and issued invoices, additional sheet of the Purchase Book, additional sheet of the Sales Book) are transferred without signature files.

For example, in order to transfer a delivery note in the form of xml in the inventory, you should add 4 files - two of them must have the xml extension (seller title and buyer title) and the corresponding two signature files with the sgn extension.

After the data has been entered, click the “Next Document” button, after which the next loaded document will open.

To go to the list of downloaded files, click on the button in the upper right corner or on the gray background.

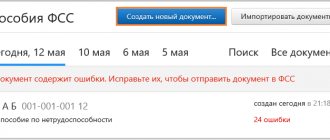

If errors are found in the xml file (for example, “The buyer’s title is not loaded,” “The buyer’s title signature is not loaded,” then you should upload the missing documents. You can also delete such a document and re-upload it from the program in which it was generated. After this, repeat the upload to Extern.

7. Once all the necessary documents have been edited, you should go to the list and click the “Proceed to Submit” button.

The button will be inactive until the “Ready to send” status appears next to each uploaded document.

8. A window with the test results will open, in which you should click the “Proceed to Send” button.

If the inventory is signed by a certificate of an authorized representative, then together with it a message of representation (CoR) is sent to the tax office.

If the form is signed with a certificate from the legal representative (manager), then the message of representation is not transmitted.

The Proceed to Submit button does not appear if there are errors in the form or representation message. In this case, you should correct the errors found and resend.

9. In the next window, you must click on the “Sign and Send” button.

10. Inventory sent. A list of documents submitted for the inventory and the status of their processing by the Federal Tax Service will be contained under the request.

After sending the inventory, the processing statuses will change as follows:

- “Sent” - documents have been sent to the tax authority. Shipping date confirmed. The system will display the date and time the inventory was sent.

- “Delivered” - documents have been delivered to the tax authority, a “Notice of Receipt” has been received;

- “Accepted” - the documents have been accepted by the tax authority, an “Acceptance Receipt” has been received. The system will display the date and time of receipt of the receipt from the Federal Tax Service.

- “Rejected” - the documents were not accepted by the tax authority, a “Notice of Refusal” was received. The system will display the date and time of receipt of the notification from the Federal Tax Service.