Mobile communications: how to control

Recording of conversations on a mobile phone for business purposes can be organized in several ways:

- detailing;

- limiting;

- using unlimited tariffs.

The detailing of the negotiations comes down to a detailed analysis of the list of calls and the telephone numbers to which they were made. Personal calls are excluded from costs, and calls of a production or work nature are taken into account.

Detailed negotiations are a compelling argument when checking the validity of costs by tax inspectors. At the same time, informal communication over the phone allows, for example, to effectively sell goods to friends, acquaintances, and relatives of company employees. This dilemma can cause conflicts when assigning costs to one category or another. In addition, carrier detailing services typically require additional fees.

When limiting negotiations, employees are allocated a certain amount monthly, which should cover official negotiations. Often, detailing precedes the limiting stage: analysis of detailed reports helps determine optimal spending limits. At the same time, for tax authorities, all amounts in excess of the limit will by default be economically unjustified.

Connecting to unlimited tariffs greatly simplifies accounting, since there is no need to control the amounts for “business” calls and separate business expenses from personal ones. In addition, according to the Ministry of Finance (letter No. 03-03-06/1/378 dated 06/23/2011), their use does not prevent them from being included as expenses for NU purposes.

The use of office telephones by employees is prescribed in the Internal Labor Regulations. Some companies publish a special LNA - Rules for the use of business cellular communications.

Important! If the SIM card is issued to an individual, for example, to the director of a company, you cannot pay for cellular communications from your current account and record it in your accounts. However, it is legal to establish compensation for an employee for using a personal telephone for business purposes.

Choosing an account for mobile phones

Currently, all public sector institutions, when maintaining records, are guided by the provisions of the following regulatory legal acts:

- GHS “Conceptual Framework”;

- GHS “Fixed Assets”;

- Instructions, approved By Order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n (hereinafter referred to as Instruction No. 157n).

In terms of accounting records - the provisions:

- Instructions, approved Order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n (hereinafter referred to as Instruction No. 162n);

- Instructions, approved Order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n (hereinafter referred to as Instruction No. 174n);

- Instructions, approved By Order of the Ministry of Finance of Russia dated December 23, 2010 No. 183n (hereinafter referred to as Instruction No. 183n).

Public sector institutions account for fixed assets in the corresponding analytical account of account 101 00 “Fixed Assets”, regardless of the purpose for which they were received by the institution (clauses 4, 5 of Instruction No. 162n, clauses 7, 8 of Instruction No. 174n , clauses 7, 8 of Instruction No. 183n). Fixed assets received by the institution in 2022, with an initial cost of up to 10,000 rubles inclusive, with the exception of library collection objects, are written off from the balance sheet and reflected in off-balance sheet account 21* (clause b, clause 39 of the GHS “Fixed Assets”).

If an institution makes a decision to transfer a registered mobile phone to an employee for personal use to perform his official duties, in order to ensure control over its safety, intended use and movement, it is reflected in off-balance sheet account 27 “Material assets issued for personal use” use by employees (employees)” at its book value (clause 385 of Instruction No. 157n). And the balance sheet reflects the internal movement between financially responsible persons in relation to property worth more than 10,000 rubles (clause 7 of Instruction No. 162n, clause 9 of Instruction No. 174n, clause 9 of Instruction No. 183n). For a mobile phone worth up to 10,000 rubles reflected off-balance sheet, the transfer for personal use is reflected by reducing off-balance sheet account 21 (clause 373 of Instruction No. 157n). ______________________ * Instruction No. 157n has not yet been amended in terms of the name and description of off-balance sheet account 21 in accordance with the provisions of clause 39 of the GHS “Fixed Assets”.

More on the topic: Form 0503737: reporting on the implementation of the financial and economic activity plan

Accounting

Expenses for communication services are expenses for ordinary activities (PBU10/99 R.2 p.5), they are associated with the production, acquisition, sale of goods, work, services. From the above it follows that they will be taken into account in accounting in “cost” accounts by department.

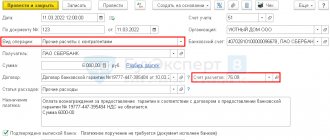

Standard wiring:

- Dt 20, 25, 26, 44 Kt 60 – mobile communications costs are taken into account (excluding VAT).

- Dt 19 Kt 60 – VAT on mobile communication services is taken into account.

- Dt 68 Kt 19 – VAT deductible.

- Dt 60 Kt 51 – payment for mobile communications has been completed.

If overspending is detected, settlements are carried out through account 73, using the corresponding subaccounts:

- Dt 73 Kt 60 – above-limit communication expenses were recorded (in the context of analytical accounting, by name).

- Dt 50 Kt 73 – expenses were repaid in cash by an employee who exceeded the limit.

- Dt 91 Kt 73 - expenses of the employee who committed overspending were written off as losses due to the inability to withhold the amount. This situation may arise if the employee managed to quit.

Compensations for the use of personal phones for business purposes (mentioned above) are also taken into account through account 73:

- Dt 20, 25, 26, etc. Kt 73 – compensation payment to the employee has been accrued.

- Dt 73 Kt 50, 51 – the company paid the employee.

Write-off of telephone costs

Just a little bit was enough for me. So please help: just write breakdowns that you know, no need for abstruse ones, 3-4 words will do. Thank you in advance